Best Investment Apps 2024

Investment apps are a must-have if you are looking to inject money into the stock markets. Not only do they allow you to check the value of your portfolio at the click of a button, but you can enter buy and sell positions no matter where you are located.

This ensures that you never miss an investment opportunity, or the ability to exit a losing trade. But, with so many free investment apps available in the market, how do you know which one to go with?

In this guide, we explore the best investment apps of 2022. We also discuss some of the key factors that you need to explore before choosing a provider, such as those surrounding fees, commissions, tradable stocks, regulation, and payments.

[toc]Top Investment Apps

You can continue reading for an in-depth look at some of the best investment apps, but if you’re just after a quick summary, check out the list below.

- Robinhood – Best investment app for US residents

- IG – UK investment app with over 10,000 assets

- Stash – US investment app with low fees

- Trading 212 – Established app with £1 investing

Best Investment Apps of 2022 Reviewed

There are now hundreds of free investment apps to choose from, so choosing the right one for you isn’t always easy. Luckily, we’re here to help, whether you’re looking for the investment apps for iPhone or investment apps for Android.

In order for us get our list of selected providers down to just five, we focused on the following requirements when conducting our investment app reviews:

- The app must be regulated by a tier-one body like the FCA, ASIC, or the SEC

- Fees and commissions must be competitive

- You should be able to deposit and withdraw funds with an everyday payment method – like debit/credit cards

- The app should give you access to heaps of stocks from various markets

- The user-experience should allow you to buy and sell shares in a seamless manner

With that in mind, below we outline the best investment apps of 2022.

1. Robinhood – 0% Fee Investment App for US Residents

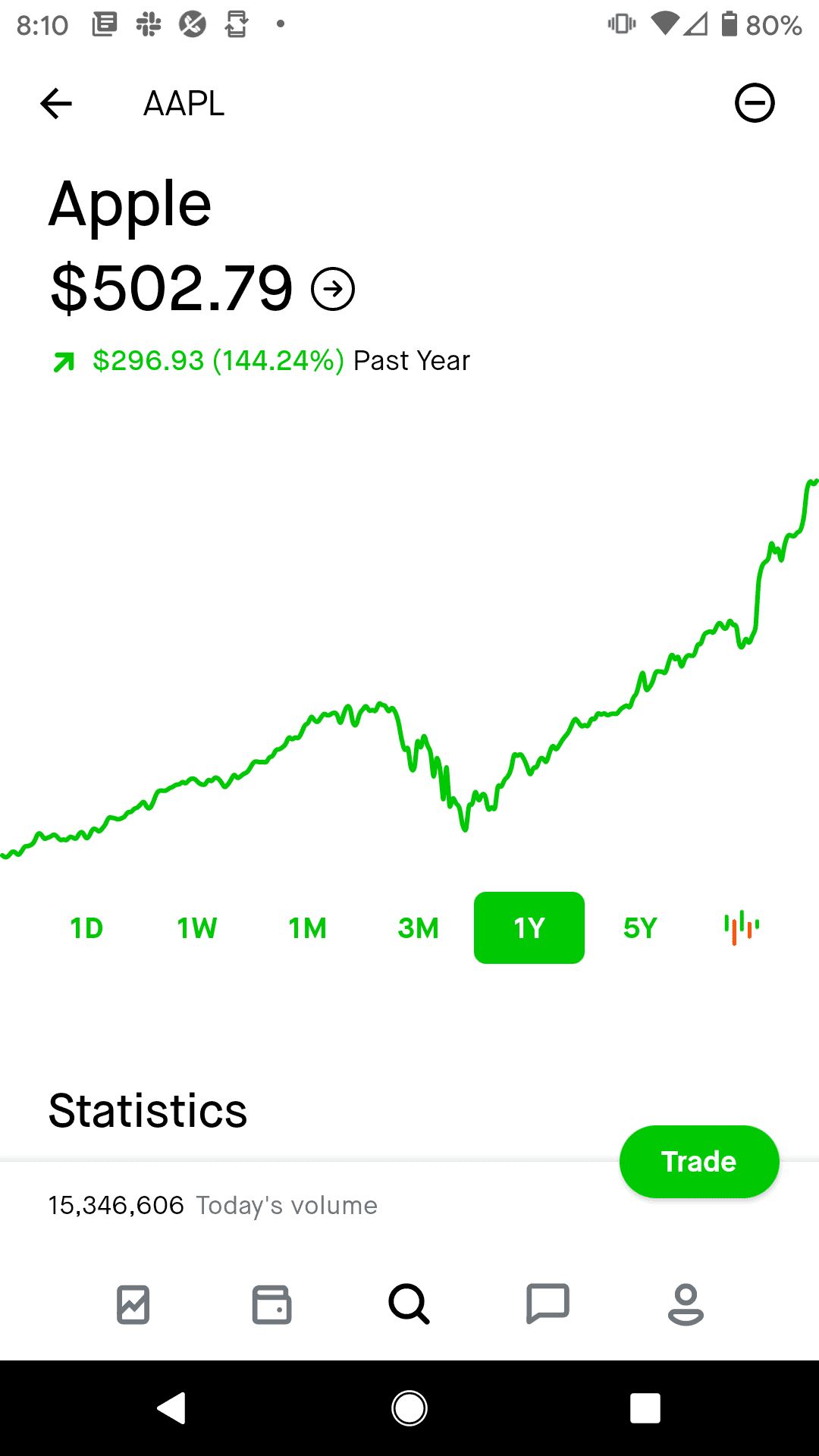

Robinhood is an investment app that has taken the US market by storm. Although the application was launched as recently as 2013, it now has over 10 million users under its belt. The vast majority of its clients are from the retail investment space, meaning that they do not come from a professional trading background.

