How to Buy Shares Ireland – A Beginner’s Guide

If you’re wondering how to buy shares in Ireland, you’re not alone. Many avid stock traders are eager to learn how to buy shares right now. But how do you buy shares in Ireland? What is the best trading platform to use in 2022?

By the end of this beginner’s guide, we’ll have explored all the key metrics surrounding the how to buy shares in Ireland topic. As a bonus, we’ll also reveal the cheapest broker that offers 0% commission stock trading. Read on to learn more.

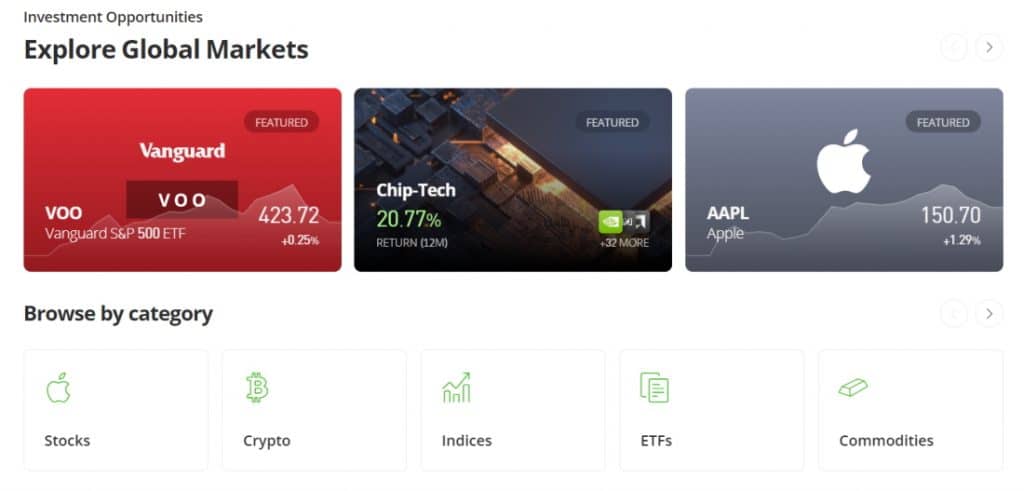

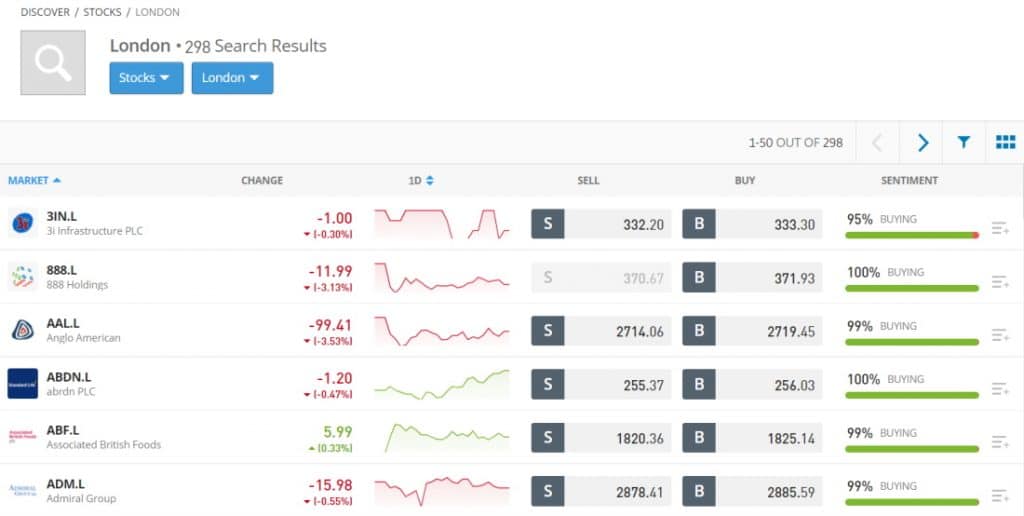

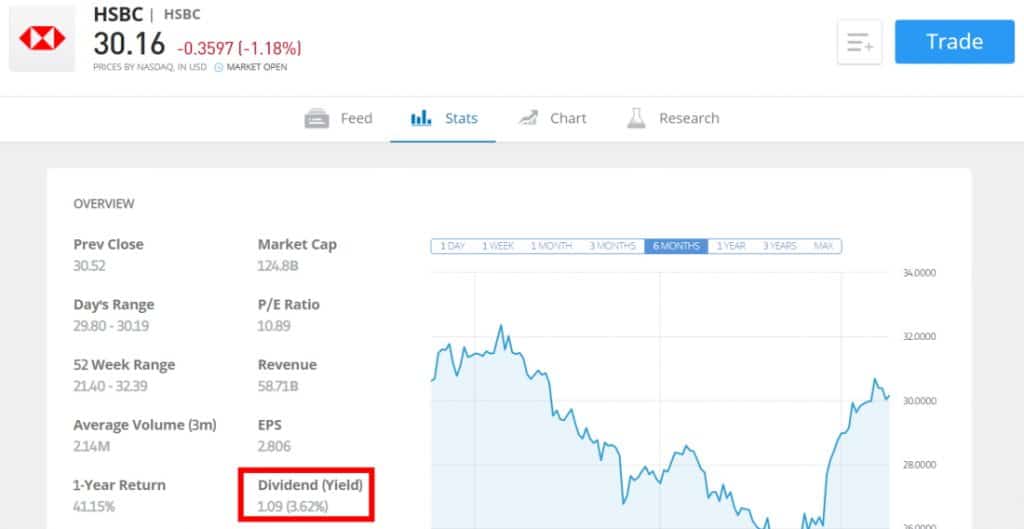

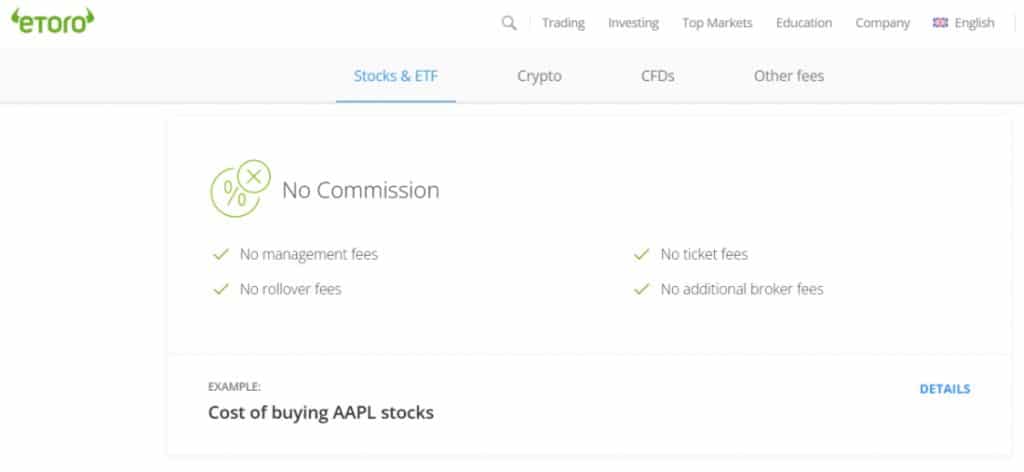

As the global economy gradually returns to pre-pandemic levels, many new investors are wondering how to buy stocks in Ireland. However, with so many stocks and trading platforms to choose from, knowing where to start can be disorientating. To begin adding stocks to your investment portfolio, you must first create a trading account with a reputable and licenced stock broker. There are heaps of discount brokers available nowadays all boasting 0% commission stock trading alongside other innovative trading features. In this convenient tutorial, we’ll show you how to buy shares in Ireland in the cheapest way possible. We’ll also go over the fundamentals of trading stocks and shares, as well as all key metrics, the buyer’s journey, and tax rules. By learning the basics of how to buy shares in Ireland, you’ll be better equipped to make better investment decisions going forward. When a business decides to go “public,” via an Initial Public Offering (IPO) it means that it will be listed on a stock exchange such as the NASDAQ, London Stock Exchange (LSE), or NYSE. As a result, retail investors can buy “shares” in the company. Therefore, you will own a share of the company based on the number of stocks that you own. Market conditions and liquidity determine the value of the shares. Simply put, if there are more buyers than sellers, the share price will rise. When that happens, the value of your investment will rise accordingly. On the other hand, when there are more sellers than buyers, the value of your stock falls. As a company shareholder, you will be eligible for a variety of benefits such as dividend payouts and voting rights. The four horsemen of tech – a quartet of big tech stocks including Microsoft (MSFT), Intel Corp. (INTC), Cisco Systems (CSCO), and Dell fueled the rise of the internet sector and drove the Nasdaq to all-time highs – helped popularise the buy-and-hold (HODL) investment strategy in the 1990s. They appeared to be such safe bets that financial experts were recommending them to investors as stocks to buy and hold for the long term. Unfortunately, many traders who followed their advice purchased late in the bull market movement, so when the dot-com bubble burst, the prices of these overpriced securities also crashed. Despite such drawbacks, the