Best Stock Market App New Zealand 2026 – Top App Revealed

Located in New Zealand and looking for the best stock trading app to buy and sell shares online? If so, there are heaps of providers to choose from – most of which offer trading apps for both iOS and Android devices.

With so many options in the New Zealand trading app scene, you need to explore what the provider offers in terms of assets, fees, payment methods, and more.

In this guide, we review the best stock trading apps in New Zealand right now. We also explain what you need to look out for when choosing an app provider and how to get started with a trading account today.

Top Stock Trading Apps 2026

Here’s a breakdown of the best stock trading apps in New Zealand right now. You will find an in-depth review of each provider by scrolling down.

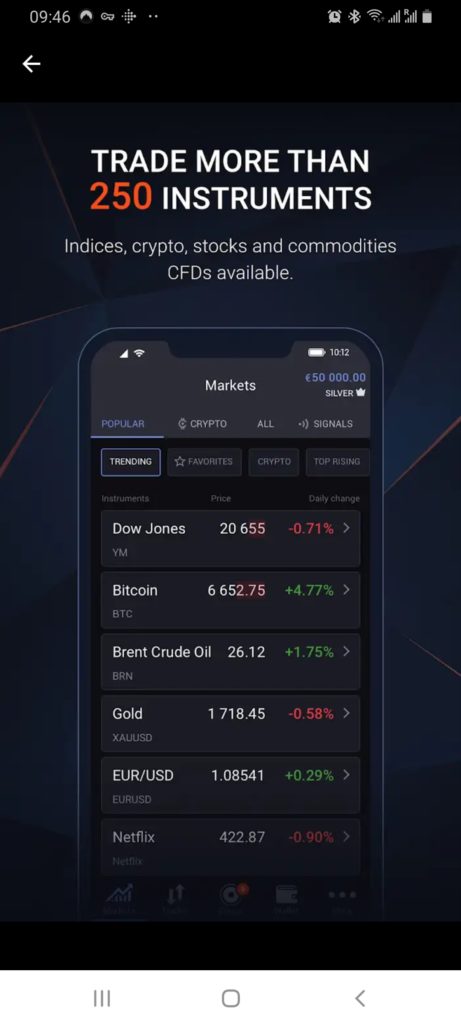

- Libertex – Best Stock Market App New Zealand with ZERO Spreads

- Plus500 – One of the Best CFD Apps for Supported Markets – 72% of retail CFD accounts lose money

- AvaTrade – Best Stock Taking App for Fans of MT4/MT5

- IG – Best Stock Trading App for New Zealand Shares

- Interactive Brokers – Best Stock Market App in Long-Term Investors

- TradeStation – Best Stock Trading App for Seasoned Pros

Best Stock Market App Reviewed

With so much choice on the table, finding the best stock trading app for your personal objectives can be challenging. We have done the hard work for you by reviewing dozens of providers active in the market. This took into account key metrics such as fees and commissions, regulation, tradable stocks, payments, and more. Whether you’re looking for the best stock market apps for Android or the top stock trading apps iPhone, we’ve got you covered.

Below you will find which of the best stock apps of 2021 made the cut.

1. Libertex – Overall Best Stock Market App NZ with ZERO Spreads

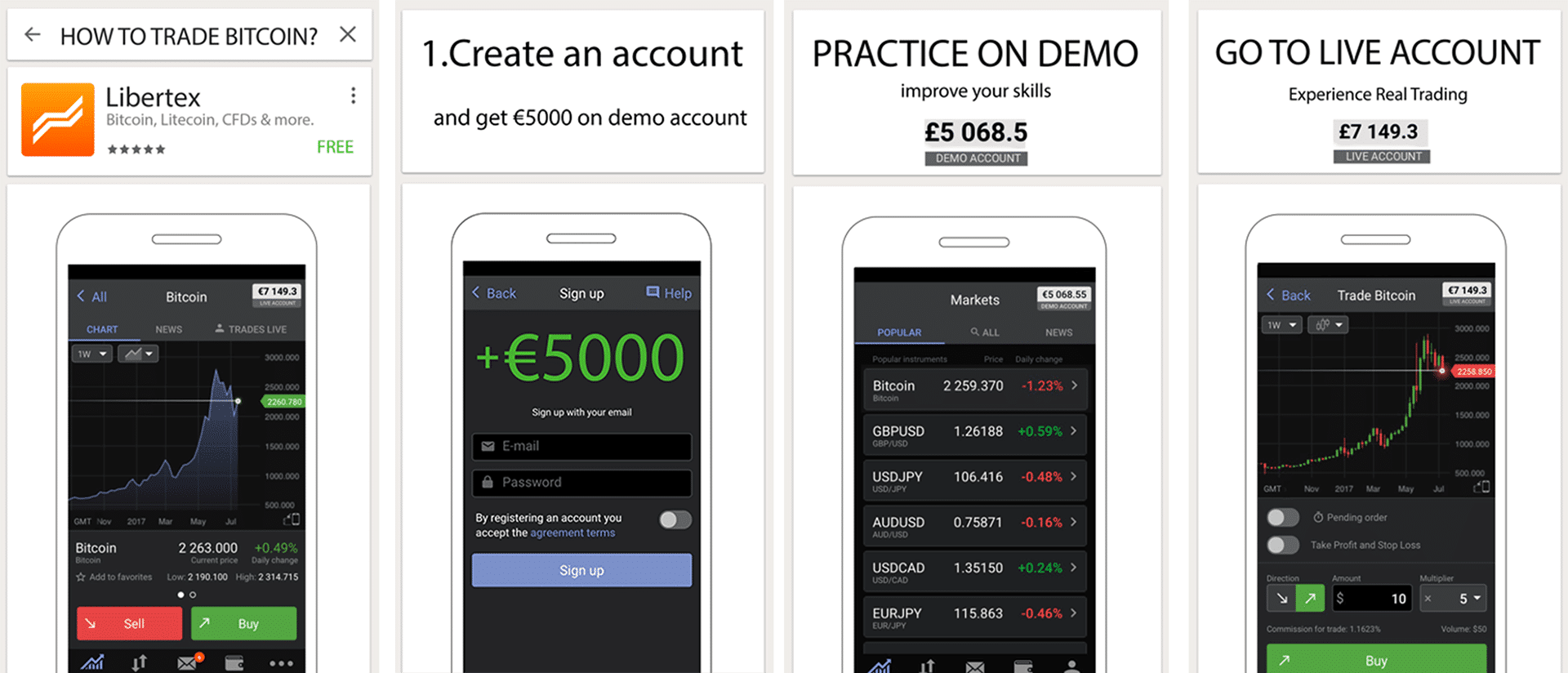

If you’re looking for the best stock trading app available to NZ residents, you might want to check out Libertex. The brokerage firm has been offering online trading services since the late 1990s. Naturally, it now has a strong presence in the mobile trading scene.