Crucially, this is because Robinhood makes the end-to-end investment process suitable for all experience levels. You can easily open an account and deposit funds through the app, and then choose which stocks you want to invest in. On top of offering a user-friendly experience, Robinhood’s rapid success could be pointed to its fee structure. After all, the app allows you to invest in stocks without paying a single cent in commission.

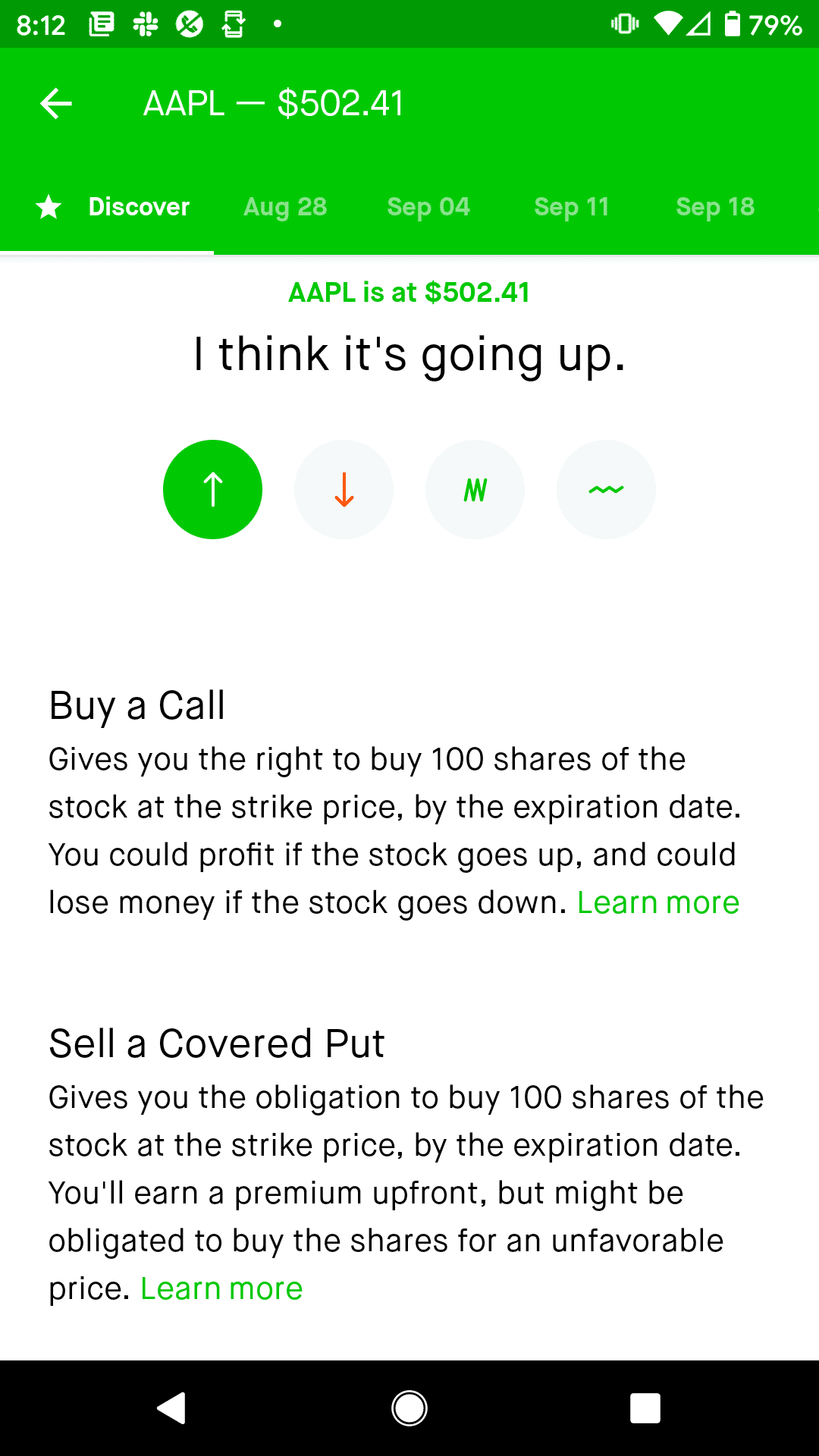

In total, Robinhood gives you access to over 5,000 stocks and ETFs. The vast majority of these assets are US-listed, apart from 250-ish international shares. You can, however, access additional foreign stocks by investing in an ETF that focuses on non-US markets. The Robinhood app also allows you to invest in cryptocurrencies like Bitcoin and Ethereum, and a full range of options contracts.

We should also note that Robinhood allows you to benefit from fractional ownership. Put simply, this means that you can invest in a ‘part-share’, as opposed to buying a full stock. This subsequently allows you to invest in companies that attract a huge stock price. For example, instead of needing to invest $3,400 into a full Amazon stock, the Robinhood app allows you to invest from just $1! In terms of getting started, Robinhood does not impose a minimum deposit amount.

You won’t, however, be able to fund your account with a debit/credit card or e-wallet. Instead, Robinhood only accepts US bank transfers. Furthermore, if you aren’t on the paid Gold Account, only the first $1,000 of your deposit will be credited instantly. The rest can take a couple of days. Nevertheless, the Robinhood app has a 4.8/5 and 4.3/5 rating on the Apple Store and Google Play , respectively. Collectively, these impressive ratings are across almost 2 million independent reviews.

