Best App for Day Trading Crypto Australia

Due to its unique nature, the cryptocurrency market offers various ways for traders to make investments and generate returns. Day trading is one of those ways; however, if this is something you’re interested in, you’ll need to partner with a reputable and cost-effective broker to do so optimally.

In this guide, we’ll review the Best App for Day Trading Crypto Australia 2024 – highlighting what options you have to choose from and where you can begin day trading crypto today in a matter of minutes!

Key Points on Crypto Day Trading Apps

- The best crypto day trading apps in Australia are applications that you can download to your smartphone that allow you to day trade in the crypto market.

- Certain day trading apps will be offered by brokerages, while others will be provided by exchanges.

- There are various strategies, like the Wyckoff Method, and digital assets to consider before you begin day trading.

Best Apps for Day Trading Crypto Australia List

Found below is a brief overview of the best crypto day trading apps in Australia available in the market right now:

- ByBit – Crypto Day Trading App with Huge Asset Selection

- Coinbase – Best App for Day Trading Crypto with Free Wallet

- Binance – Largest Crypto Exchange with Great Crypto Day Trading App

- Plus500 – Best App for Day Trading Crypto with 24/7 Support

- IG – Crypto Day Trading App with High Liquidity Levels

- Kraken – Heavily Regulated Crypto Day Trading App

- Swyftx – Crypto Trading App featuring Free Demo Account

Best Apps for Day Trading Crypto Australia Reviewed

Choosing a suitable platform to partner with can make all the difference in your crypto trading journey. Found below are our reviews of the best day trading apps for cryptocurrency on the market right now, covering all of the essential facets that you need to know.

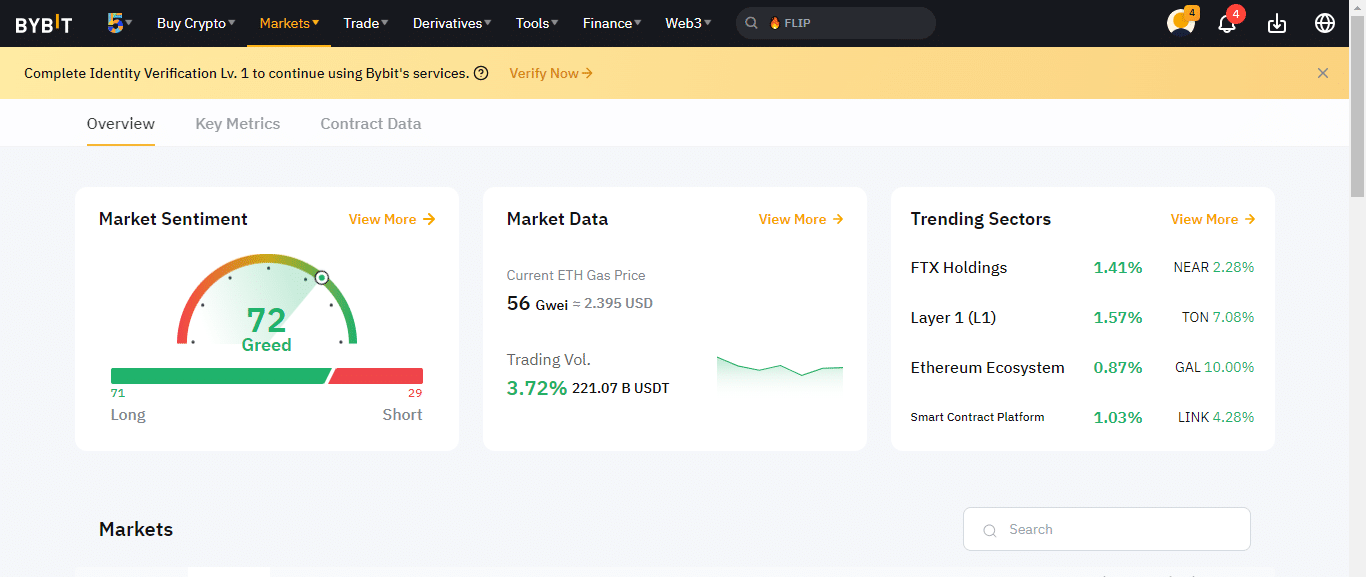

1. ByBit – Crypto Day Trading App with Huge Asset Selection

ByBit is one of the fastest-growing exchanges in the crypto world and has over 15 million registered users. Traders can choose from over 80 different cryptos, featuring popular options such as BTC and ETH, along with smaller coins such as EOS and XLM. Notably, ByBit offers various markets to trade, including the spot market and inverse perpetual futures.

