MO Investor App Review 2026 – Pros & Cons Revealed

The Motilal Oswal investment app, also known as the MO Investor, is one of the most popular and user-friendly investments and trading apps in India. This mobile application has a large number of users, which can be largely attributed to its simplicity and the excellent trading features available on the app. MO Investor is available on Google Play and Apple Store and can be used on any mobile smart phone, and even on a smartwatch.

If you are considering investing through the MO Investor app, this guide is for you. We’ll cover the most essential things you need to know about this brokerage firm and its mobile trading application, the MO Investor. We also analyze the fees and charges, features, instruments, user experience, supported assets, security and safety of funds, pros and cons, and more.

-

-

What is Motilal Oswal MO Investor?

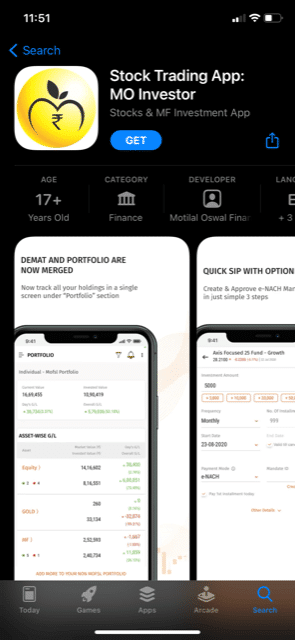

MO Investor is an online trading platform that runs on various smartphones and tablets. Investors on this Indian stock app get access to a wide range of markets and products that include equity, derivatives, commodities, FX currency pairs, mutual funds, fixed deposits, IPOs, and US equities. The MO Investor application has more than 1M installations on Google Play and is one of the most popular stock trading apps on the App Store.

The MO Investor platform is backed by Motilal Oswal Finance Service Limited (MOFSL), a popular and well-known brokerage firm that was founded in 1987 and is a member of NSE, BSE, MCX, NCDEX, under the CIN number: L67190MH2005PLC153397. Motilal Oswal is also known for being one of the most trustworthy brokerage firms in India. At the time of writing, the broker has 2500 branches across more than 550 cities across India.

What Stocks Can You Trade on the Motilal Oswal MO Investor App?

As mentioned above, Motilal Oswal Limited is a clearing member of the National Stock Exchange of India (NSE), the Bombay Stock Exchange (BSE), the Multi Commodity Exchange (MCX) and the National Commodity & Derivatives Exchange Limited (NCDEX). As such, when trading with the Motilal Oswal MO Investor app, you will get access to all Indian stocks listed on the NSE and BSE.

Moreover, the MO Investor app also covers a range of 3500 US shares, including fractional share trading.

Other Assets at MO Investor App

In addition to stocks, investors that choose to trade with this app get access to ETFs from Indian stock markets as well as from US stock markets. On top of that, the broker also offers other markets such as FX currency pairs, commodity future derivatives, mutual funds, fixed deposits, IPOs and bonds, and built-in portfolio management assets.

MO Investor Account Types

To access to MO Investor app, you must have a Molital Oswal Demat Account. For those unaware, a Demat account is the necessary regulatory tool to holding shares and securities easily in India.

When you open a Demat account with Motilal Oswal, there are three account types that you need to consider:

The Default Account – This is the standard account type offered by Motilal and is the best option for long-term investors. The Default account include trading in equity, derivatives, commodities, FX currency pairs, mutual funds, IPOs, PMS, insurance and fixed income Products

Value Addition Pack – This account type is mostly suited for active day traders as it provides a discount for high volume trading activity.

Margin Pack – This is the best trading account offered by Motilal Oswal for active stock day traders.

MO Investor App Fees & Commissions

Unlike CFD trading platforms, Motilal Oswal has a different approach when it comes to fees and charges. This is because the broker is a clearing member of Indian stock and commodity exchanges, and therefore, must charge a fixed fees per transaction. With that in mind, let’s take a close look at some of the fees charged by this broker for their basic plan.

- Equity Delivery – 0.5%

- Equity Intraday Fee – 0.05% (per side)

- Futures – 0.05% (per side)

- Currency Futures – ₹20 per lot

- Options – ₹100 per lot

Non-Trading Other Fees

There are other fees and charges to take into consideration before opening a Demat account with Motilal Oswal. These include:

- Demat and Trading Account opening – Rs. 500

- Demat AMC Charges – Fee ranges between Rs. 300 to Rs. 500 per year

- The Custodian Fee – These are charged monthly depending on the number of securities that the investors holds in the account. The fee ranges between between Rs. 0.5 to Rs. 1 for each ISIN

As concluded from the above – While Motilal Oswal claims to be among the most cost effective brokerage firms in India, it is fairly expensive in comparison to other zero-commission trading platforms like eToro, Plus500 and Fineco Bank.

