Best Copy Trading App – Trading Guide 2024

Trading cryptocurrency, forex, and other financial assets demands certain skills. Everyone knows that the markets are complex and a deep learning curve awaits every beginner. You may struggle to master how the markets work initially, but you don’t have to worry if you have a copy trading app in your arsenal.

With numerous copy trading tools on the market, beginner investors may need help finding the best copy trading app. This guide reveals “What are the best copy trading apps?” for crypto and forex enthusiasts looking to profit from the trades of seasoned investors.

Best Copy Trading Apps List

Find the top 6 copy trading apps for traders and investors in 2023 below. These platforms service millions of investors worldwide and have the lowest fees.

- eToro – Best for Social Trading

- ZuluTrade (via AvaTrade) – Best for Beginners

- MetaTrader 4 (via Libertex) – Best for Zero Commissions

- Mirror Trader (via AvaTrade) – Best Copy Trading Tool for Forex and Commodities

- cTrader (via Pepperstone) – Best Trading Platform for Straight-Through Processing (STP) Brokers

- DupliTrade (via Pepperstone) – Top Copy Trading App with Comprehensive Social Trading Tools and Platforms

Best Copy Trading Apps Reviewed

Now, let’s review each copy trading platform that makes it into our list of the best copy trading apps. We assessed the platforms’ top features, fees, usability, and supported assets during our review.

Before choosing any copy trading sites for crypto or forex trading, ensure you know its core offerings and determine if they align with your trading and investment needs.

1. eToro – Best for Social Traders

Did you know eToro is one of the largest digital asset platforms worldwide? The digital exchange heads our list of the best copy trading apps. With over 30 million users worldwide, the online trading platform needs no introduction among traders and investors in the financial markets.

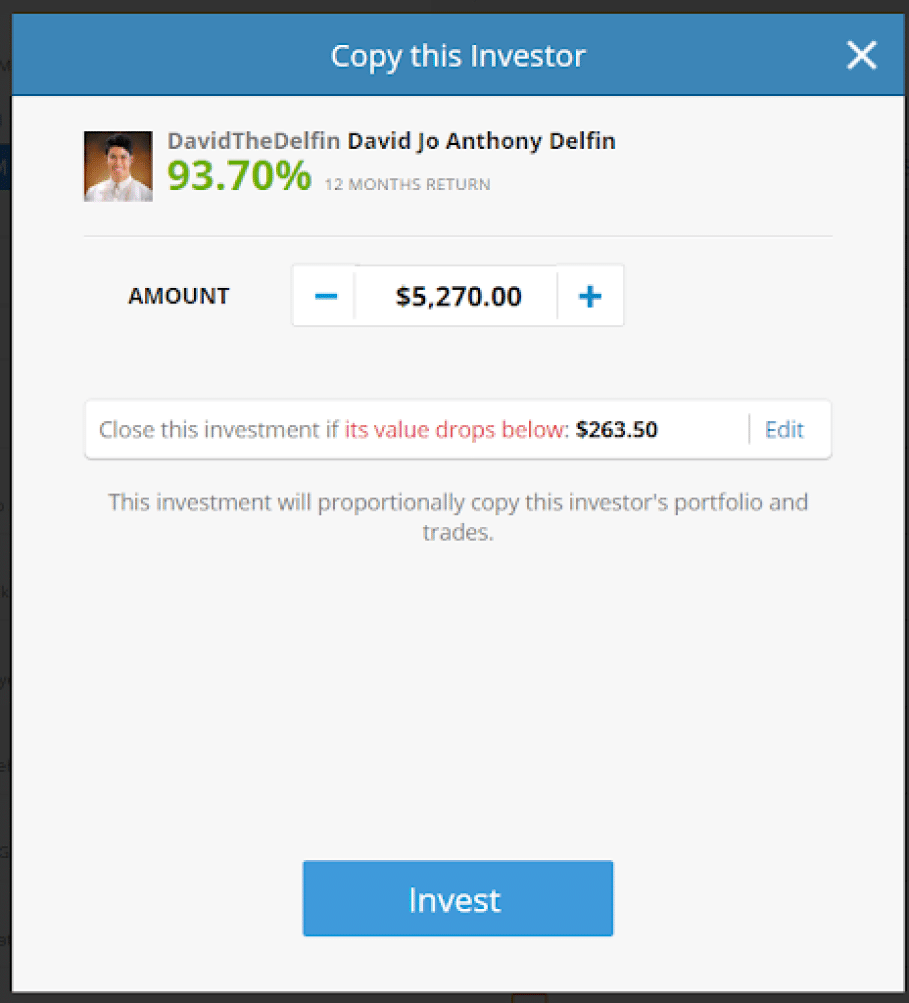

You know eToro can help you trade thousands of assets, but you probably didn’t know that it can let you copy trades of top investors and infuse them into your own trades. You can save time and reduce risks using the eToro CopyTrader feature. It helps you take the same trading positions as the professional you’re copying. So, you don’t need to open or close trades yourself.

