Best Crypto Trading Apps in Canada for Beginners 2026

Choosing the best crypto app is a risk management strategy. While beginner traders often just go with the first app that comes to mind, the consequence can be dire. Trading with an app that charges extremely high fees or an app that isn’t regulated in your country could lead to a loss of trading funds. Before choosing a crypto trading app, you should consider factors such as fees, regulation, leverage, rates and charges, minimum deposit, availability of demo trader, and the app user experience.

Best Crypto App Canada 2026 – List

- eToro (Best Social Crypto Trading App)

- BitBuy (Best CAD to crypto pair trading app)

- Crypto.com (Best crypto trading bot app)

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong.

A Closer Look At The Best Crypto Trading Apps For Beginners 2026

eToro

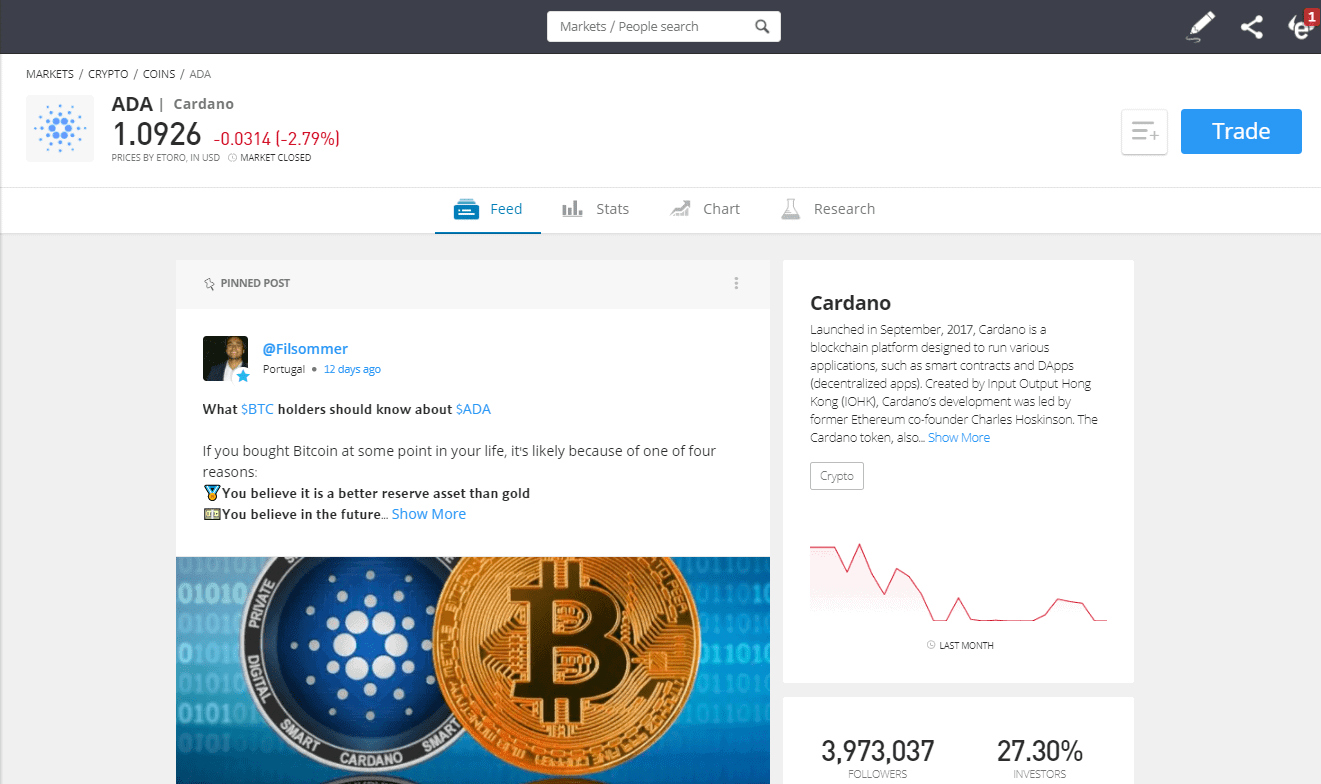

At the top of our list of best crypto trading apps in Canada is eToro- a globally renowned platform that offers 78 different crypto tokens to trade.

eToro has over 20 million users worldwide and boasts a number of excellent features including a demo account, copy trading and ready-made crypto portfolios. Furthermore, the app charges a small 1% trading fee for crypto trading, which is affordable for all types of investors and traders.