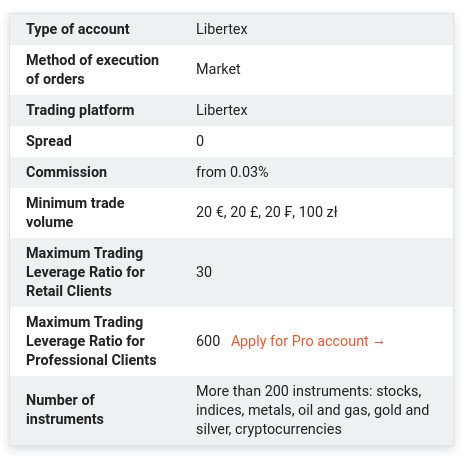

Libertex offers a great range of stocks that you can buy and sell – all of which come in the form of CFD instruments. This means that you can trade stocks at super-competitive prices. In fact, Libertex is one of the only stock trading app providers that doesn’t charge a spread.

By trading stock CFDs on this top-rated app, you will have the option of going long or short on your chosen market. This means that you can enter grades even if you think the stocks will fall in price. An additional benefit of trading CFDs on the Libertex stock trading app is that you can apply leverage.

For example, if you trade Facebook stock CFDs at a stake of $200 and apply leverage of 1:5, your position is worth $1,000. We also like LIbertex as it is great for newbies. Crucially, the minimum deposit on the app is just $10. This means that you can trade stocks with small stakes until you get a bit more comfortable with how the application works.

In terms of supported deposit methods, you can instantly fund your account through the stock trading app with a New Zealand debit or credit card. Libertex also supports e-wallets and bank account transfers. Finally, not only does Libertex have a reputation that spans over two decades, but it is fully regulated by the European-based body CySEC.

- Zero spread CFD trading

- Good educational resources

- Long established broker

- Compatible with MT4

- Competitive spreads

- Only offers CFDs

74% of retail investor accounts lose money when trading CFDs with this provider.

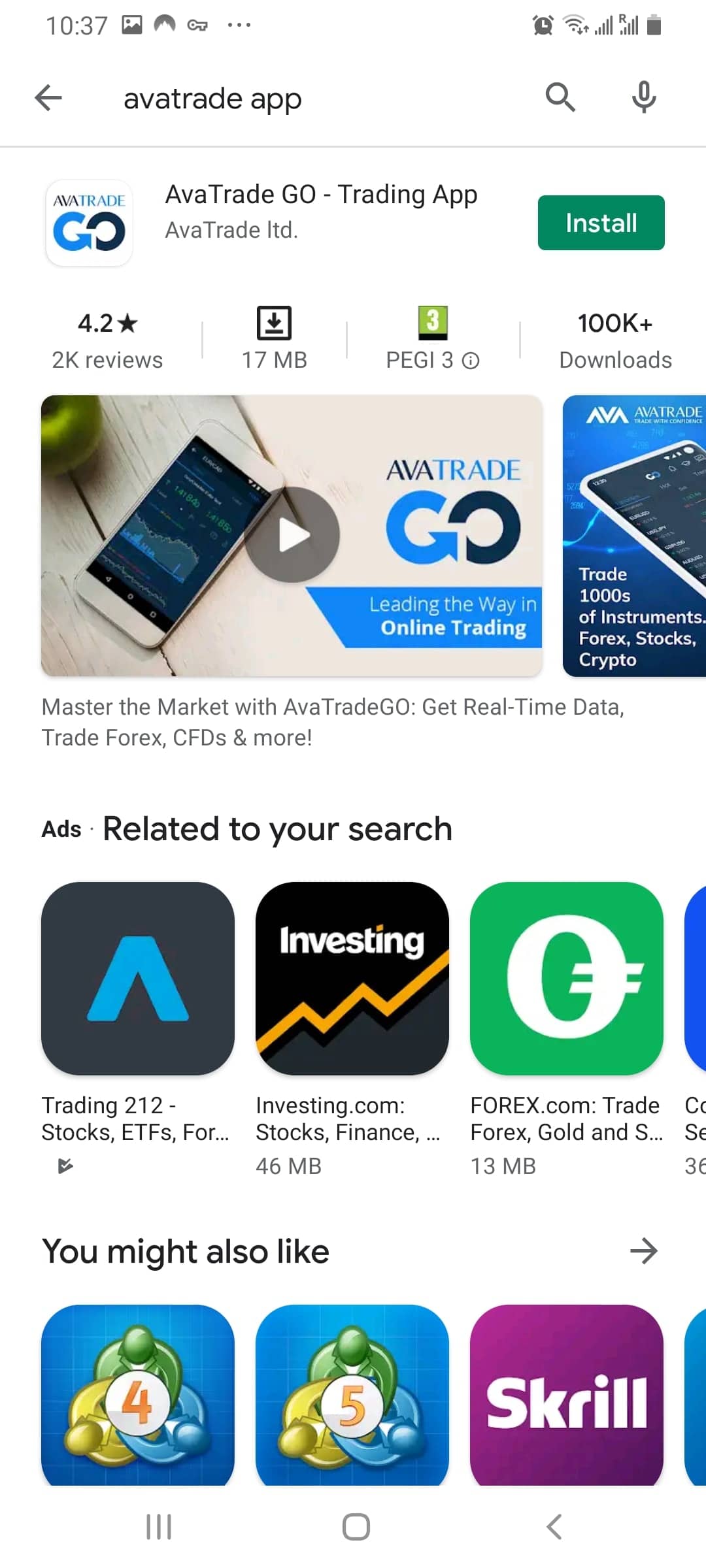

2. Plus500 – Best Stock Trading App for Supported Markets

When searching for the best stock trading app for you, supported markets is likely to be one of your main priorities. If it is, then you might want to consider Plus500. The reason for this is that Plus500 gives you access to thousands of CFD markets – including a huge range of stocks.

This includes stock markets based in Australia, the UK, Germany, France, South Africa, the US, and more. All of the stock CFDs offered by Plus500 can be traded with leverage of 1:5 and you can choose from a long or short position. Irrespective of which stocks you decide to trade, Plus500 is a commission-free platform.

Spreads are also very competitive and there are no deposit or withdrawal fees. If you’re also planning to trade other CFD asset classes, Plus500 offers a forex app facility, indices, bonds, ETFs, commodities, and digital currencies like Bitcoin. In terms of the mobile app itself, this is available on both IOS and Android devices – and can be downloaded free of charge.

Regulation-wise, Plus500 is licensed in several jurisdictions. This includes Australia, the UK, Singapore, and more. If you’re keen to get started with this top-rated stock trading app today, opening an account takes minutes. You can instantly add money to your trading account with an NZ debit/credit card, Paypal, or bank wire. The minimum deposit is $100.

Read our comprehensive Plus500 app review to find out more.

