Best Stock Trading App Canada – Top App Revealed

Based in Canada and thinking about trading stocks online? If so, it’s also worth obtaining a top-rated stock app that will allow you to buy and sell shares on the move.

In doing so, you can check the value of your portfolio at the click of the button – as well as place last minute buy and sell orders.

But, with so many stock apps now available to Canadians, which one should you choose?

In this guide, we reveal the Best Stock Trading App in Canada. On top of reviewing the best providers, we also walk you through the process of getting started with a stock app today!

Best Stock Trading App in Canada

Below you’ll find the five Canadian stock trading apps that made the cut. Scroll down for an in-depth review of each provider.

- AvaTrade – Best All-Round Stock Trading App in Canada

- Oanda – Best Trading App in Canada for Stock Market Indices

- Interactive Brokers – Best Stock App in Canada for Experienced Traders

- Forex.com – Canada Trading App With Over 4,500 Stocks

- CMC Markets – Best Canada Stock App for Technical Analysis

There are dozens of stock app providers offering trading services to Canadians these days. This can make it difficult to know which application to go with. For example, you need to consider everything from fees and tradable stocks to payments and regulation.

To help clear the mist, below you will find a selection of the best stocks app in Canada right now.

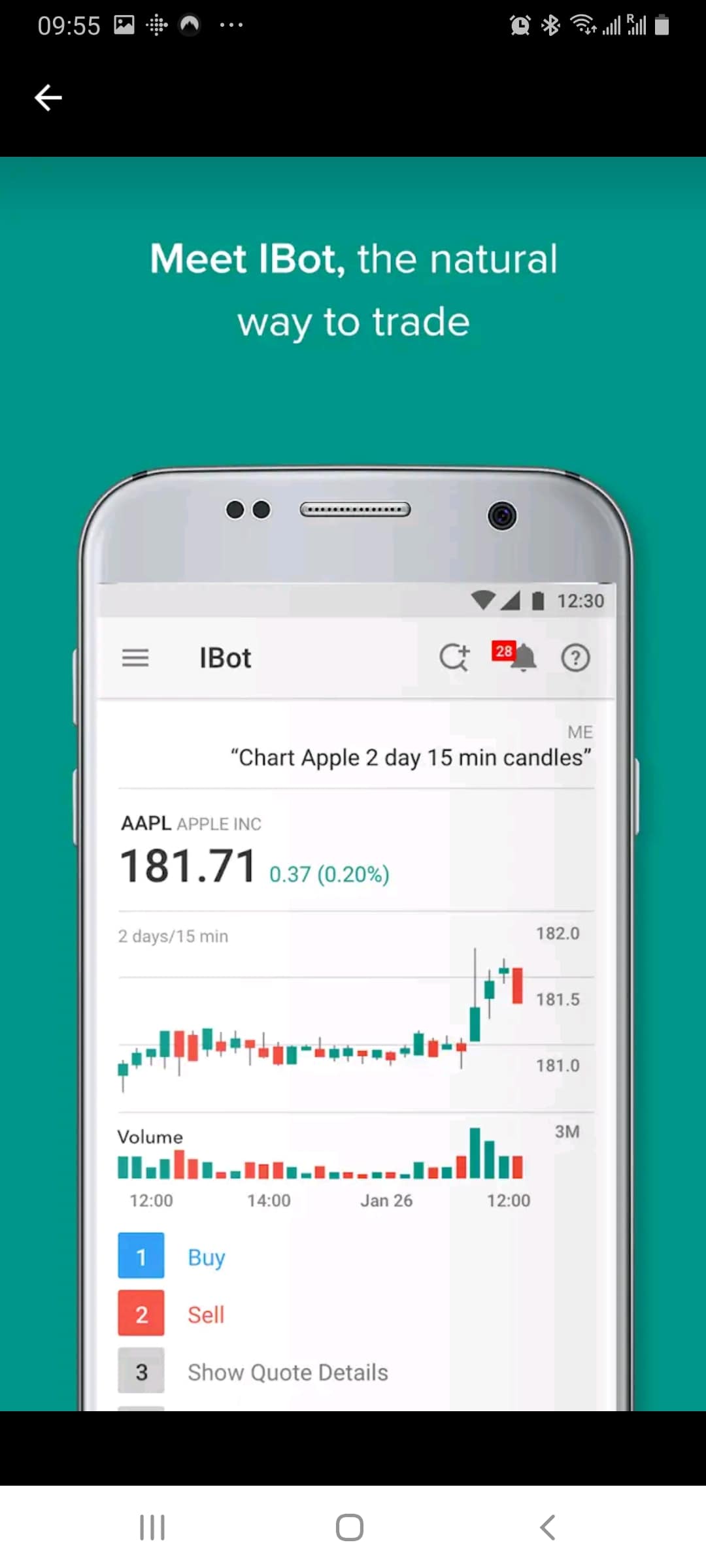

1. AvaTrade – Overall Best Stock Trading App in Canada

If you’re looking for the best all-around stock app in Canada, look no further than AvaTrade. First and foremost, AvaTrade has been active in the online and mobile trading scene since 2006.