MO Investor App User Experience

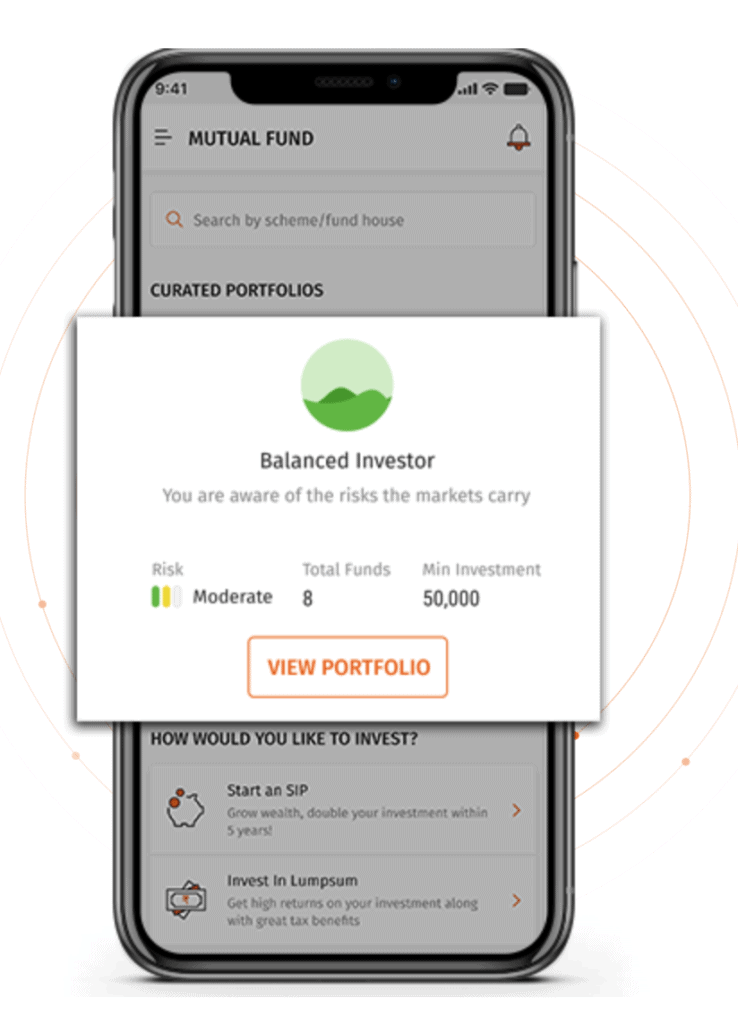

Overall, the MO Investor has a a clean and easy to use user interface that was specifically designed for inexperienced and newbie traders. The navigation on this app is extremely smooth and very user-friendly so you are not likely to find it difficult to trade on this platform. Additionally, opening an account is very simple and the app walk you through the steps.

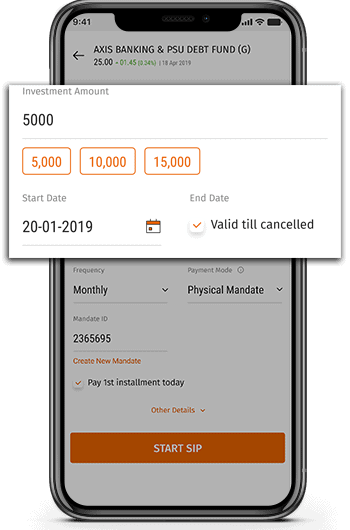

It’s also worth mentioning that the broker has recently released a revamped version of its MO Investor App which significantly improved the quality of the app. Some of the features added in the latest update include a new price alert service, customizable and multi-asset watchlist, stock SIP feature, quick order execution, live market updates, and more.

MO Investor App Tools and Features

One of the main attractions of using the MO Investor app is the variety of tools and features it offers, particularly for beginner investors. This platform is designed for ease of use and basic trading functionality, but it can also be used by more advanced traders that are looking for long-term investment strategy. As such, you will be able to take advantage of the following tools and features:

Motilal Oswal is offering the MO Investor smartwatch app, which is one of the first investment apps in India available on a smartwatch. With this app, traders can get notifications on market updates, view information on global stock markets, and track the portfolio and open positions in real-time from their smartwatch.

Suggest ME Tool

The Suggest ME Tool is an AI powered solution that essentially finds investment ideas for the investor based on previous trading activity and the user’s preferences. This tool can instantly send you notifications and investment ideas backed by the broker’s research team. The Suggest ME Tool is available on the ME Investor app at no cost.

EDUMO

As previously mentioned, the MO Investor app is mostly suited for beginner investors that lack the basic knowledge of trading and investments. As such, the broker has recently upgraded its application with the EDUMO education hub. In this section, users have access to a variety of videos, blog posts, and tutorials categorised into novice, intermediate and expert levels of investing.

