Fineco Bank App Review 2024 – Pros & Cons Revealed

Fineco Bank is an Italian institution and its stock app enables trading in financial asset classes such as shares, bonds, ETFs. Clients also gani access to options and futures, so this is venue that can cater for retail and professional customers alike.

The bank – founded in 1999 – entered the UK broking marketplace in 2017, and is arguably still establishing its brand in the UK.

In our review of the Fineco Bank stock app we walk you through the sign-up experience, breakdown the charges and fees and the features and tools available on the platform to help its clients engage in profitable trading and investment activity.

You know you are dealing with a bank when you sign up via the app, because the hoops to jump through are quite something, so you will want to read on for tips on navigating the sign up journey and to find out if it is worth effort.

This Fineco app review covers the iOS version of the app but is applicable to the Android version also. The app works in conjunction with the website, where the higher level account details are managed (finecobank.com).

-

-

What is Fineco Bank?

Fineco Bank is headquartered in Milan, Italy, and has been operating in the UK since mid 2017. The bank is regulated by the UK’s Financial Conduct Authority and the Bank of England’s Prudential Regulation Authority.

Because of its continental European footprint it provides excellent access to shares in consumer non-cyclicals with strong balance sheets, healthy dividend yields and low volatility.

Such firms are fairly plentiful in Europe and collectively have been christened the GRANOLAS by Goldman Sachs analysts. The company’s are: GlaxoSmithKline, Roche Holding, ASML, Nestlé, Novartis, Novo Nordisk, L’Oréal, LVMH, AstraZeneca, SAP and Sanofi.

So, if you are on the hunt for European stocks then it may be the one for you.

Listed on the blue chip FTSE MIB index, the bank has been active in the brokerage for more than 20 years. Owned by Unicredit, the bank has 1.3 million customers in Italy.

The company has assets of £75 billion, net sales of £4.3 billion and in the first half of 2020 executed 23 million trades on behalf of clients.

Given it is still breaking into a new market in the UK, it might be reasonable to expect some enticing deals to lure traders away from other platforms. Our Fineco app review will therefore apply a keen eye to fees and charges to see how the continental European bank compares.

What Stocks Can You Trade on the Fineco App?

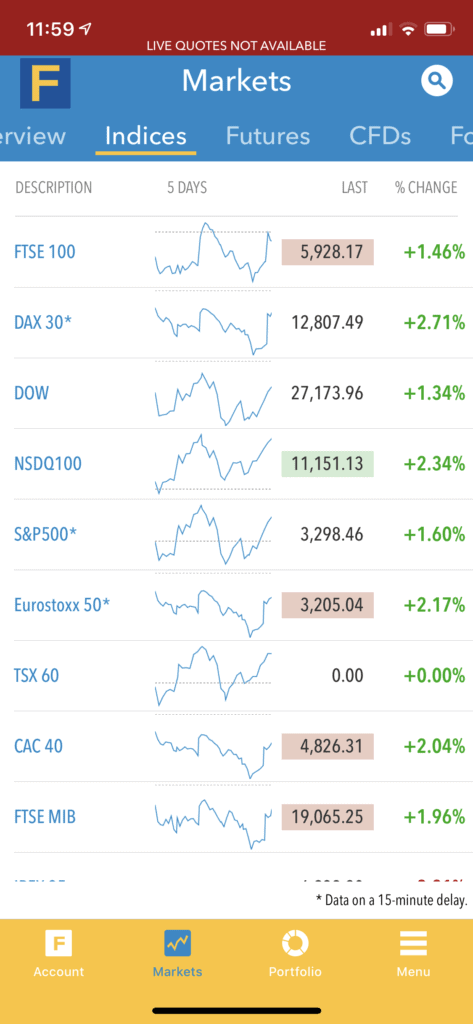

The Fineco stock app provides access to 20,000 markets across 26 exchanges around the world.

The financial instruments you can trade the full gamut of financial assets, from stocks and shares, to ETFs, CFDs and futures.

Government bonds, options and ETFs are also available to trade in their own right (not as CFDs). Contracts for differences are financial instruments issued by financial institutions that replicate the price movements of an underlying asset. The owner of the contract does not directly hold or own the underlying asset. Fineco has no cryptocurrency markets.

CFD Stocks are commission-free but not the non-CFD products such as futures, options, bonds and shares.

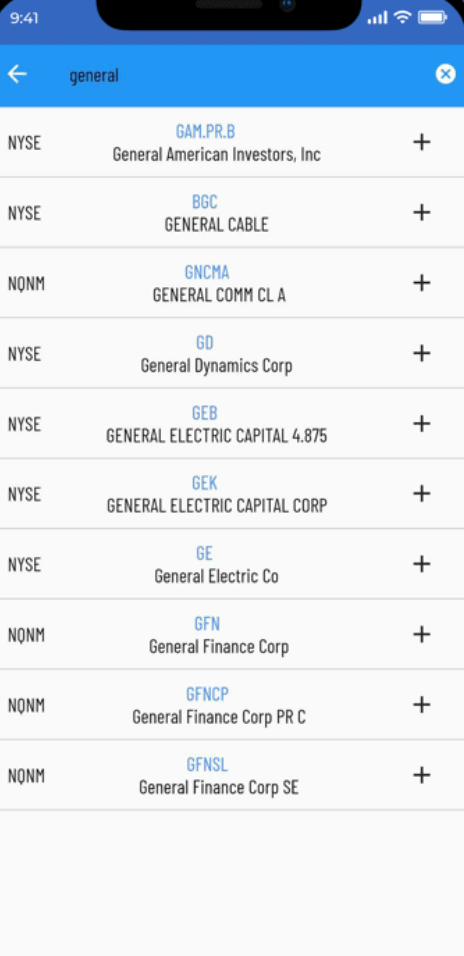

Finding stocks

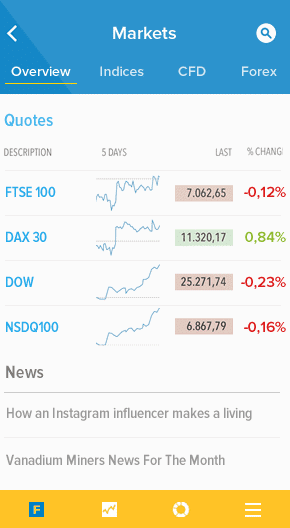

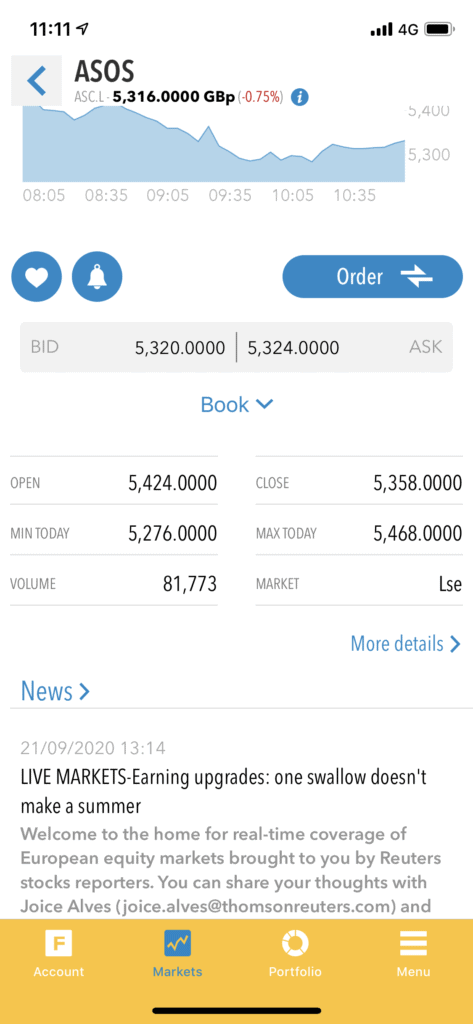

See the seach button in the top right of the interface. The search button is always in view when you are on the markets section (the second tab from the left in the bar at the bottom of the app view).

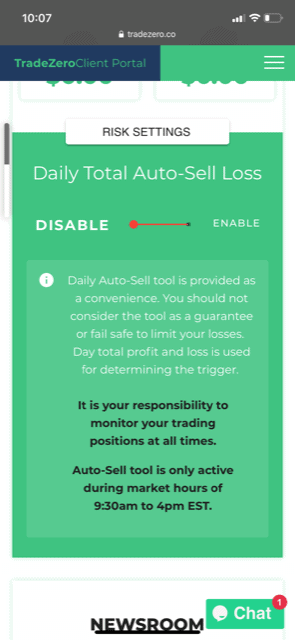

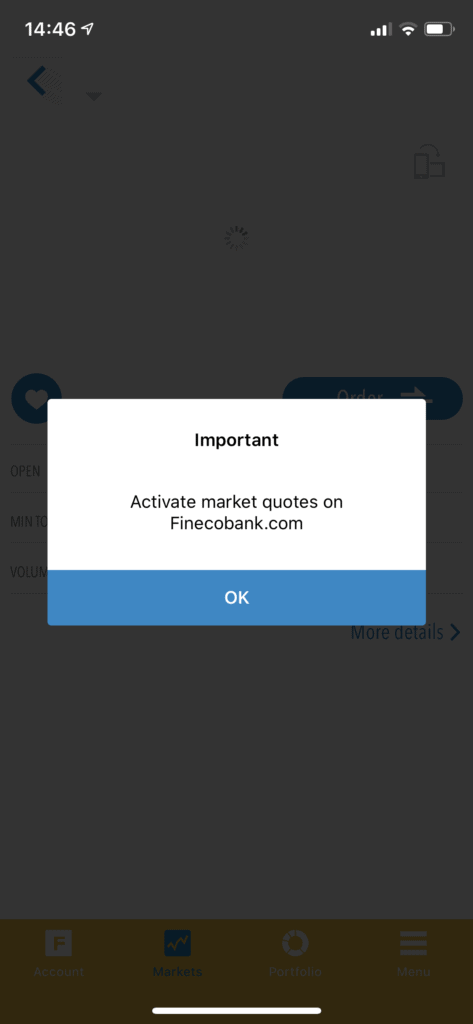

But before you will be able to find any CFD, stocks or anything else on the investment app you have to go to the website to manage your preferences and settings. Specific permission has to be given to receive live quotes.

