Best Stock Market App India – Top App Revealed

If you’re based in India and looking to buy and sell shares on the move – you’ll need a top-rated stock market app. This will allow you to trade stocks at the click of a button – no matter where you are.

You’ll also be able to check the value of your portfolio with ease, as well as perform market analysis. But, with so many stock trading apps serving Indian investors – knowing which provider to go with can be challenging.

In this guide, we review the Best Stock Market Apps in India. We also discuss the steps that you need to take to find a stock app yourself, and how you can get started with a trading account today.

Top Stock Trading Apps 2021

After reviewing dozens of providers, we got our list of the best Indian stock market apps down to just five. To find out more about what each trading app offers, scroll down to read our review.

- Libertex – Low-Cost CFD Stock Trading App with Zero Spreads

- IG – Best India Stock Trading App for Creating a Diversified Portfolio

- Skilling – Best Stock Market App for MT4

Best India Stock Trading Apps Reviewed

When searching for an Indian stock market app that meets your needs, you need to look at a range of key metrics. For example, the types of stocks that the app allows you to trade, what fees and commissions are payable, and which local payment methods are supported.

Taking all of this into account, below you will find the best stock market apps in India right now.

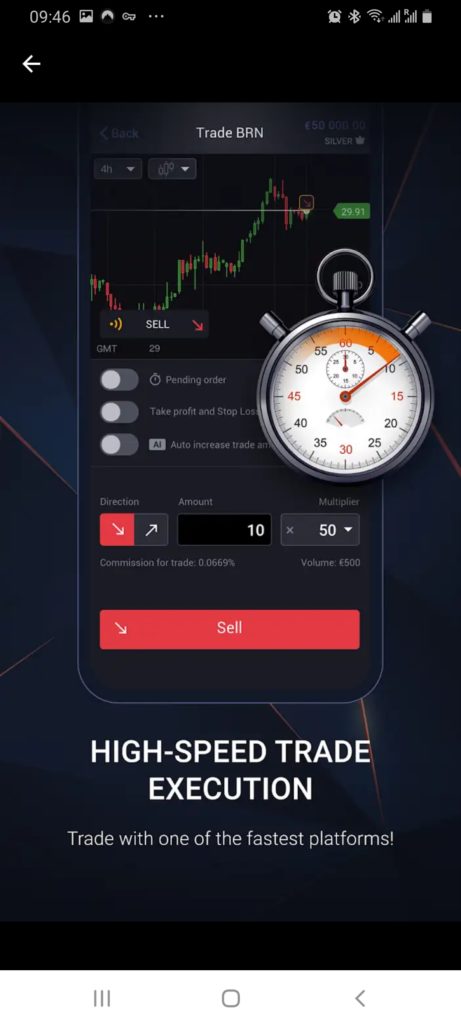

1. Libertex – Low-Cost CFD Stock Market App with ZERO Spreads

Libertex is a stock market app that is popular with day and swing traders in India. This is because Libertex does not charge any spreads. This means that you are getting the wholesale buy/sell price of your chosen stock. Put simply, this is ideal for short-term traders that target small profit margins.

While no spreads are in play on any Libertex markets, it does charge a small commission of between 0% and 0.5%. This will vary depending on the specific stock or asset class you are looking to trade.

We should also note that Libertex is suited for traders of all sizes – especially newbies. This is because the platform allows you to get started with just $10. You can fund this with a wide selection of payment methods, such as debit/credit cards, e-wallets, and bank wire. In terms of tradable assets, Libertex likes to focus on major markets only.

This means that stock-wise, most of its library centers on the NYSE and NASDAQ. Other markets include indices, forex, and commodities. When it comes to reputation, Libertex has been offering online trading services for over two decades. And most importantly – Libertex is regulated by reputable European body CySEC.

- Zero spread CFD trading

- Good educational resources

- Long established broker

- Compatible with MT4

- Competitive spreads

- Only offers CFDs

74% of retail investors lose money trading CFDs at this site.

