Oanda App Review 2024 – Fees, Features, Pros & Cons Revealed

Oanda was one of the first players on the scene of online forex trading in the US. Today, it’s a global trading platform with clients in more than 196 countries.

If you’re thinking about making the jump to forex trading, it’s worth taking a closer look at the Oanda app. This trading platform offers more than 70 currency pairs, boasts a top-tier mobile charting interface, and doesn’t require a minimum deposit to get started.

In this guide, we’ll cover everything you need to know about the Oanda app. We’ll take a close look at accounts, pricing, trading tools, customer service, and more so you can decide if Oanda is right for you.

-

-

What is Oanda?

Fast-forward nearly 25 years, and Oanda has licenses in the UK, Japan, Australia, and several other countries. While the platform doesn’t publicize how many users it has, its clientele spans fully 196 countries.

Oanda is also more than just a forex broker. The company keeps a database of forex prices going back more than 25 years, which can be used by traders as well as accountants, corporate auditors, and anyone else who needs exchange rate data. In addition, Oanda has one of the most widely used tools for finding spot exchange rate data.

In addition, Oanda supports a network for cross-country payments. The platform has partnered with Transferwise for individual payments, and it has its own forex network for routing payments from corporations around the world.

What Can You Trade on the Oanda App?

Our Oanda app review found that this app focuses primarily on forex trading. The platform lets you trade 71 different currency pairs, which includes all the major and minor pairs along with a wide range of exotics. Leverage varies from 8.3:1 for exotic forex pairs to up to 50:1 for major forex pairs.

The broker does have some CFDs (contracts for difference), but the selection is limited. There are currently 16 stock index CFDs, 31 commodity CFDs, and 6 bond CFDs. You cannot buy and sell individual stocks or ETFs through Oanda, although the stock indices span a wide range of countries.

Oanda App Account Types

Oanda offers two account types, Standard and Premium. The two accounts are essentially the same, except that Premium users get a dedicated account manager. Both accounts are free, but upgrading to a Premium account requires a minimum balance of $20,000. There is no minimum account balance to open a Standard trading account.

One of the nice things about Oanda is that inside your main account, you can have up to 19 different subaccounts. Each subaccount can have it’s own base currency, so you can trade with USD in one account and GBP or EUR in another. You can also use the subaccounts to manage different portfolios.

Oanda Fees & Commissions

Oanda has two different pricing models for forex trading. If you choose spread-only pricing, there is no commission for trading. Spreads are slightly above market average, with minimum spreads for major pairs hovering around 1.4 pips (0.014%). Minor pairs come with spreads of 2-3 pips.

If you choose Oanda’s Core Pricing model, you pay reduced spreads for forex trades but also a fixed commission on every trade. Spreads for major forex pairs can be as low as 0.3 pips and spreads for minor pairs are between 1-2 pips. The per-trade commission is $50 per million units traded.

For commodity and index CFDs, all trades are commission-free and only available at a single spread rate. Spreads for commodity CFD range from 1-3 pips, which is competitive with other CFD brokers.

Non-trading Fees

Our Oanda review found that the app doesn’t charge any fees for opening an account and there are relatively few non-trading fees across the platform. The broker does have an inactivity fee of $10 per month, but it only kicks in after two full years without placing a trade. Oanda also charges fees if you make a withdrawal by wire transfer, but it’s free to withdraw funds to a debit card.

Oanda App User Experience

Oanda’s investment app adapts its proprietary fxTrade trading platform for Android and iOS. The mobile stock app is a little bit confusing at first because it attempts to adapt the web and desktop interfaces to a smaller screen without making many changes. On the bright side, this does make it easier to switch back and forth between the desktop and mobile versions of the Oanda trading platform.

The default layout puts a chart front and center on the screen, and most of your settings and research tools are hidden in a series of menus on the left. While we didn’t love this setup, this layout can be useful for rapidly trading on the go. We found that the mobile app enables you to pull up an order form alongside the technical charts so that you can place an order without taking your eye off of the relevant price data.

Another thing we liked about the Oanda mobile app is that you can easily monitor the forex market. You can create a list of individual currencies to watch, which clearly displays the gain or loss for the day along with the current spread. Adding or removing currencies to or from your watchlist is also simple – just view the list of all forex pairs available through Oanda and tap the ones you want to monitor.