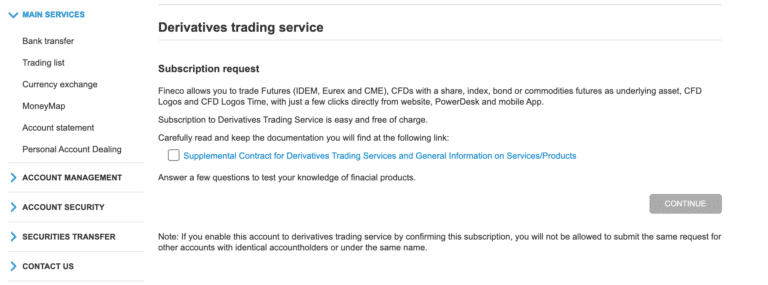

Also, to trade on derivatives of any kind (CFDs, options, futures) you will need to answer a number of questions and take a test demonstrating understanding of concepts and features such as leverage and margin.

ETFs

Although Fineco does offer markets in a variety of CFD instruments, it also hosts markets for the normal non-CFD versions of those assets.

Fineco lists both exchange traded funds (ETFs) and exchange traded commodities.

Exchange-traded funds industry ETFs are cheap ways to access asset classes by tracking and/or creating indices for the underlying assets. The issuer of the ETF directly buys assets or uses derivatives products to replicate the movement in prices of the asset. Etfs are similar to collective vehicles such as funds, but unlike them they trade normally on the stock market while funds have prices set just ince a day.

You can set up a savings plan – Fineco’s Replay and invest as little as £2.95 in ETFs every month.

Other Asset Classes

The platform is well stocked with credit market products. It lists 6,000 sovereign, corporate and structured securities in adidition government bonds. You can tell this is one of the ‘grown-up’ broker because futures and options are also available, direct from the venues, such as the CME and Europe’s EUREX and IDEM.

Fineco Account Types

Fineco has either an individual account or joint account. Because we are dealing here with a regulated bank, setting up your account is alot trckier than it is with the CFD brokers such as Plus500 or Capital.com, for example.

But the sign-up pain may well be worth it for those interested in access to derivatives such as call and put options and futures.

You can read more about the sign-up process below – but put it this way: if you expect to be up and trading in minutes, forget about it. After signing up for an account you have to wait two days for the process to complete and you can use the app.

Fineco Fees and Charges

Fineco’s has competitive and transparent fees and charges across its range of products.

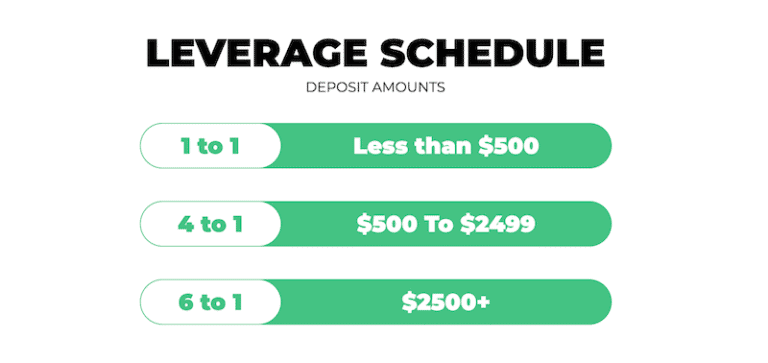

Buying CFDs is cheaper upfront because you are not buying the underlying instrument.

Spreads

Spreads vary by instrument. There is no extra costs hidden in the spread or commmission to pay on CFDs, which Fineco, not surprisingly, pushes as a key selling point.

CFD Trading

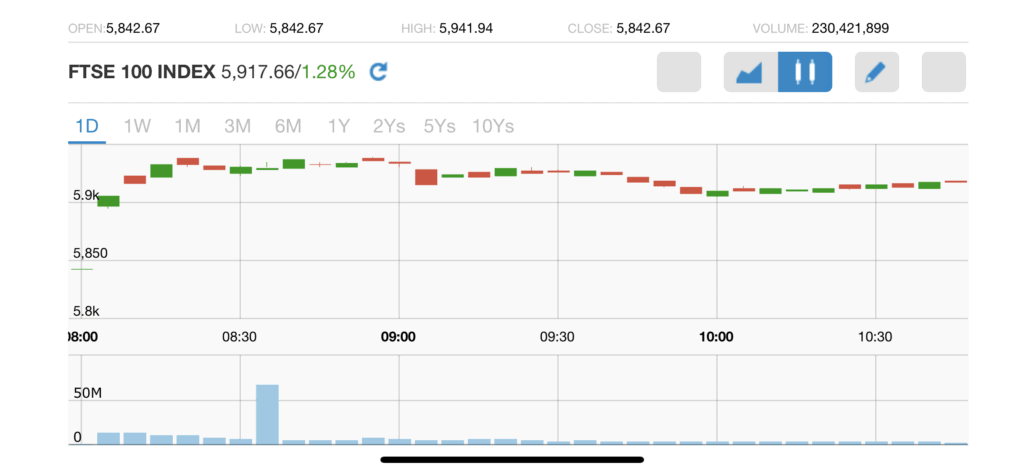

With CFD trading on Fineco you just pay the pips, which is as low as 0.4 pips for the S&P 500 index, although for the FTSE 100 is 0.6 pips.

Note the difference between the cost of trading CFD instruments such as stocks and indices compared to dealing directly in stocks. UK shares are £2.95 a trade on the London Stock Exchange but if you opted for the CFD version you would pay zero commission.

Non-Trading Fees

A big Fineco selling point is that it charges minimal of those sneaky non-trading fees.

This is especially significant when it come to CFD trading where overnight charges can be a major cost consideration when holding positions open between sessions.

- No custody or deposit fees

- No markets connectivity costs

- No inactivity charges

- No portfolio transfer costs

Fee schedule of select instrument categories:

Futures Indices CFDs FX UK Shares and ETFs Commission as low as Spread as low as Spread as low as Fixed commission $ 0.4 0.8 £ 0.7 pips pips 2.95 On CME Micro Futures and €0,75 on Mini DAX On S&P 500, 0.6 pip on Nasdaq 100 and FTSE 100 On EUR/USD. Trade 50+ FX worldwide pairs Per trade on London Stock Exchange Fineco App User Experience

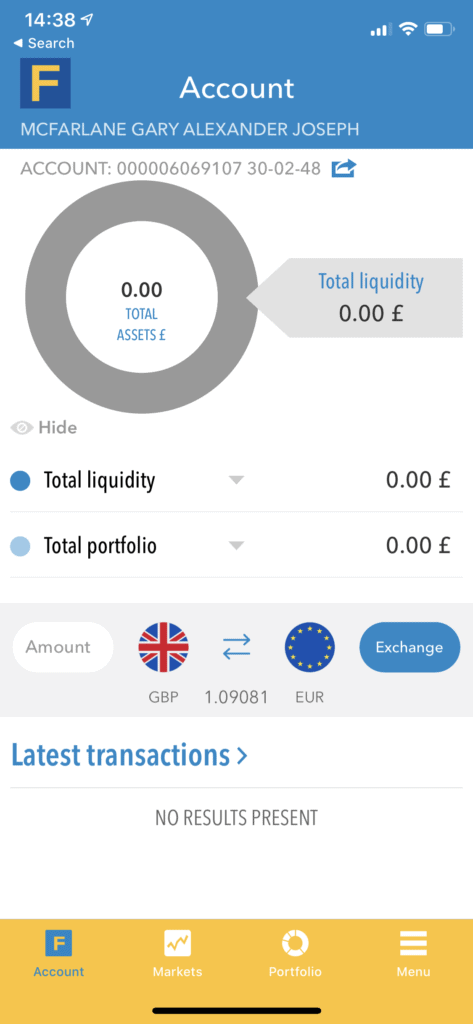

To complete this section of our Fineco Bank app review I had to wait a couple of days for authorisation to be completed and the account readied for trading the instruments.

