Best Stocks to Buy Now in Ireland – Invest with 0% Fees

Stocks continue to make headlines, prompting many investors to search for the best stocks to buy now in Ireland. All in all, even after a strong start to November, stocks are generally unchanged as we move further into the winter months.

With the US Federal Reserve applying the brakes on its bond-buyback program, and the global economy on the road to recovery post-Covid-19, all eyes are on the stock markets. In this article, we reveal the best stocks to buy right now, as well as the best stock brokers offering competitive fees and cutting-edge stock trading apps.

-

- 1. Pinterest (NYSE: PINS) – Best Growth Stock to Buy Now in 2022

- Not your typical social media outlet

- PayPal set to Buy Pinterest?

- 2. Arista Networks Inc. (NYSE: ANET) – Best Stock to Buy Now in Ireland with Q3 Revenue up by 23.7%

- What are investors responding to?

- 3. Qualcomm Inc. (NASDAQ: QCOM) – Best Shares to Invest in Now with Earnings per Share of $1.77

- Qualcomm commits to going net-zero by 2040

- 4. Goodyear Tire & Rubber Co (NASDAQ: GT) – Best stocks to invest in right now in Ireland

- Wall Street Forecasts Strong Earnings Growth

- 5. Hubbell (NYSE: HUBB) – Best stocks to invest in 2022

- 6. Accenture Plc (NYSE: ACN) – With HQs in Dublin, Accenture is one of the best shares to buy now

- 7. Ryanair Holdings plc (NASDAQ: RYAAY) – Best Stocks to Buy Now in Ireland

- Come Fly with Me, or Come Delist with Me?

- 8. Netflix Inc. (NASDAQ: NFLX) – One of the best stocks to buy now in Ireland with YTD gains of 29.62%

- 9. AMZN (NASDAQ: AMZN) – Best Stocks to buy in Ireland today

- 10. AT&T Inc. (NYSE: T) – One of the best dividend stocks with a dividend yield of 8.23%

-

- 1. Pinterest (NYSE: PINS) – Best Growth Stock to Buy Now in 2022

- Not your typical social media outlet

- PayPal set to Buy Pinterest?

- 2. Arista Networks Inc. (NYSE: ANET) – Best Stock to Buy Now in Ireland with Q3 Revenue up by 23.7%

- What are investors responding to?

- 3. Qualcomm Inc. (NASDAQ: QCOM) – Best Shares to Invest in Now with Earnings per Share of $1.77

- Qualcomm commits to going net-zero by 2040

- 4. Goodyear Tire & Rubber Co (NASDAQ: GT) – Best stocks to invest in right now in Ireland

- Wall Street Forecasts Strong Earnings Growth

- 5. Hubbell (NYSE: HUBB) – Best stocks to invest in 2022

- 6. Accenture Plc (NYSE: ACN) – With HQs in Dublin, Accenture is one of the best shares to buy now

- 7. Ryanair Holdings plc (NASDAQ: RYAAY) – Best Stocks to Buy Now in Ireland

- Come Fly with Me, or Come Delist with Me?

- 8. Netflix Inc. (NASDAQ: NFLX) – One of the best stocks to buy now in Ireland with YTD gains of 29.62%

- 9. AMZN (NASDAQ: AMZN) – Best Stocks to buy in Ireland today

- 10. AT&T Inc. (NYSE: T) – One of the best dividend stocks with a dividend yield of 8.23%

Best Stocks to Buy in Ireland Today

Wondering what the best stocks to buy now in Ireland are? Here are the ten best stocks to invest in right now in Ireland:

- Pinterest (NYSE: PINS) – Best Growth Stock to Buy Now in 2022

- Arista Networks Inc. (NYSE:ANET) – Best Stock to Buy Now in Ireland with Q3 Revenue up by 23.7%

- Qualcomm Inc. (NASDAQ: QCOM) – Best Shares to Invest in Now with Earnings per Share of $1.77

- Goodyear Tire & Rubber Co (NASDAQ: GT) – Best stocks to invest in right now in Ireland

- Hubbell (NYSE: HUBB) – Best stocks to invest in 2022

- Accenture Plc (NYSE: ACN) – With HQs in Dublin, Accenture is one of the best shares to buy now