buy-and-hold approach produces positive returns with less volatile equities, rewarding traders with high annual returns. The HODL approach is still a popular trading strategy for retail investors. The stock market has traditionally appreciated over time, with average annual returns of about 10%. The buy-and-hold method has become popular amongst cryptocurrency traders, with the likes of Bitcoin (BTC) and Ethereum (ETH) reaching unprecedented heights in recent weeks. When the value of your shares rises above the price you paid when you first purchased them, you have made a capital gain. As an example: According to revenue.ie, your payment for CGT (Capital Gains Tax), is due before you file your return. CGT can be paid online through the Revenue Online Service (ROS). You will also be able to earn money from your shares in the form of dividends. Dividends, in their most basic form, allow large firms to share their profits with shareholders. If they do, you will be entitled to a portion of the revenue. The amount of dividend income you receive will fluctuate based on how well the firm performs. Dividends are not paid on all shares, but if they are, they are normally issued every three or six months. Let’s see how dividend stocks work: While previous performance is never a guarantee of future results, the average annualised returns of the S&P 500 since 2011 are shown in the table below: To replicate these results, you’d need to invest in an ETF or mutual fund that tracks the S&P 500 benchmark stock index such as the Vanguard S&P 500 ETF, the iShares Core S&P 500 ETF, and the SPDR S&P 500 ETF Trust. Rather than just cashing out capital gains or waiting for dividend payouts, most investors prefer to reinvest these earnings to produce greater returns over the long haul. This is what’s referred to as compounding. By keeping a stock for an extended period and reinvesting capital gains regularly, you can generate profits from your existing earnings. Consider the following example of compound growth: Another important thing to consider while learning how to buy shares in Ireland is the pricing and fee structure. Commissions and bid-ask spreads are some of the most important fees and expenditures to be aware of. Trading commissions are charged when you open and close a trade. This is the broker’s way of getting compensated for offering its services to you. The amount of commission charged by different brokers varies depending on the asset traded and the type of service provided. Execution-only brokers charge cheaper commissions since they do not make trade decisions on behalf of their clients or provide advice. Traders will face a variety of charges in addition to trading commissions. Spread betting, for example, does not charge a commission and instead includes a market spread. CFD trades on stocks are subject to commission, while CFD trades on other markets are also subject to a spread. In trading, a spread is the difference between