- Heavily regulated trading platform

- 0% commission on all forex trading positions

- Leverage facilities available

- Mobile app is highly rated

- No transaction fees

- Account minimum just $100

- Heaps of forex pairs supported

- Thousands of CFD instruments

- Does not offer traditional investment assets

72% of retail CFD accounts lose money

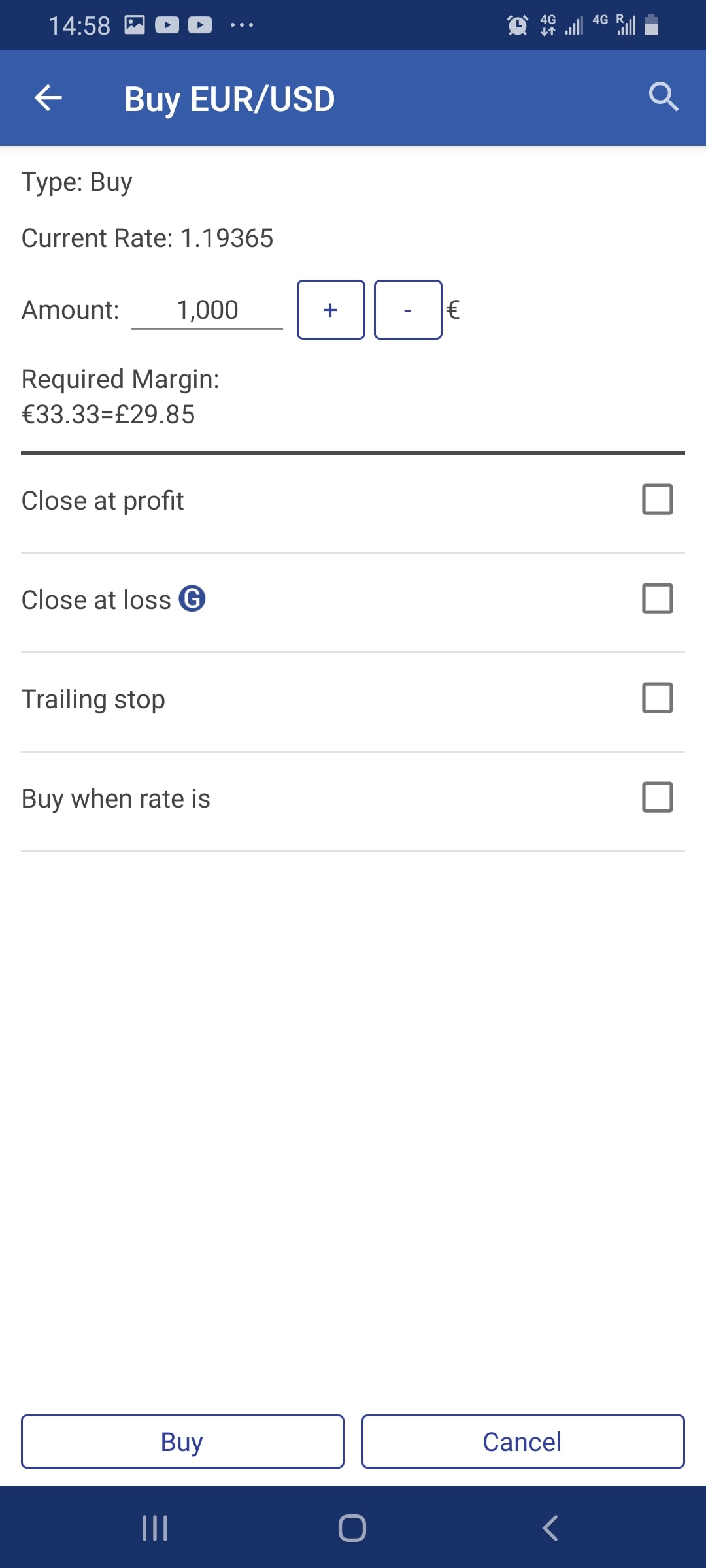

3. AvaTrade – Best Stock Trading App for Fans of MT4/MT5

Much like Libertex and Plus500, AvaTrade has an excellent reputation in the online trading scene. It primarily specializes in CFD instruments – which covers everything from forex and commodities to cryptocurrencies and bonds.

And of course, this top-rated NZ stock trading app also offers an extensive share library. Once again, this CFD provider allows you to go long and short on your chosen stock trading market. Additionally, leverage is available on all markets – with your limits depending on the specific asset.

AvaTrade is also popular in New Zealand as it offers very competitive trading fees. More specifically, you won’t pay any commissions when you trade stocks – and spreads are typically tight on major asset classes. Best of all, AvaTrade offers support for both MT4 and MT5.

All you need to do is download the MT4/5 mobile app and log in with your AvaTrade credentials. Then, you’ll have access to an abundance of advanced trading tools, technical indicators, and more. Or, you might decide to download the AvaTradeGO app – which is likely to be more suitable for newbies.

Either way, AvaTrade is regulated in several jurisdictions – so you should have no concerns regarding safety. In terms of getting started, the AvaTrade app allows you to deposit funds with an NZ debit/credit card or bank wire. The minimum deposit is just $100.

- Thousands of financial instruments supported

- Super-tight spreads on forex pairs

- Several trading platforms – including MetaTrader 4 and 5

- Regulated in several jurisdictions

- Great for news and market insights

- Low account minimums

- Best suited for more experienced traders

There is no guarantee you will make money with this provider.

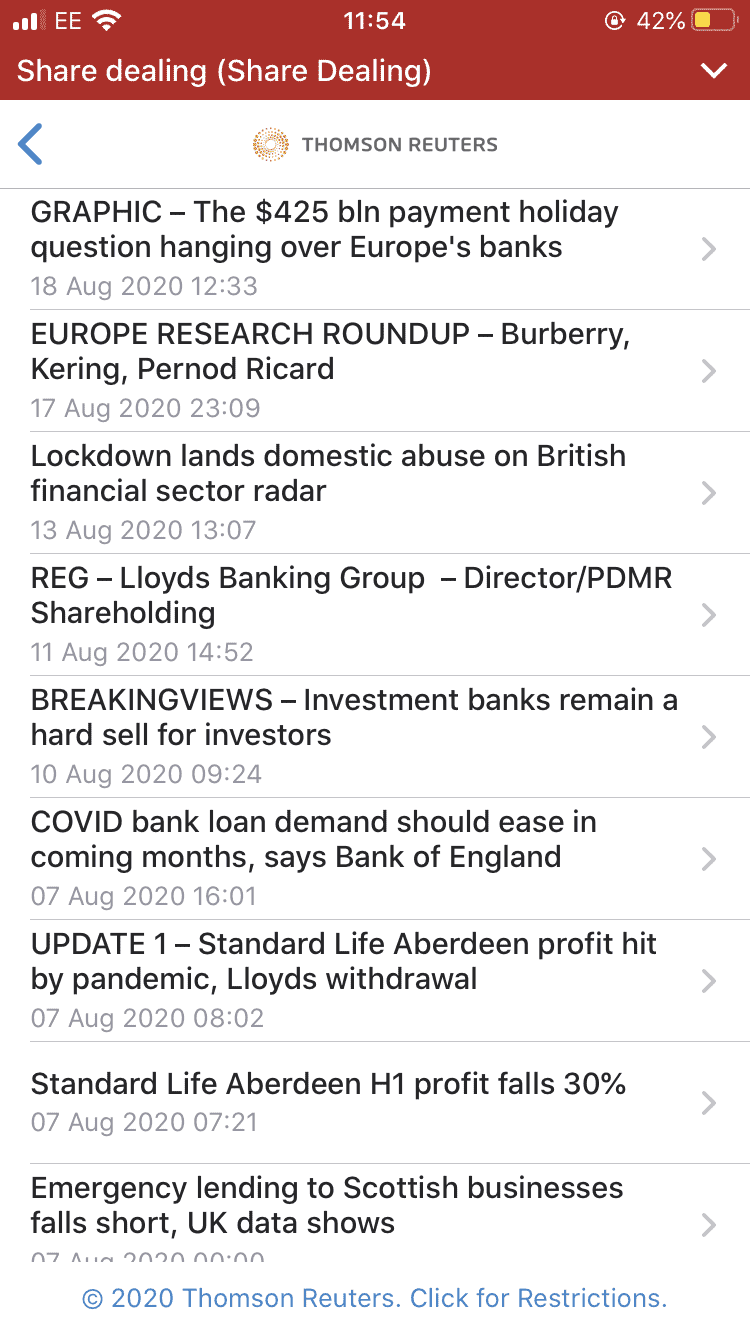

4. IG – Best Stock Market App for New Zealand Shares

Make no mistake about it – the vast majority of leading stock trading apps focus on the major markets of the US and Europe. However, if you’re looking for a trusted app provider that allows you to trade New Zealand-based companies, IG is likely to be the best option on the table.