- Ryanair Holdings plc (NASDAQ: RYAAY) – Best Stocks to Buy Now in Ireland

- Netflix Inc. (NASDAQ: NFLX) – One of the best stocks to buy now in Ireland with YTD gains of 29.62%

- AMZN (NASDAQ: AMZN) – Best Stocks to buy in Ireland today

- AT&T Inc. (NYSE: T) – One of the best dividend stocks with a dividend yield of 8.23%

If you want to start investing in the stock market right now, you’ll be pleased to learn that you can buy and sell all ten of these top-rated stocks with eToro on a commission-free basis.

Best Stocks to Buy Now in Ireland In-depth Analysis

Now let’s take a closer look at the best stocks to buy right now in Ireland.

1. Pinterest (NYSE: PINS) – Best Growth Stock to Buy Now in 2022

- Industry: Media

- Current price: $44.35

- Market cap: $28.59B

- Dividend yield: N/A

- YTD return: -34.85%

68% of retail investors lose money when trading CFDs with this provider.

Looking to generate profits over the long term? Growth stocks may be the answer. These innovative companies yield earnings and revenue much faster than their industry competitors. This means they’re better equipped to earn significant returns.

Pinterest (NYSE:PINS) is a recent example, with its stock up by over 200% since its IPO. Let’s look at why its unique business model – and potential acquisition – could help investors achieve even greater success.

Not your typical social media outlet

The social media industry is under increasing pressure from governments and activists over issues related to privacy, personal data, and fake news. Market leaders such as Twitter and Facebook (now rebranded as Meta) face the main spotlight as their business revolves around peer-to-peer engagement and personal information.

Pinterest is the black swan. Instead of interacting with words, Pinterest users communicate via the medium of images.

So far, this has been Pinterest’s winning recipe. Second-quarter revenue increased 125 percent since 2020 to $613 million, owing to an increase of 89 percent to $1.32 in worldwide average revenue per user. Pinterest has over 450 million monthly active users who frequently use the platform to learn more about products they are considering buying.

PayPal set to Buy Pinterest?

There have been reports in the last week that PayPal is looking to buy Pinterest. Analysts expect Pinterest’s shares to be valued at $39 billion, or $70 per share, should the deal go through. This would be a significant premium to the stock’s closing price of $56 per share before the stories surfaced.

With this in mind, will you add PINS stock to your investment portfolio?

2. Arista Networks Inc. (NYSE: ANET) – Best Stock to Buy Now in Ireland with Q3 Revenue up by 23.7%

- Industry: Tech Hardware & Semiconductors

- Current price: $491.87

- Market cap: $37.73B

- Dividend yield: N/A

- YTD return: +73.71%

68% of retail investors lose money when trading CFDs with this provider.

Arista Networks, a computer networking business that creates and sells multilayer network switches, is next on the list. The company developed software-driven, cognitive cloud networking for international data centers.

Arista’s award-winning systems have redefined and delivered on automation, analytics, and security. At the time of writing, ANET’s share price was up 20.39% compared to yesterday’s closing bell.

What are investors responding to?

Investors are most probably reacting to its recent financial report. For starters, it released its financial results for the third fiscal quarter on Monday. Revenue for Q3 was $748.7 million, up 23.7 percent from the previous year.

The company’s GAAP net income was $224.3 million. “Our pioneering client-to-cloud networking portfolio is in high demand across all of our customer sectors. Despite a challenging supply chain environment, I am pleased with Arista’s delivery of another record quarter of financial results in Q3 2021,” said Jayshree Ullal, President and CEO of Arista.

3. Qualcomm Inc. (NASDAQ: QCOM) – Best Shares to Invest in Now with Earnings per Share of $1.77

- Industry: Tech Hardware & Semiconductors

- Current price: $135.23

- Market cap: $152.54B

- Dividend yield: 2.01%

- YTD return: -8.94%

68% of retail investors lose money when trading CFDs with this provider.

Qualcomm is one of the leading wireless technology pioneers, responsible for the 5G network’s rollout. Its basic technologies power the mobile ecosystem today and can be found in almost every 3G, 4G, and 5G smartphone. Qualcomm is committed to taking the car, computing, and communications sectors to new heights.

