Best Forex Trading Apps 2024 – Pros & Cons

If you want to buy and sell currencies, you’ll need to find a suitable broker that offers a native forex trading app. In doing so, you’ll be able to access the forex markets 24/7 – no matter where you are located.

This means that you can enter buy and sell positions at the click of a button. Depending on your chosen provider, you might also have access to technical and fundamental research tools, deposit and withdrawal facilities, and the ability to set real-time price alerts.

In this guide, we explore the best forex trading apps of 2024. Our review process looks at various metrics – such as regulation, trading commissions, supported pairs, payments, and customer support.

[toc]Top 10 Forex Trading Apps

As per our findings, below you will find the top 10 forex trading apps for iPhone and Android. You’ll find a detailed overview of each app further down on this page.

- Plus500: Benefit from 0% commission trading at a heavily regulated broker.

- Forex.com: Best forex trading app for US residents.

- IG: Trusted UK brokerage firm launched in 1974. 0% commissions when trading forex.

- FXCM: Useful forex trading that is compatible with MetaTrader 4.

- FXTM: Forex trading app that allows you to deposit from just £/$ 10. Great for first-timers.

- Trading212: Super-clean forex trading app for UK residents. No commissions and tight spreads.

- AvaTrade: Established forex trading app with support for MetaTrader 4. Great for seasoned traders.

- 24Option: Best forex trading app for Europeans. Leverage facilities for all traders.

The Best Forex Trading Apps of 2024 Reviewed

With hundreds of forex trading apps active in the market, finding one that best meets your needs can be challenging. For example, you need to look at the types of currency pairs hosted by the app, trading fees and commissions. And whether or not your preferred payment method is supported.

To help point you in the right direction, below we’ve listed the best forex trading apps of 2024. Whether you’re looking for the best forex trading app for Android or the best iPhone forex trading app, we’ve got you covered.

