How to Buy Shares in Australia – Complete Guide

Looking to learn how to buy shares in Australia? You’ve come to the right place.

In this guide how to buy and sell shares for beginners in Australia! We don’t just explain the basics, though – we’ll also cover the best shares to invest in and show you how you can buy them without paying any commission. Let’s jump right in.

-

-

How to Buy Shares in Australia in 2021 – Quick Steps

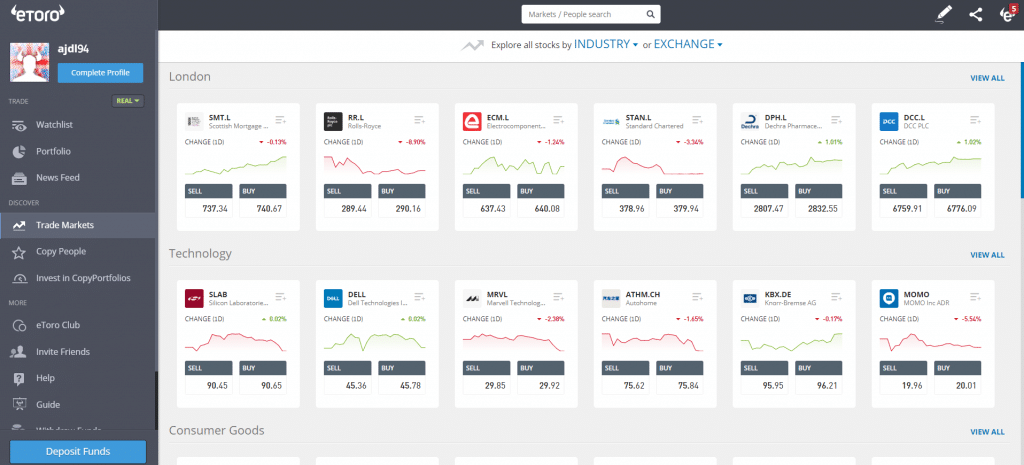

If you’re a bit more familiar with trading, you might have heard of eToro. It’s the fastest way to get in on trading, and it allows you to get in on the opportunities that you’re reading about. Using eToro is about as simple as it gets. It only takes a few minutes to set up an account, the user interface is great, and it lets you buy shares! Check out the quick setup guide below for getting started with eToro.

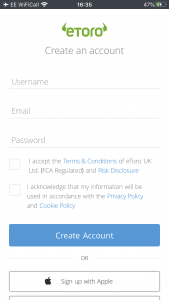

- Open an Account with eToro – Head over to eToro’s website. You’ll be given the option to “Join Now” on their homepage. To join, you’ll need to provide a username, password, and an email address. It’s quick and simple.

- Verify Your Account – After you’ve signed up for eToro, you’ll need to verify your account. To do this, you’ll need to upload a form of identification to prove you are who you’re claiming to be. This can be done using a driver’s license or a passport. In addition to this, you’ll need to provide your proof of address, like a piece of mail.

- Make an Initial Deposit – To get started with buying shares, you’ll need to deposit at least $50 USD. All eToro trades are done using USD. You’ll be able to do this using a bank account, an e-wallet, or a credit or debit card.

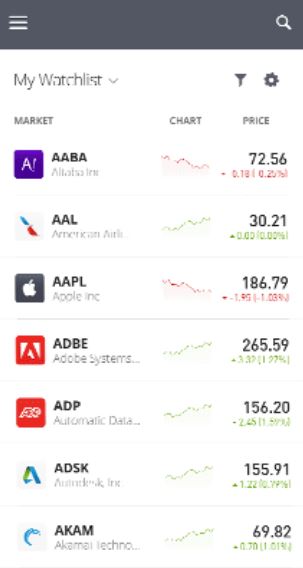

- Select Your Shares – Once you’ve got your funds deposited, you’re ready to start trading! You’ll need to select the companies you’d like to invest in using the platform. You can browse the website, get some more information on the companies you’re interested in, and select a number of shares to purchase.

