Best Micro-Investing Apps Australia – Top Apps for Beginners Revealed

Micro investing apps are getting more and more popular with Australians who wish to access the financial markets with small stakes. Not only does this allow the average Joe to invest on a tight budget, but it also enables you to create a highly diversified portfolio of assets with ease.

If you’re interested in finding the best micro investing apps in Australia, this page reviews the top providers to consider in 2025.

-

- 1. eToro – Overall Best Micro Investing App Australia

- 2. Vantage Markets – International Micro Investing App in Australia

- 3. Trade Nation– Easy-to-use Micro Investing App

- 4. Pepperstone – World Popular Micro Investing App

- 5. Plus500 – Best Micro Investing App for Low-Cost Trades

- 6. Pearler – Passive Micro Investing App in Australia

- 7. Raiz – User-Friendly Micro Investing App

-

-

- 1. eToro – Overall Best Micro Investing App Australia

- 2. Vantage Markets – International Micro Investing App in Australia

- 3. Trade Nation– Easy-to-use Micro Investing App

- 4. Pepperstone – World Popular Micro Investing App

- 5. Plus500 – Best Micro Investing App for Low-Cost Trades

- 6. Pearler – Passive Micro Investing App in Australia

- 7. Raiz – User-Friendly Micro Investing App

-

Key Points on Stock Apps in Australia

- The best micro investing apps let you deposit and invest small amounts of money directly into your trading account.

- Trading platforms that provide micro investing apps make online trading more accessible for beginner traders.

eToro AUS Capital Limited AFSL 491139. eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. See PDS and TMD

Top Micro Investing Apps 2025

Don’t have time to read our guide in full and want to get started with the best micro investing apps Australia right now? Check out the list below to see which providers stand out from the crowd!

- eToro – Overall Best Micro Investing App Australia

- Vantage Markets – International Micro Investing App in Australia

- Trade Nation– Easy-to-use Micro Investing App

- Pepperstone –World Popular Micro Investing App

- Plus500 – Best Micro Investing App for Low-Cost Trades

- Pearler – Passive Micro Investing App in Australia

- Raiz – User-Friendly Micro Investing App

You can scroll down to read a full review of each micro-investing app that made the cut.

Best Online Micro Investing Apps Reviewed

In choosing a micro investing app, your main priority is likely to be a provider that allows you to invest with small amounts. However, there are many other metrics that need to be considered too and possibly questions on your mind.

For example, how safe is the micro investing app, and does it support your preferred financial market? Do we have some of the best CFD trading apps on this list? How do I get started on micro investing?

To help clear the mist and answer your questions, below we review the best micro-investing apps Australia in 2025.

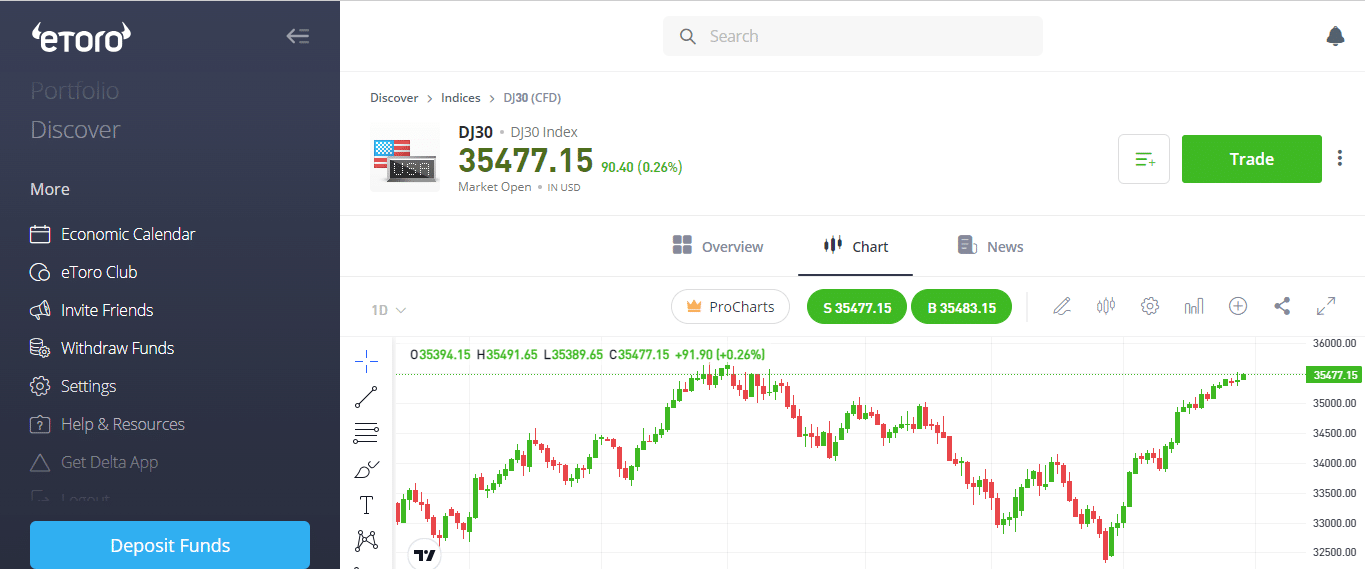

1. eToro – Overall Best Micro Investing App Australia

In reviewing dozens of providers, we found that the best micro investing app Australia is eToro, and in this detailed review, you’ll get to know why etoro is one of the best crypto apps to use in 2025.