The broker – which is headquartered in the UK and was first launched in 1974, has a huge library of stocks. Domestically, this includes the likes of Air New Zealand, The A2 Milk Company, Spark New Zealand, and more others.

If you’re also looking to access non-NZ stocks, IG covers markets in the US, Canada, UK, Europe, Asia, Australia, and more. In terms of stock trading fees, IG charges a variable commission which varies depending on the market. For example, if you decide to trade New Zealand stocks, you will pay a commission of 0.10% per slide.

This comes at a minimum of $8 on each trade. Australian stocks are slightly cheaper at 0.08% at a minimum of $7. If you’re looking to trade stocks on margin, IG offers 1:10 on most of its markets. This means that a $100 deposit will enable you to enter a stock trade worth $1,000. As all of the stocks offered to NZ residents come vis CFDs, you can also engage in short-selling.

In terms of safety, IG is regulated by several bodies, including ASIC and the FCA. You can get started with this broker in less than one day, albeit, the minimum deposit is slightly higher than the other platforms on our list at $300. Nevertheless, you can easily fund your account with an NZ debit/credit card – which is instantly processed.

Read our comprehensive IG app review to find out more.

- Trusted investment app with a long-standing reputation

- More than 17,000 financial markets

- Low stock trading fees

- Leverage and short-selling also available

- Spread betting and CFD products

- Access to dozens of international markets

- Great research department

- Minimum deposit of $250

- US stocks have a $15 minimum commission

Your capital is at risk when trading CFDs at this site.