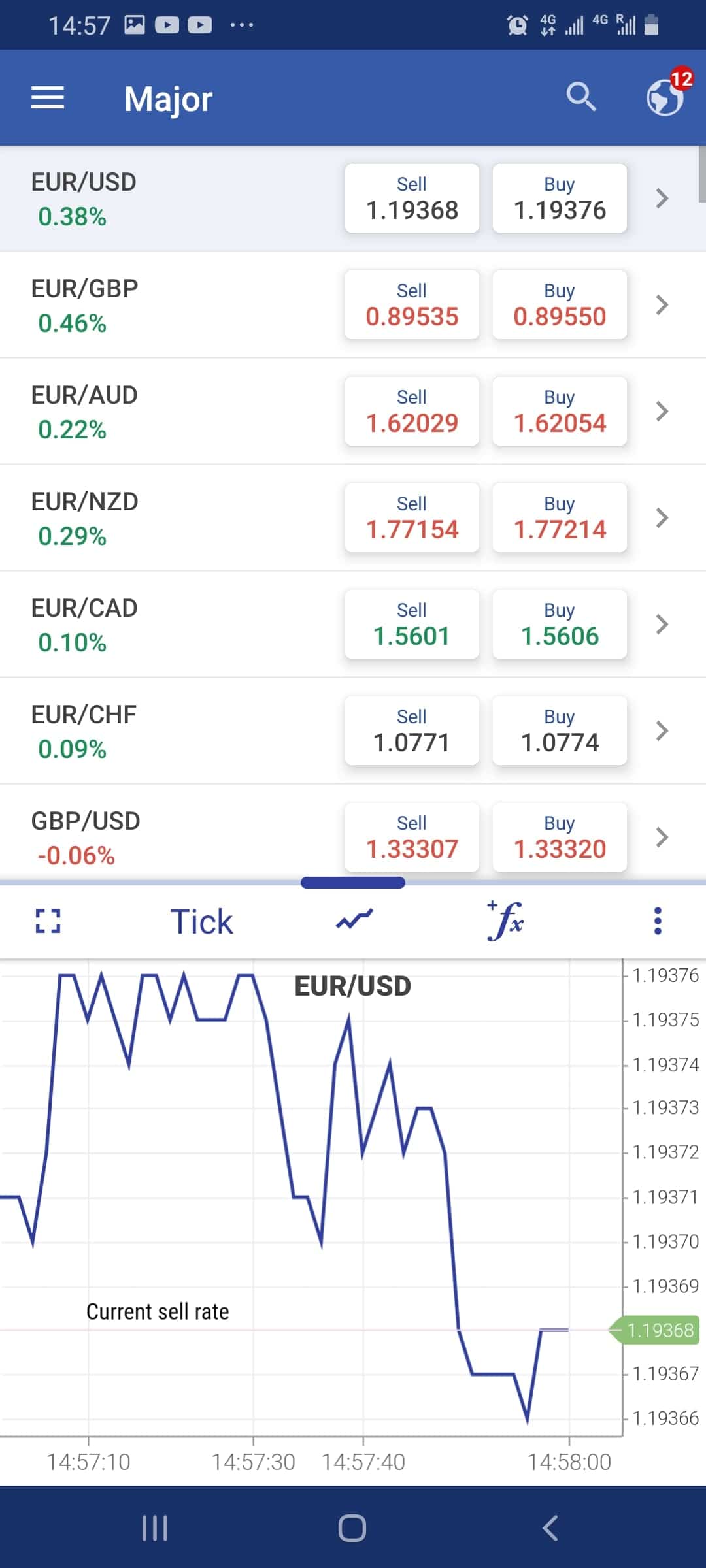

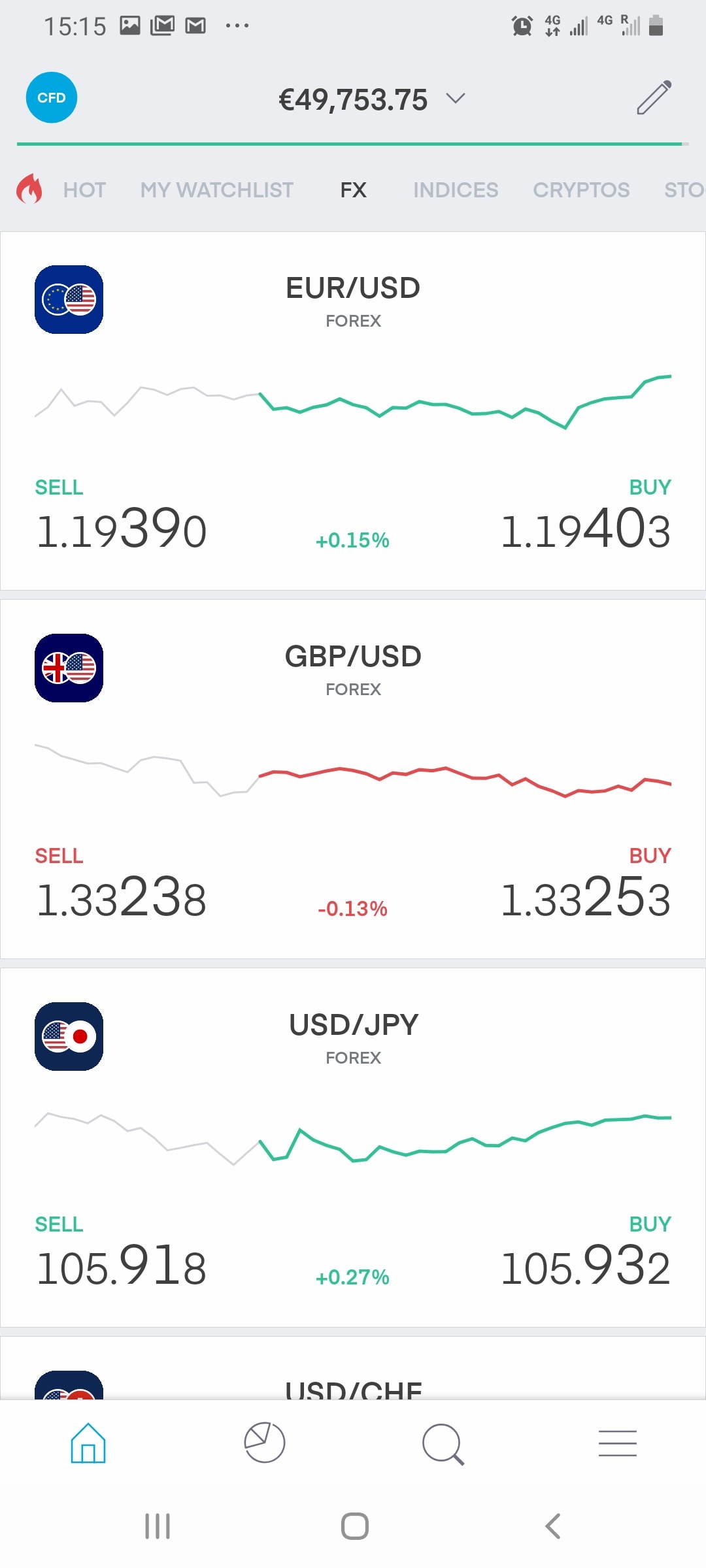

1. Plus500 – CFD Trading Platform with Forex Practice App

Plus500 is a trusted online brokerage firm that gives you access to thousands of financial instruments – all in the form of CFDs. This covers every investment class imaginable – including but not limited to stocks, indices, ETFs and options. Crucially, Plus500 also offers a fully-fledged forex trading facility.

In fact, the platform gives you access to an abundance of trading pairs across the majors, minors, and exotics. Best of all, the Plus500 trading platform is available both online and via a native app. The latter is available on both iOS and Android devices – which can be downloaded for free. Once you load the app up, you can open an account with Plus500 in minutes, and get started with a minimum deposit of just £100.

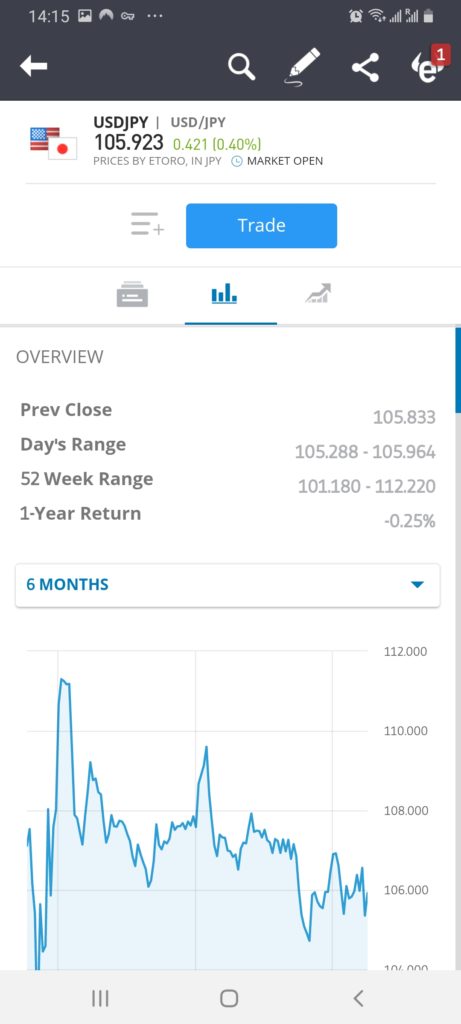

In terms of fees, Plus500 does not charge any trading commissions. Spreads are also very competitive, meaning that you can keep your forex trading costs to a minimum. Plus500 does not charge any deposit or withdrawal fees either. With that said, you will need to pay a small currency conversion fee of up to 0.5%. This is applicable when you trade an asset that is priced in a currency different to your own. For example, if you’re UK based on trade USD/JPY, then the fee will kick in.

