How to Buy Coinbase Shares UK

Cryptocurrency giant exchange Coinbase has recently announced its plans to go public through a direct listing process, which is expected to occur in late February or early March. Much like Spotify, Slack, and many other tech-related companies, Coinbase will not offer shares to the public via an Initial Public Offering (IPO) process. Instead, the largest cryptocurrency exchange in the US plans to sell its shares without the involvement of investment banks.

Nonetheless, Coinbase’s plan to go public is expected to be one of the most significant events in the market this year, particularly with the growing hype around bitcoin and the cryptocurrency market in general.

While the details of Coinbase’s IPO are not yet clear, we do know that the group has already submitted a draft registration statement with the Securities and Exchange Commission (SEC) in late December 2020.

So, in this guide, we’ll try the answer all the questions about Coinbase’s highly anticipated IPO.

-

-

Step 1: Find an App to Buy Coinbase Shares UK

Once Coinbase will become a public-listed company, you’ll be able to buy its shares on the US stock market like any other listed company. The US crypto exchange has chosen Nasdaq as the exchange for its direct listing instead of the New York Stock Exchange. This means that you’ll need to find a UK brokerage firm that gives you access to stocks on NASDAQ. Coinbase will be listed under the ticker symbol COINB.

With that in mind, let’s take a closer look at two of the most popular stock apps in the UK to buy shares in Coinbase.

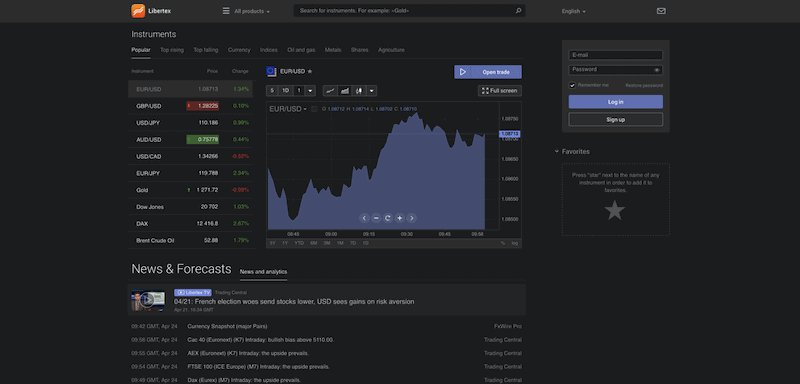

1. Libertex – Share Trading via MetaTrader4

Libertex offers its clients to trade on two trading platform – its own proprietary trading platforms that is available on any web browser and as a mobile application, or the most popular platform in the market, the MetaTrader4. The Libertex trading platform comes with helpful features like a market news feed and top rising and falling assets of the day.

In terms of pricing, Libertex is considered by many as a low-cost trading platform. This stock trading app takes another approach from other trading apps in the market. When you buy and sell stocks on this platform, Libertex allows you to trade with a zero spread and a fixed fee of only 0.15%. Lastly, Libertex is regulated by the Cyprus Securities and Exchange Commission (CySEC) under the Licence number 164/12.

75.3% of retail investor accounts lose money when trading CFDs with this provider. Sponsored ad.

Step 2: Analyze Coinbase Shares

Even though Coinbase shares are not yet listed on the US stock market, we can still evaluate the company’s performance and the price expectations of Coinbase’s share price at the time of IPO. In this section of our guide, we’ll cover crucial facts about Coinbase including an estimation of the company’s market cap, the forecast for Coinbase stock price at the time of IPO.

