Best CFD Trading App – Trading Guide 2024

CFDs are available for popular instruments like forex, metals, and commodities. These contracts for differences bring several advantages, including trading international markets with your local currency. Also, you can apply leverage to amplify your gains when trading commodities, stocks, or instruments.

The crucial part of CFDs is finding the best CFD trading app for your preferred assets. Some apps offer CFDs for specific assets and exclude the rest, making it challenging to build a portfolio. Fortunately, we’ve reviewed several platforms, including using the CFD trading app demo to get the best.

This article offers the best CFD trading app to get you started on your portfolio. With the apps on this list, you don’t need to own stocks and worry about other complexities of the market. Instead, open a CFD trading app contract to launch into the market.

[toc]Best CFD Trading Apps List

- eToro: Overall best CFD trading app

- Plus500: The best CFD trading app for risk management

- Interactive Brokers: The best CFD trading app for shares

- Forex.com: The Best CFD trading app for integrated market analysis

Best CFD Trading Apps Reviewed

Leverages allow you to trade with more money than your deposit. The broker increases your margin, setting you up for greater profits if the trade goes your way. This and other features are part of our selection criteria for the best CFD trading app.

Besides finding brokers with the best-supporting features, we are equally interested in those with a CFD trading app demo account. It is crucial for new traders to learn about these contracts and how they are executed in the market.

CFD trades can be offered by day trading or general investment apps. With that in mind, here are our top recommendations for the best CFD trading app:

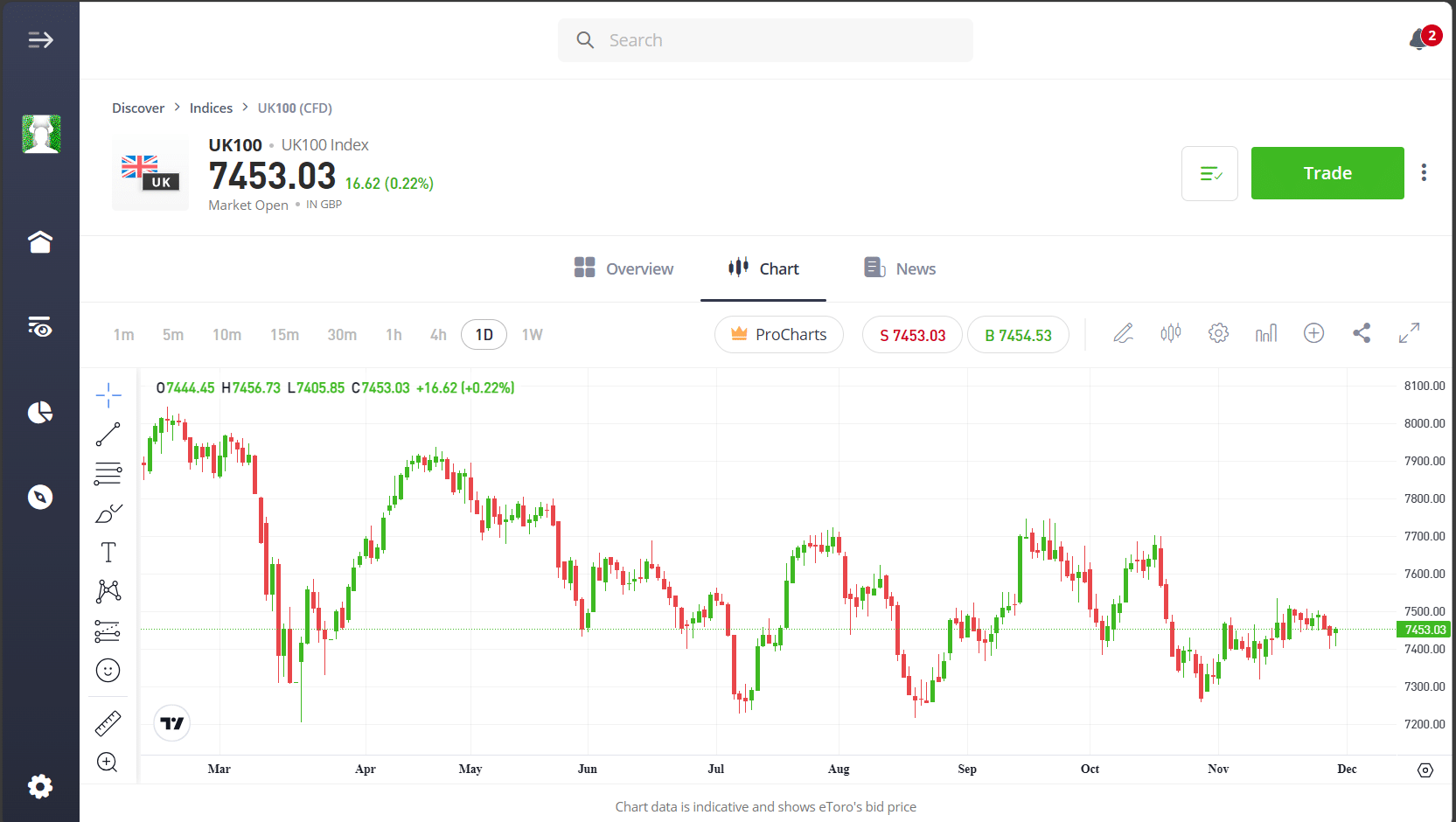

1- eToro: The Overall Best CFD Trading App

This online broker remains one of the leading CFD trading apps in the world and in the United States. It holds several licences in its operating regions, including the Financial Conduct Authority (FCA) of the UK and CySEC of Cyprus. eToro USA Securities Inc. is registered with the Securities and Exchange Commission (SEC).

Financial instruments on this platform include stocks, indices, commodities, currencies, ETFs, crypto, and NFTs. eToro offers an extensive portfolio of over 3,000 assets. Whichever market you prefer to trade CFDs in, eToro is the place to go.

