Best App For Crypto Trading In Australia Revealed!

Cryptocurrency trading remains one of the riskiest investment routes; however, cryptos and tokens have shown to also deliver incredible ROI – sometimes up to 20,000% in a single year. In this piece, we will review Australia’s eToro app and other apps like Binance, Coinbase, Crypto.com, and Coinspot, the secrets to choosing the best app for crypto trading, and factors to consider before investing in cryptocurrencies.

Top Crypto Trading Apps To Consider

Crypto.com

Crypto.com is an online brokerage platform that supports hundreds of cryptocurrency assets and NFTs, making it one of the best apps for crypto trading. With trading options like spot and futures trading, margins, crypto CFDs, and OTC, Crypto.com boasts over 50 million active users. Users can buy and sell NFTs, stake crypto, and store assets in cold wallets. The platform also houses an intuitive mobile app where you can view your portfolio and stake or swap cryptocurrencies.

Key Features

- 0.4% trading fee for new users or users that trade less than $25,000. Discounted trading fee for people that stake CRO. High-volume trades (greater than $25,000) can enjoy lower fees up to 0.04% even without staking CRO.

- Extensive tradable assets

- Lending program that allows traders to borrow crypto against their underlying assets

- Availability of trading bots

- Multi-factor authentication, whitelisting, and cold storage protects users’ funds.

- Compliance with ASIC for Australian traders

- Availability of live chat for instant customer support and email for advanced customer requests or complaints.

Pros:

Cons:

Your capital is at risk

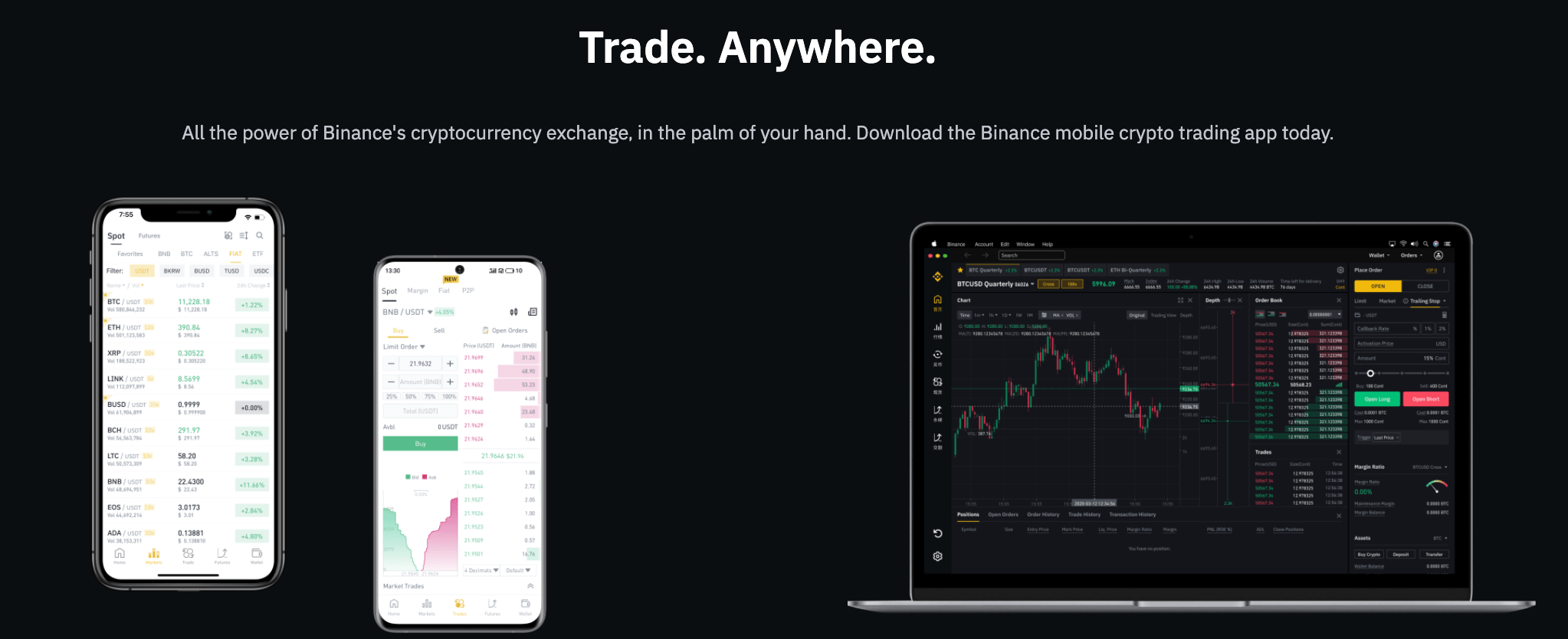

Binance

Binance is one of the best apps for crypto trading in Australia. The online brokerage was instituted in 2017 and remains a major player in the industry. Binance supports more than 365 cryptocurrencies; however, only 65 are accessible to US citizens. Binance faces frequent regulatory issues and is currently under investigation and banned in several countries.

Key Features

- The platform is ASIC licensed and Australians can trade freely on the app.

- Enterprise exchange solution powered by Cloud

- Beginners can earn crypto from learning in Binance Academy.

- Customer support: Chatbot, Twitter, and email

- Supports P2P trading, spot and margin trading, and order types like stop limit order, post only order, limit order, market order, and trailing stop order.

- Supports crypto loans

- Binance Pay facilitates sending and spending of crypto and Binance Gift Card facilitates sharing and gifting at zero costs.

Pros:

Cons:

Your capital is at risk

Coinbase

Coinbase is one of the largest Bitcoin and cryptocurrency trading platforms today. Founded in 2012, Coinbase boasts of a robust ecosystem of crypto assets and more than 13,000 financial instruments. The enterprise-scale platform has over 98 million users and 256 billion worth of assets. Coinbase hosts its users on two platforms: Coinbase and Coinbase Pro. Coinbase Pro platform offers professional traders' tools like limit orders, and stop orders, while Coinbase is elementary and excellent for beginner traders.

Coinbase is a global platform and one of the best apps to trade crypto; however, the customer support offered by the platform could be improved.

Key Features

- Coinbase has a robust collection of cryptocurrencies and financial instruments.

- One of the most beginner-friendly crypto trading app Australia

- Coinbase Pro created for advanced trading

- Mobile application has a seamless and intuitive user interface

- 98% of Coinbase assets are stored in cold wallets

- Supports diverse instruments, including forex trading

- Users can earn crypto.

- An excellent Bitcoin trading and storing app.

- Coinbase also serves as a crypto-storing wallet.

Pros:

Cons:

Your money is at risk

Coinspot

Coinspot has a seamless interface, letting you swap, buy, and sell bitcoin, Ethereum, and other altcoins within its ecosystem. Coinspot also facilitates NFT trades–which are tradable with any available cryptocurrency. The exchange's core competency is its customer support quality: Users have the option to access a personal account manager that will help through trading issues, verification, OTC trades, or whatever simple or advanced complications may arise in your trading experience.

Key Features

- OTC Trading Desks: Over the Counter trading desk is facilitated by the Lock in Pricing feature (eliminates slippage often accompanied by high volume trades). With OTC trading, traders are guaranteed instant access, as OTC eliminates the need for traditional order books.

- Supports 361 cryptocurrencies

- Trading Fee: Coinspot trading fee for market orders and OTCs is 0.1%. 1% trading fee to buy, sell and swap cryptocurrency.

- Hosts 2.5 million traders.

- Has an ASIC license, making Coinspot one of the best crypto trading apps.