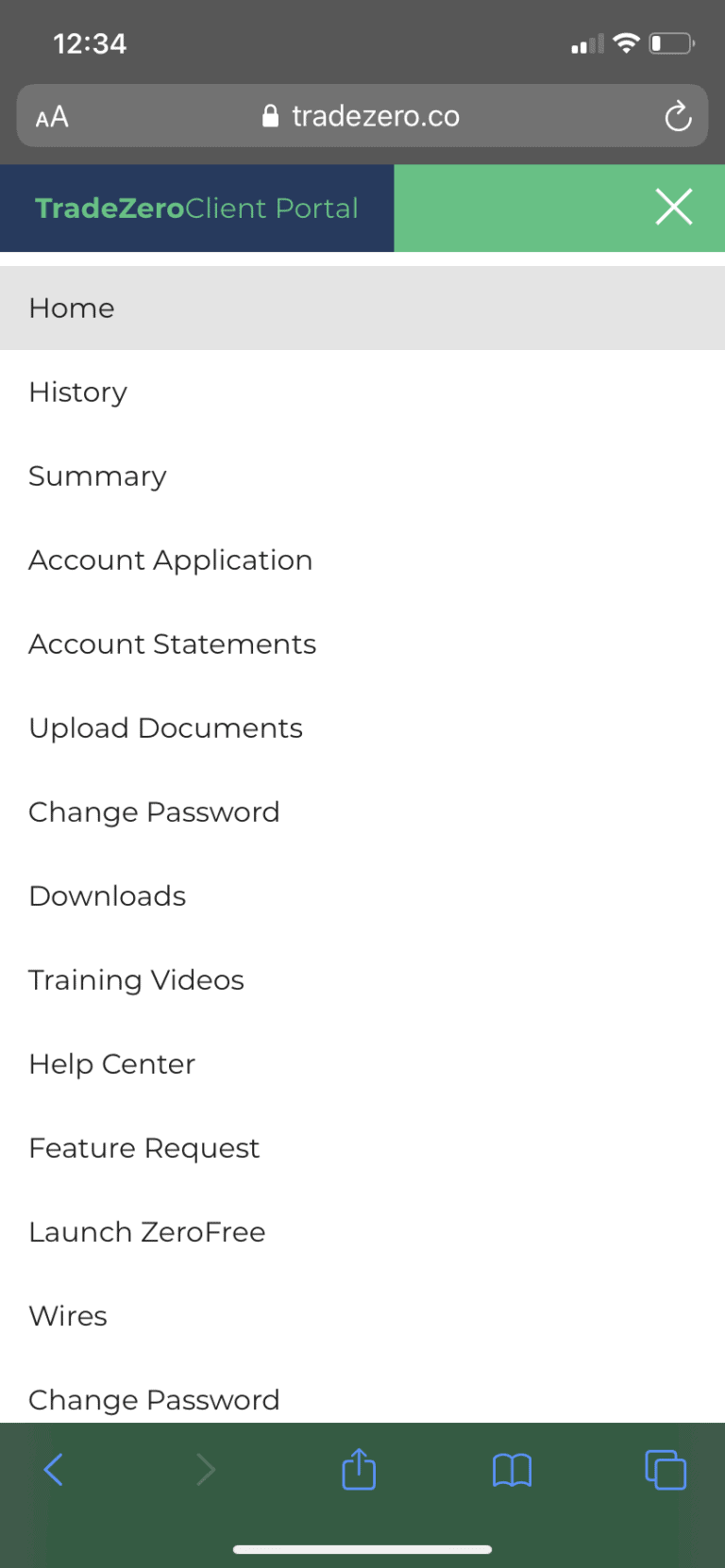

The account set-up is complicated and needs to be improved. When downloading and installing the app the user is not forwarned that it will be necessary to set up and manage the account on the website as well as seeking separtae authorisation for various services.

The app is not native. That’s to say it drags down web pages from server with minimal added formatting as opposed to those pages being coded directlly in the app. Because of this the app lacks the graphic crispness and functionality of many other stock apps.

However, if you can look past that and appreciate that most of the functionaltiy of the platform is available on the website, then this may not be an issue – taking this approach, it is best to see the app as an appendage of the website that you use for monitoring your portfolio and executing trades.

Fineco Trading Tools and Features

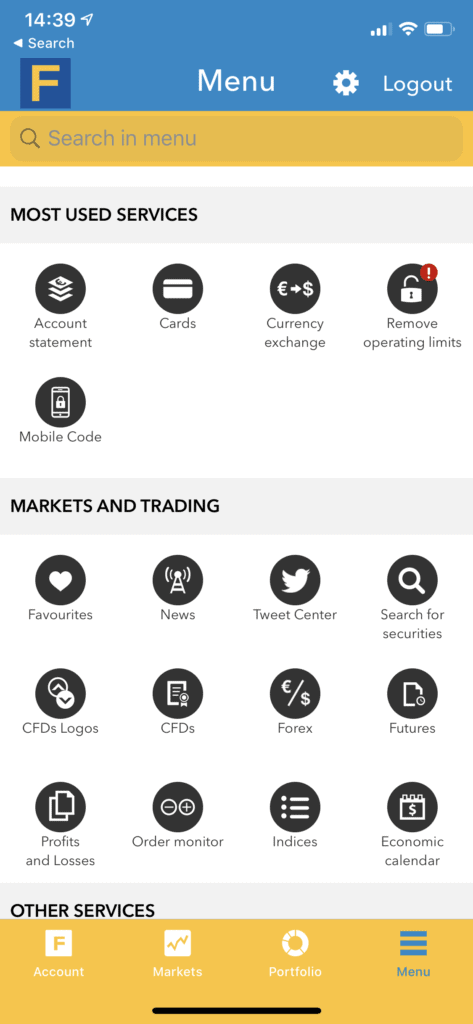

Fineco provides client with powerfiul trading tools including Level 2 services where you can see the actual order book for markets. UNfortunately, much of this s not available on the app and is confined to the website.

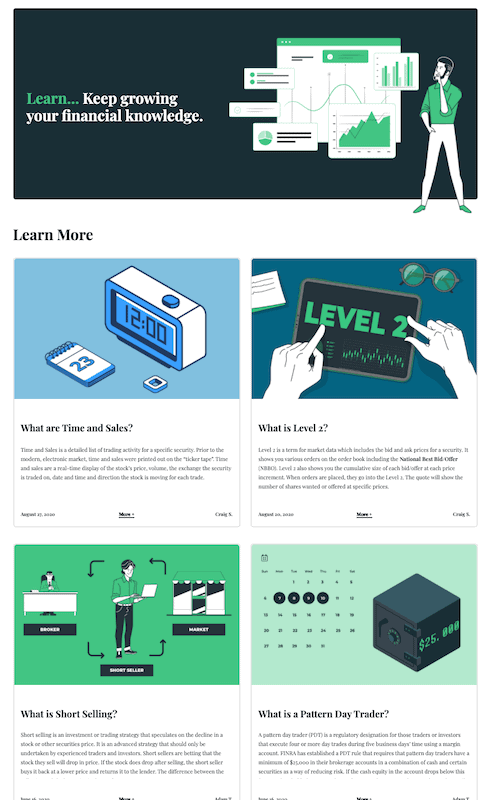

Fineco App Education, Research and Analysis

The app is fairly basic when it comes to education, although there is a dedicated education section on the website.

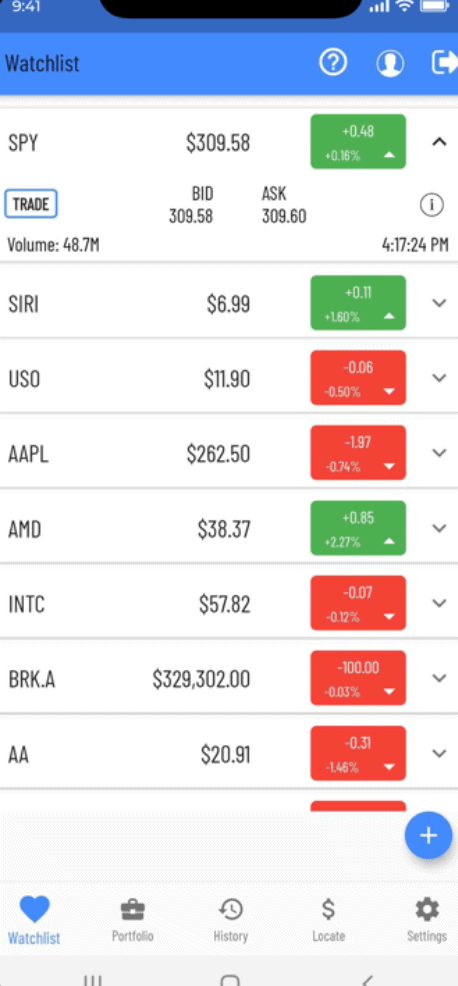

Available through the app is an up-to-the-minute news service and latest tweets from a number of mainstream financial outlets and news feed that integrate well with the stock/instruments page.

There’s also an economic calendar service but that’s about it.

Go to the menu section and under the ‘markets and trading’ you can find the economic calendar news and tweet service.

Charting

Fineco charting on the app is fairly rudimentary. As with other apps, turn your device ito landscape mode to view charts at full size and to use indicators such as moving averages. However, there are not many tools available via the app, so again you may want to do your heavy lifting on technical analysis through the website and its pro level trading solution PowerDesk that you get for free (minus the real-time quotes unless you pay extra) for entry level.

Market and limit orders

Unlike many CFD brokers you can choose between market orders and limit orders. With a limit order you set the price you want to buy at as opposed to whatever the price is when the prder is executing.