Still not convinced on the Robinhood investment app? Read our comprehensive Robinhood app review to find out more about what this firm offers.

2. IG – Best Investment App for UK Residents (10,000+ Stocks)

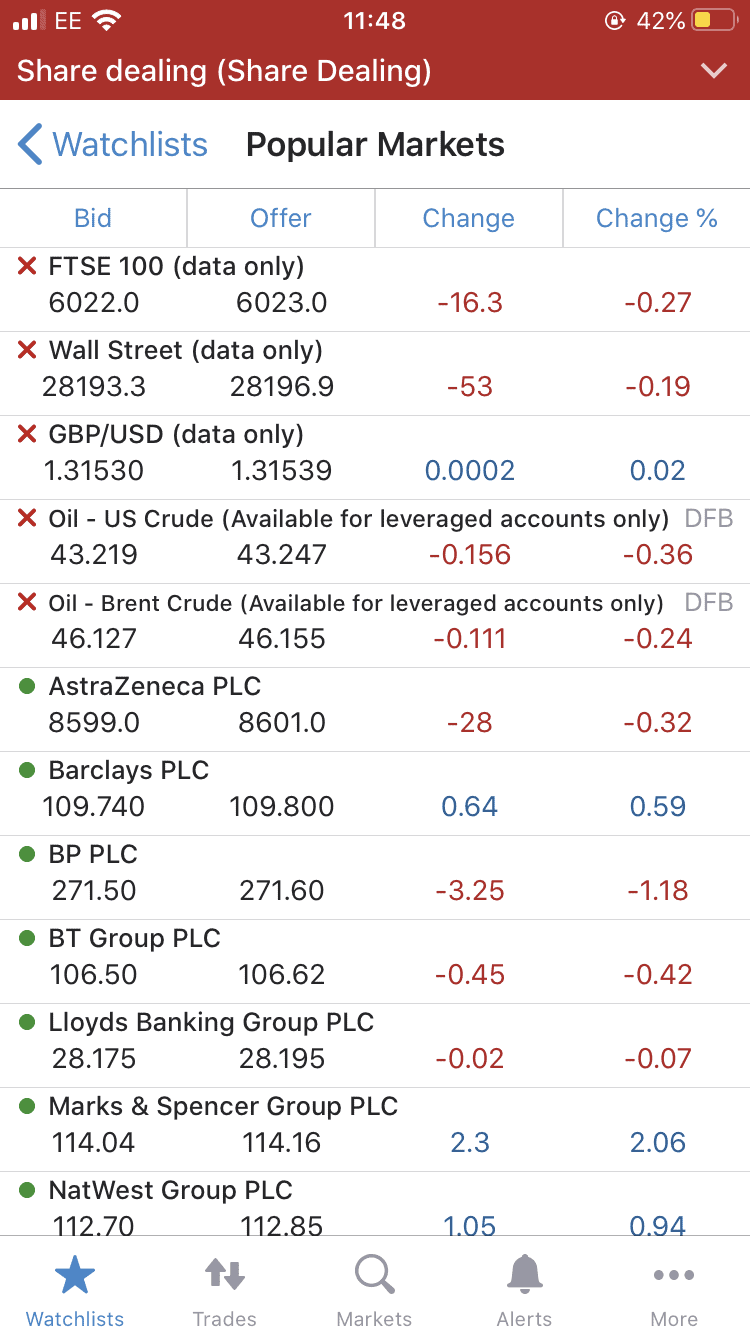

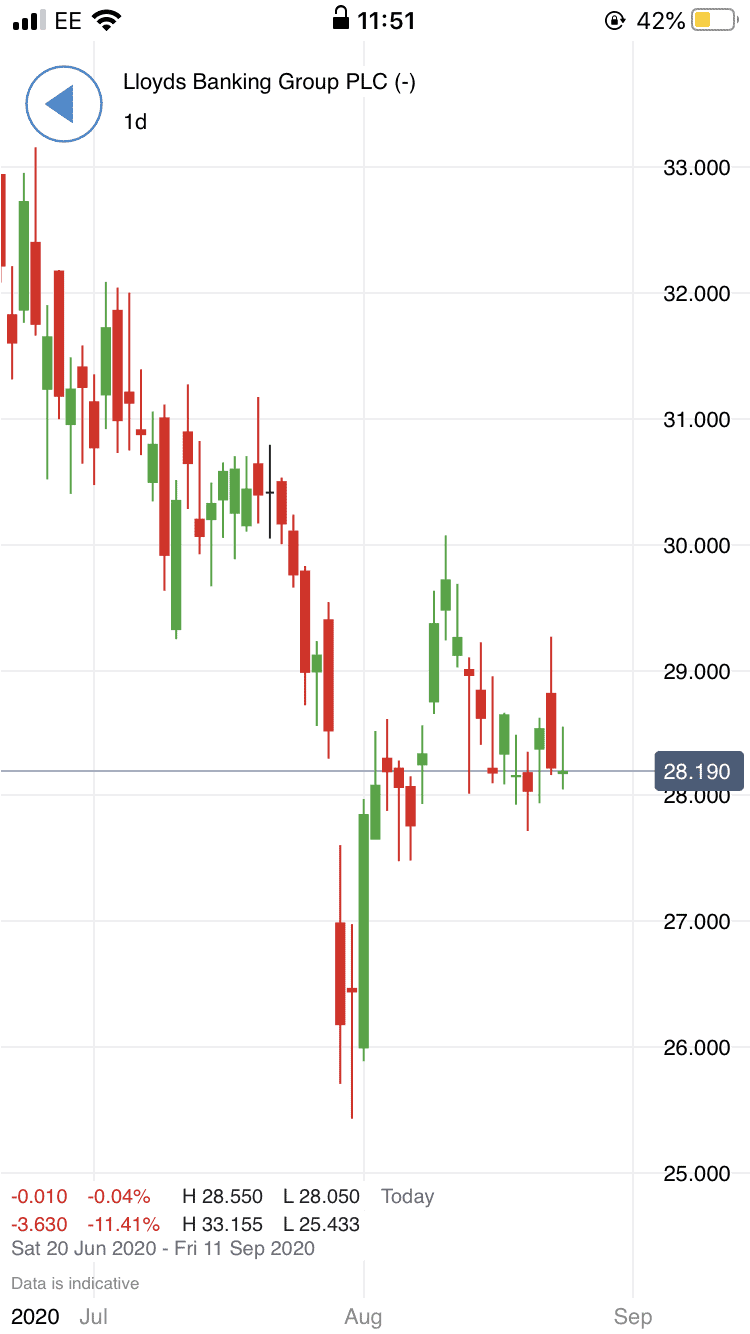

IG is a highly established UK investment app that has been trading since the early 1970s. Its parent company is listed on the London Stock Exchange, and it holds several tier-one licenses. As such, IG stands out for its strong regulatory standing and its status as a trusted UK brand. Interestingly, IG is the only stock app on our list that does not offer commission-free investing.

Instead, you will need to pay an entry-level fee of £8 per trade. This needs to be paid when you both buy and sell your chosen shares. You can, however, get this reduced to £3 if you place at least three trades per month. Crucially, although IG charges a fee for each trade that you place, it makes the cut because of the size of its stock library. This stands at well over 10,000 stocks. Naturally, this covers companies from heaps of UK and international markets.

This means that you will be able to create a highly diverse portfolio of shares when using the IG app. In terms of the application itself, this is available across both Android and iOS devices. The app is slightly more geared towards seasoned investors than the other providers on our list. This is because it comes jam-packed with features and tools that allow you to create bespoke investment decisions.

Outside of stocks, IG also offers ETFs and investment trusts. If you want to dabble in short-term trading, IG offers more than 17,000 CFD markets. This covers everything from indices, ETFs, commodities, bonds, and cryptocurrencies. You will need to deposit at least £250 when using the app, and unfortunately, fractional ownership isn’t supported. This means that you will need to buy at least one share. Supported payment methods include a debit/credit card and bank transfer, but not e-wallets.

Still not convinced on the IG investment app? Read our comprehensive IG app review to find out more.