This top-rated Australian stock app supports fractional ownership on all of its supported markets. In simple terms, this means that you no longer need to buy a full stock, cryptocurrency, or ETF.

On the contrary, Australians can now purchase just a ‘fraction’ of one asset.

This is particularly useful if you’re interested in tech stocks like Tesla, Amazon, or Google – many of which run into the thousands of dollars per stock. Instead, it’s just the spread that needs to be taking into account – which is the difference between the bid and ask price of your chosen asset. Did you know that eToro is one of the best share trading platforms Australia?

Read our in-depth guide for more details.

You can easily get started with this top-rated trading app by depositing funds with an Australian debit card, credit card, e-wallet, or bank transfer.

Still not convinced about the eToro investment app? Read our comprehensive eToro app review to find out more about what this app offers

Pros:

- Trusted brand with over 17 million client accounts worldwide

- Social and copy trading

- 2,400+ stocks listed on multiple international markets

- Personalised eToro account where you can set up trading price alerts

Cons

- Not suitable to perform technical analysis with indicators like the MACD

eToro AUS Capital Limited AFSL 491139. eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. See PDS and TMD

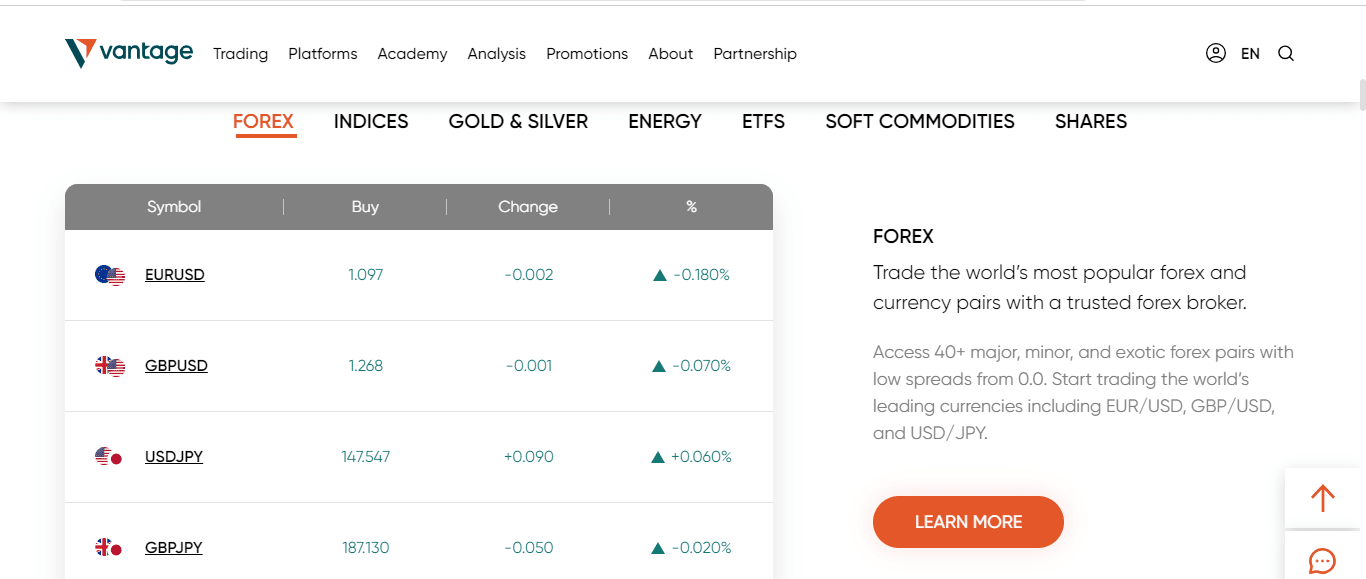

2. Vantage Markets – International Micro Investing App in Australia

Vantage International Group Limited oversees Vantage F.X., which was founded in 2009. The broker offers various financial instruments such as currency pairs, indices, energy, soft commodities, precious metals, cryptocurrencies, and stocks.

They are all regulated by the Cayman Islands Monetary Authority (CIMA). Over 130,000 active customer accounts are currently hosted within this online trading ecosystem.

While the minimum deposit for trading is high at $200, the broker charges no deposit fees, allowing customers to maximize their account balances. Various deposit methods are accepted for credit cards, debit cards, bank transfers, PayPal, Skrill, Union Pay, Neteller, SticPay, and BitWallet. Leverage can go up to 500:1, which is another attractive value proposition beyond funding.

Clients who fund their accounts with over $1,000 can access Vantage F.X.’s PRO Trader tools. More than 35,000 assets are tradable worldwide through these tools. Additionally, users have access to a premium economic calendar. Segregated accounts are also used to ensure the safety of all client funds.

Pros:

- Tools and services that add value to trading

- Spreads and commissions are very tight

- An intuitive mobile app with a wide range of features

- It is possible to invest in a variety of asset classes

- Discounts and incentives are generous

Cons

Initial deposits are higher

Your Money is at Risk.