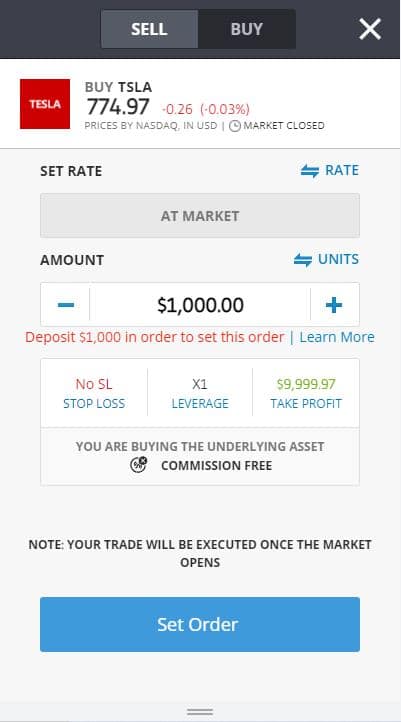

- Buy Shares – All that’s left is to buy your shares! To do that, you just need to confirm the stock you’re investing in, click “Trade,” and confirm how much you’d like to invest. It’s quick and painless, unlike other platforms on the web.

The Basics of Buying Shares

If you’re just getting started, you may now know how to buy stocks and shares with the best share trading platform Australia. No worries, the basics of buying shares are pretty easy to get the hang of. Check out some of the basics of buying and selling shares below!

What are Shares?

Shares are units of stock. This means that when you’re researching companies to invest in, you’re checking out their stock and learning more. When you’re investing in their stock, you’re purchasing shares. The number of shares a person has indicates how much ownership of a company they have.

How Much Money Can You Make from Buying Shares?

This is highly dependent upon a few things. The first thing it depends on is the stock that you buy shares of. When you purchase shares of a stock that exhibits a lot of growth, you can make a lot of money. Other stocks are slower to return on investment, however.

The next factor that comes into play is the amount of money that you invest. When you invest more, then you see a higher return on investment. As such, buying more shares can result in more money being made. Buying shares wisely is the best way to maximize your returns, however.

Capital Gains

Capital gains are one of the ways that you can make money off of shares. Capital gains are made by selling shares of a stock after they’ve been held over a period of time. Over that period of time, the shares have increased in value, and the profits you make by selling them at higher price are known as capital gains.

Dividends

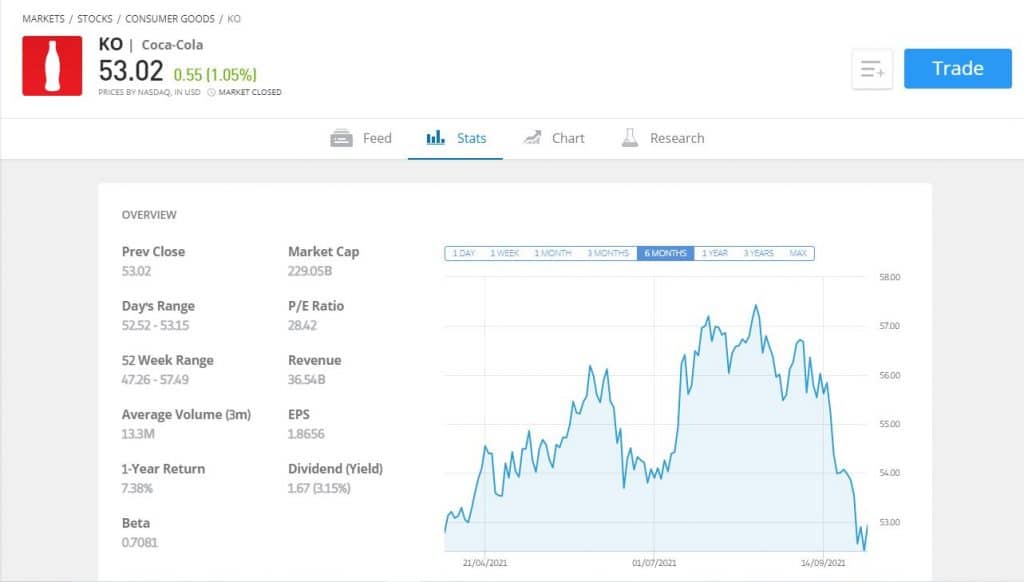

Dividends are another way to make money off of the shares that you buy. Dividends are a distribution of profits given to shareholders by a corporation. This only occurs when a company has a profit or a surplus.