MO Investor App Bonus

Motilal Oswal currently does not offer any bonuses and promotions for new clients. It does, however, offer the Refer and Earn Money Program. According to the program, investors get an Amazon Gift Voucher worth 1000 INR for every Demat Account opened via the referral.

MO Investor App Demo Account

Moiltal Oswal does not offer a demonstration trading account on the MO Investor app. This means you’ll have to find your way around without having the option to practice trading with virtual money. This is a key feature that this broker lacks when compared to other online brokers in the industry like eToro and Plus500.

Payments on the MO Investor App

When it comes to payment methods, Motilal Oswal allows its users to transfer funds via an electronic bank wire transfer. The funding process can be done directly from the mobile app and is fairly easy and safe.

With that in mind, we were a bit disappointed that the broker does not offer more payment methods on its platform and limits clients to bank wire transfer only.

MO Investor Minimum Deposit

Much like other Indian online trading brokers, MO Investor does not maintain a minimum deposit requirements. This is because the broker does not work the same as other brokerage firms where you have to deposit funds to the broker’s account. Instead, you can have zero balance anytime and transfer funds once you are planning to make a transaction.

Motilal Oswal MO Investor Contact and Customer Service

Motilal Oswal offers several methods in which clients can contact the support team. First, the broker has different phone numbers for various topics such as account opening, support related queries, and trading issues. The broker also offers users to contact the team via submit a query form, and email.

Motilal Oswal, however, does not offer a live chat support which is arguably the most convenient method the contact the broker’s support team.

Is MO Investor App Safe?

As an Indian-based broker, it is no wonder that you should have no concerns about the safety of your funds and the secruity of your data. First and foremost, Motilal Oswal is regulated and registered with SEBI as a Portfolio Manager vide registration no. INP000000670 under SEBI. The Securities and Exchange Board of India (SEBI) is the regulatory authority that is governing the functioning of the securities market in India.

More importantly, Motilal Oswal is a clearing member of of NSE, BSE, MCX, NCDEX, under the CIN number: L67190MH2005PLC153397.

The broker is also offering a two factor authentication (2FA), and use a one-time password to secure clients’ accounts.

How to Use the Motilal Oswal MO Investor App?

If you want to use the MO Investor app, the installation process is fairly easy and straightforward. To get started, simply follow the four steps below.

Step 1: Download the MO Investor AppAs previously mentioned, the MO Investor app is available on both Google Play and the App Store. To find the app, based on your mobile device’s operating system (iOS or Android), visit the store you need and type in MO Investor in the search bar.

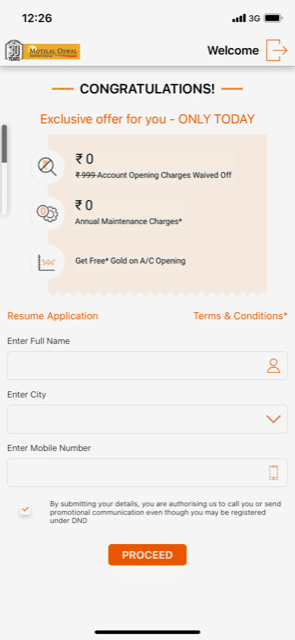

Step 2: Open an Account

Step 2: Open an AccountOnce you have installed the MO Investor app to your mobile device, you will then need to open a Demat/Trading account. Fortunately for users, the broker enables to make the account creation process via the mobile app or via its website.

In order to complete the registration process, you’ll be asked to provide your personal details, upload documentation that verifies your identity, and activate your account by submitting a verification code. The documents required to open an account with Motilal Oswal include:

- A copy of your bank account statement

- A copy of your PAN Card

- A copy of your Voter’s ID or Adhaar Card

- A copy of your photograph

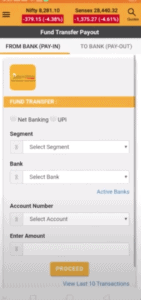

Step 3: Transfer FundsLike most online trading apps in India, Molital Oswal uses a bank wire transfer to allow users to transfer funds into their accounts. Funding your online trading account can be done directly from the mobile app. To do so, you’ll have to login to the platform, navigate to Fund Transfer by clicking on the left side drop down menu. Then, simply transfer funds from your bank account.

Step 4: Buy a Stock

Step 4: Buy a StockNow that your account is funded, you can proceed to the buying stock process on the MO Investor app. To start, search for the stock you wish to buy and click on the stock box to see the order form. Then, insert the amount you want to invest in the stock, and click on the Buy button to complete the purchase.