The company is set to announce its fourth-quarter financials after the market closes on November 3rd. What are investors and market analysts expecting to hear from the earnings report?

If past performance is anything to go by, Qualcomm’s Q3 financials showed revenue of $8.06 billion, up 65 percent since the same period last year. The company’s net income for the quarter was $2.03 billion, up 140 percent year-over-year.

Qualcomm commits to going net-zero by 2040

The tech giant also declared on Monday that it intends to reach net-zero emissions by 2040. Its plan for achieving this target will be to switch to renewable energy through Power Purchase Agreements, and use as few Renewable Energy Credits and carbon offsets as possible for residual emissions.

It also continues to develop more energy-efficient devices, including its Snapdragon platform, which features industry-leading power usage optimization. Will you be investing in QCOM stock ahead of its renewed commitment to going green?

4. Goodyear Tire & Rubber Co (NASDAQ: GT) – Best stocks to invest in right now in Ireland

- Industry: Manufacturing

- Current price: $21.09

- Market cap: $5.93B

- Dividend yield: N/A

- YTD return: +107.37%

68% of retail investors lose money when trading CFDs with this provider.

The stock price of The Goodyear Tire & Rubber Company rose 2.58 percent on the most recent trading day (Tuesday, November 2nd, 2021), increasing from $20.56 to $21.09. It has now risen three days in a row. It’ll be interesting to watch if it manages to keep increasing or if it starts to decline over the following weeks. The price varied 4.20 percent throughout the day, from a low of $20.26 to a high of $21.11. In the last ten days, the price has risen six times and is up 10.71 percent in the last two weeks. On the last day, volume fell by -326 thousand shares, resulting in a total of 5 million shares being purchased and sold for almost $100.90 million.

Wall Street Forecasts Strong Earnings Growth

The company’s management plans to save $165 million in annual costs by 2023. Goodyear will benefit from these cost savings in the form of improved earnings and free cash flow. The new Goodyear and Cooper Tires merger would have generated $690 million in free cash flow, according to 2019 figures.

Furthermore, by the end of 2022, Wall Street anticipates Goodyear to earn slightly over $700 million in free cash flow. Based on its current market price of $5.36 billion, the stock would trade at only 7.5 times FCF in 2022. That pricing looks to be extremely low, especially when you realise that 80% of its revenues come from selling replacement auto parts.

5. Hubbell (NYSE: HUBB) – Best stocks to invest in 2022

- Industry: Industrial Products

- Current price: $202.60

- Market cap: $11.02B

- Dividend yield: 2.07%

- YTD return: +29.82%

68% of retail investors lose money when trading CFDs with this provider.

Let’s take a look at the well-known Hubbell Incorporated (NYSE:HUBB). The company’s shares attracted a lot of attention due to a significant price movement on the NYSE recently, rising to $209 at one stage and falling to $179 at another.

Some share price fluctuations can provide investors with a better opportunity to enter the stock market and possibly purchase at a cheaper price. The question is whether Hubbell’s current trading price of $202.60 reflects its intrinsic value. Or, is it now undervalued as a stock, providing the perfect opportunity to buy low and sell high.

Since Hubbell’s share price is fairly volatile at the moment, it’s fair to assume that it could drop below the $200 mark, which could be a better buying opportunity for long-term investors. The HUBB share price is up 0.99% since yesterday. Furthermore, it has a dividend yield of 2.07% making it one of the best dividend stocks to keep an eye on this winter.

6. Accenture Plc (NYSE: ACN) – With HQs in Dublin, Accenture is one of the best shares to buy now

- Industry: Software & Tech Services

- Current price: $361.50

- Market cap: $237.41B

- Dividend yield: 1.07%

- YTD return: +40.96%

68% of retail investors lose money when trading CFDs with this provider.

Accenture (NYSE:ACN), one of the world’s biggest IT services, reported Q4 earnings in September. Its revenue increased by 24 percent year-on-year to $13.4 billion, meeting analysts’ expectations, while adjusted earnings per share increased by 29 percent to $2.20, beating forecasts.