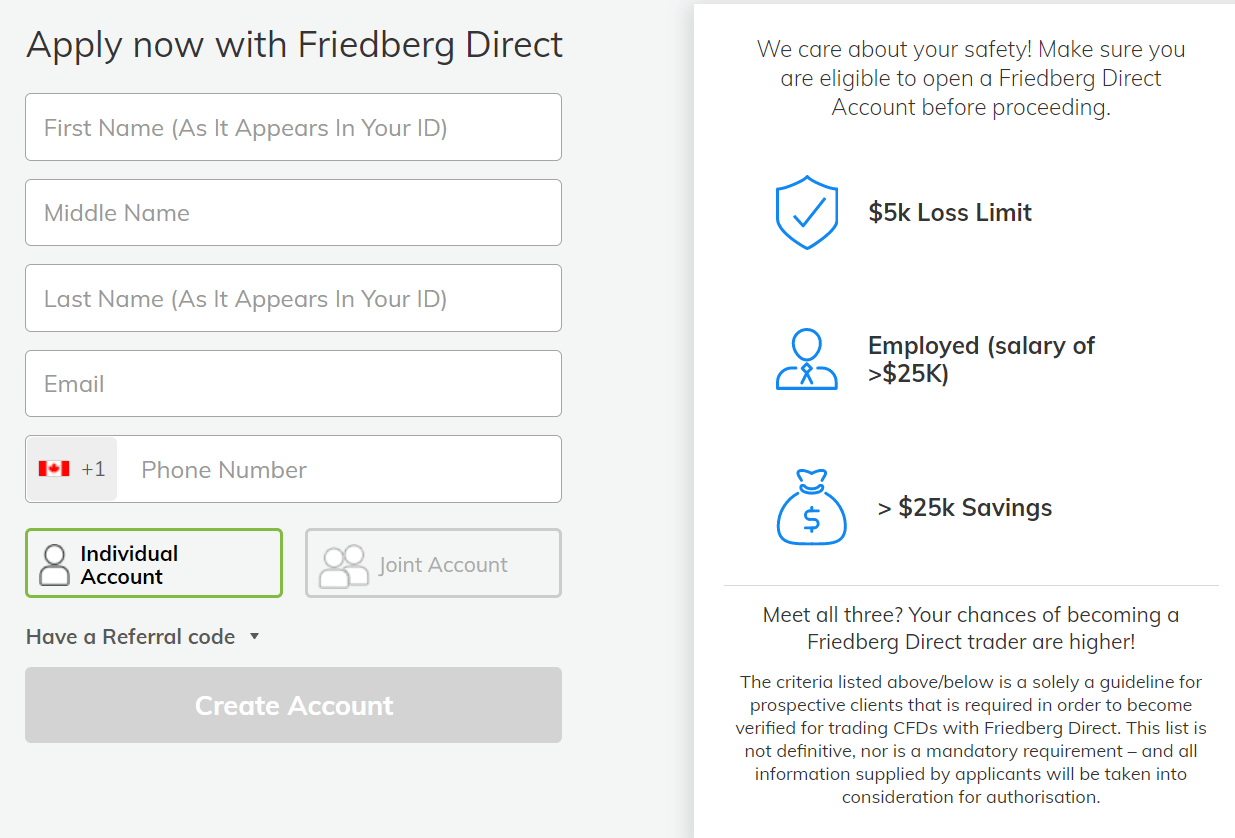

All Canadian stock trading accounts are held by Friedberg Direct – meaning that you will be covered by the Industry Regulatory Organization of Canada (IIROC) and the Canadian Investor Protection Fund (CIPF).

This ensures that you are able to trade stocks in a safe and secure manner. In terms of what you can trade on the app, AvaTrade offers thousands of CFD instruments. This covers forex, indices, commodities, cryptocurrencies, and of course – stocks.

Most of the focus in the stock trading department is on the NYSE and NASDAQ. This means that you can trade heavyweight companies like Facebook, Netflix, Tesla, and Apple. AvaTrade is particularly popular with Canadians as you can trade stock CFDs without paying any commission.

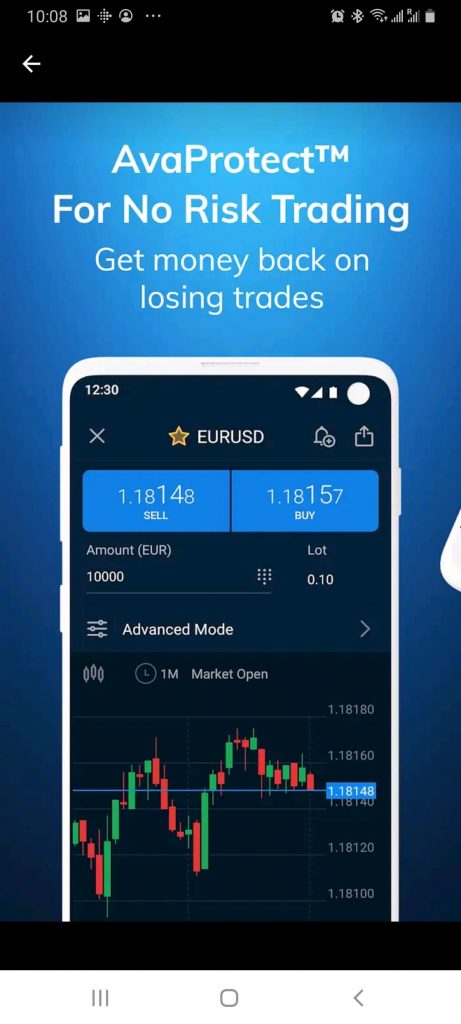

Instead, all fees are built into the spread. As you are trading CFD instruments, this also means that you will have access to leverage and short-selling facilities. The AvaTradeGO app is available on both iOS and Android devices. You might also consider the MT4/5 mobile app – which you link up to your AvaTrade account.