the buy (offer) and sale (bid) prices for an asset. The spread is an important component of spread betting and CFD trading since it determines how both derivatives are valued. Most online brokers, market makers, and other service providers will quote their pricing as a spread. This means that the price at which an asset is purchased will always be somewhat higher than the underlying market, while the price at which it is sold will always be slightly lower. In finance, spread can refer to many different things, but it typically stands for the difference between two set prices. Investors often start buying shares in Irish companies and other leading companies such as huge tech stocks when market conditions become bullish. FAANG stocks, such as Google, Facebook, Netflix, Alphabet, and Apple, are examples, but other significant Irish shares have recently caught the attention of many investors. CRH plc, Johnson Controls International plc, Kerry Group plc, and Kingspan Group plc are all top-rated Irish stocks that are currently on market analysts’ watchlists. Johnson Controls International plc, for example, has had positive earnings growth for the past five years. At the time of writing it has a market capitalization of $52.41B, and YTD gains of 57.92%. Let’s explore the best stocks to buy in Ireland right now: So far, we’ve covered the basics of how to buy shares in Ireland as well as some of the best shares to buy right now. With that in mind, it’s time to cover some of the best online stock brokers you can use in 2022 to start investing in stocks and shares with low fees and user-friendly features. Two of the best online stock brokers include eToro and Capital.com. They’re ideal for beginner traders and offer some of the most competitive fees across the board. eToro has become one of the top names amongst discount brokers. There are no deposit or account fees to worry about, and stock and ETF trades come with 0% commission. Furthermore, with a $50 minimum investment, you can buy fractional shares of major stocks from the comfort of your own home. As we’ve already mentioned, eToro also waivers the stamp duty reserve tax, saving you 0.5% on all UK stock trades. Think of passive investing as a hands-off approach to online trading. CopyTrader and CopyPortfolios are two innovative copy trading services offered by eToro. These trading tools allow you to either copy the trades of other experienced traders or invest in pre-built CFD portfolios. eToro is one of the safest and highly regulated online stock brokers. It is regulated by top-tier financial authorities including the UK’s Financial Conduct Authority, the Australian Securities and Investments Commission (ASIC), and the Cyprus Securities and Exchange Commission (CySEC). eToro also provides negative balance protection, meaning that if your account balance falls below zero you’ll be covered. Additionally, roughly all clients’ funds are held in segregated bank accounts. Pros Cons