Compound Growth

Compound growth is a term specific to investing. It refers to the geometric progression seen in the rate of return of shares over time. It is calculated by using the compound annual growth rate (CAGR). This is a good way of determining how much money needs to be invested in shares when looking to make a specific amount of money on the return.

Costs & Fees of Buying Shares

When you invest using different brokers, you may be charged a number of different fees to buy shares. Knowing what these fees and costs are can help you make the best decision when choosing a broker. Be sure to take a look at each of the different possible fees below to gain an understanding of what to expect.

Commission Fees: Some brokers will charge a commission fee for handling your assets. Depending on the amount of money that they’re handling, these fees can be anywhere from 1 to 2 percent of your managed assets. This can add up in the long run.

Spread Fees: Spread fees are a fee charged based on the difference between the bid and offer price. During times of high volatility, these two figures can change frequently. It’s a very small percentage of any transaction.

Stamp Duty: This is a government fee placed on legal documents in the transfer of assets. It’s technically a tax, and it is paid by anyone making significant trades on the stock market.

What are the Best Shares to Buy Now?

There are plenty of different stock markets available, and using an online trading platform will allow you to invest some money in some, if not all of them. When you’re looking to buy shares right off the bat, there are a few solid choices you can invest in.

Of course, major stocks to invest in on an international scale should include Tesla (NASDAQ: TSLA). This company hasn’t stopped growing in ages. While the price tends to fluctuate, it has had a constant gain for quite some time now. Another stock to keep your eye on is Disney (NYSE: DIS). Disney is a gigantic company, and with their hands in Marvel, you can be sure to see a return on investment.

If you’re looking to buy shares that are closer to home, though, there are some stocks to consider on the Australian Securities Exchange (ASX). These have a lower barrier for entry, so more shares can be purchased. Think about buying shares for Flight Centre Travel Group (ASX: FLT) and Woodside Petroleum (ASX: WPL).

Here’s a list of 10 we think fit the bar for a beginner trader:

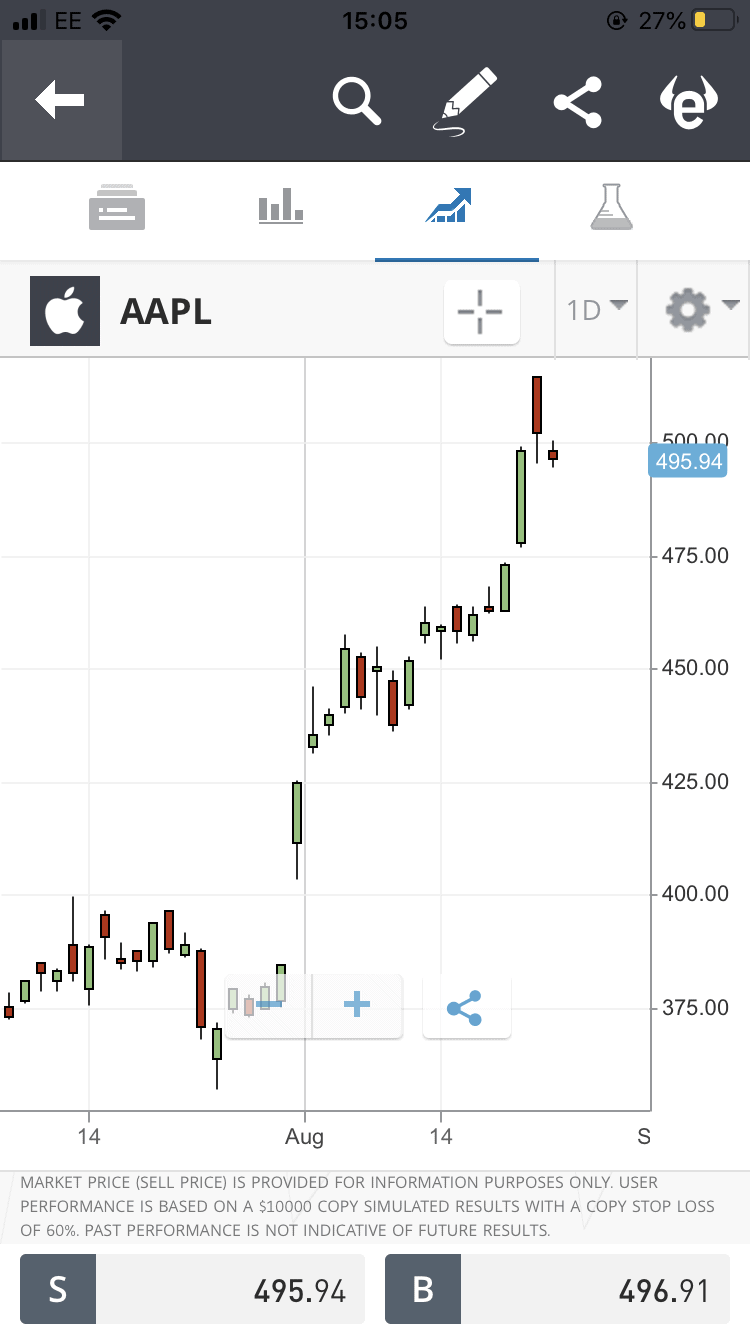

- Apple (NASDAQ: AAPL): Apple is a no-brainer. The tech company is one of the largest in the world, and they’ll be sure to keep that momentum for years to come.

- Tesla (NASDAQ: TSLA): Tesla has been making waves for years, and the electric car movement has finally taken hold. Get in now!

- The Walt Disney Company (NYSE: DIS): Disney is one of the largest entertainment companies in the world, and their growth has been steady.

- Flight Centre Travel Group, Ltd (ASX: FLT): Flight Centre has been seeing gains regardless of the pandemic, making them an Aussie stock to keep your eye on.

- Woodside Petroleum Ltd (ASX: WPL): Woodside is Australia’s largest independent dedicated oil and gas company, both of which are essential. They are a good long-term option.

- NVIDIA Corporation (NASDAQ: NVDA): With the at-home movement turning people to computer entertainment, NVIDIA has boomed. They’re a great tech stock to turn to.

- Zoom Video Communications, Inc. (NASDAQ: ZM): Zoom was an unknown company until the pandemic hit, and now they’re a household name. They’re not leaving the market anytime soon, making them a great pick.

- CrowdStrike Holdings, Inc. (NASDAQ: CRWD): Most people spend the majority of their time connected to the cloud. CrowdStrike provides protection that’s necessary to anyone who uses tech. They have a broad market share.

- The a2 Milk Company, Ltd (ASX: A2M): The a2 Milk Company provides specialized dairy products, making them a unique entry into the food industry. This specialization can lead to massive gains.

- Lynas Rare Earths, Ltd (ASX: LYC): Outside of China, Lynas is the only large producer of separated rare-earth elements. This allows them to completely cover the market in this sector.

How to Buy Different Types of Shares in Australia

Just because you’re in Australia, it doesn’t mean that you’re limited to buying shares on the ASX. However, it’s important to realize that each market or exchange has its own set of specifications and requirements. Learn about the most common shares and exchanges below.

How to Buy Shares on ASX

To purchase shares on ASX, you’ll want to navigate to the trading platform of your choice. There you’ll find all of the stock options for the ASX that are available. It allows participants to purchase shares, as well as other financial products. Stocks are available to be purchased at any time, but the markets are only open for Normal Trading from 10:00AM to 4:00PM, Sydney time. When buying shares, payments for them must be received within 2 days of closing the sale. Brokers will typically take care of this more efficiently, though.

How to Buy US Shares in Australia

To buy US shares in Australia, you’re going to need to work with a platform or a broker that has access to Wall Street. This is crucial in being able to purchase some of the most powerful stocks in the world. Make sure that you know what you’re purchasing when it comes to currency conversion, and that you’re educated on the companies. The market is open from 11:30PM to 6:00AM in Sydney time, meaning that active traders will need to be up overnight, or making trades using a suitable platform.

How to Buy International Shares in Australia

Purchasing International shares in Australia works the same way that buying US shares does. You’ll need to know a bit more information, though. There are numerous intentional exchanges, and you’ll have to know what market your shares of choice are trading on. This will affect your platform choices. Not all platforms have open access to international markets and shares.