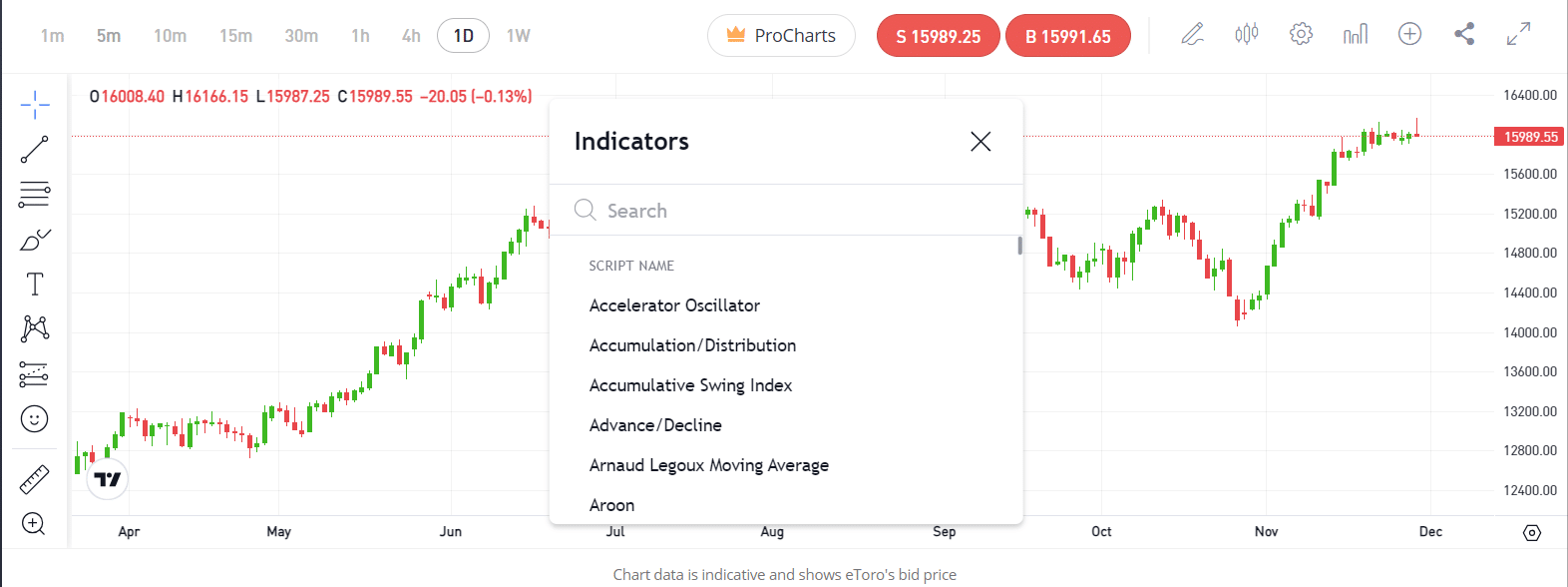

eToro is the best CFD trading app to cover many financial instruments, but that is not the best part about it. The charts can be changed from candlesticks to baseline, area, bars, columns, etc.

76% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Based on trader activities, eToro recommends the top CFDs to trade daily. If you are a new trader hesitant about depositing real cash, eToro has a CFD trading app demo for you.

This online broker allows you to add assets to your watchlists and set price alerts for them. The copy trading feature allows you to copy the trade of any proven expert. Go to the trader and click “Copy,” add your deposit, and see how the market goes.

You can copy a single trade or an entire portfolio. If you choose to trade on your own, eToro adds several supporting features. These include real-time price quotes, take-profit and trailing stop-loss, short with or without leverage, etc.

The table below shows the core features:

| Feature | Overview |

| Risk management | Offer customizable tools, including take-profit and trailing stop-loss |

| CopyTrader | Provides the option to copy a trade or the entire portfolio |

Pros:

Cons:

76% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Note: Only cryptocurrencies eToro customers in the United States will be able to trade on the platform will be Bitcoin, Bitcoin Cash, and Ethereum.

