Best ETFs Australia – Top ASX & International ETFs to Invest in

Investing in ETFs in Australia is one of the best ways to build a diversified portfolio at low cost. In this guide, we’ll highlight the 10 best ETFs in Australia you can invest in for 2026.

Best ETFs Australia 2021 List

Here’s a quick rundown of the 10 best Australian ETFs for 2026:

- Vanguard Australian Shares Index ETF (VAS) – Overall Best Australian ETF

- VanEck Vectors Australian Equal Weight ETF (MVW) – Best Performing Australian ETF

- BetaShares Australian High Interest Cash ETF (AAA) – Lowest Risk Australian ETF

- iShares Core MSCI Emerging Markets ETF (IEM) – Best Emerging Markets ETF in Australia

- Vanguard Total International Stock ETF (VXUS) – Best International ETF for Australia

- iShares MSCI China ETF (MCHI) – Top China ETF for Australian Investors

- BetaShares Australian Equities Strong Bear Hedge ETF (BBOZ) – Best Australian Inverse ETF

- SPDR S&P Global Dividend ETF (WDIV) – Best Dividend ETF in Australia

- iShares S&P/ASX 20 (ILC) – Best Australian Blue Chip ETF

- VanEck Vectors Gold Miners ETF (GDX) – Best Gold Mining ETF in Australia

Best ETFs Australia Reviewed

Let’s take a closer look at each of the best ETFs in Australia so you can decide which are right for your portfolio.

1. Vanguard Australian Shares Index ETF (VAS) – Overall Best Australian ETF

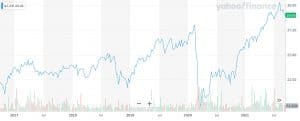

The Vanguard Australian Shares Index ETF is our top pick for investing in homegrown Australian companies. This fund mirrors the performance of the ASX 300 index, which in turn tracks the 300 biggest companies in Australia. We think this is the best ASX ETF and one of the best ways to get exposure to the whole Australian stock market.

This fund was slightly negative in 2020 because of the contraction in the Australian economy, but it returned more than 5% to investors in 2019. The largest holding is Commonwealth Bank of Australia, but you’ll also invest in household names like Westpac, Woolworths, and Afterpay. The fund charges an inexpensive management fee of 0.10% per year.

eToro AUS Capital Limited AFSL 491139. eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. See PDS and TMD

2. VanEck Vectors Australian Equal Weight ETF (MVW) – Best Performing Australian ETF

The VanEck Vectors Australian Equal Weight ETF is one of the top-performing ETFs in Australia. It’s delivered a total return of nearly 24% over the past year and has produced average gains of more than 10% per year for the past 5 years. The fund has an annual management fee of 0.35% and pays out dividends twice per year.

This fund isn’t quite an ASX ETF. Rather, it invests in 105 hand-picked blue-chip companies from Australia, including NIB Holdings, Qube Logistics, Atlas Arteria, and Mirvac Group. No individual stock makes up more than 1% of the total fund, so you get a very balanced investment with exposure to the whole Australian economy.

eToro AUS Capital Limited AFSL 491139. eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. See PDS and TMD

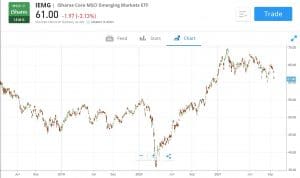

3. iShares Core MSCI Emerging Markets ETF (IEM) – Best Emerging Markets ETF in Australia

The iShares Core MSCI Emerging Markets ETF doesn’t hold any Australian shares. Rather, it focuses on investing in companies in Australia’s neighbors in Southeast Asia, as well as in China, Africa, and South America. The idea behind this fund is to invest in the largest stocks in these emerging economies, since they may have more room for growth than stocks in Australia, the US, or Europe.

This emerging markets shares ETF has produced an average annual return of 12.87% over the past 5 years. That performance comes at a cost of just 0.11% per year, making this one of the best ETFs in Australia for total return. The fund’s biggest holdings include Taiwan Semiconductor Manufacturing, Tencent, Alibaba, and Samsung.

eToro AUS Capital Limited AFSL 491139. eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. See PDS and TMD

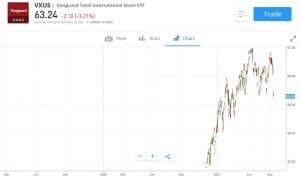

4. Vanguard Total International Stock ETF (VXUS) – Best International ETF for Australia

The Vanguard Total International Stock ETF invests in stocks from all around the world, including from both developed and developing economies. Around a quarter of the fund is devoted to emerging markets, and that portion of the portfolio looks very similar to the iShares Core MSCI Emerging Markets ETF. However, another 40% of the portfolio invests in European stocks, and another 25% is devoted to stocks in Australia and New Zealand.