Either way, AvaTrade requires a very modest minimum deposit of just $100. It takes just minutes to open an account and you can add funds with a Canadian debit/credit card to benefit from an instant deposit. Alternatively, you can also transfer funds from your bank account.

- Thousands of financial instruments supported

- Super-tight spreads on forex pairs

- Several trading platforms – including MetaTrader 4 and 5

- Regulated in several jurisdictions

- Great for news and market insights

- Low account minimums

- Best suited for more experienced traders

There is no guarantee you will make money with this provider.

2. Oanda- Best Stock App in Canada for Stock Market Indices

Oanda is one of the most established trading sites in the online space. Launched way back in 1996, the broker is now active in over 196 countries. Although Oanda is based in the US, it is super popular with Canadian traders.

This is evident by the fact that the platform is licensed by the IIROC – so you can trade safe in the knowledge that you are using a regulated app. Much like AvaTrade, you will be trading CFDs at Oanda.

Once again, this is beneficial because you will be able to choose from a buy and sell position on each trade, as well as apply leverage. In terms of tradable markets, we should note that Oanda doesn’t offer individual stocks. On the contrary, you will be trading indices.

This means that you will be looking to speculate on the future value of wider markets like the Dow Jones, FTSE 100, and NASDAQ 100. On the flip side, these indices benefit from heaps of liquidity and are relatively low in volatility. On top of indices, you can also trade over 70 pairs on the Oanda app.

The mobile application itself is very user-friendly and can be downloaded on iOS and Android devices. When it comes to trading fees, the Oanda app offers two different plans. One account type allows you to trade commission-free, albeit, with slightly higher spreads. This is beneficial for low-level traders.

If you opt for the other account type, you will pay a small commission but benefit from much tighter spreads. This is ideal if you tend to trade larger volumes. We like the fact that there is no minimum deposit on the Oanda trading app and you can fund your account with a debit/credit card or bank transfer.

- Regulated by the IIROC

- Established in 1996

- Commission-free trading plans available

- Competitive spreads

- Mobile app available on both Android and iOS

- No minimum deposit

- Does not allow you to trade individual stocks

There is no guarantee you will make money with this provider.

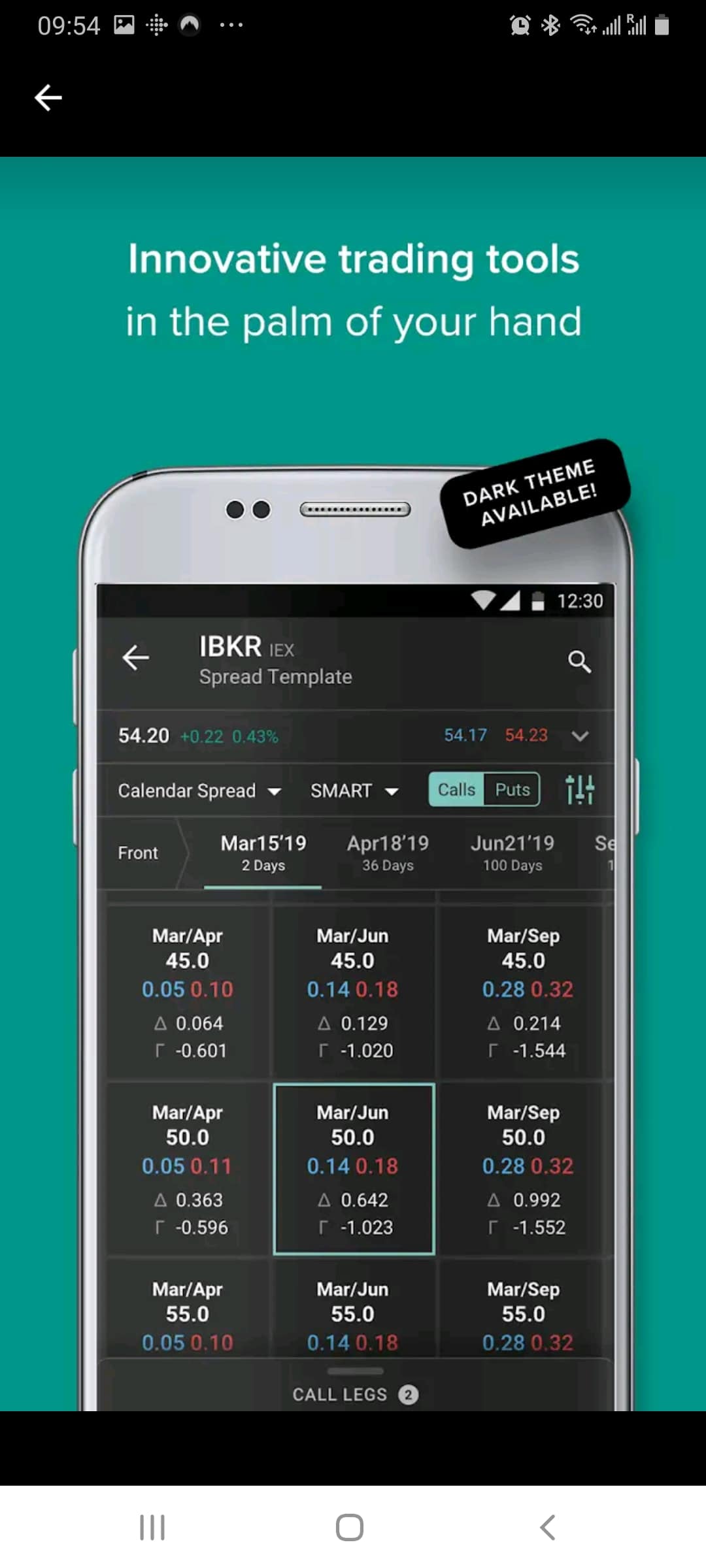

3. Interactive Brokers – Best Stock App in Canada for Experienced Traders

Interactive Brokers is a major brokerage firm that was first founded in 1978. This trading platform is regulated in several jurisdictions -including Canada, the US, UK, Australia, and Japan.