How to Sell on MO Investor App

The process of short selling a share on the MO Investor app is the same as purchasing a share. To make a short sell transaction, you will need to simply select the share that you want to sell and then buy it back when you wish to close the position. Bear in mind, however, that you must have a margin trading account in order to short sell stocks with Motilal Oswal.

MO Investor App vs eToro

To make it easier for you to choose the right broker, we have decided to compare the MO Investor app to one of the most popular online trading apps in the world, eToro. Following this review, we can say that the MO Investor is the ideal investment app for investors that are looking for buying and selling stock on Indian stock markets. This broker not only offers you access to trade shares listed on the BSE and NSE, but also gives you access to commodity exchanges in India and other attractive financial assets.

With that in mind, we also have to say that the MO Investor app is not the best nor the most cost effective trading app in the market for active day traders or expert investors. During this review, we were somewhat disappointed with the broker’s trading costs, and the level of trading terms it provides. For those that are looking for top-notch trading app with zero commission policy and access to a variety of markets and products, eToro is the ideal platform. eToro, for example, offers zero commission CFD trading on a range of markets and trading tools that are more suited for intermediate and experienced investors. Unfortunately, this is not the case when trading with the MO Investor app. This brokerage firm has various fees that are associated with the account creation process, trading activity and the broker’s account management.

Charge per Trade Annual Fee Inactivity Fee Deposit/Withdrawal Fees MO Investor App 0.50% of the transaction size Rs. 300 to Rs. 500 0 0 eToro 0 0 800 INR per month (after one year) 400 INR per withdrawal Another reason for us to believe that eToro is better than MO Investor is the selection of advanced trading tools that include the social trading CopyTrade tool. As the name implies, this tool allows you to choose another successful trader and automatically copy the trades made on the trader’s account. More than that, eToro also offers a wider range of markets to trade on. As such, you’ll get access to ETFs, cryptocurrencies and built in copy portfolios.

MO Investor App Pros & Cons

Below you will find an overview of our MO Investor app findings.

Pros

- Great trading platform for newbies

- Motilal Oswal is a trustworthy brokerage firm

- Range of features and tools

- Investors get access to BSE and NSE

- Available on Android and iOS

- A comprehensive educational hub called EDUMO

- No minimum deposit requirement

Cons

- High trading fees – Pricing structure is complicated

- Offers a limited selection of payment methods

- No access to international markets (only US equities)

- Investor don’t get access to many popular markets like digital assets

- No Live chat support

- Leveraged trading is not available

- Does not offer social trading

- No demo account

The Verdict

In summary, there’s a reason why the MO Investor has become one of the most popular trading apps in India. For the on the go investor that is looking to get access to trading on stock and commodity exchanges in India, it is highly recommended. This is because the platform is extremely easy to use, and offers the necessary trading tools to place basic orders in the market.

On the other hand, this platform is not ideal for expert traders due to its high trading fees and the lack of professional trading tools like top-notch charting package and advanced market order functionality. For that reason, we suggest looking for a zero commission stock trading app like eToro. On this platform, there are no commissions associated with share trading and you’ll get access to social trading platform as well as leverage trading.

FAQs

What device is the MO Investor app available on?

The MO Investor app runs on any smartphone mobile device and tablet.

What shares can you buy on the MO Investor app?

Motilal Oswal provide users access to all shares listed on the Bombay Stock Exchange (BSE) and the National Stock Exchange of India (NSE). This covers a range of at least 10,000 shares.

Is the MO Investor app legit?

Yes, it is completely legit. The app is supported by Motilal Oswal, which is one of the oldest and most trusted brokerage firms in India that was founded in 1987.

What payment methods does the MO Investor app support?

Users on the MO Investor app are able to transfer funds via bank wire transfer only. This can be done directly from the mobile application.

What is the MO Investor minimum deposit?

Motilal Oswal does not maintain a minimum deposit requirement. In fact, you can have a zero balance in your account any time and still own an online trading account.

Kane Pepi

Kane Pepi

Kane Pepi is a British researcher and writer that specializes in finance, financial crime, and blockchain technology. Now based in Malta, Kane writes for a number of platforms in the online domain. In particular, Kane is skilled at explaining complex financial subjects in a user-friendly manner. Kane has also written for websites such as MoneyCheck, the Motley Fool, InsideBitcoins, Blockonomi, Learnbonds, and the Malta Association of Compliance Officers.View all posts by Kane PepiMore Best Stock Market App India – Top App Revealed GuidesView all

stockapps.com has no intention that any of the information it provides is used for illegal purposes. It is your own personal responsibility to make sure that all age and other relevant requirements are adhered to before registering with a trading, investing or betting operator. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice.By continuing to use this website you agree to our terms and conditions and privacy policy.

© stockapps.com All Rights Reserved 2026We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up