How to Buy Amazon Shares UK

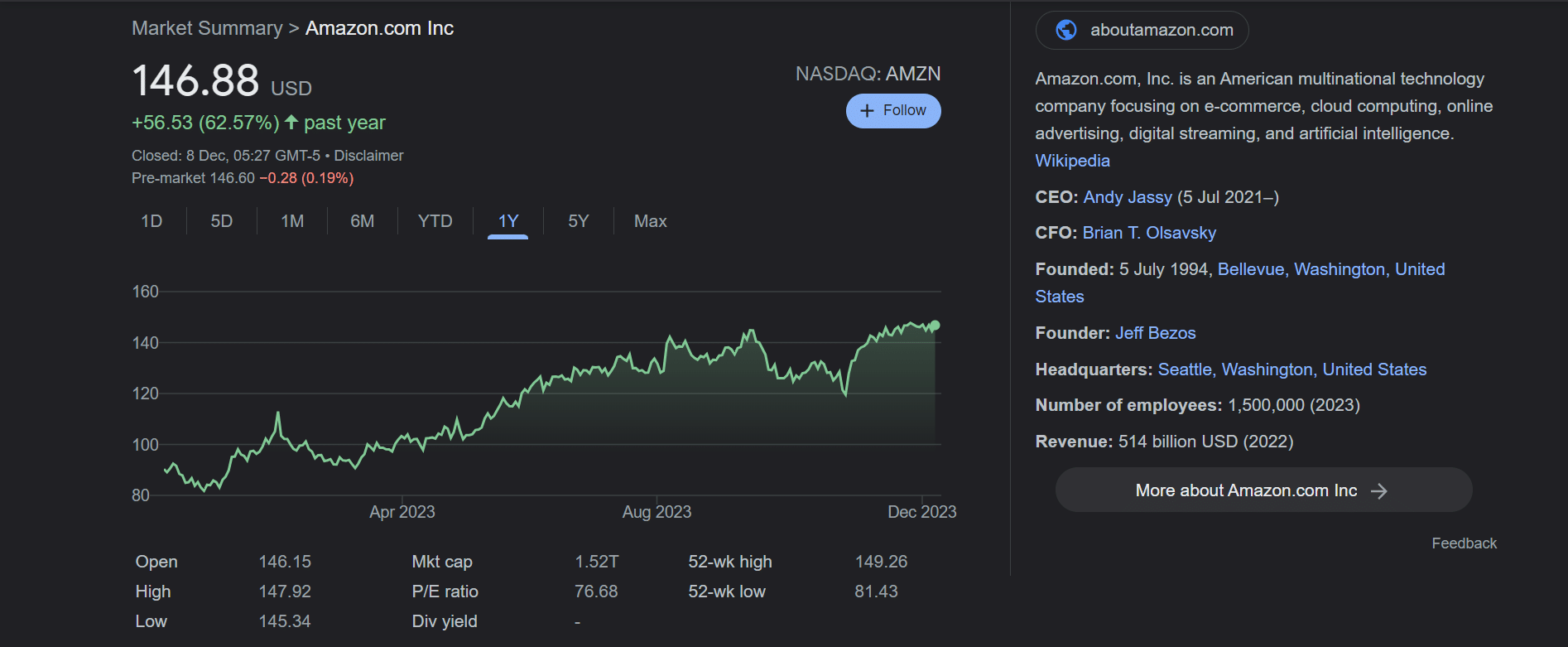

Although the Amazon is yet to pay a single dividend on its common stock since it went public in 1997, the Amazon share price continues to outperform the market year-on-year. In fact, in 2020 alone Amazon shares grew by over 75%, which was followed up by another positive return in 2021. However, the stock has tumbled 49% in 2022, marking the biggest fall since 2000.

In this guide, we show you how you can buy Amazon shares UK. We will also discuss the UK stock investment apps that offer Amazon shares.

[toc]

Step 1: Find a UK Stock App that Lists Amazon Shares UK

This is an exchange that hosts the largest tech stocks in the world – including Google, Microsoft, Facebook, and Netflix shares, to name a few.

As such, you’ll need to ensure that your chosen UK stock trading app gives you access to the NASDAQ in a cost-effective way.