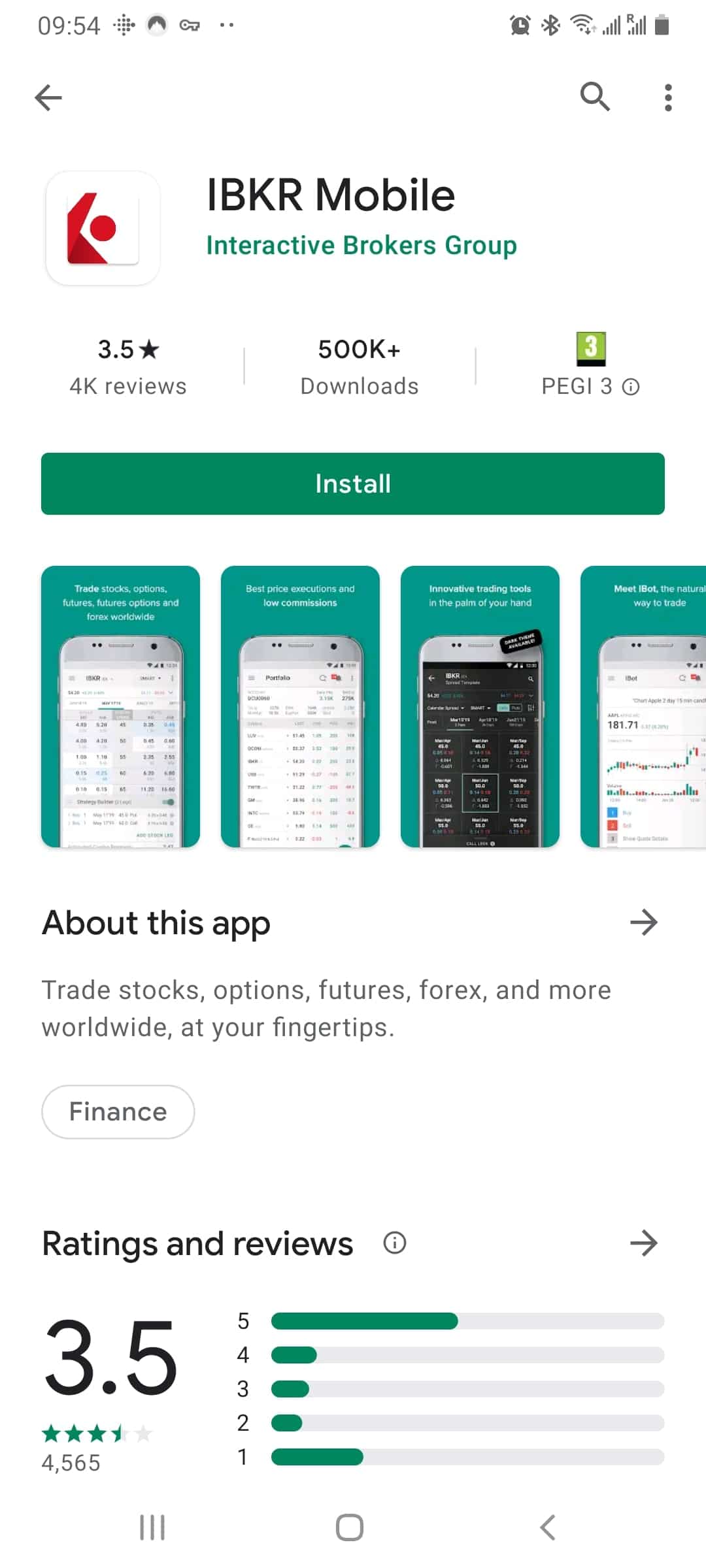

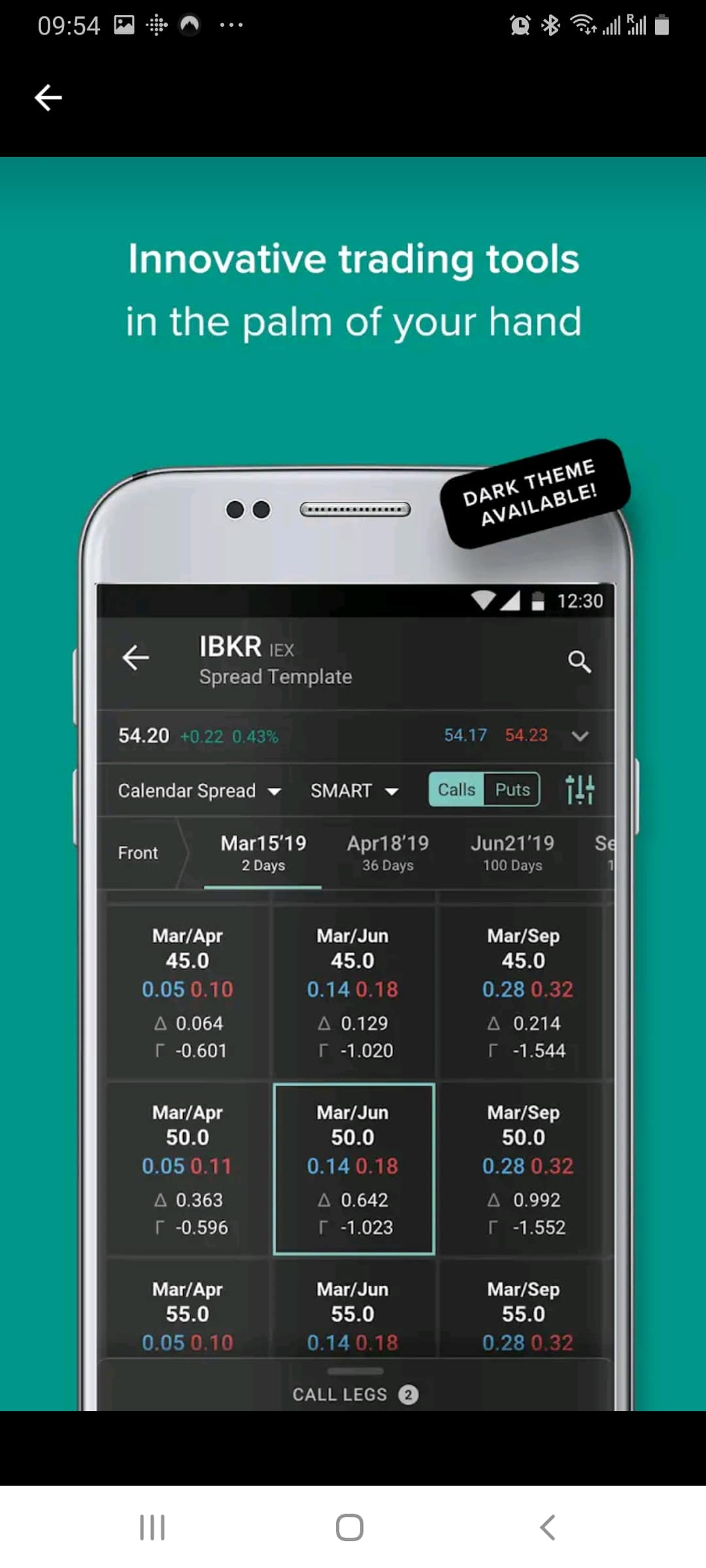

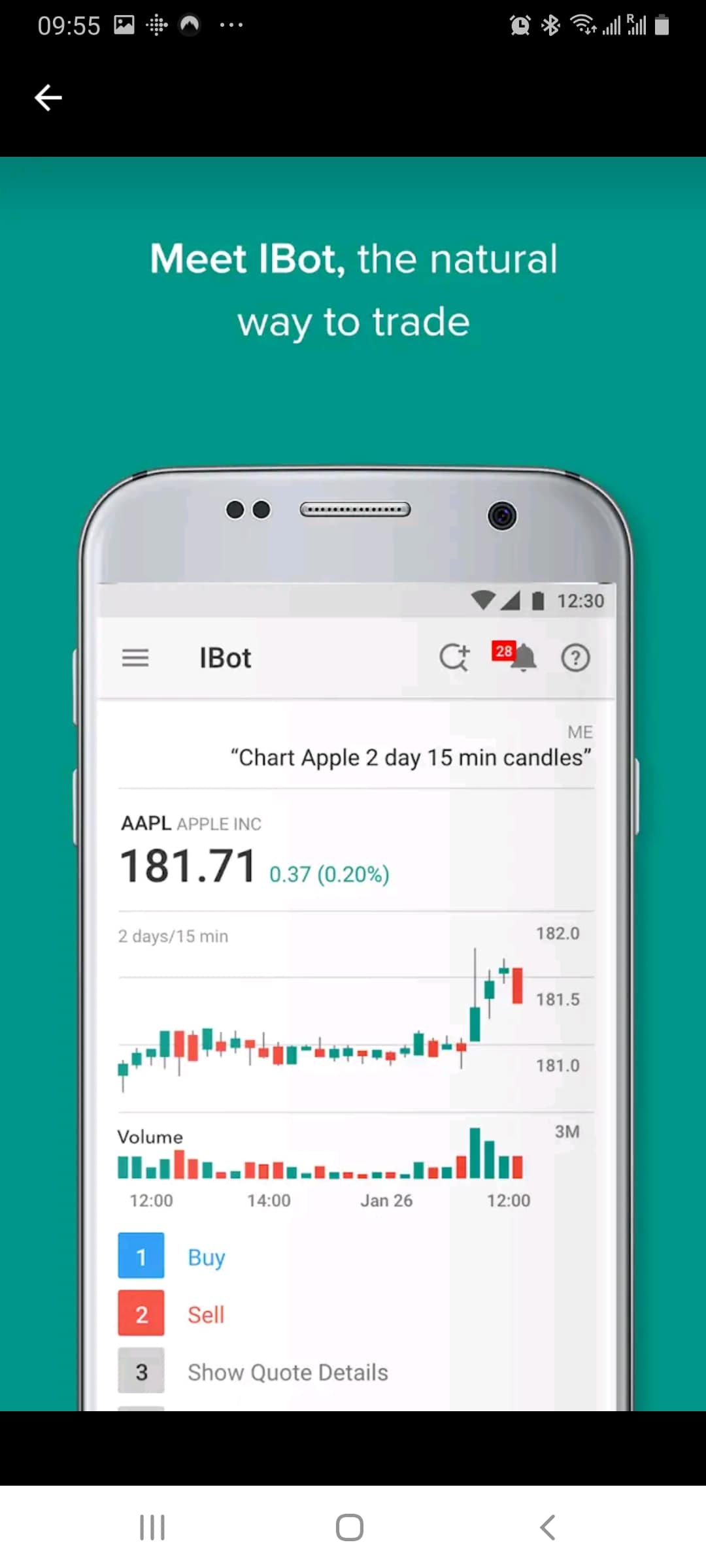

5. Interactive Brokers – Best Stock Taking App for Long-Term Investors

Interactive Brokers is a hugely popular online brokerage site that has operational since 1978. This provider is a great option if you are looking to invest in stocks over several months or years – as opposed to trading CFDs.

In fact, Interactive Brokers has one of the largest stock libraries in the space – covering dozens of financial markets from all parts of the world. You can access this suite of assets online or via the Interactive Brokers app.

Available on iOS and Android, the allows you to perform all account duties. Whether that’s depositing/withdrawing funds, placing buy and sell orders, or checking the value of your portfolio – the Interactive Brokers app has you covered. In terms of fees, this will vary depending on the account type you opt for and the stock market you wish to access.

With that said, if you opt for the Free account and buy stocks listed in the US – you won’t pay any commission at all. The Interactive Brokers app is also a great option if you are planning to invest in ETFs or mutual funds. There are thousands of on offer – making it an ideal for passive, long-term investors.

This top-rated trading app also gives you access to other asset classes. For example, you can trade forex, commodities, and heaps of CFDs. The only potential drawback with this stock trading app is that it is somewhat comprehensive. In other words, it might not be suitable for beginners.

- Huge library of traditional stocks

- Dozens of exchanges and markets covered

- CFD instruments also supported

- No minimum deposit

- Low fees starting from $0.005 per share

- More suitable for experienced investors and traders

- No debit/credit cards – bank transfers only

There is no guarantee you will make money with this provider.