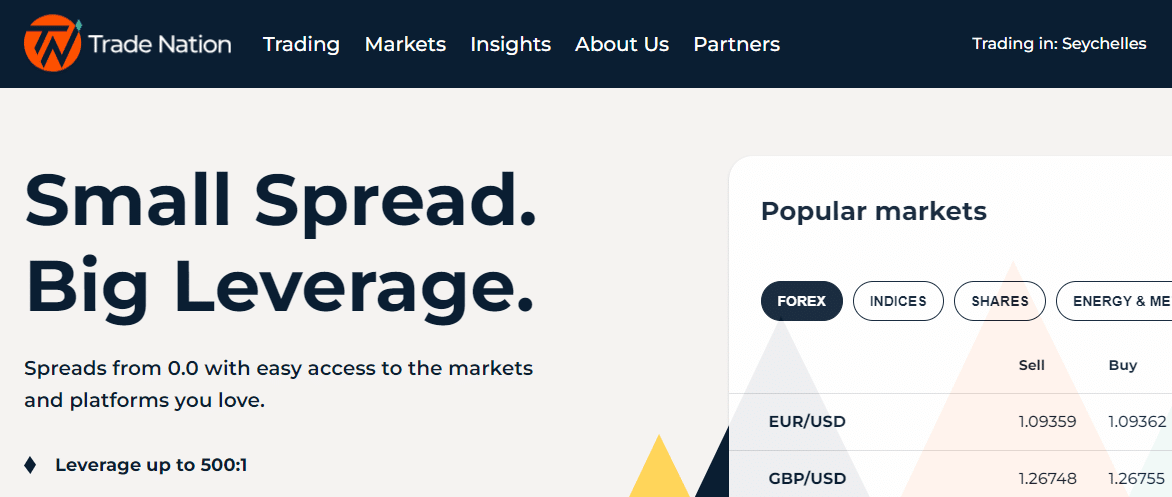

3. Trade Nation– Easy-to-use Micro Investing App

As a Forex and CFD trading broker, Trade Nation was established in 2014 under the name Core Spreads. The company’s name was changed to Trade Nation in 2019, offering commodities, metals, commodities, stocks, and bonds along with Forex, CFDs, indices, and indices.

In addition to offering services around the world, the broker operates local entities in the U.K., Australia, South Africa, and the Bahamas. Trade Nation provides comprehensive financial solutions to a wide range of clients worldwide.

Pros:

- A fully regulated brokerage

- Licenses and oversight are provided by ASIC and FCA

- Withdrawals and deposits are free

- Fixed spreads

- MT4 trading platform

- It is not necessary to make a minimum deposit

Cons

- In terms of trading proposals and conditions, regulations vary

- A 24/7 support service is not available

- Offshore entities

Your Money is at Risk.

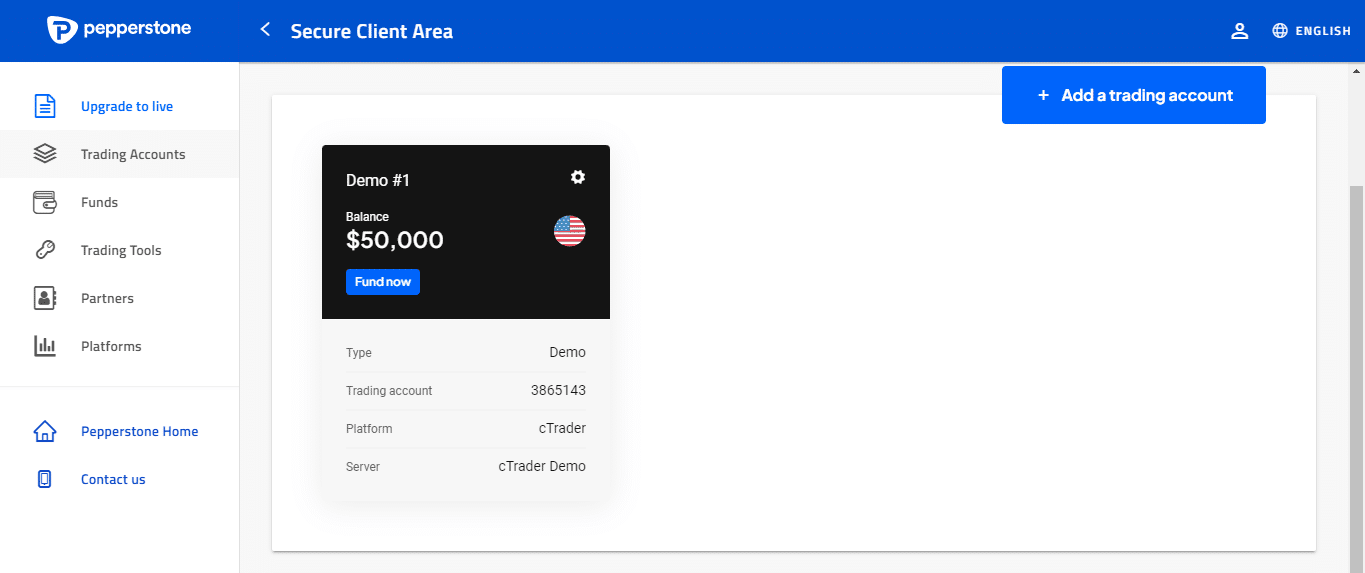

4. Pepperstone – World Popular Micro Investing App

Among Pepperstone’s products are Forex and CFDs. It was founded in 2010 and enjoys a good reputation in Australia.

