How to Buy Apple Shares UK

Based in the UK and looking to buy Apple shares? Although this multi-trillion dollar company is listed on the NASDAQ – making an investment from the UK could not be easier. All you need is a low-cost broker that gives you access to the US stock markets.

Plus, when using an FCA-regulated broker that supports fractional ownership – you don’t need to invest hundreds of pounds. Instead, you can purchase just a small fraction of one Apple share – should you wish to.

In this guide, we show you how you can buy Apple shares online in the UK.

Your first port of call is to find a stock trading app that allows you to buy Apple shares from the UK. There are dozens of options in this respect, albeit, you need to understand what fees are applicable., After all, many stock apps in the UK will charge you a premium to buy US-listed stocks. To save you countless hours of independent research – below we list a selection of FCA-regulated trading apps that allow you to buy Apple shares in a safe and low-cost manner. After reviewing dozens of stock apps that allow UK residents to buy Apple shares – we found that Libertex is one popular option in this marketplace. This investment app – which is home to over 20 million users, gives you access to over 2,400 shares from 17 different exchanges, including similar stocks like Blackberry. This includes the NASDAQ – meaning that you can buy Apple shares at the click of a few buttons. You won’t need to pay a premium to access this market from the UK. This means that you can buy Apple shares in the UK without paying any dealing fees whatsoever. There is no ongoing platform fee either, so it’s only the spread that needs to be considered when buying and selling stocks. In the case of Apple shares, this typically hovers around the 0.20%-mark, which is competitive. What we also like about Libertex is that you can buy Apple shares in the UK at a minimum investment of just $50. This is particularly interesting when you consider that in 2021, the tech firm has since hit highs of over $145. Once you have purchased Apple stocks on Libertex, you will be entitled to your share of dividends as and when they are paid. In the case of Apple, this is every three months. Nevertheless, the investment process at Libertex requires you to open an account, upload some ID, and then make a deposit. You can do this with your debit or credit card for an instantly processed transaction. When it comes to the safety of your funds, Libertex is authorized and regulated by the Financial Conduct Authority (FCA). Even more importantly – the app is covered by the Financial Services Compensation Scheme (FSCS). This ensures that you can buy, sell, and trade financial instruments in a safe environment. Finally, on top of stocks, Libertex also offers a variety of other asset classes that might interest you. This includes ETFs, cryptocurrencies, and CFDs in the form of forex, indices, and commodities. Sponsored ad. 67% of retail investors lose money trading CFDs at this site. Once you have chosen a UK stock app that supports Apple shares, you then need to do a bit of research before proceeding. This should be something that you do whenever you are considering a new investment. After all, you don’t want o rely on third-party financial advice. Instead, it’s important to make your own investment decisions. With this in mind, spend some time reviewing the following sections – where we explore key Apple stock metrics such as price action, fundamental research, and future projections. Apple went public way back in 1980 – meaning it is now one of the oldest tech companies listed in the US. During the firm’s IPO, the shares were initially priced at $22 each. However, Apple has since executed five stock splits at various ratios – so the adjusted IPO stock price stands at just $0.10. Fast forward to early 2021 and the stocks have since hit all-time highs of over $145. This means that in the four decades that Apple has been a publicly-traded company, its shares have increased by over 144,000%. In other words, had you invested £1,000 into Apple back in 1980 and were in possession of the shares – your money would now be worth over £1.4 million! Returns like this aren’t just reserved for Apple – as plenty of other tech stocks have seen huge gains over the past few decades. Other examples include Amazon shares and Microsoft shares. Nevertheless, what is particularly interesting about tech stocks like Apple is that many experienced double-digit percentage gains in 2020. For example, while many stocks are still worth less than pre-pandemic levels, Apple shares have grown by over 100% in the 12 months prior to writing this article. As a result, Apple as a company is now worth over $2 trillion. In the vast majority of cases, tech stocks do not pay dividends. This includes the likes of Alphabet, Amazon, Facebook, Tesla, Twitter, and Netflix – all of which have had a great 2020 on the stock markets. However, Apple does not fall into this club – as it has been paying dividends since 2012. On the one hand, the monetary value of Apple dividends is typically the highest of any company listed in the US. With that said, the yield on offer isn’t the highest out there. For example, based on a ‘running yield’ ratio, this stands at 0.66% at the time of writing. On the flip side, Apple did increase the size of its dividend payment by 6% last year, and 10% in each of the six years prior to that. Ultimately, the way the majority of investors make money from an investment in Apple is via capital gains. The dividend payment is, however, a nice little extra to receive on top of any stock price increases that you encounter as an Apple shareholder. In taking a closer look at the financials, Apple’s earnings per share (EPS) continues to move in the direction. For example, this went from an EPS of $1.04 in 2018, $1.25 in 2019, and $1.68 in 2020. This means that between 2018 and 2020 – the EPS has risen by over 68%. In terms of Apple’s price to earnings (P/E) ratio, this stands at just over 33 at the time of writing. This offers much more value than other high-performing tech stocks in this space. For example, Amazon currently stands at over 73 while Tesla’s has ballooned to over 1,100! If you’re wondering whether or not you should buy Apple shares – there are many metrics that you need to consider. Sure, the tech stock saw