Accenture’s cloud business is expanding as more businesses employ its IT professionals to connect their networks to public or hybrid cloud services. The company also helps businesses improve their digital marketing campaigns. As online marketing and e-commerce continue to gain traction, companies like Accenture have good potential to continue growing.

Accenture’s business is booming, but at 34 times forecast earnings, its stock may appear overvalued. Accenture’s robust growth rates, increasing exposure to the cloud, security, and digital transformation markets, as well as shareholder-friendly procedures, all support the premium price tag. As a result, despite trading near all-time highs investors believe Accenture is a good long-term investment.

7. Ryanair Holdings plc (NASDAQ: RYAAY) – Best Stocks to Buy Now in Ireland

- Industry: Aviation

- Current price: $119.33

- Market cap: $23.03B

- Dividend yield: N/A

- YTD return: +13.34%

68% of retail investors lose money when trading CFDs with this provider.

Ryanair has had a bumpy ride through the Covid-19 pandemic. Its passenger numbers have fallen by 83% in comparison to the previous year. But this hasn’t stopped the airline company from projecting new hopes moving forward.

In July 2020, Ryanair announced a loss of €185m for the first fiscal quarter of 2020. When you compare this to the €243 million net profit it made during the same period in 2019, you can see how badly the coronavirus has hurt the FTSE 250 stock and its competitors. Without doubt, the three months leading up to June 2020 were the most difficult in the organization’s 35-year existence.

Come Fly with Me, or Come Delist with Me?

Ryanair Holdings Plc announced its first quarterly profit since the pandemic began in December 2019. Furthermore, the airline company also cautioned that it will have to lower passenger fares during the winter months as a way of supporting its post-pandemic recovery.

Ryanair shares fell in Euronext Dublin trading after the airline posted a net profit of 225 million euros for the third fiscal quarter, a figure that fell short of analysts’ expectations.

The Dublin-based firm is also discussing plans to delist from the London Stock Exchange (LSE), a move that will dishearten some investors.

8. Netflix Inc. (NASDAQ: NFLX) – One of the best stocks to buy now in Ireland with YTD gains of 29.62%

- Industry: Media

- Current price: $679.02

- Market cap: $300.54B

- Dividend yield: N/A

- YTD return: +29.87%

68% of retail investors lose money when trading CFDs with this provider.

Netflix (NASDAQ: NFLX) invented the streaming entertainment industry in 2007, and it has reaped the rewards ever since. In the last five years, the stock price has increased by more than 500 percent. Its success has drawn in heaps of competitors, namely Walt Disney and Amazon Prime Video.

Despite users having an abundance of streaming options, customers appear to be aligned with Netflix. This is good news for Netflix as subscribers are what keep its business afloat.

Netflix has continued to benefit from the move away from conventional television, to a more personalised streaming service. The Covid-19 pandemic forced people to stay at home, resulting in a growing dependency on streaming services as a form of entertainment.

NFLX stock is trading at a P/E ratio of 61.26, close to the lowest it has sold since 2017. Many investors agree that Netflix is here to stay, making it a good long-term investment as we move further into the digital age.

9. AMZN (NASDAQ: AMZN) – Best Stocks to buy in Ireland today

- Industry: Retail – E-Commerce Discretionary

- Current price: $3,321.88

- Market cap: $1.68T

- Dividend yield: N/A

- YTD return: +4.24%

68% of retail investors lose money when trading CFDs with this provider.

Amazon.com (NASDAQ:AMZN) shocked the market earlier this year by announcing that founder Jeff Bezos would step down as CEO in the third quarter of 2021. Amazon appointed Andy Jassy, who previously led the firm’s rapidly expanding cloud computing operations, would take over as CEO.

On Thursday 28th October 2021 Amazon reported Q3 results, falling short on both top and bottom lines. Additionally, it gave a Q4 sales guidance that was below Wall Street analysts’ forecasts.

Amazon shares fell more than 4% in extended trading last month after it reported weaker-than-expected Q3 results and issued gloomy guidance for the key festive season.