We should also note that Plus500 offers leverage facilities to all account users. Once again, ESMA limits will apply for the UK and European traders. Those based elsewhere – alongside professional clients, will be offered much higher limits. Finally, you should have no concerns over safety when using the Plus500 CFD trading app. Crucially, Plus500UK Ltd is authorized & regulated by the Financial Conduct Authority (#509909). If you’re based outside of the UK, you will fall under the scope of an alternative regulatory body.

- Heavily regulated trading platform

- 0% commission on all forex trading positions

- Leverage facilities available

- Mobile app is highly rated

- No transaction fees

- Minimum deposit just £100

- Heaps of forex pairs supported

- Thousands of CFD instruments

- Does not offer traditional investment assets

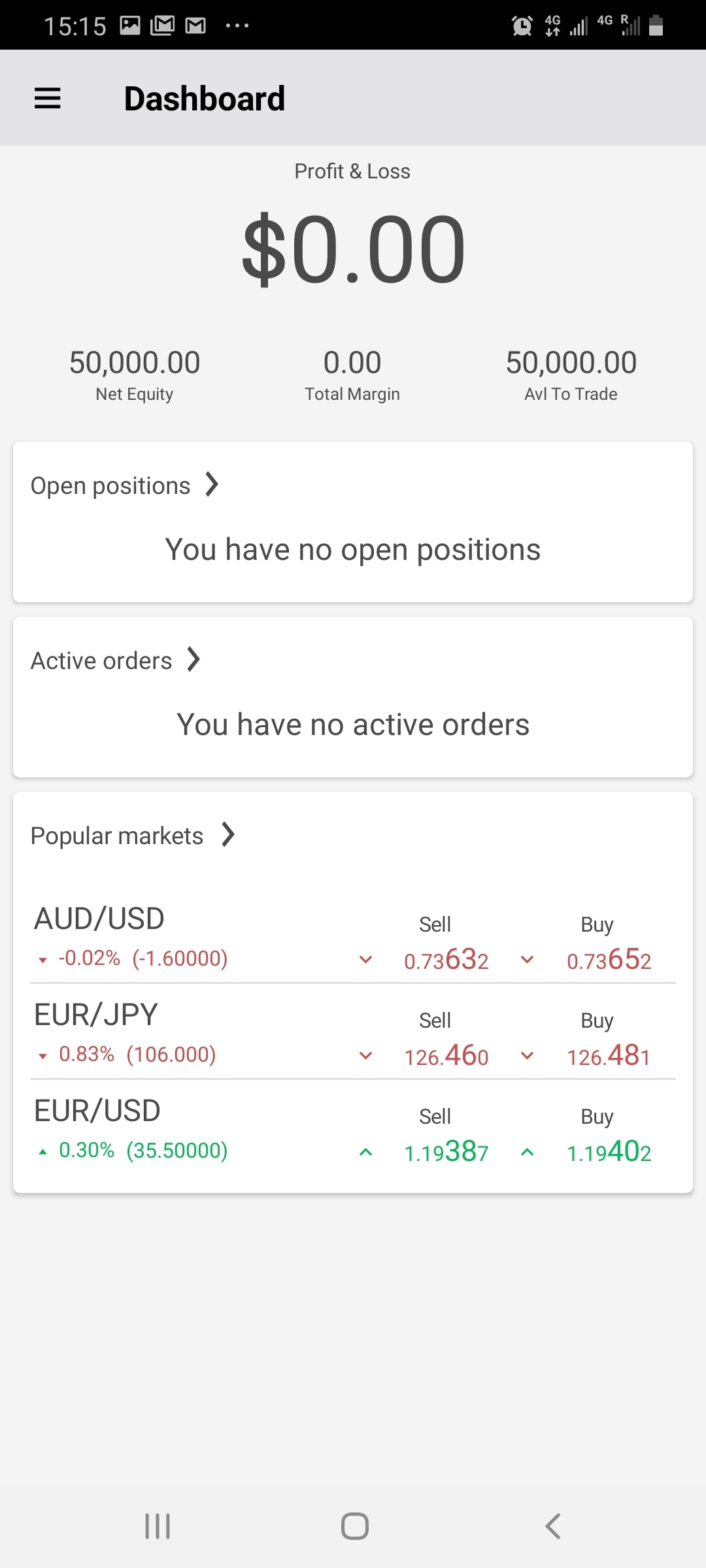

2. Forex.com – Best Forex Trading Platform for US residents

If you’re looking to combine the benefits of forex trading and real-time investment news, look no further than Forex.com. The online currency trading specialist offers a hugely extensive library of pairs – all of which can be accessed via the mobile app. Once again, this covers both iOS and Android devices. All major and minor pairs are covered, alongside dozens of exotics.

