ANZ App Review – Pros and Cons Revealed

Looking for a stock app in Australia? ANZ is one of the biggest brokers in Australia and offers access to more than 2,000 shares on the Australian Stock Exchange. In addition, ANZ lets you trade thousands of international shares, ETFs, and options.

However, ANZ has very high fees and the broker’s mobile app offers almost no features for stock trading.

So, is ANZ right for you? In our ANZ app review, we’ll cover everything you need to know about this Australian brokerage.

-

-

What is ANZ?

In addition to a wide range of banking services, ANZ has a share trading platform. You can trade virtually all companies on the Australian Stock Exchange (ASX) in addition to thousands of shares on the New York, London, Tokyo, and Hong Kong Stock Exchanges. ANZ also supports ETF trading and stock options trading.

What sets ANZ apart is that it offers different trading platforms for different types of traders. Long-term investors can take advantage of ANZ’s Standard trading platform, which offers charting, market news, watchlists, and more. Active traders can use the Pro trading platform, which includes dynamic stock data, quantitative analysis from Morningstar, and other advanced features.

It’s important to note that ANZ’s mobile trading features are very limited. The ANZ mobile app is designed primarily for banking. You can connect your investment account to monitor your balance and transfer money to or from other ANZ accounts. However, you can’t view technical charts or place trades using the ANZ mobile app.

What Stocks Can You Trade on the ANZ App?

The ANZ Australian stock market app offers thousands of stocks from around the world. The company has a major focus on Australia and gives you access to the more than 2,000 stocks trading on the ASX. ANZ also offers its account holders early access to new IPOs on the ASX.

If you want to trade international stocks, you have a lot of options. ANZ carries shares from the NYSE and NASDAQ in the US as well as from the London, Hong Kong, Tokyo, and Singapore Stock Exchanges. In all, ANZ has nearly 20 different markets to choose from.

Active traders will be happy to find that ANZ offers not just stocks, but also stock options. These are primarily available for Australian companies, although you can find US and international stock options as well. You have flexibility to write call and put options in addition to purchasing options.

ETFs and Index Funds

ANZ also offers two types of funds: ETFs and mFunds.

ETFs (exchange-traded funds) are available from the ASX as well as any of the international markets to which ANZ provides access. The only unusual thing about trading ETFs with ANZ is that the broker requires you to invest a minimum of $500 AUD per ETF.

mFunds are professionally managed funds available only to ANZ clients. They are essentially mutual funds built by ANZ. The minimum investment you must make in an mFund varies by fund, and these can have management fees of up to several percent.

ANZ Account Types

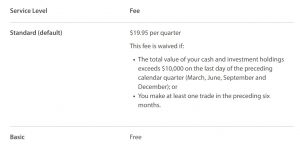

All investments with ANZ take place inside an ANZ Share Investing Account, which is distinct from the company’s many banking accounts. However, within the Share Investing Account, you can choose between two different service levels.

The Basic service level is free, but only offers delayed market data. So it may work for some long-term investors, but is not suitable for active traders who depend on real-time stock prices.

The Standard service level costs $19.95 AUD per quarter and upgrades you to real-time market data across ANZ’s platforms. Notably, the fee is waived if you have at least $10,000 AUD in assets with ANZ or if you make at least one trade every 6 months. So, the $19.95 fee is more similar to an inactivity fee than to a quarterly account fee.

ANZ also gives traders an option between Standard and Pro trading platforms. The free Standard platform includes all the tools that most long-term investors will need. You can set up watchlists and alerts, discover new investments with a global stock screener, and access ASX announcements and sector analysis. The Standard platform also includes conditional orders and basic stock price charts.

The Pro platform costs $49.95 AUD per month, although this fee is waived if you place at least 5 trades in the month. This platform adds features that are critical for active trading, such as multi-monitor support, the ability to create custom trading layouts, and a professional charting package with dozens of technical indicators and drawing tools. The Pro platform also comes with an advanced market news feed from Reuters and quantitative research from Morningstar, the widely renowned market analysis firm.

ANZ Fees & Commissions

While it’s possible to use ANZ’s platform for free, the vast majority of traders will want a Standard account and the Pro trading platform. If you’re able to make 5 trades per month, this account setup will still be free. However, if you only trade rarely or have an account balance under $10,000, you’ll pay $49.95 AUD per month for the Pro platform and $19.95 AUD per quarter for real-time market data.

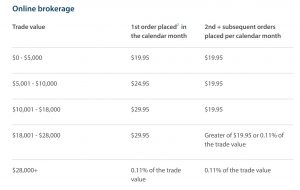

In addition, ANZ charges lofty commissions. Trading Australian shares or ETFs costs $19.95 to $29.95 AUD for your first trade of each month (depending on the size of the trade), and $19.95 AUD for each trade after that. Notably, this is more expensive than trading Australian shares with Westpac, another ‘big four’ Australian bank and brokerage, and pricier than many online-only brokers.

