Best Stock Brokers Ireland – Compare Top Stock Brokers with Low Fees

If you’re looking to trade stocks in Ireland, you’ll need to create an account with a licensed and reputable stock broker. Due to the popularity of online trading, there is an abundance of brokers to choose from – which can make narrowing down the selection quite tricky.

In this guide, we’ll explore the Best Stock Brokers Ireland in detail, highlighting which platforms offer the best services and showing you where you can invest in stocks today – with no commissions!

-

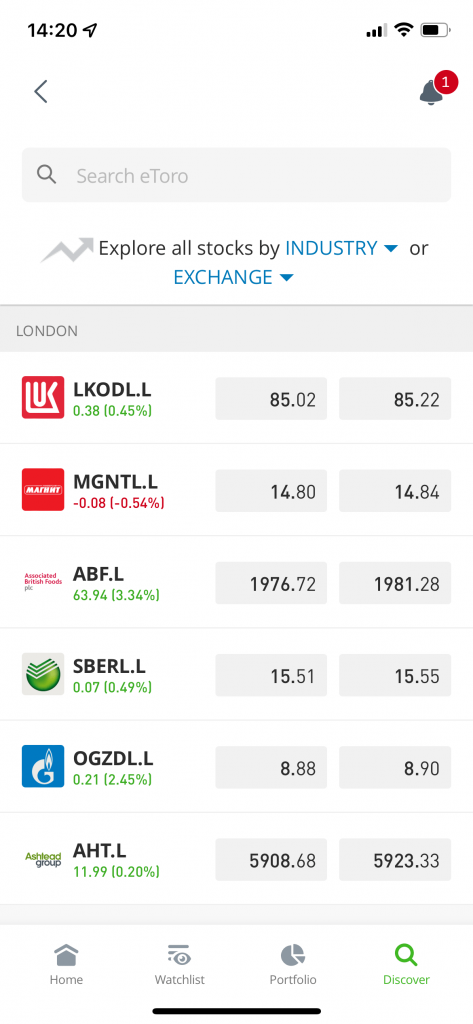

- 1. eToro – Overall Best Stock Broker Ireland

- 2. Capital.com – Best Irish CFD Broker with Low Fees

- 3. Libertex – Cost-Effective Trading Platform with Tight Spreads

- 4. Avatrade – Best Stock Broker Ireland with Central Bank Regulation

- 5. Fineco – Respected Stock Broker Listed on Stock Exchange

- 6. Plus500 – Best Stock Broker Ireland for Customer Support

- 7. Interactive Brokers – Reputable Trading Platform for Advanced Clients

- 8. Degiro – Irish Trading Platform with Multiple Account Options

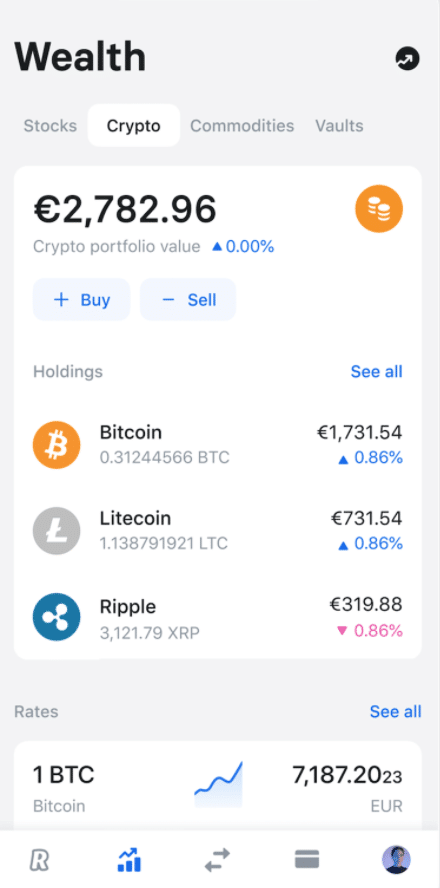

- 9. Revolut – User-Friendly Stock Broker App

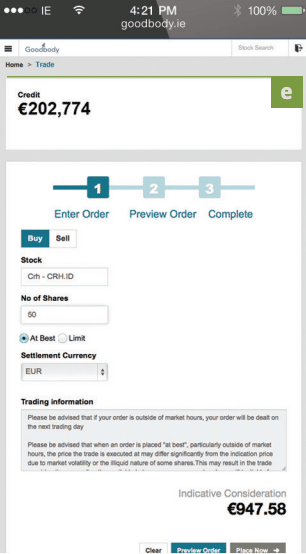

- 10. Goodbody – Best Stock Broker Ireland for Experienced Traders

-

- 1. eToro – Overall Best Stock Broker Ireland

- 2. Capital.com – Best Irish CFD Broker with Low Fees

- 3. Libertex – Cost-Effective Trading Platform with Tight Spreads

- 4. Avatrade – Best Stock Broker Ireland with Central Bank Regulation

- 5. Fineco – Respected Stock Broker Listed on Stock Exchange

- 6. Plus500 – Best Stock Broker Ireland for Customer Support

- 7. Interactive Brokers – Reputable Trading Platform for Advanced Clients

- 8. Degiro – Irish Trading Platform with Multiple Account Options

- 9. Revolut – User-Friendly Stock Broker App

- 10. Goodbody – Best Stock Broker Ireland for Experienced Traders

Best Stock Brokers Ireland 2022 List

If you’re looking for the best stock brokers Ireland – look no further! Found below is a breakdown of the top trading platforms for Irish clients, all of which are reviewed in the next section.

