Kotak Stock Trader App Review 2026 – Pros & Cons Revealed

Kotak Stock Trader App is a widely used mobile trading app supported by Kotak Securities Limited, an Indian based financial services company. This online trading provider is a subsidiary of Kotak Mahindra Bank Ltd, an Indian private bank headquartered in Mumbai, Maharashtra, India.

The mobile trading application, which is available for both Android and iOS devices, is among the most popular trading apps in India and provides access to an all-in-one platform where investors can trade in different types of instruments including equity, derivatives (futures, options, and foreign indices), currency derivatives, fixed deposits and bonds, Initial Public Offerings (IPOs), and ETFs.

At present, the app has more than 500,000 installations in India. It is also considered by many as one of the best stock market trading apps of the Indian share market and was specifically designed for on the go traders that want to get access to the Indian stock and derivatives markets. But, is Kotak Stock Trader app is the right trading platform for you?

In this review, we cover everything you need to know about the Kotak Stock Trader app before you open an online trading account. We reveal the broker’s features, fees, tradable assets, reliability, pros and cons, and more.

-

-

What is Kotak Stock Trader App?

The Kotak Stock Trader app, also known as KST, enables users to buy and sell securities on the Bombay Stock Exchange (BSE) as well as the National Stock Exchange of India (NSE). In addition, users get access to depositories and fixed income assets, meaning that this platform can also be used as an investment banking platform. The application is available on both Google Play and the App Store.

What Stocks Can You Trade on the Kotak Stock Trader App?

As we mentioned above, the Kotak Stock Trader App is focused on the Indian stock market. As such, this brokerage firm is offering investors access to all stocks listed on the BSE and NSE exchanges. Basically, this includes access to more than 10,000 shares of Indian companies ( around 8900 companies on the Bombay Stock Exchange, and around 1600 companies listed on NSE).

On the negative side, Kotak Securities does not yet cover companies listed on US and international markets meaning that investors on this platform get access to shares listed on the Indian stock market only.

Other Assets at Kotak Stock Trader App

Besides Indian shares, Kotak Securities offers investors to trade on other products and markets via the mobile application. This includes FX currency pairs, futures and options, and commodities.

Kotak Stock Trader Account Types

Kotak Securities Trader app offers a selection of nine account types for various targeted customers. But in order to trade via the Kotak Stock Trader mobile application, users must register for the Demat and Trading account. The Kotak Demat account, also known as dematerialized account, simply allows investors to hold company shares and securities electronically.

Kotak also offers three types of Demat accounts:

- Regular Demat account – A regular trading/Demat account is needed for investors who reside within India

- Repatriable Demat account – A trading account for non-resident Indians. In order to be eligible for the Repatriable Demat account, the client must have a Non-Resident External (NRE) bank account.

- Non-repatriable Demat account – Another Demat/Trading account for non-resident Indians (NRIs). However, with this account type, a user cannot transfer funds abroad.

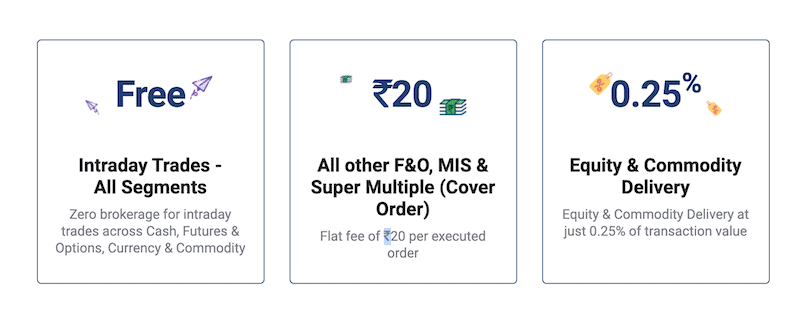

one of the benefits of opening the Kotak Demat account is the ability to join the Trade Free Plan. This is simply a brokerage plan that enables users to take advantage of free intraday trades, equity and commodity delivery trades, high exposure trades, and the top stock pick feature. To get the most of Kotak’s app, we would suggest joining the Trade Free Plan.

Kotak Stock Trader App Fees & Commissions

Overall, the pricing structure at the Kotak Stock Trader app is a bit complicated and unclear. Nonetheless, there’s a number of different fees you need to take into account including the actual brokerage charges, account opening charges, annual maintenance charges, fund transfer charges, research charges, and other hidden charges.