In terms of pricing, this will depend on the Forex.com account that you open. For example, the Standard Account allows you to trade forex via the mobile app on a commission-free basis. But, a Commission Account will cost you $5 per standard lot. Although you’ll pay this at both ends of the trade, you will benefit from tighter spreads.

In terms of research tools, the Forex.com app is extremely strong when it comes to the fundamentals. This is because you will have access to economic and financial news stories throughout the day. You’ll also have access to an economic calendar, and market insights from the app’s global research team. If you like the sound of Forex.com, the app allows you to deposit funds with a debit/credit card ($100 minimum) or bank wire (no minimum). There are no fees applicable.

- Specialist forex trading app

- Access to dozens of currency pairs

- Particularly strong when it comes to exotic currencies

- No minimum deposit when opting for a bank wire

- Also offers CFDs

- Heavily regulated – including US licenses

- Top-notch forex and economic news

- Does not support e-wallets like Paypal and Skrill

80% of retail investors lose money trading CFDs at this site.

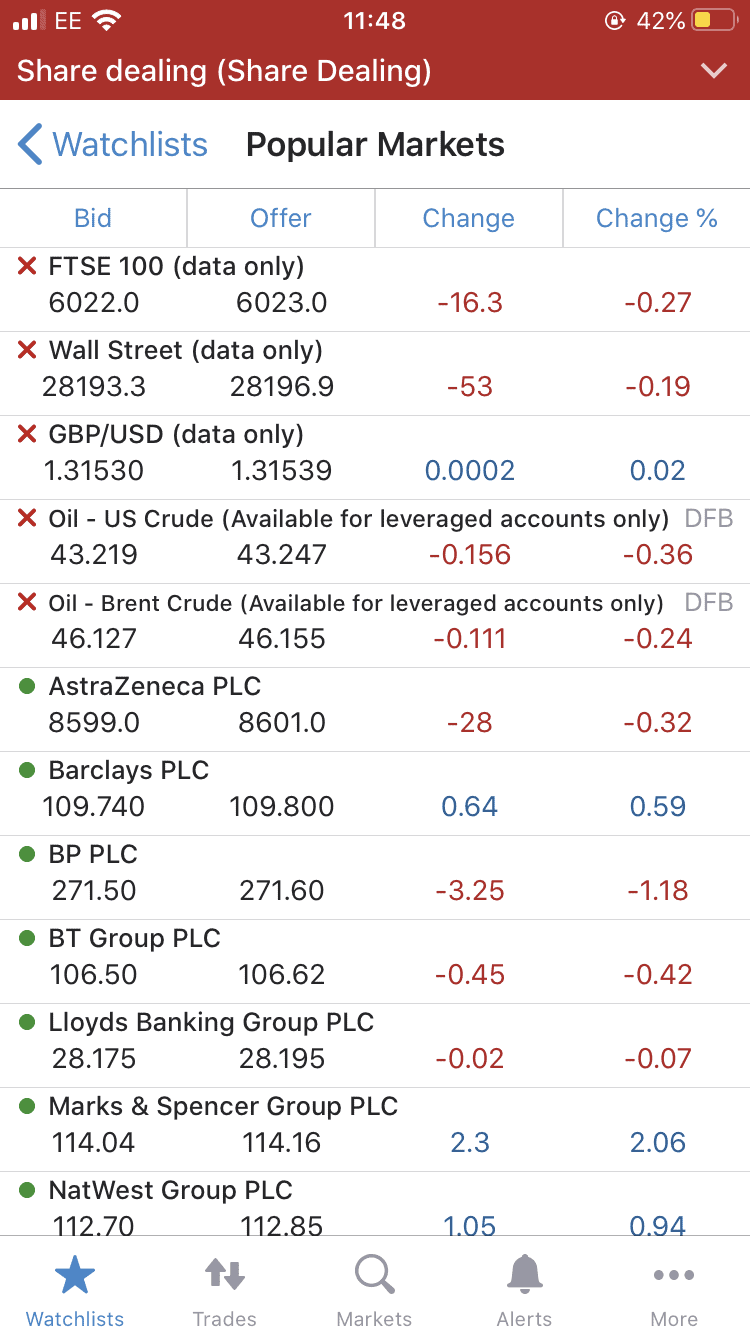

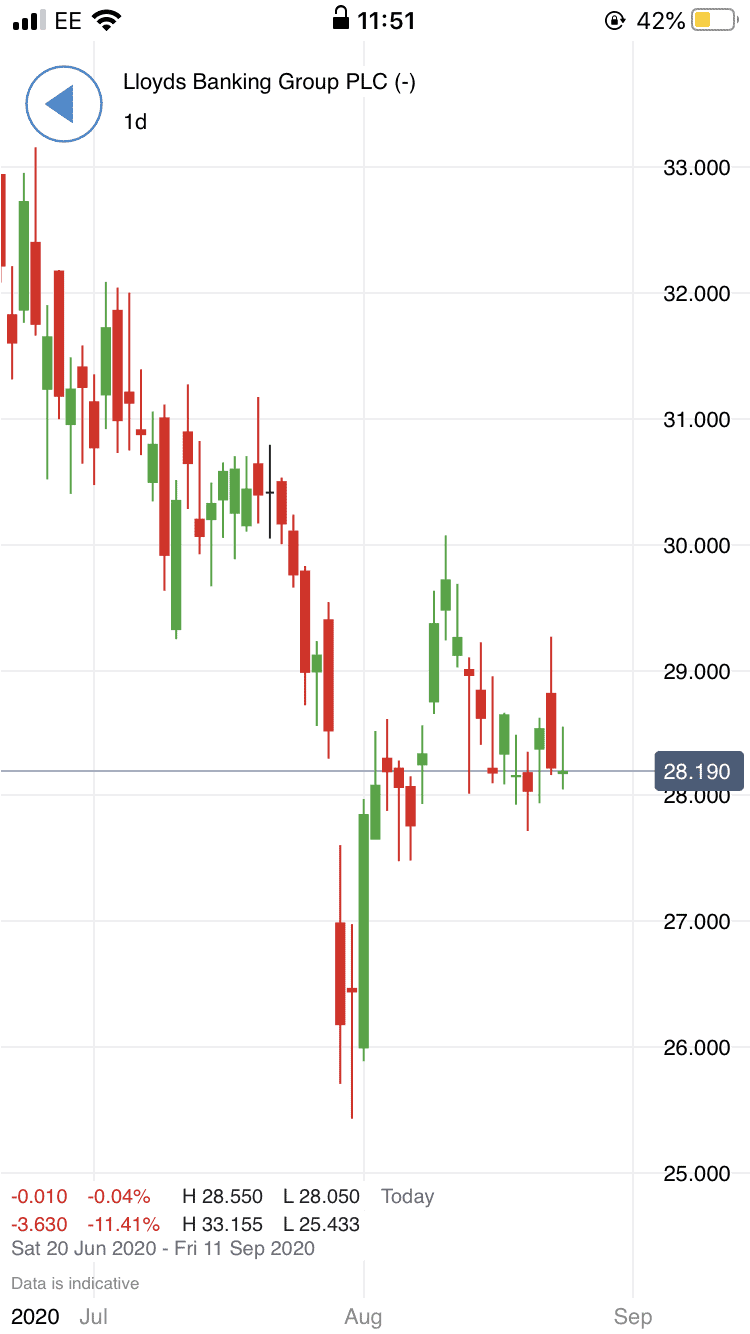

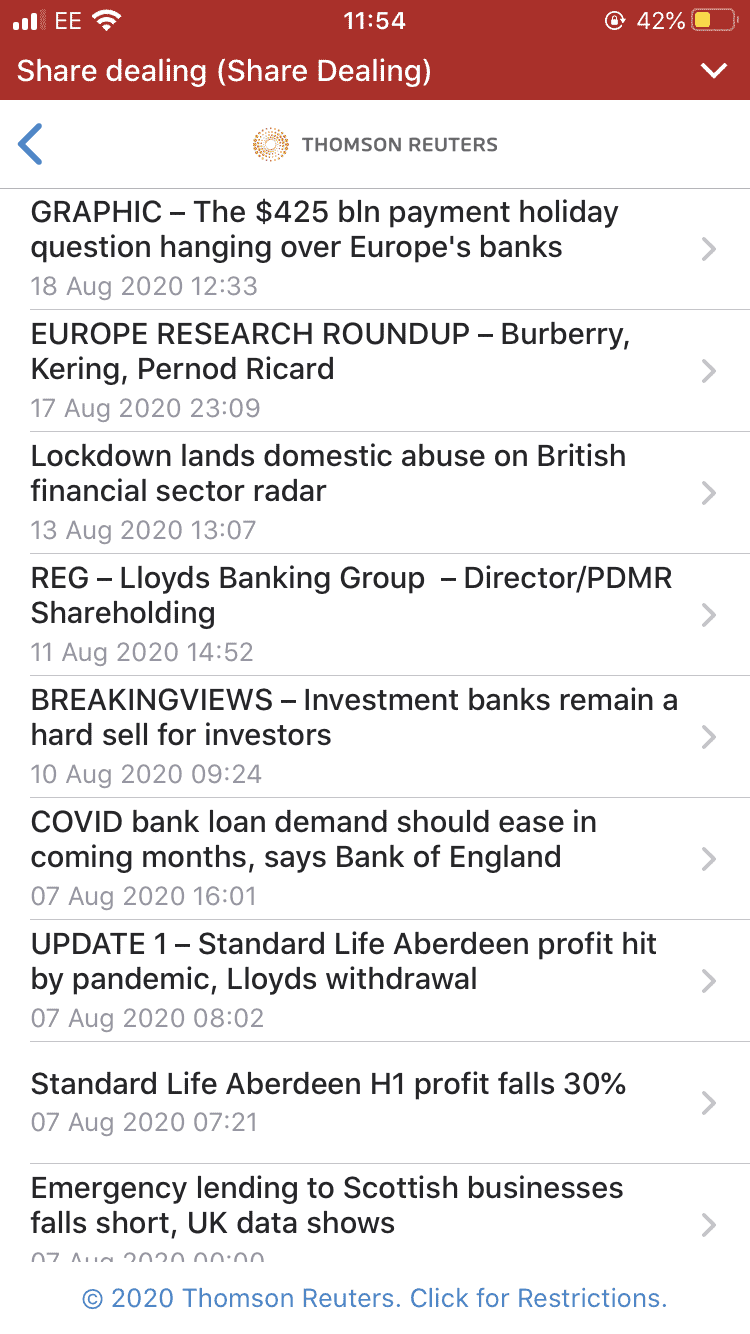

3. IG – Best Forex Alerts App

IG is a market leader in the UK brokerage scene. Launched way back in 1974, the firm is a publicly-listed company with hundreds of thousands of traders under its belt. On top of traditional share dealing and CFD trading, IG is also home to a fully-fledged forex department. This includes well-over 90+ individual pairs, so there is a currency market to suit traders of all shapes and sizes.

You can, of course, access the IG trading suite online or via its mobile app. The latter is compatible with Android and iOS devices. All buy and sell positions come commission-free when trading forex via the app, which is great. With more than 17,000 instruments hosted by the broker, you can also trade stocks, cryptocurrencies, commodities, bonds, and more.

The IG forex trading app comes with a range of features. This includes advanced chart reading tools and real-time price alerts. You’ll get up-to-date news directly through the app, which includes a dedicated Reuters live feed. Leverage facilities are available on all of the app’s supported currency pairs. Your limits will be dictated by your location and trading status. You’ll need to deposit at least £250 to use the IG app. The broker is regulated by the Financial Conduct Authority and ASIC, alongside a number of other licensing bodies.

Want to learn more about the IG trading app? Check out our expert IG review.

- Trusted broker with a long-standing reputation

- More than 17,000 markets listed

- Over 90+ currency pairs supported

- Leverage and short-selling also available

- 0% commissions on forex trading

- Access to dozens of international markets

- Great research department

- Minimum deposit of £250

- US stocks have a $15 minimum commission

There is no guarantee you will make money with this provider.