- eToro – Overall Best Stock Broker Ireland

- Capital.com – Best Irish CFD Broker with Low Fees

- Libertex – Cost-Effective Trading Platform with Tight Spreads

- Avatrade – Best Stock Broker Ireland with Central Bank Regulation

- Fineco – Respected Stock Broker Listed on Stock Exchange

- Plus500 – Best Stock Broker Ireland for Customer Support

- Interactive Brokers – Reputable Trading Platform for Advanced Clients

- Degiro – Irish Trading Platform with Multiple Account Options

- Revolut – User-Friendly Stock Broker App

- Goodbody – Best Stock Broker Ireland for Experienced Traders

Top Stock Brokers in Ireland Reviewed

Choosing which broker to partner with can be challenging, especially if you are new to trading. To help streamline this process, we’ve reviewed the best online stock brokers in-depth, highlighting their features, fee structures, and tradeable assets.

1. eToro – Overall Best Stock Broker Ireland

eToro offers over 2000 stock CFDs to trade, all of which can be traded with no commissions. As eToro offers these stocks as CFDs, traders can utilise leverage on their positions, with up to 1:5 leverage provided. In addition, eToro allows short selling on stock CFDs, which significantly boosts investment opportunities.

The minimum deposit at eToro is only $50 (€44), which can be made via credit/debit card, bank transfer, and e-wallet – including PayPal. eToro even offers a free demo account for all users, allowing beginners to practise trading in the markets. Finally, eToro has a dedicated ‘Academy’ service, filled with free tutorials and educational articles.

Pros

- Regulated by the FCA, CySEC, and ASIC

- Trusted brand with over 17 million client accounts worldwide

- Buy stocks without paying any commission or share dealing charges

- Social and copy trading

- Buy stocks or trade CFDs with leverage

- 2,400+ stocks listed on multiple international markets

- Personalised eToro account where you can set up trading price alerts

Cons

- Not suitable for advanced traders that like to perform technical analysis

68% of retail investors lose money trading CFDs at this site.

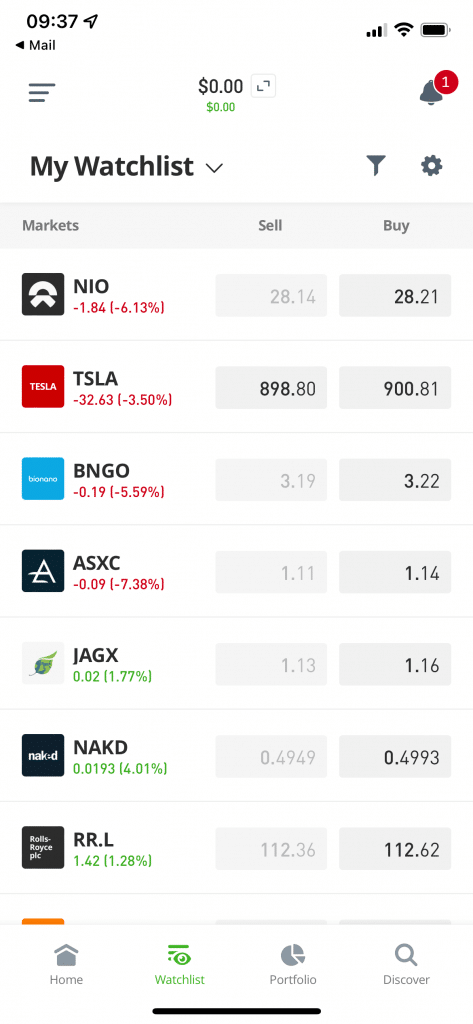

2. Capital.com – Best Irish CFD Broker with Low Fees

If you’re wondering how to buy shares, you may also wish to consider using Capital.com. Capital.com is an online stock broker that primarily focuses on CFDs. Due to this, users can trade thousands of assets with 0% commissions, only having to pay the spread. What’s more, as Capital.com offer leverage and short-selling opportunities, investors have great flexibility in their investment decisions.

In terms of deposits, Capital.com’s minimum deposit threshold is one of the lowest in the business, allowing users to fund their accounts from as little as $20 (€17.70). Like other brokers, Capital.com accepts credit/debit cards, bank transfers, and e-wallet deposits – all of which are free to make. Aside from this, Capital.com charges no monthly account or inactivity fee and even offers free withdrawals.

Finally, Capital.com’s trading platforms are sleek and well designed, ideal for beginner traders. Users can download the app on iOS or Android and trade on the go, even using the app’s AI-powered analysis tools. You can even access great charting features on the app, with over 70 indicators to use.