A pure intermediary, it does not have a dealing desk and operates based on a NDD/STP model. There are no conflicts of interest between brokers and their clients (as with market makers) since brokers do not act as counterparties for trades placed by traders.

Pepperstone is regulated by the FCA of the UK, CySEC of Cyprus, and ASIC of Australia, among others. The trading platform supports various financial instruments, such as Forex currency pairs, cryptocurrencies, stock indices, precious metals, and energy contracts.

In addition, Pepperstone has relatively low spreads and does not restrict trading strategies (scalping, hedging, E.A.s, etc.).

Depending on your account type, you can use Metatrader (Pepperstone offers Metatrader 4 and Metatrader 5) or Trading View (the most basic account). The platform is widely known and popular among traders all over the world.

Pros:

- Opening an account is easy and quick

- The spreads and commissions are low

- It is not necessary to make a minimum deposit

- There are no inactivity fees

Cons

- There are a limited number of assets that can be traded

- There are no CFDs available on European stocks

- It is not suitable for investment over the long term

Trading CFDs and FX carries significant risk and is not suitable for everyone. You have no interest in the underlying asset.

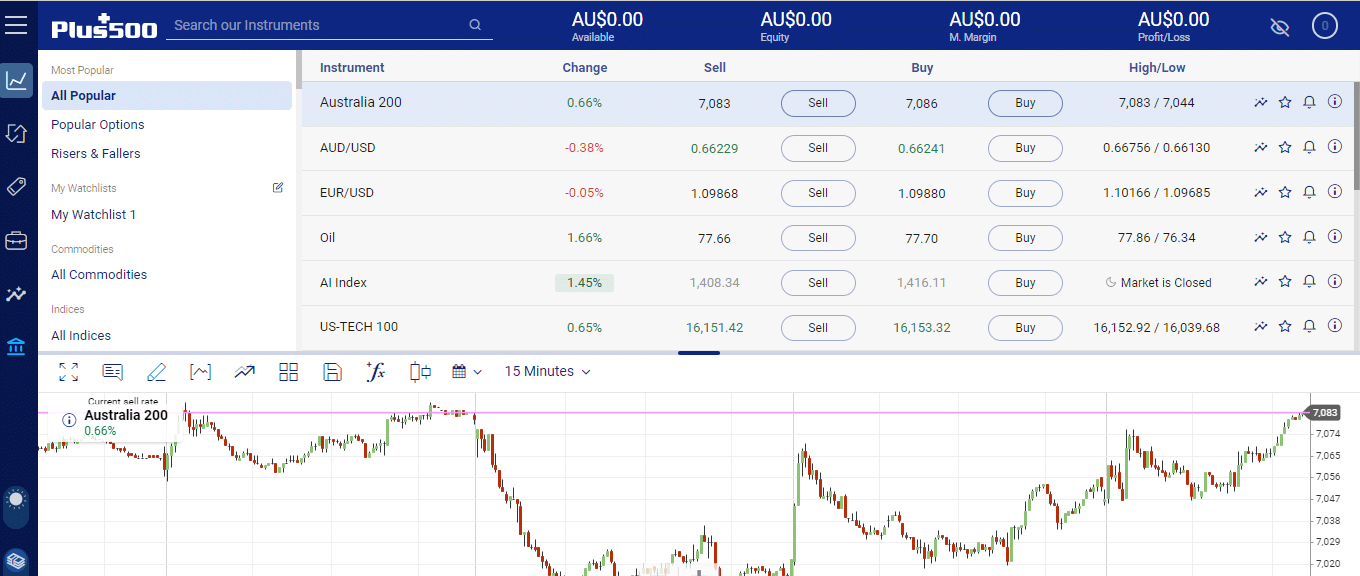

5. Plus500 – Best Micro Investing App for Low-Cost Trades

In this Plus500 app review, you’ll see that as one of the most popular CFD brokers, Plus500 has disadvantages, such as being unable to invest in stocks or ETFs, but only in derivatives.

Scalable Capital and Freedom24 are good alternatives if you want to invest in real assets instead of CFDs. Spanish residents cannot trade CFDs since they are unregulated financial instruments.

Six students founded this Israeli CFD broker over a decade ago. There are thousands of customers at Plus500 today, and the company is even listed on the London Stock Exchange.

CFD traders with experience might find Plus500 appealing. Since Plus500 requires leverage, you must be comfortable with it. Leverage should be handled with caution if you are dealing with it.

Pros:

- There are no commissions on buys and sells, and spreads are tight

- Fast and reliable execution of orders

- Real-time quotes and advanced analytical tools

- Leverage up to 1:30

- There is an unlimited and free demo available

- Analyzing tools for advanced users

- Fast and secure withdrawals

Cons

- It is not possible to own actual assets or have shareholder rights when trading CFDs

- Corporations and businesses cannot open trading accounts

- There are no social trading features

Your Money is at Risk.

6. Pearler – Passive Micro Investing App in Australia

Pearler Micro, launched in 2022, has swiftly emerged as a leading micro-investing app, providing

Being among the top share trading platforms, with a minimum initial spend of just $5, users can access a diversified portfolio comprising eight ETFs, including options focused on Australian and US large-cap shares, as well as sustainable and ESG-focused ETFs.

