Best Investment Apps Australia – Top App Revealed

Investing apps make it easy to put your money into the market while you’re on the go. That’s important since it makes it as convenient as possible to put away money for your future or to stay one step ahead of the market.

With the best investment apps Australia, you can pick out stocks and ETFs, trade forex, or build a diversified portfolio from anywhere. Many of these apps are just as comprehensive as a traditional desktop platform – and in some cases, even more so.

In this guide, we’ll take a closer look at the 6 best investment apps Australia to help you find the one that’s right for you.

-

-

Best Investment Apps in Australia

There are dozens of investment apps in Australia. They range from beginner-friendly robo-investing platforms to in-depth technical trading apps.

Here, we’ve rounded up the 6 best investment apps Australia for every type of trader and investor:

- eToro – Overall Best Investment App Australia

- Vantage Markets – International Investment App in Australia

- Trade Nation– Easy-to-use Investment App

- Pepperstone – World Popular Investment App

- Plus500 – Best Stock Investment App for Low-Cost Trades

Best Investing Apps Australia Reviewed

The top investment apps in Australia are all very different from one another. To find the one that’s right for you, let’s take an in-depth look at what each app offers. Whether you’re you’re looking for the best investment apps, the best share trading platforms for beginners or the top stock apps Australia, we’ve got you covered.