Pros

- Industry-leading spreads

- 0% commission on all asset classes

- Great selection of currency pairs

- 24/7 trading

- Clean and crisp mobile application

- Deposit from just €/$20

- FCA-regulated

Cons

- Minimum deposit of €250 when using a bank account

75.26% of retail CFD accounts lose money when trading CFDs with this provider.

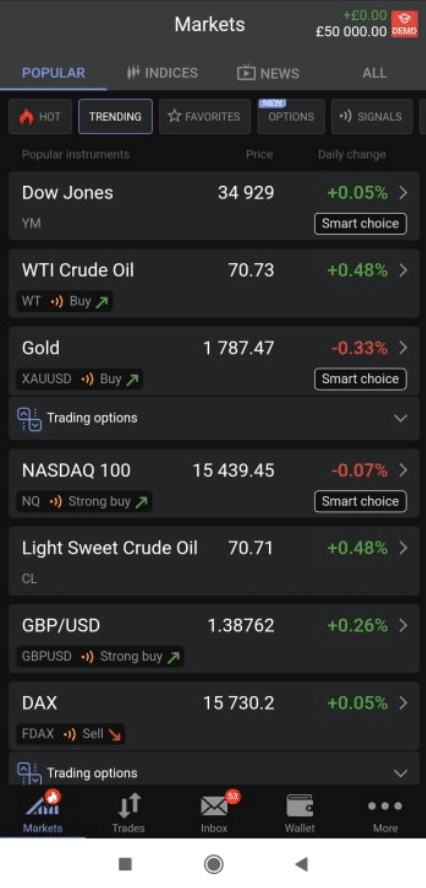

3. Libertex – Cost-Effective Trading Platform with Tight Spreads

Libertex is another great online stock broker to consider, especially if you are looking to trade in a low-cost manner. One of Libertex’s main selling points is that it offers zero spreads on many assets. However, even on the assets where a spread does apply, it tends to be extremely tight – especially for liquid assets.

Libertex will charge a small commission on CFD trades unless you open a Libertex Invest account, which allows you to invest in real stocks with no commissions – and also earn dividends. You can even buy stocks on the go using the Libertex app, which is an award-winning platform featuring over 120 stock CFDs and a free demo account.

Finally, Libertex also offers other financial instruments to trade, including indices, commodities, and FX. If you opt to trade the latter, Libertex provides full support for MT4 – opening up a way for traders to automate their FX-trading through robots and advisors!

Pros

- Industry-leading spreads

- 0% commission on all asset classes

- Great selection of currency pairs

- 24/7 trading

- Clean and crisp mobile application

- Deposit from just €/$20

- FCA-regulated

Cons

- Minimum deposit of €250 when using a bank account

86% of retail investor accounts lose money when trading CFDs with this provider.

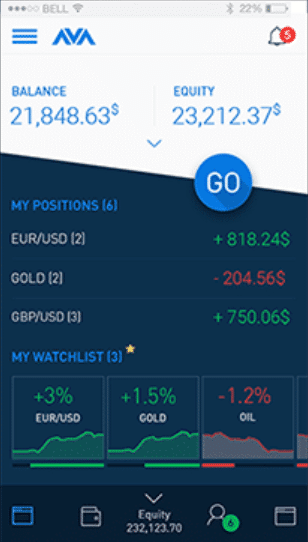

4. Avatrade – Best Stock Broker Ireland with Central Bank Regulation

AvaTrade is one of the best European stock brokers available to Irish traders, boasting regulation and oversight from the Central Bank of Ireland. Like many other CFD brokers, AvaTrade offers commission-free stock trading, with users only having to pay a small spread on each trade. Notably, AvaTrade has over 600 stocks to trade across various exchanges.

Users can trade on the web browser or AvaTrade GO, with the latter being AvaTrade’s new mobile app. The app has various trading tools and charting features, complete with price alerts and multilingual support. Finally, with minimum deposits quoted at €100 and full support for Euros as a base currency, AvaTrade is ideal for beginner traders from Ireland.

Pros

- Industry-leading spreads

- 0% commission on all asset classes

- Great selection of currency pairs

- 24/7 trading

- Clean and crisp mobile application

- Deposit from just €/$20

- FCA-regulated

Cons

- Minimum deposit of €250 when using a bank account

71% of retail CFD accounts lose money with this provider.