Speed has been an issue for the Oanda mobile app in the past, but we didn’t experience any problems when trading with the app on Android. The company rolled out a completely revamped version of the app in 2019, so it seems likely that it has spent the past year fixing minor bugs that could have slowed down price data.

Oanda Trading Tools and Features

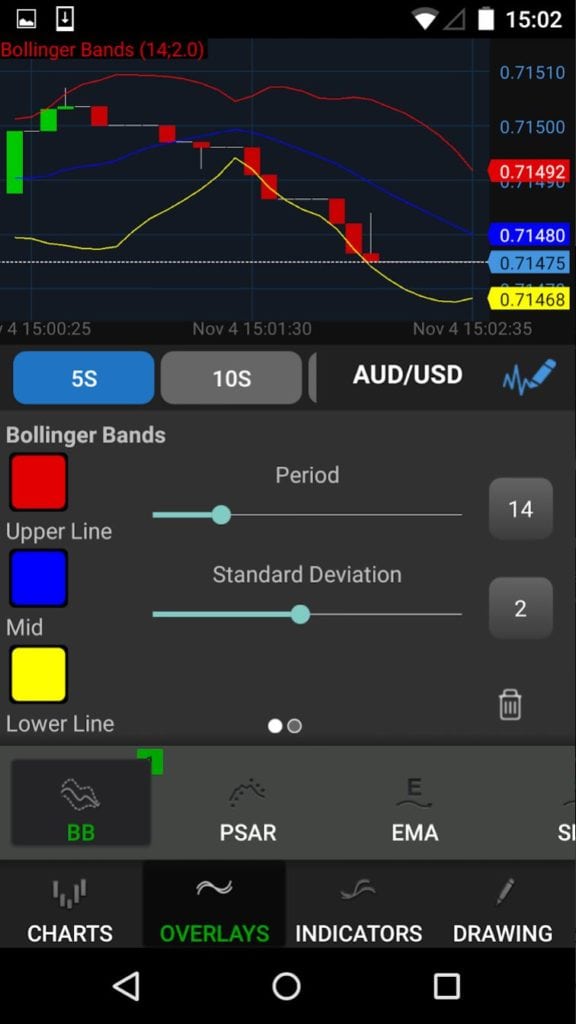

The Oanda app centers around technical charting and trading. Charts are almost constantly on your mobile screen, with all other menus seemingly appearing over edges of the chart as you access features on the app.

Overall, we were very impressed with the Oanda app’s charting interface. It has more than 30 technical indicators built in, along with a huge variety of drawing tools. All overlays and studies are accessed from a separate menu on the bottom of the screen, and a menu pops up so that you can easily customize settings for any indicator. Changing the time interval of your chart is easy, too, thanks to a series of buttons at the bottom of the screen that range from five seconds to one day.

The drawing tools in particularly are impressive for a mobile trading app. You can easily add not just trendlines, but also Fibonacci retracements, arcs, and pivot points.

The only additional feature we’d like to see here is syncing with custom indicators built using the desktop or web interface. The Oanda mobile app doesn’t do this, so your ability to monitor complex trading strategies on your smartphone is limited. If you do need custom indicators on your mobile device, the best solution is to switch from Oanda’s fxTrade app to the MetaTrader 4 app (with which Oanda is compatible).

Perhaps the best thing about the Oanda mobile app is that you can trade right from the technical charts. Tapping an ever-present price box brings up a new order form without obscuring the chart.

Even better, the mobile app offers the ability to set stop loss and take-profit levels simply by clicking on the chart. Of course, this can be somewhat tricky if you’re on a smartphone rather than a tablet.

Once you have open positions or orders, you can monitor them at any time through the order form menu. There are separate tabs for current positions, active orders, and historical orders so that it’s easy to keep track of your trades.

Oanda Currency Converter

Oanda offers a currency converter and calculation tool that produces foreign exchange rates compiled from leading market data contributors. It’s rates are trusted and used by many organizations, such as tax authorities and auditing firms.

There’s also Oanda’s historical currency converter. This has 25 years worth of historical FX data across 38,000 currency pairs, which makes Oanda one of the leading sources of this kind of information.