Trading features include:

- Access to 26 stock, fixed income (bonds) and dervicatives markets

- 20,000 instruments

- Live profit and loss position

- Account monitoring

- Multicurrency mobile banking account, unlike Revolut or Hargreaves Lansdown

- Real-time notifications and alerts

Fineco App Bonus

Fineco does not have a referral programme.

Fineco Demo Account

Fineco does not offer a demo account.

Fineco Payments on the Stock App

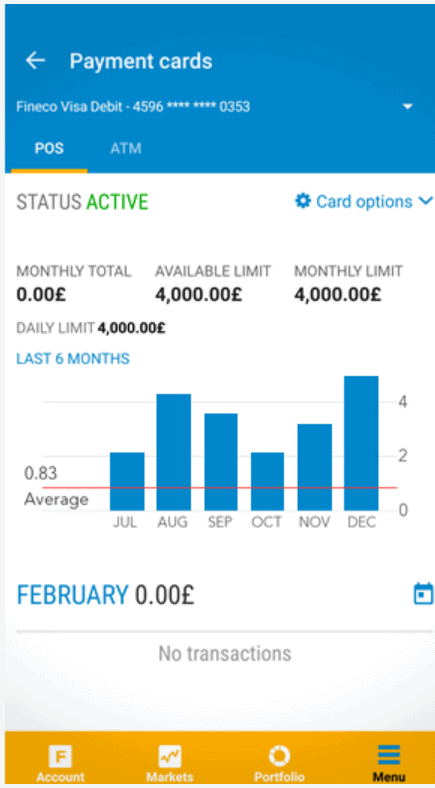

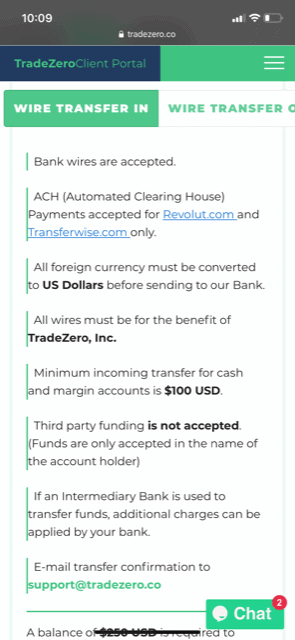

Initial deposits can only be made by bank transfer, but therafter deposit payments and withdrawals can be done with a bank debit card.

There are no deposit or withdrawal fees to pay.

Fineco provides multicurrency accounts with an impressive choice of 21 base countries.

Fineco Contact and Customer Service

Telephone support and other channels such as email can be used to contact Fineco. When we reached out to enquire about account activation, being able to speak to someone on the phone was not a problem.

Customer service is the sort of thing you don’t worry too much about until you need it. Therefore it should not be underestimated the importance of good communication channels between client and platform. You don’t want to find yourself in a situation where a trade has executed incorrectly and there’s no one you can get hold of except a ‘robot’ in a live text.

Because Fineco is a bank its service levels tend to much better than less well-resourced outfits such as some of the newer UK CFD brokers .

Is Fineco safe?

Fineco Bank is safe in the sense that it is fully regulated and licensed by the UK Financial Conduct Authority and all relevant European financial authorities. Because it is regstered in the UK it means in the event of business failure (the bank goes bust for example), you will be compensated up to £85,000 by the UK’s Financial Services Compensation Scheme.

Bank-level security systems and the mandatory segregation of client funds from those of the business are matters subject to regular surveillance by banking and financial market authorities. Also Fineco’s listing on the Milan Borse confirms this is an established company, even if it is new to the UK, so the likelihood of business failure should be remote.