Over 4,000 assets exist for you to trade and invest in on eToro. You can diversify your portfolio across stocks, cryptocurrencies, commodities, indices, forex, exchange-traded funds (ETFs), and non-fungible tokens (NFTs). The diverse opportunities across the global market make eToro a comprehensive trading platform.

The CopyTrader feature is integrated into the eToro Exchange. That way, you can access it in one place and with a single account. In other words, you don’t need any additional forex copy trading app because the robust platform has everything you need.

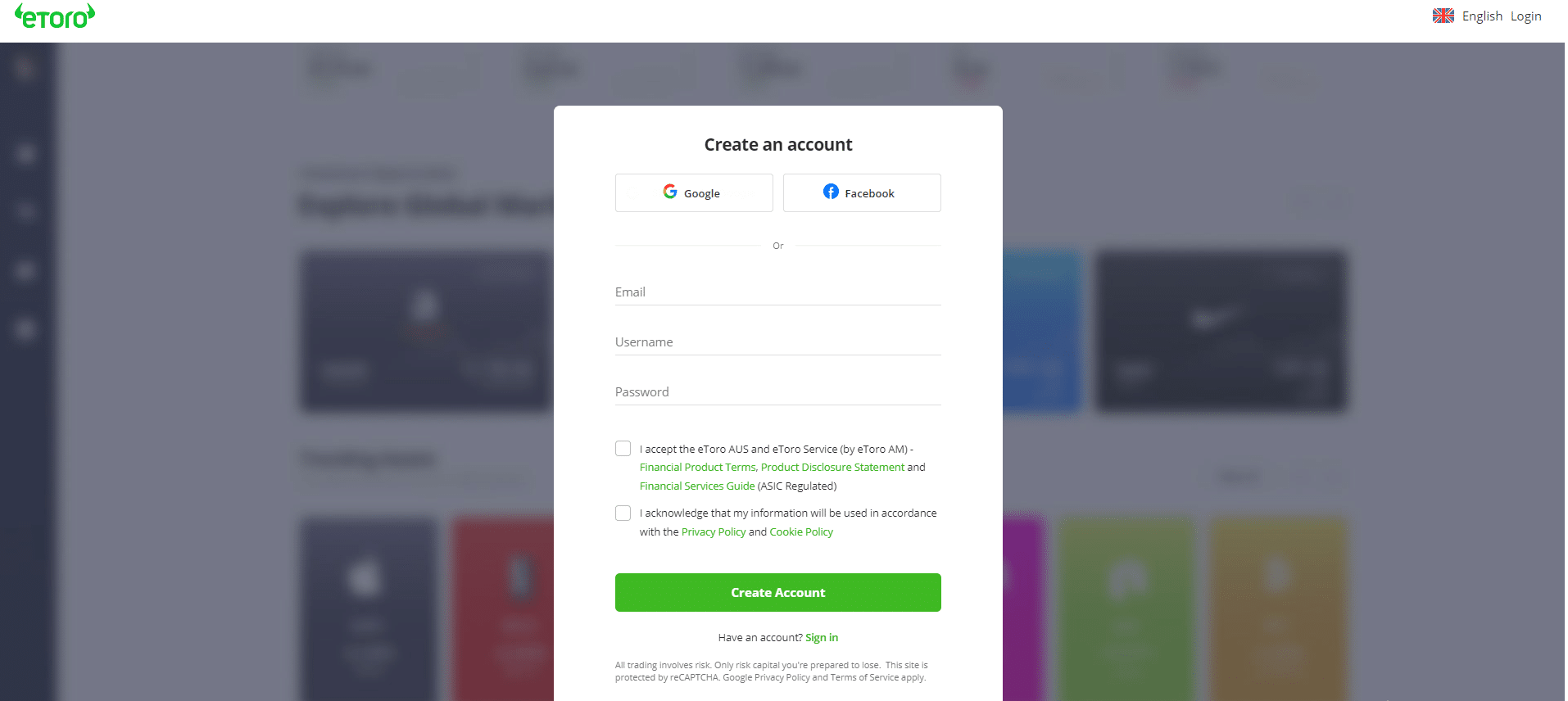

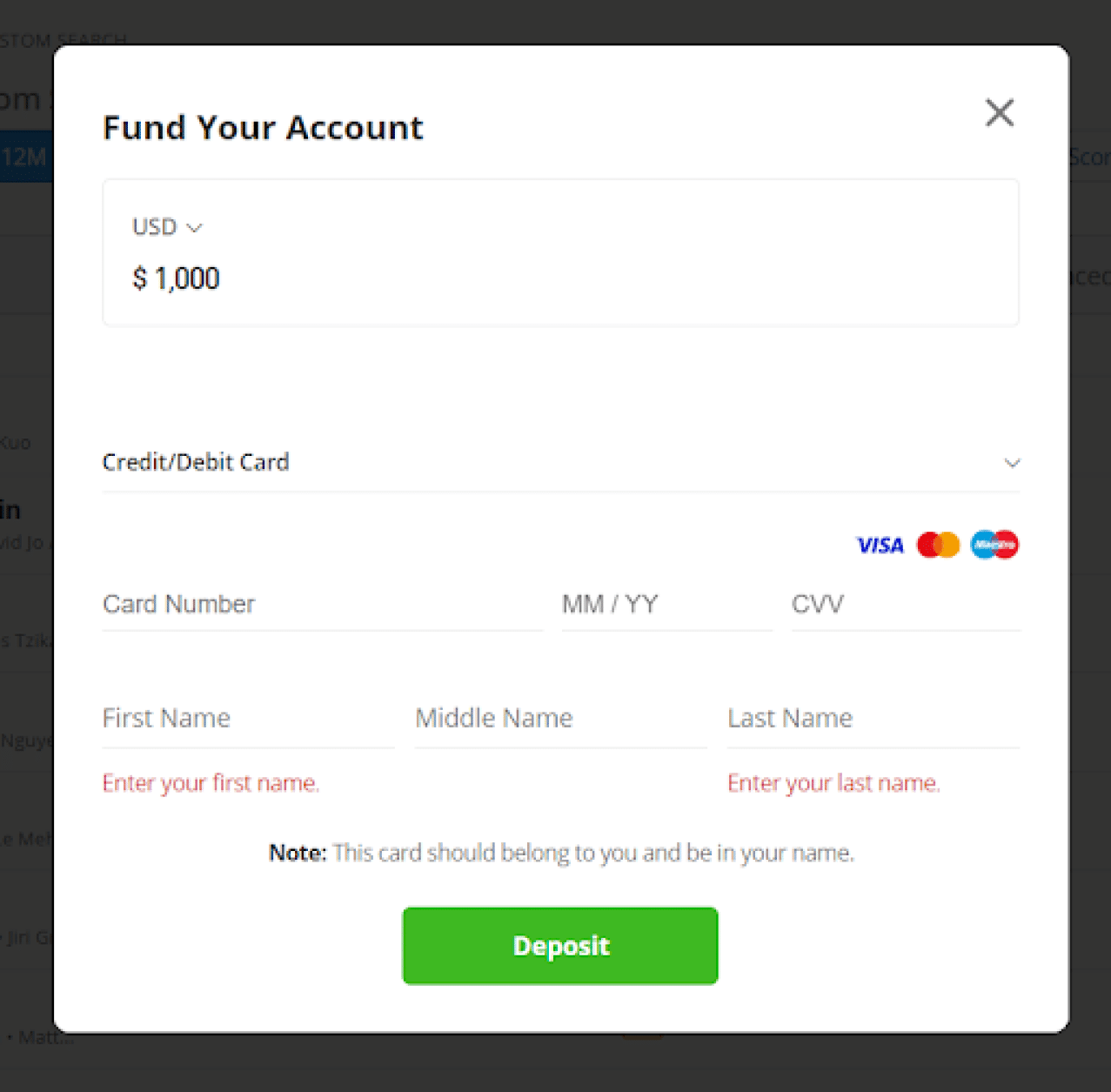

The user-friendliness makes eToro a top destination for you if you are a beginner trader or an investor with inadequate experience in trading. To copy trades on eToro, you only need to create and verify a new brokerage account and deposit a minimum of just $10 to start trading, making the platform a low-cost option for you to consider. However, the minimum amount you can invest in a trader is $200.