- ‘Earnings: $6.12 vs $8.92 per share expected, according to analysts surveyed by Refinitiv’

- ‘Revenue: $110.81 billion vs $111.6 billion expected, according to analysts surveyed by Refinitiv’

Earnings and Revenue figures according to Refinitiv and CNBC.

10. AT&T Inc. (NYSE: T) – One of the best dividend stocks with a dividend yield of 8.23%

- Industry: Telecommunications

- Current price: $25.28

- Market cap: $1.68T

- Dividend yield: 8.23%

- YTD return: -14.15%

68% of retail investors lose money when trading CFDs with this provider.

This year, AT&T (NYSE: T) made two big measures to restructure its company. In August, it separated DirecTV, AT&T TV, and U-verse into a new independent company. AT&T kept a 70% ownership position in the “new” DirecTV, while the investment firm TPG purchased the other 30%.

Secondly, AT&T said that by Q3 2022, it would merge WarnerMedia with Discovery (NASDAQ: DISCK) to form a new stand-alone firm. AT&T shareholders are set to gain 71 percent of the new company’s shares, with Discovery investors receiving the remaining 29 percent.

However, AT&T’s recovery plans haven’t enticed many investors back to the stock, which has dropped by over 14% YTD and is down 30.86% in the last five years.

With its recent update, AT&T didn’t provide any new figures, but it did confirm that the WarnerMedia spin-off will be completed by the end of 2022.

AT&T is confident that the divestment will allow its core business to concentrate on growing its 5G networks and give rivals like T-Mobile a run for their money.

Best Stocks to Buy Right Now

Now that we’ve covered the best stocks to buy now in Ireland, let’s examine a couple of stocks that most Wall Street investors are adding to their watchlists.

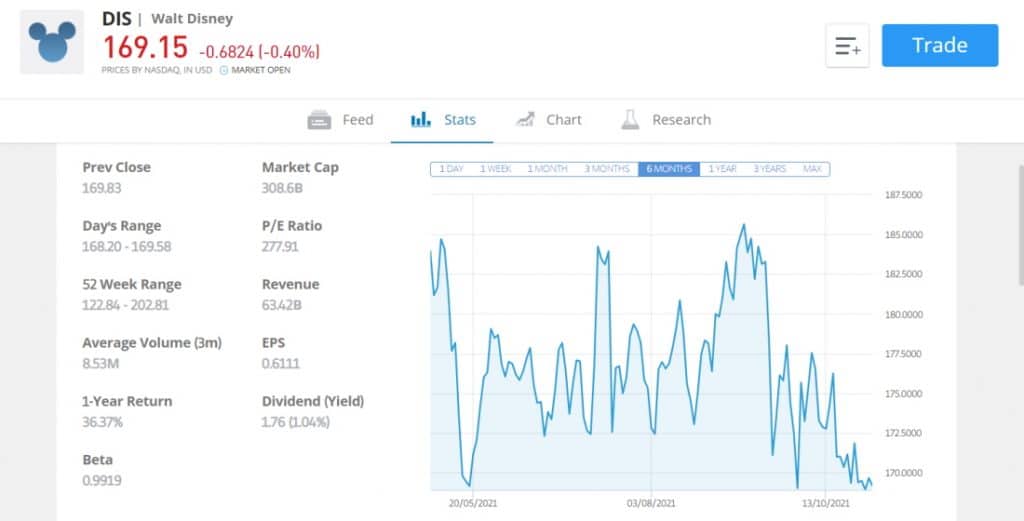

Tesla and Walt Disney

Tesla is off to a good start this month. It said over the weekend that it delivered 241,300 vehicles in the third quarter, a 73 percent increase year-over-year at a time when other automakers were seeing sales fall off the edge. According to estimates, only 221,000 new Tesla cars were expected to reach the market.

Walt Disney, on the other hand, continues to outperform in the streaming industry, despite a slowdown following a good fiscal third quarter. DIS stock is still trading modestly down in 2021, despite a post-pandemic recovery. A strong performance in November might help the company reverse its year-to-date slide.

How to Buy Stocks in Ireland

If you want to buy the best stocks in Ireland today, you’ll need to open a trading account with a reputable online stock broker. As a result, let’s cover how to buy shares in Ireland with eToro. This leading broker also offers one of the best stock trading apps.