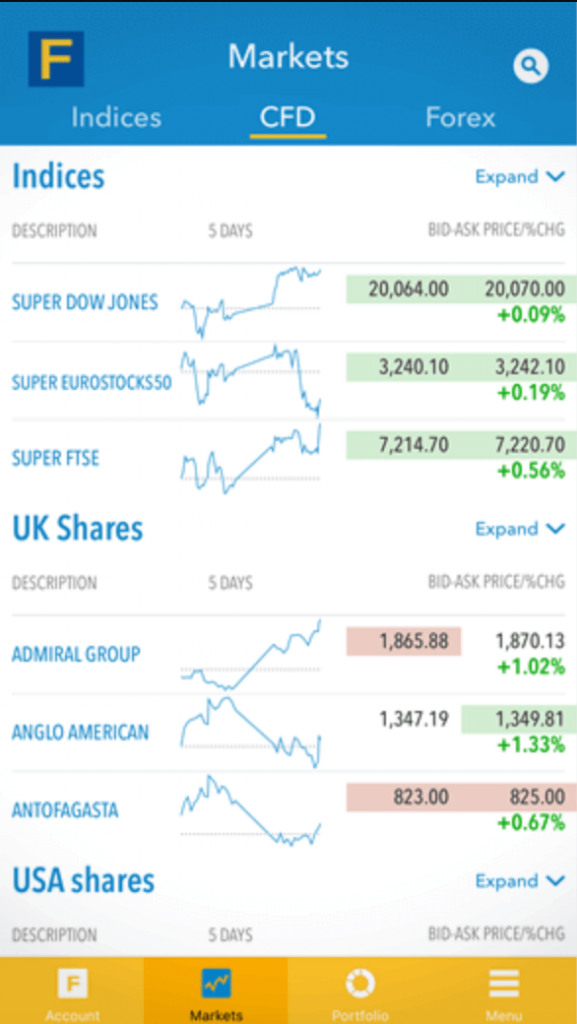

5. Fineco – Respected Stock Broker Listed on Stock Exchange

Fineco is also worth considering if you’re looking for the best stock broker Ireland, as this online broker has a stellar reputation in the trading scene. Founded in 1999, Fineco is regulated by the FCA and is even listed on the Italian Stock Exchange. Although Fineco doesn’t offer commission-free trading, it does charge a relatively cheap flat fee of £2.95 per trade for UK shares and $3.95 per trade for US shares.

The trading platform offered by Fineco is top drawer, featuring price alerts, portfolio reports, and OTP authorisation. Fineco also offers extensive trading ideas, featuring sentiments from various top analysts. Finally, Fineco also has a section dedicated to educational material, with tutorials, videos, and webinars targeted at beginner traders.

Pros

- Industry-leading spreads

- 0% commission on all asset classes

- Great selection of currency pairs

- 24/7 trading

- Clean and crisp mobile application

- Deposit from just €/$20

- FCA-regulated

Cons

- Minimum deposit of €250 when using a bank account

Your capital is at risk

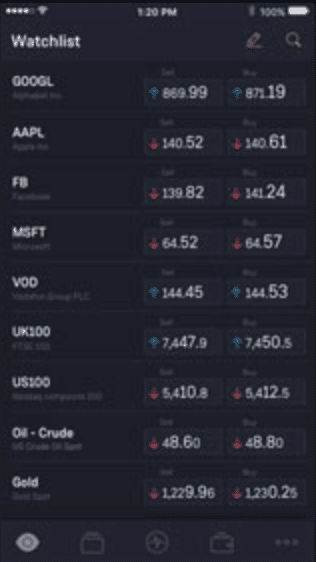

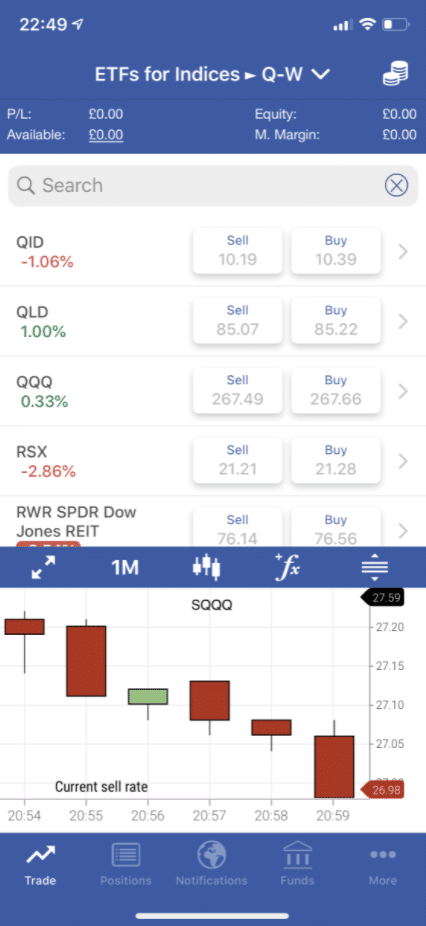

6. Plus500 – Best Stock Broker Ireland for Customer Support

Plus500 is a very popular online brokerage in Ireland, offering thousands of CFDs for clients to trade. All CFDs can be traded commission-free, with costs built into the spread. Aside from stocks, clients can trade FX, ETFs, commodities, and bonds – with the option of leverage included in most of these asset classes.

The minimum deposit is $100 (€88), which can be made for free via credit/debit card, bank transfer, and e-wallet. Notably, Plus500 has one of the best trading platforms in the business, with an extensive selection of order types and technical indicators to use. Finally, Plus500 offers 24/7 customer support via WhatsApp, live chat, and email – with a ‘Contact Us’ page for all other inquiries.