For international share and ETF trades, you’ll pay $59 AUD per trade for trades up to $10,000 and 0.59% of the trader value for trades greater than $10,000. mFund investments cost $29.95 AUD per trade.

Options trades also carry a lot of commissions. Buying or selling options costs $34.95 per leg of your trade, and you’ll face an additional $19.95 fee if you choose to exercise options.

All of these fees make ANZ very expensive for the average trader. There aren’t any options for reducing or eliminating your trade commissions at this time.

ANZ App User Experience

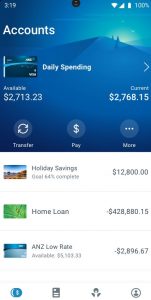

The ANZ mobile app is available for iOS and Android. It’s most helpful if you have not just a Share Investing Account with ANZ, but also bank accounts and credit or debit cards. The app is laid out so that you can easily monitor your balances across all of your accounts and move money between them.

We found the ANZ app easy to use, but we were disappointed with its trading capabilities. The app has almost none of the features or analysis tools that the ANZ desktop platforms offer, so it’s not all that useful for trading and investing.

ANZ App Tools

The ANZ app for iOS and Android is less focused on trading and more focused on banking. ANZ doesn’t offer a dedicated app for share investing – the only app available is the same one that ANZ banking clients are encouraged to use.

As a result, the utility of the app for trading and investing is extremely limited. You can view your investment account balance, but not your current profit/loss, unrealized gains, or open stock positions. There is also no way to research stocks or ETFs through the app or to access any of the features of the desktop trading platforms, such as technical charts or market news feeds.

The main function of the app as far as traders are concerned is that it enables you to transfer money from any ANZ bank accounts you have into your investment account or vice versa.

ANZ App Education

The ANZ app also doesn’t offer any educational resources for traders. The ANZ website is also relatively light on educational resources, although you will find some short articles explaining the different types of assets that ANZ offers.

ANZ App Bonus

ANZ does not offer a sign-up bonus for new investors at this time. There are also no incentives to open an ANZ Share Investing Account if you’re already an ANZ banking client.

ANZ App Demo Account

Neither the ANZ mobile app nor the desktop platforms offer a demo trading account. ANZ’s fee structure and investment minimums for ETFs and mFunds also mean that it’s difficult to get started with this brokerage without taking on a significant amount of financial risk.

Payments on the ANZ App

ANZ accepts payment by bank transfer only. You can easily transfer funds to your account from another ANZ bank account using the mobile app. If you want to transfer funds from an external bank account, you’ll need to use the web interface.

ANZ Contact and Customer Service

ANZ offers customer service by phone and email from Monday to Friday, 8 am to 8 pm (Sydney time). You can also get help with a Share Investing Account at a local branch, of which there are more than 1,200 throughout Australia, New Zealand, the US, UK, and Europe.

Is ANZ Safe?

ANZ is one of the ‘big four’ investment banks in Australia. As such, it is considered extremely trustworthy and is under a lot of scrutiny by regulators in Australia and around the world.

The bank’s trading division is specifically regulated by the Australian Securities and Investment Commission (ASIC). ANZ is also publicly traded on the ASX and releases quarterly financial reports.

How to Use the ANZ App

The ANZ app is available in Google Play and the Apple App Store. However, in order to set up a new Share Investing Account with ANZ, you’ll need to visit the bank’s website. Let’s take a closer look at how to invest with ANZ and use the ANZ app.

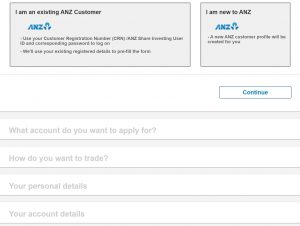

1. Open an Account

Visit ANZ’s share investing website to open a new Share Investing Account. You can open a trading account regardless of whether you’re already an ANZ client or not. Just click ‘Apply Now’ and enter your information.

2. Verify Your Identity

Before ANZ will complete your account setup, you need to verify your identity in accordance with Australian financial regulations. You can complete this step by uploading a copy of your driver’s license or passport along with a bank statement or utility bill that shows your current address.

3. Connect the ANZ App

Now you’re ready to use the ANZ app. Download the app from the Apple App Store or from Google Play and log in using your ANZ credentials. You’ll then be able to see your Share Investing Account as well as any other accounts you have with ANZ.