68% of retail investors lose money when trading CFDs with this provider. Capital.com offers FX trading as well as a plethora of CFD derivatives. Traders have access to MetaTrader 4, mobile trading apps, web and desktop platforms, spread betting, TradingView, and other top-rated trading platforms. Capital.com charges minimal forex and CFD fees. You’ll also be pleased to learn that FCA and CySEC clients can now trade real stocks on a commission-free basis. Non-trading fees are also modest, with no inactivity fees or withdrawal charges. Stock index CFD fees, on the other hand, are not competitive. If there is 0% commission on stock trades, you’ll be asking yourself ‘what fees will I have to pay when trading assets with Capital.com?’ The answer to this is bid-ask spreads. This is the difference between the quoted buying and selling prices. As well as heaps of CFDs, you can also trade commission-free real stocks and ETFs (exchange-traded funds). Capital.com account holders have access to shares listed on 7 international stock markets. The selection of stock CFDs is vast, with over 3,700 to choose from you’ll be spoilt for choice. CFDs are leveraged, speculative instruments that pay the difference in settlement price between the opening and closing of a position. CFDs offer a tax-efficient way of gaining exposure to financial markets without taking ownership of the underlying assets. CFD trading allows you to bet on the fluctuating prices of volatile financial markets such as forex, stocks, and commodities. Capital.com is regulated and licensed by top-tier financial institutions such as the UK’s Financial Conduct Authority and CySEC. In terms of client fund protections, UK-based clients are protected up to £85,000, while EU-based clients are protected up to €20,000, if the broker goes bankrupt. Furthermore, Capital.com stores its clients’ funds in separate bank accounts and provides negative balance protection, which means you will be protected if your account balance falls below zero. Pros Cons