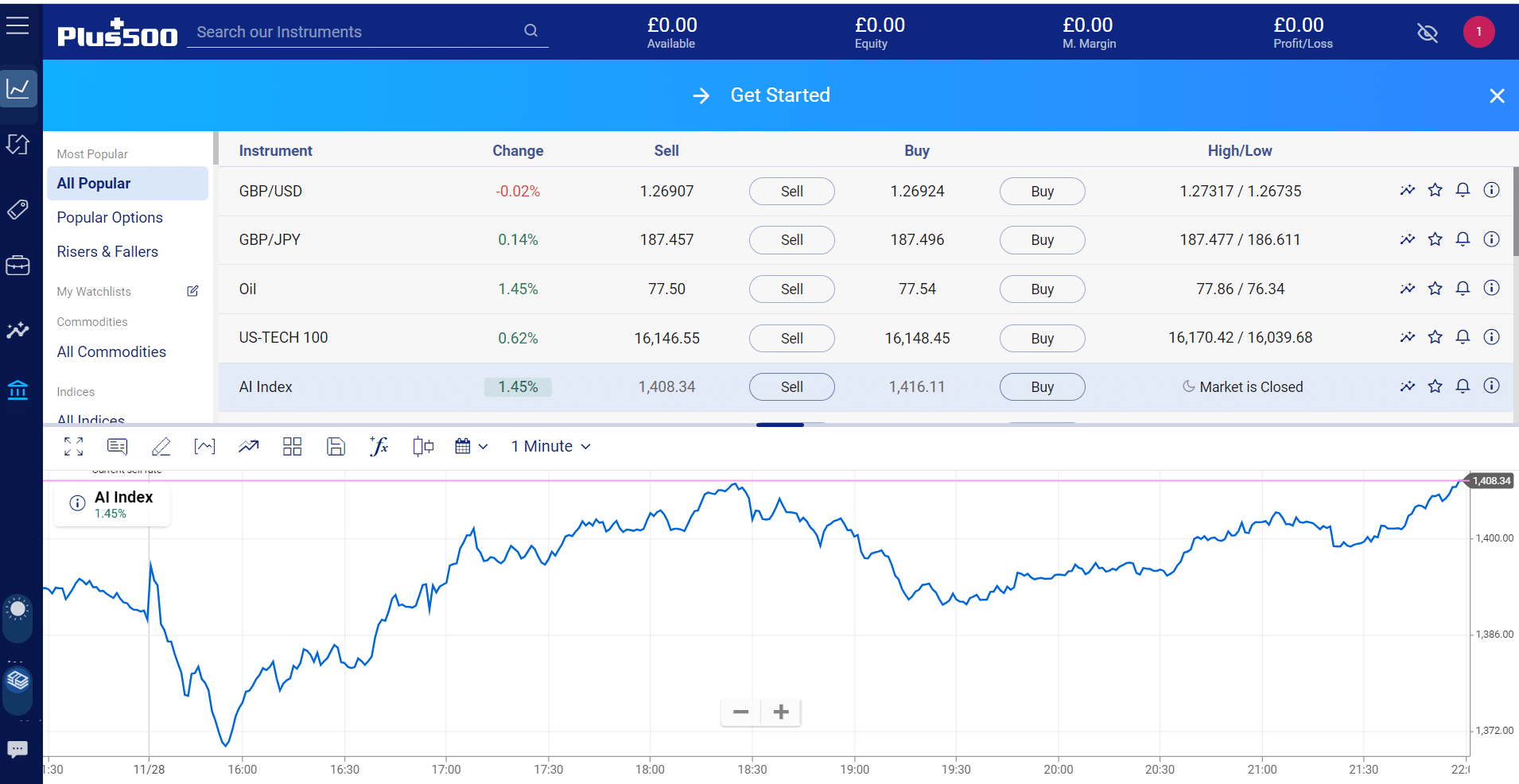

2- Plus500: The Best CFD Trading App for Risk Management

This global fintech group offers over 2,800 CFDs on forex, indices, shares, commodities, etc. It adds tight spreads and zero deposit fees with advanced risk management tools. With the latter, you can set a “close at profit” or “close at loss” price level for your trades.

Plus500 offers a guaranteed stop order for your trading position, which limits your potential loss. This setting closes your position automatically, even when the market moves against you. With the high risk of trading CFDs, these additions make Plus500 the best CFT trading app for risk management.

Trailing stop is another risk management tool you can use to minimize your losses. Real-time quotes are available to guide you all the way, with endless trading opportunities.

Plus500 is one of the best commodity apps available in the US, and you can leverage that to enjoy CFD trades. Leverage is available up to 1:300 with other supporting features. You can fund your account with Visa or Mastercard to start trading.

Insights is the newest feature of this online broker. This section provides exclusive trading data on the PC site or mobile app. Taking a moment to review this data can make all the difference in your future CFD trades.

You can see what other customers are doing, review trends, and fine-tune your trading decisions. This section features traders’ trends, traders’ sentiments, media trends, etc.

This broker offers a CFD trading app demo for new traders. This and other nifty features place it among our recommendations for the best CFD trading app.-

| Feature | Overview |

| Insights | Provides exclusive data on customer activities in real-time |

| Technical charts | Analyze financial instruments with different tools, including technical indicators |

Pros:

Cons:

3- Interactive Brokers: The Best CFD Trading App for Shares

This online broker stands out with its extensive support for share CFDs. It offers over 8,500 shares for global trading, with several benefits. You only need a minimum of a 20% initial margin to start trading CFDs on the platform.

Interactive Brokers does not offer commission-free trades, but its commissions are affordable. All US shares have a 0.5% commission, while other global shares have a 0.05% commission. You will enjoy even lower rates if you are an active trader on the platform.

The IB SmartRouting technology determines the CFD reference price. Other financial instruments enjoy lower margins of 5%. These include indices and metals.