2. IG – Best India Stock Market App for Experienced Traders

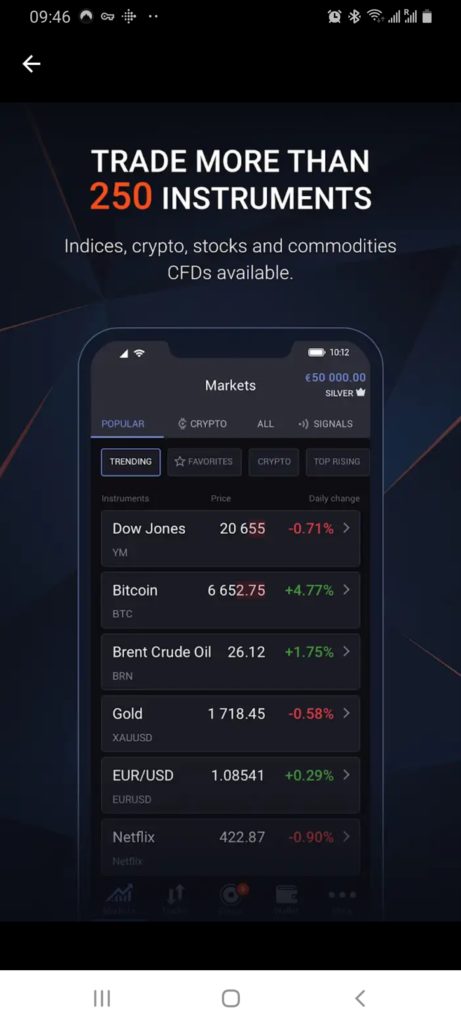

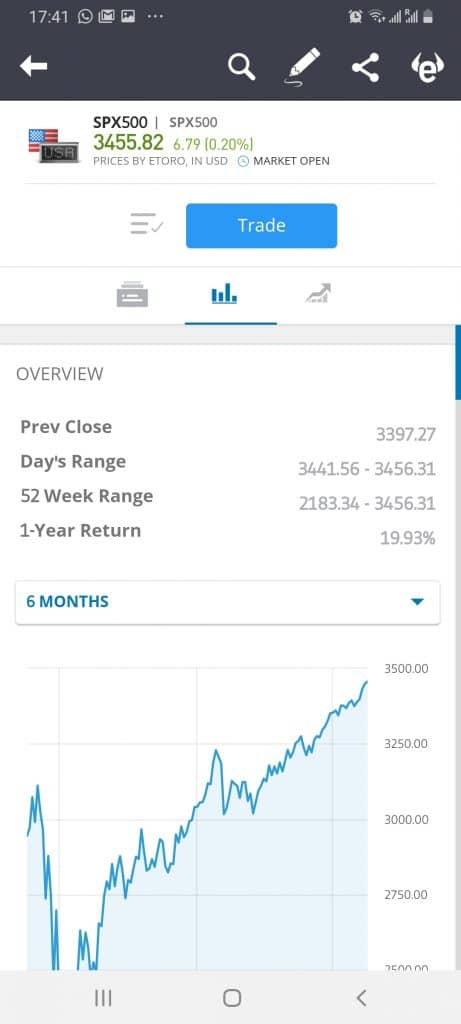

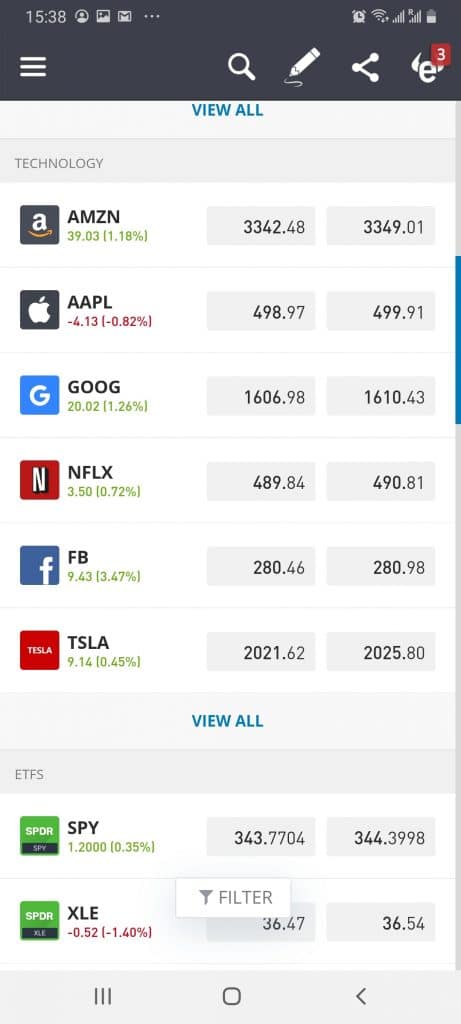

When it comes to asset diversity, IG is a market leader. The provider is home to over 17,000 financial markets – all of which are represented by CFDs. This means that you can profit from rising and falling markets, as well as apply leverage. The stock market app comes packed with tools and features, which are potentially more suited for seasoned pros.

This covers chart reading tools, technical indicators, and advanced order types. You will also have access to real-time news developments via the app. In terms of tradable markets, the IG stock market app covers dozens of exchanges – both large and small. Trading ommissions will vary depending on the specific exchange but typically average 0.10%. This is charged at both ends of the trade.

There is, however, a minimum trading commission that needs to be met on all positions. Again, this will vary from market to market but usually amounts to $10. As such, the IG stock market app won’t be suitable for low-level traders. The minimum deposit here is $300 – which you can meet with a debit/credit card or Indian bank wire. Take note, you can’t deposit funds via the iOS version of the app – so you’ll need to do this online.

The iOS version also lacks pricing alerts and notifications, albeit, this is something that IG is looking to resolve in the coming months. All in all, IG is most certainly more expensive than the other stock market apps we have reviewed this far. But, the provider has a superb reputation in the brokerage space that dates all of the way back to 1974. This is enhanced by the many brokerage licenses held by IG – which includes the FCA and ASIC.

Read our comprehensive IG app review to find out more.

- Trusted investment app with a long-standing reputation

- More than 10,000 stocks listed

- Good value share dealing services – fees as low as £3 per trade

- Leverage and short-selling also available

- Spread betting and CFD products

- Access to dozens of international markets

- Great research department

- Minimum deposit of £250

- US stocks have a $15 minimum commission