How to Buy IPO Shares in Australia

If you’re new to buying and selling shares, you may not know what an IPO is. IPO stands for initial public offering. This occurs when a company decides to go public and participate in the stock market. If you want to buy IPO shares in Australia, you need to fill out an application through your broker to be given access to these shares. You’ll also need to know what companies are planning on going public, and whether or not they should be invested in.

If you’re working with a great platform or broker, you’ll be given access to all of the shares above. You’ll want to put your investments into eToro, as they can assist you with every one of the options listed above. What’s more is that they’ll alert you to new IPOs, and will keep you informed. It’s obvious that eToro is the trading platform of choice.

Best Australian Stock Brokers

You’ve made it this far, so you must be pretty invested in investing. We’re proud of that pun, so don’t knock it too hard. If you’re looking for the best Australian stock brokers, look no further. We’ve got two options below, and every one of the pros and cons you’ll come across. Check them out!

1. eToro – Buy Shares in Australia

When you sign up with eToro, you get the security of keeping your funds safe. No matter where you’re located, your information is protected thanks to their high standards.

We touched on fees above. One of the best things about eToro is the way that they handle their fees. Trades can be as low as $50, and you’ll never be required to buy whole shares for the more expensive stocks you have your eye on. This means you’ll never miss out on buying major players. You’ll just be able to buy them in a way that works for you.

You might be worried about your level of knowledge when it comes to eToro. You’ve got nothing to worry about, there. The interface that eToro provides is helpful, and it’s easy to navigate, even for traders that are just starting out. Another great option for those just getting started is their CopyTrader tool. This lets a user copy a popular investor’s portfolio, taking some of the guesswork out of trading. It copies everything from their positions to their investment proportions. It’s great for new users.

Plus, the interface can be fully mobile, meaning that you can browse, buy, and sell from anywhere! Check out all of the pros to using eToro below.

Pros:

- Low barrier to entry with $50 minimum deposit

- Access to more trading options than other platforms

- The CopyTrader tool, letting you copy a popular investor until you get the hang of things

Cons:

- Inactivity fees

- Withdrawal fees

eToro AUS Capital Limited AFSL 491139. eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. See PDS and TMD

Tutorial – How to Buy Tesla Shares on eToro

We’re going to show you in XX steps just how you can get started. Tesla is one of the hottest stocks around, so you’ll probably want a piece of the action. Learn how to buy Tesla shares on eToro using these simple steps!

Step 1: Sign Up for eToro

Head over to eToro’s website, and click the “Join Now” button. You’ll just need a few details to start. Come up with a username and password, and provide a valid email address. This is important.

Step 2: Verify Your Account

You’ll need to verify your identity. This step only takes a few minutes. To speed along the process, make sure that you have a form of identification and a proof of address with you. The form of identification can be a driver’s license or a passport. To take care of this, click on the option that says “Complete Profile” on the Account Dashboard.

Step 3: Make a Deposit

Using either your bank account information, your e-wallet, or a credit or debit card, it’s time to deposit funds. eToro requires that all new users deposit $50 USD to start. On the left, at the bottom of the Dashboard, you’ll see the option “Deposit Funds.”

Step 4: Search for Tesla

Now you’re ready to start investing! To do that, though, you’ll need to find Tesla. At the top of the webpage, you’ll have the option to search for stocks. Type “Tesla” into the search bar and hit Enter on your keyboard to find Tesla. You’ll be directed to their company page on eToro.

Step 5: Invest

In the top right corner, you’ll be able to choose to trade Tesla once your deposit has cleared. You’ll be directed to an order box. Here you’ll choose how much you’d like to invest in the specified stock. Once you’ve chosen all of your options, click the “Open Trade” option.

How Are Shares Taxed in Australia?

In Australia, there are no capital gains tax rates. Instead, any money made from buying shares and their gains are added to your income. This makes it easier on you and the tax authority.

How to Choose the Right Shares for Your Portfolio

Now that you’re ready to start buying shares, it’s important that you know how to choose the right shares for your portfolio. There are a few things to consider when buying and selling shares.

