IIFL Markets App Review 2026 – Is it legit?

IIFL Markets app is a popular mobile trading application that offers users to trade on thousands of shares, commodities, options and mutual funds from top exchanges in India. The app, made by IIFL securities, is known to have an impressive array of features and trading tools that make it very effective for trading and investment purposes.

But before you open an account with this broker, it is crucial that you find out the ins and outs of how this mobile trading application works. In this review, we will explore the IIFL Markets mobile trading app and the features the brokers provide on this app. We will analyze the broker’s fees and charges, account types, bonuses, pros and cons, and more.

-

-

What is IIFL Markets App?

The broker was founded in 1995 and has over 10,000 employees in India. It is authorized and regulated by ‘SEBI Capital markets’ under the registration number INB 011097533, and ‘SEBI Derivatives’ under the membership number NCDEX-CO-04-00378.

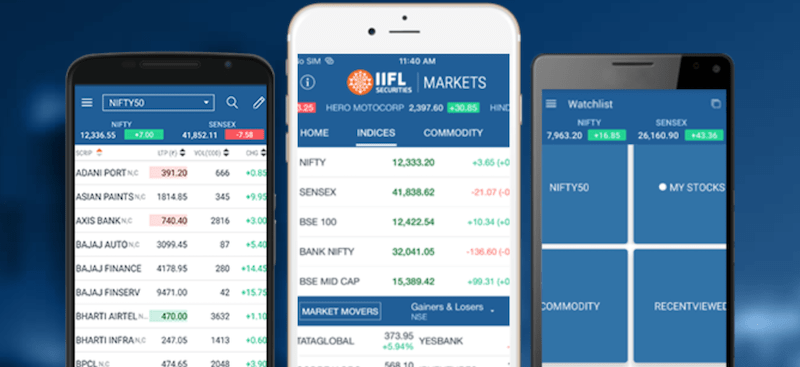

Essentially, Infoline provides two different mobile apps – one is the IIFL Markets app that enables users to trade on equities, commodities, currency pairs, and derivatives & options. The second one is designed for mutual funds trading and is called the IFLL MF App.

What Stocks Can You Trade on the IIFL Markets App?

The IIFL Markets mobile application is an Indian stock market app available on desktop, mobile, and tablets that offers thousands of individual shares from the Bombay Stock Exchange (BSE) and the National Stock Exchange of India (NSE). Additionally, the platform gives access to Initial Public Offerings (IPOs) on both stock exchanges. This simply means that investors that choose to trade with IIFL app get access to over 10,000 listed stocks.

However, while the IIFL Markets trading app boasts thousands of Indian shares, you won’t be able to buy and sell foreign shares. With this broker, the only way to buy foreign shares is through global ETFs or mutual fund that tracks international equities.

Other Tradable Assets at IIFL Markets App

The IIFL Markets app offers a huge range of tradable assets besides stocks. This includes:

- Commodities – The broker offers all commodities futures listed on the NDCEX and MCX. This includes gold, silver, platinum, aluminum, energy (oil, natural gas), agriculture, etc.

- FX Currency pairs – A wide range of currency pairs vs the Indian Rupee.

- Futures & Options – Investors can trade on futures and options on a variety of assets like global stock indices, stocks, commodities, etc.

- Mutual Funds – A variety of Mutual Funds through 42 AMCs. These can be matched to the investor’s investment goals and different risk levels.

IIFL Markets App Account Types

Basically, when you open an account with IIFL you can choose between a Demat account and a Trading account. However, in order to trade on the broker’s mobile trading application, you need to open a Demat account. A Demat account enables a user to hold and manage shares and securities electronically and is mandatory in India in case you want to invest your money in the stock market.

IIFL offers three types of Demat accounts to choose from depending on your residential status.

- Regular Demat Account – This is a dematerialized account for any investor that resides in India. This account type is the standard option for equity trading and investment.

- Repatriable Demat Account – This account type is suited for non-resident Indians that wish to trade equities with IIFL.

- Non-repatriable Demat Account– This account is also made a non-resident Indian investor, however, you are not allowed to transfer funds abroad with the non-repatriable Demat account. Instead, you must link your account to a Non-resident Ordinary (NRO) bank account.