7. Interactive Brokers – Reputable Trading Platform for Advanced Clients

Interactive Brokers has one of the best reputations in the industry and is regulated by the FCA and the SEC. The broker has been around since 1978 and offers a vast range of assets to trade, including 78 different stock markets. In terms of fees, users will have to pay a small commission per share traded, which works out to be £3 for trades valued at less than £6,000.

Interactive Brokers also offers a Pro account, which has a volume-based pricing structure – ideal for high-volume traders. Aside from trading fees, Interactive Broker doesn’t charge any deposit fees, although they only accept bank transfers for EU clients. Finally, IB’s trading platform (called the Client Portal) is tailored towards beginners and advanced clients, making it highly versatile for all users.

8. Degiro – Irish Trading Platform with Multiple Account Options

Degiro was established in 2008 and has a banking license, adding significant credibility to the platform. Degiro is ideal for Irish traders, as the platform supports EUR as a base currency and allows free deposits. In terms of deposit methods, Degiro accepts bank transfers and various e-wallets – although it doesn’t support credit/debit cards at this time.

Degiro shines when it comes to trading fees, as the only fee that applies is a 0.50 handling fee for US-based shares. However, UK shares will come with a flat fee of £2.25 per trade. Aside from trading fees, Degiro charges no hidden costs and offers five different account types to choose from, ensuring there’s an option for everyone. Many accounts allow margin trading, whilst some even offer short selling facilities.

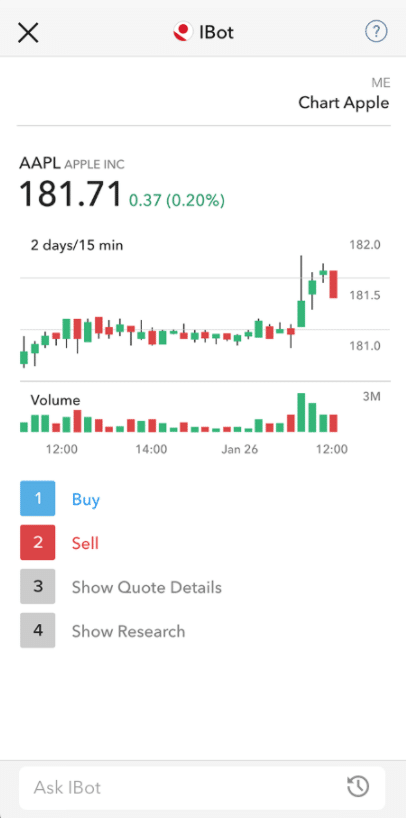

9. Revolut – User-Friendly Stock Broker App

Revolut entered the trading scene in 2019 and has rapidly grown its service to include Irish clients. The platform is regulated in various countries worldwide, including in the UK by the FCA. If you opt for the Standard account, you’ll get one free trade per month; however, if you pay £12.99 per month for a metal account, you’ll get unlimited free trades.

No non-trading fees are charged, and Revolut allows users to open an account in minutes. Notably, Revolut only accepts USD deposits, so Irish traders will need to exchange their EUR holdings before making a deposit. Finally, Revolut’s mobile app is one of the best in the business, featuring Touch ID, numerous order types, and over 850 stocks to trade.

10. Goodbody – Best Stock Broker Ireland for Experienced Traders

Finally, we have Goodbody, a leading financial services firm in Ireland. Goodbody offers a ‘Goodbody Connect’ service, allowing investors to trade over 1000 shares across ten global markets. A commission of €25 per trade is charged for clients, although this is mitigated somewhat because the Central Bank of Ireland regulates the platform.

Goodbody also offers various services dedicated to businesses and corporations, highlighting that this platform is targeted more towards experienced traders. However, Goodbody does offer the ability to invest in many Irish shares, which is ideal if you’re looking to gain exposure to this geographical area.

Stock Brokers in Ireland Comparison

Broker Name Number of Stocks Pricing Structure Fee to Buy Amazon Shares Account Management Fee? eToro 2000 0% commission + Spread No fee No Capital.com 3600 0% commission + Spread No fee No Libertex 120+ Variable commission based on asset (Free on Libertex Invest) Variable (Free on Libertex Invest) No Avatrade 626 0% commission + Spread No fee No Fineco 3000+ Flat fee per trade $3.95 (€3.50) No Plus500 1900 0% commission + Spread No fee No Interactive Brokers 16,000+ Volume-based structure Either $1 or 1% of trade value No Degiro 5000+ 0% commission + €0.50 handling fee €0.50 No Revolut 850+ Either 0.25% of trade size or £1 (Free trades on Metal account) Either 0.25% or £1 (free on Metal account) The standard account is free; the Metal account is £12.99 (€15.20) per month Goodbody 1000+ €25 per trade €25 €100 per annum What is a Stock Broker?

As the name implies, a stock broker is a platform that allows users to access the financial markets and trade stocks. Brokers essentially act as the ‘middleman’ in the exchange, allowing users to invest in the best stocks to buy. As they enable the facilitation of trades, stock brokers will receive a ‘cut’ for their services – which usually comes in the form of a commission per trade or the spread.