Another appealing feature of the eToro app is that it offers a native wallet- eToro wallet. This means that you can trade, invest and hold your crypto assets in one place. The minimum deposit to start using the app is just $20 and you can place trades for as little as $10.

eToro supports fractional crypto trading, which means that you can by small portions of tokens. For example, it is possible to buy just $10 worth of Bitcoin (BTC) instead of investing in an entire token.

Key Features

- $100K demo account

- Supports social trading and copy trading

- Offers technical price charts, market news and educational resources

- Available on IoS and Android

- Supported by 140 countries around the globe

- Regulated by the FCA, ASIC and CySEC

- Ready-made crypto protfolios

- 1% crypto dealing fee

- Regulated by reputable organizations in the UK, Cyprus and Australia

- Offers social trading features

- Free to sign up

- Free deposits and withdrawals

- Accepts a wide range of payment methods

Cons:

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong.

BitBuy

With over $5 billion cryptos traded and 400,000 Canadians served, BitBuy is the best crypto app with the lowest trading fees to use in Canada. BitBuy was established in 2016, offers a secure portal for crypto trading and supports a number of cryptocurrencies, including Bitcoin, Ethereum, and Cardano, and has a powerful mobile interface that enhances users to trade on the go.

Key features

- Crypto assets are stored in cold storage.

- Regulated by the Canadian Securities Administrators and the Ontario Securities Commission.

- Live order book for pro trading

- Advanced trading tool in the pro platform

- Facilitates CAD to crypto and crypto to crypto pairs.

- Has mobile application features for iOS and Android.

- BitBuy is registered with Fintrac as a money facilitator.

- Supports automated trading

- Deposits and withdrawals are facilitated through credit cards, bank wire, and Interac.

Pros:

- Low trading fees of 0.1% to 0.2%

- Assets held in cold storage

- Facilitates CAD to crypto trades

- $50 sign-up bonus

- Narrow spreads of 0.3%

- Intuitive mobile application

- BitBuy pro facilitates advanced trading

- Excellent customer service

- Supports automated trading through dedicated API

- You can get instant quotes from live traders (pro account).

Cons:

Your money is at risk

Crypto.com

On August 15, 2022, Crypto.com announced that it was approved by the Ontario Securities Commission (OSC) and is now regulated to facilitate crypto transactions in Canada. With an existing 50 million users, the exchange has an impressive user interface and supports automated trading.

Key Features

- Supports over 250 cryptocurrencies and tokens

- Cashback of up to 5% when you use Crypto.com metal Visa card

- Supports NFT trading

- It can serve as a decentralized center-place with its own wallet

- Offers loans to users

- 24/7 support

- Deep dive analysis and market research resources

- Invest and earn up to 14.5% on cryptocurrencies

- Trading bots: Set trading parameters, and allow the bot automatically open and close positions on your behalf.

- Crypto.com university offers intensive cryptocurrency education.

Pros:

- Crypto wallet available

- 24/7 support

- Offers trading bots that would remove the burden of constantly monitoring the market

- 50x leverage

- Supports a large number of cryptocurrencies

Cons:

Your money is at risk

What is the best app for trading cryptocurrency in 2026?

eToro is one of the best apps to consider for crypto tarding in Canada. The app is desigend for those trading fractional amounts of crypto and has a user-friendly interface and low fees! Other great apps include Crypto.com and Bitbuy. Altogether, your decision on a cryptocurrency app is dependent on your core needs: Here are the factors you must consider:

Fees: Trading fees vary across different apps. Some exchanges charge higher trading fees for small trades and small fees for larger trades. Determine the volume of your trade and the most affordable fees (all other factors considered). Some apps charge less or even non-existent fees for their premium or pro users. Ask questions before registering for an app.

License: Even if you choose the best crypto app, you would be violating regulatory restrictions set by your country. More importantly, using an unlicensed app will expose you to unprecedented dangers, like loss of funds, fund freeze, and sudden closure. A regulatory institution can order an app to cease services within a jurisdiction without warning.