In total, this Vanguard ETF invests in over 7,200 stocks and has produced average returns of 10.13% per year for the past 5 years. It’s one of the cheapest Australian ETFs, with an expense ratio of just 0.08%.

eToro AUS Capital Limited AFSL 491139. eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. See PDS and TMD

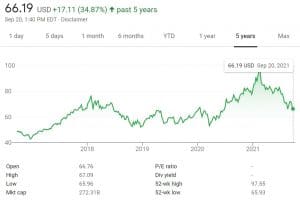

5. iShares MSCI China ETF (MCHI) – Top China ETF for Australian Investors

For Australian investors who want to invest in Chinese stocks, the iShares MSCI China ETF is one of the best ways to do so. This ETF is directly focused on China and invests in more than 600 different Chinese companies. Some of these are tech giants like Alibaba and Tencent, but many are manufacturing, healthcare, and consumer-oriented companies that don’t get as much attention on the international stage.

This China ETF returned 26.75% in 2020 and has delivered annualized average returns of 15.93% for the past 5 years. The 0.59% annual management fee is on the expensive side for an Australian ETF, but that’s more than compensated for by the fund’s outstanding performance.

eToro AUS Capital Limited AFSL 491139. eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. See PDS and TMD

6. BetaShares Australian Equities Strong Bear Hedge ETF (BBOZ) – Best Australian Inverse ETF

The BetaShares Australian Equities Strong Bear Hedge ETF is an inverse ETF that lets you bet against the ASX. Unlike other ASX ETFs, this fund gains value when the ASX drops and loses value when the ASX rises. So, it can be used to make a bearish bet on the Australian economy or to hedge against other investments in Australia.

Thanks to the strength of the Australian economy in recent years, this fund hasn’t performed well. It’s lost more than 80% of its value in the past 5 years. However, we think this fund is worth including on the list of the best ETFs in Australia because it’s one of the few ETFs that lets you easily bet against the country’s top companies.

eToro AUS Capital Limited AFSL 491139. eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. See PDS and TMD

7. SPDR S&P Global Dividend ETF (WDIV) – Best Dividend ETF in Australia

The SPDR S&P Global Dividend ETF is designed for Australian dividend investors. This ETF invests in 94 dividend stocks from around the world, including companies like Exxon Mobil, Keyera, Phillip Morris, and H&R Block. It pays out dividends to investors once per month and has an average annual distribution yield of 4.79%.

The fund comes with an annual management fee of 0.40%, which is reasonable given that paying out dividends monthly can be expensive for the fund. However, note that the fund only has around $330 million in assets under management. This small size means that it can be hard to buy and sell shares of the fund compared to other top Australian ETFs.

eToro AUS Capital Limited AFSL 491139. eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. See PDS and TMD

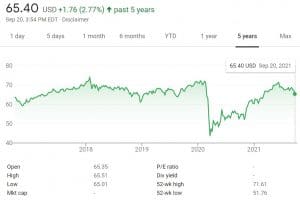

8. iShares S&P/ASX 20 (ILC) – Best Australian Blue Chip ETF

The iShares S&P/ASX 20 ETF is an ASX ETF that only tracks the 20 biggest companies in Australia. Essentially, it’s a pared-down version of the Vanguard Australian Shares Index ETF (VAS), our pick for the overall best ETF in Australia. More than 25% of the fund is invested in the Commonwealth Bank of Australia and CSL Ltd., and another 25% is invested in BHP Group, Westpac, and National Australia Bank.

The fund has slightly underperformed the ASX 300 over the past 5 years, delivering an annualized average return of 10.91% compared to 11.16% for the ASX index. It also has a management fee of 0.24% per year, which is more than twice the fee of the Vanguard ETF. However, this limited ASX ETF can be a good option if you want to invest directly in Australia’s largest companies.

eToro AUS Capital Limited AFSL 491139. eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. See PDS and TMD

9. VanEck Vectors Gold Miners ETF (GDX) – Best Gold Mining ETF in Australia

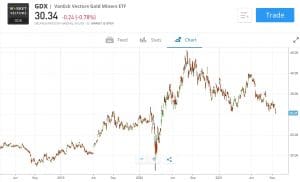

Australia’s economy is heavily dependent on mining, and especially gold mining. So, it makes sense for investors to consider one of the best gold ETFs in Australia: the VanEck Vectors Gold Miners ETF. This fund invests in 55 of the biggest gold mining and processing companies in the world, including Australian companies like Newcrest, Northern Star, and Evolution Mining.

