Best Investment Apps in Canada 2024 Revealed

In the past, investing in stocks and currencies was quite difficult. Most times, you had to spend a lot of money, speak to a broker in person or over the phone, and pay heavy broker commissions. Today, with investment apps, you can use small funds to invest over an easy-to-understand interface on your PC or mobile device. Let’s explore Canada’s best investment apps of 2024 and how you can grow your wealth with long-term investment.

Best Investment Apps 2024 – List

BitBuy – The best investment app dedicated to Canadian investors

Crypto.com– Best auto-trading app for cryptocurrency investing

Your money is at risk

Best Investment Apps 2024 – Reviewed

BitBuy

Bitbuy is one of Canada’s best investment apps. The trading platform is regulated by the Ontario Securities Commission (OSC), Canadian Securities Administrators (CSA), and FINTRAC. BitBuy supports cryptocurrency trading and investment and offers technical indicators, tools, and a robust blog section that helps people navigate crypto investment and trading.

Key Features

- Supports over 25 different cryptocurrencies

- Depending on your investment skills, you can sign up for the Express Trade or the Pro Trade account. The pro account has more advanced trading tools.

- Bitbuy supports organizations through its corporate solutions by seamlessly integrating cryptocurrency with your payment options.

- Supports CAD/Crypto pair

- Assets are stored in a cold wallet.

- Supports auto trading through its robo-trade API

- The app caters to both advanced and beginner investors.

- Users can choose Interac as a payment option.

- Cold wallet storage ensures safer asset storage.

- While BitBuy only offers crypto investment and trading opportunities, the platform has announced that it will soon start providing ETFs (Fractional investments in company stocks) in the near future.

- Supports only cryptocurrency trading. Doesn’t offer a variety of instruments.

Your money is at risk

Crypto.com

Crypto.com is an old-timer for crypto and stock investing. For all your cryptocurrency transaction requirements, Crypto.com stands out as one of the best investment apps, especially with its sleek and beginner-friendly interface, making it suitable for investors of any expertise level.

Crypto.com also has its own native coin, called CRO. Investors who hold CRO benefit from lower platform fees and an excellent staking program with a high APR.

Key features

- Cashback Visa Card: Several reward tiers are available for the Crypto.com Visa Card according to how much CRO you are presently staking.

- Discount on every tier: Every tier often offers discounts for certain services, including Spotify, Netflix, or even Airbnb. Free ATM withdrawals and payback rates ranging from 1% to 5%, depending on the amount of CRO risked, are additional bonuses.

- High-interest rates: You may obtain a maximum yearly percentage income of 14.5 percent with Crypto.com’s Earn program (APY). As an illustration, consumers may earn up to 6% on their Ethereum (ETH).

- No FDIC Coverage: Although these interest rates are higher than any other high-yield savings account rates available, keep in mind that since they are not covered by the Federal Deposit Insurance Corp., and may pose more risks. Additionally, you get basic interest, which means your profits won’t grow over time.

- Users with large CRO balances are eligible for reduced trading fees.

- Receive up to 8% in cash back at Crypto.com. Spending using a Visa debit card for customers with large CRO balances.

- Margin trading options are restricted.

- High evaluations for cybersecurity.

- Higher trading costs apply to lower trading volumes.

- Funds are not insured by the FDIC.

Your money is at risk

How To Use The BitBuy Investment App

BitBuy is out top recommended investment app to use in Canada. The app is great for both beginner and experienced investors and makes entering the crypto market simple. Below, we will walk you through how to get started with BitBuy today.