Oanda App Education, Research and Analysis

Our Oanda app review found that it offers a handful of features for education and market analysis. However, many of these features are not available through the mobile app.

To start, the broker offers a wide range of webinars that can help you get a grip on current market conditions. These webinars are often available in multiple languages, and you can always access recorded versions of past webinars if you want to dive into a full library of educational resources. The catch is that these videos are only available through Oanda’s web interface, not through the mobile app.

Similarly, Oanda’s demo trading account is available online, but not through the platform’s mobile app. As a result, the mobile app is primarily suitable for live trading by more experienced forex and CFD traders. It’s not a hub for education, even though Oanda has plenty of education resources.

For market research, Oanda’s platform includes tools like an economic calendar and news feed. Both of these are available through the mobile app, although the news feed can be hard to navigate on mobile since it’s rather crowded.

The problem is that Oanda leaves many of its best research and analysis tools for the web platform. The trading software offers a volatility graph, correlation analysis, and a currency strength heatmap, but none of these are available on mobile. The broker’s analysts also offer daily commentary on market-moving news, but this isn’t generally included in the mobile news feed. Instead, you need to head to Oanda’s website to get this commentary.

On the whole, there’s a lot of room for improvement in the Oanda mobile app in terms of what education and research features are included. Oanda already offers these features through its web and desktop interfaces – it’s just a matter of adding them to the mobile app.

Oanda App Bonus

Oanda doesn’t offer any sign-up bonuses to attract new traders to the app. This is partly because it has a strong reputation and excellent trading tools. The broker simply doesn’t need to sweeten the deal to attract new traders.

Oanda Demo Account

Oanda offers a demo trading account, but unfortunately it’s not available through the mobile app. You can access Oanda’s web interface through your smartphone, but the experience is far from seamless. This is somewhat disappointing, since it means you have to trade live in order to use the Oanda app.

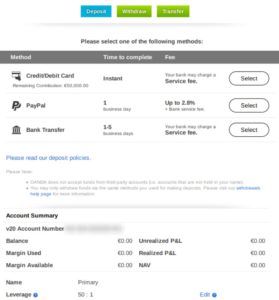

Payments on the Oanda App

The payment methods you can use to fund your Oanda account will depend on what country you’re in. US users can make payments by debit card (Visa and Mastercard), wire transfer, bank transfer, and check, but not using an e-wallet or credit card. Meanwhile, UK and European users can pay by debit or credit card, PayPal, or bank transfer. Australian users can pay by debit or credit card and bank transfer, but not PayPal.

Importantly, making a deposit from the mobile app is easy. You can link your card, bank account, or PayPal account during your first transfer so that future deposits and withdrawals are seamless.

If you want to withdraw money, your options are limited to funding your debit card or conducting a wire transfer. Debit card withdrawals are free up to one per month, while wire transfers cost $20 each.

Oanda Minimum Deposit

You’re not required to deposit funds to open a new Oanda account, which makes trying out this broker relatively risk-free. There also isn’t a minimum amount that you’re forced to deposit when you do go to fund your account.

Oanda Contact and Customer Service

Our Oanda review found that this stock app offers customer service 24 hours a day 5 days a week – basically, the same hours as the forex market.

The easiest way to get in touch with the company is through live chat, which is available online and through the Oanda mobile app. The downside is that you have to deal with a virtual assistant first, so it can take a few minutes to get a human representative on the other end of the chat.

You can also reach Oanda by phone or email. Email responses can take several days, so we recommend calling or trying the live chat for most pressing support questions.

Is the Oanda App Safe?

Oanda has been around for nearly 25 years and is regulated by numerous top-tier financial authorities. Those include the UK’s Financial Conduct Authority, Australia’s Securities and Investment Commission, and the US’s National Futures Association. The company also issues some public financial statements in the US, although it isn’t traded publicly on any stock exchange.

In the UK and Canada, investors are further protected with account guarantees in case Oanda ever goes out of business. US traders will want to note that forex trading accounts with Oanda are not covered by SIPC insurance like stock trading accounts.

Another assurance that Oanda is relatively safe come in the form of negative balance protection for all accounts. This ensures that when trading with leverage, you can never lose more money than you have deposited in your account.

How to Use the Oanda App

Want to get started trading with the Oanda app? We’ll walk you through the process to set up an Oanda account and start trading forex or CFDs.

