How to Buy Facebook Shares UK

Want to buy Facebook shares in the UK? This US tech giant is one of the largest companies in the world and has long been flirting with a $1 trillion market cap. Even better, Facebook has aggressive plans for global growth.

To invest in Facebook stock in the UK, all you need is a mobile stock app that offers trading on the US stock market. In this guide, we’ll highlight UK stock apps that offer Facebook shares and show you how to buy Facebook shares UK.

-

-

Step 1: Find a UK Stock App that Lists Facebook Shares UK

In order to buy Facebook shares in the UK, you’ll need a UK stock app that offers trading on these shares. Facebook trades on the NASDAQ stock exchange in the US and is one of the largest companies in the world, so it’s easy to find a broker that carries this stock.

While a lot of UK brokers offer trading on Facebook shares, though, they’re not all the same when it comes to fees, trading tools, and other key elements. To save you hours of research, we’ll cover two of stock apps you can use to buy Facebook shares in the UK today.

1. Libertex – Buy Facebook Shares with 0% Commission

Libertex is one of several popular UK stock apps you can use to buy Facebook shares. This mobile-friendly stock broker offers trading on nearly 2,000 shares from the UK, US, and around the world. Plus, you can invest in Facebook shares through hundreds of ETFs, including many that cover the US stock market and tech sector.

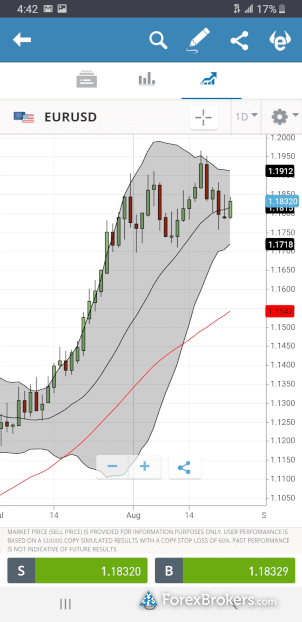

Libertex gives you the option to buy shares outright or to trade Facebook share CFDs (contracts for difference). Either way, all trades on Libertex are 100% commission-free. If you decide to trade Facebook CFDs, you can apply leverage up to 5:1 to your position.

This brokerage stands out for the quality and depth of its trading tools. To start, the mobile charting platform is incredibly advanced. You can access over 100 different technical studies and drawing tools, and easily customise your analysis with just a few taps. Libertex also provides access to professional stock research, so you can check your own technical analysis against the 12-month price target that Wall Street is predicting for Facebook.

Libertex also has a built-in social trading network. You can follow traders from the UK and US to swap trade ideas, share stories of your winning trades, and find new stocks to trade. This network is also very helpful because you can quickly spot shifts in market sentiment around Facebook shares.

If you want to build a portfolio quickly, Libertex supports copy portfolios. You can copy a premade portfolio with just a few taps, or mimic a day trader’s moves to actively trade around Facebook’s share price.

Libertex is regulated by the UK Financial Conduct Authority (FCA) and offers 24/5 customer support by phone and email. The Libertex mobile app is available for iOS and Android. Read our comprehensive Libertex app review to find out more about what this brokerage app offers.

Sponsored ad. 67% of retail investors lose money trading CFDs at this site.

Step 2: Is Facebook a Popular Share Among Investors?

Once you’ve decided on a UK stock app to buy Facebook shares, it’s time to do a deep research dive into this tech company. It’s important to know exactly why you’re buying Facebook shares and what the future for this company might hold when you invest.

Facebook Share Price UK Action

Facebook launched on the NASDAQ stock exchange on May 12, 2012, at a price of just $38 per share. At the time, it was one of the most widely talked-about stock debuts on Wall Street. Facebook shares dropped sharply after the IPO to an all-time low of just $17.73.

If you had bought shares at that price, you would today be sitting on a nearly 1,500% return. From 2013 to 2018, Facebook stock began a relentless climb. The stock hit $100 per share in 2015 and $200 per share in 2018.