double-digit gains in 2020 – making the company a great hedge against COVID-impacted industries. However, this isn’t to say that Apple shares will continue their bullish stock market run indefinitely. As such, below are some common factors traders may consider before buying Apple shares in the UK. Depending on when you read this article on how to buy Apple shares in the UK – you might have a chance to invest at a discount. In investment terms, this means that the shares are potentially trading at an amount below their true value. For example, Apple last hit all-time highs of $145 in early January 2021. At the time of writing in mid-March, the same shares are trading in the $123-$125 region. When going through the process of finding good long-term value stocks – one of the most important things to look at is the balance sheet. After all, this gives us a clear birds-eye view of how strong or weak the company’s financials are. In the case of Apple’s balance sheet – it really doesn’t get much better. For example – as per its most recent earnings report, Apple is currently sitting on over $195 billion in cash. This is actually 2% more than the prior quarter. Having such a large amount of cash is crucial for several reasons. Not only does it ensure the firm is financially stable and well-prepared for challenging times, but it allows Apple to diversify into other markets. It also ensures that the tech firm can continue to invest money into new and exciting technologies – as it has done for the prior four decades. But perhaps even more importantly, Apple’s cash hoard allows it to continue its share buyback program. This is where it buys shares back from the open marketplace. In turn, as there are fewer shares in circulation, this has the desired impact on the stocks increasing in value. Since early 2021, more than $380 billion has been spent by Apple for this purpose. Services – as opposed to physical products like the iPhones and iPad, offer significantly larger operating margins for Apple. This includes everything from Apple TV, Apple News and the App Store to Apple Music and Apple Fitness Plus. As per its most recent earnings report – its services division saw revenues rise by 24% to over $15.8 billion. The general consensus on Wall Street is that Apple is still a firm buy. There is just too much to like about this innovative tech stock – even with a valuation of over $2 trillion. On the one hand, you would be lead to think that at current prices – there is only so much upside potential available. But, when you look at how Apple stocks reacted to the wider pandemic – shareholders increased their wealth by over 70% in 2020 alone. One thing many people find attractive about Apple is that it continues to bring out new and exiting products – ensuring that it isn’t overly reliant on iPhone sales. This includes its Apple Fitness Watch, which continues to fly off the shelves. And of course – Apple’s services division is also continuing greatly to the company’s bottom line. The addition of 5g to its latest iPhone rollout is yet another thing for shareholders to get excited about. Apple is one of the very few leading tech stocks that has a dividend policy in place. Although there are much more attractive yields on offer, don’t forget that Apple increased its dividend by 6% last year. In each of the six years prior to that, the increase stood at a whopping 10%. Remember, it’s super important to always do your own research and form your own opinion when making any investment, as there’s never a guarantee you’ll make money and your capital is at risk. If you have performed lots of research on the future potential of Apple shares and wish to complete your purchase right now – follow the steps outlined below. Once again, there are many stock apps in the UK that allow you to buy Apple shares – here’s what the process typically looks like with an FCA regulated broker. First and foremost, head over to your chosen broker’s website – either on your laptop or mobile phone, to start the account opening process. Before you are able to deposit, you will need to upload a copy of your passport or driver’s license. Either way, you will need to make a deposit before you can buy Apple shares. Common supported payment methods include a debit/credit card, bank transfer, or e-wallet. Now that you have a fully-funded account, you can proceed to buy Apple shares. Like the image below, enter ‘Apple’ into the search box and click on the top result. You will then see an order box. All you need to do here is enter the amount that you wish to invest. To complete your investment in Apple shares – click on the ‘Open Trade’ button. This guide has discussed just how easy and cost-effective it now is to buy US-listed shares like Apple in the UK. While it may be one of the most poplar stocks among investors, make sure you do your research and are aware of the risks before making an investment in Apple. Apple first went public in 1980. Opting for the NASDAQ exchange, the shares were priced at $22 each during its IPO. However, based on adjusted prices for its 5 stock splits, its IPO price actually amounts to just $0.10. This means that those investing £1,000 back in 1980 are now looking at a portfolio value of over £1.4 million! Yes, there are dozens of FCA-regulated brokers that allow you to buy Apple shares in the UK. You do, however, need to check how much the broker charges – as there is often an FX fee that applies.. Unlike fellow tech stock counterparts Amazon, Facebook, Tesla, and Netflix – Apple has a dividend policy in place. In fact, the firm has been paying a quarterly dividend since 2012. You can buy Apple shares some FCA-regulated brokers without paying any commission. At the time of writing in early 2021, Apple shares are hovering above the $120-$125 mark. The shares last hit all-time highs of $145 in late 2020. stockapps.com has no intention that any of the information it provides is used for illegal purposes. It is your own personal responsibility to make sure that all age and other relevant requirements are adhered to before registering with a trading, investing or betting operator. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice.By continuing to use this website you agree to our terms and conditions and privacy policy. Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers. © stockapps.com All Rights Reserved 2024