This gold ETF has delivered an average annual return of 5.64% over the past 5 years, although that’s weighted down by a significant negative return in 2020. It’s one of the largest funds we’ve reviewed with more than $12.8 billion in assets under management and has an expense ratio of 0.51%.

eToro AUS Capital Limited AFSL 491139. eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. See PDS and TMD

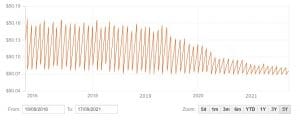

10. BetaShares Australian High Interest Cash ETF (AAA) – Lowest Risk Australian ETF

The BetaShares Australian High Interest Cash ETF is a low-risk Australian ETF that invests primarily in cash, money market funds, and bonds. The fund has an annualized average return of just 1.48% over the past 5 years, so this isn’t the ETF of choice if you want to beat the ASX.

However, it’s a very safe option that you can use to hedge against investments in the stock market and that holds its value even when the market drops. The main advantage of the AAA ETF is that it delivers a consistently higher return than other cash investments in Australia like savings accounts.

eToro AUS Capital Limited AFSL 491139. eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. See PDS and TMD

What are ETFs?

ETFs, or exchange-traded funds, are baskets of stocks or other assets that you can buy and sell on stock exchanges just like shares of individual companies. The best ETFs in Australia let you invest in dozens or even hundreds of companies in a single trade, making it easy to create a diversified portfolio with little effort or cost.

When you invest in an ETF, you’re effectively buying shares of all the stocks that the ETF holds. So, ETFs rise and fall in value in response to changes in the prices of the assets they hold – if an ETF’s holdings perform well, the fund itself will rise in value proportionally. In addition, ETFs pay out any dividends that the underlying stocks pay to shareholders.

How are ETFs Traded?

ETFs are traded on stock exchanges like the Australian Stock Exchange (ASX) or the New York Stock Exchange (NYSE) or NASDAQ in the US. You can buy and sell shares of Australian ETFs just like you would buy and sell shares of individual companies. The only difference is that instead of buying just one company, you’re buying many different companies when you invest in ETFs.

Types of ETFs

There are several different types of ETFs available to Australian investors. Here, we’ll cover some of the main types of ETFs in Australia to help you decide which funds are best for your portfolio.

Index ETFs

Index ETFs are one of the most common types of funds you’ll find. These are ETFs that track a specific stock market index, like the ASX 300 in Australia or the S&P 500 index in the US. Index ETFs don’t try to beat the market. Rather, they make it easy to invest in the whole market at once.

A neat thing about index ETFs is that some of them are country-specific. For example, ASX ETFs like the Vanguard Australian Shares Index ETF let you invest in 300 of the biggest companies in Australia. The iShares MSCI China ETF lets you invest in 600 of the biggest companies in China.

One major advantage to index ETFs, and ASX ETFs in particular, is that they’re very inexpensive. The Vanguard Australian Shares Index ETF has an annual management fee of just 0.08%.

Sector ETFs

Sector ETFs let you invest in a particular market sector, often across international lines. The VanEck Gold Miners ETF, for example, lets you invest in gold miners from the US, Australia, South Africa, and elsewhere.

Sector ETFs have higher management fees than index ETFs, but you have the freedom to build a portfolio around specific investment ideas or trends. If you think the tech sector will outpace the broader stock market, you can invest in a FAANG ETF that gives you exposure only to this sector. There are also Bitcoin ETFs that let you invest in Bitcoin or cryptocurrency-related companies.

Inverse & Leveraged ETFs

Inverse and leveraged ETFs are specialized ETFs that let you bet against the market or amplify your exposure to the market. Inverse ETFs like the BetaShares Australian Equities Strong Bear Hedge ETF let you bet against the Australian stock market. Leveraged ETFs, like a 3X S&P 500 ETF, rise or fall multiple times over for every $1 change in the underlying market.

Inverse and leveraged ETFs can be risky since they typically invest in short-term derivatives. They also always lose value over time because of the way they’re structured, so it’s important to use these ETFs only for short-term trading.

Dividend ETFs

Dividend ETFs like the SPDR S&P Global Dividend ETF are funds that focus on dividend investing. They typically invest in companies that reliably pay out dividends and have high dividend yields. Dividend ETFs pass on payout to investors monthly, quarterly, or twice a year.

Are ETFs a Good Investment?