However, as previously mentioned, stock trading on the Kotak Stock Trader app can be done by opening the Demat account that enables users to join the Trade Free Plan. This plan offers users to get:

- Zero brokerage fees on intraday trades

- Rs.20 per order for futures and options

- Rs.20 for cover order (a market order that is placed along with a Stop Loss order)

- Margin trading is available

- Zero account opening charges

- 0.025% interest rate per day for stocks used as margin

- 0.04% per day for margin trading facility

- 0.05% per day for any other debit balance

Additionally, as Kotak offers share trading directly on NSE and BSE exchanges, you’ll have to take into consideration taxes and regulatory charges that include:

- STT/CTT charges

- Transaction charges

- Stamp Duty charges

- Investors Protection Fund interest rate

While it is clear that Kotak makes the effort to reduce the fees associated with trading activity, there are other brokerage firms in the markets that offer users commission-free trading and a much more cost-effective trading environment. As such, we suggest checking eToro, Robinhood, and Plus500 that all offer CFD trading on thousands of financial assets.

Kotak Stock Trader App User Experience

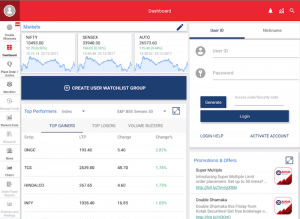

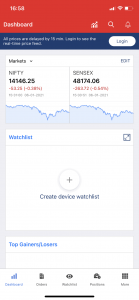

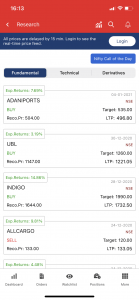

In terms of the app’s user experience, the Kotak Stock Trader platform is very easy to use and does not require any technical skills. In that sense, it is an ideal trading application for newbies and long-term investors. Overall, investors that choose to trade via this app will get the basic trading tools that include a news section, research, stock charts, gainers and losers, stocks by volume, watchlist, etc.

Having said that, the app falls short by not having advanced trading tools and features. Its charting package is not the best on the market, and you will be missing crucial features like price alerts and an advanced orders panel. Ultimately, the platform has been designed for basic trading needs, meaning that the Kotak Stock Trader app is not recommended for active day trading or high maintenance stock market activities.

Kotak Stock Trader App Tools and Features

As Kotak Stock Trader App has been designed for the on-the-go investor, you will get access to the following tools and features when using the app, such as:

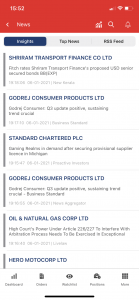

News Section

One of the best features we found on the Kotak Stock Trader app is the news section. This allows you to get access to real-time domestic and global stock markets news from top financial news providers such as Business Line, Business Standard, Livemint, CNN, Money Control, Times of India, and Economic Times.

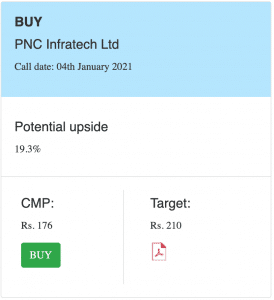

Top Stock Picks & Live Research Call

For those who want to get into the market but aren’t sure how to find investment ideas, Kotak analysts’ team posts every month/week its top-performing stock picks.

In addition, the Trade Free Plan allows users to get access to the Live Research Calls feature. By using this feature, investors get a view of stock and derivatives recommendations categorized to fundamental and technical analysis.

A Range of Trading Platforms

Besides the Kotak Stock Trader App, Kotak offers a decent selection of desktop and web-based trading platforms. This includes the TradeSmart terminal and the Keat Pro x that are most suited for experienced traders, and the All-New Websites, which is a desktop web-based trading platform.

Kotak Super Multiple

Generally, Kotak Securities does not offer leveraged trading when using its mobile app. However, online trading customers can utilize the Super Multiple that simply enables a 50 times exposure on some assets (under certain conditions). Take note that the service is suited for traders who want to take the advantage of intraday trading in large volumes on stocks, options, and futures contracts.

Kotak Stock Trader App Bonus

At the time of writing, Kotak Securities does not offer any bonus for new or existing clients. However, it does provide a refer and earn program that allows a user to get 15% of the cumulative referral transactions as referral points.

Kotak Stock Trader App Demo Account

One of the disappointing aspects found in this review is that Kotak does not offer a demo account for potential users to get familiar with the platform before risking real capital. For those that prefer to test the platform before depositing funds, we recommend using demo account on brokers like eToro, IG, or Plus500.