In terms of fees, ByBit uses the classic ‘maker and taker’ model, meaning that you’ll have to pay a small fee when buying or selling an asset. Market makers are charged 0.1% per trade, whilst market takers are charged 0.1%. Aside from these fees, ByBit doesn’t charge anything to make a crypto deposit from an external wallet, although deposits in AUD will come with a charge set by the relevant third-party payment provider.

ByBit’s app has an easy-to-use design, with clear areas for buying and selling coins. Users can purchase with a credit or debit card, and the app allows push notifications to be set when the price meets a certain level. ByBit, being one of the best altcoin apps, handles up to 100,000 transactions per second and boasts no downtime or server overload, which is crucial for day trading. You can even access 24/7 customer support directly within the app, should you need any questions answered.

Pros:

Pros:

- Over 80 cryptos to trade

- Low trading fees

- The app can handle up to 100,000 trades per second

- 24/7 customer support

Cons

- Cannot withdraw in AUD

Cryptoassets are highly volatile unregulated investment products. No EU investor protection.

2. Coinbase – Best App for Day Trading Crypto with Free Wallet

Another of the best crypto day trading apps in Australia is Coinbase. You’ll likely have heard of Coinbase, as this platform is the second-largest crypto exchange in the world, just behind Binance. Due to it being an exchange, Coinbase allows users to fund their trading accounts using cryptocurrencies and FIAT, offering a vast array of coins and trading pairs to invest in.

Being one of the best Bitcoin wallet apps, Coinbase has over 800 total assets that users can trade and store.

When you day trade crypto, you’ll have to pay a spread plus a commission on each trade. Firstly, Coinbase charges a spread of around 0.5% when you buy or sell cryptocurrency, although this can be higher during periods of volatility. In addition to the spread, traders will have to pay a fee, depending on their trade volume and payment method.

However, if you use Coinbase Pro, you’ll only have to pay a maker or taker fee of 0.50% for a trading volume less than $10,000 (14,038 AUD).

Coinbase offers two trading apps for users to trade on – the basic Coinbase app or Coinbase Pro. The former is targeted at casual traders and has basic features that allow you to buy and sell coins in just a few taps. The latter may be better for day traders as it features the maker/taker fee structure and has advanced charting and analysis features to boost your effectiveness.

Finally, Coinbase even offers a free crypto wallet for all users, supporting over 800 assets – including NFTs!

Pros:

Pros:

- World’s second-largest crypto exchange

- Two trading apps to choose from

- Free crypto wallet app

- Thousands of potential assets to trade

Cons

- High trading fees

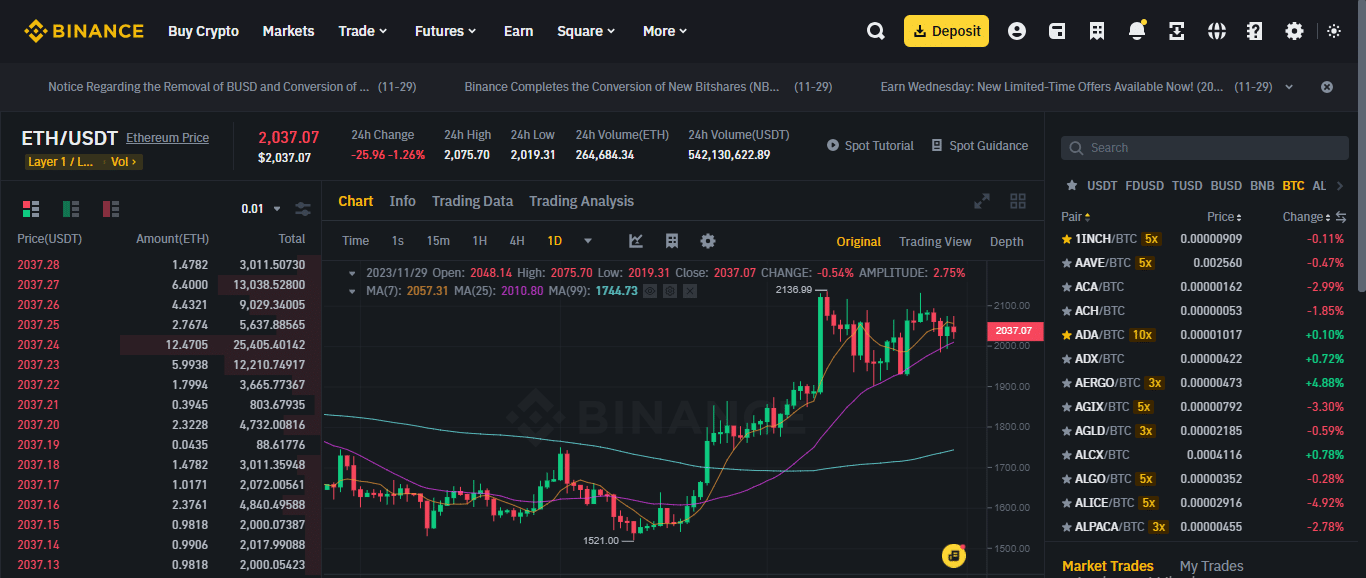

3. Binance – Largest Crypto Exchange with Great Crypto Day Trading App

Established in 2017 by Changpeng Zhao, Binance has evolved into a cryptocurrency juggernaut, boasting 150 million active users globally. The heart of its ecosystem, Binance Coin (BNB), offers perks like trading fee discounts and participation in token sales, contributing to its popularity.

It’s not news that this is one of the best bitcoin trading apps. With a staggering array of supported cryptocurrencies exceeding 500, Binance provides a diverse portfolio for traders, extending beyond major coins to include various altcoins and tokens.

Navigating the platform is made accessible for both novice and seasoned traders, featuring an intuitive interface and advanced trading options such as spot and futures trading. Binance’s global influence is further emphasized by its multilingual support and round-the-clock customer service, catering to a broad user base.

As of 2023, Binance stands as a launchpad for new projects and tokens, facilitating token sales and fostering innovation in the crypto space. An example is its Binance NFT platform, which launched in 2021 and is recognized as one of the best NFT apps out there.

Despite occasional delays in customer support, Binance’s competitive trading fees reinforce its status as a premier choice for cryptocurrency enthusiasts. Thorough research becomes pivotal for users to harness the full potential of this influential exchange and navigate its complexities securely.

Pros:

Pros:

- Extensive Cryptocurrency Selection

- User-Friendly Interface

- Binance prioritizes the security of user funds, employing measures such as two-factor authentication and withdrawal whitelist settings.

- Global Accessibility

- The platform’s trading fees are competitive, and users can further reduce these fees by utilizing the native Binance Coin (BNB) for transactions.

Cons

- Limited Fiat-to-Crypto Trading Pairs

- Customer support delays during peak times,

The table below compares all platforms discussed earlier;

| Platform | ByBit | Coinbase | Binance |

|---|---|---|---|

| User Base | Over 15 million registered users | Over 103 million registered users | 150 million active users globally |

| Digital Assets | 400+ | 800+ | 500+ |

| Trading Markets | Spot market and inverse perpetual futures | Vast array of coins and trading pairs | Spot and futures trading |

| Fees | Maker: 0.1%, Taker: 0.1% | Spread (around 0.5%) + Commission | Competitive trading fees |

| App Design | Easy-to-use with clear buying/selling areas | Basic app and advanced Coinbase Pro | User-friendly with advanced trading options |

| Customer Support | 24/7 customer support in the app | 24/7 priority support | Multilingual support with 24/7 customer service |

What is Crypto Day Trading?