In terms of tradable markets, the Interactive Brokers app offers virtually every type of financial instrument imaginable. This covers stocks, forex, ETFs, bonds, options, futures, and more.

What we really like about this Canada stock app is that you can choose from traditional equities or CFDs. If opting for the former, you can buy and sell stocks from dozens of domestic and international exchanges. If you like the sound of stock CFDs, then again, you’ll have access to leverage and short-selling capabilities.

When it comes to fees, the Interactive Brokers app offers very competitive commissions. For example, you can trade traditional equities from just $0.005 per share. This comes with a minimum of $1 and a maximum of 1% of the trade value.

There are higher-tier plans available too, which gives you access to even lower stock trading fees. We should note that Interactive Brokers is best suited for experienced Canadian traders. This is because the platform comes with a significant number of tools and features which at times – can seem somewhat overwhelming.

On the flip side, the stock trading app is actually a lot more user-friendly than the online platform. In terms of getting started, the KYC process at Interactive Brokers is a bit slow, often taking a couple of days. Once you are set up, there is no minimum deposit in place. Only bank transfers are supported – so no debit/credit cards.

- Huge library of traditional stocks

- Dozens of exchanges and markets covered

- CFD instruments also supported

- No minimum deposit

- Low fees starting from $0.005 per share

- More suitable for experienced investors and traders

- No debit/credit cards – bank transfers only

There is no guarantee you will make money with this provider.