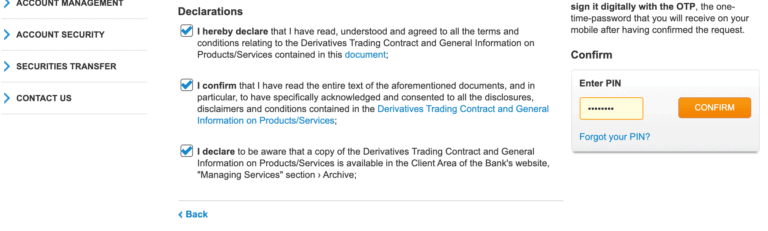

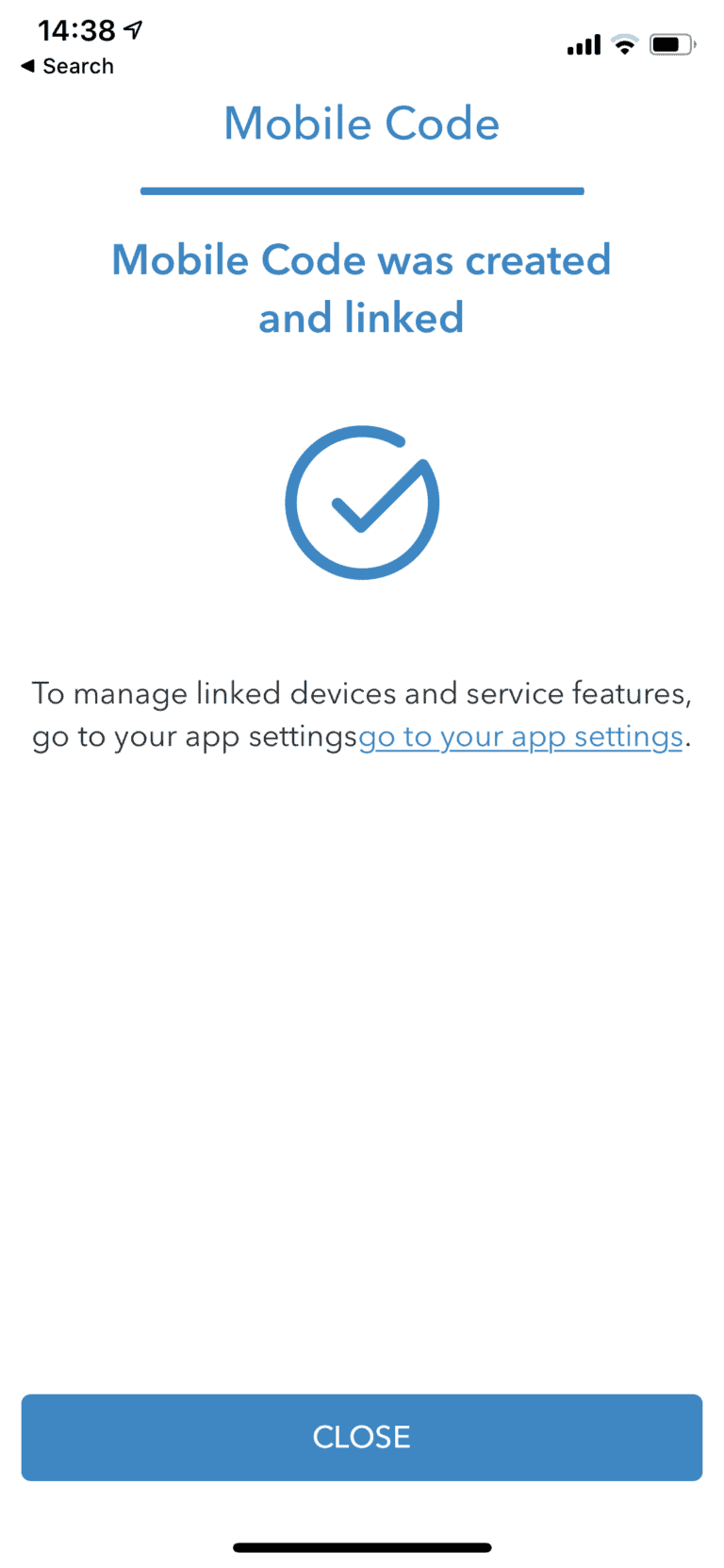

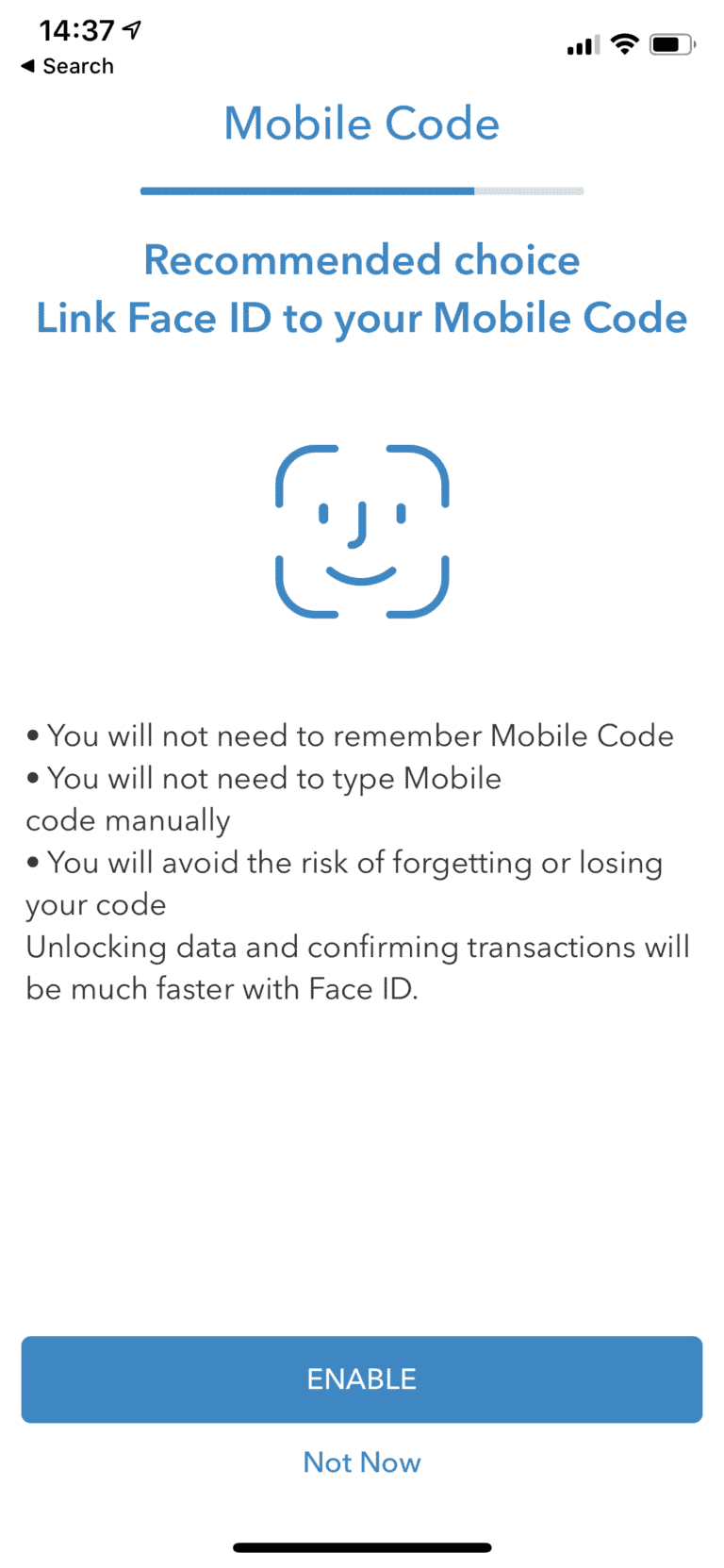

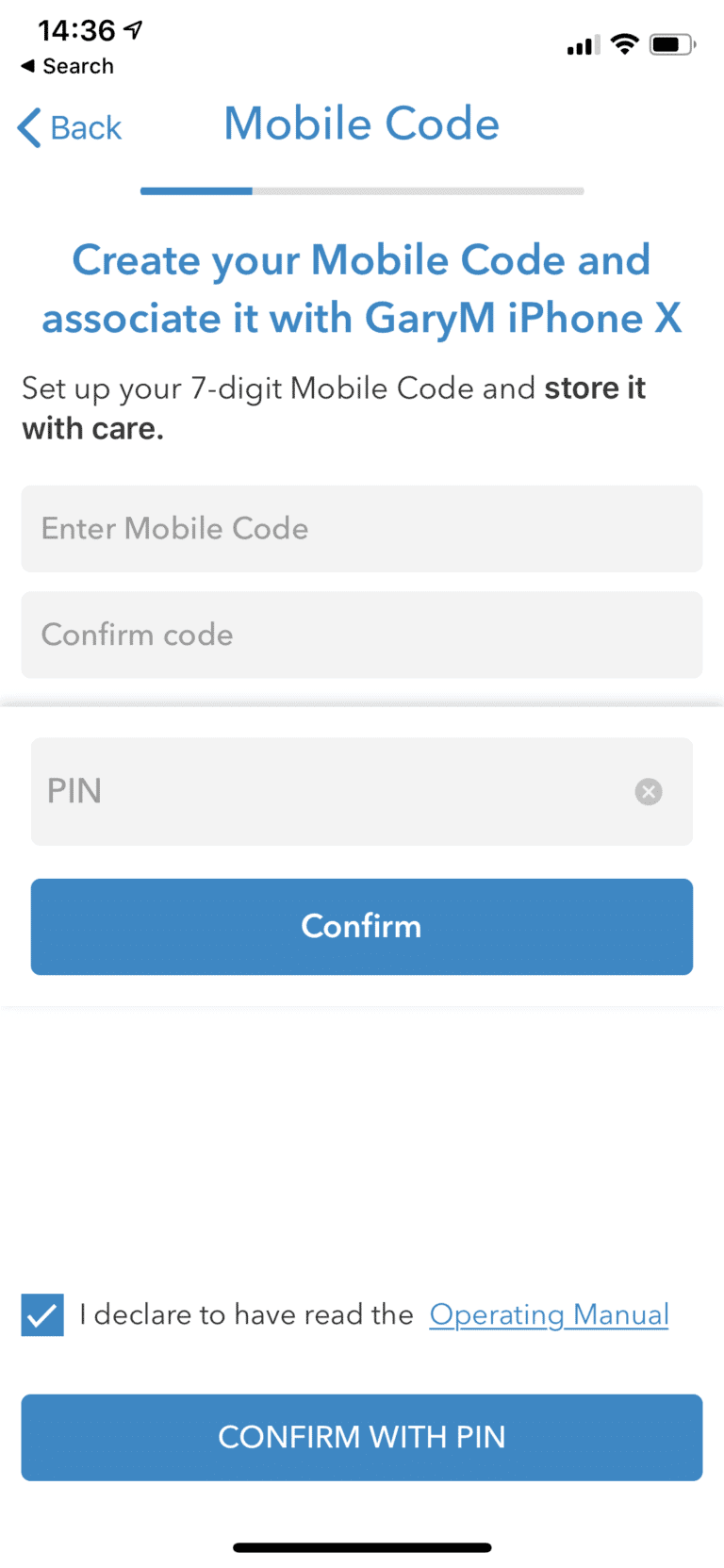

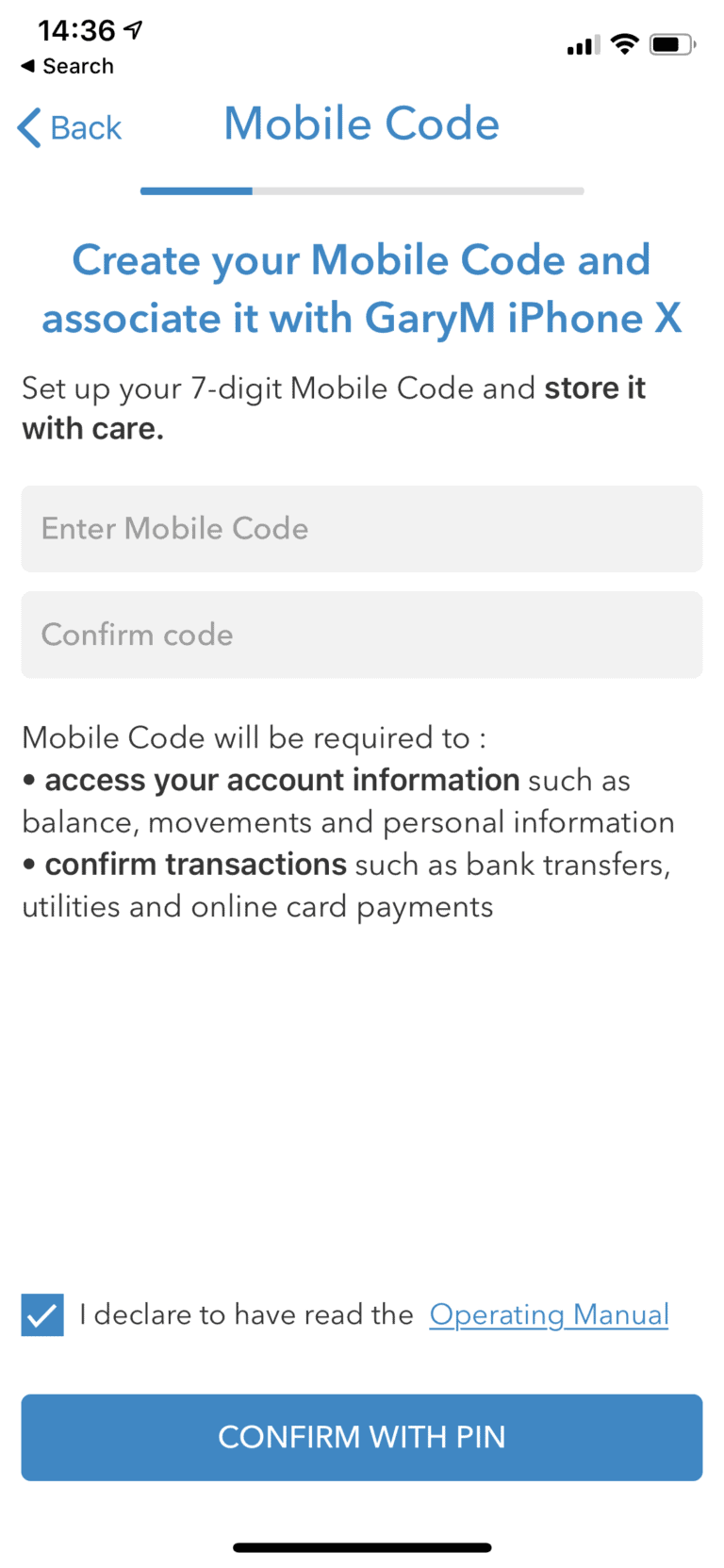

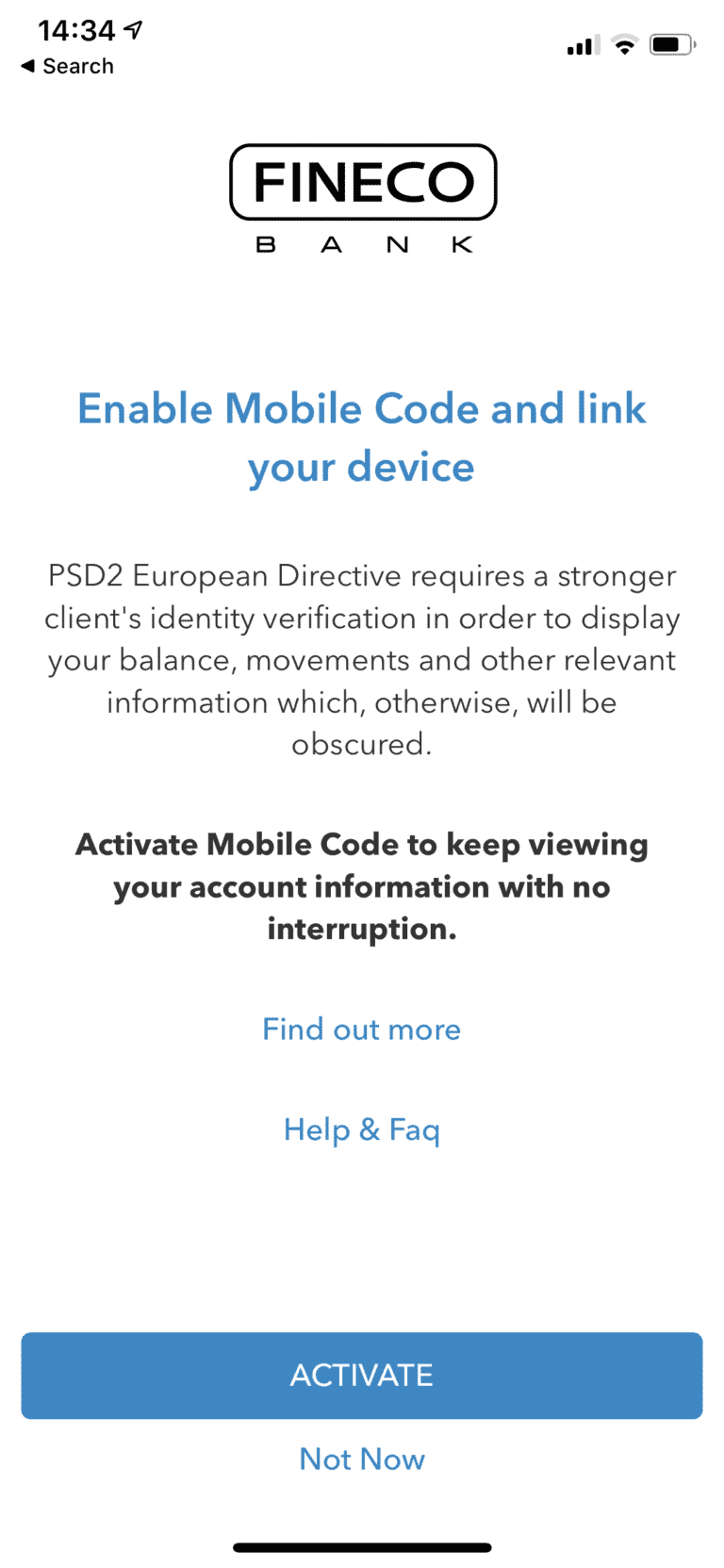

Platform security appears to be very strong, given with clients regarded to enter their client PIN whenever they want to authorise a change to their account (via the website client area). Also, your mobile device is secured with a further layer of security that links the app with an individual mobile device.

How to Use the Fineco App

Downloading the Fineco and downloading and installing the app on your phone is of course merely a matter of a quick search in the app store for your Android or Appple device and installing.

However, Fineco prevents use of the app until approval of the account and receipt by the customer of their activation code. The code should arrive within a couple of hours but the authorisation will take a couple of days, or did in my case.