As defined by Business Insider, crypto day trading is a short-term trading strategy based on buying and selling crypto assets on the same day. This is at the other end of the spectrum to ‘buy and hold’ techniques, which involve taking a position in an asset and holding for days, weeks, or months.

Day trading the crypto market is possible because the market is inherently volatile, meaning there are regular opportunities to make a return each day. The listing of some of the best meme coins also allows traders to participate in the general trend of market activity, which can lead to profit or loss.

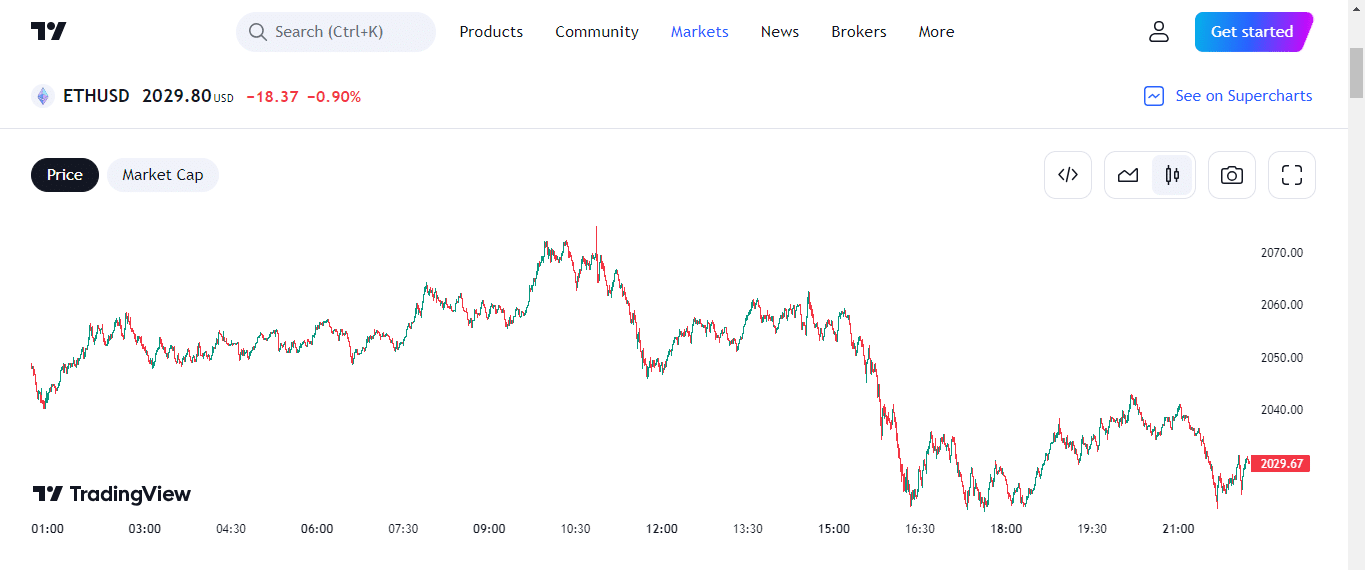

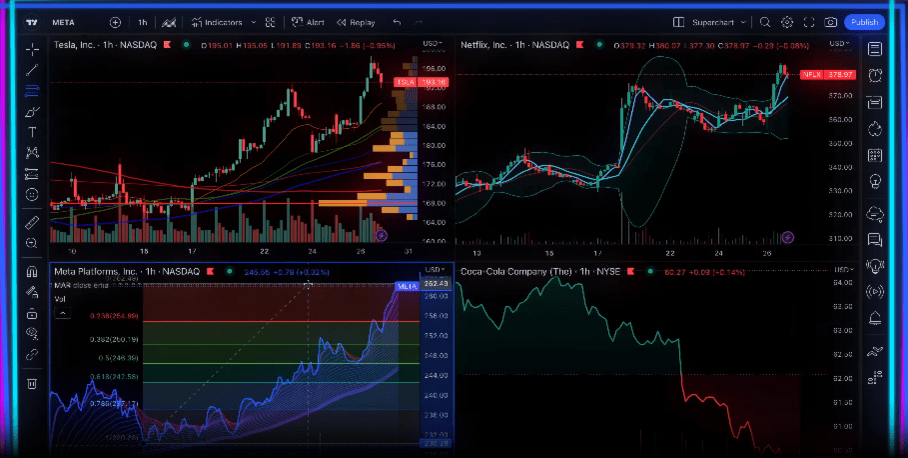

The price chart will be your best friend when investing with the best crypto day trading apps in Australia. As there is no “best time to trade crypto“, most crypto day traders employ extensive technical analysis to find areas of support and resistance, which can then inform trade ideas.

Day traders tend to look for small price movements, taking advantage within the space of hours or even minutes. Although this strategy is riskier than longer-term strategies, it can offer up scope for greater returns on a more consistent basis.

What are the Best Cryptocurrencies for Day Trading?

Are you looking for the best crypto for day trading? Below are five of the top day trading cryptos and why they suit this strategy.

1. Bitcoin (BTC)

BTC is our pick for the best crypto to day trade, as this coin has the greatest liquidity levels of all the cryptocurrencies.

2. Ethereum (ETH)

Ethereum is a blockchain platform designed to host decentralized applications. Much like when trading Bitcoin, Ethereum trading is often relatively low-cost and provides higher returns than BTC for each upward or downward move. Furthermore, due to ETH’s rise in popularity, the coin is easily accessible on pretty much all brokerages and crypto exchanges.

3. Tether (USDT)