Your capital is at risk when trading CFDs at this site.

3. Skilling – Stock Market App With Several Platforms

Skilling is another stock market app that is popular with Indian traders One of the main attractions of the app is that you have access to several trading platforms. For those of you looking to trade via a basic, user-friendly interface, you can utilize the Skilling app.

However, if you want to place more sophisticated orders, employ advanced technical research and install automated trading robots – Skilling also supports MT4 and cTrader. All you need to do is download the respective app and log in with your Skilling account details.

When it comes to tradable markets, Skilling focuses primarily on US stocks. You can also trade forex, digital currencies, commodities, and indices. All markets on the Skilling platform are commission-free and spreads are usually very competitive.

The minimum deposit at Skilling is just $100 – and it’s stock market app supports debit/credit cards and e-wallets. You should have no concerns regarding safety, as the app is licensed by CySEC and the FSA, and authorized by the FCA.

- More than 700 share CFDs

- Commission-free share trading with tight spreads

- Range of three trading platform

- Supports algorithmic trading

- Supports the MetaTrader 4

- User-friendly mobile app for iOS and Android

- Number of tradable markets somewhat small

75% of retail investor accounts lose money when trading CFDs with this provider.

How to Choose the Best Stock Market App for You

If you like the sound of one of the top-rated Indian stock apps that we have discussed, then you’re good to go. However, if you feel that you want to do a bit of DIY research before signing up, we are now going to walk you through the many factors that you need to look out for when choosing the best app for stock market trading for you.

Regulation

With that being said, you need to be extremely vigilant when assessing the regulatory standing of a stock market app before opening an account – as many operate without a license.

As such, we would strongly suggest that you only consider stock trading apps that are regulated by a reputable body. All of the apps listed on this page are licensed by either the FCA, ASIC, or CySEC.