Interactive Brokers provides easier exposure to currencies than most financial products. It offers direct access to inter-bank quotes, which give real-time prices from 14 of the largest FX dealing banks in the world. Also, the broker offers automatic overnight position rolls.

The FX Trader is available to trade forex CFDs. This platform offers real-time streaming quotes, up and down indicators, trading volumes, pending trades, executions, positions, and average price plus P&L. Hence, Interactive Brokers qualifies among the best forex apps in the US.

The table below outlines the major features of this online broker

| Feature | Overview |

| FX Trader | It provides an optimized trading platform for the currency market. |

| Trader Workstation | Designed for active traders, with support for multiple products |

Pros:

Cons:

4- Forex.com: The best CFD Trading App for Integrated Market Analysis

If you’d rather learn and perfect your skills with a CFD trading app demo, Forex.com is the broker to register with. This platform provides $50,000 to demo accounts for CFD trading across different financial instruments, including stocks and commodities. You will access over 2,500 headline names from the US and UK for trading opportunities.

Stock trades are available with a 0% commission. However, spread costs will apply to your trades. Review them before executing any trade.

To boost its CFD stock trading, Forex.com adds stock news and analysis. This section brings the latest happenings to your screen. Combine that with the economic calendar and you have a robust trading platform with supporting features for decision making.

Besides stocks, Forex.com allows you to trade commodities through CFDs. You can speculate in new markets like oil and wheat and hedge against inflation. Also, you can trade on the native Forex.com platform or take your trades to MetaTrader 5.

Forex.com is among the best demo trading apps. Notwithstanding, its live accounts are well taken care of. You’ll get market-leading prices to inform your long or short position on the CFD trades.

Extensive trading research is available on this platform. Forex.com adds integrated market analysis and Reuters news. Most importantly, these features are available on the mobile app.

| Feature | Overview |

| TradingView Charts | It offers over 80 indicators, 14 timeframes, and 11 chart types |

| Performance Analytics | Provides tools to analyze your trading decisions |

Pros:

Cons:

CFD Trading Explained

To new traders, contracts for differences may sound complicated, especially since you don’t own actual stocks. There are several ways to trade in a market without owning assets. One way is through derivatives, which include futures and CFDs.

Most online brokers turn to contracts for differences when they can’t offer specific assets in your region. That is often due to local regulations. Hence, you can trade CFDs for assets in the UK and still profit.

Derivatives, whether CFDs or futures, involve speculation. You can do that randomly, but that approach is liable for heavy losses. Instead, you want to make informed speculations about an asset’s price.

One way to gather more information is through alternative data services that collate market sentiments. With enough data and analysis, you will improve your skills in reading the market flow. Make the right speculations, and you will come out on the other side with a profit.

You can grab a CFD trading app demo with some training materials to boost your skills in CFD trading. That is our recommendation for new traders unfamiliar with how contracts for differences work. Notwithstanding, we will lay the groundwork in this article.

This section will cover the basics of contracts for differences, how they work, and how you can profit from them. You’ll also learn how to select the best CFD trading app for your preferred assets. We will share the top considerations needed to get the best.

What is CFD trading?

CFD is an acronym for contracts for differences. These are contracts between you and the broker where you speculate on the price of a financial instrument.

You or the broker will pay the difference between the price at the end and the one at the beginning. That is based on the outcome and the terms of the contract. In one sense, you are betting against the market.

CFDs derive their value from the underlying assets. For example, the price you will pay for a Tesla CFD is the same as the price of one share of Tesla on the stock market. Once the contract is bought, you’ll wait until the end to see if your speculations are correct.

With CFDs, you can bet on whether the price will rise or fall. That takes us to the two positions in CFD trading:

- The long position or buy: In this position, your bet is on the price to rise at the end of the contract. If that happens, you will receive the difference between the initial and final price. Get it wrong, and you will be the one paying the difference.

- The short position or sell: In this position, you speculate that the price will fall at the end of the contract. If your speculation is true, you will receive the difference between the initial and final price.