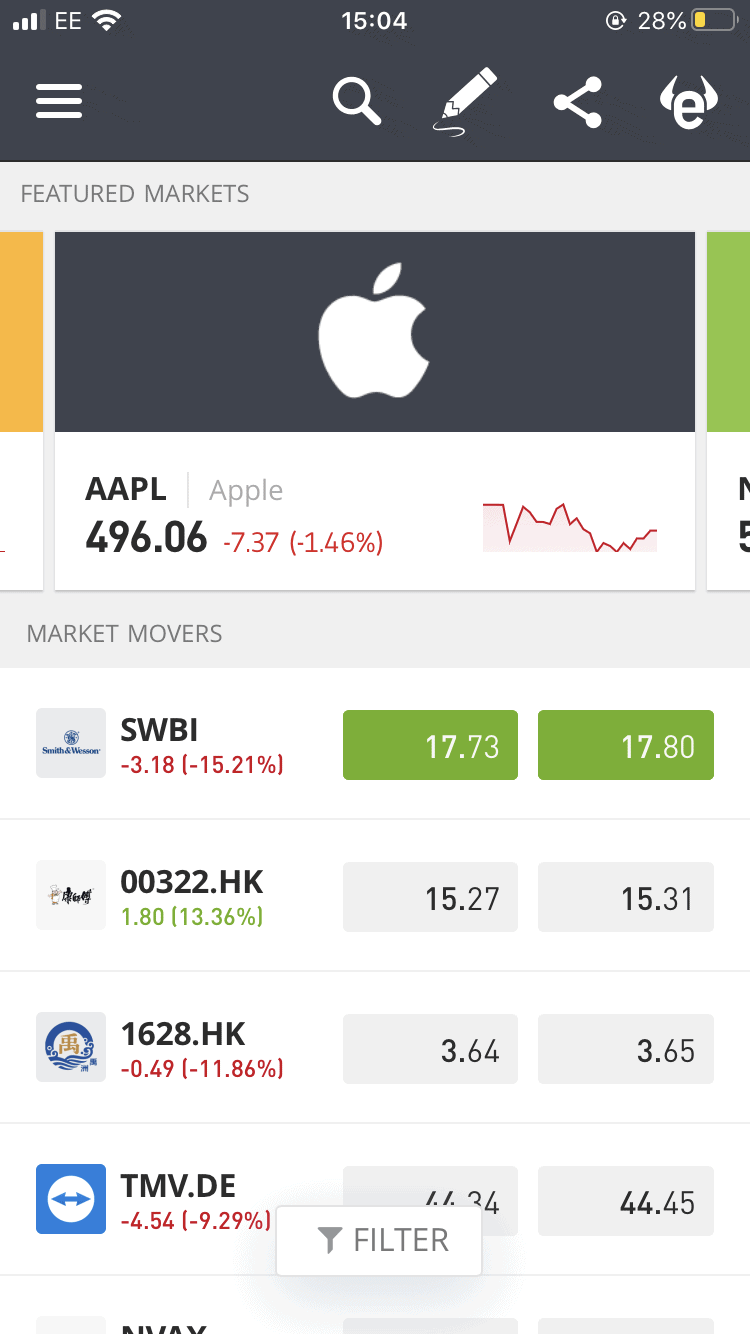

Step 1: Find a UK Stock App that Lists Apple Shares UK

1. Libertex – Popular Trading App with Apple Shares

Step 2: Is Apple a Good Investment?

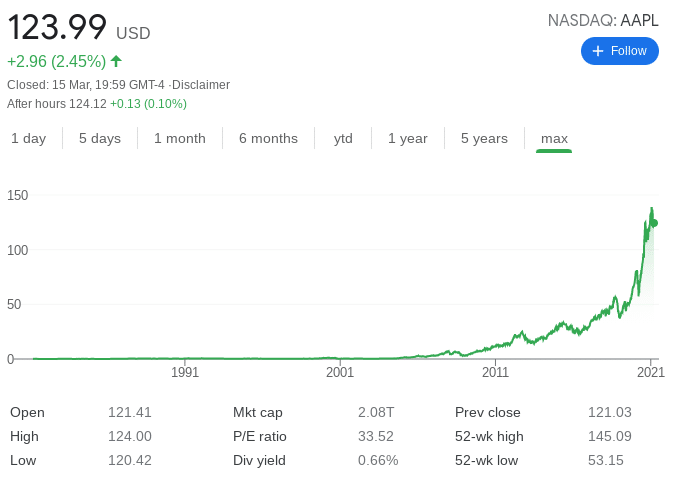

Apple Share Price UK Action

Does Apple Pay Dividends?

Apple EPS and P/E Ratios

Should I Buy Apple Shares?

Apple Trading at a Discount

Balance Sheet and Cash

Services Division Continues to Thrive