Offering automation features such as weekly or monthly investments and round-up capabilities, Pearler Micro stands out for its user-friendly approach. Notably, fractional units are allocated for amounts that don’t cover the cost of a whole unit.

The platform’s commitment to passive investing is reflected in its no-brokerage-fee model, with a small monthly fee applicable for account balances of $100 or more.

This cost-effective tool, devoid of gimmicks, emphasizes educating users on mastering the nuances of passive investing, making Pearler Micro an ideal choice for those seeking a straightforward and regulated micro-investment solution.

Pros:

- Pearler Micro requires a minimum initial spend of $5, making it accessible for investors at various levels.

- Passive Investing Focus

- The app offers eight diversified investment options, allowing users to choose from various ETFs based on their preferences.

- Investors can automate weekly or monthly investments with a minimum of $5

Cons

- Users with account balances over $100 are subject to a monthly fee.

- Pearler Micro does not distribute returns; instead, all returns are automatically reinvested to grow the investment.

7. Raiz – User-Friendly Micro Investing App

This is a user-friendly micro-investing app that transforms your spare change into a diversified investment portfolio. With nine portfolios catering to different risk preferences, users can effortlessly set up recurring payments or make

What sets Raiz apart is its commitment to security and legitimacy. Raiz ensures compliance and accountability and this is because its an ASX-listed company with an Australian Financial Services License overseen by ASIC.

Perpetual Corporate Trust Limited, an independent custodian, manages funds held in Raiz accounts, offering an additional layer of security.

Raiz’s popularity, especially among millennials, is attributed to its seamless approach, which allows users to invest modest amounts without disrupting their lifestyle.

Whether you’re a novice or an experienced investor, Raiz provides a trustworthy platform to start your investment journey, emphasizing the importance of time in the market over timing the market.

Pros:

- Users can choose from pre-set portfolios or create custom portfolios with different ETFs.

- The platform includes an ethical investment option for users who prioritize socially responsible investing.

- Regulatory Compliance.

- Raiz’s round-up feature automates contributions.

Cons

- Users may find the advertising on the app to be annoying or intrusive.

- Raiz’s read-only access to bank accounts and the potential sale of aggregated purchasing data raise privacy concerns.

For a quick glance through all that has been discussed, see the table below;

App Overview Fees Vantage Markets Overseen by Vantage International Group. Offers various financial instruments. Regulated by CIMA. No deposit fees; minimum deposit $200. Leverage up to 500:1. Trade Nation Established in 2014, offering Forex and CFD trading. Regulated by ASIC and FCA. No minimum deposit. Pepperstone Founded in 2010, known for Forex and CFDs. Regulated by FCA, CySEC, and ASIC. No minimum deposit. Plus500 Established over a decade ago, popular for CFD trading. Offers leverage up to 1:30. No commissions on buys and sells, tight spreads. Pearler Micro Launched in 2022, provides micro-investing through the Pearler Investors Fund. Minimum initial spend of $5. Small monthly fee for balances over $100. Raiz User-friendly micro-investing app. Nine portfolios for different risk preferences. ASX-listed with ASIC oversight. Monthly fee for account balances over $100. Micro Investing Apps Explained

In other words, the barriers often found at traditional brokerage platforms – such as account minimums and high fees – are removed. Instead, the best micro-investing apps in Australia allows you to invest in the financial markets with really small stakes.

For example, our top-rated provider eToro supports fractional shares, meaning that you don’t need to buy a full stock. Instead, as long as you meet a small minimum purchase of $50 – you can invest as little as you like.

In some cases, micro-investing apps in Australia allow you to round up your debit/credit card transactions. For example, you might spend $9.70 on a book and the app will round up the transaction to $10. The balance of $0.30 will then be added to your investment portfolio.

Is Micro-Investing a Good Idea?

Micro-investing is a good option for many investors due to its numerous benefits. Firstly, it provides an accessible entry point into the world of investing, especially when you get to use the best forex apps, allowing individuals to start with small amounts of money. This low barrier to entry enables those with limited financial resources to participate in the markets and build their wealth gradually.

Moreover, micro-investing platforms often offer fractional shares, enabling investors to own a portion of expensive stocks they might not be able to afford outright. This diversification potential is particularly appealing, as it allows investors to spread their risk across multiple investments.

Of course, as is advisable on any financial front, you must do your own research, as certain fears and uncertainties can cripple your growth and profitability in this space.

Micro-investing promotes regular saving and financial literacy by encouraging regular contributions. By automating small investments, individuals can develop a habit of saving and grow their investments over time.

While micro-investing offers several advantages, it is important to consider its potential drawbacks. One significant concern is the impact of transaction fees. Micro-investing platforms often charge fees for each transaction, and when investing small amounts, these fees can eat into returns and diminish the overall profitability of investments.

Additionally, the limited investment options available on micro-investing platforms may restrict investors’ ability to diversify their portfolios fully.

How to Choose the Best Micro Investing App in Australia for You

There are many micro-investing apps available to Australians in 2025. As we briefly noted earlier, you should never open an account with a provider just because they support micro-investments. Instead, there are many other metrics that you need to cross off before taking the plunge.