Step 1: Open an Account

First and foremost, head over to the eToro website and click on ‘Join Now’. You’ll be asked to enter some personal information, such as your name, home address, birth date, and phone number. You’ll also need to choose a username and a secure password.

Step 2: Upload ID

As part of the KYC regulations you’ll need to verify your identity and address. This is done by uploading copies of your passport or driving license, and a recent utility bill or bank account statement.

Step 3: Deposit Funds

It is simple to fund your eToro brokerage account. You will have several payment options to choose from. Credit cards, debit cards, bank wire transfers, and e-wallets such as PayPal and Neteller are all supported payment methods.

The minimum deposit is only $50, and the only account base currency available is USD. This means that if you deposit in GBP, you will be charged a 0.5 percent conversion fee.

Step 4: Buy Shares

Now that you’ve verified and deposited funds, you’ll be able to buy shares with the click of a button.

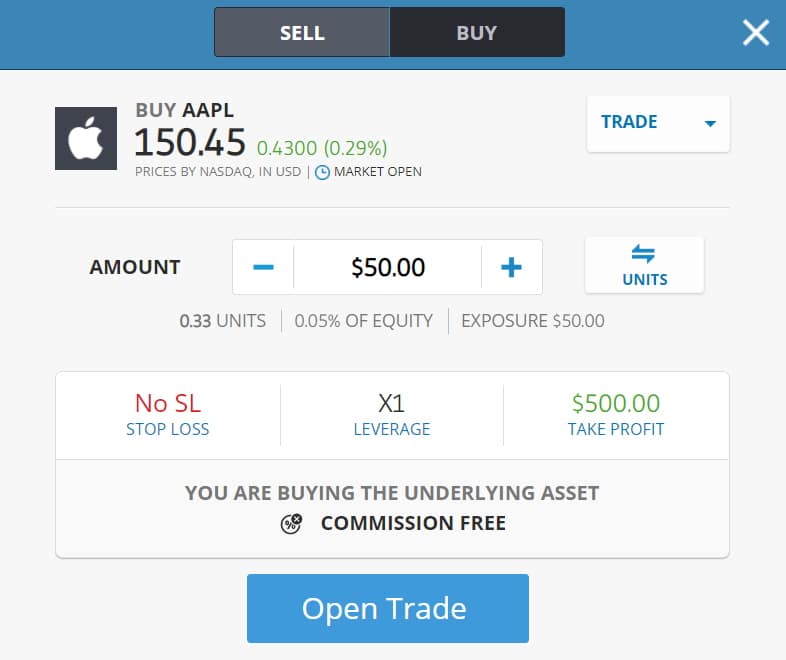

If you already know which stocks you want to add to your investment portfolio, just type the ticker or the name of the company into the search bar. In this example, we’re looking to invest in Apple stock.

After clicking on the ‘Trade’ button you’ll be able to enter the amount of capital you want to invest, as well as place any stop-loss and take-profit orders. eToro also facilitates fractional share trading, meaning you can invest in portions of whole shares with a minimum investment of $50.

To complete your order just tap on the ‘Open Trade’ or ‘Set Order’ button.

How We Choose Which Stocks are Best to Invest in

It takes a lot of fundamental and technical analysis to figure out which stocks are the best to buy right now. We comb the markets looking for the best trading opportunities for our readers. This way you’ll be able to make informed investment decisions.

With that in mind, here are some of the ways we identify the best stocks to buy now in Ireland.