Tether is anchored to the USD price – meaning that it should stay at (or as close to) $1 as possible. However, due to many factors, USDT can sometimes stray from the $1 mark, which provides ample opportunity to day trade it. For example, if USDT rose to $1.01, you can short it and generate a return of 1% once it returns to its base level!

4. Ripple (XRP)

Although XRP is a little more volatile than some other options on this list, it’s ideal for risk-seeking day traders. This cryptocurrency regularly moves 3-5% in a matter of hours, meaning you stand to make great returns if you can time the market. Furthermore, XRP tends to have clear support and resistance levels as depicted by multiple candlesticks, which help improve trading effectiveness.

5. Binance Coin (BNB)

Finally, Binance Coin is also an excellent option for day traders, as the coin is backed by the reputable nature of its native platform, Binance. Much like XRP, BNB’s chart displays clear support and resistance levels, and if you drop down to the 15-minute crypto trading chart pattern, you can see that BNB has many small price movements throughout the day that can be capitalized on. Finally, due to its liquidity, there doesn’t tend to be any huge spikes in price, which could trigger your stop loss.

Crypto Day Trading Strategies

Learning how to day trade crypto can make all the difference in your journey. Let’s discuss three of the best strategies to employ and how they can improve your trading effectiveness.

1. Scalping

This strategy involves small trade windows, often lasting minutes or even seconds! Scalpers take advantage of small price movements and aim to make small returns on each trade. Although returns are small, scalpers tend to make numerous trades per day, equating to solid gains across the entire week.

2. Trade Breakouts

Breakouts occur when the price ‘breaks out’ of the range it has been trading in. This range will be the area between solid support and resistance levels, where the price tends to trade sideways. By keeping an eye on any break of these levels, along with indicators such as the moving average, you can place orders above or below the breaking point and generate quick returns.

