Angel Broking App Review 2021 – Pros & Cons Revealed

Angel Broking is a popular web and mobile trading platform based in India. The broker allows you to invest in a full range of equities and trade other assets like forex, commodities, and bonds.

But, is Angel Broking the right stock market app for you?

In this article, we review the Angel Broking app from top to bottom. We cover tradable markets, fees and commissions, payment methods, regulation, and more.

-

-

What is Angel Broking?

Angel Broking is an India-based brokerage site that allows you to invest and trade from the comfort of your home.

The provider is also behind a hugely popular mobile trading app – with the platform claiming that this has been downloaded more than 4 million times.

This covers over 2.15 million registered clients – making Angel Broking one of the largest investment apps in India. In terms of what you can trade, most Indians opt for a Dermat Account.

This covers traditional stocks and shares that you will purchase and own outright. In addition to equities, the Angel Broking app also allows you to trade a wide selection of other financial instruments.

This includes everything from bonds and currencies to commodities and debt securities. Angel Broking is also popular with Indians as the provider gives you access to IPOs. This is a great way of gaining exposure to young Indian companies.

What Stocks Can You Trade on the Angel Broking App?

In a nutshell, if you’re looking to buy individual shares – Angel Broking focuses exclusively on Indian companies. On the one hand, this is ideal if you are looking to invest in home-grown stocks.

But, you won’t be able to buy foreign shares – such as those listed on the NYSE, Nasdaq, or London Stock Exchange. The only way around this is to invest in an ETF or mutual fund that tracks foreign equities.

Other Tradable Assets at Angel Broking

The Angel Broking app actually has a really diverse range of asset classes on offer.

This includes:

Commodities

Some of the most popular commodities that can be traded on the Angel Broking app include:

- Gold

- Oil

- Copper

- Silver

- Zinc

- Nickel

- Natural Gas

- Agricultural Products

Forex

Some of the most popular forex pairs that can be traded on the Angel Broking app include:

- EUR/USD

- AUD/USD

- USD/CHF

- USD/CAD

- NZD/USD

Bonds

Our Angel Broking app review found that you can also purchase a good range of bonds, including:

- Convertible Corporate Bonds

- Non-Convertible Corporate Bonds

- Sovereign Gold Bonds

- Tax-Free Bonds

Derivatives

If you’re a seasoned trader with an understanding of complex financial products, you might as be interested in the following derivative markets at Angel Broking:

- Futures

- Options

- Margin Trading

- Leverage

Angel Broking Account Types

Our Angel Broking app review found that the provider offers several account types.

The one that you opt for will ultimately depending on which assets you are planning to trade.

Dermat Account

The Dermat Account at Angel Broking is the most popular account type. For those unaware, a ‘Dematerialized Account’ or simply ‘Dermat’ for short, is a legal requirement when buying shares in India.

Put simply, this is the account type required if you are an Indian citizen and planning to buy shares in Indian-listed companies.

As we cover in more detail later, you will need to provide a full host of documents before you can open a Dermat Account at Angel Broking. This is to ensure that the broker remains compliant with domestic securities legislation.

Trading Account

This particular account type on the Angel Broking app is for those of you that wish to trade on a short-term basis. In other words, you’ll be buying and selling financial instruments via an intraday or swing-trading strategy.

In terms of what you can trade on this account type, this covers the previously discussed commodities, forex, and derivatives.

IPO Account

As the name suggests, this account type gives you access to Indian IPOs (Initial Public Offering). This allows you to invest in up and coming companies that are still at the very start of their corporate journey.

Not only does the Angel Broking app give you access to the IPO market, but it also provides heaps of research materials. This includes an in-depth analysis and prospectus on the company that is about to launch its domestic IPO.