PriceChoosing stocks that are within your price range is a good way to narrow down the field. However, thanks to eToro, if you’re set on buying shares of a stock that’s out of your price range, you can! You don’t have to buy whole shares on eToro, you can invest what you have.

Volatility

It’s unlikely that you’ll want to purchase shares of a stock that’s volatile. You want to choose something that seems to be stable, and that you can predict the path of. If you choose something too volatile, you may end up losing more than you make. Volatile stocks should be kept to a minimum until you’re sure of what you’re doing.

Diversification

A diverse portfolio is a happy portfolio. Investing in different industries and sectors means that you can keep your funds spread out. Investing too much in the same industry can become problematic if industry-wide issues arise.

How to Sell Shares in Australia

Selling shares in Australia is a pretty simple process. Once you’re ready to sell some of the shares that you’ve purchased, you can sell them through a registry or a broker. Selling through a registry requires more work to be put in than selling through a broker does, and you’ll be doing that work. Selling through a broker is the easier route, and the choice that most people make. Shares are transferred to and and handled by the broker, meaning you can take a hands off approach.

Conclusion

It isn’t as hard to buy shares in Australia as you may have initially thought. Especially when you use a broker like eToro. They believe that everyone having access to the stock market, nationally and internationally, is important. Using their platform you can buy and sell shares from all over the world! The best part? It’s safe and secure. Plus, you don’t have to invest a lot to get started.

If you’re ready to start buying and selling shares, sign up for eToro today. It’s the easiest way to get started, by far.

eToro – Buy Shares in Australia

eToro AUS Capital Limited AFSL 491139. eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. See PDS and TMD

FAQs

How do I buy shares in Australia?

To buy shares in Australia, you’ll need to have a broker. You can also sign up for a broker platform and start trading independently with services like eToro. To buy shares, research the company you’re interested in, and make sure you know exactly how much you want to invest. Then, head over to eToro and get signed up!

Can I buy shares without a broker?

A trading platform is technically considered a broker, just to clear that up before beginning. That being said, there are a number of ways to purchase shares without a broker in Australia. You can invest in a managed fund, or take a look at IPO crowdfunding opportunities before companies go public. Additionally, your company may allow you to purchase funds of their stock without a broker. In addition to these options, you can receive shares through an off-market transfer. These shares are inherited, or are a gift. You can also invest in a share purchase plan (SPP) through your company in some cases.

How do I buy shares on Commsec?

To buy shares on Commsec, you simply log in to your account and head over to the Trading tab. Here you’ll be able to place orders for shares of stocks that you’re interested in investing in.

How do I buy Bitcoin shares?

Many trading platforms have enabled users to start buying cryptocurrencies, like Bitcoin. eToro is one of those platforms. You can buy Bitcoin “shares” in a fashion similar to buying traditional stocks. Be sure to check out eToro’s cryptocurrency options!

What is the minimum amount to buy shares in Australia?

Different brokers will have different minimum amounts. The best part of eToro is their low barrier for entry. To start trading any shares on any market or exchange, you just need $50 USD. eToro wants people to have the power to invest!

Where is the best place to buy shares in Australia?

Without a doubt, eToro is the best trading platform to purchase shares in Australia. They have no commission fees, and no monthly fees. This means that you can put more of your money towards investing! If you’re looking to buy shares in Australia, be sure to sign up for eToro today.

Kane Pepi

Kane Pepi

Kane Pepi is a British researcher and writer that specializes in finance, financial crime, and blockchain technology. Now based in Malta, Kane writes for a number of platforms in the online domain. In particular, Kane is skilled at explaining complex financial subjects in a user-friendly manner. Kane has also written for websites such as MoneyCheck, the Motley Fool, InsideBitcoins, Blockonomi, Learnbonds, and the Malta Association of Compliance Officers.View all posts by Kane Pepistockapps.com has no intention that any of the information it provides is used for illegal purposes. It is your own personal responsibility to make sure that all age and other relevant requirements are adhered to before registering with a trading, investing or betting operator. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice.By continuing to use this website you agree to our terms and conditions and privacy policy.

© stockapps.com All Rights Reserved 2024

Scroll Up