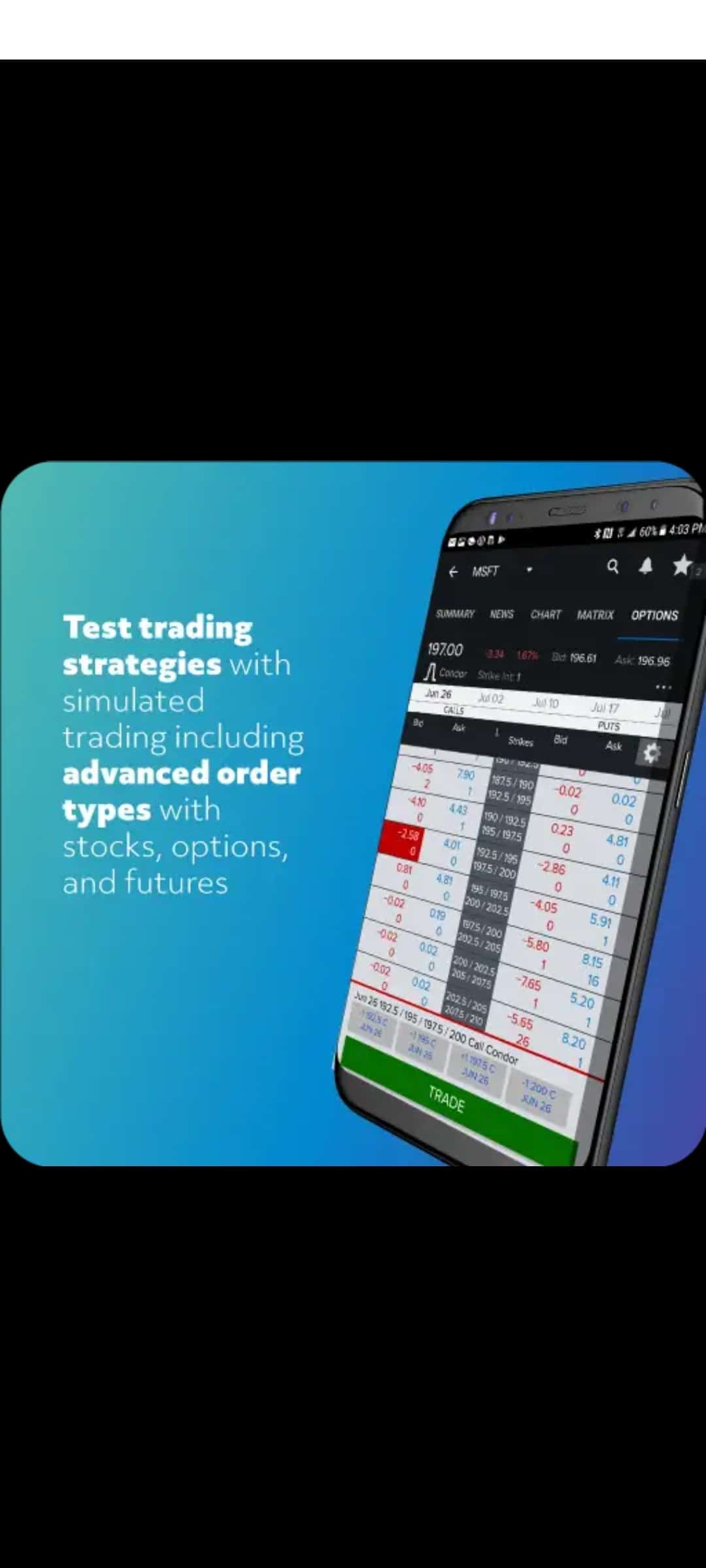

6. TradeStation – Best Stock Market App for Seasoned Pros

If you’re a seasoned stock trader that wants access to highly advanced tools and features, TradeStation might be your best option. This popular brokerage firm offers thousands of markets – all of which can be traded online or via the mobile app.

This includes stocks, ETFs, cryptocurrencies, options, futures, mutual funds, and bonds. The application also gives you access to IPOs – should you want to invest in a company before it hits a public exchange.

This top-rated investment app comes packed with advanced charts and technical indicators. You can customize your chart analysis screen to the ‘t’, use drawing tools, and easily explore trends at the click of a button. The TradeStation app also comes with a full range of basic and advanced order types, alongside custom price alerts.

When it comes to trading commissions, this top stock market app allows you to trade shares commission-free. Options and futures are also competitive at just $0.50 and $0.85 per contract, respectively. Maring accounts are also available at TradeStation, albeit, you’ll need to deposit at least $2,000 to be eligible.

- Great trading app for seasoned pros

- Heaps of stocks, ETFs, cryptrocurrencies, bonds, and more

- Trade options and futures from just $0.50 per contract

- $0 comimssion on stocks

- Mobile app is packed with advanced chart reading and drawing tools

- Excellent reputation

- Newbie traders might find the app overwhelming

- Margin accounts require a minimum deposit of $2,000

There is no guarantee you will make money with this provider.

How to Choose the Best Stock App for You

This guide has reviewed the best stock apps available to New Zealand residents in 2021. However, no-two trading apps are the same – meaning that you should still perform a bit of research on the provider before signing up. Your research journey should include key metrics like regulation, commission, tradable stocks, payments, customer support, and more.

To help point you in the right direction, the sections below will explain what you need to look out for when choosing the best stock app for you.

Regulation

The most important factor that needs to be considered when choosing a stock app is that of regulation. After all, you will be depositing funds into the trading app – so you need to ensure that you are covered by a range of investor protections. First and foremost, all of the New Zealand stock apps that we have discussed today are regulated by at least one tier-one body.

This includes the likes of:

- Australian Securities and Investments Commission (ASIC) in Australia

- Cyprus Securities and Exchange Commission (CySEC) in Europe

- Financial Conduct Authority (FCA) in UK

Although you might be looking for a trading app that is regulated in New Zealand, there are a few options on the table. However, in comparison to the apps we have discussed today – these providers fall short in several areas.

The good news is that the likes of ASIC, CySEC, and the FCA are reputable financial bodies that are tasked with keeping you and your fellow traders safe.

For example, all three bodies require stock trading apps to keep client funds in segregated bank accounts. They must also ensure that the trading apps keeps your personal information safe and that all clients have their identity verified.

At the other end of the spectrum, if you come across a trading app that isn’t regulated by a reputable body, avoid it. These apps are known to skirt around key regulation surrounding fund segregation and KYC (Know Your Customer) controls – so make sure you stick with licensed platforms that can legally accept New Zealand residents.

User Experience

We find that the end-to-end user experience can be hit or miss with stock trading app providers. For example, some of the New Zealand trading apps that we tested were really clunky and difficult to navigate. A few of the apps even came with lag when we tried to place a stock trading order. This can be devastating if you are looking to enter or exit a trade immediately.

On the flip side, the best stock trading apps that we reviewed on this page all offered a great user experience. This was the case on both iOS and Android devices. For example, it was easy to open an account with the provider directly within the app – as was adding funds.

Additionally, the apps reviewed on this page also made it easy to find the specific stock that we were looking to trade. It is also important to explore what the research and analysis section is like on your chosen stock app. After all, you might be planning to read pricing charts on the app – which can be challenging on a smaller screen.

Tradable Stocks

If you are looking to focus exclusively on stocks, then make sure that you know which markets are supported by the trading app provider. For example, the best stock trading apps that we came across also a vast number of financial markets. This includes major markets in the UK, US, and Europe – as well as Asia and the Middle East.