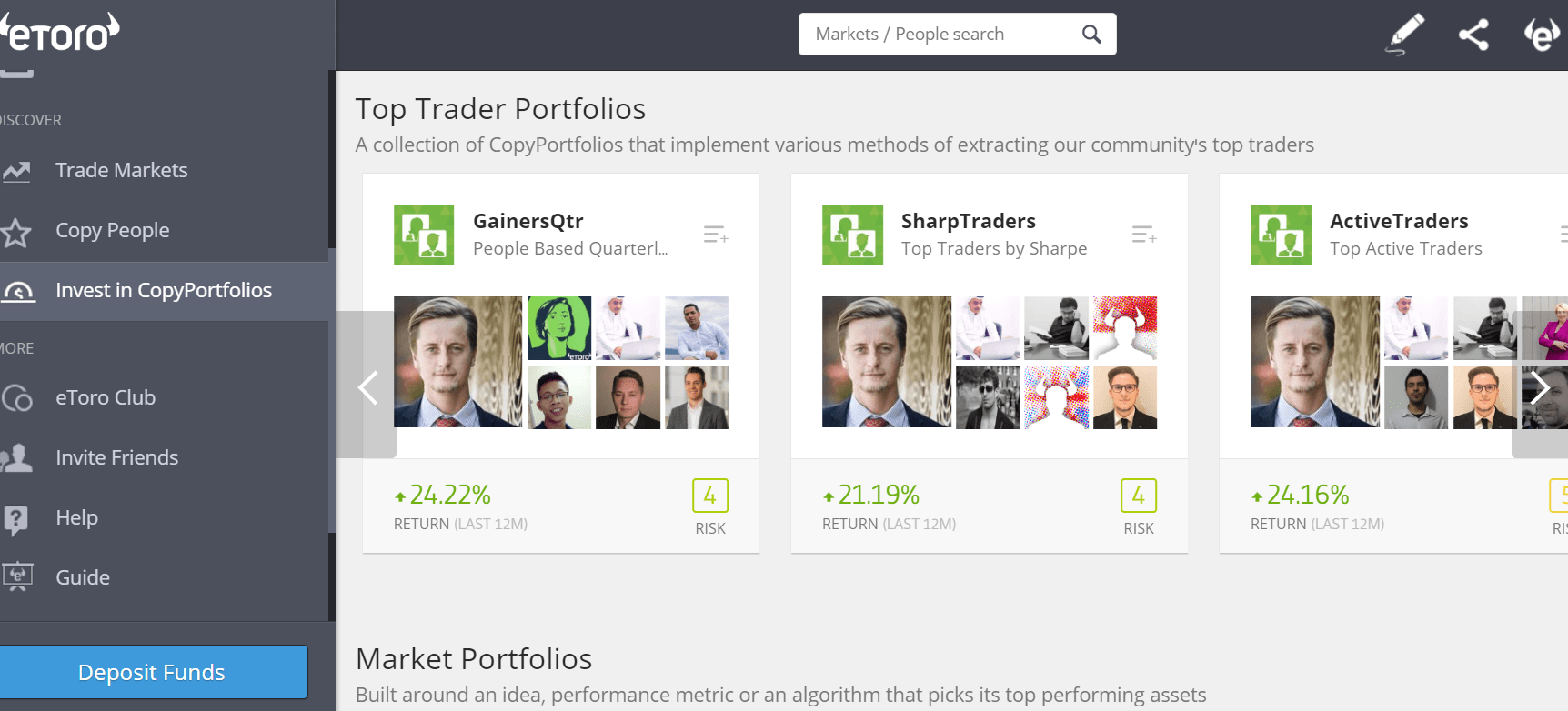

1. eToro – Overall Best Investment App Australia

The eToro app is our overall best investment app Australia. This versatile app offers trading on thousands of stocks from around the world, including over 800 from the US and hundreds more on the Australian stock market.

eToro also enables you to invest in more than just stocks.

The eToro app is available for iOS and Android devices and provides an excellent platform for long-term investors and short-term traders alike. It’s easy to sort through the thousands of securities being offered thanks to simple, customizable watchlists and a helpful search function.

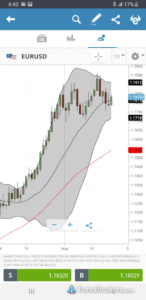

Short-term traders will find detailed technical charts that can be expanded to use your full screen. There’s also a simple drop-down menu that enables you to add and customize over 100 technical indicators.

For long-term investors, eToro offers research from professional stock analysts. You can see what analysts think a stock will be worth one year from now, as well as whether they rate it a buy, sell, or hold. The app also offers a simple breakdown of companies’ financial data so you can get a sense of how they stack up against competitors.

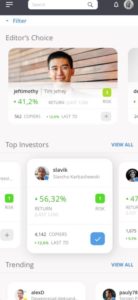

The eToro app also stands out for serving as a social network. You can follow other traders and copy their portfolios in just a few taps. This is an especially great way to build a specialized portfolio – say, one that focuses on renewable energy or AI companies.

eToro is regulated by the Australian Securities and Investments Commission (ASIC). The platform makes payments easy since it accepts credit or debit cards as well as PayPal, Neteller, and Skrill. Plus, customer support is available 24/5. It’s also one of the best crypto apps offering a crypto staking service, and direct access to 41 different cryptocurrencies.

Pros

- Thousands of global stocks

- User-friendly interface with full-screen charts

- Includes analyst research and fundamentals

- 24/5 customer support

Cons

- Doesn’t support Google Pay or Apple Pay

eToro AUS Capital Limited AFSL 491139. eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. See PDS and TMD