Whether ETFs are a good investment for you depends on your investing goals. For many Australian investors, ETFs make a lot of sense. They let you build a diversified portfolio in just a few trades, and give you exposure to a huge range of companies and markets. That diversification means that you’re more protected against a downturn in any single market sector.

Another advantage to ETFs is that they’re put together and supervised by experienced fund managers. These managers work hard to make sure that the fund remains true to the index or market it’s meant to represent, and that the ETF remains balanced over time as the prices of stocks change. This lessens the need for you to rebalance your own portfolio frequently and reduces the amount of portfolio management you need to do.

The main downside to ETFs is that they don’t offer the same direct exposure to any one company’s performance that individual stock investing does. Say Westpac’s stock shoots up 50%. If you bought individual Westpac shares, your investment’s value would grow by 50%. However, if you own an ETF in which Westpac shares make up just 5% of the total portfolio, the fund might only rise by 1-2% depending on how all the other shares inside the fund are performing.

Another thing to keep in mind about ETFs is that they come with management fees. These are often inexpensive, especially for ASX ETFs like the Vanguard Australian Shares Index ETF. However, they can add up to more than 0.5% per year for some specialized or actively managed ETFs.

How to Choose the Right ETF for Your Portfolio

Choosing the best ETF for your portfolio comes down to thinking about what you want to invest in. Are you investing in ETFs to try to beat the market while still keeping some diversification in your portfolio? Or are you using ETFs to try to match the market or reduce your overall investment risk?

If you’re trying to beat the market, you’ll want to look at sector or country-specific ETFs like the iShares Core MSCI Emerging Markets ETF, the iShares MSCI China ETF, or the VanEck Gold Miners ETF. There are dozens of other sector-specific ETFs for everything from tech to finance to healthcare and beyond. Be sure to look carefully at how these funds have performed in the past and what stocks they hold.

If you just want to match the market, consider funds like the Vanguard Australian Shares Index ETF or the VanEck Vectors Australian Equal Weight ETF. There are also funds for the major US stock indices like the S&P 500 and NASDAQ 100.

Keep in mind that you can have multiple investment goals and multiple portfolios. For example, you may want to invest half your money in an index ETF, and then use the other half of your money to try to beat the market with sector-specific ETFs. You can also mix ETF investing with investing in individual stocks.

Best ETF Brokers

In order to invest in the best ETFs in Australia, you’ll need a stock broker that offers ETF investing.

1. eToro – Overall Best ETF Broker in Australia

eToro is our number 1 pick in Australia for investing in ETFs. This ETF app trading on more than 250 ETFs, including many of the 10 best ETFs in Australia we reviewed. In addition, eToro lets you invest in fractional shares of ETFs with as little as $50. Did you know that eToro is also one of the best crypto apps across the board?

eToro is our number 1 pick in Australia for investing in ETFs. This ETF app trading on more than 250 ETFs, including many of the 10 best ETFs in Australia we reviewed. In addition, eToro lets you invest in fractional shares of ETFs with as little as $50. Did you know that eToro is also one of the best crypto apps across the board?

eToro also has another trick up its sleeve for investors who are interested in ETFs: copy portfolios. With eToro’s copy portfolios, you can invest in custom portfolios put together by expert investors and traders. You’ll find tons of thematic portfolios as well as portfolios centered on Australian investments. eToro is also the best share trading platform Australia offering stocks across 17 international markets.

eToro makes it easy to invest by accepting a wide range of payments. You can deposit funds by credit card, debit card, or PayPal, and you only need $50 to get started. On top of that, eToro offers 24/7 customer support.

Read our comprehensive eToro app review to find out more about what this ASIC-regulated broker offers.

- Trade over 250 ETFs

- Fractional share investing in ETFs

- Supports copy portfolios

- 24/7 customer support

- Little professional research on ETFs

eToro AUS Capital Limited AFSL 491139. eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. See PDS and TMD

How to Invest in ETFs

Ready to invest in the best ETFs in Australia? We’ll show you how to get started with eToro in 4 simple steps.