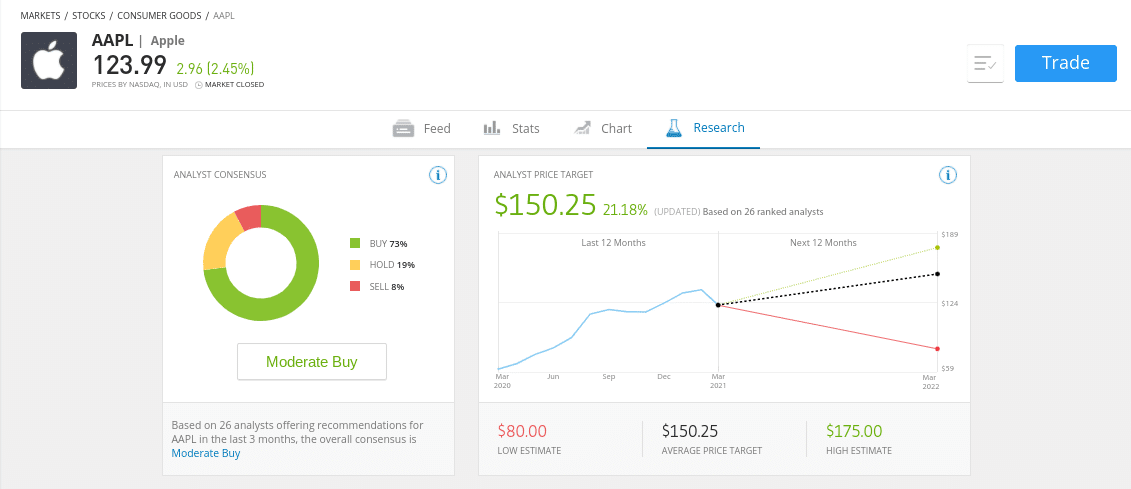

Apple Shares Buy or Sell?

Step 3: How to Buy Apple Shares in the UK

Open a Brokerage Account and Add Funds

Step 4: How to Invest in Apple in the UK

Conclusion

FAQs

When did Apple first go public?

Can you buy Apple shares in the UK?

Does Apple pay dividends?

What is the cheapest way to buy Apple shares in the UK?

How much are Apple shares?

Kane Pepi

Kane Pepi