Things to Note About CFD Trading

We’ve identified crucial points to note about CFD trading. They include the following:

- You don’t own any asset in the contract

- The profit or loss is the product of the entry and price difference and the number of CFD units

- One CFD unit equals one share of the underlying asset (the prices are the same)

- Several CFD units can make up one CFD contract, depending on how you want it.

- You can use leverage to trade more than your deposit. However, online brokers require specific margins to lend you leverage.

Besides making money off your speculation, you can also sell your CFD if the price goes up in a long position. As simple as our CFD explanation sounds, much goes into speculation.

You need the best CFD trading app to get unrivalled supporting features for CFDs. The next section will deal with what to consider when picking an online broker.

Regulation

CFDs are unlike other financial instruments. Their over-the-counter nature places them outside the regulation of most authorities. Hence, CFDs are banned in most countries and regions.

This calls for extreme caution when picking and registering with a CFD online broker. Such platforms must be regulated by local and regional authorities where the underlying assets are provided. If you are trading US and UK assets, then the broker should be licensed in these countries.

Regulatory bodies in the US include the Commodities Futures Trading Commission (CFTC) and the Securities and Exchange Commission (SEC). These bodies may not regulate CFD trading, but they’ll regulate the underlying assets on the platform. Also, look for local (state) agencies to certify the broker’s presence in your state of residence.

If you are trading assets in Australia, the broker should be licensed with the Australian Securities and Investment Commission (ASIC). You’ll find the license information on the broker’s legal page.

With brokers, especially those listed on this page, offering trading markets across dozens of countries, tracking all regional licenses can be challenging. Instead, ensure the broker is licensed to provide that asset or trade in your region.

The advantages of using regulated brokers include the following:

- Regulatory bodies ensure fair trading practices for traders

- Regulated online brokers must adhere to high-security standards against theft and data breaches

- You can file a public complaint for any unfair practice

- You are not in violation of any laws

Assets

New traders may find it challenging to pick CFD contracts. That’s because you should be knowledgeable about the underlying assets before trading. If you are new to trading, we recommend using a CFD trading app demo to learn about the market and its features.

Once you’ve gained knowledge about your preferred assets, including their price flows, you can set up CFD trades. The next step is finding the best CFD trading app that features your preferred assets.

Unless you have specific assets and prefer to stick to them, we recommend picking online brokers with a wide range. Those listed on this page offer CFDs in shares, stocks, commodities, metals, ETFs, crypto, etc. Contact customer support if you are unsure what the platform supports.

The best AI stock-picking apps will get you onboard with trendy and high-potential stocks. They are helpful when you don’t have the luxury of researching stocks and other assets. Once picked, you can turn to analysis tools to see their potential.

Ensure you have a sizeable grasp of an asset’s performance before speculating on its price. Dramatic events can happen and swing prices in the opposite direction. However, you won’t be far off the mark if you invest time in understanding your preferred assets.

Ensure adequate diversification when trading CFDs. A diversified portfolio is one of the strategies experts use to offset their losses. They’ll have highly volatile assets on the one hand and, on the other, low volatile assets.

Trading Tools and Features

Our reviews of the top CFD trading apps have covered some essential tools and features. You can stick to the simple clicks of buying and selling, but that won’t take you far on a CFD trading app. Instead, gathering information to understand patterns and critical events that can influence prices will take you far.

This aspect of trading is achieved through tools and features. The prominent toll categories you should consider include the following:

- Technical analysis tools: These tools are used to analyze price charts, identify patterns, and make possible predictions. Online brokers present price movements on charts. However, you need technical indicators to make sense of them. These indicators include moving averages, relative strength index (RSI), Bollinger bands, etc.

- Economic calendars: Upcoming events can influence stock and market prices. For example, a tech expo might cause the price of a company’s stock to rise in anticipation of a new product launch. The best CFD trading apps will have in-built economic calendars to help users keep tabs.

- Risk management tools: We’ve identified a few risk management tools during our brief reviews. Pick apps that allow users to cut their losses, stop a trade when they hit specific profit margins, etc. These are essential, especially for day traders with quick-moving markets.