Payments on the Kotak Stock Trader App

At present, Kotak Securities offers only one method to transfer funds into your online trading account. This can be done via bank wire transfer once you have installed the application on your mobile phone.

Kotak Stock Trader Minimum Deposit

There is no minimum deposit required to open a trading account with Kotak Securities. You can even have zero balance in your account anytime, however, once you made a transaction you must meet the minimum amount required in order to open a position.

Kotak Stock Trader Contact and Customer Service

Kotak Securities offers several useful ways to contact its support team. These include phone, email, WhatsApp number, and a chat feature that is available on the mobile application. Note that the customer support via chat is available between Monday to Friday – 8 am to 6 pm and Saturdays – 9 am to 2 pm.

Is Kotak Stock Trader App Safe?

As a mobile trading app of one of the largest retail banks in India, it is no wonder that the Kotak Stock Trader mobile app is completely safe and secure. First and Foremost, Kotak Securities is a trading house and clearing member of BSE Limited, National Stock Exchange of India Limited (NSE), and MSEI. On top of that, it is a subsidiary firm of the Kotak Mahindra Bank. As such, the Kotak Trader app runs on the existing order routing system of Kotak securities. Crucially, the data being transferred between the mobile app and the Kotak Securities routing system is secured using industry-standard security protocol HTTPS, which is the highest level of encryption supported is AES-128 bit encryption

In terms of clients’ data protection and security, the authentication for the app is done through Client ID and 2 levels of passwords, including security key code. Additionally, the Stock Trader mobile app doesn’t store the clients’ data details.

The bottom line, we can confirm that clients’ funds are safe and secure at Kotak Securities.

How to Use the Kotak Stock Trader App

By now, you should have enough information about the merits of the Kotak Stock Trader app. If you are still interested in trading on this popular application and need help in installing it to your mobile phone, in this section of our guide we are going to show you the process to start trading with the Kotak Stock Trader app.

Step 1: Download the Kotak Stock Trader AppThe first thing you need to do is to visit Google Play or App Store, type in Kotak Stock Trader in the search bar, and download the application.

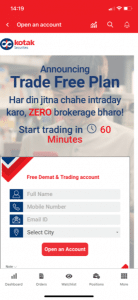

Step 2: Open an Account

Step 2: Open an AccountNow that the application has been installed on your smartphone, you’ll have to open an online trading account with Kotak Securities in order to be able to trade the markets. Unfortunately, opening an account via the mobile app is not possible so users must complete the registration via the broker’s website. Bear in mind that it takes around 2 weeks for the broker to receive the application and allow you to start trading (unless you choose the Trade Free Plan).

At Kotak, you will need to open a Demat/Trading account if you wish to trade online. As part of the registration process, you’ll have to submit your full name, mobile phone number, and city of residence in India. To verify your identity, you’ll also have to submit the following documentation:

- Identity proof

- Address proof

- Income proof

- Bank account proof

- PAN card

- Passport-sized photographs

Step 3: Transfer FundsOnce you have received the account approval, you can then transfer funds from your bank account. Bear in mind that you must have a bank account with one of the following banks: ICIC Bank, Citibank, HDFC Bank, AXIS Bank, Kotak Mahindra Bank, Indusind Bank, Federal Bank/ SBI Bank/ ING Vysya Bank

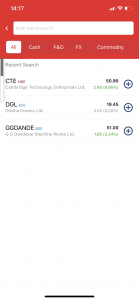

Step 4: Buy a StockAs soon as your funds have been transferred to your Kotak account, you can search for the stock you wish to invest in and place a buying order. To do that, click on the search icon at the top of the screen. As you can see in the image below, you’ll be able to choose the market you wish to trade on – equities (cash), futures and options, FX currency pairs, and commodities. To view stocks, choose the All or Cash tabs.

Then, you can place a buying order. In the order form, click on the buy button, and then enter the amount you wish to invest in the chosen stock.

How to Sell on Kotak Stock Trader App

Luckily for Kotak’s investors, Kotak Securities enables borrowing funds and short sell shares. For those unaware, a short sell position means a trader can borrow shares from the broker, and sell the shares with the intention of making a profit when the price of the asset decrease in value.

If you want to short-sell stocks on the Kotak mobile app, simply navigate to one of the stock you wish to sell and click on the sell button.