IIFL Markets App Fees & Commissions

Though IIFl is considered a discount brokerage firm in India, there are some fees and charges you must know before you open an online trading account with this broker. These can be categorized into trading and non-trading fees. Bear in mind that IIFL offers the Zero Brokerage plan that provides free equity delivery trades. Below we outline the broker fees and charges on trading activity.

Type of Investment Brokerage Fee Equity Delivery Rs. 0 Equity Intraday ₹ 20 or 0.05% (whichever is lower) Equity Futures ₹ 20 or 0.05% (whichever is lower) Equity Options ₹ 20 Currency Futures & Options ₹ 20 Commodity F&O ₹ 20 or 0.05% (whichever is lower) Direct Mutual Funds 1% to 1.5% for regular mutual funds Non-Trading Other Fees

On top of the trading-related fees charged by IIFL, there are also non-trading charges that you need to take into account. These include:

- Demat and Trading Account opening charges – Rs. 295

- Account Processing Charges – Rs. 0

- Trading AMC – Rs. 0 for the first year

IIFL Markets App User Experience

IIFL Securities clearly has developed an all-in-one trading solution for its customers. Overall, the app’s functionality enables users to get quick access to market news, updates, trading tools, and, of course, buying and selling stocks and other assets.

Notably, while the app’s user interface is not outstanding, you do get the most essential tools to make investment and day trading activity. As such, you’ll be able to create your own watchlists, get free research reports, get instant notifications based on your preferences, and easily place orders.

Having said that, one of the things we did not like about IIFl is that requires you to switch between two different mobile apps if you wish to trade stocks and mutual funds. As we mentioned above, the broker offers two mobile applications – IIFL Markets and IIFL MF. As such, it requires users to get familiar with two trading platforms and switch between the two whenever you want to trade in different markets.

IIFL Markets App Tools and Features

The IIFL markets app comes with some extra features to make the trading experience different than what other brokers offer. Some of these features include:

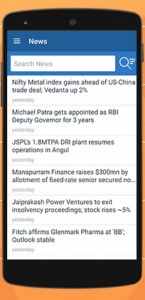

IIFL Markets App Official TVC/Finance News

One of the most useful features available on the IIFL Markets app is the TVC, which is a collection of Indian stock market news that available directly on the mobile app. With this feature, users can get updates on the latest events in the Indian and global stock markets with Live TV and YouTube videos.

On top of that, the broker gives access to live, in-depth coverage and analysis of Indian and international companies, financial markets, and macroeconomic news.

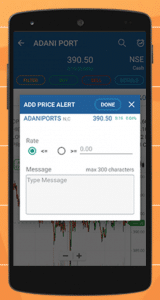

Price Alert Notifications

With the IIFL Markets app, you have a one-place screen inside the app to organize the notification you wish to receive based on your preferences. For example, if you wish to receive notifications on a certain stock or commodity, you simply have to set your preferences on the notification center.

Trading Tips

Another feature available on the IIFL Markets app is the trading tips that allow you to get a flow of trading tips for equities, futures & options, currencies, and commodities. The trading tips feature comes at no cost and is available on both desktop and mobile apps.

IIFL Markets App Bonus

Due to regulatory restrictions, IFLL Securities is not allowed to offer a sign-up bonus for new and existing clients. There are also no promotions or incentives for existing clients besides the broker referral program.

IIFL Markets App Demo Account

Unfortunately, you will not be able to open a demo account with IFLL Markets before and after you open a real live trading account. The broker simply does not offer a demonstration account that allows users to get familiar with the platform before depositing funds. A demo account normally is offered by most online brokerage sites as it is an essential tool for users to understand the platform and the broker’s trading condition before risking capital.

Payments on the IIFL Markets App

IIFL accepts payments via bank wire transfer and cheque only, which is somewhat disappointing. However, it does offer a variety of methods to transfer funds when linking your bank account to your trading account and vice versa. As such, you’ll be able to use the following methods when you transfer and withdraw funds.

- Online transfer via TT Web

- Online transfer through IMPS/NEFT/RTGS

- DD Pay Order

- Cheque

IIFL Markets App Minimum Deposit

Investors that wish to open an online Demat trading account with IIFL Markets do not have to meet any minimum deposit requirement. At the same time, if you want to open a margin trading account, you’ll have to meet the minimum deposit requirement of RS. 10,000.