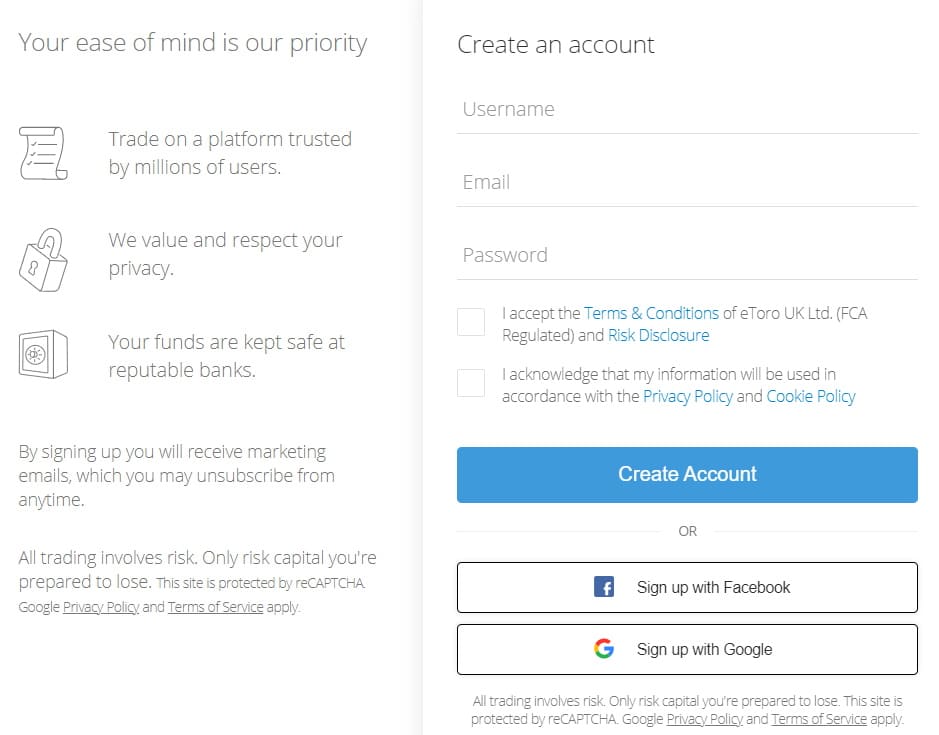

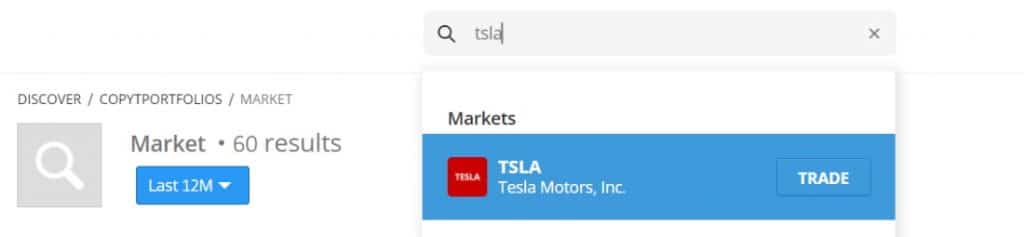

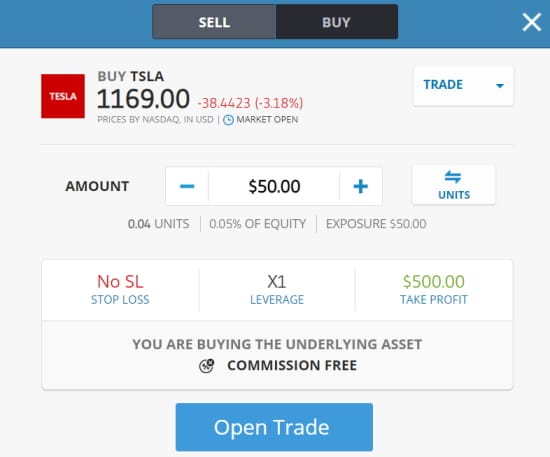

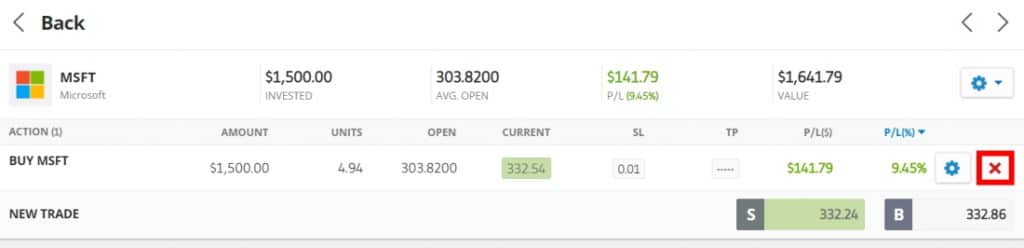

75.26% of retail investor accounts lose money when trading spread bets and/or CFDs with this provider. If you’re still wondering how to buy Tesla shares in Ireland, we’ll lead you through four easy steps to get you buying and selling the best stocks right now. To get started, go to the eToro website and click the ‘Join Now’ button. To open a live investment account, enter your email address and choose a username and password. As eToro is authorized by the Financial Conduct Authority, CySEC, and ASIC, new users must verify their accounts before they can trade. This is a straightforward, all-digital process. Upload proof of ID (a copy of your passport or driver’s licence) and proof of address (a copy of a bank statement or utility bill) to your account dashboard using the ‘Complete Profile’ option. For new account holders, the minimum deposit is just $50 and there are no deposit fees. You’ll be able to choose from a range of payment options including credit cards, debit cards, bank transfers, and electronic wallets such as PayPal and Skrill. You can begin investing immediately after funding your account! Simply enter the company’s name or ticker symbol into the search field and press the ‘Trade’ button. Following that, you’ll see an order box where you can select how much you want to invest and whether or not to place stop-loss or take-profit orders if you’re trading CFDs. Once you’re satisfied with everything, click ‘Open Trade.’ If you sell shares (or any other sort of real estate) for a higher price than you paid for it, you will have made a capital gain. This capital gain is subject to Capital Gains Tax (CGT), which is currently payable at a rate of 33% in Ireland. Diversification involves putting all your eggs in multiple baskets. A well-diversified portfolio may include dozens, if not hundreds, of different stocks rather than simply one or two. Not only that, but you’ll be investing in companies covering a range of sectors, ensuring that you aren’t overexposed to a single industry. You can invest in a percentage share of a stock by buying fractional shares. This is useful when considering the market prices of several blue-chip stocks, such as Amazon and Alphabet, which have share prices above $2,000. As such, eToro allows you to buy fractional shares in top-rated stocks for as little as $50. As a result, you can still gain exposure to blue-chip stocks without spending thousands of dollars. You’ll want to consider key metrics such as price and market volatility when choosing the right stocks to add to your portfolio. While penny stocks trade for less than £1 and $5, blue-chip stocks such as Amazon have a share price of 3,295.43 USD. With that said, you’ll need to consider your budget and risk tolerance whenever you choose stocks to invest in. Volatility is the rate at which the price of a stock rises or falls over a given period. Increased stock price