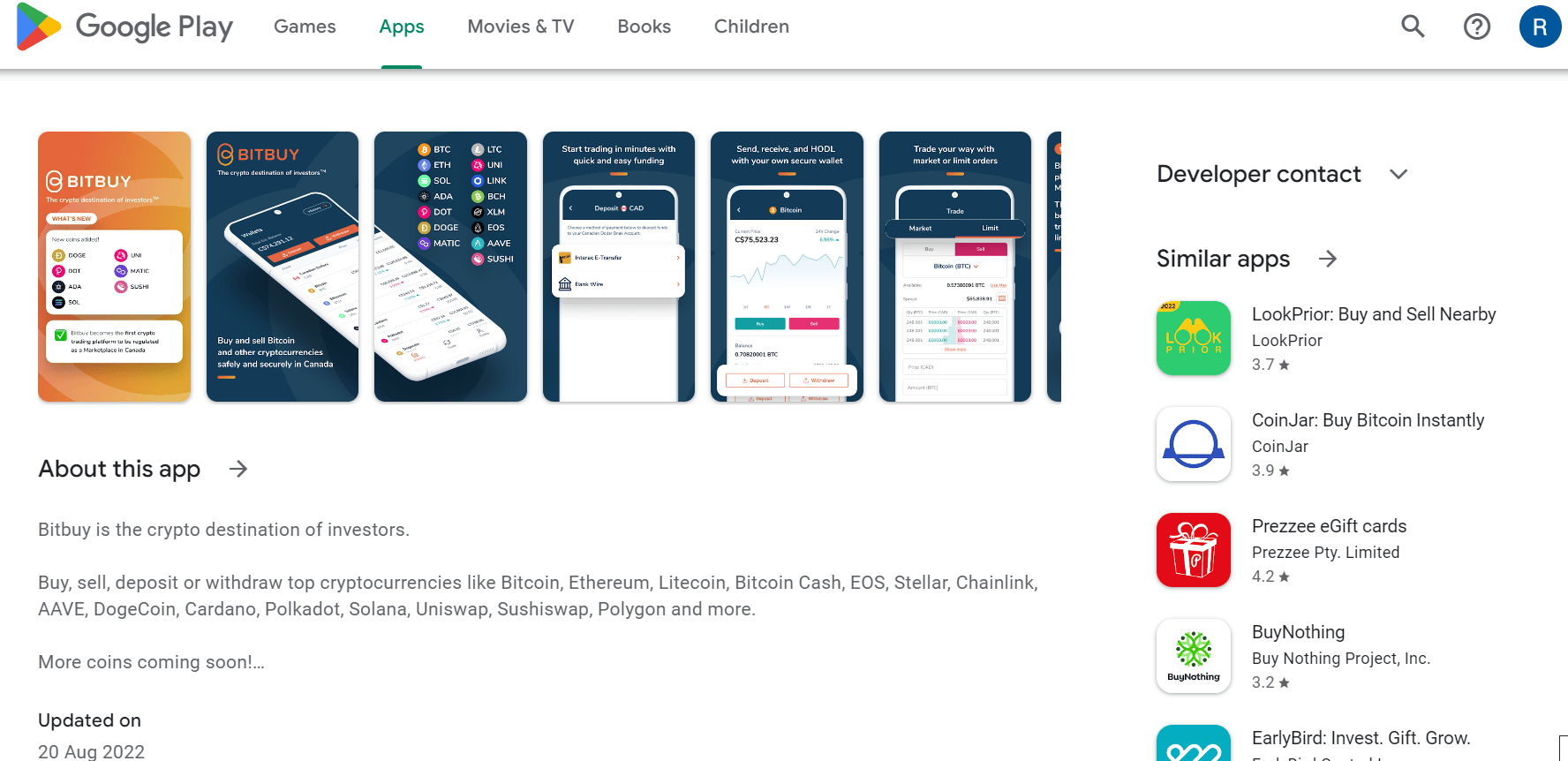

Step 1: Download the mobile app

You can download the BitBuy mobile app on Android and iOS. BitBuy mobile application has almost the same investment features as the web trader.

Step 2: Create an account

Log into the Bitbuy mobile platform and click on the Get Started button. Provide your email, name, username, password, and phone number.

Step 3: Verify your ID

Before you can use the app, you need to verify your identification. Submit a clear picture of your government-issued ID or passport. Ensure that the picture shows all four borders of the ID card. Do not edit the picture. For proof-of-address verification, you can submit a recent bank statement that contains your address.

Step 4: Fund your account

Once you sign into the Bitbuy platform, click on Deposit Funds. Bitbuy supports bank transfer, Skrill credit/debit card, PayPal, and Payoneer, amongst other payment options.

Your money is at risk

What Is The Best Investment App For Beginners?

