Westpac App Review – Pros & Cons Revealed

Westpac is one of the ‘big four’ banks in Australia, and it’s also one of the biggest stock brokers in the country. Westpac offers trading on virtually the entire Australian Stock Exchange along with thousands of other shares from around the world.

Westpac has a variety of powerful tools for Australian stock traders, including a mobile stock app, expert analysis, and conditional trading orders. However, this broker isn’t cheap thanks to a commission of $19.95 AUD per trade.

So, is Westpac right for you? In our Westpac app review, we’ll cover everything you need to know about trading with this Australian broker.

What is Westpac?

Given Westpac’s size and legacy, it should come as little surprise that this broker is extremely plugged into global markets. With the Westpac Australian stock app, you can trade not only all Australian Stock Exchange (ASX)-listed companies, but also shares from over 25 major stock exchanges around the world. Westpac also offers thousands of ETFs, options, and warrants.

Westpac’s share trading division is geared towards a wide audience. Traders can find the technical analysis and research tools needed to make decisions in real time, while long-term investors can benefit from zero-fee accounts and access to thousands of different funds. Westpac is also renowned for its expert analysis, which includes daily share tracking and recommendations.

What Stocks Can You Trade on the Westpac App?

Westpac has one of the broadest offerings of any Australian stock broker. With the Westpac trading app, you can buy and sell over 2,200 companies listed on the ASX. In addition, as one of the largest investment banks in the country, Westpac handles many of Australia’s IPOs. Westpac share traders get early access to these IPO offerings.

You also get access to thousands of shares from stock exchanges in New York, London, Frankfurt, Johannesburg, Hong Kong, and elsewhere. In fact, you can trade virtually any companies that are part of the S&P 500 index in the US or the FTSE 250 index in the UK.

One thing that advanced traders especially will like about Westpac is that this broker offers stock options trading. You can buy and sell contracts as well as write put and call options to generate income. Westpac also occasionally offers warrants, which are a type of stock option issued directly by companies.

Notably, Westpac generally sticks to share trading and stock derivatives. You cannot trade other types of assets, such as forex, commodities, or cryptocurrencies, with the Westpac app.

ETFs and Index Funds

Westpac offers share trading on ETFs on the ASX and across its 25+ international markets. In all, there are thousands of funds to choose from. That gives you a lot of flexibility to quickly build a globally diversified portfolio with exposure to specific industries in specific countries.

Westpac doesn’t offer mutual funds since ETFs are typically more cost-effective and offer exposure to many of the same assets. In addition, Westpac does not offer trading on indices, although there are plenty of ETFs available that track global indices.

Westpac Account Types

Westpac offers a single share trading account, the Cash Investment Account. This account is completely free to set up and doesn’t carry monthly subscription fees or inactivity fees. In addition, there is no minimum balance required to open this account and you can earn 0.05% interest on any funds sitting in your account.

Note that Australians who are already Westpac customers can trade through their existing accounts, including some checking accounts. However, trading with another Westpac account entails significantly higher commissions than trading through a Cash Investment Account.

Westpac Fees & Commissions

Westpac’s commissions are expensive, although they’re in line with other major Australian investment banks like ANZ. Each time you buy or sell Australian shares or ETFs, you’ll pay a commission of $19.95 AUD per trade or 0.11%, whichever is greater. If you trade stock options in Australia, the commission is $38.95 per trade or 0.35%.

For international share trading, the commission varies according to the specific market you’re trading in. US share trades cost $19.95 USD for trades up to $5,000 USD or $29.95 USD for trades up to $10,000 USD. For larger trades, Westpac charges 0.31% of your trade’s value. Options trades are even pricier, at $57.95 USD plus $1.10 USD per contract.

Trades on the London, Hong Kong, and Tokyo Stock Exchanges cost $57.95 USD each. European shares carry a commission of $115 USD per trade.

These fees can be hard to stomach for frequent traders, which is one of the major disadvantages to Westpac.

The good news is that most traders will pay very few non-trading fees. Keeping a Westpac Cash Investment Account is completely free and there’s no inactivity fee to worry about. You’re also free to move money around between accounts at Westpac or between your Cash Investment Account and external bank accounts with no charges.

Westpac App User Experience

Westpac’s mobile app for iOS and Android offers an extremely capable trading platform. This app includes virtually all of the features you’ll find through the web interface, so you’re not missing out on anything when trading on the go. That’s important, since some Australian competitors have slimmed-down trading apps that support order entry and little else.