- News: The news we speak of here is filtered news. Some online brokers allow users to filter the news feed and allow only those related to their portfolios to show. That nifty addition can make all the difference in a split-second profitable trade.

Other tools that can boost your performance include alerts, stock comparison tools, heatmaps, etc. if you have them, then you are not far off from making reasonable trading decisions.

Mobile App and Device Compatibility

Our final step in identifying the best online broker is mobile compatibility. This aspect is non-negotiable unless you want to be trading on your PC 24/7. Even that, in itself, means carrying your PC everywhere you go.

Periodic traders or holders may have little need for trading on mobile devices. If you are more active, then opt for a platform that is compatible with smartphones and tablets. The online brokers listed on this page have mobile apps for Android and iOS devices.

76% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

CFD Trading Strategy

Learning how to read and interpret charts is essential to building any strategy. Some brokers allow strategy testing through simulations. You can build yours and run them under real-market conditions.

Popular strategies for CFD trading include the following:

- Hedging with CFDs: Losses will likely happen, but you can offset them. Hedging involves opening several positions to offset losses that may occur on an existing trade. The positions may have low returns but enough to cover your losses if the existing trade goes south.

- Day trading: This strategy requires focusing on technical analysis instead of fundamental factors that may affect an asset. It involves opening positions quickly to profit from small price movements during the day. You might make profits from this strategy, but it requires constant monitoring with stock alerts and other notifications.

- CFD news trading: This strategy requires investing according to economic calendars. It is often applied to long-term trades, but it can be effective for short-term action. You’ll need reputable news sources to keep up with economic changes.

CFDs are not recommended for long-term trading, even though they do not have expiration dates. The use of leverage can also prevent you from holding the trade for the long term. Instead, focus on sharpening your skills to make more accurate speculations for the short term.

Don’t go in for long-term trades if you do not have enough margin. Brokers will implement a forced sell if you no longer meet the margin requirements.

Do not spend above your budget when trading CFDs. Maintain discipline, regardless of new promising trades that pop up after you’ve exhausted your budget.

Develop strategies and test them with demo accounts. eToro, Plus500, and Forex.com have demo accounts to get you onboard.

76% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Advantages and Disadvantages of CFD Trading

The table below summarizes the advantages and disadvantages of CFD trading:

| Advantages | Disadvantages |

| Lower margin requirements | It allows users to copy entire portfolios or open trades |

| Provisions for leverage | High leverage increases the losses |

| Access to trade without currency conversions | It is not viable for long-term trades because of the margin needed to maintain it |