This includes:

Regulation

All of the best micro-investing apps Australia discussed on this page are authorized and regulated by ASIC. This means that you’ll be protected by several safeguards – such as client funds being held in segregated, tier-one bank accounts.

ASIC-regulated micro-investing apps must have strong financial stability, clearly display the risks associated with investing, and have their books audited on a regular basis.

Crucially, if you come across a micro-investing app that isn’t regulated by ASIC – avoid it.

Assets

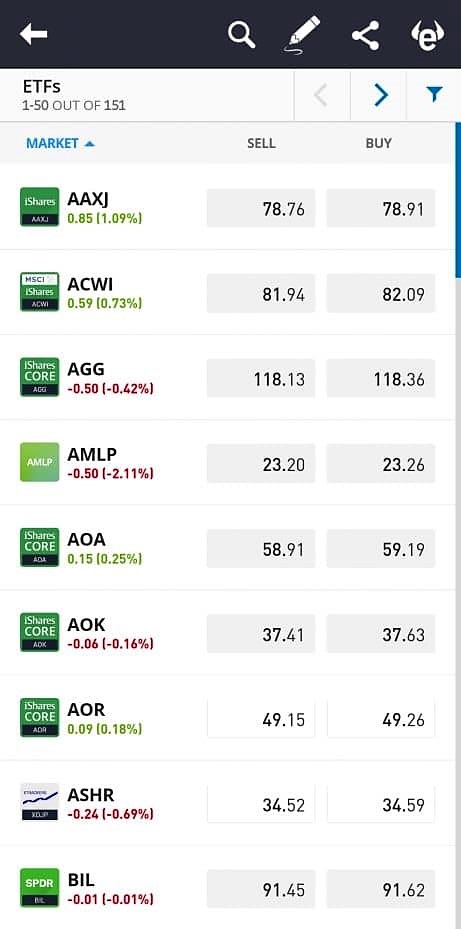

One of the main drawbacks with micro-investing apps is that in the vast majority of cases – you won’t be able to pick and choose your own investments. Instead, platforms like Riaz, FirstStep, and Spaceship Voyager ask you to select a pre-packaged portfolio that is based on your financial goals and attitude to risk.

While this might suit those of you who wish to invest passively, such a strategy can be restrictive. For example, Riaz portfolios can contain as little as 4 ETFs, while Spaceship Voyager portfolios often contain many of the same stocks.

This is why we much prefer eToro, which offers the best of both worlds. That is to say, you can elect to invest passively via a CopyPortfolio or by utilizing one of the best Copy Trading apps.

The latter allows you to mirror a successful eToro trader like-for-like. Most importantly, eToro also allows you to pick and choose your own individual investments. This includes over 2,400 stocks from 17 exchanges, and although this app might not be among the best ETF apps, it has more than 250 ETFs, and 16 digital currencies to offer investors.

Fees

Even the best micro investing apps Australia charge fees. After all, they are in the business of making a profit. In some cases, micro investing apps charge a flat monthly fee.

For example, Raiz charges $2.50. But, the app also multiplies an annual fee of 0.275% against the amount you have invested.. Spaceship Voyager is very competitive in this respect, as you will only pay a fee when you invest more than $5,500.

Even then, the fee starts at just 0.05% per year.

Other fees that you need to factor in include:

- Deposit/Withdraw Fees

- ETF Expense Ratio

- Spreads

- Early Redemption Fee

Ultimately, we found that the best micro investing apps Australia are very transparent about the fees they charge.

Tools and Features

When reviewing the best micro investing apps Australia, we came across a number of notable features that you might find of interest.

This includes:

Debit Card Round-Up

Some micro investing apps allow you to round up your debit card transactions. As we covered earlier, this is a great way to invest your spare change into the financial markets. Although the specific amounts will be minute, this can quickly add up if you keep the round-up feature activate for several years.

Portfolio Rebalancing

The best micro investing apps Australia will take full control over your portfolio. This means that you can sit back and invest in a completely passive nature – not least because the provider will rebalance the assets in your portfolio on a regular basis.

Automated Investments

We also like micro investing apps in Australia that allow you to set up an automatic investment plan. For example, you might decide to invest $10 every Friday or $100 at the end of each month. Either way, app provider will automatically debit your account on your chosen date – and when invest the money into your chosen portfolio.

Savings Goals

A lot of micro invest apps will also allow you to set up specific savings goals. For example, you might be saving money towards a new car. By entering the amount you wish to save and the date you need to reach your target – the micro investing app will give you regular updates on your progress.

Device Compatibility

Micro investing apps are still relatively new in the Australian market. As such, you might find that a new provider will initially release their app on just one operating system.

In turn, you need to ensure that the app is compatible with your device. The good news is that all of the best micro investing apps discussed on this page are available on both iOS and Android phones.

Payments

In order to use a micro investing app, you will first need to make a deposit. Most of the apps that we came across support bank account transfer only. Some – such as those listed on this page, also accept debit card payments. In the case of our top-rated micro investing platform – eToro, you can also deposit and withdraw funds with an e-wallet like Paypal.

Customer Support

Baring in mind that micro investing apps are typically aimed at Australians with little to or no investment experience, you’d expect the provider to offer top-notch customer support.