The table below compares different kinds of trading styles and their accompanying risks;

| Trading Style | Description | Time Horizon | Risk Tolerance | Suitable Markets | Analysis and Strategy |

|---|---|---|---|---|---|

| Day Trading | Buying and selling financial instruments within the same trading day. | Short-term (Intraday) | High | Stocks, Forex, Cryptocurrencies, Futures | Technical analysis, charts, patterns, momentum trading. |

| Swing Trading | Holding positions for a few days to weeks, capturing “swings” in the market. | Short to Medium-term | Moderate to High | Stocks, Forex, Cryptocurrencies, Commodities | Technical and fundamental analysis, trend identification, chart patterns. |

| Position Trading | Holding positions for weeks, months, or even years, based on long-term trends. | Medium to Long-term | Moderate to Low | Stocks, Forex, Commodities, Bonds | Fundamental analysis, economic factors, long-term trends. |

| Scalping | Making numerous small trades to capture minimal price changes; often in seconds or minutes. | Very Short-term | High | Forex, Cryptocurrencies | Technical analysis, fast execution, real-time market data. |

What to Consider Before Day Trading Crypto

Before you take the plunge and begin day trading crypto, there are certain things you must keep in mind. We won’t tell you the best crypto to buy, but these factors will help you make a good choice overall:

- Risk Tolerance: As day trading is considered riskier than other strategies, it probably isn’t the best tactic for risk-averse traders. It’s wise to assess your risk tolerance level before deciding whether to day trade.

- Investment Goals: Day trading can be ideal if you’re looking to generate market-beating returns – although these returns can only be achieved if you are skillful. Review your investment goals and decide whether day trading is the correct strategy to help you meet them.

- Market News: Due to day trading’s short-term nature, news events can cause volatility which may affect your position. Ensure you’re aware of these events and trading appropriately.

- Safety: Opting for a day trading platform with high security is essential.

- Available Time to Research: Day trading requires research and analysis, which may be tricky if you don’t have the time during the day.

Crypto Day Trading Signals

Crypto-day trading signals are trade ideas researched by experienced and knowledgeable traders, which are then passed on to other traders. These signals usually come in the form of a buy or sell trade idea, featuring the appropriate entry point, along with stop loss and take profit levels.

Crypto-day trading signals tend to require a subscription to a third-party provider. They are ideal for beginners or traders who do not have the necessary time to research the market for trade opportunities.

The best day trading signal providers will send the signals directly to your phone via email, text, or Telegram message. In terms of providers, our top two recommendations would be Learn2Trade and CryptoSignals.org:

- Learn2Trade – Free telegram group with three signals per week and an 82% success rate; VIP telegram group with 3-5 signals every day and an 82% success rate.

- CryptoSignals.org – Free telegram group with over 24,000 members and three signals per week; VIP telegram group with 2-3 signals every day and an 82% success rate.

Day Trading Crypto Tips

Finally, now that you understand what the best crypto day trading apps in Australia are, found below are five top tips to keep in mind when crypto day trading:

- Try a Crypto Day Trading Course – Numerous educational content providers offer day trading courses designed to improve the success of beginner traders. By utilizing these courses, you can significantly speed up your trading learning journey.

- Join a Day Trading Crypto Reddit Group – Reddit groups are a great way to get trade ideas and learn about the markets for free. However, be sure to do your own research on top of what you learn in the group.

- Use the Best App for Day Trading Crypto – By using one of the best day trading apps in Australia, you’ll be able to trade cost-effectively and benefit from helpful features such as price alerts and in-depth charting options.

- Conduct Extensive Technical Analysis – Use technical analysis to find support and resistance areas that can provide trade opportunities. You may also wish to employ indicators such as the MACD and Bollinger Bands.

- Optimize your Risk/Reward Ratio – Ideally, you’ll want to look for a risk/reward ratio of at least 1:2. However, never trade more than you can afford to lose, and always stick to your plan!

Best App for Day Trading Crypto Australia: Conclusion

To summarise, this guide has covered everything you need to know about the best crypto day trading apps in Australia, touching on their features and highlighting how to choose between them. By reviewing the list we presented earlier, you’ll have all the information you need to start day trading optimally today.

References

https://www.finra.org/investors/investing/investment-products/digital-assets

https://www.cnbc.com/select/coinbase-crypto-exchange-review/

https://www.bloomberg.com/cryptocurrencies-v2

https://www.ft.com/content/037d32e2-fc6e-48a2-bf05-9096fb740f85

https://www.forbes.com/advisor/au/investing/cryptocurrency/