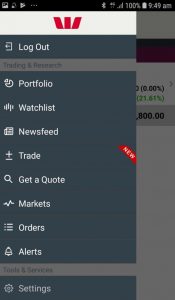

The downside to having everything, though, is that the Westpac app can feel crowded at times. There’s a lot of information on each page, and there are so many pages that the app doesn’t use a simple menu across the bottom of the screen. Instead, there’s a sidebar menu with 8 different pages in the navigation.

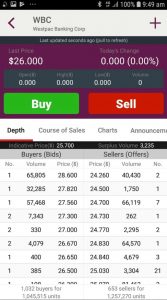

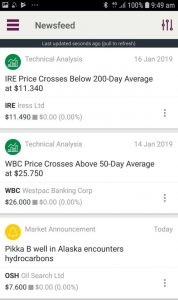

Once you land on the right page, it’s easier to get your bearings. Westpac does a nice job of formatting its trading data for a compact, vertical screen. You can also turn your phone horizontally to display full-screen charts, which is helpful for adjusting technical studies. The market news feed is also particularly well-adapted to a smartphone screen, since it uses a vertical feed that you can easily scroll through.

One thing we especially liked about the Westpac app is that it supports push alerts. So, if you have SMS and email alerts set up through the web interface, they can be delivered as push notifications on your phone. You can also create new custom alerts through the app.

Westpac App Tools

The Westpac mobile app and web interface provide a relatively wide range of tools to help you trade more effectively.

Charting

Westpac offers fairly robust technical charts that are easily customized using the mobile app. You can modify charts between several popular layouts, including candlestick charts, as well as view chart intervals from one minute to one month.

The diversity of technical indicators that Westpac provides isn’t stellar, but you get access to the most commonly used studies. For example, moving averages, Bollinger Bands, MACD, and RSI are all available through the app. You can modify the timescale of any indicator, but you don’t have complete control over the underlying formulas and you cannot create your own custom indicators.

Stock Research

One of the features that sets Westpac apart from competitors is its stock research. With Westpac, you get access to daily updates (in your account dashboard or sent by email) that summarize how each of the stocks in your portfolio are faring.

In addition, Westpac provides up to three daily recommendations based on analyst research. The ‘Consensus’ recommendation is based on a survey of analysts within Westpac’s investment arm, while the ‘Morningstar Quantitative’ recommendation is based on a model from renowned investment research firm Morningstar. You can also get ‘Morningstar Premium’ recommendations for $20 a month – and this fee is waived if you place two trades in the month.

Conditional Trading

Westpac offers six different order types, including advanced orders like automated trailing stop losses. Using the mobile app, you can combine any of these order types to create rules around when to buy or sell a specific stock. In effect, you can develop conditional orders that enable you to catch a breakout just as it’s beginning or that help you close out your positions at the first sign of a downturn.

Alerts

Westpac also uses its conditional order framework to support alerts. You can get alerts by SMS or email when a stock reaches a specific price or if a set of defined conditions is met.

Westpac App Education

Although Westpac places a lot of emphasis on trading tools, the mobile app offers surprisingly little in the way of educational resources. Westpac offers basic explanations of complex instruments like options and warrants, but there are no trading tutorials or strategy guides available.

The fact that there is no demo account is also disappointing, since there’s no way for new traders to practice buying and selling shares in a risk-free environment.

Westpac App Bonus

Westpac currently does not offer any sign-up bonus for new traders. This broker rarely offers bonuses since it has such wide name recognition in Australia.

Westpac App Demo Account

Westpac doesn’t offer a demo account. However, you can open a Cash Investment Account and begin exploring the Westpac app’s features and tools without depositing any money.

Payments on the Westpac App

The Westpac stock app doesn’t offer the same breadth of payment methods as many competing online stock brokers. Westpac requires that you use a bank account to transfer money into your Cash Investment Account. You cannot pay by debit or credit card, although Westpac will accept electronic transfers from platforms like PayPal that support bank transfers. Transfers typically take up to 2-3 days to settle, so your funds are not available for trading right away.

On the plus side, it’s easy to integrate your Westpac Cash Investment Account with any other accounts you have at Westpac. So, if you want to keep your checking, savings, and investment accounts all together for convenience, Westpac makes that easy to manage.

In addition, Westpac doesn’t charge any deposit or withdrawal fees. There are also no minimums on how much money you can deposit or withdraw at one time.

Westpac Contact and Customer Service

Westpac offers customer service by phone from 8 am to 7 pm Monday to Friday. The company does not offer contact information for international clients, and Westpac’s primary customer support pages are focused on banking services rather than stock trading.