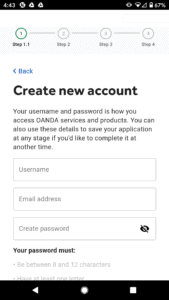

Step 1: Download and Install the Oanda AppThe Oanda app is available through the Google Play Store or Apple App Store. Whether you’re looking for the Android Oanda app or the iPhone Oanda app, just open the app store and search ‘Oanda fxTrade.’

Hit ‘Install’ and the app will be loaded onto your phone automatically.

Step 2: Open a Trading AccountWith the Oanda app installed, open it up and create a new trading account. The process differs slightly based on what country you’re in. But all new accounts will require a username and password along with personal details like your name, email address, and birthdate.

In the US, you’ll need to verify your identity by providing an address and social security number. In the UK and Europe, you can verify your identity by providing a photo of your driver’s license or passport and a photo of a recent utility bill.

Step 3: Deposit FundsYou’re not required to make a deposit when you first open an Oanda account, but you’ll need to fund your account before you can start trading. Click on the profile button in the upper left and then select ‘Deposit Funds’ to initiate a transfer.

Step 4: Place Your First TradeNow you’re ready to place your first trade with the Oanda app. Select from one of the available price quotes to open a chart for that currency pair. Then click ‘New Trade’ to open an order form.

You can choose whether to buy or sell the currency pair, as well as set stop loss or take profit prices if desired. The Oanda app also lets you select a trailing stop for more flexible trades. When you’re ready, hit ‘Submit Order’ to complete your trade.

How to Sell on Oanda App

Selling your open positions with the Oanda app is simple. Open up your account page to view existing trades, and tap on the position you’d like to sell. Oanda will open another order form that is pre-filled with the parameters for your sale. All you have to do is tap ‘Submit Order’ to sell your position.

Oanda App Pros & Cons

Pros

- Trade directly from the charting interface

- Offers trading for more than 70 forex pairs

- Leverage up to 50:1

- Two pricing options available

- No minimum deposit required

- Very advanced mobile charting tools

- 24/5 customer service

Cons

- No stock trades and few CFDs

- Demo account doesn’t work on mobile

- Few education features on the mobile app

- Mobile interface is crowded

The Verdict

The Oanda app is an excellent mobile trading platform for forex traders. You get commission-free or low-spread trading on more than 70 currency pairs, along with low-cost CFD trading on stock indices and commodities. However, it’s important to note that Oanda doesn’t offer any stock or ETF CFDs, and its range of CFDs overall is smaller even than what many competing forex broker offer.

While the Oanda mobile app isn’t perfect, we love the powerful charting and trading interface that it’s built around. The app makes it incredibly easy to place trades without taking your eyes off of price data, which can be a significant advantage on fast-moving market days.

Overall, Oanda is a good choice for forex traders in need of a mobile trading solution.

FAQs

Is Oanda available in the US?

Yes, Oanda is available in the US as well as in nearly 200 other countries around the world.Can you buy stocks with Oanda?

Oanda doesn’t offer stock or ETF trading. However, you can trade 16 stock index CFDs that represent major country-specific stock markets.Is there a minimum deposit to open an Oanda account?

Oanda doesn’t require any minimum deposit to open a new trading account.Does Oanda offer demo trading accounts?

Our Oanda app review found that it offers a demo trading account for free. However, demo trading is only available for web and desktop, not for mobile.What base currencies does Oanda support?

You can fund your Oanda account with USD, GBP, EUR, AUD, CHF, CAD, HKD, JPY, and SGD. Notably, you can open multiple subaccounts within your Oanda account and fund each with a different base currency.Michael Graw

Michael Graw

Michael Graw is a freelance finance and trading journalist based in Bellingham, Washington. Michael’s expert trading guides and investment analysis articles have featured in many leading publications, such as TechRadar, Tom’s Guide, LearnBonds, and BuyShares.View all posts by Michael Grawstockapps.com has no intention that any of the information it provides is used for illegal purposes. It is your own personal responsibility to make sure that all age and other relevant requirements are adhered to before registering with a trading, investing or betting operator. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice.By continuing to use this website you agree to our terms and conditions and privacy policy.

Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers.

© stockapps.com All Rights Reserved 2024

Scroll Up