These days there is an abundance of stock brokers to choose from, most of them offering a wide array of asset classes to invest in. Thanks to technological advances, most brokers will allow clients to trade on their computers or mobile devices – with synchronicity across all platforms. Finally, many stock brokers will also offer dedicated services to aid beginners, such as educational materials or demo accounts.

Types of Stock Brokers

The best stock brokers Ireland can be divided into two main categories – traditional brokers and CFD stock brokers. Let’s discuss each of these in turn to understand the difference between them.

Traditional Broker

If you’re wondering how to trade stocks, then using a traditional stock broker is the way to do so. Put simply, these brokers allow clients to invest in ‘real’ stocks – meaning that clients will own the underlying asset. Due to this, users who partner with traditional brokers will get access to dividends from any dividend-paying stocks they own. However, as these assets are not derivatives, there is no scope to use leverage to boost potential profits.

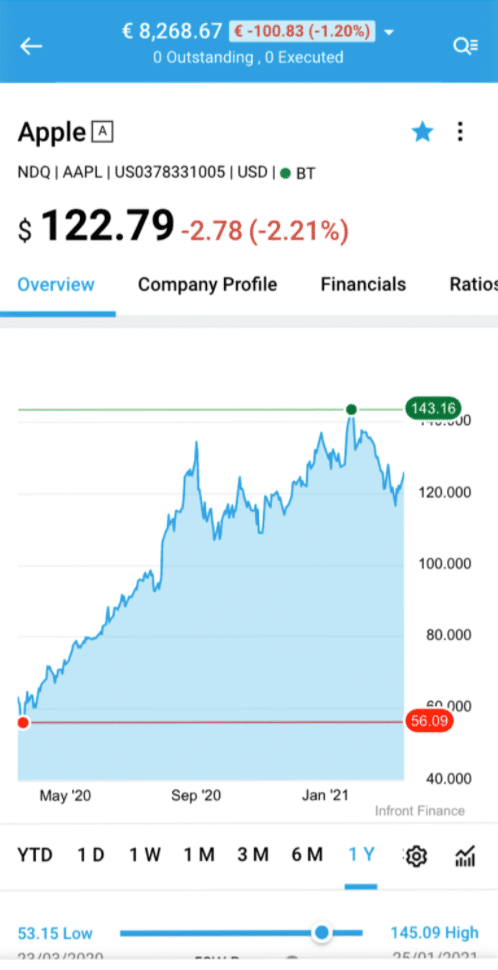

CFD Stock Brokers

On the other hand, CFD stock brokers allow users to buy and sell CFDs, which are contracts based on the price of an underlying asset. For example, if you purchased an Apple stock CFD, the value of your position would fluctuate depending on the price movements of Apple’s shares. The critical difference between this broker type and traditional stock brokers is that CFD brokers allow clients to use leverage, boosting potential profits (and losses). Furthermore, many CFD brokers allow clients to short sell, dramatically increasing trading opportunities.

How We Rank the Best Stock Brokers

Choosing which stock broker to partner with can make all the difference in the markets – that’s why it’s crucial to do your research beforehand! Found below are some of the top things to consider when reviewing the best stock brokers Ireland:

Fees

Most online trading platforms will charge either a per-trade commission or a spread, which is the difference between the buy and sell prices on an asset. Spreads tend to work out better in the long run, especially if you are an active trader. In addition, keep an eye out for non-trading fees, such as deposit, withdrawal, and inactivity fees, as these can add up in the background.

Range of stocks

The number of equities available to trade should be considered, as this can significantly influence your trading opportunities. Most top brokerages will offer hundreds (if not thousands) of tradeable stocks, often from stock exchanges worldwide. Moreover, some brokers (like eToro) will allow clients to invest in real stocks and stock CFDs, depending on their preferences.

Regulation and security

When share dealing and trading CFDs, it’s best to partner with a broker regulated by one or more top-tier entities. For example, eToro is regulated by the FCA, ASIC, and CySEC, which provides clients with extensive investor protection. Some brokers (e.g. AvaTrade) are even regulated by the Central Bank of Ireland!

Platform quality

Many traders these days wish to trade on the go, so partnering with a broker that has a user-friendly app is a must. Look out for apps with sleek interfaces and a responsive design, as these will help smooth the investment process. In addition, brokers tend to also offer browser-based platforms, which usually have some additional features that apps do not.

Trading tools

Trading tools aren’t just useful when forex trading – they’re also helpful for stock trading! Ideally, you’ll want to use a broker that offers excellent charting features, such as technical indicators. Furthermore, some brokers even provide innovative copy trading features; for example, eToro allows users to automatically copy the trades placed by experienced traders in a completely passive fashion!

Customer service

Finally, the level of customer service offered by the platform should be considered. The best stock brokers Ireland will provide 24/7 support, usually in the form of a live chat feature or telephone support. Furthermore, keep an eye out for brokers with an extensive FAQs section, as this can usually mean your questions are answered right away.

How to Get Started with an Irish Stock Broker

Before we finalise this guide, let’s discuss the investment process. Found below are the four quick steps you need to follow to sign up and begin trading with eToro – all in less than ten minutes!