IIFL Markets App Contact and Customer Service

When it comes to customer care, IIFL Securities is making an effort to provide top-notch support service. First, you can contact the support team via a live chat though it is available on the broker’s website only. Additionally, IIFL offers support via phone, WhatsApp, and email. Lastly, potential and existing users can use the broker’s FAQ section to get answers on various topics.

Is IIFL Markets App Safe?

IIFL Securities is one of the largest and most well known independent brokerage firms operating in India. It has around 2000 branches and over 10,000 employees across the country. Further, it is a public listed company with a market cap of nearly Rs. 44B at the time of writing.

IIFL Securities is also registered and regulated by the Securities and Exchange Board of India (SEBI) and is a clearing member of NSE, BSE, MCX, and NCDEX. All things considered, the IIFL Markets app is safe and secure and is under scrutiny by top regulators in India.

In terms of security features, IIFL offers the MPIN password code, which means a user must enter a 4 digit code in order to be able to open the mobile app.

How to Use the IIFL Markets App

By now, you should have enough information to assess the merits of the IIFL Markets app. If you want to open an account with this broker, simply follow the steps outlined below.

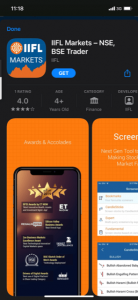

Step 1: Download the IIFL Markets AppAt first, you need to visit the Google Play or Apple Store and install the app on your mobile device.

Step 2: Open an Online Demat Account

Step 2: Open an Online Demat AccountIn order to be able to trade on the IIFL Markets app, you first need to open an online Demat account. This account essentially enables you to hold securities electronically and is mandatory for Indian residents.

The process to open an account is fairly simple. First, you need to apply for a Demat account and submit the KYC details. Then, you’ll have to submit documents that verify your identity. These include the following:

- Proof of Identity (PAN with photograph mandatory)

- Proof of Address (Passport/ Voters Identity Card/ Ration Card/ Registered Lease or Sale Agreement of Residence/ Driving License/ Flat Maintenance bill/ Insurance

- Aadhaar Letter issued by Unique Identification Authority of India.

- A utility bill – Gas bill/Bank Account Statement/Passbook/Telephone Bill

- Proof of Bank account

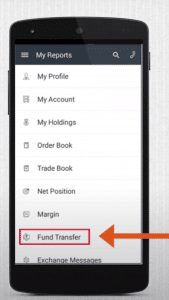

Step 3: Transfer FundsAs previously mentioned, this broker enables users to transfer funds when linking their bank account to the trading account or by cheque. Crucially, you can also transfer funds via the mobile app. In order to transfer funds via the mobile app, go to ‘My Dashboard’, then navigate to ‘My Reports’ and click on ‘Transfer Funds’.

Step 4: Buy a Stock

Step 4: Buy a StockTo buy shares on the IIFL Markets app, you have to choose a stock and place an order on the stock instrument page. Then, when you want to send the order to the exchange, you’ll need to insert the number of shares you wish to buy, the price, and the validity of the order. To complete the purchase, click on Buy.

How to Short Sell Stocks on IIFL Markets App

When using the IIFL Markets app, investors are allowed to short sell stocks. This is a great benefit of this trading platform as not all brokers in India authorize short-selling transactions. For those of you who are not familiar with the term, short selling means an investor is allowed the borrow shares from the broker and return these stocks to the broker once purchased back. This type of transaction is another way for users to make a profit when the price of an asset drops.

IIFL Markets App vs eToro

If you’re looking for a stock trading app for stock and commodity trading in India, you should take IIFL Markets app into consideration. This mobile app has a lot to offer and evidently, it is among the most downloaded mobile trading apps in India with over 1M users on Android, 150K+ on iPhone, and 60K+ on iPad.

But the IIFL Markets app has some down points, especially for those that wish to trade US and international equities, and more exotic markets like the cryptocurrency market. In that case, it might worth considering other brokers like eToro. This stockbroker has a mobile trading app that includes a much more diversified selection of instruments such as US stock, European stocks, ETFs, digital assets, a huge selection of FX currency pairs, commodities, and built-in copy portfolios.