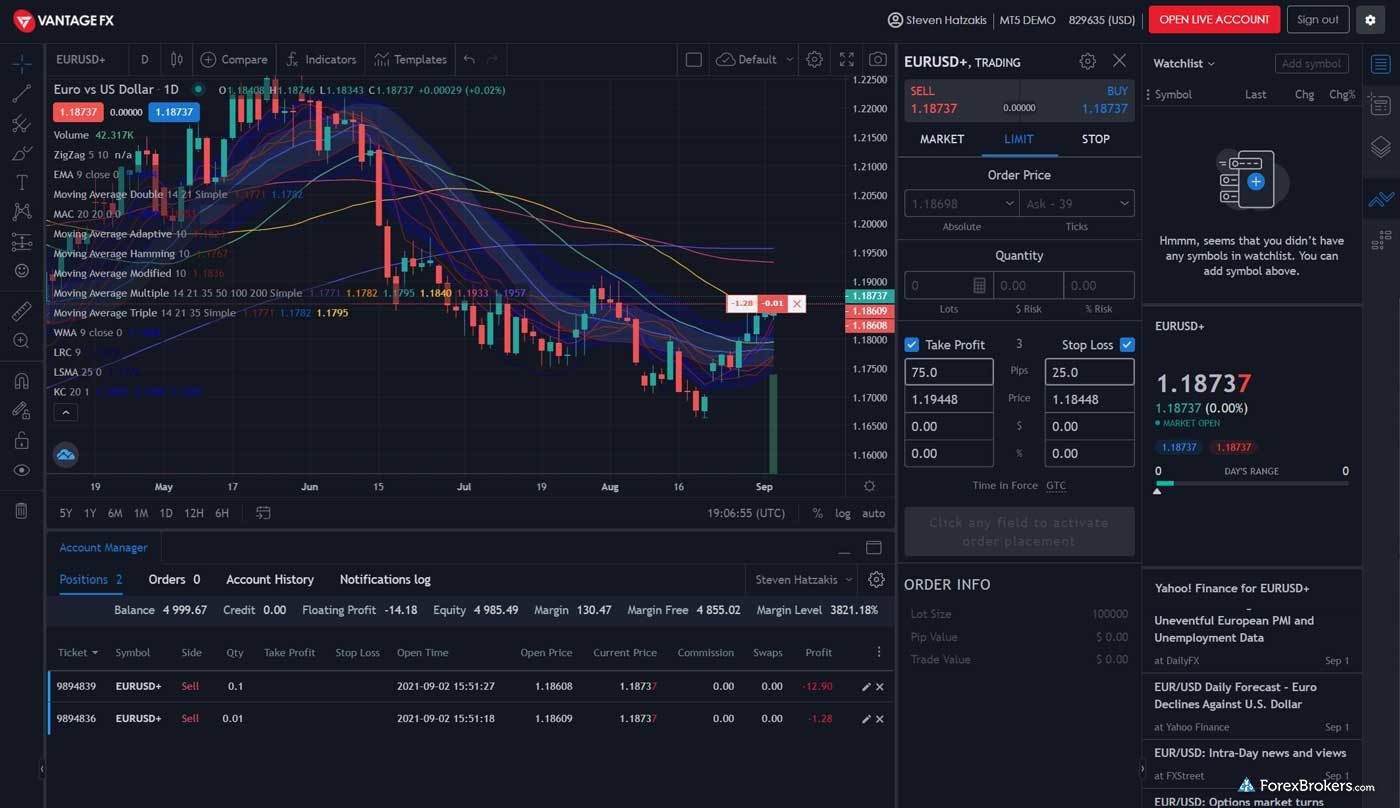

2. Vantage Markets – International Investment App in Australia

Trading conditions are offered by Vantage to retail clients worldwide in a transparent ECN/STP environment without dealing desk intervention since it was founded in 2009. More than 300 instruments are currently available across multiple asset classes, including foreign exchange, commodities, stocks, indices, metals, energy commodities, ETFs, CFDs, and cryptocurrencies.

An ECN broker obtains institutional-grade liquidity by utilizing top-tier liquidity providers (LPs), ensuring fast execution speeds on all trades and tight spreads that start at 0 pips, which are very similar to interbank spreads. There are some of the world’s largest institutions contributing liquidity to Vantage Markets’ deep institutional liquidity pool, including JP Morgan, HotSpot F.X., National Australia Bank (NAB), Citibank, BNP Paribas, HSBC, Royal Bank of Scotland (RBS), Credit Suisse, Goldman Sachs, Bank of America, UBS, and others.

Trading platforms include MetaTrader 4 (MT4), MetaTrader 5 (MT5), and various other trading platforms available for desktop, web, and mobile devices. Your account value determines whether you can leverage up to 1:500. A $200 minimum deposit is required, and you can deposit your funds in various ways.

With Vantage, brokers can stay up-to-date and competitive with the latest innovative technologies. Through a partnership with Equinix, the company offers a diverse network of fiber-optic-connected servers. Using fiber optic lines, they can guarantee minimal latency and 100 Gb/s bandwidth with low latency. In addition to servers in New York and London, the broker’s clients have access to ECN market liquidity directly on their platforms for fast execution.

Over 930,000 active clients worldwide are served by the company, founded in 2009. It now has over 1,000 employees in 30 global offices.

The company also uses oneZeroTM MT4 Bridge, a price aggregator connecting clients’ MT4 platforms directly to dark liquidity sources. A large number of market orders can be handled by the oneZeroTM MT4 Bridge system (up to 500,000 trades executed per millisecond). In addition, 150 unique price sources can be processed at high speed. With Intel Xeon® E7 processors and Turbo Boost technology, oneZero® MT4 Bridge is kept running at high speeds, ensuring 99.99% uptime, 3.2 GHz frequency, and the ability to process 18 cores simultaneously.