In some cases, such as Libertex, the provider is licensed by all three. This ensures that your money is protected at all times and you are able to trade stocks in a safe and secure environment.

In particular, the aforementioned regulatory bodies require stock market apps to keep your money in separate bank accounts from its own. In turn, this ensures that the provider cannot use your capital in the event it ran into financial difficulties.

User Experience

If you’ve never traded stocks through a mobile application, then it is crucial that your chosen provider offers an all-round user-friendly and seamless experience. After all, you will be risking your own funds, so you don’t want your trading endeavors hindered by a smaller screen.

In particular, it should be straight forward to navigate through the app when finding your preferred market. This should include both a search facility and a filter box. The latter makes it easy to browse the many stocks hosted by the app.

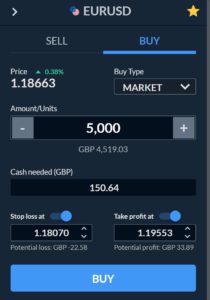

And of course, it should also be easy to place your required stock market orders. For example, entering your stake, applying leverage, and setting up limit, stop-loss, and take-profit orders should be a breeze. The app should also make it a simple process when it comes to checking your profit/loss reports and current portfolio value.

Tradable Stocks

While some stock apps in India focus primarily on US exchanges, others offer dozens of tradable markets.

The best stock apps in India also cover a combination of stock ownership and CFDs. This means that should you want to invest in a stock long-term, you will own the shares outright. However, it’s also handy to have access to CFDs in the event you wish to short-sell a stock or apply leverage.

Fees

When you use an Indian stock market app to trade shares, you will always need to pay a fee of some sort. The main fees that you need to look out for are listed below:

- Commission: Trading commissions are charged by most brokers, but not all. For example, Libertex, Plus500, and Skilling offer a 100% commission-free service, while IG and Libertex don’t. If your chosen app does charge a commission, this will usually come in the form of a variable fee that is charged against your stake. For example, IG charges 0.1% on most of its markets.

- Spreads: Apart from Skilling, all stock apps in India charge an indirect fee known as the spread. As we briefly mentioned earlier, this is the gap in pricing between the buy and sell rate. You’ll want to ensure that your chosen app offers ‘tight’ spreads, as this will minimize your overall stock trading costs.

- Transaction Fees: Some stock market apps in India charge a transaction fee when you fund your account or request a withdrawal. The fee, is charged, can vary depending on the payment method.

- Currency Conversion: The vast majority of stock market apps in India will charge a currency conversion fee on Rupee deposits. This can vary wildly, although the best rate we have seen is offered on the Libertex app. At just 0.5%, this is very competitive.

- Inactivity Fee: Most trading apps in India charge an inactivity fee on dormant accounts. The account will be marked as inactive after a period of 3, 6, or 12 months – depending on the provider. In turn, you’ll pay a monthly fee for as long as the account remains inactive, or when your balance hits zero.

As you can see, there are heaps of potential fees that you might run into when researching a stock market app. This is we suggest considering one of the five providers we have discussed on this page. In doing so, you can rest assured that we have already done the hard work for you by exploring the fee structure in full.

Trading Tools & Features

We prefer stock market apps that come packed with tools and features. For example, Libertex offers a Copy Trading feature that allows you to mirror the trades of an expert investor like-for-like.

You only need to meet a $200 minimum and you can pull your money out whenever you wish. The aforementioned platform also offers an innovative feature called ‘Fractional Ownership. Put simply, this allows you to buy or trade a fraction of a single share.

This is hugely beneficial when accessing major US stocks that often cost hundreds of dollars per share. In some cases (such as Amazon), one share runs into the thousands of dollars. But, by using the Libertex stock market app, you can invest from just $50 per trade – irrespective of how much the share is worth.

Education, Research & Analysis

Any seasoned trader in India will tell you the importance of research and analysis. Without it, you are trading stocks blindly. As such, it makes sense to make a stock market app that offers a variety of research tools. For those of you looking to invest in the stock markets long-term, you’ll want access to real-time financial news.