Below we have listed two share dealing platforms in particular that allow you to buy Amazon shares in the UK.

Step 2: Why do People Invest in Amazon?

Once you have decided which stock app you want to use – and whether you want to buy or trade Amazon shares, it’s then time to do a bit of research.

After all, even though Amazon’s share price is up over 85% in the past five years, it doesn’t mean that the stocks will continue to rise indefinitely.

As such, the sections below will outline some key information that traders often take into account before you invest in Amazon UK.

Amazon Share Price UK Action

Had you shared the vision of Jeff Bezos back in 1997 when Amazon first went public, you would now be looking at unprecedented gains. Back then, the shares would have cost you just $18 each. However, we need to adjust this future to take into account the many stock-splits that Amazon has initiated. As such, the initial Amazon share price UK was effectively just $1.73.

Fast forward to 2023 and the same Amazon shares will cost you over $1362 each. That works out at end-to-end gains of over 78,000%. In simple terms, had you invested £1,000 into Amazon back in 1997, your investment would now be worth over £1.36 million. However, it’s not always been smooth-sailing for Amazon shares.

On the contrary, the stock was heavily impacted by the Dot Com bubble of the early 2000s. In fact, it took over a decade just for Amazon shares to get back to pre-bubble levels. But, as we now know, it’s been up, up, and away ever since. In more recent times, it goes without saying that Amazon benefited from the coronavirus pandemic.

While most of its divisions and subsidiaries performed well in 2020, it was its core retail platform that smashed through market and stock tip services expectations. In turn, Amazon shares started the year at $1,900 each – representing a 12-month increase of 75%. All in all, this means that Amazon is now a multi-trillion dollar company.

Since the pandemic, Amazon has gone from strength to strength, diversifying into various high-growth markets. One of the most exciting elements of Amazon’s ongoing strategy is within the flourishing cloud-computing sector, where Amazon holds the largest market share through the company’s Amazon Web Services (AWS) division.

According to Yahoo Finance, this market is expected to be valued at $947 billion by 2026 – almost double its 2022 value. This highlights the vast growth opportunity that Amazon has here, which is bolstered by its e-commerce and streaming segments.

Does Amazon Pay Dividends?

When you think about the characteristics that a company needs to pay its shareholders dividends, Amazon possesses them all. This includes a long-standing listing on a major stock exchange, continued growth, market dominance, and of course, billions of dollars worth of cash on hand.

However, you might be surprised that to this date, Amazon is yet to pay a single penny in dividends. This is the case with other so-called FAANG stocks such as Facebook, Netflix, and Google. This isn’t uncommon for high-growth companies to opt not to pay a dividend, as they tend to reinvest profits to provide further growth. However, this does mean that any gains you make from Amazon shares will come through share price increases.

Amazon EPS and P/E Ratios

As per its most recent annual report for Q3 2023, Amazon has an earnings-per-share (EPS) of $0.94. This easily beat the best stock analysis apps expectation, prompting a boost in the share price.

At the time of writing, Amazon stocks carry a price-to-earnings (P/E) ratio of 74.11. Ordinarily, a P/E ratio this high would indicate that investors are overly focused on the ‘potential’ of Amazon as opposed to what revenues it is generating right now.

With that said, above-average P/E ratios seem to be accepted now when it comes to tech-oriented stocks like Tesla shares listed on the NASDAQ.

Amazon Q3 2023 Earnings Report

| Revenue | 143.08B USD | 12.57% ⬆️ YoY |

| Net Income | 9.88B USD | 243.98% ⬆️ YoY |

| Diluted EPS | 0.94 | 235.71% ⬆️ YoY |

| Net Profit Margin | 6.9% | 205.31% ⬆️ YoY |

| Cost of Revenue | 75.02B USD | 6.77% ⬆️ YoY |

Is Amazon a Popular Investment Among Traders?

So now that we have covered the Amazon share price UK history, dividend policy, and key account ratios – we now need to look at the fundamentals. Amazon is widely considered one of the most popular stocks, but why is this?

Below you will find some of the most important factors, including past performance, volatility and future outlook, that people often use to determine whether Amazon shares are a buy or sell.