3. Stash – User-Friendly Investment App for US Residents

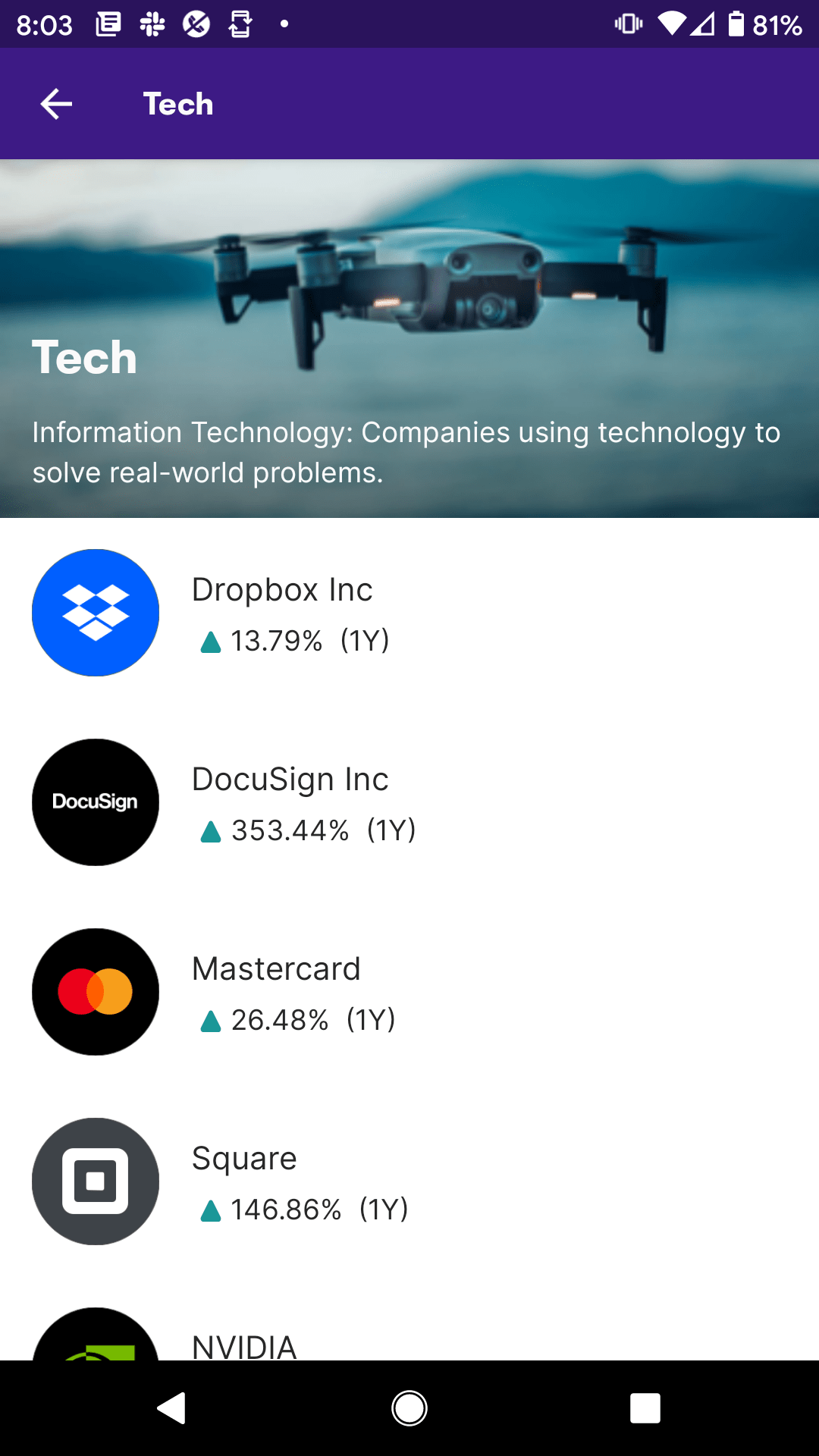

Stash is often considered a direct-competitor to Robinhood. This is because the investment apps share a lot of similarities. For example, both Stash and Robinhood allow you to invest on a commission-free basis and allow you to purchase fractional shares. At Stash, this means that you can invest in your chosen company from just a few dollars.

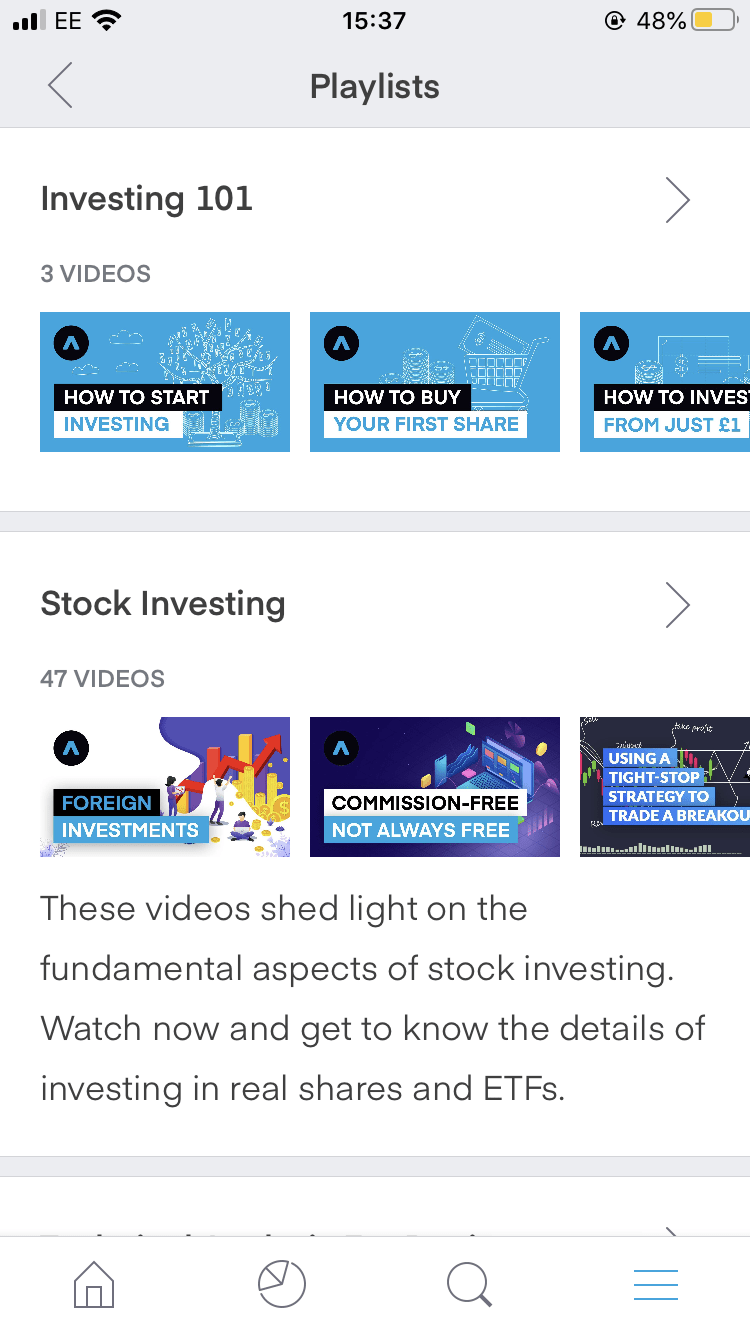

With that being said, Stash pips Robinhood when it comes to user-friendliness. This is because Stash has been built specifically for newbie investors. On top of a straightforward investment process, the app comes jam-packed with educational resources. This includes a range of investment guides and explainers, as well as blogs dedicated to personal finance. As such, if you have never placed a single stock trade before, then Stash is likely to be up your street.

Nevertheless, there is no minimum deposit amount at Stash, which is great for those of you that wish to start off with small stakes. You will, however, need to pay a monthly fee at Stash. If you simply want to buy and sell stocks, you’ll pay just $1 per month.

There are also accounts at $3 and $9 per month which come with additional perks – such as opening a ROTH/IRA account. When it comes to funding, Stash only accepts US bank transfers. As such – and much like Robinhood, you won’t be able to deposit funds with a debit/credit card or e-wallet. We should also note that Stash offers a digital bank account to all users, which includes a pre-paid MasterCard. If you open one, you can instantly transfer funds into your Stash investment app.