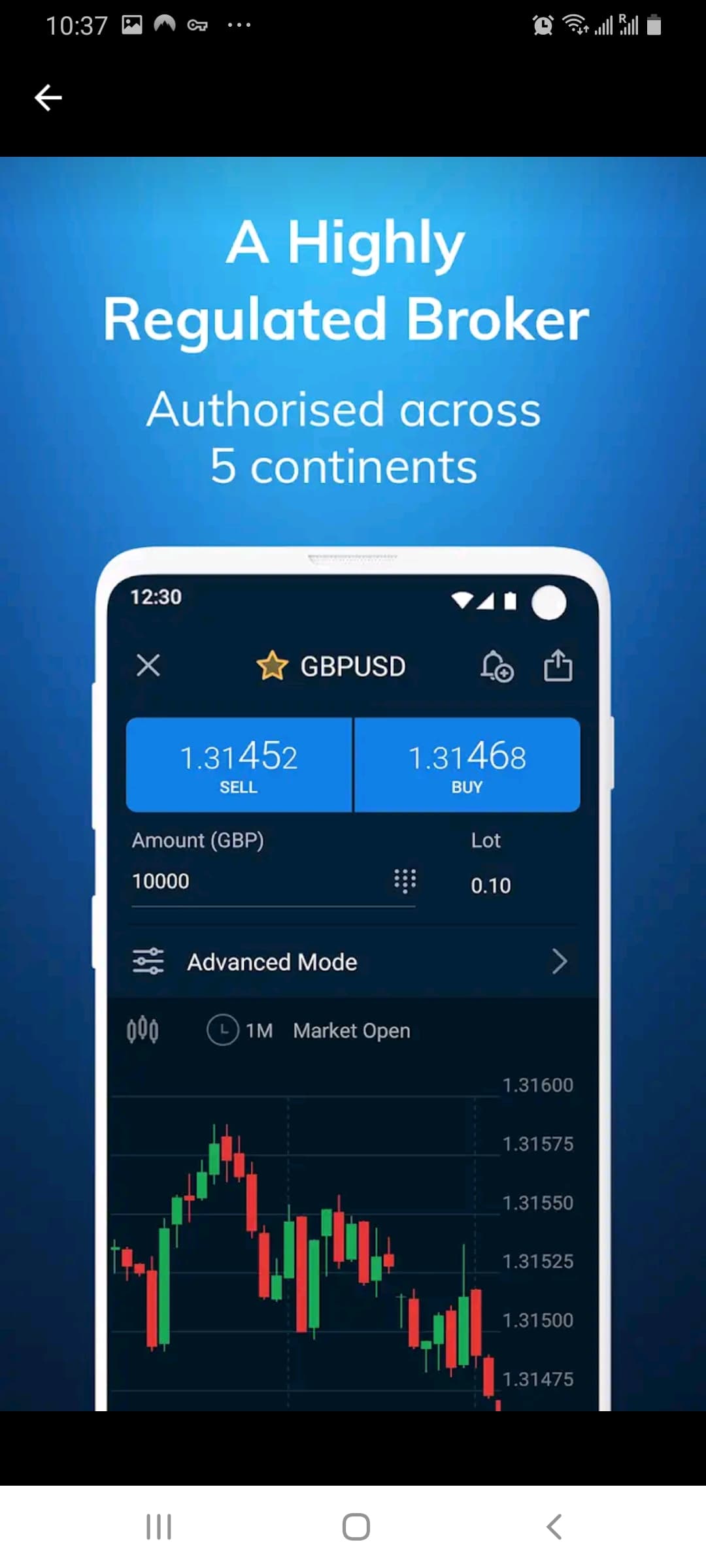

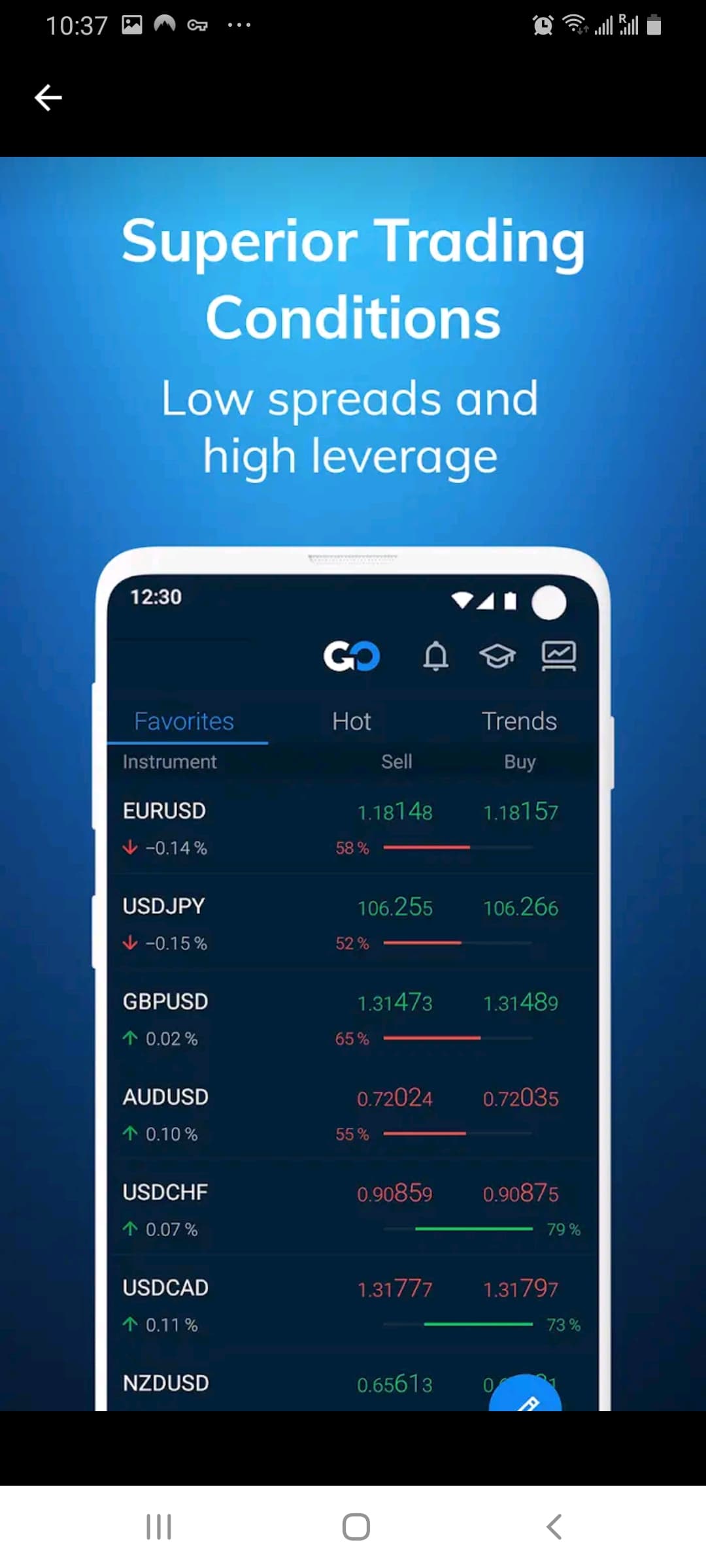

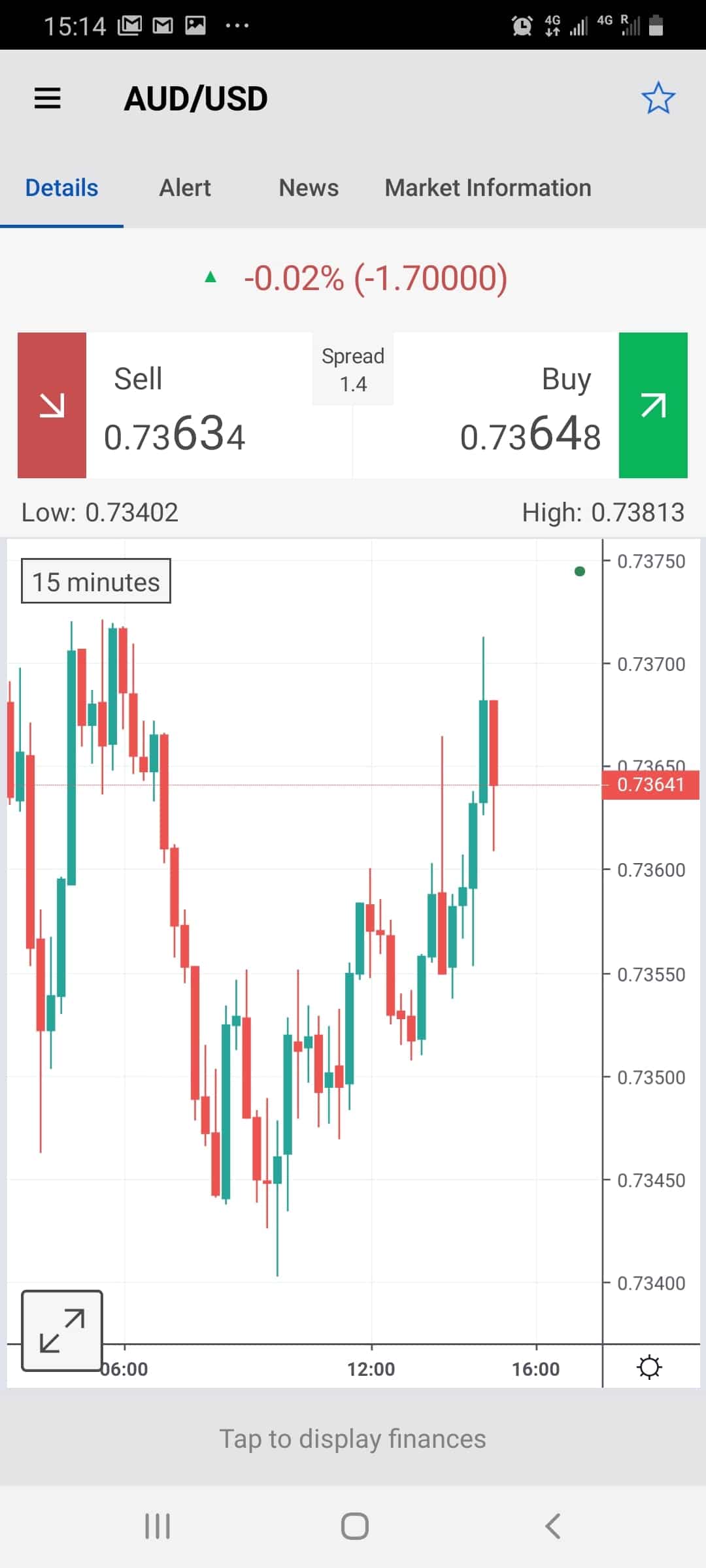

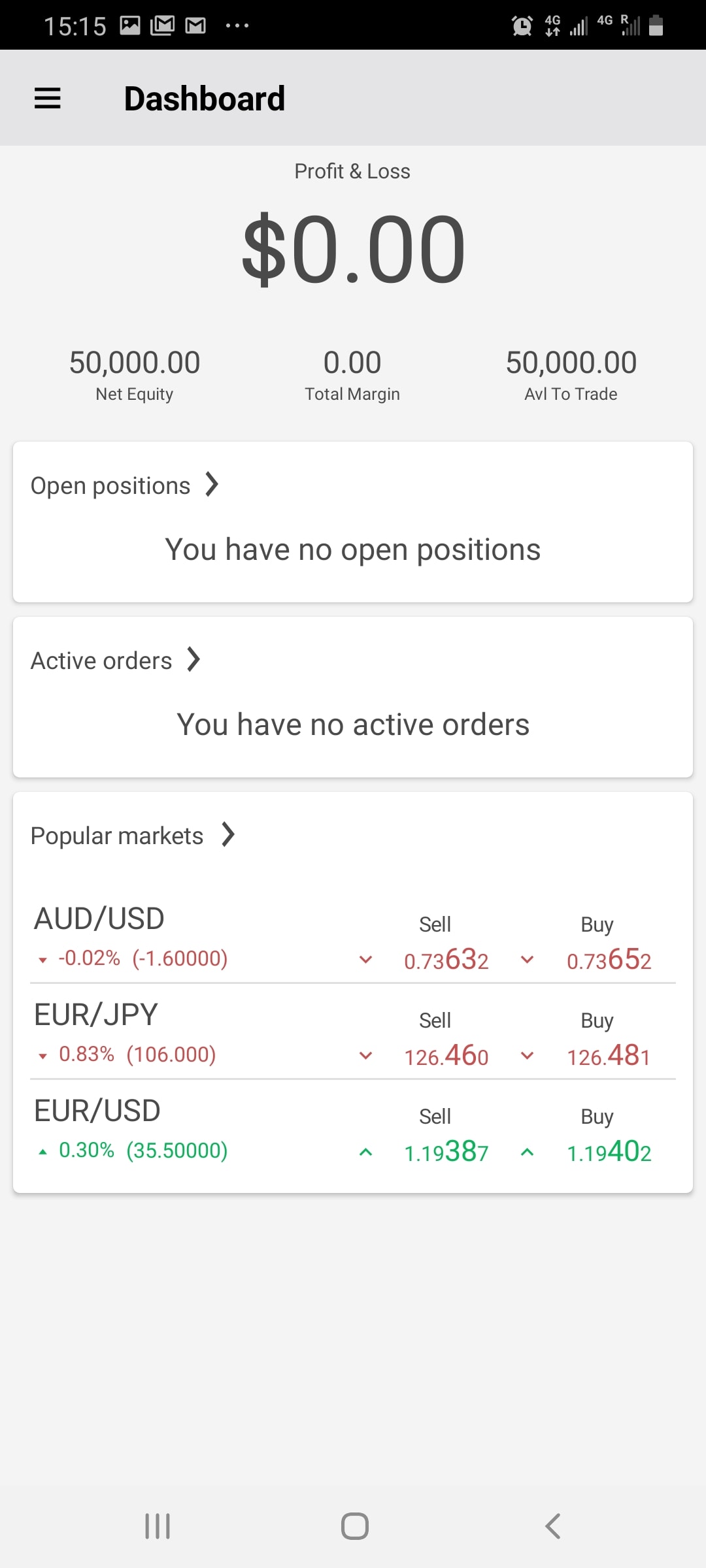

4. Forex.com – Canada Trading App With Over 4,500 Stocks

Although Forex.com is a major player in the online currency trading scene – it is also strong in other asset classes. In particular, this trading app offers over 4,500 stocks that you can trade at the click of a button.