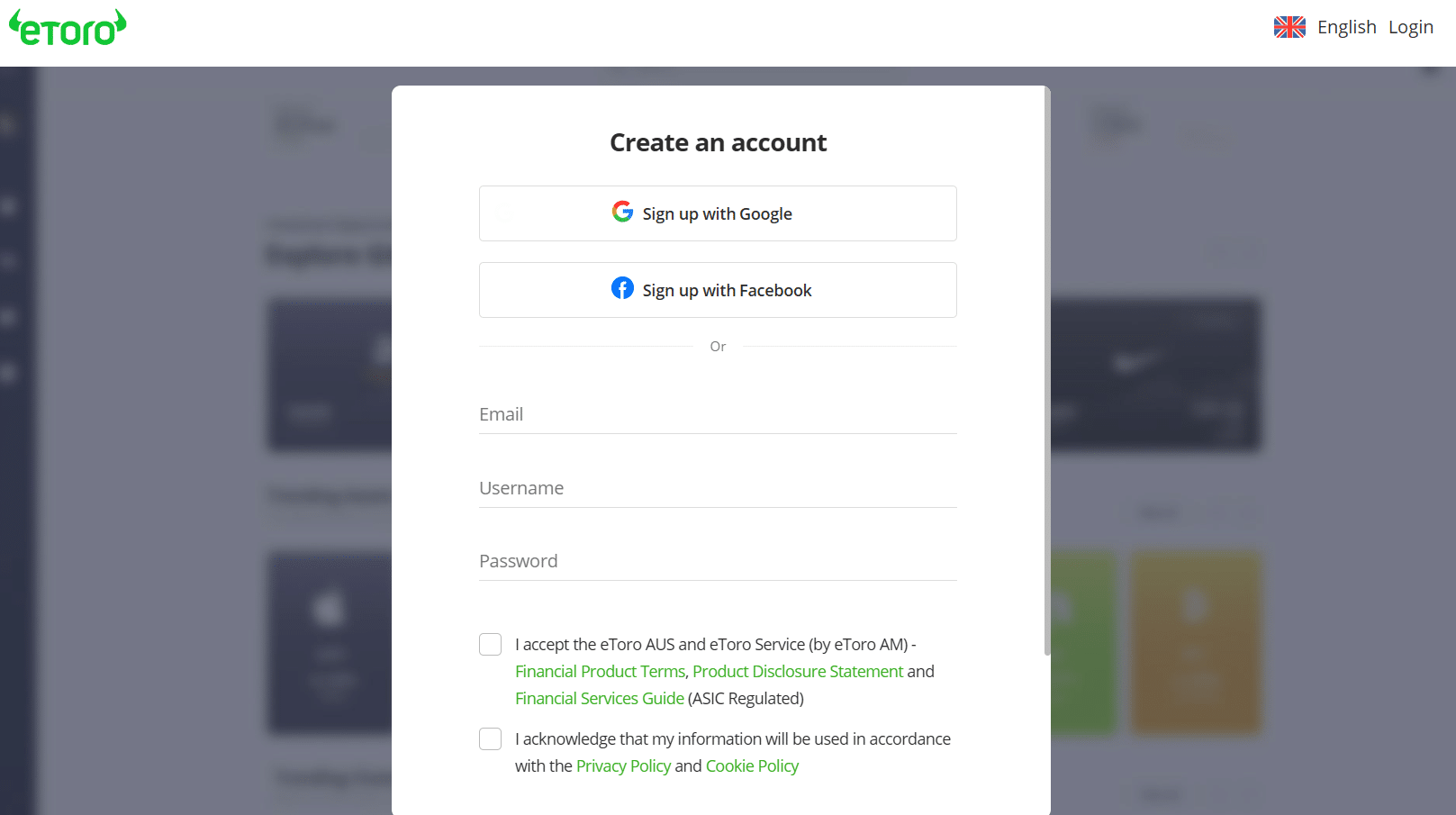

Best CFD Trading App – eToro Tutorial

eToro offers trading with a user-friendly interface and advanced traders. It is the ideal blend for beginners and expert traders. In addition, it is available for US residents.

While signing up, you can pick a demo or live account. We recommend starting with the demo or virtual account if you are new to CFD trading. You can practice with the $100,000 virtual balance as you learn more about CFDs from what we’ve written on this page.

eToro is a robust platform with many features, including technical charts and trending topics. The registration process is as follows:

Here’s a complete guide to trading on eToro:

Best CFD Trading App – Conclusion

Leverages in CFD trading increase profit margins. You can make several times more than what your margin could cater for. However, the same thing applies to losses.

Register with regulated brokers. Ensure the broker provides risk management tools and other features to boost decision-making.

Visit eToro to get started with the demo CFD trading account. Verify your identity and deposit for real-money CFD trades.

76% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

References

- https://money.usnews.com/money/blogs/the-smarter-mutual-fund-investor/slideshows/economic-factors-that-influence-stocks

- https://www.bloomberg.com/markets/economic-calendar

- https://money.usnews.com/investing/stock-market-news/articles/how-fed-decisions-impact-the-stock-market

- https://www.investor.gov/introduction-investing/general-resources/news-alerts/alerts-bulletins/investor-bulletins/investor-5

- https://www.theguardian.com/technology/2021/feb/07/are-share-trading-apps-a-safe-way-to-play-the-markets