Resources: Trading resources have long become integral parts of an exchange’s offering. Cryptocurrency trading is risky, and people can lose big on CFDs. Leverage may also open you to more significant losses. Trading resources, market insights, regular updates, and technical indicators help you conduct in-depth fundamental and technical analysis before investing in a cryptocurrency.

Demo trading: Choose a crypto trading app that allows you to paper trade without exposing you to the risks of the live market. All the best crypto apps in this piece offer demo trading accounts with virtual funds.

Other factors to consider:

- Minimum deposit

- Spreads

- Leverage: The higher the leverage, the higher the winning stake. But remember, higher leverage also means losing a lot of money if the trade does not go your way.

- Mobile app functionality: The best app to buy crypto has excellent mobile functionality. Consider your schedule. You need an app with independent functionality; that is, one that allows you to access most features of the web trader on the app. The app’s design must be receptive.

How To Use eToro- The Best Crypto Trading App in Canada

Signing up for eToro will only take a few minutes, and the process is seamless.

Quick Steps to Signing Up to eToro:

- Click ‘sign up’

- Enter your email

- Create a secure password and provide personal details

- Verify your account

- Deposit funds

- Start demo trading

Step 1: Fill out the online registration form

To create an account, you will need to enter your email address. You will then be asked to create a password and a username.

Use a memorable username: Your username is your account identity. You will need this to access your account each time that you choose to use the platform. It is also important to use a password that is safe- don’t use a word that could be easily guessed by hackers!

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong.

Step 2: Provide information for your profile

As well as a username and password, you will be required to fill in some personal information such as your address.

During this step, you will also need to verify your account with a birth certificate, driver’s license and proof of address.

Step 3: Deposit funds

Once your account has been verified, you will need to deposit funds in order to being trading. eToro accepts a number of popular Canadian payment methods and the minimum deposit is $20.

Step 4: Switch to demo trading

Before making any real trades, we recommend practicing with the demo trading account. The eToro demo trader is a great way to test out the platform ad try different strategies before putting your money at risk.

Step 5: Download Mobile App

Visit your PlayStore for Android or the iOS store for iPhone and search for the eToro app. The app shouldn’t take too long to install.

Once it has been installed, sign in with your email/username and password. You should then be able to access your trading account on your phone.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong.

Top Tips For Using A Crypto Trading App

Conduct research and analysis

Research and analysis are essential to successful trading. The research process begins before you start trading. Every successful investor knows that trading is a journey—a task meant to move you from point A to point B—a journey meant to take you from non-profit to profit. Understanding your risk appetite, gauging crypto investment literacy, and determining the instruments you will love to trade are essential.

Short-term or long-term? You need to determine if you want to trade for the short term or invest for the long term. This decision will influence the instrument you choose and the strategies you use for investment.

Fundamental and technical analysis:

Cryptocurrencies are volatile—this is as fundamental as the word can get; however, there is much to learn about an asset. An asset’s fundamental behavior and how it interacts with external situations like global economic happenings, media play, and influencer support are parts of the factors you must consider. You should also consider an asset’s adoption—an asset with user functionality and a stable and increasing user base is more likely to grow in value.

For example, Bitcoin is one of the world’s most adopted means of exchange. Bitcoin is the eighth largest company in the world—per market capitalization, according to CoinMarketCap. Will its influence and value continue to increase? Will Bitcoin remain relevant in the next ten years the way the dollar is relevant today? Can Bitcoin hit $120,000 per coin as some analysts have predicted, or will it constantly hover around the $20,000 to $30,000 points? Has Bitcoin reached its optimum value (that is, it would no longer move above a price point and continue to cycle around such a point)?

Ethereum, on the other hand, is a widely adopted blockchain used by many other cryptocurrencies and NFT ecosystems. Ethereum adoption is strong, and as it moves from a proof-of-work model to a proof-of-stake model, its energy-reserving system would mean a lot more positive nods from clean energy enthusiasts.

Fundamental analysis is intrinsic and helps you understand the behavior of an asset. On the other hand, technical analysis studies an asset’s price movements of assets and uses historical data to speculate future directions. In technical analysis, you will use tens of technical indicators to determine price patterns and open positions from a favorable standpoint.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong.