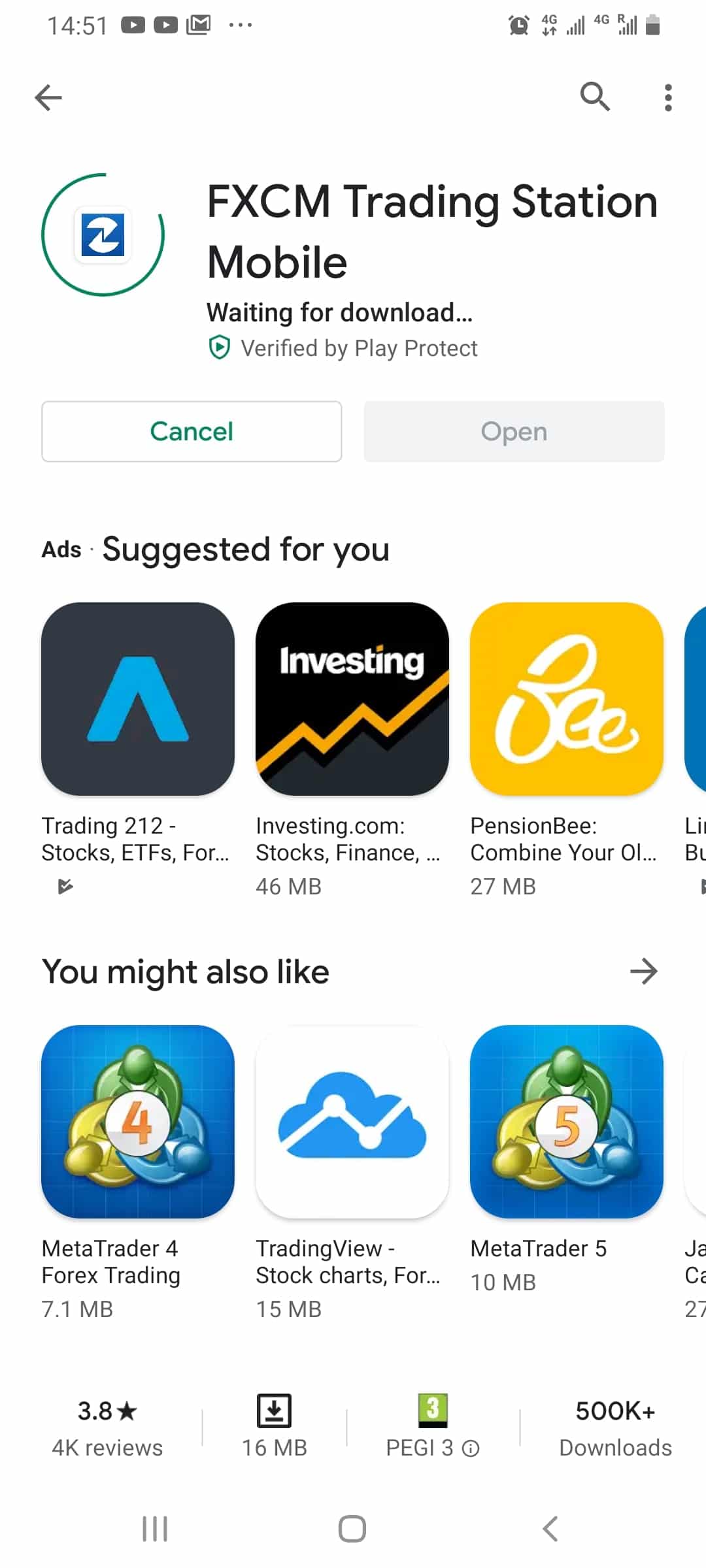

4. FXCM – Best Forex App for MetaTrader 4

One of the main attractions of using the FXCM forex trading app is that you can choose from several platforms. This includes hugely popular MetaTrader 4 (MT4), ZuluTrade, and the FXCM Trading Station. You can also integrate TradingView into your account, which is great for advanced chart analysis and research. In particular, MT4 will suit those of you that plan to engage with automated strategies.

This is because you can install a forex robot (also called EA) directly into the platform, which will then buy and sell currencies on your behalf. In order to do this, you will first need to instal the system via your desktop device. After that, you can monitor and adjust the forex robot trading through the app. In terms of the specifics, all of the aforementioned apps are available on Android and iOS devices. When it comes to fees, FXCM does not charge any commissions.

Spreads are also very competitive – especially when trading majors pairs like EUR/USD. If you’re based outside of the EU, the minimum deposit is just $50. This is great for starting off with small stakes. EU countries, however, will need to meet a $360 minimum. You can get money into your FXCM account via a debit/credit card, e-wallet, or bank wire. FXCM is regulated by the Financial Conduct Authority, meaning that the platform mustadhere to high standards.

- Financial Conduct Authority-regulated

- Lots of currency pairs to trade

- Choose from several trading platforms – including MT4

- Supports EAs and forex robots

- 0% commission on all assets

- Tight spreads

- Minimum deposit of $360 for EU clients

There is no guarantee you will make money with this provider.

5. FXTM – Best Forex Trading App for For Small Stakes ($10 minimum)

If you want to start trading straight away, FXTM offers an extensive list of supported currency pairs. You can also trade other CFD instruments, such as spot metals, stocks, and indices. The FXTM app offers several account types. If you’re just starting out, you might be suited for the Cent Account. This permits a minimum deposit of just £/$ 10.

The Standard Account is also popular with newbie investors and requires a minimum deposit of £/$ 100. Either way, all account types on the FXTM app allow you to trade forex without paying any commissions. What we also like about FXTM is that you get to choose from two trading platforms. You can elect to use the provider’s in-house platform – which is great for those of you that are just starting out in the world of forex.

Alternatively, the broker also supports MT4. This will give you more options when it comes to chart reading and technical analysis, as well as enabling automated forex robots. We should also note that the FXTM app is good obtaining market insights – which comes via blogs and videos. This forex trading app is, of course, heavily regulated. It holds multiple licenses in several jurisdictions, including the UK. Unfortunately, US traders are not eligible to open an account with FXTM.

- Provides heaps of educational resources

- Great for market insights and market research

- Several account types supported

- Extensive forex department

- No commissions when trading currencies

- Great reputation and heavily regulated

- Does not support US traders

There is no guarantee you will make money with this provider.

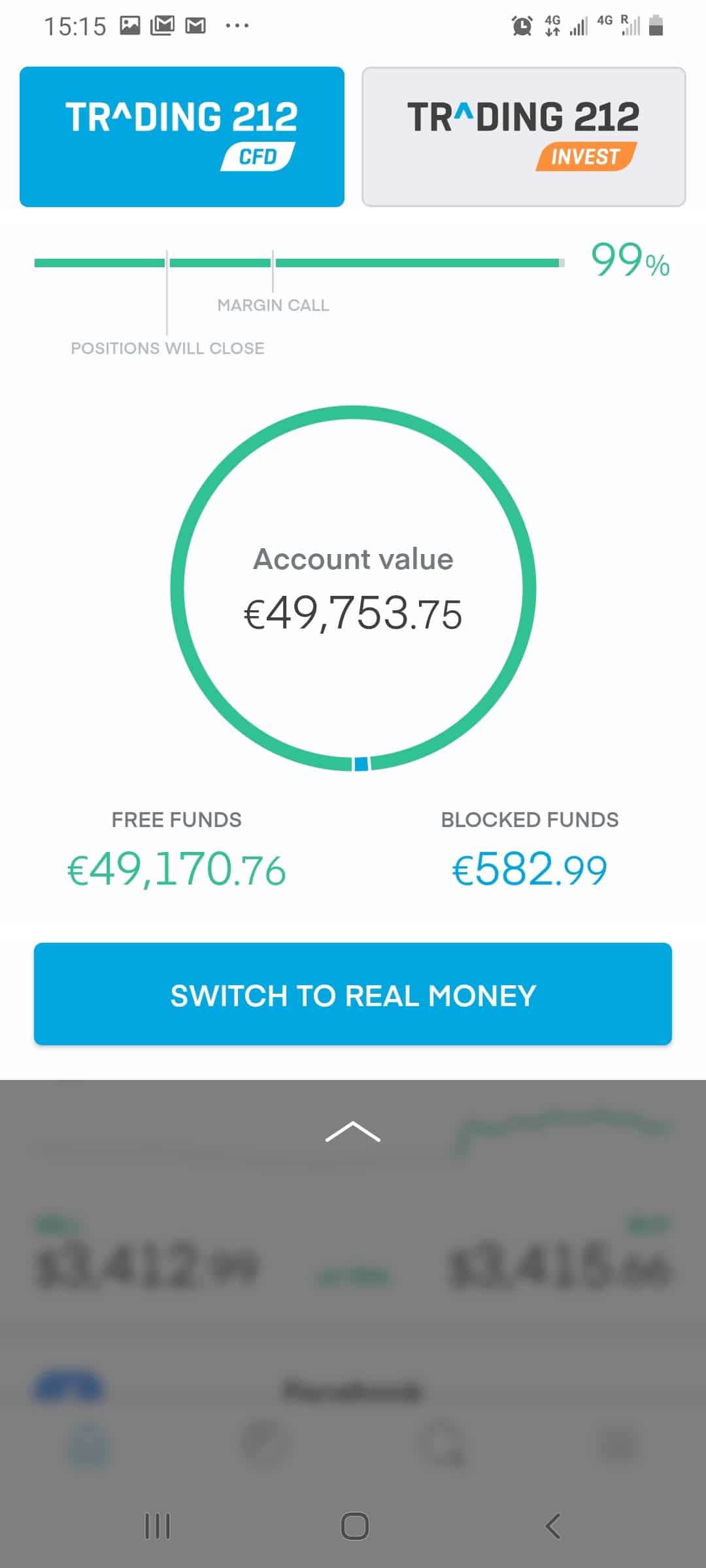

6. Trading 212 – Best UK Forex Trading App for Demo Accounts

Trading 212 is an online trading platform that is proving popular with UK investors. Considered one o the best CFD trading platforms, it offers two main account types – traditional share and ETF dealing, and CFD trading. The latter is where you will find an extensive forex trading department. On top of its main desktop trading facility, the broker also offers a proprietary application.