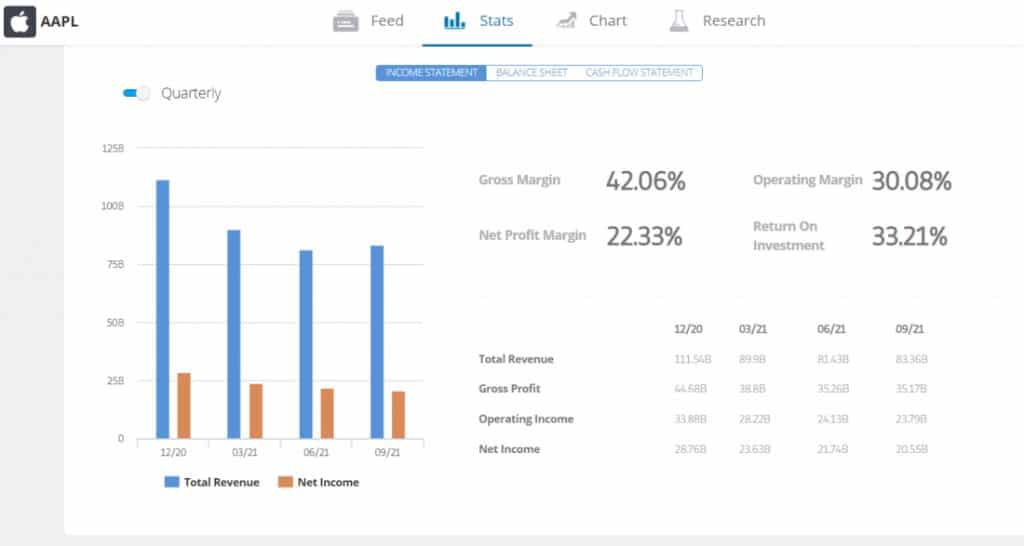

Fundamental analysis

Fundamental analysis involves assessing and analysing a company’s revenue, financial performance, earnings growth, past performance, free-cash-flow, sales figures, dividend yields, and E/P ratios.

When the fair value of a stock exceeds its current share price, it’s a sign that investors are undervaluing the stock.

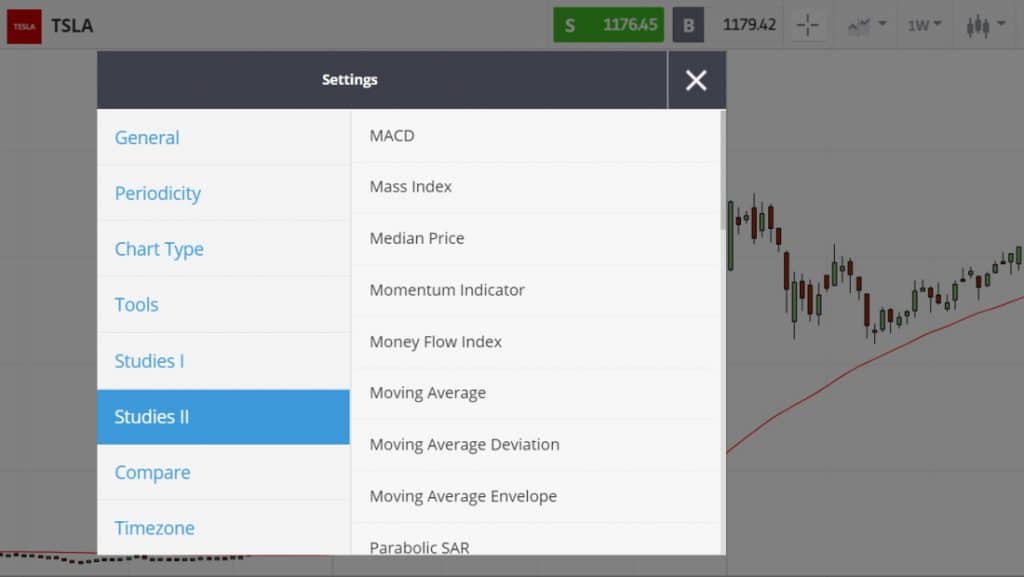

Technical Analysis

Another important metric we use to identify short-term opportunities is technical analysis. This type of chart analysis involves examining a company’s price movements to forecast future price movements. RSI (Relative Strength Index) and MACD (Moving Average Convergence Divergence) are two popular technical indicators.

The RSI momentum indicator is used to analyse overbought and oversold trends in the price of a stock by measuring the size of recent price movements.