Crucially, trading at eToro’s platform is completely commission-free, unlike IIFL Markets. This means that you do not need to pay any fixed fees when you enter and exit from a position. Instead, you pay the buy and sell spread only. The bottom line, eToro is a more cost-effective trading app than the IIFL Markets app, in particular for active traders.

Charge per Trade Annual Fee Inactivity Fee Deposit/Withdrawal Fees IIFL Markets app Equity delivery- Free Intraday trades – ₹ 20 or 0.05% (whichever is lower)

Rs. 250 from the 2nd year 0 0 eToro 0 0 800 INR per month (after one year) 400 INR per withdrawal To be honest, eToro doesn’t have the same range of stocks and assets as IIFL Market. However, it does offer a more advanced trading platform, and more importantly, a fully-fledged social trading platform. eToro is mostly known as the largest social trading platform in the world with around 12 million members on its network, and a plethora of social trading features. The most famous one is the CopyTrade tool that simply enables users to automatically copy the trades of another top-performing investor on the network.

IIFL Markets App Pros & Cons

Below you will find an overview of our IIFL Markets app findings.

The VerdictPros

- Active brokerage firm in India since 1995

- Regulated by SEBI

- Excellent trading features available on the mobile app

- No minimum deposit requirement

- Offers a live chat support

- Great notifications alert service

- Offers the Zero Brokerage plan – No equity delivery fees

Cons

- IIFL does not offer a commission-free trading platform

- Only Indian shares

- No demo account

- A limited selection of payment methods

- Cryptocurrency trading is not available

- Charges annual maintenance fees

- No sign-up bonus

There’s no doubt that many investors in India will find the IIFL Markets app as the ideal trading solution, and rightfully so. Overall, it provides the basic needs for any investor that want to get access to stocks, commodities, options, and IPOs trading in India. Moreover, the app comes with special features and tools like the notification alert service and trading tips.

However, the main issue with the IIFL Markets app is that it is limited in terms of the selection of products and markets available. With this app, you won’t be able to trade on US and international stocks, cryptocurrencies, and global ETFs. Additionally, as IIFL is a clearing member of Indian exchanges, you’ll have to pay fixed trading fees as well as annual maintenance charges.

As such, if you are looking for an alternative, we suggest you check other platforms like eToro. This broker offers commission-free trading and very few account charges. On top of that, you’ll get access to a social trading network and a broad variety of markets to trade on.

eToro – Buy Shares with 0% Commission

67% of retail investor accounts lose money when trading CFDs with this provider.

FAQs

What device is the IIFL Markets app available on?

IIFL Markets mobile trading app is available on iOS and Android mobile and tablet devices.

What shares can you buy on the IIFL Markets app?

Investors that decide to use the IIFL Markets trading app can trade all shares listed on BSE and NSE.

Is IIFL Markets app legit?

Yes, IIFL Markets is a mobile trading app from IIFL Securities, a subsidiary of India Infoline. This broker has been active in the Indian financial markets since 1995 and is regulated and authorized by SEBI.

What payment methods does the IIFL Markets app support?

IIFL Markets app supports bank wire transfer and cheque as payment methods.

What is the minimum deposit requirement at IIFL Markets app?

IIFL Securities does not hold any minimum amount required to open a Demat trading account.

Kane Pepi

Kane Pepi

Kane Pepi is a British researcher and writer that specializes in finance, financial crime, and blockchain technology. Now based in Malta, Kane writes for a number of platforms in the online domain. In particular, Kane is skilled at explaining complex financial subjects in a user-friendly manner. Kane has also written for websites such as MoneyCheck, the Motley Fool, InsideBitcoins, Blockonomi, Learnbonds, and the Malta Association of Compliance Officers.View all posts by Kane PepiMore Best Stock Market App India – Top App Revealed GuidesView all

stockapps.com has no intention that any of the information it provides is used for illegal purposes. It is your own personal responsibility to make sure that all age and other relevant requirements are adhered to before registering with a trading, investing or betting operator. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice.By continuing to use this website you agree to our terms and conditions and privacy policy.

© stockapps.com All Rights Reserved 2026We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up