This ensures that you are able to trade currencies no matter where you are located. What we really like about the Trading 212 app is that you can start trading forex via its demo account without needing to register. Ordinarily, forex trading apps require you to open a standard account before you gain access, so this is a major plus-point. Your forex demo app account will be funded with £50,000 is paper money, so you can get a feel for how the markets work before risking your own capital, this is a huge benefit to using a paper trading app and is recommended before you start real trading,

In terms of fees and commissions, the Trading 212 app charges nothing to trade. Not only is this the case with its forex and CFD trading facility, but also traditional stocks and shares. Crucially, the Trading 212 app stands out for because there is no minimum deposit policy. Instead, you can deposit as little as you like. You can also choose from a variety of payment methods – including debit cards, credit cards, e-wallets, or traditional bank wire.

Trading 212 also comes packed with a variety of educational and research materials. This is ideal for newbies, as you can continue to build on your trading knowledge over the course of time. To illustrate just how popular the app is with forex traders, Trading 212 has a rating of 4.7/5 on the Apple Store, and 4.5/5 with Google Play. Finally, the Trading 212 app is licensed by the Financial Conduct Authority and partnered with the FSCS. The latter protects your trading capital up to the first £85,000.

Still not convinced on the Trading 212 investment app? Read our comprehensive Trading 212 app review to find out more about what this brokerage firm offers.

- 0% commission on all asset classes – including forex

- No minimum deposit

- Your money is protected by the FSCS and Financial Conduct Authority

- CFD trading is also supported – as is leverage and short-selling

- Excellent reviews on Google Play and Apple Stores

- More than 500,000 trusted clients

- Stocks and Shares ISAs offered for tax-efficient savings

Tax treatment depends on individual circumstances and change or may differ in a jurisdiction other than the UK.

- Still relatively unheard of in the UK trading space

- Limited fundamental analysis tools

There is no guarantee you will make money with this provider.

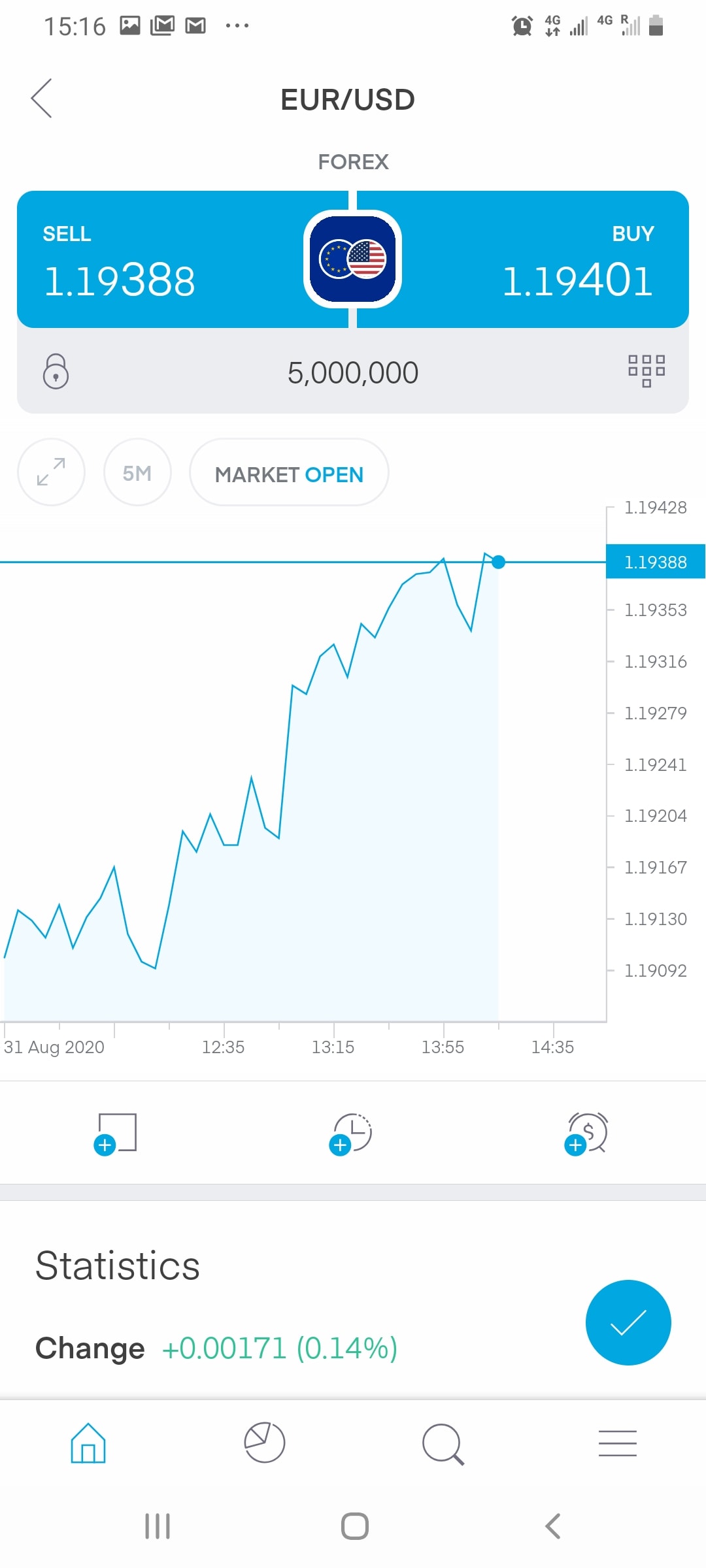

7. AvaTrade - Best Forex News App

In particular, AvaTrade is useful for those of you seeking a forex news app. This is because you can elect to receive real-time notifications when a news story is published on the site. The app also comes packed with market insights and analysis, which is great for building your own short-term trading strategies.

In terms of the fundamentals, the AvaTrade app gives you access to thousands of financial instruments. On top of stocks, commodities, indices, options, ETFs, bonds, and cryptocurrencies - you'll also have access to dozens of forex pairs. This covers most majors, minors, and a large suite of exotics.

Spreads are super-competitive, too. For example, EUR/USD comes with a minimum spread of 0.9 pips. When it comes to the trading platform itself, you can choose from MetaTrader 4 and 5, or the AvaTrade Go software. If it's your first time trading, you might be best to stick with the latter.

- Thousands of financial instruments supported

- Super-tight spreads on forex pairs

- Several trading platforms – including MetaTrader 4 and 5

- Regulated in several jurisdictions

- Great for news and market insights

- Low account minimums

- Best suited for more experienced traders

There is no guarantee you will make money with this provider.