Unfortunately, we came across a number of apps that allow offer support via email. This means that you might need to wait a couple of days before you receive a response to your query.

On the other hand, most of the micro investing apps that we have reviewed today offer an in-build Live Chat facility. This is great, as you speak with an advisor at any time.

The table below gives an overview of all factors considered;

Consideration Details Regulation ASIC-regulated for client protection and financial stability. Assets Pre-packaged portfolios based on financial goals and risk tolerance. Limited ability to pick individual investments. Fees Varying fees, including monthly fees, annual fees (% of invested amount), and additional fees like deposit/withdrawal fees, ETF expense ratios, spreads, and early redemption fees. Transparent fee disclosure. Tools and Features Debit card round-up, portfolio rebalancing, automated investments, savings goals, device compatibility with iOS and Android. Customer Support Varies, with some apps offering live chat and others limited to email support. How to Get Started with a Micro Investing App

If you think that micro investing apps mirror your financial goals and investment experience, we are now going to show you how to get started. The walkthrough below you show you how to get set up with our top-rated micro investing provider – eToro.

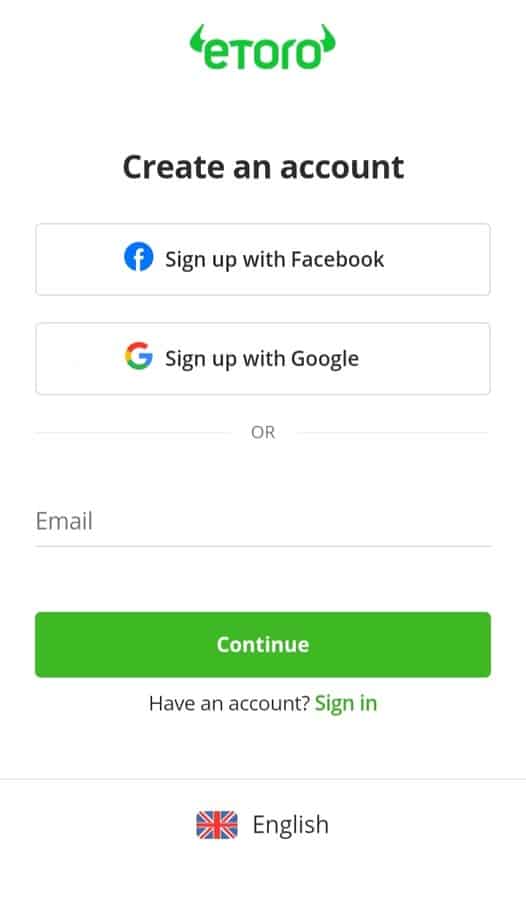

Step 1: Download and Install the eToro AppYou will first need to visit the eToro website via your mobile web browser. Look out for the ‘Join Now; button to begin the account opening process.

Here, firstly, you will need to provide some personal information, including your name, home address, Australian Tax Identification Number, email, and mobile number.

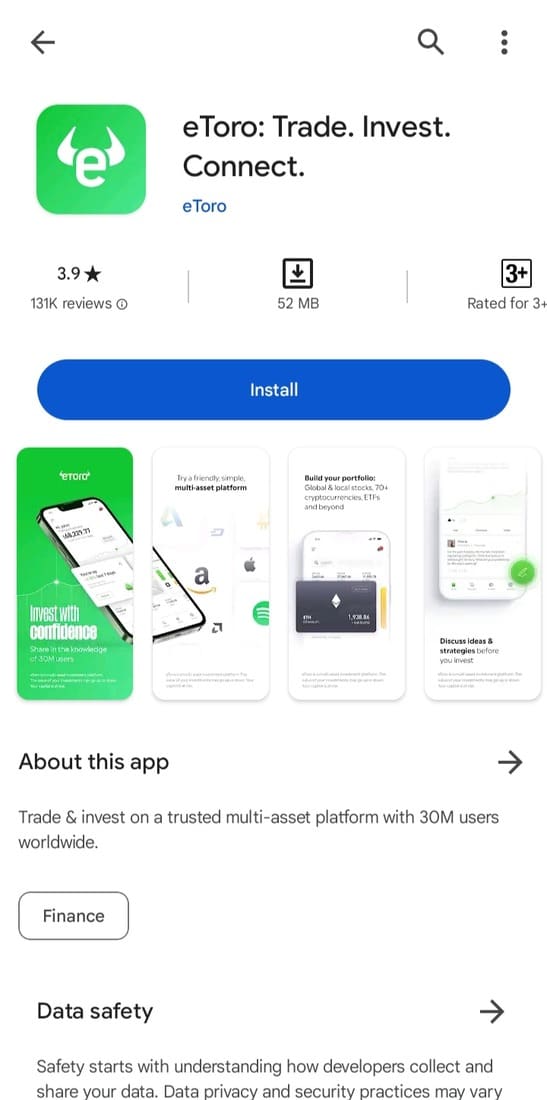

Step 2: Download the eToro AppOnce you have opened an account, eToro will redirect you to the Google Play or Apple Store download page. This is the safest way to obtain the app, as you can be 100% sure you are downloading the official version and up-to-date version.

Step 3: Login and Deposit FundsOnce you have successfully installed the app, proceed by logging in with the username and password you chose in Step 1. Subsequently, you will need to make an initial deposit.. You can instantly deposit funds with your Australian debit/credit card or an e-wallet like Paypal. Another thing you can do is make a manual bank transfer, but this will take a few days for eToro to process.