You can transfer funds into your trading account using the app. However, if you want to buy shares, you’ll need to log into the ANZ trading platform on your desktop or through your phone’s web browser.

How to Sell on ANZ App

Unfortunately, there is no way to sell stocks or funds using the ANZ mobile app. In order to sell shares, you’ll need to log into the ANZ trading platform on your desktop or your phone’s web browser. Once in the trading platform, you can see what shares you own and set up a sell order easily.

ANZ vs eToro

If you’re looking for a mobile stock trading solution, ANZ isn’t one of the best options available. The mobile app is geared towards banking and doesn’t allow you to buy or sell shares on the go, let alone analyze your investments.

For the majority of Australian traders, eToro has more to offer. This stock broker has a mobile trading app that includes advanced technical charts, a social trading network, and dozens of other advanced features. On mobile, you can simply turn your phone sideways to access full-screen technical charts with over 100 built-in indicators. Or you can search stocks and instantly see what professional market analysts think about their prospects.

The mobile app isn’t the only way in which eToro is better than ANZ for traders, either. eToro offers low-cost share dealing. Although you’ll pay a small spread for your trades, it’s typically around 0.3% of your trade’s value. That’s a fraction of the flat $19.95 AUD commission that ANZ charges for share trades.

Charge per Trade Annual Fee Inactivity Fee Deposit/Withdrawal Fees ANZ $19.95 to $59 $0 to $679 $0 £0 eToro N/A $0 $10 per month (after one year) $5 per withdrawal To be fair, eToro doesn’t have quite the same breadth of Australian shares as ANZ. However, it has over 800 stocks and 450 ETFs from the US, UK, Australia, and elsewhere, so most investors won’t find themselves short on companies or funds to trade. In addition, eToro offers cryptocurrency trading, so you can build a much more diversified portfolio than is possible through ANZ.

ANZ Stock App Pros & Cons

Pros

- Trade the entire ASX

- 19 international stock markets

- Access to Australian IPOs

- Invest in professionally managed mFunds

- Simple mobile transfers through the app

- Regulated by ASIC and widely trusted

Cons

- Very expensive commissions

- Only accepts bank transfers

- Mobile app doesn’t allow trading or analysis

- Real-time price data costs extra

- Advanced trading platform costs extra

The Verdict

While some Australian traders will find things to like about ANZ, this broker’s stock app falls well short of the mark. ANZ charges exorbitant trading commissions along with expensive monthly and quarterly fees for basic things like real-time price data. There are few incentives to come to ANZ, too, since the broker doesn’t offer a sign-up bonus or discounts for existing banking clients.

The most significant issue with ANZ is that the company’s mobile app doesn’t support stock trading. You can view the balance in your investing account, but you cannot actually buy or sell stocks from the app nor access technical charts, news feeds, or other analysis tools. ANZ may be a giant in banking, but it has a long way to go if it wants to compete as an online broker.

Instead of ANZ, we recommend that Australian traders take a look at eToro. The eToro mobile app is extremely user-friendly and supports advanced features like full-screen charting, push alerts, and a global social trading network.

Ready to start trading with eToro? Click the link below to sign up for an account today!

eToro AUS Capital Limited AFSL 491139. eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. See PDS and TMD

FAQs

Does ANZ require a minimum deposit to open a trading account?

ANZ doesn’t require any minimum deposit to open a Share Investing Account.

Can US traders open a trading account with ANZ?

No, ANZ only offers the Share Investing Account to Australian residents.

How do I deposit funds into an ANZ trading account?

You can deposit funds to an ANZ trading account by bank transfer only. You may transfer funds from a connected ANZ bank account or an external bank account.

Can I trade stocks with the ANZ mobile app?

The ANZ mobile app does not allow you to trade stocks. You must use the web platform to make trades. The mobile app only enables you to view your current investment account balance.

Is ANZ a regulated stock broker?

Yes, ANZ is regulated by the Australian Securities and Investment Commission (ASIC).

Kane Pepi

Kane Pepi

Kane Pepi is a British researcher and writer that specializes in finance, financial crime, and blockchain technology. Now based in Malta, Kane writes for a number of platforms in the online domain. In particular, Kane is skilled at explaining complex financial subjects in a user-friendly manner. Kane has also written for websites such as MoneyCheck, the Motley Fool, InsideBitcoins, Blockonomi, Learnbonds, and the Malta Association of Compliance Officers.View all posts by Kane Pepistockapps.com has no intention that any of the information it provides is used for illegal purposes. It is your own personal responsibility to make sure that all age and other relevant requirements are adhered to before registering with a trading, investing or betting operator. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice.By continuing to use this website you agree to our terms and conditions and privacy policy.

© stockapps.com All Rights Reserved 2024Scroll Up