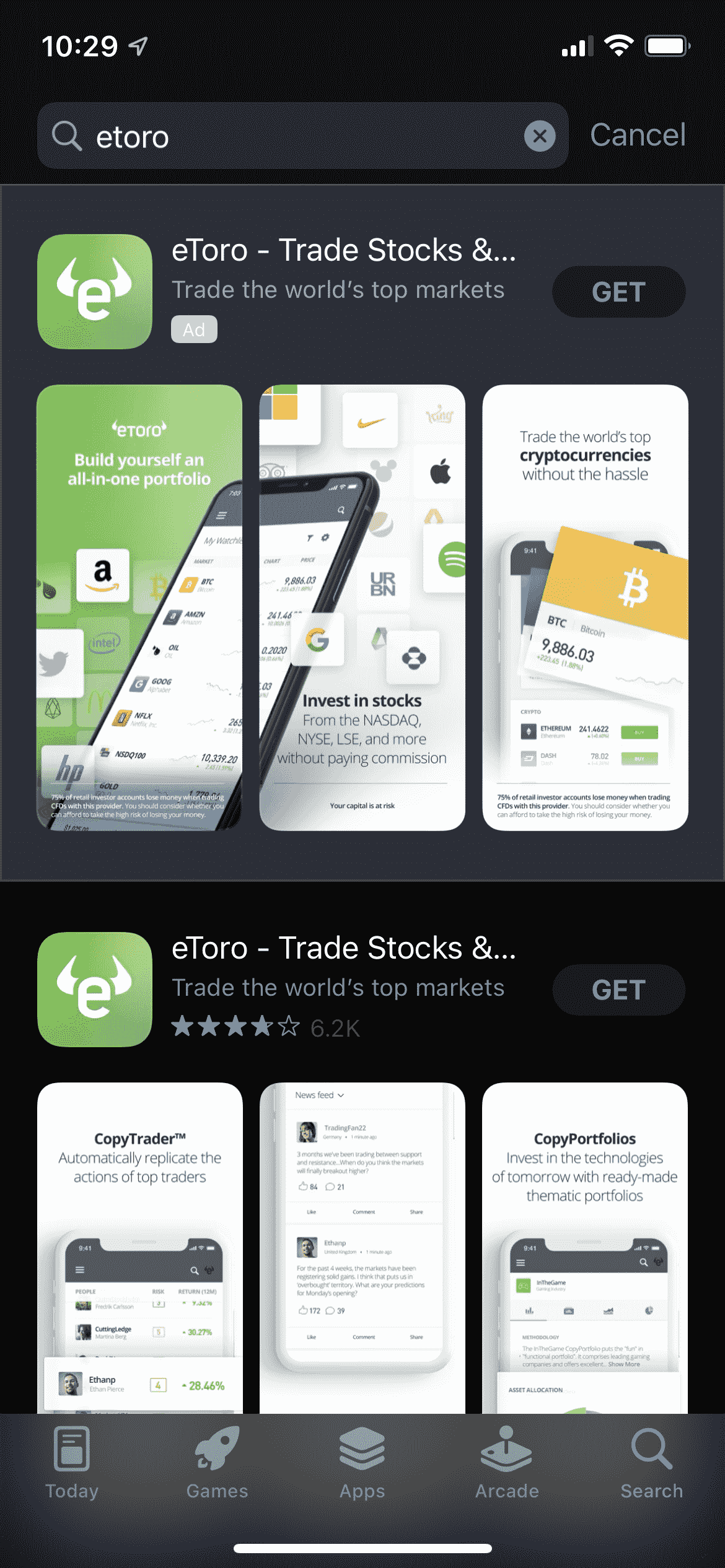

Step 1 – Download App and Create Account

Head over to the App Store or Google Play and search for ‘eToro’. When the trading app appears, download it and sign up. eToro will then ask you to provide a valid email address and choose a username and a password to open your trading account.

Step 2 – Complete Verification Process

As eToro is heavily regulated, new users must verify themselves before trading. To do so, click ‘Complete Profile’ on your account dashboard and enter the required details for the KYC checks. You’ll also have to upload proof of ID (copy of passport or driver’s license) and proof of address (copy of bank statement or utility bill).