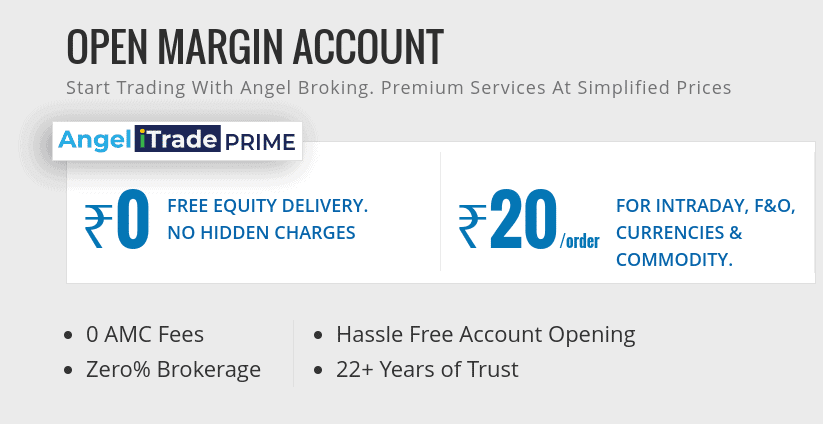

Margin Trading Account

Our Angel Broking app review found that you will need to open a dedicated margin trading account if you wish to access leverage.

As per SEBI rules, you will need to maintain a 50% margin at all times. In simple terms, this means that you can trade with twice the amount you have in your Angel Broking account.

Don’t forget – trading with margin can amplify both your profits and losses. In fact, if your trading position goes against you by a significant amount, you can and will lose your entire margin balance.

Angel Broking Fees & Commissions

Angel Broking claims to be one of the most cost-effective brokerage firms in India. With this in mind, we dig deep to evaluate each and every relevant fee that you are likely to come across.

Here’s what you need to know about Angel Broking fees and commissions.

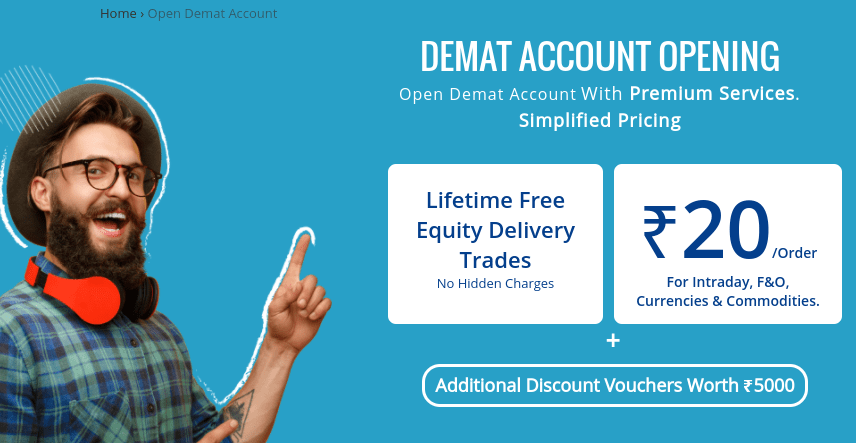

Share Dealing

If you are simply planning to buy stocks and shares at Angel Broking, then you can do this on a commission-free basis. As is the case with all India-based brokerage firms, you will need to pay Security Transaction Tax (STT) on each trade.

This amounts to just 0.1% on both buy and sell orders. Additionally, when buying shares, you will pay a 0.015% stamp duty tax. Again, this is simply collected by Angel Broking and passed on to the relevant authorities.

Trading Commission

If you are planning to trade assets – such as commodities, forex, futures, and options – then you will pay the lower fee of ₹ 20 per order or 0.25%. Although at first glance this might sound competitive, it actually isn’t.

For example, there is a full range of regulated online brokers available to Indian citizens that are commission-free. This includes eToro – which charges no commissions or account maintenance fees whatsoever.

Account Management Charge

Our Angel Broking app review found that you will need to pay an account management charge of Rs.20 + taxes per month. However, this is waivered on most account types for the first year.

Angel Broking App User Experience

The Angel broking isn’t the most user-friendly option in the Indian market. In fact – and much like the main desktop version, the app is somewhat cumbersome to navigate.

This viewpoint is supported by the reviews that you will find on both app stores. For example, Angel Broking carries a poor rating of 3.8/5 on Google Play.

This is across a comprehensive 132,000+ individual ratings. The app is also poorly rated on the Apple Store at 3.7/5.

Angel Broking App Tools

Although not overly comprehensive, the Angel Broking app does come with several tools that might interest you.

This includes:

Portfolio Tracking

One of the best things that you can do with the Angel Broking app is check the value of your portfolio at the click of a button. In fact, all you need to do is open the app and you will be presented with the current performance of your portfolio in real-time. This means that you don’t need to wait until you get home to your desktop computer.