It goes without saying that very few stock trading apps cover the New Zealand Exchange – as demand from international investors is somewhat thin on the ground. However, if this is something you are after, IG offers heaps of NZ companies that can be traded at the click of the button.

Real Stocks or CFDs

In addition to the specific markets and exchanges on offer, you should also check whether the trading app offers real stocks or CFDs instruments. By “real stocks”, we mean that you will own the actual shares outright and thus – be entitled to certain perks like dividends and voting rights.

With that said, most stock traders in New Zealand will opt for CFDs. This is because stock CFDs give you a lot more flexibility than traditional shares. For example, not only can you apply leverage on your chosen stock CFD market, but you can also choose from a long or short position.

Fees

All stock trading apps in New Zealand charge fees. This can come in various forms, which we elaborate on in more detail below.

Stock Trading Commissions

In most cases, your chosen stock trading you will charge you a commission on each position that you enter.

For example, we mentioned earlier that IG charges 0.10% per slide when you trade New Zealand stocks. This means that you will pay this commission when you open an order and again when you close it.

For example, if you entered the stock trading position with a $10,000 stake – your 0.10% commission would amount to $10. Then, if you closed the position when it was worth $12,000 – your 0.10% commission would cost you $12.

On the other hand, some of the best stock trading apps that we reviewed on this page allow you to buy and sell shares commission-free. This means that all trading fees are built into the ‘spread’, which we discuss below.

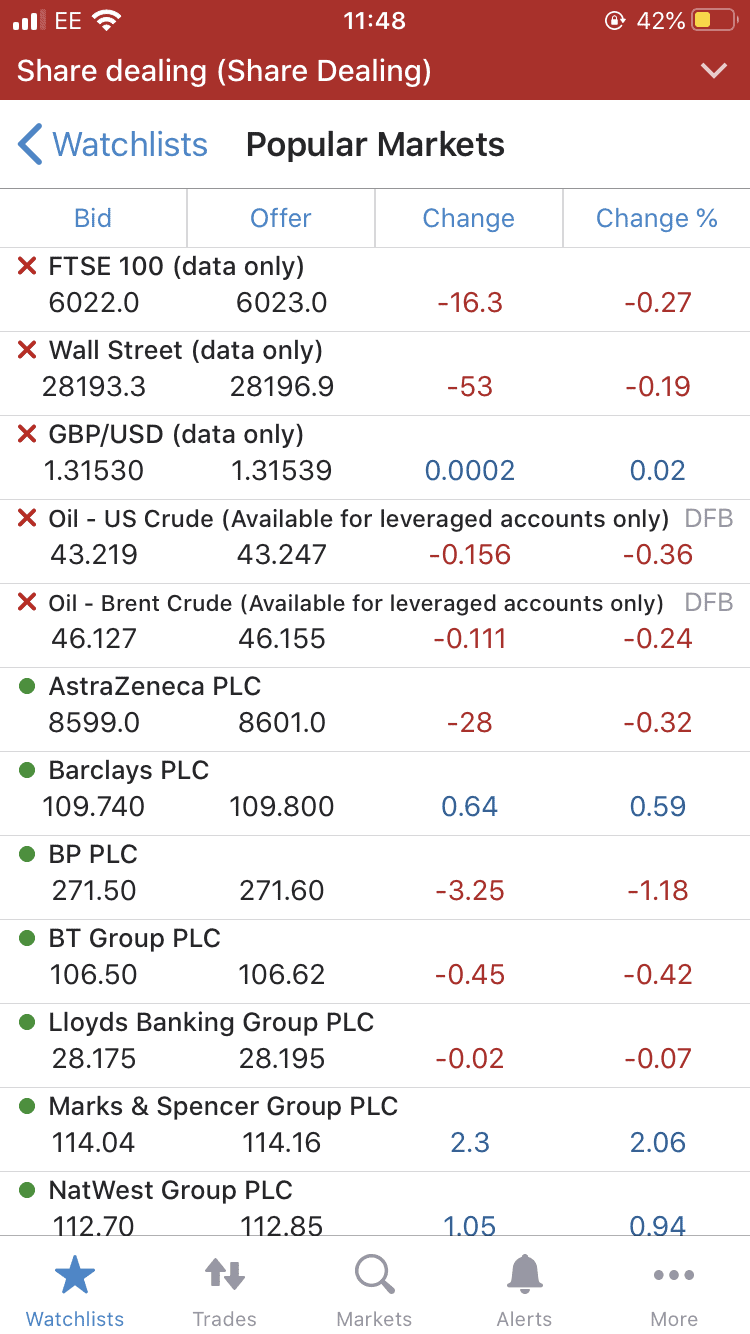

Spreads

The spread is the gap between the ‘buy’ and ‘sell’ price offered by your chosen stock trading app. In the traditional stock investment scene, this is known as the ‘bid’ and ‘ask’ price.

Either way, this gap in pricing is an indirect fee that you need to take into account when choosing a stock trading app. For example, let’s suppose that you are trading Air New Zealand stocks and the spread amounts to 0.6%. In simple terms, irrespective of whether you go long or short, you are instantly in the red by 0.6% when you open the trade.

With that being said, our top-rated stock trading app Libertex is one of the only providers we have come across that doesn’t charge any spreads. This means that you are getting the wholesale rate.

Other Fees to Consider

There are several other fees that you need to consider when choosing a top-rated New Zealand stock trading app.

This includes:

- Overnight Financing Fees: If you decide to trade stock CFDs, these are leveraged financial products. This means that for each day that you keep your position open, you will pay an overnight financing fee. The specific fee can vary depending on the broker, asset class, stake, and whether you keep the position open over the weekend.

- Inactivity Fees: Most stock trading apps have an inactivity fee policy in place. This kicks in when your account is marked as dormant – typically because you haven’t traded for a certain amount of time (usually 12 months). When it does, a fee will be deducted from your account every month until you start trading. If your account balance is empty anyway, you won’t be charged anything.

- Transaction Fees: While the best stock trading apps allow you to deposit and withdraw funds on a fee-free basis, others will charge you a fee. This might be a flat fee or a variable percentage that is multiplied against your deposit/withdrawal amount. Always check this before opening an account.

Ultimately, there are many fees to consider before you choose a stock trading app – so make sure you do a bit of homework before taking the plunge.

Trading Tools & Features

Once you have crossed off the fundamentals of regulation, user experience, and fees – it’s then time to explore what trading tools and features the app offers. This can and will vary depending on the platform and of course – what you are looking for specifically.

Nevertheless, some of the best tools and features offered by top-rated trading apps include the following:

- Automated Trading: If your chosen trading app offers supported for either MT4, MT5, or cTrade – then you will be able to benefit from automated trading. This is executed via a software file that you install into the respective third-party platform. Then, the ‘robot’ will buy and sell stocks on your behalf.

- Economic Calendar: Don’t make the mistake of discounting the importance of an economic calendar. This will outline the date of time of key upcoming events. For example, this might be an earnings report of a specific stock or a meeting by the US Federal Reserve.

- Leverage: If you have a higher appetite for risk then you might be considering leverage. After all, this allows you to trade with more money than you have in your stock trading account. Most of the stock trading apps listed on this page offer leverage – some at 1:10 on share CFDs.