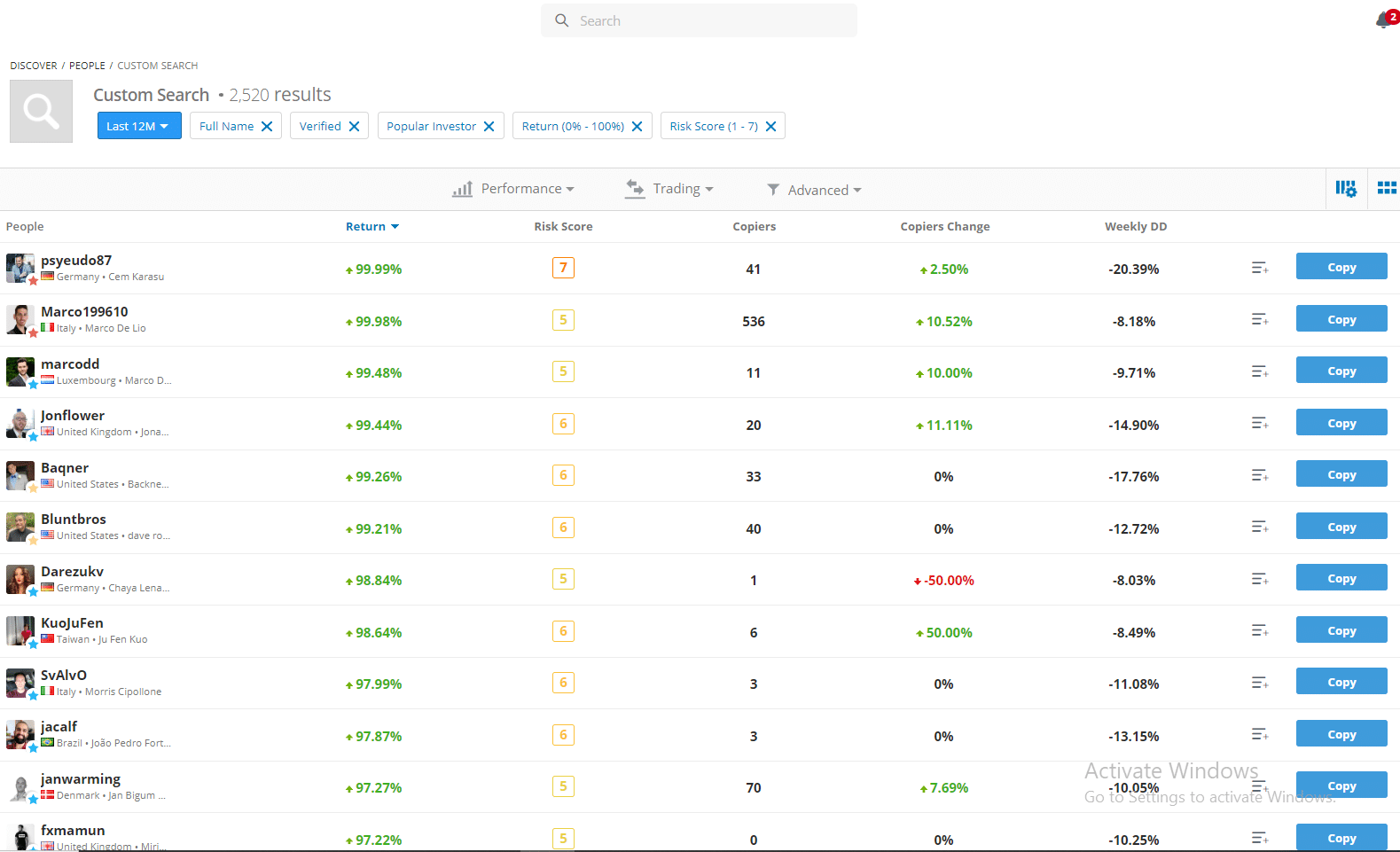

Each trader has a unique market, depending on their strength. So, how can you find the best copy traders? The answer is simple. Filter the traders using factors like their dedicated markets (asset types), return on investment (ROI), and the number of copiers they have. You can also use the star rating and certification badge to identify genuine traders.