volatility sometimes indicates higher risk and allows an investor to forecast future fluctuations. eToro makes selling shares as easy as buying them. Here’s how to sell shares in Ireland from the convenience of your own home: It is vital to remember that your request will be fulfilled during standard market hours. With the average stock market return being roughly 10%, most traders want to learn how to buy shares in 2022. Although the stock market can be volatile, a well-diversified portfolio can help weather the impacts of extreme volatility and yield positive long-term returns. If you’re looking to buy shares in Ireland, we recommend eToro. This CySEC-regulated online broker provides copy trading as well as zero percent commission on real stocks and CFD trading. You can also purchase and sell stocks using the eToro mobile app.

68% of retail investors lose money when trading CFDs with this provider. You can buy shares in Ireland by opening an account with eToro. Once you’ve deposited funds, you’ll be able to search for your favourite stocks and invest with a minimum investment of just $50. Alternatively, you could use eToro’s copy trading features to passively invest in 17 international stock markets with the click of a button. To buy Tesla shares in Ireland, log in to your eToro brokerage account and search for TSLA in the search bar. Tap on the ‘Trade’ button next to the relevant result and enter your preferred investment amount. Once you’re happy with your choices click on ‘Open Trade’ to buy shares in Tesla. The best tech stocks to add to your watchlist as we head into the second half of November include Intel Corporation, NVIDIA, Wolfspeed Inc, and Teradyne. We’ve reviewed heaps of online stock brokers, and found eToro and Capital.com to be the best choices for 2022. Both brokers offer real stock trading on a commission-free basis. Additionally, you can also speculate on the price movements of the underlying assets via CFD trading. eToro also offers copy trading and fractional share trading, giving it a slight advantage over its competitors. Surplus cash is money that the company does not need to run or expand its business. A company may choose to give this money back to its shareholders. This can take the shape of a dividend payout or by repurchasing the shares. However, there are various reasons why a firm may benefit from buying back its shares, including ownership consolidation, undervaluation, and improving key financial statistics. stockapps.com has no intention that any of the information it provides is used for illegal purposes. It is your own personal responsibility to make sure that all age and other relevant requirements are adhered to before registering with a trading, investing or betting operator. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice.By continuing to use this website you agree to our terms and conditions and privacy policy.

How to Buy Shares in Ireland Right Now – Quick Walkthrough

The Fundamentals of How to Buy Shares

What is a share in a company?

Can Trading Shares be Profitable?