- Short-Selling: There might come a time where you research the performance of a stock and concluded that it is likely to go down in value. If this is the case, then you’ll need to choose a stock trading app that offers short-selling facilities. This is relatively straight forward, as is the app offers stock CFDs, you’ll be able to short-sell with ease.

The above tools and features are just a select few. There are many more, albeit, you just need to check whether the stock trading app in question offers your chosen tool/feature before signing up.

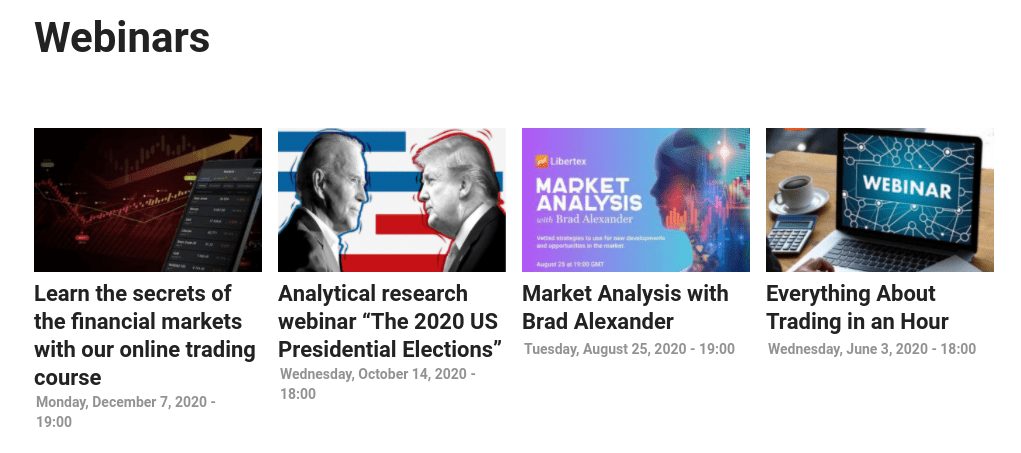

Education, Research & Analysis

If this is going to be your first time trading stocks – whether that’s online or via a mobile app, you’ll want to pick a provider that offers a good range of educational tools. In its most basic form, this might be a selection of guides and explainers on key trading principles.

With that said, the best stock trading apps will often provide mini-courses that guide you through the trading journey bit-by-bit. Additionally, we also like it when stock trading app providers host regular webinars. This will not only give you the chance to listen to the thoughts of an experienced in-house trader, but also gain some crucial market insights.

Irrespective of whether you are a seasoned pro or newbie trader – you’ll also want to ensure that your chosen stock trading app offers suitable research and analysis tools. Regarding technical analysis, this should include heaps of indicators so that you can study the price action of your chosen stock. You’ll also want access to real-time financial news.

Device Compatibility

Although the best stock trading apps in New Zealand are usually compatible with both iOS and Android, one version of the application might not perform as great as the other. For example, we have previously come across stock trading apps that allow you to deposit and withdraw funds on Android, but not iOS.

This means that those with a phone backed by the latter will need to fund their account via the online website. Similarly, we have also reviewed providers that allow you to set up pricing alerts and notifications on one operating system, but not the other. As such, if you are looking for the best stock apps for Android or iOS – make sure that it performs well on your respective device.

Payment Methods

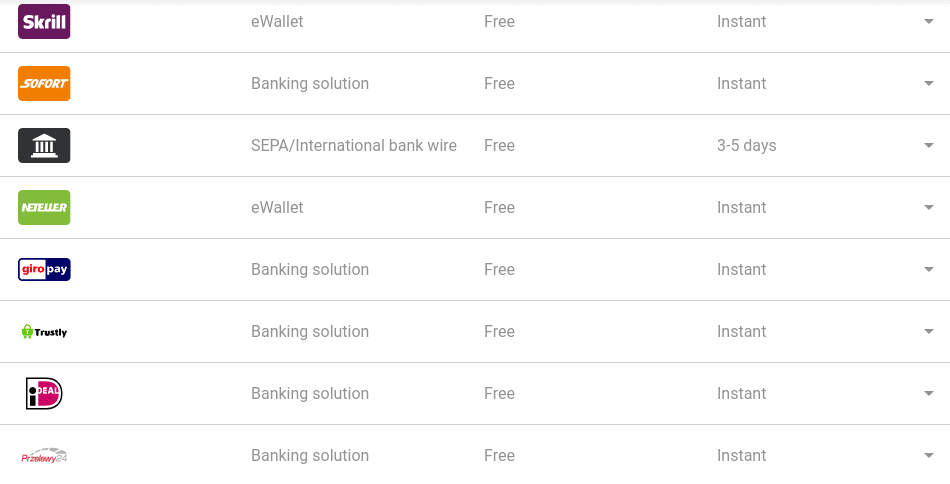

Assuming that your chosen stock trading provider allows you to deposit and withdraw funds via the app (which most do), you need to check whether your preferred payment method is supported. Typically, it’s just a case of opening the app, entering your NZ debit/credit card details, and choosing how much you wish to deposit.

Then, the provider will credit your stock trading account instantly. Some of the best trading apps also offer support for e-wallets, and even Google and Apple Pay. If you come across an app provider that only supports bank wires, you might want to avoid it. This is because it can take several days for the funds to arrive.

Customer Service

Last, but certainly not least, is that of customer support. In an ideal world, your chosen stock trading app will have a Live Chat facility built-in. This means that you can speak with an advisor in real-time – should you run into any issues. Alternatively, you might need to send an email or raise a support ticket.

This means that it can take several hours or even days to receive a response. Some stock trading apps also offer telephone support, but you might need to call a non-NZ number. In terms of support hours, this is usually 24 hours per day between Monday and Friday, which mirrors the traditional stock markets.

How to Download a Stock App & Start Trading

If you’ve read our guide up to this point – you should now have a good idea of which stock trading app you want to open an account with. If, however, you’re trading stocks for the first time – it might be worth reading through the step-by-step walkthrough outlined below.

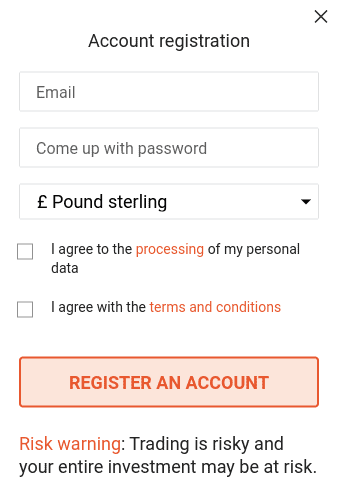

For this, we are showing you how to get started with our top-rated New Zealand stock app – Libertex.

Conclusion

In conclusion, New Zealand residents now have access to a plethora of top-rated stock apps. With so much choice in the market, you need to do a bit of research to ensure your chosen provider meets your trading needs. This should center on things like commission, payment types, supported markets, and of course – regulation.

If you don’t have time to cipher through dozens of potential suitors – Libertex is a great stock trading app to consider. Not only can you trade heaps stocks without paying any spreads, but the regulated platform allows you to get started with a minimum deposit of just $10.

You can get started with Libertex right now by clicking on the link below!

Libertex – Best Stock Market App for Beginners NZ – 0% Spreads

74% of retail investor accounts lose money when trading CFDs with this provider.