Coinbase Share Price

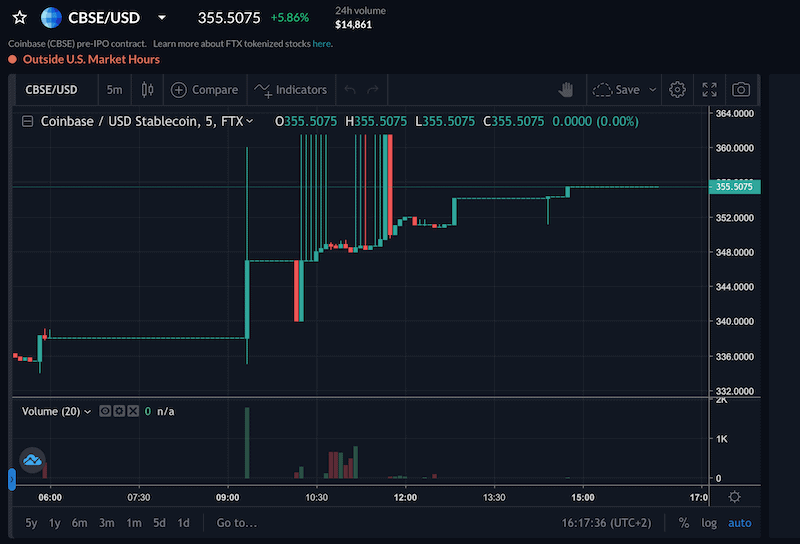

Currently, there are a lot of speculations about the price of Coinbase stock when it goes public. Luckily, one of the crypto exchanges, FTX, has issued futures contracts of Coinbase stock ahead of its initial public offering (IPO). The pair symbol is CBSE/USD and it is trading at around $350 per share as of February 15. These contracts enable investors to speculate on Coinbase’s stock price at public opening.

Coinbase Stock Fundamentals

Being one of the largest cryptocurrency exchanges in the world and the largest cryptocurrency exchange in the US, Coinbase is currently valued at a market cap of around $63 billion. Overall, it has 43 million users in over 100 countries and $455 billion in total volume traded. On top of that, Coinbase claims to have a total amount of $90 billion worth of assets on its platform.

Coinbase has also raised over $500 million from leading hedge funds and VCs since its foundation in 2012. Unlike many other growth companies that go public with the goal to raise capital before becoming profitable, Coinbase is already a profitable company according to reports from 2018 and 2019. This essentially means that Coinbase is a relatively stable company and not a young startup.

Coinbase Dividend Information

As a new company in the market, Coinbase is not expected to pay dividends in the near future.

Why Do People Buy Coinbase Shares UK?

Shares in IPOs are quite often primarily allocated to financial institutions and large hedge funds. In that matter, Coinbase IPO is another step for the broad acceptance of cryptocurrencies and will enable more traditional investors to gain exposure to digital assets without investing in volatile crypto coins like Bitcoin, Ethereum, and IOTA.

Of course, there is always a risk to invest in a company that operates in an unregulated environment. However, buying Coinbase shares is not buying bitcoin or any other digital asset in the market. Technically, Coinbase is a cryptocurrency exchange and as such, the main question here is whether Coinbase is a good company and still has further growth potential.

Below, we have outlined some of the main reasons why buying Coinbase shares might be a good long term investment.

The Crypto Market is Gaining Momentum

Since the incredible run of bitcoin and other cryptocurrencies has started, no one can no longer ignore the positive momentum of this phenomenon. At the time of writing, the cryptocurrency market has a total market value of around $1.4 trillion, with bitcoin’s market capitalization is nearly $900 billion. If Bitcoin becomes a globally accepted store of value and cryptocurrency exchange will be recognized by more investors and companies, then Coinbase’s revenues will continue to grow over the next years.

Coinbase is a Profitable and Stable Company

In 2018, Coinbase reported $520 million in total revenue, and in 2019, it has reported a net profit of $163 million on the $543 million in total revenue. As for last year, although Coinbase has not yet submitted the report for 2020, there are rumors that Coinbase’s annualized revenue reached $2.3 billion and net profit grew by 20%.