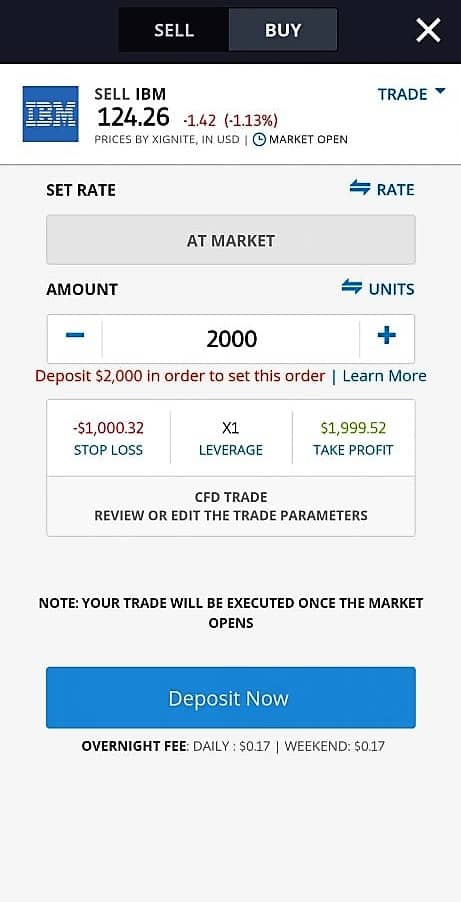

Step 4: Make a Micro InvestmentYou are now ready to make some micro investments. As noted earlier, the minimum crypto investment is just $25, and stocks can be purchased for just $50. Most ETFs can also be invested in from just $50.

To find your chosen asset, use the search box at the top of the page. Then, click on the ‘Trade’ button to load up the order form.

All you need to do here is enter the amount that you would like to invest – ensuring that they meet the minimum for the respective asset class.

The Verdict

No longer do you need to invest large amounts to gain access to the global stock markets. Instead, when using the best micro-investing apps in Australia, you can often get started with just a couple of dollars. As we have discussed on this page, the best providers give you access to a broad range of markets at very competitive fees.

Are you looking to get started with the best micro-investing app in Australia right now? eToro is well worth considering. This ASIC-regulated app supports thousands of markets, allowing you to pick and choose the stocks or ETFs you wish to invest in. Additionally, it provides insights into the best crypto to buy.

eToro – Overall Best Micro Investing App

eToro AUS Capital Limited AFSL 491139. eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. See PDS and TMD

References

- https://www.finra.org/investors/insights/micro-investing

- https://corporatefinanceinstitute.com/resources/wealth-management/micro-investing-platform/

- https://www.cnbc.com/2018/04/25/micro-investing-lets-you-build-wealth-a-few-dollars-at-a-time.html

- https://www.cnbc.com/2012/05/15/how-to-get-it-right-with-charts.html

- https://www.bloomberg.com/professional/blog/technical-indicators-point-to-growth-stocks-beating-value/

FAQs

What is the best micro-investing app Australia?

After reviewing dozens of providers, we found that eToro is the best micro-investing app Australia. By going through a quick 10-minute account opening process, you can invest from just $25 upwards.

How do micro-investing apps work?

Most micro-investing apps initially ask you to outline your financial goals and tolerance to risk. Then, you will be offered a pre-built portfolio that aligns with your profile. Once you have selected a portfolio, it’s then just a case of funding your account. It is important to remember that micro-investing apps cannot offer you financial advice – unless authorized to do so from ASIC.

Are micro-investing apps worth it?

Whether or not micro-investing apps are worth it will depend on your investing experience and financial goals. For example, if you have virtually no knowledge of trading and wish to passively invest a few dollars here and there – then micro-investing apps are great. But, if you’re looking to pick and choose your own investments and want full control over where your money goes – you might find micro-investing apps a bit restrictive.

Are micro-investing apps in Australia legit?

All of the best micro-investing apps discussed on this page are authorized and regulated by ASIC. As such, you can be sure the application is legit. However, we also came across micro-investing apps that are unregulated or simply licensed in shady offshore locations. These apps should be avoided.

What is the minimum micro investment?

The minimum investment amount will be determined by the app provider. With that said, most micro-investing apps in Australia have a minimum deposit requirement that is just a few dollars. In some cases, there is no minimum account balance at all.

Kane Pepi

Kane Pepi

Kane Pepi is a British researcher and writer that specializes in finance, financial crime, and blockchain technology. Now based in Malta, Kane writes for a number of platforms in the online domain. In particular, Kane is skilled at explaining complex financial subjects in a user-friendly manner. Kane has also written for websites such as MoneyCheck, the Motley Fool, InsideBitcoins, Blockonomi, Learnbonds, and the Malta Association of Compliance Officers.View all posts by Kane Pepistockapps.com has no intention that any of the information it provides is used for illegal purposes. It is your own personal responsibility to make sure that all age and other relevant requirements are adhered to before registering with a trading, investing or betting operator. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice.By continuing to use this website you agree to our terms and conditions and privacy policy.

© stockapps.com All Rights Reserved 2025

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.OkScroll Up