The best part is that using the eToro social trading app for copying trades is free. That means you can lock in your potential profits without deducting charges or commissions. However, you should pay attention to potential spreads and overnight fees. How can you determine the associated fees? They depend on the open position you copy from another trader, and eToro provides more information about them.

You can also get trading tips and insights from experienced copy traders to discover new trading strategies.

| Copy Trading Platform | eToro |

| Supported Assets | Stocks, forex, crypto, ETFs, commodities, indices, NFTs |

| Copy Trading Fees | No additional fees (Spreads may apply) |

| Inactivity Fee | $10 per month after 1 year of inactivity |

Pros:

- Automated copy trading

- Zero fees or commissions

- 4,500+ tradeable assets, including stocks, crypto, and ETFs

- Beginner-friendly platform

Cons:

- Investors can copy only 100 traders simultaneously

- A minimum of $200 is required to copy a trader

2. ZuluTrade (via AvaTrade) – Best for Beginners

If you have been active in the financial markets for a while, ZuluTrade needs no introduction. But why is the copy trading app worth considering for social trading? First, the ZuluTrade copy trading platform is powered by AvaTrade, one of the world’s most popular digital asset exchanges with millions of customers worldwide.

But it doesn’t end there because the ZuluTrade copy trading tool can help you find top-performing traders across various financial markets to copy their trades. These investors are from diverse online brokers outside AvaTrade, so instead of having multiple trading accounts, you can access a broader investment landscape using ZuluTrade.

Are you looking to diversify your portfolio across various securities? ZuluTrade supports forex, commodities, indices, stocks, and cryptocurrencies. That means with a ZuluTrade account, you can invest in diverse cryptocurrency options, making it the best crypto copy trading app.

At the same time, you can trade diverse currency pairs in the forex market, including popular options like EUR/JPY, EUR/USD, GBP/USD, and USD/JPY. So, ZuluTrade also has a shout as the best forex copy trading app for investors.

According to ZuluTrade, 73% of its customers profit from copying top-leading investors. That means you have a potentially high success rate if you choose the copy trading platform for your trading needs. However, we couldn’t verify this claim during our review.

To leverage the ZuluTrade automated social trading tool, you must create a free AvaTrade account, navigate to the integrated copy trading channel, and connect with market leaders sharing their trading strategies.

You can choose an investor to copy based on your investment capital, risk tolerance, and past win rate. You can also interact with these market leaders and other investors using the platform’s social tools.

If you are a beginner, AvaTrade offers educational materials that you can leverage to understand how trading and investing in the digital currency markets work.

Regarding fees, ZuluTrade offers subscription plans from $10 per month, depending on the number of Leader Strategies you want to copy. There are also 3-month, 6-month, and 1-year plans at $9.5, $9, and $8.3, respectively.

However, if you already have an AvaTrade account or have registered with the platform’s integrated brokers or co-branded brokers, you are not required to pay subscription fees to use ZuluTrade.

| Copy Trading Platform | ZuluTrade |

| Supported Assets | Stocks, commodities, cryptocurrencies, Forex, indices, etc. |

| Copy Trading Fees | Subscription plans from $10 per month |

| Inactivity Fee | $50 per quarter after 3 months of inactivity |

Pros:

- Affordable plans from $10 per month

- 73% claimed success rate

- Extensive market coverage across Forex and crypto

- Automated and manual trading options are available

Cons:

- Stocks and ETFs are available as CFDs only

3. MetaTrader 4 (via Libertex) – Best for Zero Commissions

MetaTrader 4 (MT4) is another copy trading app you can consider when looking for the best copy trading tool. The trading tool is available to traders and investors worldwide, and you probably know it for its advanced price charts and market analysis. However, you’ll be glad to know that MT4 has a robust copy tool as an added feature.

So, how does MT4 copy trading work? The MT4 platform integrates with Libertex to give you access to its mirror trading feature. The app’s integration with such a global cryptocurrency broker makes MT4 a top choice for online traders and investors. However, unlike the previous two copy trading platforms, you can only trade currencies on MT4. So, if you’re a Forex trader, MT4 is a great choice for you.

You’ll find over 45 currency pairs to trade on MT4. These include popular Forex pairs like the EUR/USD, USD/JPY, and GBP/USD. There are also analytical tools available via plugins to conduct broader market research.

Do you want to trade cryptocurrencies? You can use MT4’s Economic Newsfeed to determine the best time to trade crypto and other securities.

MT4 stands out from other top copy trading platforms with its no desk dealing (NDD) feature. With this additional feature, MT4 executes your orders automatically to avoid delay intervention.