Generally, the numbers are not surprising given the fact that the total crypto trading volume on the Coinbase exchange is about $455 billion with more than 43 million users on its platform. Additionally, Coinbase makes money from its crypto wallet and its crypto card services that work similarly to bank services – it charges a fee for every fund transfer or transaction made by the user.

Coinbase’s IPO Could Enable Traditional Investors to Gain Exposure to the Crypto Market

Another reason people may opt to buy Coinbase shares is simply the fact that it will enable more traditional investors to invest in crypto-related operations without having to buy volatile assets like Bitcoin, Etehereum, Litecoin, and any other altcoin out there.

Step 3: Open a Stock Trading App Account

In order to buy shares in Coinbase, the first thing you need to do is to open an online trading account with a UK regulated brokerage firm. To help you get started, we are now going to show you the account creation process.

At first, visit the broker’s website and register for an online account. You will be asked to provide your full name, email address and create a password.

Then, you will be required to verify your identity by uploading both a proof of identity (POI) and proof of address (POA). Once your account has been verified, you can then fund your account with the minimum requirement of $250 (around £180). The following payment methods are supportred – debit or credit card, UK bank transfer, PayPal, Neteller, or Skrill.

Step 4: How to Buy Coinbase Shares UK: Tutorial

Technically, the process of buying Coinbase shares on the platform will be similar to any other asset that is currently offered by the broker. To buy Coinbase shares in the UK, simply follow these four steps below.

- Log in to the trading dashboard.

- Search for Coinbase at the search bar at the top of the screen.

- Set the amount you wish to invest in Coinbase. Bear in mind that the stock app provides leverage of 5:1 for US shares.

- Click on the Open Trade button.

Conclusion

If everything goes as expected for Coinbase, it will be the first-ever cryptocurrency exchange to go public and trade in the share market. With a market cap of around $63 billion and more than 43 million users on its platform, Coinbase is not a small company that needs new capital to survive. Evidently, Coinbase issues shares to the public via a direct listing, which is a way for companies to help their employees and early investors to sell their stocks to the public.

FAQs

When Coinbase is going public?

At the time of writing, the exact date of Coinbase IPO is not clear, but the company is expected to offer shares to the public in Late February early March.

Can you buy Coinbase stock right now?

Coinbase shares are not yet available to purchase on any exchange. However, when the company goes public you’ll be able to purchase the stock like any other listed stock in the US markets. Meanwhile, you can track the Coinbase IPO stock price via the Coinbase futures on the FTX exchange.

How many users does Coinbase have?

According to Coinbase, it currently has more than 43 million active users on its exchange.

Is Coinbase profitable?

Because Coinbase is not yet a public listed company, it is not clear if it was a profitable company in recent years. Having said that, Coinbase’s CEO Brian Armstrong has revealed that Coinbase was profitable between 2017-2019.

How can people buy Coinbase shares?

Essentially, investors can buy shares in Coinbase when it goes public via the stock market or through a CFD brokerage firm. While there are pros and cons to each method, the easiest way to buy Coinbase shares when it goes public is via the CFD market.

Kane Pepi

Kane Pepi

Kane Pepi is a British researcher and writer that specializes in finance, financial crime, and blockchain technology. Now based in Malta, Kane writes for a number of platforms in the online domain. In particular, Kane is skilled at explaining complex financial subjects in a user-friendly manner. Kane has also written for websites such as MoneyCheck, the Motley Fool, InsideBitcoins, Blockonomi, Learnbonds, and the Malta Association of Compliance Officers.View all posts by Kane Pepistockapps.com has no intention that any of the information it provides is used for illegal purposes. It is your own personal responsibility to make sure that all age and other relevant requirements are adhered to before registering with a trading, investing or betting operator. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice.By continuing to use this website you agree to our terms and conditions and privacy policy.

Trading is risky and you might lose part, or all your capital invested. Information provided is for informational and educational purposes only and does not represent any type of financial advice and/or investment recommendation.

Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers.

© stockapps.com All Rights Reserved 2026

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up