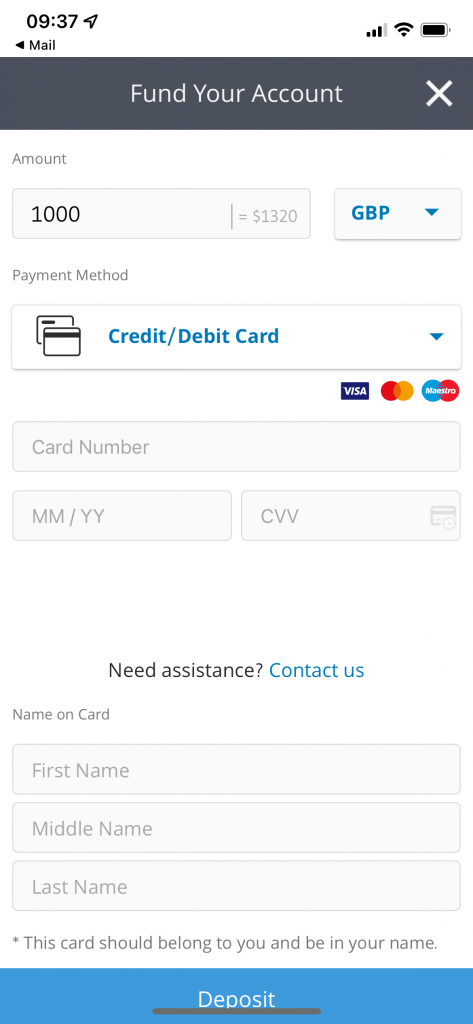

Step 3 – Fund your Account

New eToro users must deposit at least $50 (€44) before trading. In terms of deposit methods, Irish clients can fund their accounts via credit/debit card, bank transfer, or e-wallets such as PayPal and Neteller.

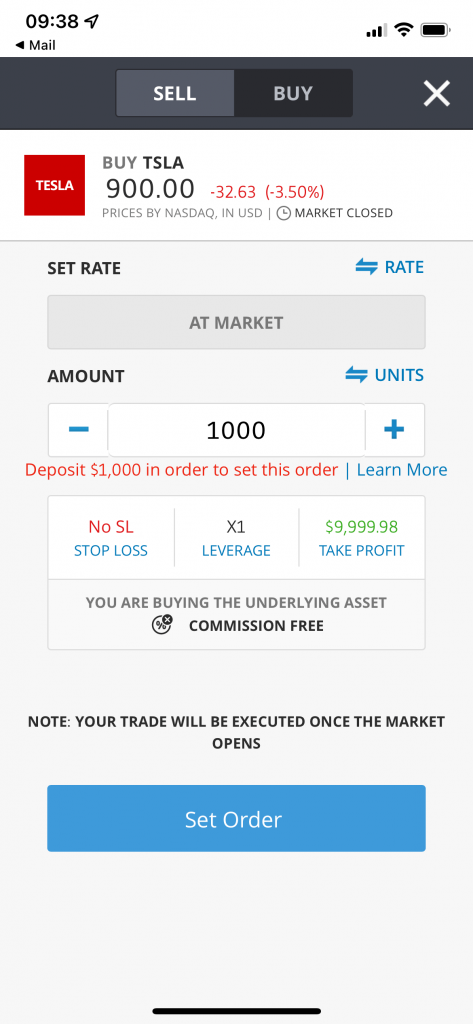

Step 4 – Buy Stocks

Type the name or ticker symbol of the stock you’d like to trade into the search bar and click ‘Trade’. In the order box that appears, enter your desired position size (minimum of $10), opt for a stop-loss or take-profit level if you wish, and then click ‘Open Trade’.

Best Stock Brokers Ireland – Conclusion

In summary, this guide has explored the best stock brokers Ireland, highlighting which platforms offer the best features and lowest fees. By reviewing the list presented earlier in this guide, you’ll have all the tools you need to begin trading effectively right away.

If you’re looking to start trading today, we’d recommend using eToro. Thanks to 0% commission stock trading and thousands of assets to trade, eToro is the ideal platform for Irish traders looking to get involved in the financial markets.

eToro – Overall Best Stock Broker Ireland with 0% Commission

68% of retail investor accounts lose money when trading CFDs with this provider.

FAQs

What is the best stock broker in Ireland?

Our pick for the best stock broker in Ireland is eToro. This is because eToro offers 0% commission trading on stocks and is regulated by numerous top-tier entities.

How much does it cost to use a stock broker?

Each broker will have its own fee structure, although common structures include a commission or a spread (the difference between the buy and sell prices on an asset).

What is the cheapest stock broker in Ireland?

We found that eToro was the cheapest stock broker through our research and testing. This is because the platform charges no commissions and offers tight spreads.

How much does a stock broker make?

Stock brokers’ income will vary depending on their fee structure and the amount of trading volume they facilitate – although the figure will likely be in the tens of millions for the top platforms.

What is the best stock broker for beginners?

eToro is our pick for the best broker for beginners, as it offers a free demo account and an extensive library of educational resources called the ‘eToro Academy’.

Connor Brooke

Connor Brooke

Connor is a Scottish financial expert, specialising in wealth management and equity investing. Based in Glasgow, Connor writes full-time for a wide selection of financial websites, whilst also providing startup consulting to small businesses. Holding a Bachelor’s degree in Finance, and a Master’s degree in Investment Fund Management, Connor has extensive knowledge in the investing space, and has also written two theses on mutual funds and the UK market.View all posts by Connor Brookestockapps.com has no intention that any of the information it provides is used for illegal purposes. It is your own personal responsibility to make sure that all age and other relevant requirements are adhered to before registering with a trading, investing or betting operator. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice.By continuing to use this website you agree to our terms and conditions and privacy policy.

© stockapps.com All Rights Reserved 2026We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up