- Affiliate and referral programs help you earn cryptocurrency

- Facilitates NFT trading

Pros:

Cons:

Your money is at risk

Top Tips For Choosing A Crypto Trading App

Consider fees

Some platforms may charge higher fees than usual, but their intuitive user interface, educational resources, affiliate, referral program, and ease of use on mobile may make the platform worth it. You also need to consider your trading volume. Some exchanges reward high-volume traders with lower-than-usual fees. Other exchanges charge high on small volume trades.

- Withdrawal fees: How much will the exchange charge you to withdraw your funds? A $5 flat withdrawal fee may be unwise If you trade low volumes. Imagine shedding $5 to withdraw just $50. Select platforms with low to zero withdrawal fees.

- Trading fees: How much will you lose when you execute a trade? Most platforms have flexible fee structures, depending on the volume of trade and instrument traded.

- Deposit fees: Choose platforms that charge little to zero deposit fees.

Check Regulation

A cryptocurrency exchange must be licensed to practice within a jurisdiction. All online brokerages are directed to display licensing information on their websites. Some of the most prominent license and regulatory bodies are Securities and Exchange Commission (SEC)—United States, Bank Secretary Act (BSE)— United States, Financial Conduct Authority (FCA)— United Kingdom, Australian Securities, and Investments Commission (ASIC)—Australia, Canadian Conduct Authority (CCA)—Canada.

Before you determine the best cryptocurrency trading app, you must confirm that the app is licensed to operate in your country.

Chose an app with a low minimum deposit

The best app to buy cryptocurrency often allows low minimum deposits. Except you want to invest high volumes (which you shouldn’t if you are just learning the rope), you should use exchanges like Crypto.com.

Look for apps that offer a demo account

The best crypto trading app has a demo account. Do not invest in an app that doesn’t run a sophisticated demo account. Demo accounts help beginner investors to trade risk-free, understand the trading platform, and understand the crypto trading market. Market orders, limit orders, and stop loss orders may sound fanciful and easy to execute, but you can make mistakes if you do not understand the term. When you lose virtual money on a demo account, you may not feel the full emotional impact since it's play money. The trick is to create a sense of loss and push objective reasoning even if you are paper trading.

Consider analysis and research tools

Analysis and research tools help traders make informed decisions before executing a trade or instructing an order. Without the proper tools, traders are simply gamblers hoping for the best. Fundamental analysis tools study the intrinsic value and nature of the instrument. News, and consistent industry updates on the instruments you choose will help you see potential price movements before they happen. Let’s say you invest in a Metaverse native token: the owners announce that they have pulled the ICO date forward or they have launched a proof-of-stake model and will begin the transition from proof-of-work in the next couple of months; quick access to such news will push you to buy more of the token before the news gets to mass media. The basic concept of trading is to buy low and sell high. Every investment strategy and order must fulfill the condition to sell higher than the price you buy, and instant access to industry news often guarantees that you buy tokens and cryptocurrencies at discounted prices.

Are Crypto Trading Apps Safe?

Crypto trading apps are intrinsically safe; however, like every system in the world, they are subject to malicious attacks. Crypto apps sit on blockchain networks. Blockchain networks are immutable: simply put, a data point on a blockchain network cannot be changed except if it is validated by 51% of the remaining data points. The probability of breaking a blockchain network is close to impossible, and an utter waste of time. That said, hackers that have incredible financial backing, like Lazarus Group–a North Korean-backed hacking organization, can devote months to hacking large exchanges.

The best crypto trading apps have proven to be safe. Security measures a crypto trading app must have include:

- A cold wallet to store crypto assets: When cryptocurrencies are stored in cold wallets, they are basically untouchable, except if you give access to another person.

- MFA or 2FA: Two-factor or multi-factor authentication prevents easy login. For example, some trading apps will lock your account and send an email once they notice that you are logging in from a strange IP address or a strange location.

- Licenses: The best app to buy cryptocurrency holds the necessary licenses to operate within the jurisdiction it operates and is regulated by the appropriate agencies.