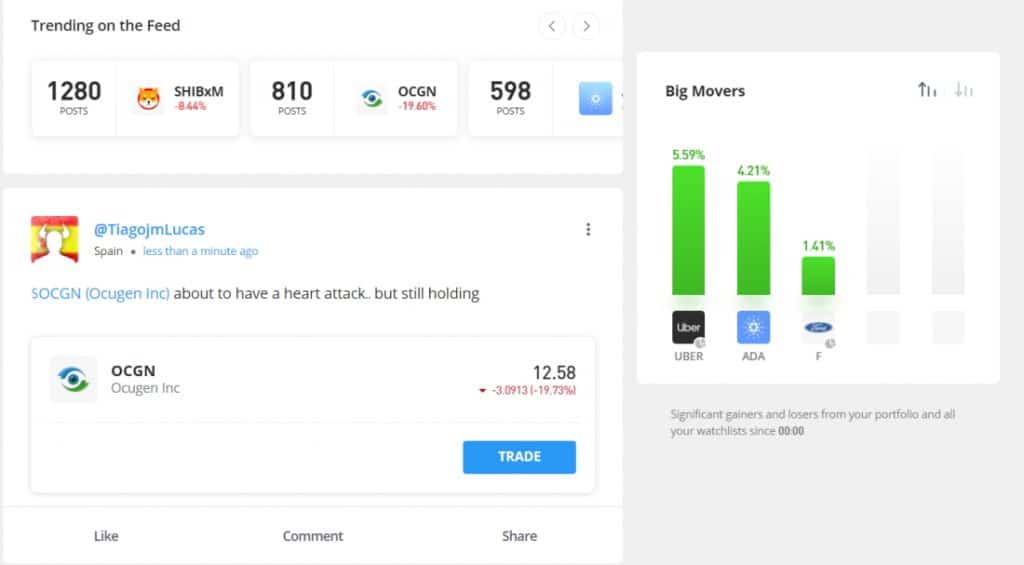

Market News

Stock prices fluctuate throughout the day because the supply-demand balance is constantly shifting. When more investors try to buy a stock, the market price rises, and vice versa. Market news and trends have a strong influence on supply and demand.

Nonetheless, relying on real-time news is not an effective stock-picking strategy for most investors. Experienced investors typically react to an event in advance, rather than when it makes headlines.

The Bottom Line

In the aftermath of the pandemic and Brexit, the stock markets and the Irish economy have been rattled. However, with many market analysts anticipating a rapid global economic recovery, now may be the best time to invest in Irish stocks.

We’ve covered everything you need to know about the best stocks to buy now in Ireland, as well as how to invest in stocks with eToro. If you want to diversify your investment portfolio and gain exposure to global stock exchanges, open an account with eToro and trade stocks without paying a penny in commission.

eToro – Buy the Best Stocks with 0% Commission

68% of retail investors lose money when trading CFDs with this provider.

FAQs

How to buy shares in Ireland?

Buying shares in Ireland is simple and easy. Firstly you need to open and verify a brokerage account with a trusted trading platform. We recommend eToro as it facilitates commission-free stock trading, alongside CFD trading, copy trading and a host of other innovative trading tools. eToro also offers ETFs. Once you’ve deposited funds into your trading account, simply search for the stocks you’re looking for and click on ‘Trade’.

How to avoid paying capital gains tax on shares in Ireland?

All traders have a yearly CGT exemption. This capital gains tax allowance currently sits at £12,300 and is fixed at this rate until mid-2026. Therefore, if your total CGT is within the threshold, you won’t have to pay any tax.

What are shares?

Shares typically represent ownership in a particular business. For instance, you could own five Alphabet shares. When you buy shares, you gain ownership of the underlying asset. Investors looking for long-term investments will buy shares of a company with the view that those shares will appreciate over time, spurring the share price higher.

What are the best Irish shares to buy now?

Some of the hottest shares listed on the Irish stock exchange include Kerry Group plc, Smurfit Kappa Group plc (ISEQ: SK3), Kingspan Group plc, Hibernia REIT, and CRH plc.

Tommy Smith

stockapps.com has no intention that any of the information it provides is used for illegal purposes. It is your own personal responsibility to make sure that all age and other relevant requirements are adhered to before registering with a trading, investing or betting operator. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice.By continuing to use this website you agree to our terms and conditions and privacy policy.

© stockapps.com All Rights Reserved 2025