Kotak Stock Trader App vs eToro

Kotak Stock Trader app is an excellent choice for Indian-residents that want to get access to online trading on BSE and NSE stock exchanges. However, when taking into account other factors like leverage trading, fees, and social trading features – there’s no doubt that eToro is a better online trading solution. First, eToro offers zero-commission leveraged trading on a variety of assets that includes popular ETFs, built-in portfolios, and cryptocurrencies (not available on Kotak’s app).

Additionally, eToro offers a social trading experience where users can interact with each other and automate the trading activity of other investors. As such, if opting for eToro, you will be able to use the eToro Copy Trading feature that allows you to select an experienced trader with a successful track record and automatically copy the trades of the one you choose.

Then, Kotak is not a discount broker and is considered quite expensive compared to other online brokerage firms. Unfortunately, we have found some hidden fees on Kotak’s trading service. For example, in order to subscribe to the Trade Free Plan, you’ll have to pay a nominal amount of Rs 999 per year. Overall, eToro’s mobile trading is cheaper than the Kotak Stock Trader app.

Charge per Trade Annual Fee Inactivity Fee Deposit/Withdrawal Fees Kotak Stock Trader 20 INR per executed order Rs. 499 0 0 eToro 0 0 800 INR per month (after one year) 400 INR per withdrawal Finally, while Kotak Securities offers a modest selection of research, analysis, and educational tools, it still lacks many of the features available at other online brokers like eToro. This includes a robust charting package, leveraged trading, and fast order execution. More than that, we have found that the account creation process at Kotak is unclear and extremely complicated when compared to eToro.

Kotak Stock Trader App Pros & Cons

Below you will find an overview of our Kotak Stock Trader app findings.

Pros

- Huge range of Indian shares to trade on

- Safe and secure trading application

- Solid user interface – Easy to use

- Good platform for beginners

- Access to BSE and NSE

- Offers a wide range of research and analysis tool

- Available on Android and iOS

Cons

- High trading charges and fees

- Cryptocurrency trading is not available

- Long process to open an account

- A limited selection of payment methods

- No access to international markets

- Does not offer leveraged trading

- No CFDs

- Basic charting package

The Verdict

All in all, Kotak Securities offers a solid mobile trading app for Indian traders that are looking for access to share trading on the NSE and BSE. In this sense, it is one of best stock trading apps in India and of the easiest to use and cost-effective platforms in the market, with great research and market analysis tools.

With that in mind, the Kotak Stock Trader app lacks some crucial features and functionality. Its charting package is basic, and stock trading could be pricey in comparison to other trading platforms in the market. Moreover, Kotak does not offer leverage trading nor trading on cryptocurrency pairs. As such, we suggest checking other platforms like eToro before signing up with Kotak Securities.

eToro – Buy Shares with 0% Commission

67% of retail investor accounts lose money when trading CFDs with this provider.

FAQs

What device is the Kotak Stock Trader app available on?

Kotak Stock Trader app is available on the following smartphone devices: Nokia, Blackberry, Samsung, LG, Motorola, Micromax, HTC, and iPhone.

What shares can you buy on the Kotak Stock Trader app?

Kotak Securities offers users to trade on all stock listed in the Indian NSE and BSE stock exchanges.

Is the Kotak Stock Trader app legit?

Absolutely, Kotak Stock Trader app is backed by Kotak Securities, which is one of the most well-known brokerage firms in India and is a subsidiary of Kotak Mahindra Bank Ltd.

What payment methods does the Kotak Stock Trader app support?

Transferring funds to Kotak Stock Trader app is done via bank wire transfers.

What is the Kotak Stock Trader app minimum deposit?

There is no minimum deposit amount required to open a trading account with Kotak Securities. Instead, users have to synchronise their bank account with the mobile app and meet the minimum amount required to open a position.

Kane Pepi

Kane Pepi

Kane Pepi is a British researcher and writer that specializes in finance, financial crime, and blockchain technology. Now based in Malta, Kane writes for a number of platforms in the online domain. In particular, Kane is skilled at explaining complex financial subjects in a user-friendly manner. Kane has also written for websites such as MoneyCheck, the Motley Fool, InsideBitcoins, Blockonomi, Learnbonds, and the Malta Association of Compliance Officers.View all posts by Kane PepiMore Best Stock Market App India – Top App Revealed GuidesView all

stockapps.com has no intention that any of the information it provides is used for illegal purposes. It is your own personal responsibility to make sure that all age and other relevant requirements are adhered to before registering with a trading, investing or betting operator. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice.By continuing to use this website you agree to our terms and conditions and privacy policy.

© stockapps.com All Rights Reserved 2026We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up