Bitbuy remains the best investment app for beginners. The platform gives users access to intensive training, market analysis and updates, fundamental analysis of instrument classes, and a range of major cryptocurrencies. Bitbuy’s trading platform is simplistic. The interface is incredibly simple, and data presentation is colorful. For Canadians who are bothered about FINTRAC and OSC regulations, Bitbuy is the best trading option.

For users who want to leverage auto-trading to pick the best assets to buy, Crypto.com is the safest option. You can check our list of the best crypto apps for other app options for crypto investment.

Top Tips For Using Investment Apps Safely

Use a secure password

Security breaches can happen when traders and investors are careless with their passwords. Follow these protocols to ensure that your password is constantly secured:

- Use a password that is difficult to guess: 5533, the name of your favorite sports team or your child’s name, are memorable, but they are easy to guess. Use a password that contains at least 8 characters, including an uppercase, a lowercase letter, a number, and a symbol.

- Do not use the same password for multiple accounts: Complex passwords are hard to remember, especially if you have multiple; however, if you use one password for all your accounts, if there is a security breach on one of the accounts, the hacker will have access to other accounts. You can use Google Secure Passwords to save passwords; this way, Google can always remind you whenever you browse on Chrome.

Activate two-factor authentication

2FA is a process where a system or portal requests extra authentication before giving access to an account. Different online investment apps offer different 2FA types. Check out these 2FA protocols:

- Code sent to your phone: If you use your mobile device to set up a 2FA, no one will be able to access your investment account until they input the code sent to your mobile device.

- Phone number and email: The system requests for a code or a link sent to you before giving access to whosoever wants to access your account. A password cannot override a 2FA.

- Location-locked 2FA: If your 2FA is location, an extra layer of security is activated whenever you sign into your account from an unfamiliar place. For example, suppose you have been signing in to your BitBuy account from Canada for five months and you travel to the US. In that case, if you sign in, a 2FA protocol will automatically launch, and you won’t have access to the account unless you complete the authentication process.

- Key words: Cold wallets offer phrases generated at random by AI to users. The wallet will request the words anytime you log into the account.

Use a secure internet connection

Public wifi is great. You can get a quick sneak into your investment account in the office and check for updates, open and close a few positions, and invest in some coins. The issue, however, is that public wifi is not secure, and hackers can access private information, including email and passwords, to some of your most important accounts. If you log into an unencrypted website (website without the HTTPS prefix), other network users can hijack your browsing session and log into your computer, accessing the password to your trading account.

Follow these steps to protect your crypto investment wallets:

- Assume that all public wifis are unsafe: Assume that all public wifis are unsafe. Do not log into an unsecured website or a website with only first-page encryption. Also, that a website has HTTPS encryption does not mean that the website is safe. Hackers often mask their phony and fake websites under the HTTPS protocol to escape scrutiny.

- Only log into your account for a short time: When connected to a public network, be as quick as possible if you have to log into your investment app. Log out at once when you are done.

- Use your mobile data instead of public wifi: If possible, use your mobile network.

- Pay attention to warnings from your web browser.

Look for regulated platforms

Regulation is an important factor when considering the best investing apps. The major risks of trading with an unregulated app are:

- You are really not protected, and your data can be breached.

- There is no consumer protection or hope for a refund if the platform suffers a breach.

Regulation bodies ensure that trading platforms undergo strict licensing procedures to ensure the safety and security of all users. If a platform is unwilling to go through thorough regulatory processes, do not trust them with your money.

Some of the most reputable regulation platforms include Financial Conduct Authority, FCA, Australian Securities and Investments Commission, ASIC, the SEC, and OSC, amongst others. These bodies are created to ensure that online platforms protect the data and funds of their users.

Your money is at risk

Avoid ‘gambling’ by conducting thorough research and analysis

Cryptocurrency apps often have disclaimers like ‘87% of investors lose their money.’ Investment is deep and extensive and requires thorough research and market analysis for profitable trades.

Investing isn’t gambling. Just because Bitcoin had a massive 10-year run that saw its value increase almost 200,000% between 2011 and 2021 does not mean every cryptocurrency will have such a run.