Phone: 13 13 31

Is Westpac Safe?

Westpac is one of the ‘big four’ Australian banks, so it is one of the safest and most trustworthy stock brokers in Australia. The bank receives strict oversight from Australian financial regulators and the share trading division is overseen by the Australian Securities and Investment Commission. In addition, Westpac is publicly traded on the ASX and puts out regular financial reports (although these provide little insight into the share trading division specifically).

How to Use the Westpac App

The Westpac app is pretty easy to get started with. Let’s walk through the process in four simple steps:

1. Download the Westpac App

The Westpac trading app is available for iOS and Android through the Apple App Store and Google Play. Visit Westpac’s website to find links to the app for your device, then download and install the app.

2. Open a Westpac Account

To start trading with the Westpac app, you’ll need a Cash Investment Account. You can sign up for a new account directly through the app. Note that you will need to verify your identity before registering if you are not already a verified Westpac client.

3. Fund Your Account

Next, add funds to your Westpac account. Westpac only supports bank transfers, either from other accounts you may have at Westpac or from an external bank account. There’s no minimum deposit required.

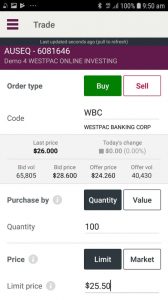

4. Place Your First Trade

Now you’re ready to buy your first stock with the Westpac app. From the app menu, select ‘Trade’ and then enter the ticker symbol for the stock you want to buy. Enter the quantity of shares you want to purchase and the type of order you want to use. When you’re ready, click ‘Buy’ to place your order.

How to Sell on Westpac App

Selling shares on the Westpac app uses a similar process to buying shares. Simply navigate to the ‘Trade’ page and enter the ticker symbol of the stock you want to sell. At the top of the order page, tap ‘Sell’ so that it is highlighted. You can then decide how many shares you want to sell and choose your order type. Click ‘Sell’ at the bottom of the page to complete your order.

Westpac vs eToro

Westpac has a lot to offer for traders in Australia. But how does this broker compare to one of our most highly recommended online brokers, eToro?

Overall, we think eToro is a better choice for most Australian traders than Westpac.

| Charge per Trade | Annual Fee | Inactivity Fee | Deposit/Withdrawal Fees | |

| Westpac | $19.95 (ASX) to $115 (International) | $0 | $0 | $0 |

| eToro | N/A | $0 | $10 per month (after one year) | $5 per withdrawal |

However, eToro offers a lot more than just share trading. So, if you want to build a more diversified, global portfolio, eToro has a wider variety of assets to trade compared to Westpac.

In terms of trading tools, eToro and Westpac have a lot in common. Both offer market news feeds, consensus price targets from trusted analysts, a variety of order types, and mobile price alerts.

eToro, though, stands out for it’s advanced social trading network and support for copy trading. You can interact with millions of other traders around the world and see what stocks are popular on eToro at any given time. In addition, you can put your portfolio in the hands of professional traders or quickly copy a portfolio to diversify your holdings.

On the whole, we think eToro is more affordable than Westpac and offers a wider variety of assets to trade. While eToro might fall short if you only want to trade Australian stocks, it’s very competitive with Westpac if you want to trade well-known global companies. Both brokers offer robust mobile apps, but eToro’s social trading network gives it a significant edge over Westpac.

Westpac Stock App Pros & Cons

- Thousands of Australian and international shares

- Trade options, warrants, and IPOs

- Supports conditional trading orders

- Email and SMS trade alerts

- Integrates with Westpac bank accounts

- Customer support 5 days a week

- Highly trustworthy

- Very high commissions

- No demo account

- Only accepts bank transfers

- Deposits take several days to settle

The Verdict

Westpac is a familiar name for Australians in need of a stock trading app. This ‘big four’ bank and investment platform offers trading on the entire ASX exchange as well as thousands of US, UK, and global shares. Westpac even offers option and warrant trading, plus access to IPOs in Australia.

Unfortunately, Westpac’s commission structure makes it prohibitively expensive for many traders. The trading fees are especially hard to swallow when you consider that eToro, one of our top rated stock apps.

eToro may not have quite the same selection of Australian stocks as Westpac, but it offers most major Australian companies along with more than 800 other shares from around the globe. In addition, eToro supports cryptocurrency trading. We also like eToro’s social network, which makes trading more interactive and gives you the option to copy the moves of professional traders.

Overall, we think Australians looking for a stock app will have the best experience with eToro. Click the link below to sign up for an account today!

eToro AUS Capital Limited AFSL 491139. eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. See PDS and TMD