Pros

- Low non-trading commissions

- Opening an account is super-fast

- Processes for depositing and withdrawing funds are smooth

Cons

- The selection of products is limited

- There is room for improvement in customer service

- Only the U.K. offers investor protection

Your Money is at Risk.

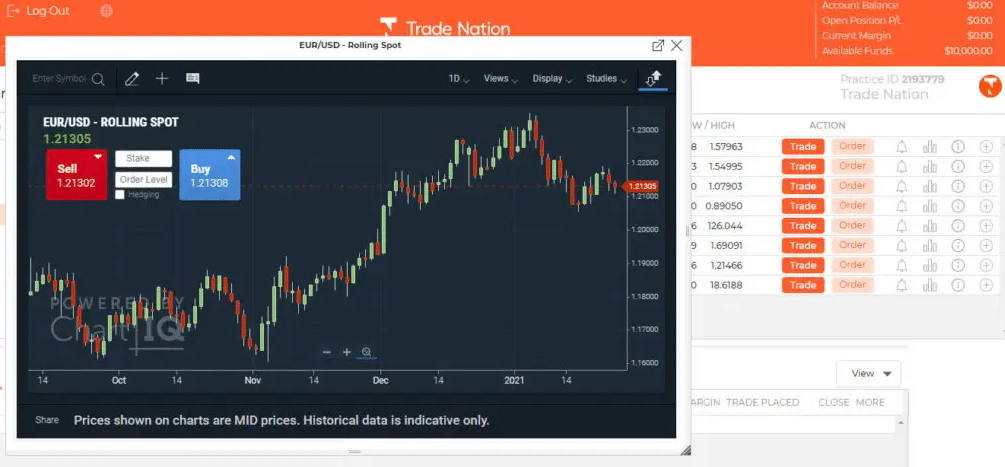

3. Trade Nation– Easy-to-use Investment App

Trading Nation is a multi-regulated broker with offices in South Africa, the United Kingdom, and Australia. It is regulated in South Africa (FSCA), the United Kingdom (FCA), Australia (ASIC) and the Bahamas (SCB). They strive to offer the best products, leverage, and customer trading experiences to attract clients worldwide.

The company has been known as Core Spreads since 2014, even though it was founded in 2020. As one of the most popular brokers, they offer fixed spreads and low trading costs.

The company’s brand values and business outlook are very important to them. The company’s mission and focus are a “client-first approach” and a “fresh approach to trading.”

MetaTrader 4 (MT4) will also be offered on the Trade Nation app and trading platform. Their proprietary platform offers a wide range of tradable assets with fixed spreads and guaranteed stops. You’ll find it extremely user-friendly if you’re familiar with MetaTrader 4. It is currently not possible to add your own indicators or E.A.s.

Pros

- An environment that is beginner-friendly

- Trading accounts are available in eight account base currencies to all traders

- Quality trading tools on a proprietary trading platform

- A balanced asset selection is essential for international traders

Cons

- There are a limited number of payment processors

Your Money is at Risk.

4. Pepperstone – World Popular Investment App

In 2010, Pepperstone launched its Pepperstone Group of companies, which offers spread betting and Forex services. The brand is regulated by the FCA, ASIC, CySEC, BaFIN, SCB (Bahamas), CMA (Kenya), and DFSA (Dubai).

Pepperstone clients can choose MT4, MT5, and cTrader, each with mobile, desktop, and web versions. The social trading network and TradingView charts are also integrated into cTrader. CTrader offers DupliTrade, while Pepperstone offers MirorTrader, RoboX, myFxbook, and RoboX for MetaTrader.

The company’s platform also supports algorithmic trading, news spike trading, scalping, and hedging. More than 1200 CFDs are available on the market in Forex, Indices, Stocks, Commodities, ETFs, Cryptocurrencies, and Currency Indices. You can open a virtual trading account for demo purposes.