Still not convinced on the Stash investment app? Read our comprehensive Stash app review to find out more about what this app offers.

4. Trading 212 – Leading UK Investment App – 0% Commission on Shares

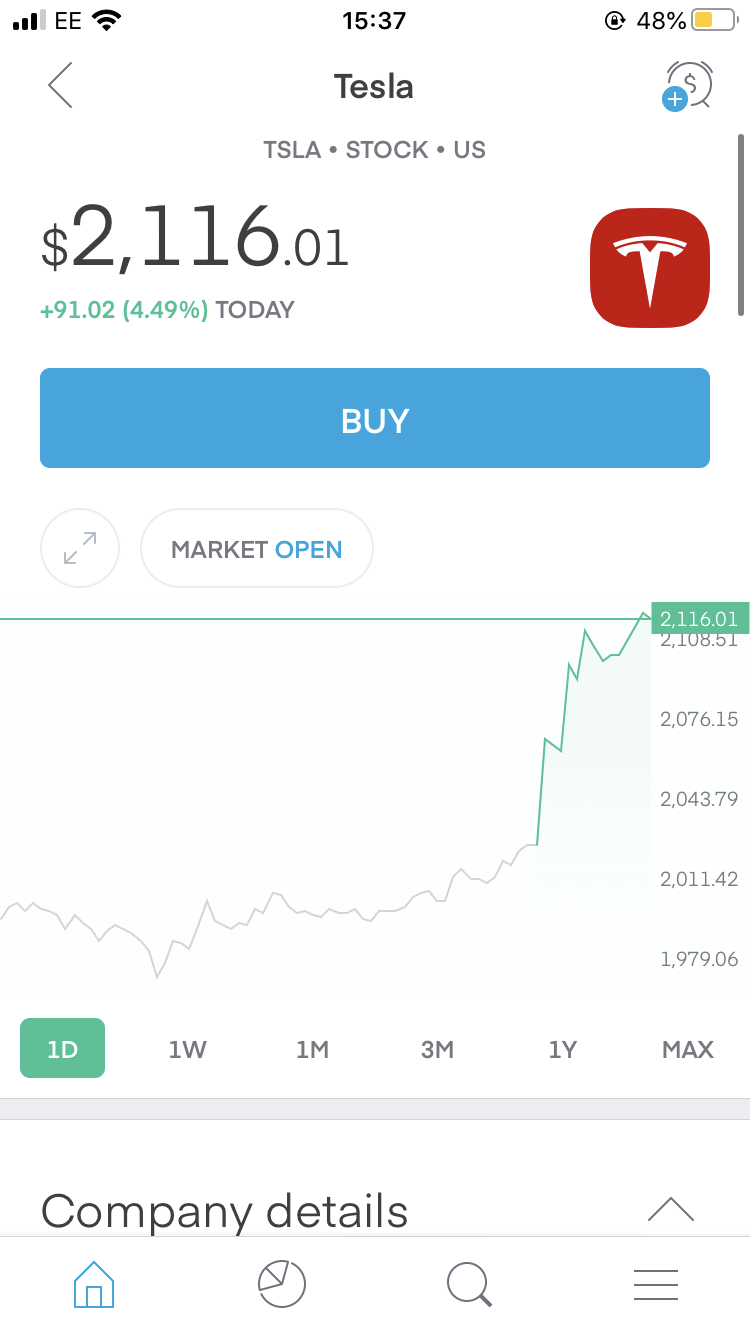

Regarding the former, this includes markets in the UK, US, Switzerland, and more. When investing in non-UK markets, you will still benefit from the commission-free offering and will not need to pay a foreign exchange fee. What we also like about Trading 212 is that it supports fractional shares. This means that you can invest in your chosen stock from just £1. An additional feature available on the Trading 212 investment app is that of its ‘Auto Invest’ offering.

This allows you to automatically reinvest your dividends. This is great, as it allows you to benefit from ‘compound interest’. This is where you earn ‘interest on your interest’ and thus – can grow your wealth much faster. On top of its traditional stocks and ETF department, the Trading 212 app also offers a CFD trading facility. This allows you to apply leverage and even short-sell assets. There is also an option to open a Stocks and Shares ISA, meaning you can shield some of your capital gains tax.

In terms of the mobile application itself, this is available on Android and iOS devices. Once you load the app up, you can choose from a real money account or start off with demo funds. The Trading 212 app has positive reviews on Google Play and the Apple Store, with a rating of 4.7/5 and 4.5/5, respectively. Trading 212 is regulated by the FCA and partnered with the FSCS.

Still not convinced on the Trading 212 investment app? Read our comprehensive Trading 212 app review to find out more about what this Trading 212 offers.

How to Choose the Best Investment App for You

Although we have discussed some the best investment apps in the sections above, it is important to remember that you have hundreds of stock investment apps to choose from. As such, there might come a time where you decide to use an investment app that is not discussed on this page. Similarly, you might want to perform some additional research on our selected providers before taking the plunge.

Either way, below we list some of the most important factors that you need to look out for when choosing the right investment app for you.

Regulation

Although one would think that all online investment apps are regulated, this is, unfortunately, not the case. That is to say, there are several mobile apps out there that allow you to buy and sell shares, even though they do not have the legal remit to do so.