Getting started on MT4 is straightforward. Visit the MT4 website and create a new trading account in a few minutes. The account comes with 1:1000 leverage and automated trading features. You can also access all the features on the MT4 mobile app if you prefer trading on the go.

Are you a beginner trader? If yes, consider starting your MT4 trading journey with a demo account. The paper trading account lets you access the platform’s features using virtual money worth $50,000.

Regarding fees, the Libertex MT4 platform charges trading fees starting from $0.04, which is one of the lowest on the market. Traders can also expect spreads from 0.0 pips.

| Copy Trading Platform | MetaTrader 4 |

| Supported Assets | Forex |

| Copy Trading Fees | From $0.04 |

| Inactivity Fee | $10 monthly after a 180-day inactivity period |

Pros:

- NDD automated trading feature

- Demo account with a $50,000 paper money

- Accounts come with 1:1000 leverage

- 45 tradeable currency pairs

Cons:

- The platform focuses on the forex market

4. Mirror Trader (via AvaTrade) – Best Copy Trading Tool for Forex and Commodities

Next on our list of the best copy trading apps is Mirror Trader. The top crypto copy trading app is available via AvaTrade’s copy trading platform called AvaSocial. This social trading platform connects traders and investors looking to mirror trades and make profitable decisions.

As the name implies, the Mirror Trader automates copy trading with its advanced technology. After choosing a copy trader, beginners can get trading signals and enter trading positions instantly. For instance, you can automatically short or long BTC with your AvaTrade account when you follow trading decisions from the platform’s high-performing traders.

That means your trading activities are based on their strategies, and your profits are determined by their effectiveness and profitability.

Mirror Trader is one of the earliest platforms for copying trades, and the copy trading tool offers users access to 200+ brokers with diverse assets. The asset classes include stocks, commodities, options, ETFs, forex, and cryptocurrencies. In other words, Mirror Trader by AvaTrade is a top crypto copy trading app for beginner investors.

Another top feature of the Mirror Trader is its support for various trading strategies for day traders and long-term investors. You can implement strategies like scalping, day trading, and momentum trading using the signals from the best day trading app.

On top of that, the top social trading app integrates with other copy trading tools like MT4, MT5, and ZuluTrade to offer users the complete forex trading experience.

All you need to do to access the exciting features on Mirror Trader is create a new AvaTrade account and navigate to the copy trading section. You can enjoy a potentially profitable journey with the extensive educational materials and top-performing investors on the platform.

| Copy Trading Platform | Mirror Trader |

| Supported Assets | Forex, crypto, commodities, indices, options, and stocks |

| Copy Trading Fees | Subscription plans from $10 per month |

| Inactivity Fee | $50 per quarter after 3 months of inactivity |

Pros:

- Integration with ZuluTrade, MT4, and MT5

- Zero commissions for trades

- Robust educational resources

- Comprehensive range of securities and financial instruments

Cons:

- Tradeable stocks and ETFs are available as CFDs

5. cTrader (via Pepperstone) – Best Trading Platform for Straight-Through Processing (STP) Brokers

cTrader is a beginner-friendly trading platform powered by Pepperstone, a renowned forex trading app for the European market. Pepperstone is a top cTrader platform for many reasons.

First, the trading platform offers 1,200+ tradeable instruments across currencies, crypto, indices, commodities, and stocks. That means traders and investors looking for a top crypto copy trading platform will fancy Pepperstone.

In addition, Pepperstone offers an impressive fill rate of 99.94%, devoid of dealing desk intervention. So, the platform executes trades instantly with no human interaction. Regarding its copy trading features, cTrader is a great choice because it supports cryptocurrency and forex enthusiasts.

With the copy trading feature, traders can reduce risks and avoid losing substantial parts of their capital to the volatile crypto market. Another reason traders choose cTrader is its support for STP (Straight-through processing) execution. In other words, it connects users with the best STP brokers, like Pepperstone, that eliminate internal dealer desks and price manipulation.

cTrader has no minimum deposit, as the supported copy traders have individual minimums. That means users can choose which copy trader best suits their budgets and investment strategies.