The Smart Trader Tools offered by Pepperstone include MetaTrader, Autochartist, and Delkos add-ons. Market research is provided through written and video reports by an in-house team. Pepperstone offers pre-recorded educational content for traders of all levels.

Pros

- Brokers who are multi-regulated

- Reputation for excellence

- Trading can be conducted on a variety of platforms

- For technical solutions, platforms and tools are great

- There are low spreads

- A competitive environment for trading

Cons

- Only CFDs and Forex are available

- There is no 24/7 support available

- There is a 30-day expiration date on Demo Accounts

Your Money is at Risk.

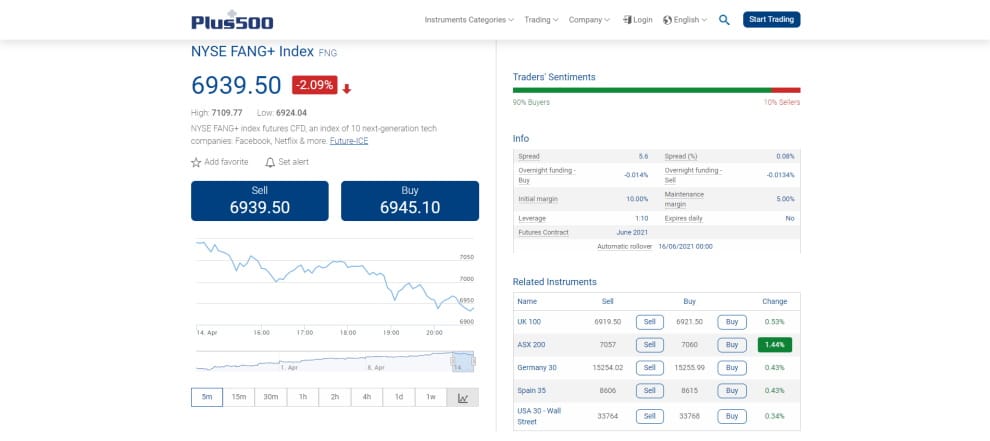

5. Plus500 – Best Stock Investment App for Low-Cost Trades

Plus500 offers CFDs on cryptocurrencies, commodities, currencies, indices, stocks, ETFs, and other assets and securities. You can speculate on the movements of assets’ values using CFDs, which allow you to do so without owning them. Unlike other trading options, cryptocurrency trading offers leverage (although at a much lower level). Using leverage to trade cryptocurrencies can maximize your profits but also result in greater losses if the market moves against you.

Therefore, Plus500 does not allow you to buy cryptocurrencies; you must use a cryptocurrency exchange or broker to buy them. Trades related to coin value changes can be executed rapidly using the platform. You can capitalize on the market by using several techniques and tools described below.

Plus500 offers live chat and email support 24/7. Multiple languages are available for email support, so you can choose the one that suits you best. If live chat is unavailable, you can still contact them via their ‘Contact Us’ form. In case you need a faster response than email, you’ll have to use Plus500’s live chat.

If considering using Plus500’s services, you should explore their demo account first. The platform system can be practiced without any risk of losing money. The simulator lets you learn about CFDs traded on Plus500 and experiment with trading in a simulated environment.

Pros

- A total of 2,800 CFDs are available

- A user-friendly and functional platform

- FCA-regulated (UK)

- Stop-loss guaranteed orders

- The use of robust risk management tools

Cons

- Customer service is lacking

- CFD trading is not available to U.S. clients

- The trading platform cannot be paired with other trading tools or platforms

Your Money is at Risk.

How to Choose the Best Investment Apps Australia for You

As you’ve seen from our list of the best investment apps Australia, these apps are tailored to many different types of investors. So, how do you choose the app that’s right for you?

Let’s take a closer look at some of the key factors to consider when choosing an investment app.

Regulation

Regulation may not be the most exciting thing to think about when picking an investment app, but it is one of the most important factors you should consider. Regulated brokers have to follow strict rules to keep your money safe and to ensure that you’re getting fair trades with no funny business when it comes to pricing.

Most of the best investing apps Australia are regulated by the Australian Securities and Investment Commission (ASIC), which is the country’s top financial watchdog. ASIC is recognized around the world as one of the toughest financial regulators, so you can generally trust an ASIC-regulated broker.