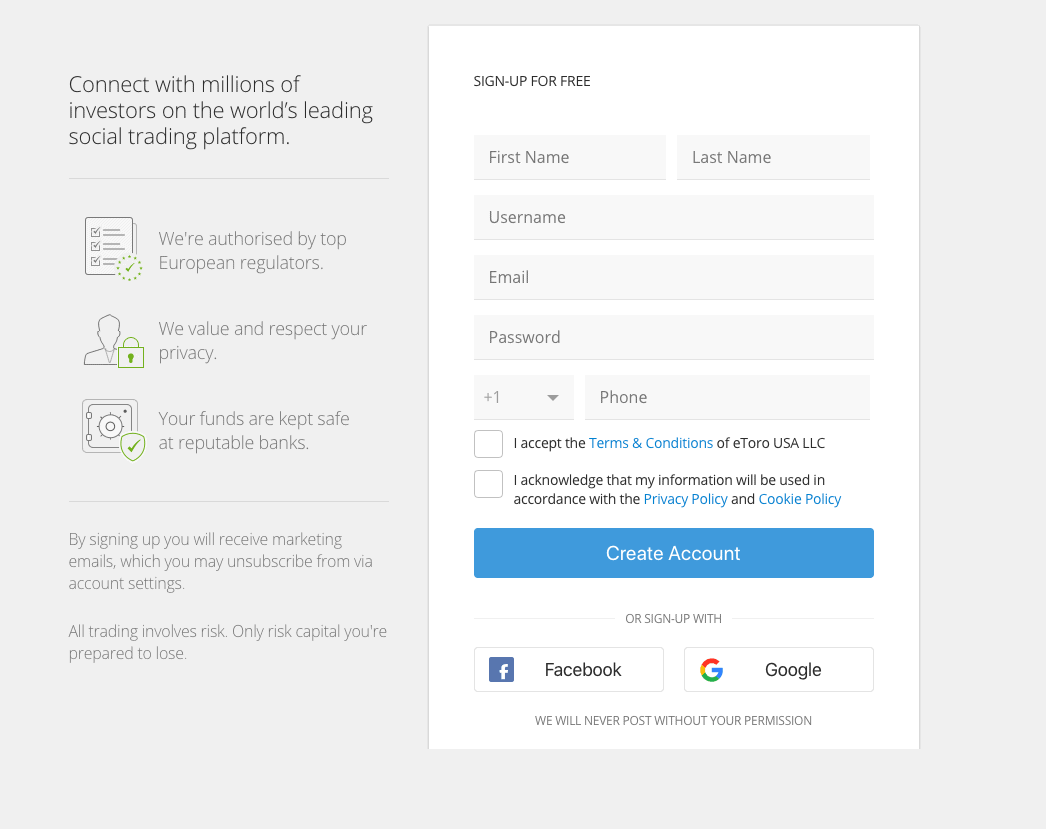

Step 1: Open an eToro Account

The first step to investing with eToro is to open a new trading account. Head to eToro’s homepage and click ‘Join Now.’ Enter your email, a new username, and a password, then fill in your name and other personal details.

eToro AUS Capital Limited AFSL 491139. eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. See PDS and TMD

Step 2: Verify Your Identity

eToro is regulated by top-tier authorities including the Australian Securities & Investments Commission (ASIC). These regulators require all new traders to verify their identity before you can start trading. You can complete this step online by uploading a copy of your passport or driver’s license along with a copy of a recent utility bill or financial statement.

Step 3: Deposit Funds

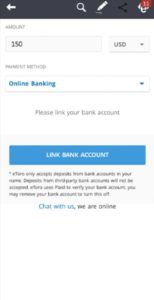

eToro requires a minimum deposit of $50 when you open a new account. You can make a deposit by credit card, debit card, PayPal, bank transfer, Neteller, or Skrill.

Step 4: Buy Your First ETF

Once you’ve made a deposit, you’re ready to buy your first ETF in Australia. Search for the ticker symbol of the ETF you want to buy or click on ‘ETFs’ under the ‘Markets’ tab to see all of the funds available on eToro. Once you find the fund you want to buy, click ‘Trade’ to open a new order form.

eToro AUS Capital Limited AFSL 491139. eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. See PDS and TMD

In the order form, enter the amount you want to invest in the ETF. You can invest any amount over $50. Enter a stop loss or take profit level for your trade if it makes sense for your investment strategy, and then click ‘Open Trade’ to finish investing in your first ETF. However, they are not guaranteed over slippages.

Conclusion

The best ETFs in Australia give you exposure to some of the country’s biggest companies as well as to the wider world of stocks from the US, Europe, and Asia. ETFs offer instant diversification and enable you to invest in markets that can’t easily be accessed through individual stock investing. When choosing ETFs, think carefully about whether you want to try to match the stock market’s performance or to try to beat the market.

Ready to buy your first ETF in Australia? Sign up with eToro today and trade more than 250 funds!

eToro – Buy the Best ETFs in Australia

eToro AUS Capital Limited AFSL 491139. eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. See PDS and TMD