The process was the most complicated and convoluted process encouterned by this reviewer of stock apps, but this is a reflection of the fact that Feneco is a bank and as such has many more regulatory hurdles to clear than say a CFD broker.

Step 1: Download and Install the Fineco AppFind Fineco Bank app in the app store and download.

Step 2: Open a Stock Trading AccountOpening a stock trading account witth Feneco requires th opening of an account with the bak. Tere isn’t a separate share dealing account – or ISA (individuals savings account) or SIPP (self-invested personal pension) accounts for that matter.

The account opening process is quite involved, as you would expect with a bank.

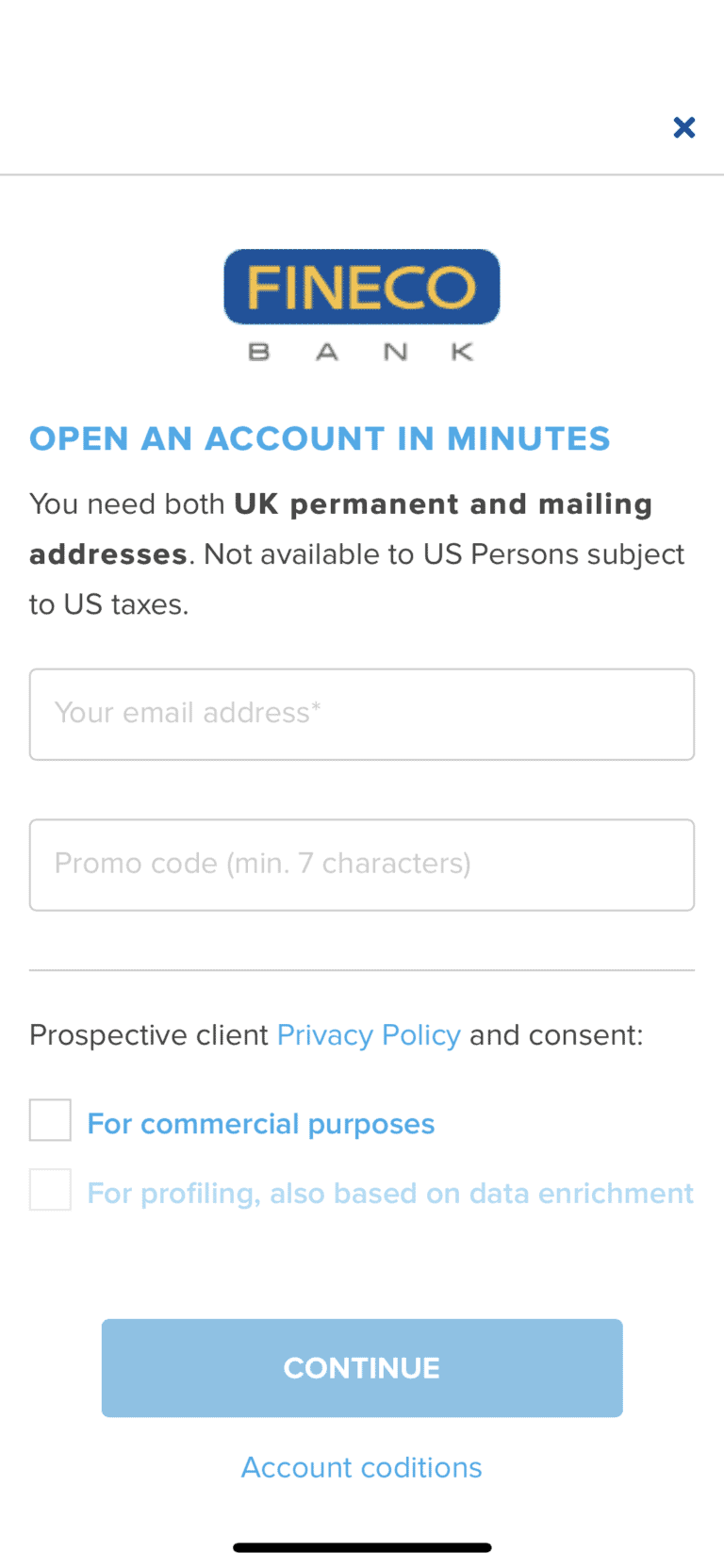

We arrive at the landing page (see below):