In fact, the best stock market apps in India allow you to set up notification alerts. This means that you will receive a message in real-time when one of the stocks you are watching has a news story released about it. For those of you interested in day or swing trading, then you’ll want to choose a stock market app that offers chart analysis.

This might include technical indicators and drawing tools, as well as the ability to customize your trading screen. But, most importantly, these technical tools must be accessible in a user-friendly manner. After all, you will be using a smaller screen to perform your analysis, which can be difficult if the app hasn’t been correctly optimized.

Device Compatibility

In most cases, the best stock market apps in India are built for both iOS and Android devices. However, one version of the app might run better than the other, so it’s important to do some research. The best way of doing this is to read the reviews posted on Google Play or the Apple Store.

These reviews are useful because they are published by Indians that have actually used the app in question. Alternatively, if the stock market app offers a demo trading facility, you can test this out for yourself without risking a single rupee.

Payment Methods

Some stock market apps make it a challenge for Indians to fund their trading account. This is because they only support bank wire transfers. This is a cumbersome way of depositing funds, as the transfer can take several days to arrive.

Instead, it’s best to stick with stock market apps that support instant payment methods. For example, all of the providers we have discussed today support debit and credit cards. Some platforms – like Libertex – also support a selection of e-wallets.

You also need to assess what the situation is with FX conversions. As we covered earlier, rarely do stock market apps offer support for the Indian rupee, meaning that the provider will charge you an FX fee. Anything above 0.5% should be considered costly, so be sure to check this before opening an account.

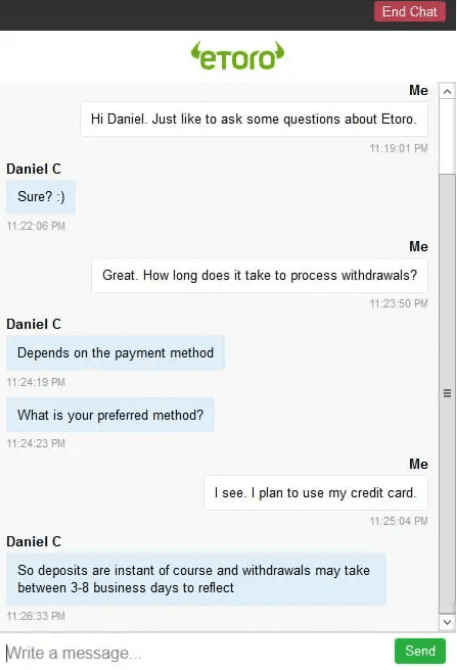

Customer Service

Most stock market apps come with a comprehensive FAQ section that seeks to answer the most commonly asked questions. However, there might come a time where this isn’t sufficient, and thus – you require instant support. As it is all-but-certain that you will be using an overseas stock market app, there are a couple of considerations to make.

Firstly, you need to check what hours the customer service team works. For example, North American providers are several hours behind India, so you don’t want to have to wake up in the middle of the night just to receive assistance. The best stock market apps typically offer support on a 24/5 basis.

Secondly, you need to check what support methods are available. Live chat is the best, as there is no requirement to call an international toll number. Some stock market apps give you access to this feature directly from within the application, which is super convenient.

How to Download a Stock Market App & Start Trading

Now that we have covered the most important factors to look out for when choosing a provider, it’s now time to walk you through the signup process. The guidelines below are based on the top-rated stock market app Libertex – which is hugely popular with Indians.

Conclusion

More and more Indians are turning to stock market apps – sometimes in conjunction with a standard online brokerage account. Either way, the best stock apps allow you to buy and sell shares on the move.

You can also access other important features, such as depositing and withdrawing funds, performing technical analysis, or simply checking the value of your portfolio.

Having spent countless hours reviewing the many providers supporting Indians, we concluded that Libertex is by far the best stock market app. This heavily regulated app is simple to use, offers 17 different markets, supports heaps of payment methods, and, most importantly – charges no commissions.

Libertex – Overall Best Stock Market App India with 0% Commission

67% of retail investor accounts lose money when trading CFDs with this provider.