Below are research and analysis strategies you should master before investing:

Fundamental Analysis: Fundamental analysis defines the intrinsic nature of an asset; for example, fundamental analysis of a company’s stock includes the industry, competitors, global economic situations, the company executives, profitability and proposed profitability, and many other factors. When studying an asset’s fundamental analysis, you should be able to create historical links that connect events with the rise or fall of the asset’s market price. When Elon Musk announced that he wanted to become the majority shareholder of Twitter, Twitter’s shares rose, but when he announced a temporary hold on the deal due to Twitter’s bot issues, the company’s share suffered considerable depreciation. Before choosing a stock app for investment, ensure that the app releases frequent and in-depth updates, market analyses, and news reports on the stock or instruments you choose.

Technical analysis: Technical analysis uses technical indicators like the Relative Strength Index, Resistance and Support points to determine an asset’s direction. Technical analysts explore historical data on charts and find patterns and price movements. Technical analysis calculations can be hectic, especially if you are new: the trick is to master one strategy before jumping to a second. You should also use an investment app that offers intensive trading and investing knowledge resources.

Demo trading: Demo trading is an interface created by online trading apps to allow users to experience the market, get access to virtual funds, trade/invest and learn without the risks of losing real money. Platforms like Bitbuy allow users to create virtual accounts with funds that can be anywhere from $10,000 to $100,000. Beginners can practice trading strategies and learn and professional investors can try out advanced strategies and replicate them on real accounts. If you are a beginner investor, it’s important to use a demo trading account and learn about the platform and market before making decisions in the live market.

Your money is at risk

Other good investment practices include:

- Understanding your investment goals: Investments are often long-term, so it’s important to map out a plan and have goals. Are you investing in retirement or an automobile? How much do you have? What’s the volatility of other assets you hold? Today, there are thousands of altcoins, most of which promise to be the next big thing, but we have seen coins drop. While not as volatile as crypto investment, blockchain investment still has its risk. Investing in ETFs in the long term may not yield extreme ROI; however, if the company grows and become more adoptable, early investors will enjoy excellent paydays.

- Diversifying your portfolio: Again, it is unwise to tie investment capital into one portfolio. With diversification, if an asset behaves poorly, another asset doing well will buffer the loss from the former. It’s important to diversify instruments and also diversify assets within each instrument. For example, instead of investing in the stocks of just one company, you can invest in three companies. You can also invest in currencies and cryptocurrencies.

- Knowing when to leave: It’s important to know when to buy, sell, and leave the market entirely. A lot of investors fail because emotions drive them. Fear, greed and hope are three powerful emotions you must master and control. Fear makes you sell an asset because you think the price will crash (even when technical indicators suggest otherwise). Greed forces you to hold on to an asset when you should sell. When an asset hovers around a price point it has historically shown not to climb, it has reached the resistance level (demand is considerably higher than supply). Once the market corrects itself, the price will drop; however, greedy investors will hold until the asset drops. Hope makes investors hold on to a dipping asset. The hopefuls pray and wish for the price of the asset to climb back when all relevant indicators point otherwise.

- Do not invest more than you are willing to lose: All investments have their risks. Trading CFDs, buying ETFs, or investing in foreign exchange can yield impressive returns; however, you can lose all your money. It’s important to never put in more than you are willing to lose, especially when you are a beginner trader still learning the ropes. Often, the media hypes an instrument, creating excessive demands and increased price. Smart investors know just how much to put in an asset, even if all indicators show that the asset might be a unicorn.Price corrections, controversies, media, and financial statements are some of the few factors that can affect the price of a stock. While a stock does not oscillate like cryptocurrencies, they are often easily affected by controversies. For example, the recent scandal in the Adidas and Ye relationship has caused the shares of the company to dip, wiping out profit of more than a year. Sometimes, even the savviest analyst may not see price storms.

Best Investment Apps 2024– Conclusion

For Canadians, Bitbuy is an excellent investment app that is regulated by a number of major bodies. The app provides easy access to the crypto market as well as a great variety of tools and educational features. The registration process is simple, and you could start investing today!

Your money is at risk

FAQs

How to use investing apps in Canada?

Are investing apps safe?

Is eToro good for beginners?

Is eToro regulated in Canada?

Can I use PayPal with an investment app?