6. DupliTrade (via Pepperstone) – Top Copy Trading App with Comprehensive Social Trading Tools and Platforms

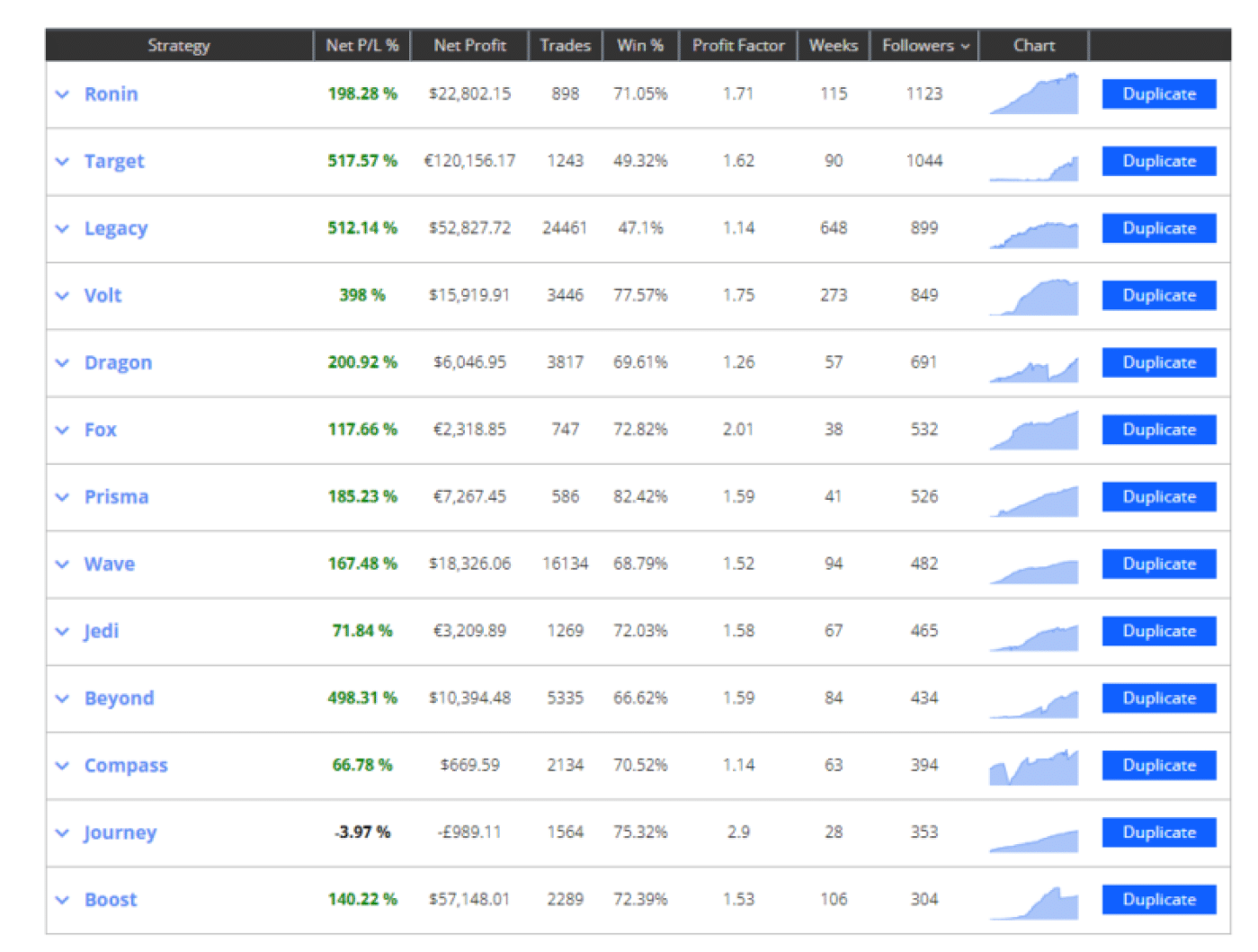

DupliTrade is the last copy trading platform that makes the best 6 options for traders and investors in 2024. Like cTrader, DupliTrade integrates with Pepperstone to offer the platform’s customers seamless access to copy trading features.

Besides integrating with one of the biggest trading platforms, DupliTrade is a top Forex copy trading app because it supports top-level copy traders with verifiable track records. Unlike other copy trading sites with hundreds of copy traders, DupliTrade has a select few expert traders.

Similarly, the copy trading platform supports diverse instruments, including commodities, stocks, currency indices, and ETFs. So, users’ chances of success when using the DupliTrade copy trading features are among the best on the market.