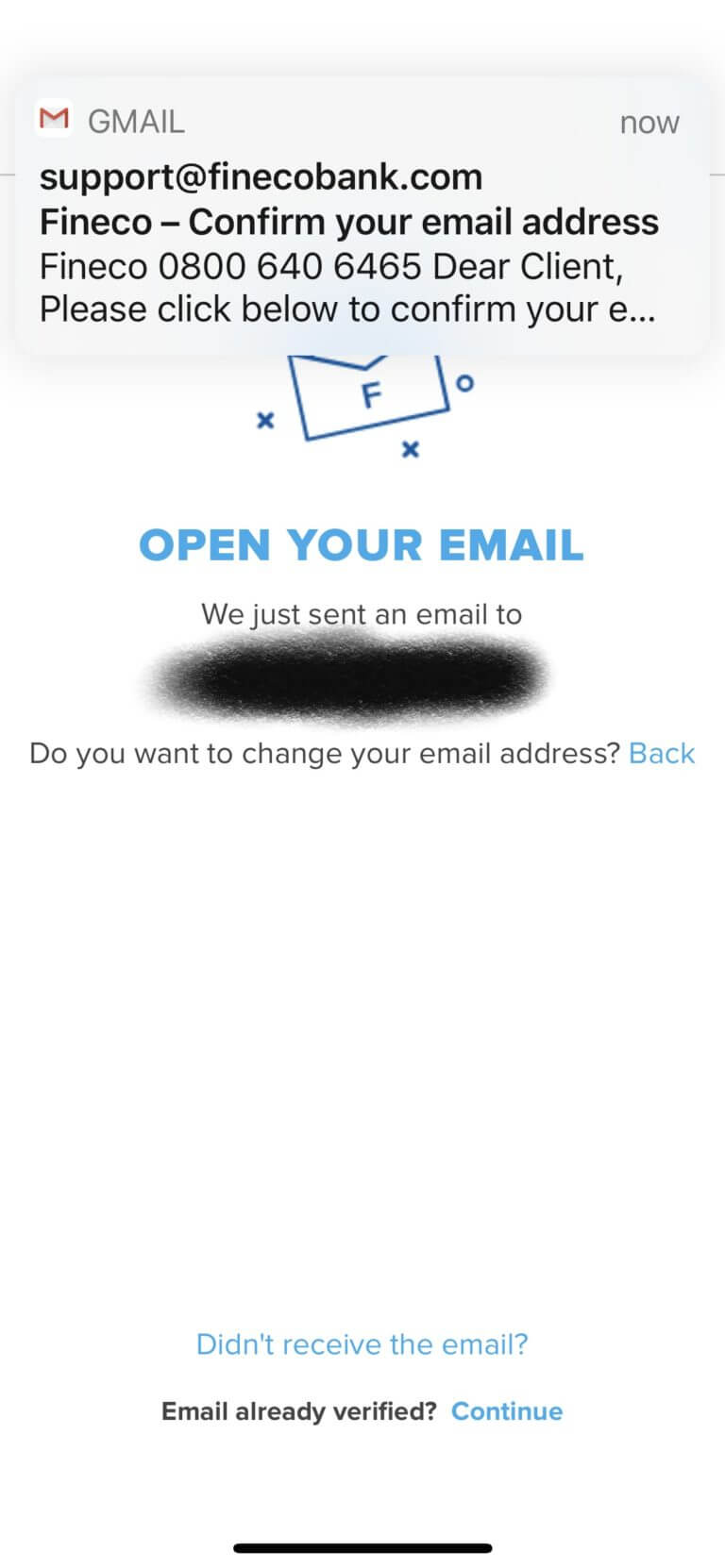

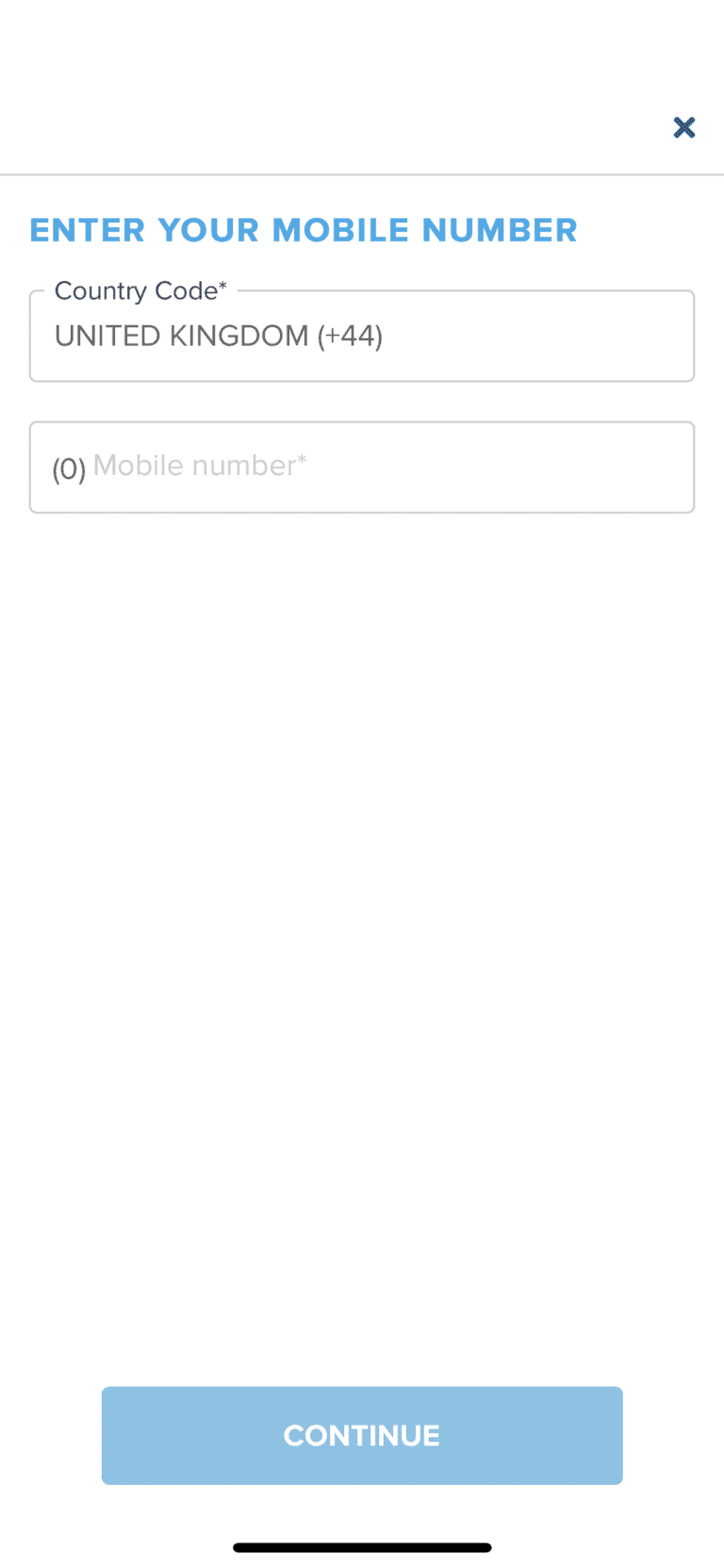

Provide your email:

Now you need to upload a photo of your passport or drivers licence. You will also need your national insurance number and provide your citizenship and address details:

Uploading the document photos was tricky. It took me three goes to get ir right. On the iOS app you are taken out of the app to a web page in the browser. The photo capture process was clunky to say the least, but persevere.

Next, there’s some more information about yourself to divulge, such as what you intend to use the account (select invest,emt/trading) for, region of business, sector of activity and a declaration concerning anti-corruption and conflict of interest regulations, eg are you are politically exposed person (politician, civil servant working with :

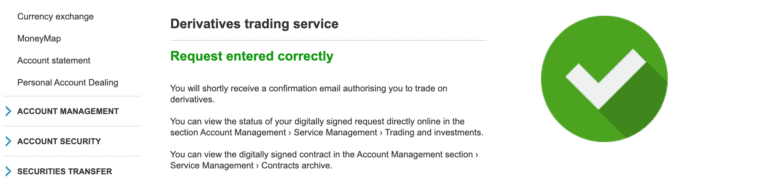

You can now select your payment service. Because you will be able to trade with derivatives products – from CFDs to futures and options. Now lots of terms agreements have to be digitally signed (phew!):

After digitally signing the documents you will be presented with a welcome screen. Turn on app push notifications. But instead of opening up on the landing page of the app, we are greeted with the following alert: “Your account will be open shortly”:

So, after completing an arduous sign-up, the new customer still does not have access to the app, not even in a demo mode.

After waiting a hour or so I reached out to Fineco to see how long it would take at their end to get the account ready. The shocking reply “two days” was the answer from the telephone support operative.

Fineco compares poorly with the competition on sign-up process, but that is balanced by the fact that you get access to a lot more markets than your standard UK retail broker offers, such as apps from platforms like eToro and the UK’s largest retail stockbroker, Hargreaves Lansdown.

Admittedly, Fineco’s Bank’s status means it is in a different regulatory category to CFD brokers and the Hargreaves of this world, so we can’t take issue there – it is the implemenation of the process itself that is the problem.

For example, the sign-up journey takes you back and forth between the app and the web browser only to lock the newly onborded out of the app at the end of the sign-up journey.

The back and forth is a result of the process not being handled natively inside the app, perhaps because of difficulties of integrating some of the bank’s legacy back office systems. Whatever the reason, the client onboarding needs to be improved.

Eventually, I was able to make progress with the sign-up when tan email came through from Fineco saying the account was ready. But in order to see anything much in the app you need to go to the website and turn on quotes for the various markets.

Stock are shown ni the app under their various indices. So if you are looking for a french share – perhaps one of the GRANOLAS we mentioned earlier, such as Sanofi.

To find Sanofi manually – go to Indices > CAC40 > select stock.