Some investment apps that operate in Australia are regulated by other countries’ financial watchdogs. That’s not a problem as long as the regulators are known to be reliable. Any apps operating in Australia still have to follow many of the rules set by ASIC.

User experience

Investing apps offer a lot of tools to help you manage your money and spot opportunities. But for all of those tools to be useful, the app needs to organize them in a way that provides an excellent user experience.

Many traditional brokers in Australia focus on their web or desktop platforms at the expense of their mobile apps. That’s a big reason why all 6 of our top-rated investment apps are relative newcomers – brokers that understand what users need from a mobile experience and are able to combine that with powerful investing tools.

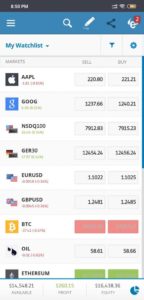

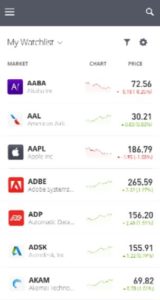

To make sure you’re getting a strong mobile user experience, look for features like full-screen technical charts and lists of securities that you can scroll through. It’s also helpful to have the ability to tag assets as favorites or add them to a watchlist in just a few taps.

Another thing to consider is the overall layout of the app. We typically prefer apps that have an always-accessible search bar, as well as tabs that enable you to quickly move between your current portfolio, charts, research, and watchlists.

Tradable assets

What assets are available to trade is another major consideration when choosing an investment app. Ultimately, what assets you need comes down to your investing goals.

Most investors will want access to stocks and ETFs. All of the apps we reviewed provide this, and most offer a selection of thousands of shares from around the world. However, not every app offers a huge selection of ETFs – some offer just a few dozen funds, while others, like eToro, offer hundreds.

It’s also important to consider whether you want to build your own portfolio or invest in one that’s ready-made for you. Raiz offers a selection of 6 pre-made portfolios, while eToro enables you to copy the portfolios of professional traders on its massive social network.

If you want to branch out beyond stocks and funds, look for trading in forex, commodities, stock indices, and cryptocurrencies. Many of the investment apps we reviewed offer these assets.

Fees

Fees are a major concern with any investment app. Typically, brokers make money through one of two fees: commissions or spreads.

Commissions are fixed fees that you’re charged every time you make a trade. Spreads are variable percentage fees that are baked into the buy and sell prices of securities.

Which type of fee is more expensive comes down to how much you trade and how much these fees cost. In general, 0% commission investment apps with low spreads are cheaper for most investors.

Some investment apps also charge account fees. For example, you might face a monthly account management fee, like with Raiz. You might also be charged an inactivity fee if you don’t log into your account or place a trade for several months. These inactivity fees can be easy to avoid as long as you remember them.

Trading tools & features

The trading tools that each investment app offers can vary widely. In apps focused on helping you build your own portfolio, look for in-depth technical charts that you can use to spot setups and price trends. Watchlists are also extremely helpful, since you can keep an eye on companies you like and purchase them during a price dip.

It’s also a good idea to look for professional analyst research, which can help you figure out what ‘smart money’ thinks about a particular asset. Many apps also offer a market sentiment indicator, which shows you whether other investors using the app are net buying or net selling an asset.

Another helpful feature to look for is recurring investments, which enables you to automatically transfer money for investment at daily, weekly, or monthly intervals. This ensures that you’re consistently saving money to invest.

One thing that most investment apps in Australia don’t offer, but we’d like to see more of, is portfolio analysis tools. Selfwealth offers a portfolio performance comparison feature, but it doesn’t give insight into whether your portfolio is fully diversified.

Payment methods

Before you sign up for an investment app, check to see what payment methods the app allows to fund your account. Nearly all brokers will accept bank transfers, but those aren’t always the most convenient way to pay.

Instead, look for mobile-friendly methods like Apple Pay and Google Pay. If you use e-wallets like PayPal, also check whether your broker accepts payment from these online services. Some brokers even accept debit or credit cards for payment.

Customer service

If you ever need help with your investment account, it’s nice to know that customer service is readily available. Be sure to check the hours of your app’s customer service team – some brokers offer 24/5 or 24/7 customer support, while others have limited business hours.