While this covers popular stocks like Uber, Nvidia, Amazon, and Worldpay – you can also trade heaps of less liquid companies. This allows you to diversify across several marketplaces – subsequently ensuring that there is always a trading opportunity on the horizon.

In terms of fees, Forex.com allows you to trade stocks from just 1.8 cents per share. This is very competitive, especially when you consider the tight spreads on offer. Both leverage and short-selling are available, and you have several trading platforms to choose from.

For example, if you’re looking for a user-friendly experience, then you can download the native Forex.com stock app. This is easy to use and compatible with both iOS and Android devices. Or, you might decide to trade stocks on your phone vis MT5. This offers much more in the way of technical indicators and research tools.

This also permits automated stock trading robots – meaning that you can buy and sell shares without needing to lift a finger. The Forex.com app is also great for educational resources – with lots of guides and trading explainers on offer.

In terms of getting started, there is no minimum deposit at Forex.com when opting for a bank wire. You can also deposit funds with a debit/credit card or Paypal, but this requires a minimum of $100. Finally, we should note that Forex.com is heavily regulated – with licenses in several jurisdictions.

- Specialist forex trading app

- Access to dozens of currency pairs

- Particularly strong when it comes to exotic currencies

- No minimum deposit when opting for a bank wire

- Also offers CFDs

- Heavily regulated – including US licenses

- Top-notch forex and economic news

- Does not support e-wallets like Paypal and Skrill

80% of retail investors lose money trading CFDs at this site.

5. CMC Markets – Best Stock Trading App Canada for Technical Analysis

On the one hand, performing technical analysis on a small mobile screen can be challenging. This is why most traders will research stock price action on a desktop device.

With that said, CMC Markets is the best stock app in Canada if you also want the option of researching charts on your phone. This is because the app has been built from the ground up with technical traders in mind.

You will be able to fully customize your trading app dashboard to the ‘t’ at CMC Markets. This comes alongside over 35 mobile-friendly technical indicators, full order ticket functionality, and real-time charting. This ensures that you can place buy and sell orders on the move – no matter where you are located.

The CMC Markets mobile app is available on Android and iOS devices – covering both smartphones and tablets. When it comes to the stock trading arena, the CMC Markets app offers over 9,400 shares from 23 different international markets. This is a huge offering and allows you to target markets of all shapes and sizes.

In particular, this includes almost 600 Canada-listed stocks. What we really like is that you can trade Canadian stocks by putting up a margin of just 15%. This allows you to trade with much more capital than you have in your CMC Markets account.

In terms of fees, this will depend on the stock market that you wish to trade. For example, Canadian stocks can be traded at a commission of 1 cent per share, with a CAD $8 minimum in place. CMC Markets holds that all-important IIROC license – so you can trade stocks without needing to worry about safety.

- Regulated by the IIROC

- Over 9,400 stocks supported

- Low commission model

- Spreads are comeptitive

- Great app for performing technical analysis

- Heaps of other CFD markets supported

- Does not offer traditional stock ownership – CFDs only

There is no guarantee you will make money with this provider.

How to Choose the Best Stock Trading App for You

So now that you have a selection of stock market apps to choose from, you are ready to begin your trading adventures. With that said, it is also worth performing some research of your own to ensure that your chosen stock app is suitable for your needs.

To point you in the right direction, below you will find a list of metrics that should be considered in your hunt for the best stock app in Canada.

Regulation

First and foremost, you need to spend some time exploring how safe the stock app in question is. This is because you will be depositing your own money into the app and thus – you need to be 100% sure that your capital is safe. The best way of doing this is to see what licenses the broker holds.

In an ideal world, your chosen best stock trading app will hold a license from the IIROC. This means that the platform is regulated in Canada and is required to comply with a range of licensing conditions.

For example:

- All IIROC brokers and trading apps are required to perform KYC checks on new clients. This means that you need to upload a copy of your government-issued ID before you can withdraw your funds out.

- If your chosen stock app is licensed by the IIROC and becomes insolvent, you will benefit from an Investor Protection Scheme. This currently stands at CAD $1 million.

- The IIROC stock app must clearly explain the risks involved in trading. This is especially the case when trading leveraged products like stock CFDs.

As you might have noticed, the Canadian best stock apps that we have discussed on this page are actually licensed by several regulators. This includes the likes of the UK’s FCA and Australia’s ASIC. As such, by choosing a stock trading app that is regulated on several fronts – you know that the provider is legit.

User Experience

Make no mistake about it – if you’re a seasoned stock trader that is looking to perform advanced technical analysis, this is going to be much easier on a standard desktop trading platform. With that said, there might come a time when you are away from your desktop device and you want to find a stock trading opportunity.

As such, it is imperative that your chosen Canada stock trading app offers a seamless user experience. For example, it should easy to load the app up and find your chosen market. It should also be straightforward to research stock trading prices and ultimately – place buy and sell orders.

This is why it’s always a good idea to start off with a demo account – if that’s something offered by your chosen stock trading app. These demo accounts typically mirror real-world market conditions – so it gives you a 360-degree overview of whether or not the Canadian stock market app in question is suitable for your financial goals.