Amazon has Shown That it is Immune to the Covid Pandemic

Seasoned investors will always contemplate how likely it is for a stock to defend its self to a wider recession or economic downturn. In this sense, risk-averse investors with the aid of stock portfolio trackers will usually add ‘defensive stocks’ to their portfolio during times of uncertainty. This usually centres on stocks operating in stable industries – such as pharmaceuticals, retail, or tobacco.

However, in recent years it was tech stocks like Amazon that led the way. After all, while most stock sectors saw huge losses back in 2020 due to the pandemic, Amazon thrived. In fact, as we noted earlier, Amazon stocks finished the year 75% up. This price increase can be attributed to Amazon’s stellar business model and focus on e-commerce, which was appealing to consumers who were forced to stay inside during the lockdowns.

Services Divisions are Doing Really Well

However, other divisions are slowly but surely eating away at this dominance. At the forefront of this is the various service-based subsidiaries that fall under the Amazon brand.

For example, Amazon Prime subscriptions continue to rise, as does the content streaming service of the same name. As noted earlier, you also have Amazon Web Services (AWS), which is by far the largest player in the cloud computing arena. We should also mention other up-and-coming Amazon divisions that are likely to thrive in the near future, such as groceries, drone deliveries, and AI.

Strong and Stable Balance Sheet

Irrespective of whether or not you think Amazon shares are a buy, there is no getting away from the fact that the firm possesses a considerably strong balance sheet. This shouldn’t be discounted, as the balance sheet is what allows organisations to weather the storm of prolonged economic downturns.

In the case of Amazon, the tech stock was sitting on over $64 billion in cash at the end of Q3 2023. Plus, with the firm not tied to a dividend policy of any sort, this means that it can use its vast cash balance to fund new ventures.

This is especially important, as Amazon is invested in a wide range of cutting-edge technologies which naturally, will burn through cash until the product or service is financially marketable.

Regulators are a Potential Chink in the Armour

Perhaps one of the biggest threats facing Amazon stocks at present is that several key regulators could prove problematic for the firm. For example, the European Commission officially opened a case against Amazon in April 2022 to determine whether the company was in violation of antitrust laws.

In turn, the biggest fear for shareholders is that this could lead to several key changes in how Amazon is allowed to run its business. You then need to look at U.S. President Joe Biden’s plan to raise the corporate tax rate in 2023. This would have a huge impact on Amazon’s bottom line – meaning less free cash flow available for reinvestment.

Step 3: How to Buy Amazon Shares in the UK

So now that we have discussed the ins and outs of what to consider before you invest in Amazon, we are now going to show you how to complete your share purchase online.

The steps below will walk you through the typical process with a FCA regulated stock trading platform.

Open a Brokerage Account and Add Funds

So, head over to a regulated broker and open an account. This requires some personal information from you, such as your name, address, date of birth, etc.

To verify your account on day trading apps and thus remove withdrawal restrictions, upload a copy of the following two documents:

- Passport or Driver’s License

- Recent Utility Bill or Bank Account Statement

Now it’s time to make a deposit.

You can instantly deposit funds at most brokers with the following payment methods:

- Debit Card

- Credit Card

- Paypal

- Skrill

- Neteller

- Klarna

- Trustly

- UK Bank Transfer

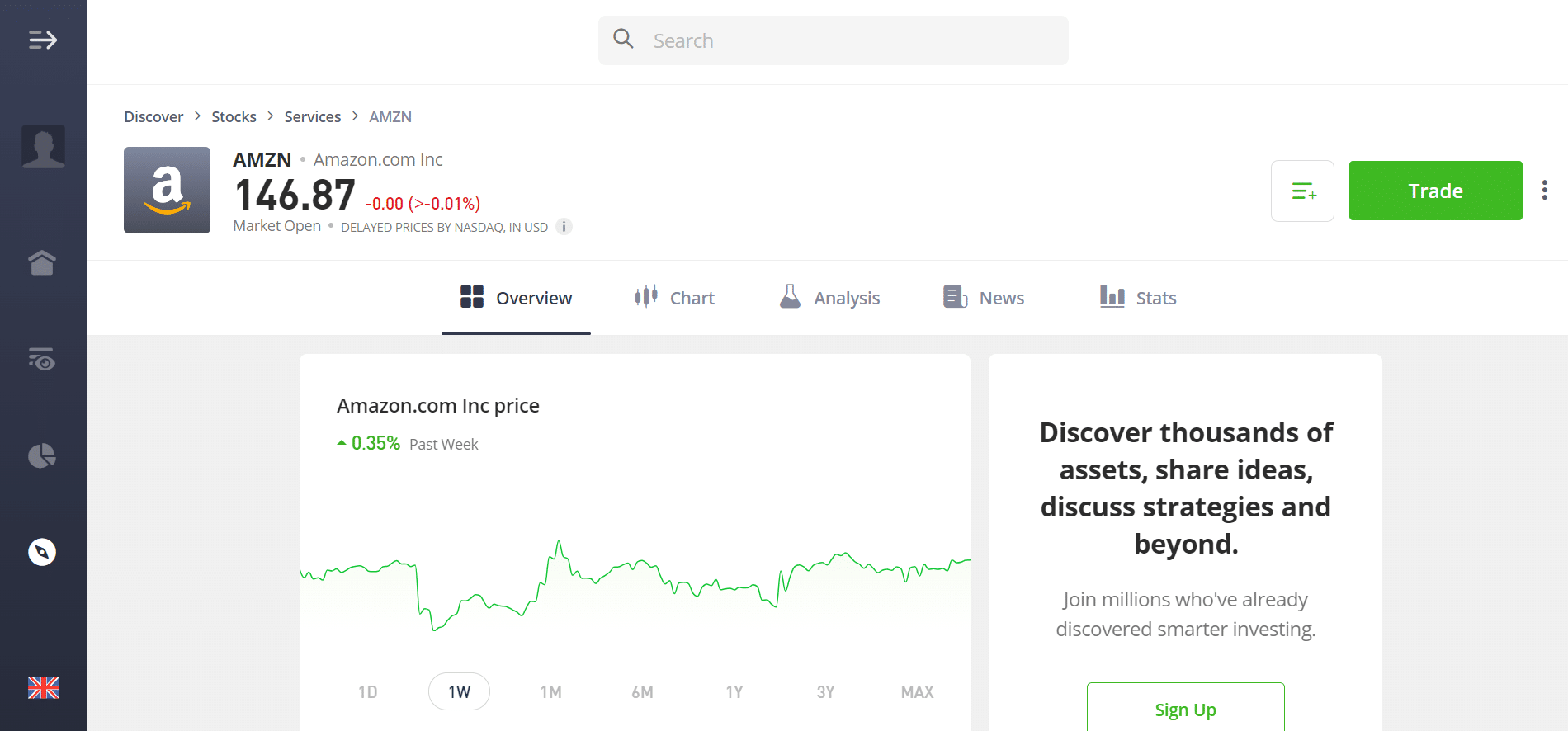

Step 4: How to Invest in Amazon UK

- Once your deposit has been processed, you can then buy Amazon shares.

- Enter “Amazon” into the search box and click on the ‘Trade’ button.

- Then, you will need to fill out a basic order form, like the image below.

- All you need to do here is enter your stake.

- To complete your Amazon share purchase, click on the ‘Open Trade’ button.

Amazon 2030 Price Prediction

The prediction about Amazon’s market cap in 2030 suggests that it could reach around $2.5 trillion. This reflects a compound annual growth rate of approximately 7.5%. However, it’s important to note that predicting future market performance is inherently uncertain.

Based on stock market research and analysis softwares, Amazon has seen its market cap increase sixfold over the past seven years. While it may be challenging for the company to replicate such exponential growth in the next seven years, significant expansion is still expected.

Factors that could contribute to Amazon’s future growth include its continued dominance in e-commerce, expansion into new markets and industries, innovations in technology and logistics, and potential acquisitions or strategic partnerships.

Conclusion

This guide has walked you through the process of how to buy Amazon shares online in the UK. While one of the most popular stocks to buy, remember to do lots of research and weigh up the risks if you’re considering investing in Amazon shares.

References

- https://www.aboutamazon.eu/who-we-are

- https://finance.yahoo.com/quote/AMZN/?guccounter=1

- https://www.cnbc.com/quotes/AMZN

- https://www.forbes.com/advisor/investing/how-to-buy-amazon-stock/

- https://www.etoro.com/markets/amzn