In addition, consider the options you have for getting in touch. Can you call or get connected immediately through live chat, or do you have to send an email and wait days for a response? If a broker offers live chat, make sure it’s accessible from within the mobile app.

How to Download the Best Investment App Australia & Start Trading

Ready to start trading with the best Aussie investment app? We’ll show you how to get started with eToro, which offers multi-asset trading with powerful trading tools, and a seamless mobile experience.

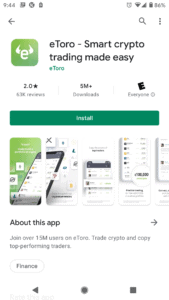

1. Download the eToro App

To begin, open the Google Play store or Apple App Store on your smartphone and search for ‘eToro.’ Download and install the app onto your device.

2. Sign Up

Next, register for a new eToro account. Open the eToro app and tap ‘Join Now.’ Then enter a new username and password and click ‘Create Account.’ Alternatively, you can sign in to eToro using your Google or Facebook accounts.

Before you can start trading, you’ll need to verify your identity. Snap a photo of the picture page of your passport or your driver’s license and upload it to the app. You’ll also need to take a photo of a recent utility bill that shows your address.

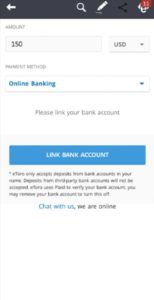

3. Deposit Funds

The next step is to fund your investment account. You can pay by debit or credit card, PayPal, Neteller, Skrill, or bank transfer. Note that eToro does not support Google Pay or Apple Pay at this time.

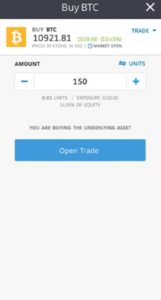

4. Start Trading

Head to your account dashboard and browse assets, or search for a specific stock or security by tapping the magnifying glass at the top of the screen. When you find the asset you want to trade, tap on it and then tap ‘Trade.’

That will open a new order form, where you can enter the details of your trade.

When you’re ready, click ‘Open Trade’ to make your first investment with eToro.

Best Investment Apps Australia – Conclusion

The top investment apps offer an excellent mobile user experience, trading tools that are just as powerful as what you’d get on a desktop platform, and a huge range of assets to trade.

Ready to start trading with the best investment app Australia? Click the link below to sign up for eToro today!

eToro – Overall Best Investment App Australia

eToro AUS Capital Limited AFSL 491139. eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. See PDS and TMD

FAQs

Do the best investment apps Australia charge a monthly account fee?

Most investment apps in Australia do not charge a monthly fee. However, watch out for account-based management fees (like at Ruiz) or inactivity fees (like at Plus500 and eToro).

Can I contribute to my superannuation account through an investment app?

Ruiz (formerly Acorns) allows you to manage an existing superannuation account. However, none of the other investment apps we reviewed support superannuation accounts.

Can I invest in US stocks with an investment app?

All of the best investing apps Australia we reviewed allow you to invest in both ASX-listed and US shares.

What is ASIC?

ASIC is the Australian Securities and Investments Commission. This agency is the top financial regulator in Australia and sets the rules that investment apps must follow.

Can I invest in mutual funds with an investment app?

Most Australian investment apps allow you to invest in ETFs, not mutual funds. ETFs offer the same level of diversification and work similarly to mutual funds, but they are typically much cheaper to invest in.

Kane Pepi

Kane Pepi

Kane Pepi is a British researcher and writer that specializes in finance, financial crime, and blockchain technology. Now based in Malta, Kane writes for a number of platforms in the online domain. In particular, Kane is skilled at explaining complex financial subjects in a user-friendly manner. Kane has also written for websites such as MoneyCheck, the Motley Fool, InsideBitcoins, Blockonomi, Learnbonds, and the Malta Association of Compliance Officers.View all posts by Kane Pepi

stockapps.com has no intention that any of the information it provides is used for illegal purposes. It is your own personal responsibility to make sure that all age and other relevant requirements are adhered to before registering with a trading, investing or betting operator. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice.By continuing to use this website you agree to our terms and conditions and privacy policy.

© stockapps.com All Rights Reserved 2024We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.OkScroll Up