Capital Gains

Dividends

Year

Average Closing Price

Open

High

Low

Close

Annual % Change

2021

4,174.97

3,700.65

4,536.95

3,700.65

4,486.46

19.45%

2020

3,217.86

3,257.85

3,756.07

2,237.40

3,756.07

16.26%

2019

2,913.36

2,510.03

3,240.02

2,447.89

3,230.78

28.88%

2018

2,746.21

2,695.81

2,930.75

2,351.10

2,506.85

-6.24%

2017

2,449.08

2,257.83

2,690.16

2,257.83

2,673.61

19.42%

2016

2,094.65

2,012.66

2,271.72

1,829.08

2,238.83

9.54%

2015

2,061.07

2,058.20

2,130.82

1,867.61

2,043.94

-0.73%

2014

1,931.38

1,831.98

2,090.57

1,741.89

2,058.90

11.39%

2013

1,643.80

1,462.42

1,848.36

1,457.15

1,848.36

29.60%

2012

1,379.61

1,277.06

1,465.77

1,277.06

1,426.19

13.41%

2011

1,267.64

1,271.87

1,363.61

1,099.23

1,257.60

0.00%

Compound Growth

How to Buy Stocks in Ireland – Fees & Expenses

What are trading commissions?

What are bid-ask spreads?

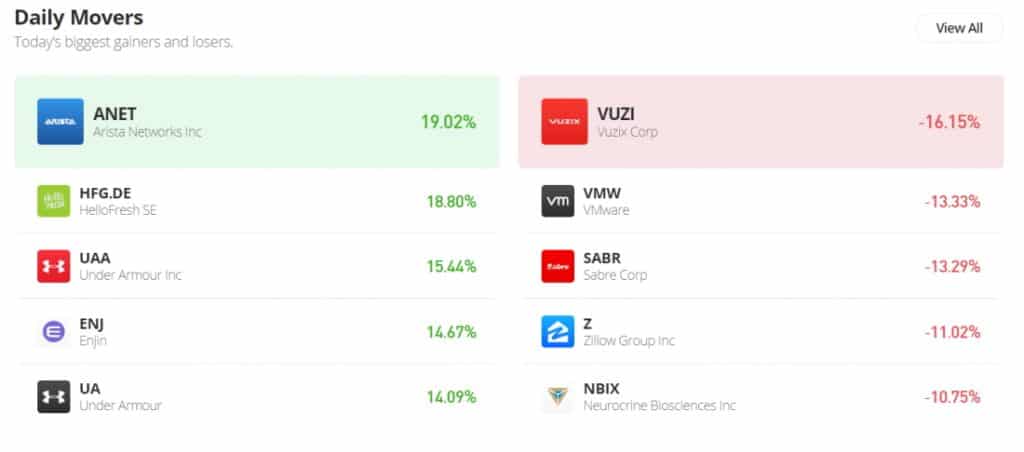

What are the Best Shares to Buy Now in Ireland?