Tradable Stocks

There is a vast disparity between the types of stocks you can trade depending on your chosen app. For example, some Canada stock market apps offer thousands of tradable stock markets. This might include major exchanges found in the US, Canada, and the UK – alongside less liquid markets in South Africa and India.

At the other end of the spectrum, some trading apps offer a skin and bonds stock arena. In other words, you might only have access to a handful of stock markets at best. As such, you should check to see what stocks you can trade on the app before opening an account.

In addition to supported markets and exchanges, you also need to explore whether you are buying traditional shares or trading CFDs. Don’t forget, while the latter offers leverage and short-selling facilities, you won’t own the underlying stock.

Fees

The best stock apps in Canada allow you to trade in a cost-effective manner. Trading fees can and will vary – not only in price but the way in which the fee is charged. For example, some stock apps in Canada allow you to trade commission-free. This means that your trading fees are built into the spread.

In other cases, your chosen stock app might charge a variable commission that is multiplied against your stake. There are also stock apps in Canada that charge a flat fee. For example, CMC Markets charges $0.01 per share when trading Canadian stocks.

On top of commissions and spreads, you need to check the fee table to see what other charges might come into play. For example, some stock apps in Canada will charge you a fee when you deposit and/or withdraw funds. Most apps also charge an inactivity fee on dormant accounts – which usually kicks in after 12 months.

Trading Tools & Features

Once you have crossed off the fundamentals of regulation, tradable markets, and fees – you then need to look at what tools and features your chosen stock app offers.

This might include the following:

- Leverage: If your chosen stock app offers CFD instruments, then you should have access to leverage. If so, check what limits you will be able to get.

- Fractional Ownership: If you are looking to buy and sell traditional shares via your chosen stock app, then check to see if it supports fractional ownership. This means that you can buy a fraction of a share, meaning there is no need to fork out over $3,000 to invest in Amazon!

- Orders: Stock orders tell your chosen app what trade you wish to place. While all stock trading apps offer buy/sell and limit/market orders, you’ll also want access to stop-loss and take-profit orders. It would also be good if the stock app offers trailing stop-loss and guaranteed stop-loss orders for extra flexibility.

- Automated Trading: If you are interested in automated trading, check to see whether or not this is supported. AvaTrade offers a mirror trading service, which allows you to copy one of its successful traders like-for-like.

Education, Research & Analysis

If you’re planning to trade stocks without performing any research, then you may as well flip a coin. As such, check to see what research and analysis tools your chosen stock app supports. In an ideal world, the app will give you access to real-time financial news.

You should also have access to heaps of technical indicators. With that said, these should be mobile-friendly so that you can perform your analysis directly from the app. We are also fans of price alerts that send a notification to your phone when a stock hits a specific target.

When it comes to education, this is an important metric if you are just starting out in the world of stock trading. For example, it’s really useful if the app offers guides and explainers on key trading terms. This will allow you to become a better stock trader over time.

Device Compatibility

Stock apps for Android and iOS are built specifically for the respective operating system. This means that the user experience on one device-type might be different from the other. For example, we have previously come across Canada stock apps that work really well on Android, but not so well on iOS.

Once again, the only sure-fire way of testing this yourself is to first open a demo account with the stock trading app. Alternatively, you can read reviews from the respective Google Play or App Store to gauge what the general sentiment is.

Note: If you are specifically looking for the best stock apps for iPhone or stock market apps for Android – most brokers cover both bases. However, this isn’t always the case, so be sure to check.

Payment Methods

There is nothing worse than going through the sign-up process with a broker only to find out that it doesn’t support your chosen payment method. We find that the best stock apps in Canada also heaps of different funding options.

For example, AvaTrade allows you to deposit funds with a Canadian debit/credit card – meaning the funds will be added to your account instantly. Forex.com also offers Paypal – which is great for e-wallet fans. Some apps even support Google and Apple Pay – which is also a convenient way to deposit/withdraw funds.

In the vast majority of cases, you will also be given the option of transferring funds from your Canadian bank account. While this is reasonably convenient, it is important to remember that bank transfers often take a few days to be credited by stock investing apps.

Additionally, you also need to check what deposit/withdrawal fees apply – if any. Finally, check how long the stock app takes to process withdrawal requests. In an ideal world, the app provider should take no more than 24-48 hours.

Customer Service

The best stock apps in Canada offer top-notch customer service. This should include the option of speaking with a support agent in real-time via live chat or the telephone. If it’s an email-only service, then expect to wait hours or even days to get a response.

In terms of working hours, the best stock market apps in Canada operate on a 24/5 basis to mirror the traditional stock markets. If this isn’t offered, you need to make sure that the stock app offers support during standard Canadian business hours – especially if it is based overseas.

How to Download the Best Stock App & Start Trading

If you’re itching to start trading right now but need a little guidance in getting set up – we are now going to walk you through the process with AvaTrade. This top-rated stock market app is regulated by the IIROC, offers commission-trading, and requires a minimum deposit of just $100.

Here’s what you need to do:

Best Stock Trading App – Conclusion

Stock trading apps in Australia are a must-have for those looking to invest in the financial markets. Sure, you won’t be able to perform in-depth technical analysis on a small screen – but all other account features can be accessed with ease.

For example, the best stock trading apps allow you to buy and sell shares, check your open positions, make use of educational fundamental research tools, and deposit/withdraw funds.