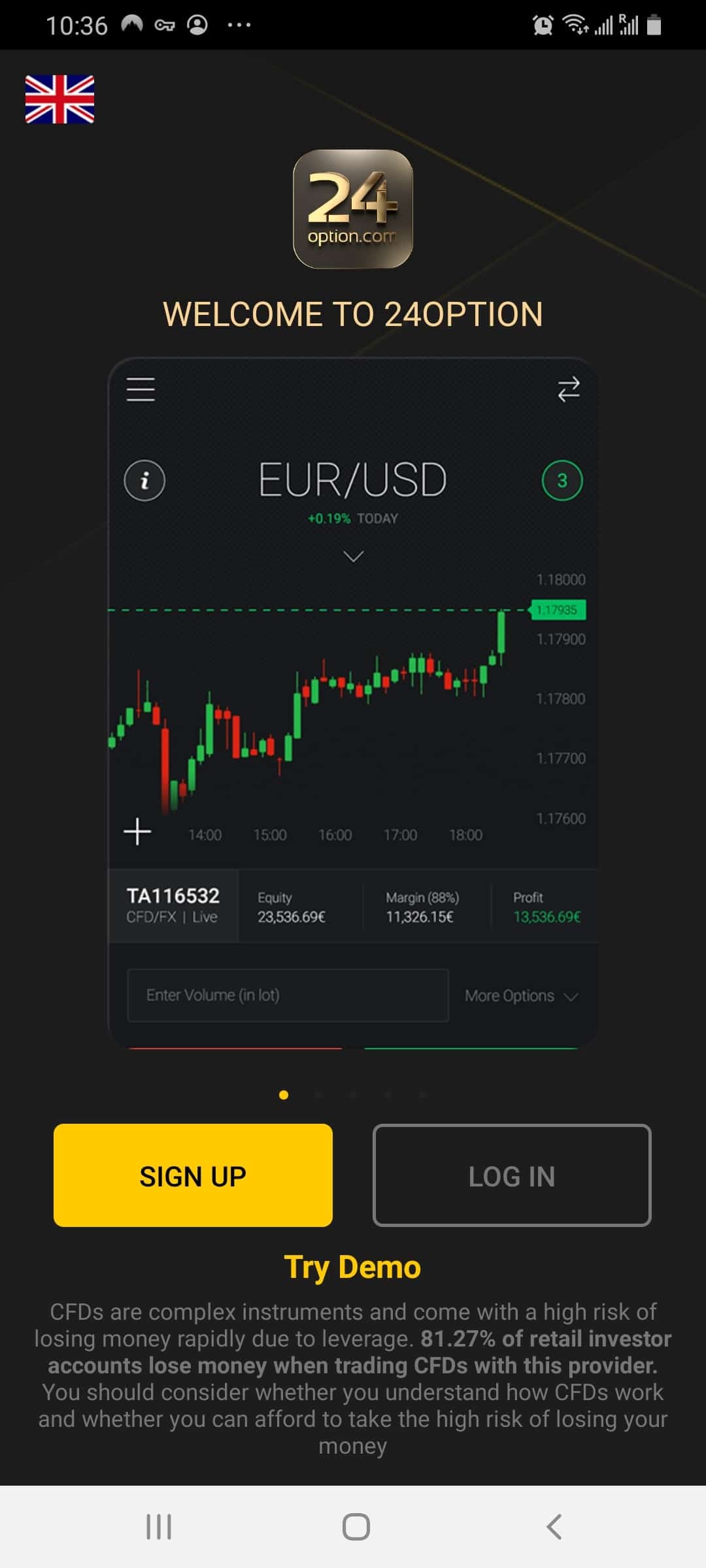

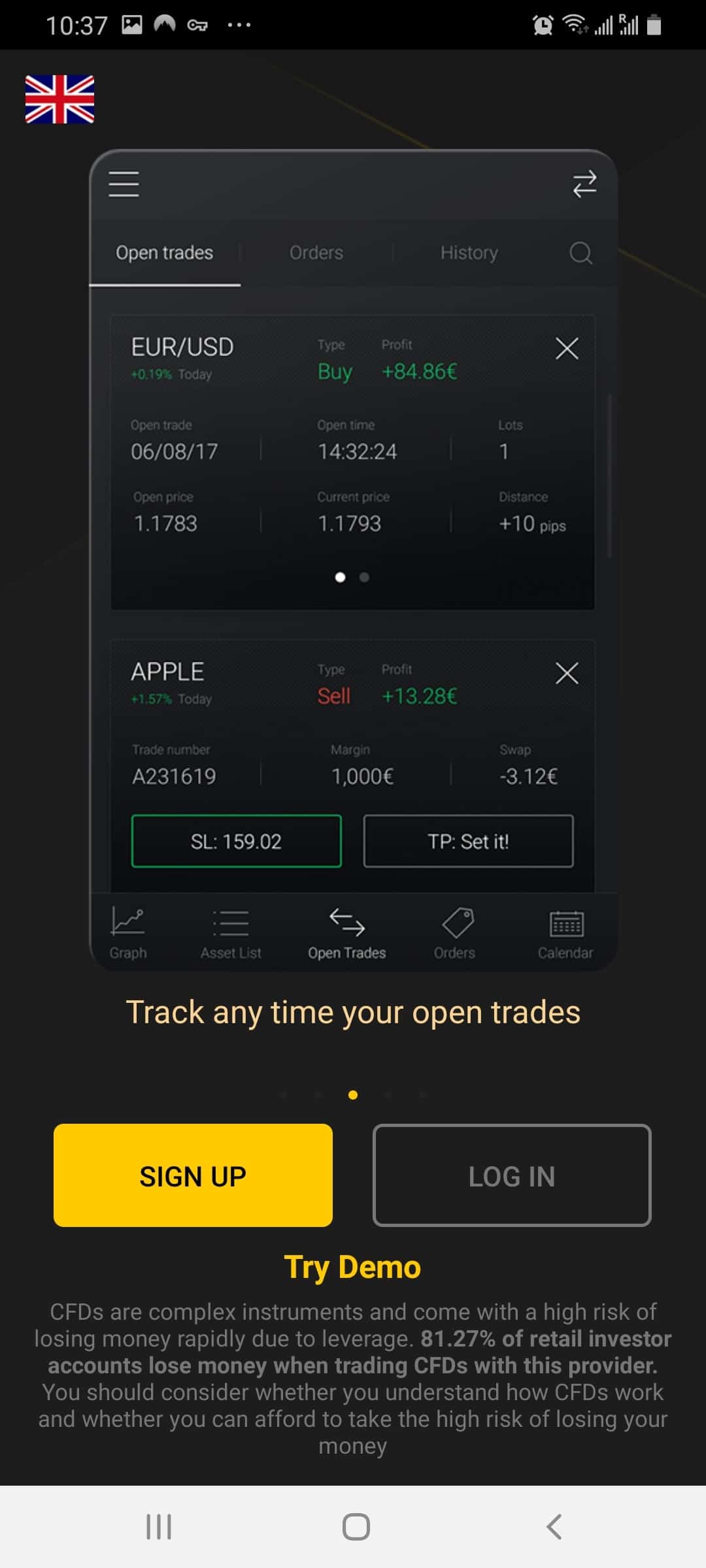

8. 24Option - Best Forex Trading App for Europeans

You can do this online or via the Options24 app. All trading pairs can be traded with leverage, with limits going as high as 1:30 for retail traders. As always, higher limits are available for professional clients. The trading platform is backed by MetaTrader 4 - so you'll have access to heaps of technical indicators and chart drawing tools.

You can also deploy automated EAs, which is great for those of you that wish to trade passively. There are no commissions to contend with when you trade forex via the app, and spreads are competitive on major pairs. You can easily deposit funds via the app with a variety of payment methods.

This includes debit/credit cards, e-wallets, and bank wire transfer. When it comes to minimum deposits, this depends on your preferred payment method. For example, debit/credit cards have a low minimum at just $/£ 100, but bank wire transfers are higher at $/£ 1,000.

- Trade forex pairs without paying any commission

- Heaps of other CFD assets supported – such as stocks, cryptocurrencies, and indices

- Minimum deposit of $/£ 100 when using a debit/credit card

- E-wallets supported

- Supports MetaTrader 4

- Minimum deposits on bank wires at $/£ 1,000

There is no guarantee you will make money with this provider.

How to Choose the Best Forex Trading App for You

So now that we have discussed the best forex trading platforms currently in the market, we are now going to explain some of the metrics that you need to look out for before taking the plunge.

Just like when choosing a stock app or investment app, there are many important factors to consider. After all, no-two forex trading apps are the same, so you need to be 100% sure that the platform is right for you.

Regulation

The most important metric to look out when searching for a forex trading app is respective to regulation. Put simply, if your chosen broker isn't licensed by a reputable body - avoid it. Reputable licensing bodies include the Financial Conduct Authority (UK), SEC (US), and ASIC (Australia).