How to Buy Shares in Ireland – Best Shares to Buy Right Now

Best Online Stock Brokers

1. eToro – Best Online Stock Broker Offering Fractional Share Trading

Costs and Fees

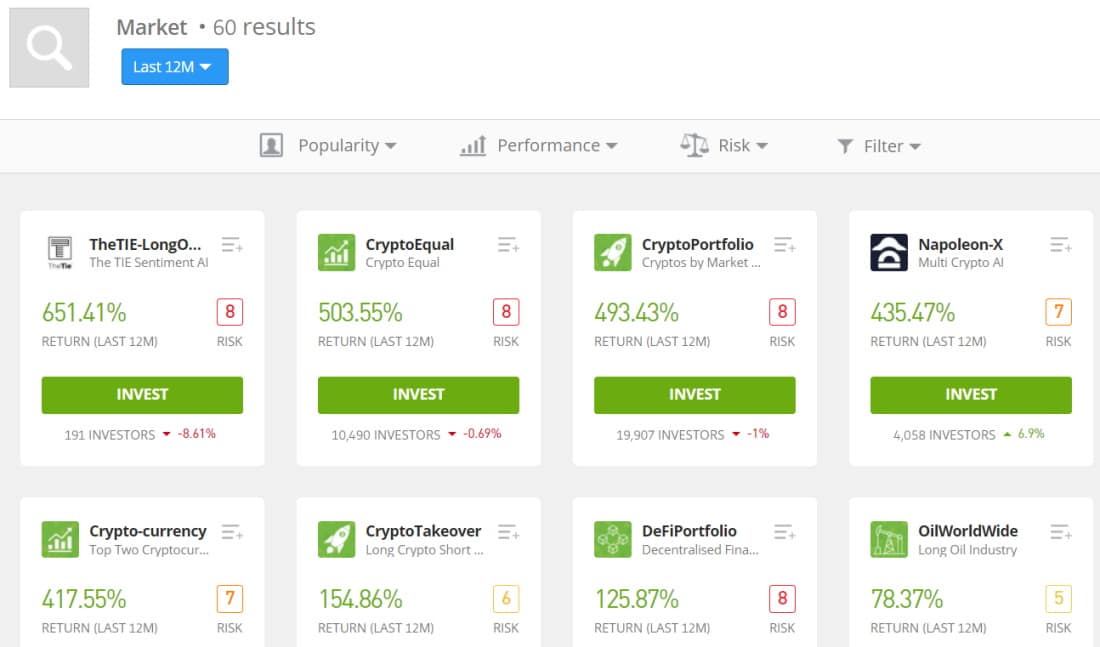

eToro’s copy trading features

Regulations and Safety

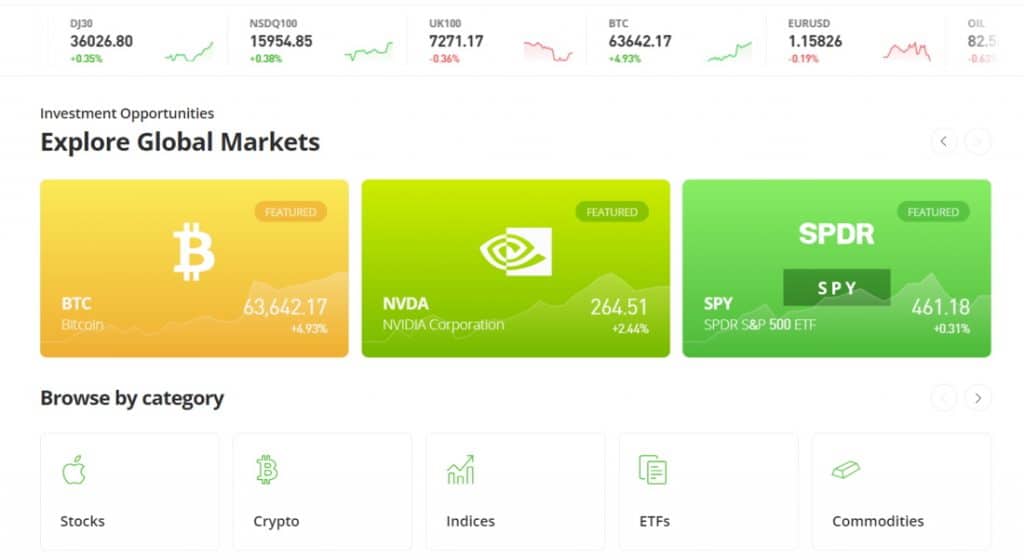

2. Capital.com – Best Global CFD Broker Offering Commission-free Stock CFDs

Costs and Fees

Tradable assets

Regulations and Safety

Tutorial – How to Buy Tesla Shares on eToro

Step 1: Set up a Brokerage Account

Step 2: Verification

Step 3: Fund your Account

Step 4: Search for Tesla and Buy Shares

Are Shares Taxed in Ireland?

Picking the Right Stocks for Your Investment Portfolio

Diversification

Fractional share trading

Price and Volatility

Selling Shares in Ireland

How to buy Shares in Ireland – Expert Verdict

eToro – Best Online Stock Broker to Buy Stocks with 0% Commission

Frequently Asked Questions on How to Buy Shares in Ireland

How to buy shares in Ireland?

How to buy Tesla shares in Ireland?

What shares to buy now?

Where to buy shares in Ireland?

Why do companies buy back shares?

Tommy Smith

© stockapps.com All Rights Reserved 2025