Store your crypto in a cold wallet

The best app for cryptocurrency offers cold wallets to store your assets. Cold wallets hold your assets offline—completely inaccessible to other people—secured and safe. If the exchange you use does not offer cold storage, you should consider using a trusted third-party wallet.

Avoid guessing the market

Crypto trading isn’t guessing. The market might be volatile—but you can chart objective speculations from proven and researched strategies. The market exists in cycles, and you must be able to determine the position your asset sits. What’s the cycle, and should you open or close or position? When you decide the direction of an asset, you can execute CFDs and other strategies that will maximize your profit.

Create a risk management strategy

Cryptocurrency trading and investment are mainstream, and many people are investing in coins and NFTs, hoping to profit from the market. Like every other investment sphere, cryptocurrencies carry their risks: cryptos are volatile, susceptible to sudden price movements, and there is a higher risk of capital loss.

Any serious-minded crypto investor must institute risk management and strategies to ensure that losses are plugged before they drain your portfolio.

Here are some ways that you can create a risk management strategy:

Determine your threshold: Never invest more than you can lose, however bullish or promising the market may seem. Your risk threshold differs from another person’s, so you should never invest a certain amount just because somebody else does.

Calculate your risk-reward ratio when you choose a specific coin, and decide how much you are willing to risk within a certain period.

Choose a secure trading platform: A secure trading ecosystem ensures that you trade in a safe environment. Choose a trading platform that is regulated in your country.

Research the risks of trading certain coins: Is rug pull possible? Is the coin overhyped? Evaluate the hacking history of a trading platform and how safe a coin is.

Determine if a platform is safe: Does the platform offer a cold wallet or use a third-party wallet? How responsive is the platform’s customer support?

Diversify your portfolio: Do not keep all your eggs in a basket. The golden rule of investment is never to concentrate your total investment capital on only one portfolio. Diversify your investment in coins that meet predetermined criteria and trade them. A diversified portfolio protects your bottom line. Even if a coin fails, the successes of other coins will buffer your loss.

Have a defined exit strategy: A defined exit strategy is one that you must comply with, regardless of the circumstance. Determine when you will go out and the maximum loss your portfolio will suffer before you exit a market. A lot of people are motivated by fear, hope, and greed. When the market dips and continues, you must have a pre-established exit strategy below which you must sell your asset if the price goes under. Hoping that a coin will somehow resurrect when all technical indicators point to a looming end is folly. The best traders do not make moves from emotions. Every trading strategy has to be objective and indicate when you will exit a coin or the cryptocurrency market altogether.

Use a demo account to practice

A demo account allows you to paper trade—that is, trade simulated live markets without the risk of losing your capital. A demo account is a practice account that enables beginner investors to to get familiar with crypto trading and the trading platform. Demo trading also allows advanced traders to practice new strategies in simulated live market conditions and replicate these strategies if found successful.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong.

Best Crypto App Canada – Our Conclusion

eToro is the best crypto app to use for trading crypto in Canada. Its top features, include demo trading, copy trading, availability of trading resources and technical indicators, and competitive trading fees.

As always, it is important to research all of your options before deciding on the best app for you.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong.

FAQs

eToro is the best app for cryptocurrency trading if you love social trading, interacting with other traders, and copy-trading successful trading strategies. BitBuy is the only trading app that offers crypto-CAD pairs, and Crypto.com has one of the most intuitive trading bots. For the friendliest beginner experience, traders can choose Coinbase.

The best bitcoin app is eToro. If you are a beginner, you can choose Coinbase—Coinbase app is specially designed and simplified to accommodate beginners.

Different countries and regions have bodies that regulate cryptos and exchanges. The Australian Securities and Investments Commission regulates cryptocurrency apps in Australia, FCA in the UK, and the Canadian Securities Administrators, CSA, in Canada.

Consider the risk-reward ratio of the coin you decide to trade; choose the trading app; diversify your portfolio; create risk-management strategies; paper trade for a while if you are a beginner. What is the best app to use for crypto

What is the best bitcoin trading app?

Are crypto apps regulated?

How to Start Trading Crypto in Canada