Notifications

You can receive real-time updates directly on your phone about key pricing trends. You can select specific assets in this respect, so you are always one step ahead of the curve. Additionally, you can also set up custom price alerts. This allows you to enter or exit a market when a specific price-point is triggered.

Live Markets

The Angel Broking app gives you direct access to live market conditions. This includes a full wealth of information, such as buy and sell price, daily price action, volatility, and wider market sentiment. The live market section is offered in conjunction with 21 customizable charts.

Loan Against Securities

Another useful tool available on the Angel Broking app is that of ‘Loan Against Securities’. As the name suggests, this allows you to raise finances against outstanding equities.

In other words, rather than selling your stocks to raise capital, you take out a loan against their current market value. This allows you to raise the capital that you need while at the same time – keeping hold of your investments.

Angel Broking App Bonus

Although the Angel Broking app doesn’t offer a sign up bonus per-say, it does remove the annual maintenance charge in year one for new Dermat Account customers. This saves you Rs.20 + taxes.

Angel Broking App Demo Account

Angel Broking does not offer a demo account, which is somewhat disappointing. This is offered by most online brokerage sites – especially those in the intraday trading scene.

Payments on the Angel Broking App

It is relativity straightforward to get money into your Angel Broking account. In fact, the app supports both debit card deposits and local bank transfers.

Regarding the latter, the broker has direct payment gateways with over 40 Indian banks. This ensures a timely deposit process.

Once your account is verified, deposits are usually credited instantly.

Angel Broking Minimum Deposit

A minimum deposit amount isn’t stipulated by Angel Broking. However, you will need to invest at least Rs.20 per order that you place.

Angel Broking Contact and Customer Service

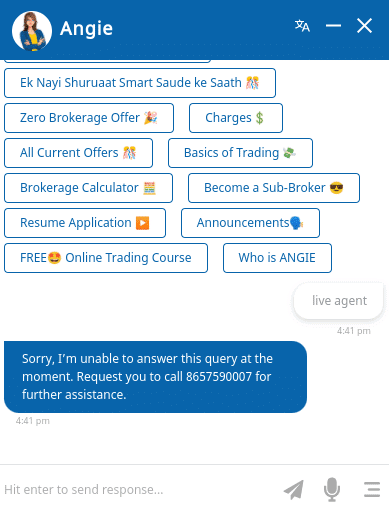

When it comes to customer support, we did come across a live chat button on the Angel Broking app. However, upon clicking it, we soon discovered that this is a ‘chat bot’.

In other words, it’s a glorified FAQ facility that will eventually redirect you to the main Angel Broking call centre.

For general telephone inquiries, you can call the team at Angel Broking on 8657590007.

Alternatively, you can send an email to [email protected].

Is Angel Broking Safe?

Angel Broking is a safe and secure trading platform that has been active in the Indian brokerage scene since the 1980s. It is legally able to accept Indian citizens, process deposits and withdrawals, and of course – facilitate investments.

How to Use the Angel Broking App

If you want to open an account with Angel Broking today, follow the steps outlined below.

Step 1: Fill out Application FormTo get the ball rolling, you will need to fill out an application form. This will require your full name, mobile number, and current city.

Step 2: Confirm Mobile Number

Step 2: Confirm Mobile NumberAngel Broking will now send you a unique code to your mobile phone via SMS. You need to enter this code into the online application form.

Step 3: Personal InformationAngel Broking will now ask you to enter your personal information. This includes your date of birth, home address, and bank account details.

Step 4: Submit Verification DocumentsAs a broker that complies with all domestic laws on securities and KYC, you will now be asked to upload two verification documents.

This includes:

- Proof of Identity: You can choose from one of the following; Pancard, Passport, Voter ID, Driving License

- Proof of Address: You can choose from one of the following; Passport, Voter ID, Registered Lease or Sale Agreement, Driving License, Utility Bills

Take note, you can’t send the same document for both the proof of identity and address.

Step 5: Deposit Funds and TradeAs soon as your Angel Broking account has been set up, you can proceed to make a deposit. As we covered earlier, you can choose from a debit card or local bank transfer.

On funding your account, you can then download the Angel Broking app to your iOS or Android device. You will be able to login with the same credentials that you choose when opening the account.

Then, it’s just a case of choosing which asset you want to invest in or trade.

Angel Broking vs eToro

Although Angel Broking ticks a lot of boxes, we sought to find out whether or not there is a better option for Indian traders. Taking into account that eToro is now home to 13 million traders – many of whom are based in India, we decided to compare the two brokers.