As such, it goes without saying that you should ensure that your chosen investment app is licensed by a tier-one body before you part with your money. Some of the most respected and stringent licensing bodies in the investment scene include:

- SEC (US)

- FINRA (US)

- CySEC (Cyprus)

- FCA (UK)

- ASIC (Australia)

- MAS (Singapore)

The above regulatory bodies ensure that free investment apps keep client funds in segregated bank accounts and protect personal data. They also require investment apps to identity all account users through government-issued ID, and clearly present the risks of investing to those on retail client accounts. All of the investment apps listed on this page are licensed by at least one tier-one body.

Investment Assets

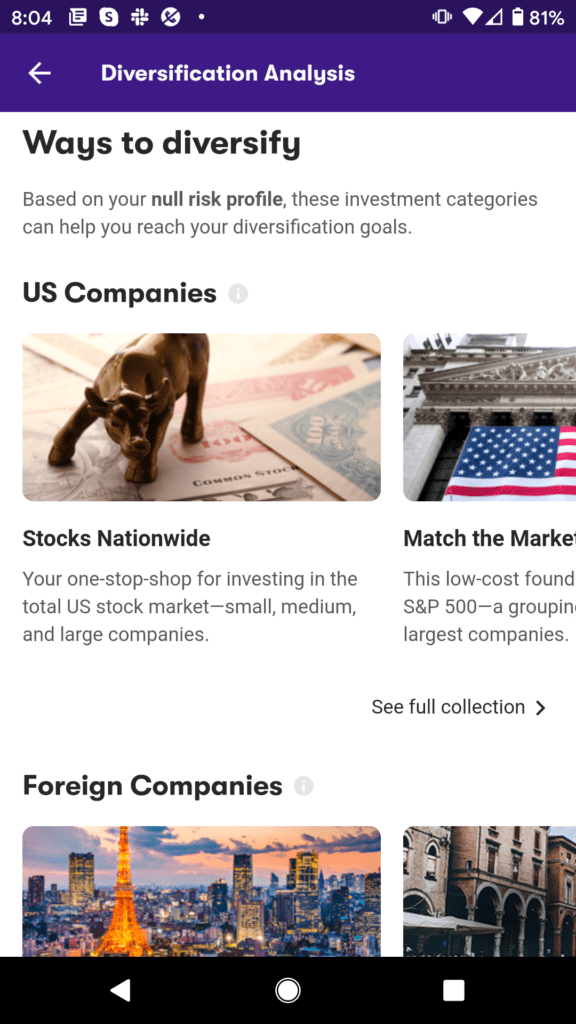

Although your chosen investment app might be licensed, it might fall short in the asset department. As such, you need to explore what stocks the app allows you to invest in. This can vary wildly depending on the broker in question.

For example, the likes of IG and Trading 212 give you access to thousands of stocks across heaps of international exchanges. Stash, on the other hand, only allows you to invest in US-listed stocks. While this might be suitable for some of you, it won’t if you want to gain access to several marketplaces through a single account.

Additionally, there might come a time where you want to invest in assets other than just stocks. This might include mutual funds, ETFs, cryptocurrencies such as DeFi Coins or investment trusts. Most of the online investment apps we have listed on this page also give you access to CFD trading facilities.

Fees

The fees associated with buying and selling stocks are now just a fraction of what they used to be. After all, four of our five selected investment apps allows you to purchase stocks without paying a single cent in commission.

The exception to this is IG – which charges a flat fee on each purchase. This means that you will pay a fee when you buy your chosen stocks, and again when you sell them. Although this isn’t ideal, IG made our list of selected investment apps because its stock library exceeds 10,000+ equities.

Nevertheless, other fees to look out for when choosing an investment app are:

- Spreads: This is the difference between the buy and sell price of an asset. The wider the spread, the more you indirectly pay in fees. This is because you need to make gains equal to at least the spread just to break even.

- Maintenance Fees: Even the best stock investment apps will charge maintenance fees. This is a recurring fee that you need to pay just to use the app – and is typically charged every month.

- Transaction Fees: These are fees charge every time you deposit and withdraw funds. Some investment apps allow you to transact for free, while others don’t. As such, check this before opening an account.

- Currency Conversion: Some investment apps charge a currency conversion fee when you attempt to access international marketplaces. Others will charge this when you deposit in a currency other than US dollars.

- Inactivity Fees: Some investment apps charge an inactivity fee when your account remains active for a specified period of time. You won’t need to pay this if you have stocks held in your account, even if you haven’t used it for months on end.

As you can see from the above, there are many fees that you need to be made aware of in your search for the best investment apps, which is why the research process can be time-consuming.

Platform & Usability

Once you have spent the required time assessing fees, your focus then needs to move on to the application itself. That is to say, you need to explore whether or nor the investment app is user-friendly.

This is especially the case if you are investing for the first time, as you don’t want to be overwhelmed by advanced features and tools. If the investment app offers a live demo account, this is particularly;y useful. After all, you will have the opportunity to test out the app without needing to risk your own funds.

Trading Tools & Features

Just because an investment app is user-friendly, this isn’t to say that it shouldn’t come packed with useful features.

If you are more of an advanced investor, you will likely seek more sophisticated tools. The IG investment app, for example, is super-strong in the charting arena. You’ll have access to drawing tools and several technical indicators, as well as have the option of adjusting the candlestick timeframe.

Education, Research & Analysis

If you are a complete novice that is looking to take a slow and steady approach to investing, you’ll want to choose an app that offers in-house educational materials. This might include investment guides and explainers, and handy videos, too.