You can streamline your search for the best traders to buy signals from using their past data from DupliTrade to assess their skills and estimate your profitability. However, you must make a minimum deposit of AUD 5,000 (or the equivalent in other currencies) to use its copy trading tool.

If you are a beginner trader on DupliTrade, consider using the demo trading app to better understand how the tool works. By doing so, you can test the traders’ efficiency and mitigate the risk of losing money. Ready to begin your journey? Create a free DupliTrade account with Pepperstone to start trading.

Copy Trading Explained

Before choosing the best copy trading app, it’s imperative to understand what copy trading is and how it works. The sections below explain the concept of mirroring trades in detail to help you determine the various kinds of copy trading platforms and how to choose traders to copy.

What is Copy Trading?

Copy trading is a trading strategy that involves mirroring the trading activities of another trader. Usually, the copied trader is more experienced and has an impressive track record, while the copier is a beginner who needs help navigating the complex financial markets.

In other words, using the best stock trading apps with copy trading features helps inexperienced traders improve their potential profits and reduce risks by taking the same positions as professional traders. Note that copy trading can be executed manually or automatically.

Copy Trading Systems

Beginner investors can simplify their journey with copy trading. However, understanding the various copy trading systems is crucial for them to determine the best strategy to trade with.

All-in-One Copy Trading Brokers

All-in-one brokers are copy trading platforms with diverse tools for buying and selling cryptocurrencies and other financial instruments, investing in various digital asset markets, and copying trades to find the best opportunities for success.

The brokers also integrate with copy trading apps like MT4, MT5, and cTrader to allow investors to mirror and automate trades with one account.

Robots and Algorithmic Software

Modern trading has evolved with the use of the best AI stock trading apps. As such, some copy trading tools use artificial intelligence (AI) and sophisticated algorithms to automate trades on their users’ behalf.

Install the copy trading app on your mobile or desktop device and connect it to your trading account to use such platforms. Afterward, the bot will start trading based on your pre-configured commands.

Signals (Semi-Automated)

Unlike fully automated copy trading, signals are not fully automated because they allow traders to execute trades manually. As such, some copy trading platforms have signal providers that send trade signals to their subscribers to infuse into their own trades.

Copy Strategies

The idea behind copy trading is to copy the strategies of skilled traders using copy trading apps. However, there are various copy strategies, depending on the trader. These include day trading, scalping, intra-day, and momentum strategies.

You can choose your most preferred strategy and leave the copy trading tool to automatically enter and exit trades using the strategy.

How to Choose Traders to Copy

As stated earlier, beginners may need help choosing the best copy traders. Here are key considerations before choosing a copy trader on any trading platform.

Assets

There are thousands of assets in the financial and cryptocurrency markets. Choose only a copy trader investing in the same asset classes you want to trade. For instance, you should find the best stock trading signal providers if you prefer trading stocks.

Conversely, if you prefer cryptocurrency trading, choose copy traders with access to the best crypto trading apps and crypto assets.

Trading Performance

Another important metric to consider when choosing a copy trader is their trading performance or history. Doing so will help streamline your search to only the best-performing traders to copy and make profitable deals.

Risk

Finally, opt for copy traders with the same appetite for risk. If you are risk-averse, you should only follow investors with similar trading models to minimize risks and potential losses. You can also opt for ETFs on the best ETF trading apps to manage risks in the stock market.

Now that you understand the intricacies of copy trading and how to choose traders to mirror their trades, it’s time to begin your trading journey on eToro, our overall best copy trading app. Follow the easy steps below to use the eToro CopyTrader feature.Best Copy Trading App – eToro Tutorial

Best Copy Trading App – Conclusion

In this guide, we’ve reviewed the best 6 copy trading apps, the top copy trading strategies, and how to choose the most suitable traders to duplicate their trades.

eToro is our top choice for copy trading. The social trading platform is beginner-friendly and it has over 4,000 tradeable instruments. You can diversify your investments across the forex, stocks, and crypto markets with no copy trading fees.

References

https://corporatefinanceinstitute.com/resources/management/straight-through-processing-stp/

https://www.nasdaq.com/articles/ai-trading-what-is-ai-trading-how-its-used-in-stock-trading

https://en.wikipedia.org/wiki/Social_trading

https://www.forex.academy/how-to-choose-the-best-forex-traders-to-copy-trade/

https://en.wikipedia.org/wiki/Financial_instrument

FAQs

Is copy trading available in the US?

Is a copy trading app safe?

Is copy trading good for beginners?

How do I get into copy trading?