If you're based in Asia, you will likely fall within the remit of MAS (Singapore). All of the forex apps listed on this page are licensed by at least one regulator. As such, your funds will be held in segregated bank accounts, and you will need to provide ID before a withdrawal is permitted.

Forex Trading Assets

The forex trading scene is home to dozens of currency pairs. Most brokers focus on majors and minors, as these are the most traded forex pairs in the industry. Think along the lines of USD/EUR, GBP/USD, and AUD/NZD. Such pairs come with the highest spreads and largest trading volumes - meaning they are highly conducive for seasoned investors.

In terms of exotics, these are forex pairs that contain at least one emerging currency - such as the Turkish lira. Crucially, it's best to check what pairs are supported before opening an account with your chosen forex trading app.

Fees

Attempting to understand the pricing structure on your chosen forex app can be challenging. This is because there are heaps of fees that you need to look out for. At the forefront of this is a trading commission that is charged every time you enter a buy or sell position.

Fortunately, the vast bulk of forex trading apps that we have discussed on this page allows you to access the forex markets on a commission-free basis. This ensures that you keep your trading costs to a minimum.

With that said, there are several other fee types that you need to keep an eye on - such as:

- Spreads: All forex apps will charge a spread on the pairs they offer. This is simply the gap between the buy and sell price. We prefer platforms that offer spreads of below 1 pip on major pair. Anything more than this is somewhat uncompetitive.

- Overnight Financing: All forex instruments are leveraged products, meaning that you will be charged overnight financing fees if you keep the position open beyond standard trading hours. This is charged as an interest rate percentage, which is then multiplied by the size of the position.

- Payment Fees: Some brokers will charge you a fee when depositing and/or withdrawing funds. If so, the fee might vary depending on the specific payment method and account type.

- Inactivity Fees: If your account is marked as dormant, you might incur inactivity fees. This is usually charged as a fixed monthly fee until you place a trade or the account goes down to zero.

It is advisable to spend some time researching the ins and outs of your chosen broker's fee policy before opening an account.

Platform & Usability

In order to buy and sell currencies, you need to use a trading platform. This will come in one of two forms. Firstly, some forex trading apps will design their own trading platform that is native to the broker. Alternatively, some investment apps have partnered with third-party platforms like MetaTrader4. Some investment apps - such as IG and FXCM, offer you the best of both worlds.

Then, you need to explore whether or not the app's supported trading platform is user-friendly. After all, you don't want to choose a platform that is jam-packed with sophisticated and complex tools if you are a complete forex novice. The easiest way to assess this is to make use of the forex trading app's demo account facility - if one is offered.

Trading Tools & Features

On top of the core trading platform itself, forex trading apps will typically offer a range of additional features and tools.

If you're already a seasoned trader, then you'll know first-hand the importance of performing technical analysis. As such, you'll want to look out for drawing tools and technical indicators - and how these function on a smaller screen. You can usually evaluate what features are on offer at the forex trading app through the broker's main website.

Education, Research & Analysis

The best forex trading apps in the arena will ensure that they cater to newbies. Providers will do this by offering in-house educational resources - such as guides on forex terminology and trading strategies. Some will even offer webinars or video-based training courses - all of which can be accessed via the mobile app.

You also need to consider what research resources are offered. As we covered earlier, this should include the ability to perform technical analysis through the app, without being hindered by smaller screen sizes. Furthermore, you will also need access to fundamental research -such as real-time forex news and an economic calendar.

Device Compatibility

It is estimated that over 99% of those using a mobile phone will have an operating system backed by either iOS or Android. With this mind, those of you on Windows or Blackberry are going to be disappointed. Either way, you still need to check whether or not your specific device is compatible with your chosen forex trading app before proceeding.

Payments

You will need to deposit funds with a supported payment method if you wish to trade via a forex app. The most convenient way of doing this is with a debit/credit card, e-wallet, or through Google/Apple Pay. These methods will allow you to deposit funds instantly and in most cases - free of charge.

If you want to deposit via bank wire, this is supported by most forex trading apps. However, it typically takes 2-3 working days for the funds to arrive. Once again, you need to check this before opening an account with your chosen provider.

Customer Service

Finally, it's worth spending a couple of minutes exploring what customer support channels are available. If you seek assistance through the app, then live chat is the best option. Failing that, you might have access to a telephone support line.

An email is also an option, albeit, you won't benefit from real-time support. You should also check to see what times the customer service team are active - especially if using an international broker.

What App Do Most Forex Traders Use?

The app most widely used by forex traders depends on their individual strategy, skills and experience. Popular apps used by forex traders include Plus500 and Forex.com; however, there are many others that are used around the world. Most forex traders prefer to use an app that offers low trading fees, a variety of analysis tools and a good trading platform interface. Forex trading typically requires in-depth research and analysis so it is important that forex trading platforms can cater to this.

Another popular trading platform used by forex traders is Meta Trader 4/5. Meta Trader is an advanced trading terminal that is supported by a number of popular brokers. You can access Meta Trader through a broker or open an account directly with the trading platform. If you choose the second option, you will have to create an account with a broker at a later stage. Meta Trader is considered to have the best trading analysis tools and supports 128 different currency pairs.

What is the Best Forex Signals App?

Once you have found a forex trading app that meets your needs, it is then worth thinking about strategy. That is to say, how do you intend on evaluating which way the markets are likely to go?

The most seasoned of forex traders will perform advanced technical analysis - meaning they look for historical pricing trends to determine whether a currency pair is likely to go up or down in value.

Ultimately, unless you have years' worth of experience under your belt, you are going to find chart analysis somewhat challenging. If this sounds like you, a good solution is to consider signing up to a forex signal service.

- Forex signals are trading 'suggestions' that are sent directly to your phone.

- The provider behind the app will have no affiliation with a brokerage firm. If it did, this would be a conflict of interest.

- Signals are usually generated by advanced algorithms that scan the forex markets 24/7.

- Once received, the signal will tell you what price to enter and exit the market at.

- It will also send you the required stop-loss and take-profit target prices to ensure the trade remains low-risk.

There are hundreds of forex signal providers active in the market. Some are great, while others are nothing more than a scam. In our view, we find that Learn 2 Trade stands out from the crowd. The UK-based signal platform offers trading suggestions in real-time via the Telegram app. You will receive each and every data-point required to act on the signal in a risk-averse manner - such as the entry, exit, stop-loss, and take-profit price.

Learn 2 Trade offers two options - a free plan that comes with 3 signals per week or its premium plan at 3-5 signals per day. Crucially, we like the fact that Learn 2 Trade offers a 30-day money-back guarantee and that its premium plan starts at just £14.16 per month (6-month plan).

Can Forex Trading Be Profitable?

Forex trading has the potential to be profitable, but it is essential to recognize that success relies on several critical factors. Firstly, having a well-defined trading strategy is paramount. A trading strategy outlines specific rules and guidelines for entering and exiting trades, which helps traders make objective decisions rather than relying on emotions or impulsive actions. Additionally, thorough analysis is crucial to identify favorable trading opportunities. This involves examining economic indicators, chart patterns, and market trends to make informed predictions about price movements.

Furthermore, effective risk management is vital in forex trading. This entails setting appropriate stop-loss orders, managing position sizes, and diversifying trades to limit potential losses. It is important to remember that forex trading involves inherent risks, and losses are inevitable at times. Successful traders understand the importance of managing risk and avoiding excessive exposure to any single trade.

The Verdict

In summary, forex trading apps are a must if you are planning to buy and sell currencies on a regular basis. Even if you plan to use your desktop device throughout the trading week, it's still imperative that you have access to an app. In doing so, you'll never miss a trading opportunity. You will also be able to exit a losing position at the click of a button - as opposed to needing to wait until you get home.