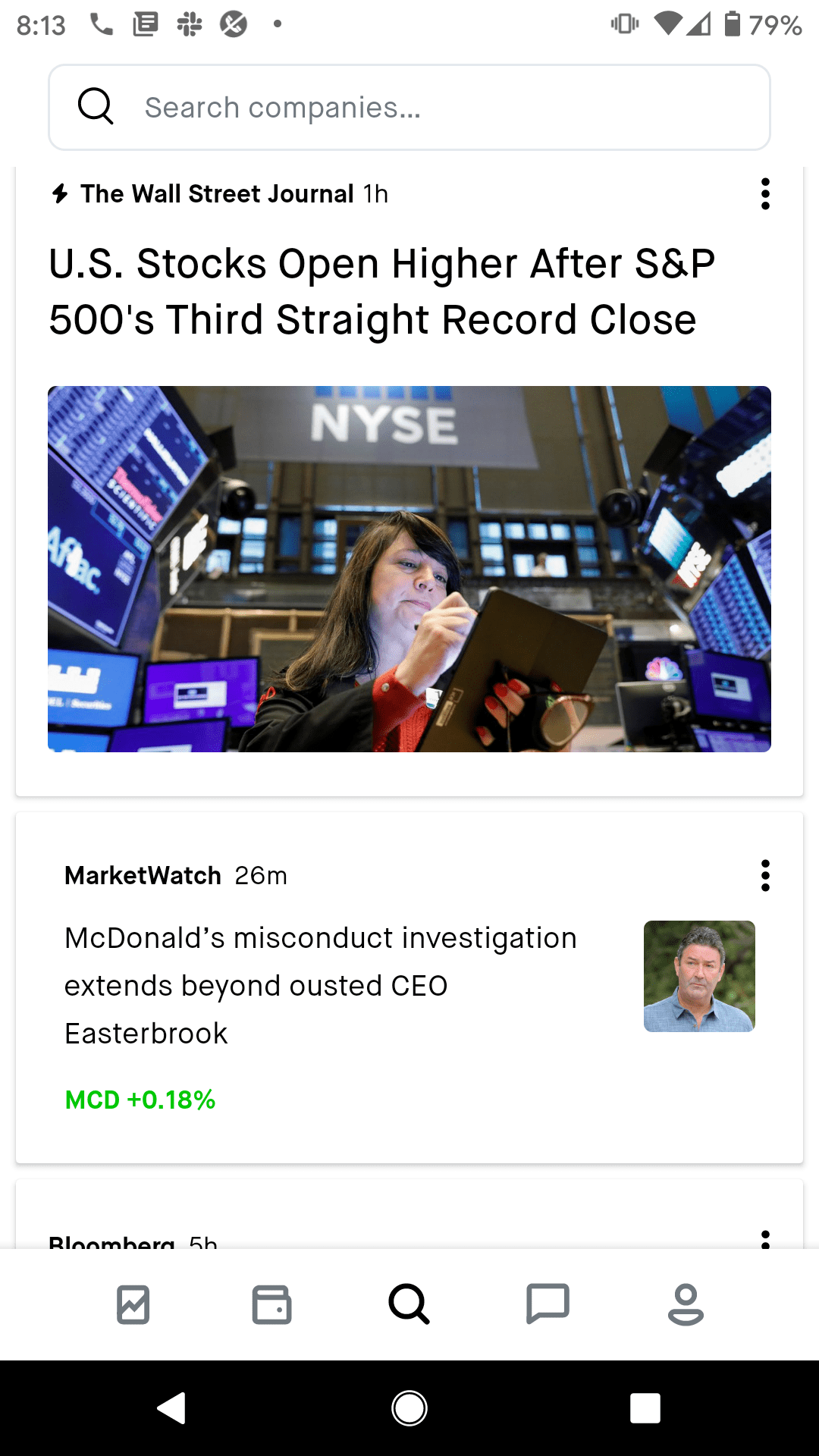

Some of the best investment apps will go one step further by offering regular webinars. Robinhood even gives you access to live earnings reports, which you can listen to through the app.

When it comes to analysis, it is a major plus-point if your chosen investment app offers fundamental research tools. Specifically, if you have access to real-time news, earnings reports, and market insights – this will avoid the need to use a third-party research provider.

Device Compatibility

Of course, it goes without saying that you need to check whether or not your chosen investment app is compatible with your device. As we have covered, most brokers will design their app for both iOS and Android devices.

If you have an operating system that isn’t compatible with the app, then you will be able to invest via your standard mobile web browser. The process won’t, however, be as smooth as a dedicated app that has been designed specifically for your operating system.

Payments

You will be using an investment app to purchase and sell stocks with real money. As such, you need to consider how you intend on getting funds into and out of the app.

Some of the most commonly supported payment methods are:

- Debit cards

- Credit cards

- E-wallets

- Google Pay

- Apple Pay

- Bank transfer

All of the above payment methods allow you to deposit funds instantly – apart from bank transfers. With that said, your chosen investment app might not offer your preferred payment method, so you need to check this before signing up.

Customer Service

There is nothing worse than opening up an account with an investment app, only to discover that customer support is below-par. There are several factors that you need to check in this respect. For example, you’ll need to explore what support methods are on offer – such as live chat, telephone support, or email.

Additionally, you also need to check what hours the customer service team are active. In most cases, investment apps offer support on a 24/5 basis to mirror that of the traditional stocks and shares space.

The Verdict

As we have discussed throughout our guide, investment apps should be a minimum requirement for all stock market traders. This is because at the click of a button – you will be able to check the value of your portfolio and enter buy/sell positions. You will also be able to perform market research and execute deposits and withdrawals.

All of this can be achieved irrespective of where you are – as long as you have an internet connection. With so many free investment apps on the market, we hope that our guide has helped clear the mist in your search for an app that meets your needs.