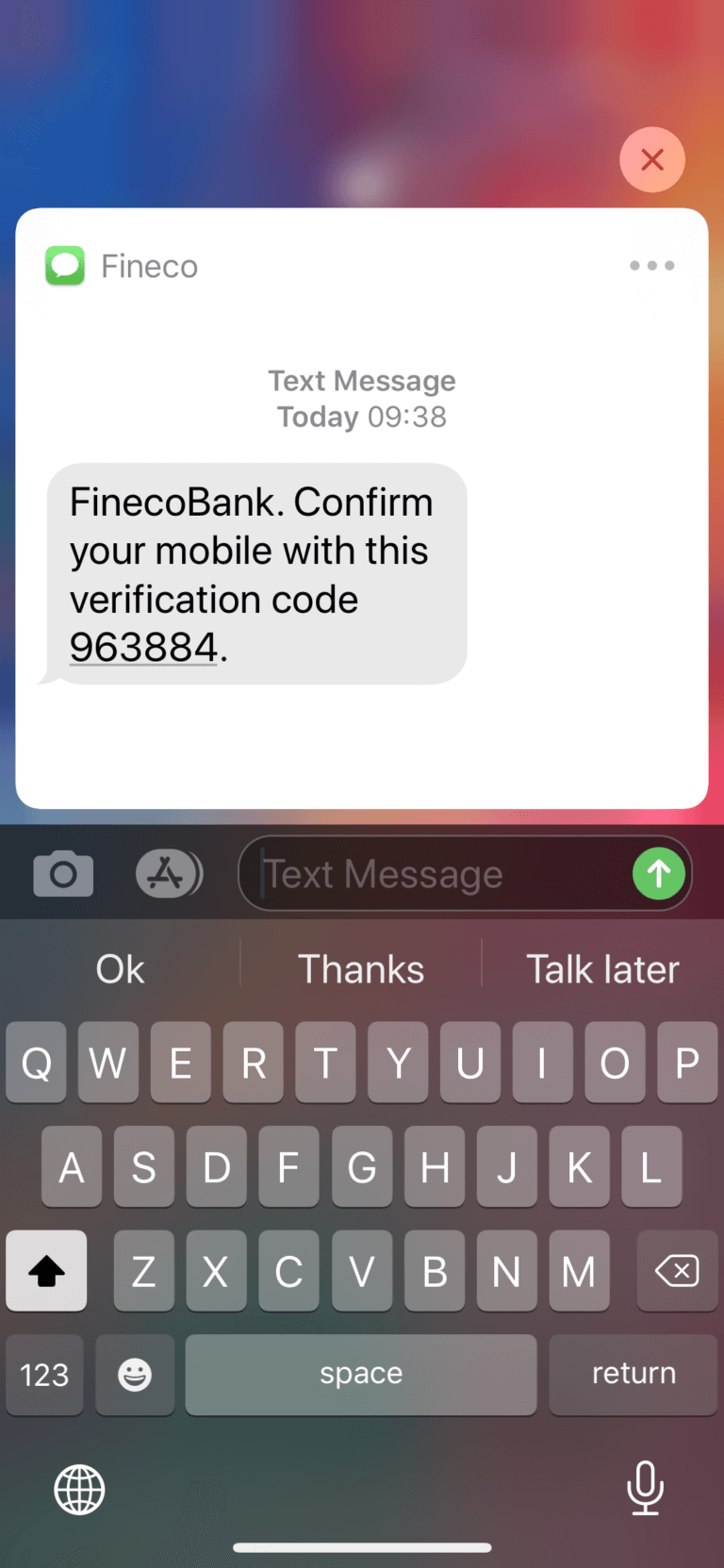

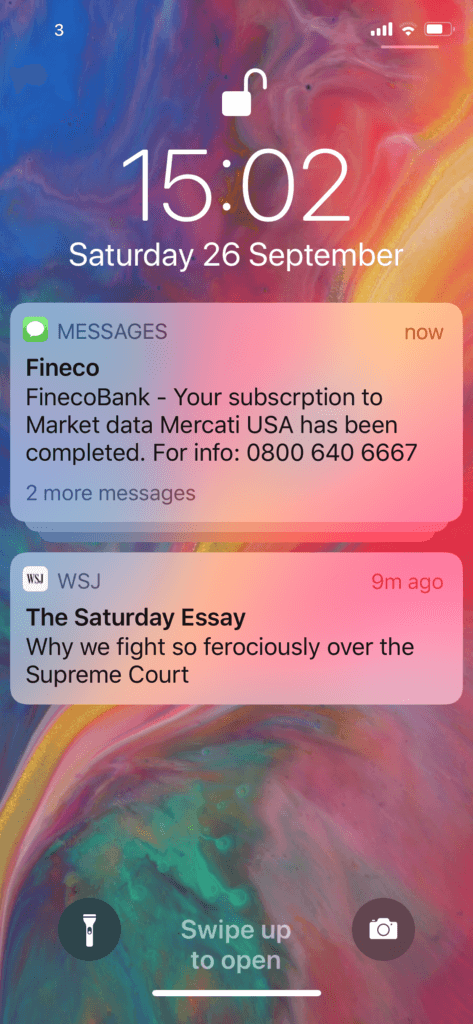

For every market you are interested in you have to tuen on quotes via the website client area. After doing so you will receive an SMS message confirming each change that you made.

Fineco requires clients to visit the client area on the website to set-up and manage many features such as the eight-number client service PIN.

A nice feature is that for every change you make to your account you will receive a text message (see screenshot above).

Step 3: Deposit FundsFunds are not deposited until the account is approved. There is no minimum deposit amount and no charges for account inactivity. Deposit is by bank transfer only.

Step 4: Trade StocksWhen you receive the email from Fineco informing you that your account is ready, you are ready to deposit funds and trade stocks and much more. Fineco has among the widest array of products from a UK online broker, be it the CFD brokers or the UK’s top two investment platforms, Hargreaves Lansdown and Interactive Investor.

How to Sell on Fineco App

Go to the portfolio page and select the stock or other instrument you want to sell. Open its dealing page and click ‘sell’. Alternatively search for a CFD or other derivative you may wish to open a sell position in and click order and then set up your deal.

Fineco Stock App Pros & Cons

Pros

- No minimum deposit amount

- Transparent and competitive pricing

- Broad product offering includes CME options and futures

- Pay 0% commission when buying CFD stocks and indices and extras

- Can choose between CFDs or buying shares and other assets directly

- No overnight custody charges on CFDs

- Because it is a bank it is even more heavily regulated than an ordinary broker

- European bank, so may be good fit depending on individual circumstances post-Brexit

- Brexit might impact current ‘passporting’ arrangements for financial products crossing European borders.

- A European bank account for trading opens up more stock options in contniental Europe.

Cons

- Convoluted sign-up process, document upload prone to fail

- Locked out of app until ‘account ready’ email arrives, which can take two days

- No referral programme

- No dedicated separate trading account. You have to open a full banking account in order to trade

- PowerDesk Mac installer doesn’t work

The Verdict

It is hard to do a fuller Fineco app review until we get sight of the activation email from Fineco Bank.

The sign-up process has its problems, but some of them arise from the nature of the regulatory burdens a bank has to contend with.

Nevertheless, from what ew can see of the app design from the app sign-up process, it needs to be improved to make the journey easier, in particular the know-your-customer (KYC) processes around document upload.

However, once you get past the sign-up, a world of multiple asset classes to trade and invest in awaits.

Options and futures are available as either CFD instruments or in the form of the actual underlying asset itself. There are not many online brokers operating in the UK retail space offering options trading on the world’s largest derivatives trading venue, the Chicago Mercantile exchnage (CME), but Fineco is one of them.

Providing you stay the course and are not put off by the sign-up hoops you have to jump through, and the wait for activation before being able to get into the app and start trading, then Fineco is attractive to those looking beyond the world of CFDs that want access to thousands of equities, funds and ETFs directly.

With Fineco you can choose between the cheaper CFD approach to trading and the traditional direct buying and selling of shares, which is not an option available with many UK online brokers, be it via website ot stock app.

The app also provides exposure to both government and corporate bonds, ETFs and funds.

Finceo Bank – Competitive Transparent Trading & Investing with Mobile Banking Built in

FAQs

Is Fineco available in the US?

No. The Fineco app is only available in Europe.What stocks does Fineco offer?

Fineco offers thousands of stocks and other financial instruments across 26 markets.Can you short-sell stocks on the Feneco app?

Yes. You can use futures and options to profit from fallling prices. CFDs are the cheapest way to short an index but are aguably riskier than options and bonds.Is Feneco regulated?

Yes, Feneco is a bank and is regulated by the UK Financial Conduct Authority and European financial authorities. You are protected from platform failure up to the value of £85,000 through the UK government's Financial Services Compensation Scheme.Is Fineco available on iOS?

Yes, the stock app is available for both iOS and Android platforms.Gary McFarlane

Gary McFarlane

Gary is financial editor and analyst at Finixio. Until July 2020 he was the cryptocurrency analyst at the UK's second-largest investment platform, Interactive Investor. He also worked for respected investment magazine Money Observer where he wrote on subjects as diverse as social trading and intellectual property protection. At Money Observer Gary initiated coverage of bitcoin in 2013. He writes widely on finance and investment and provides expert commentary to the national media. Other publications Gary has written for include The FinTech Times, City AM, Coin Desk, Ethereum World News, and InsideBitcoins.View all posts by Gary McFarlanestockapps.com has no intention that any of the information it provides is used for illegal purposes. It is your own personal responsibility to make sure that all age and other relevant requirements are adhered to before registering with a trading, investing or betting operator. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice.By continuing to use this website you agree to our terms and conditions and privacy policy.

Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers.

© stockapps.com All Rights Reserved 2024

Scroll Up