At the end of 2018, the Facebook share price dropped back to just $125 per share. The company came under scrutiny for the Cambridge Analytica scandal, in which a UK company was found to have misused information from Facebook for political advertising in the 2016 US presidential election. Around the same time, Facebook came under fire for its role in human rights abuses in India and Myanmar.

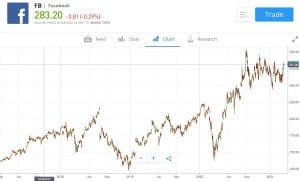

Despite the criticism, Facebook shares climbed back to over $220 per share before the COVID-19 pandemic hit. Shares plunged to a low of $137 during the March market crash, but quickly reached a new all-time high in May 2020.

Since then, Facebook shares have hovered between $260 and $300. Shares are currently priced at $283.20 apiece.

Does Facebook Pay Dividends?

Facebook does not pay dividends and never has. Although Facebook is highly profitable, the company has no plans to issue a dividend to investors at this time.

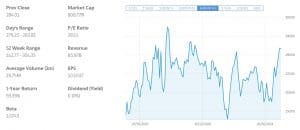

Facebook EPS and P/E Ratios

Facebook reported an earnings per share (EPS) of $10.09 for 2020, up from $6.43 in 2019. The company benefited from the coronavirus pandemic as users spent more time on its social network, even as advertising budgets shrank in response to the global economic crisis.

At the current share price, Facebook has a price to earnings ratio (P/E ratio) of 28.1. This is considered to be on the high side by many value investors, but is relatively low for US tech stocks. Facebook has a market cap of $808 billion.

What is There to Consider Before Investing in Facebook

Facebook stock is one of the most widely watched instruments on Wall Street. This social networking company is used by over 2.8 billion people around the world, including in fast-growing regions like India, Southeast Asia, and Africa. The company has also proven that it’s capable of monetizing all of these users and making advertisers happy.

On the other hand, Facebook is facing pushback from regulators in the US, Europe, and Australia. The company has a reputation problem in much of the West, too.

So, should you buy Facebook shares today? Here’s what investors commonly consider before buying a stock.

Growth and Value

Typically, investors need to choose between growth stocks and value stocks. But with Facebook, you can have both.

With an $800 billion market cap, Facebook is hardly a startup that will see its price double every year. But the company is still valued at just one-third of what Apple is valued at, so there’s plenty of room for growth. That’s especially true when you consider that more people use Facebook – and have access to its social network – than use Apple products.

At the same time, some analysts believe Facebook’s stock price doesn’t really reflect this growth potential. The shares carry a P/E ratio of just 28, which is incredibly low in the tech sector. Apple stock, by contrast, has a P/E ratio of over 33, and Amazon stock has a P/E ratio of over 74.

Global Infrastructure

At some point in the last decade, Facebook changed from being just another social network – like Twitter or Medium – into being a key part of global infrastructure. For a majority of the 3 billion people who use this platform, Facebook is their primary source of media and their main connection to the internet. In fact, in many countries in Southeast Asia, Facebook essentially is the internet.

That makes Facebook both indispensable and incredibly valuable to many people. Even users who complain about Facebook’s privacy issues or lament the company’s size refuse to leave the social network.

At the same time, advertisers absolutely love the data that Facebook provides and the prices for which it can target ads to highly specific audiences. The company grew its advertising revenue by 12% last year, even in the midst of a global pullback in advertising spending. As Facebook rolls out its tighter integration of Instagram and WhatsApp, expect the platform to cut costs and become even more efficient at connecting users and advertisers.

Headwinds Can Be Overcome

Facebook hasn’t breached the $1 trillion market cap mark yet in large part because of a few significant headwinds the company is facing.

First, Facebook is facing antitrust lawsuits in the US and Europe. In the US, antitrust investigators seek to break up Facebook, Instagram, and WhatsApp.

While that could be devastating for Facebook, prospective investors may want to see it as a black swan risk. It’s an unlikely punishment even if Facebook is found guilty of violating antitrust law, and virtually impossible to enforce given how tightly integrated these 3 platforms are. A fine or regulations are much more likely, and those are more likely to benefit Facebook by hurting smaller competitors.