On the one hand, Angel Broking is well worth considering if you are looking to invest exclusively in Indian equities. However, you won’t have access to other popular stock exchanges. For example, eToro is home to 17 international markets – which includes the NYSE, Nasdaq, and London Stock Exchange.

This means that you can invest in companies like Apple, Amazon, and Facebook at eToro, but not at Angel Broking. Additionally, eToro offers more in the way of passive investing. Sure, you can invest in a range of Indian funds, but again, much of the focus is on domestic markets.

Equity Investment Trading Commission Monthly Fee Deposit/Withdrawal Fees Angel Broking Free + taxes Up to 0.25% Rs.20 + taxes Depends on payment issuer eToro Free 0% Nothing £4 per withdrawal At eToro, not only will you have access to some of the largest ETF providers globally, but also Copy Trading facilities. This means that you can copy an eToro trader like for like – at an amount proportionate to what you invest. This is especially useful if you want to actively day trade instruments like forex, and commodities – but you don’t have the experience to do it yourself.

Finally, and perhaps most importantly, eToro is a more cost-effective trading app than Angel Broking. For example, while the latter will charge you up to 0.25% when trading forex and commodities, eToro is 100% commission-free. This is also the case when you buy shares and ETFs. Further, eToro does not charge a maintenance fee, while Angel Broking charges Rs.20 + taxes per month.

Angel Broking Stock App Pros & Cons

Below you will find an overview of our Angel Broking stock app findings.

Pros

- Access to heaps of Indian equities

- Easily invest in domestic IPOs

- Margin accounts available

- Trade futures, options, commodities, and forex

- No share dealing fees when buying equities

- Good reputation

Cons

- No support for e-wallets

- Does not allow you to buy stocks from overseas

- Limited funds on offer

- Monthly account fee kicks in after the first year

- No Copy Trading features

- App can be cumbersome to use

The Verdict

In summary, as Indian stock trading apps go, Angel Broking is well worth considering. Not only will you be able to invest in heaps of India-based companies, but you can also trade commodities and currencies. We also like that Angel Broking gives you access to newly launched IPOs.

However, Angel Broking does fall short in several key areas. Notably, you won’t have access to international stocks, and the trading app itself is somewhat clunky. In comparison, we found that eToro is a much better option for Indian investors and traders. You can buy equities from companies listed in 17 international markets – including the US.

This, alongside its ETF, forex, cryptocurrency and commodity department – is offered on a commission-free basis with no monthly fees. On top of accepting heaps of debit/credit cards and e-wallets, eToro is regulated by the FCA, CySEC, and ASIC – so your money is safe at all times.

eToro – Best Indian Stock App with 0% Commission

67% of retail investor accounts lose money when trading CFDs with this provider.

FAQs

What device is the Angel Broking app available on?

Angel Broking is available on both Android and iOS devices. If you don’t have a phone with one of these operating systems, you won’t be able to use the app. You can, however, still access your Angel Broking account via your mobile web browser.

What shares can you buy on the Angel Broking app?

The Angel Broking specializes exclusively on Indian equities. .

Is the Angel Broking app legit?

Yes, Angel Broking has been active in the Indian brokerage scene since the 1980s. It is authorized to offer brokerage services with all relevant Indian bodies.

What payment methods does the Angel Broking app support?

The Angel Broking app supports debit cards and local bank transfers.

Does Angel Broking offer mutual funds?

Yes, but these mutual funds are locally based.

Kane Pepi

Kane Pepi

Kane Pepi is a British researcher and writer that specializes in finance, financial crime, and blockchain technology. Now based in Malta, Kane writes for a number of platforms in the online domain. In particular, Kane is skilled at explaining complex financial subjects in a user-friendly manner. Kane has also written for websites such as MoneyCheck, the Motley Fool, InsideBitcoins, Blockonomi, Learnbonds, and the Malta Association of Compliance Officers.View all posts by Kane PepiMore Best Stock Market App India – Top App Revealed GuidesView all

stockapps.com has no intention that any of the information it provides is used for illegal purposes. It is your own personal responsibility to make sure that all age and other relevant requirements are adhered to before registering with a trading, investing or betting operator. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice.By continuing to use this website you agree to our terms and conditions and privacy policy.

© stockapps.com All Rights Reserved 2026We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up