Another headwind that Facebook faces is a shift in public opinion, at least in the US and Europe. The public largely sees the company as self-serving rather than interested in the greater good, and there’s an enormous trust gap between Facebook and its users.

Still, that hasn’t hurt Facebook at all up to this point – and the company appears to be finally taking its image problem seriously. Even a few small gestures of goodwill by Facebook can go a long way towards restoring trust in its platform and keeping its cash river flowing for years to come.

Step 3: How to Buy Facebook Shares UK

Ready to buy Facebook shares in the UK? We’ll show you how to invest in Facebook following the typical process of an Financial Conduct Authority-regulated broker.

Open a Brokerage Account and Add Funds

To get started, head to Google Play or the Apple App Store and search for your chosen broker. Tap on the stock app and then tap ‘Install’ to add it to your device.

Open the app and then tap ‘Join Now’ to create a new account. You can sign up using your email address, your Google login, or your Facebook login.

Regulated UK Brokers require you to verify your identity in order to comply with the FCA’s Know Your Customer (KYC) regulations. Just snap a photo of your driver’s license or passport and a photo of a recent utility bill to complete this verification step.

Next, deposit funds into your account. Most brokers accept debit card, credit card, PayPal, Neteller, Skrill, or bank transfer.

Step 4: How to Invest in Facebook UK

From the mobile app’s dashboard, tap on the magnifying glass at the top of the screen and search for ‘Facebook.’ When it appears, tap on the company, and then tap ‘Trade.’

In the order form, enter the amount you want to invest in Facebook shares. You can also select a stop loss or take profit level if it fits with your investing strategy.

When you’re ready, tap ‘Open Trade’ to buy Facebook shares.

Conclusion

Facebook is one of the biggest tech companies in the world, but this social networking giant still has room to grow. The company managed to increase advertising revenue even in the midst of the coronavirus pandemic, and it has ambitions to scale its user base even further throughout the developing world.

FAQs

Who is the CEO of Facebook?

Who is the CEO of Facebook? Mark Zuckerberg, who founded Facebook as a student at Harvard University, is still the CEO of Facebook today. His voting shares give him complete control over the company’s direction.

Can I buy Facebook shares with an ISA or SIPP?

Yes, you can invest in Facebook shares through an ISA or SIPP. Your brokerage must offer these account types and enable you to buy shares on US stock exchanges. Keep in mind that ISAs and SIPPs have limits on how much you can deposit each year.

Can Facebook be broken up?

A federal antitrust lawsuit in the US has recommended breaking up Facebook, Instagram, and WhatsApp. It is not clear whether such a breakup is technically possible, and the lawsuit is likely to take several years or longer to be resolved.

Does Facebook operate in China?

Facebook has been completely blocked in China since 2009 after Facebook refused to provide the Chinese government with private information about its users.

Does Facebook pay for news?

Facebook recently got into a standoff with the Australian government over payments to news organisations for news stories shown in Facebook’s feed. The company established a partnership that pays some news organisations, but Facebook does not currently pay for news in other countries.

Kane Pepi

Kane Pepi

Kane Pepi is a British researcher and writer that specializes in finance, financial crime, and blockchain technology. Now based in Malta, Kane writes for a number of platforms in the online domain. In particular, Kane is skilled at explaining complex financial subjects in a user-friendly manner. Kane has also written for websites such as MoneyCheck, the Motley Fool, InsideBitcoins, Blockonomi, Learnbonds, and the Malta Association of Compliance Officers.View all posts by Kane Pepi

stockapps.com has no intention that any of the information it provides is used for illegal purposes. It is your own personal responsibility to make sure that all age and other relevant requirements are adhered to before registering with a trading, investing or betting operator. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice.By continuing to use this website you agree to our terms and conditions and privacy policy.

Trading is risky and you might lose part, or all your capital invested. Information provided is for informational and educational purposes only and does not represent any type of financial advice and/or investment recommendation.

Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers.

© stockapps.com All Rights Reserved 2025

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.OkScroll Up