How to Buy Gamestop Shares UK

Even if you’ve never previously traded a single stock – there is every chance that you have come across GameStop shares in recent weeks.

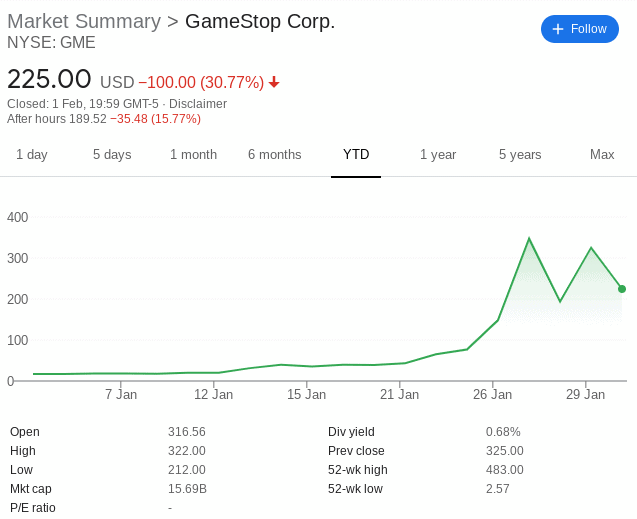

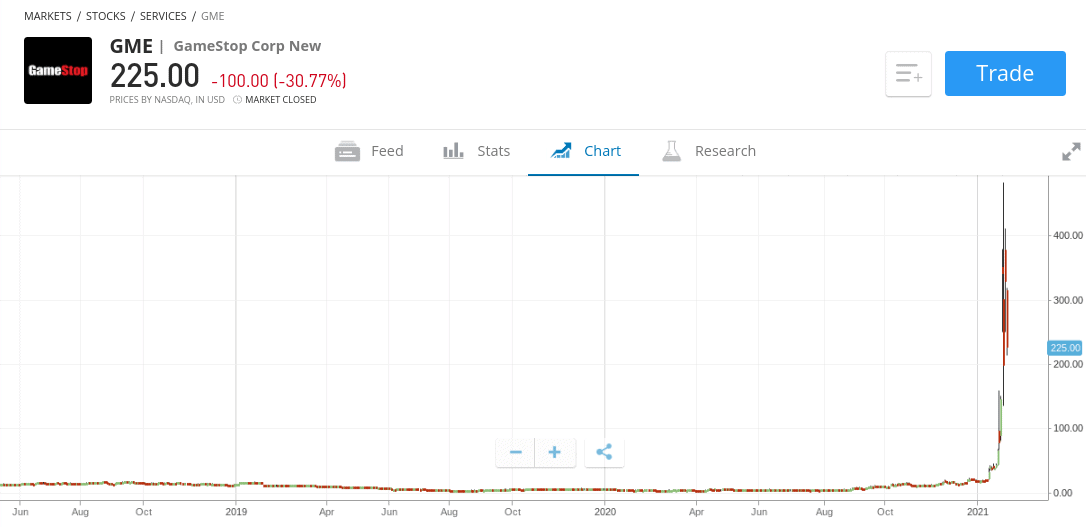

After all, the US video game retailer saw its stocks go from a mere $17 to highs of $483 in less than one month of trading.

This was all facilitated by a group of Reddit users who collectively agreed to buy GameStop shares in their droves – subsequently resulting in peak gains of over 2,700% in January 2021 alone.

In this guide, we show you how to buy GameStop shares online in the UK. We also give you a full and frank breakdown of what risks to consider before investing in this stock and how the stock has performed.

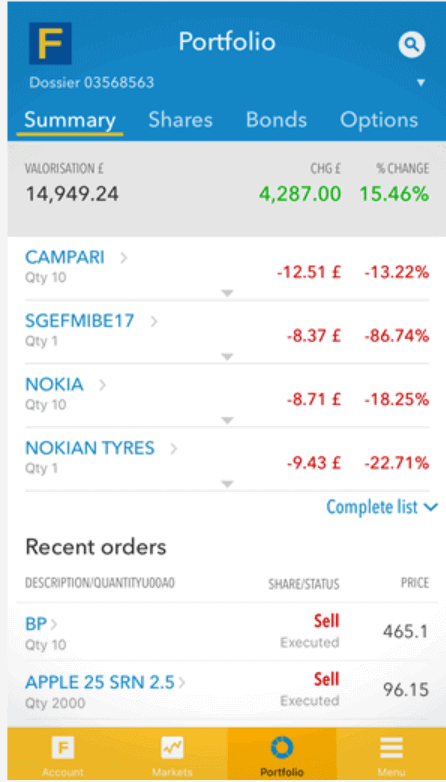

As you might know, Gamestop is a US-based company that is listed on the New York Stock Exchange (NYSE). As such, not only do you need to find a UK stock broker that gives you access to US shares, but one that doesn’t charge a premium. After all, most UK share dealing sites charge both a commission and FX mark-up when you look to buy international assets. With this in mind, below you will find a small selection of UK trading apps that allow you to buy GameStop shares in a low-cost manner. Additionally, the provider is super cost-effective – especially when it comes to buying non-UK stocks. Naturally, this broker allows you to buy GameStop shares at the click of a button. All you need to do is open an account, upload some ID, and add some funds. In terms of pricing, Fineco Bank charges a commission of just $3.95 when you buy US-listed stocks. If you also plan on buying some UK shares, you’ll pay just £2.95 per trade. Take note, there is a 0.25% annual maintenance fee applicable on all investments held on Fineco Bank. In terms of account minimums, this top-rated broker requires a deposit of just £100 upwards. There are no fees to add or withdraw funds, albeit, the only supported payment method is a bank transfer. Your capital is at risk. Sponsored ad. Make no mistake about it – GameStop shares were struggling before the infamous WallStreetBets saga. As such, you need to ask yourself whether you are investing in the company because you think it represents a good long-term investment – or you’re simply jumping on the Reddit bandwagon. Either way, we would suggest reading through the following sections to evaluate whether or not GameStop is a good investment for you and your financial goals. GameStop Corp. (GME) first went public in 2012 – opting for the NYSE. Back then, a single share would have cost you in the region of $10. It’s been somewhat of a rollercoaster ride since, with GameStop shares going through several peaks and troughs. With that said, it’s probably sensible to focus on the recent share price action – which started in the first week of January 2021. When the market bells first rang for 2021, GameStop shares were trading at just over $17 each. By the second week of the month, the shares had already hit highs of $40. Fast forward the last week of January, and the same shares peaked at $483. That’s an increase of over 2,700% in just one month of trading. Where the shares are headed next remains to be seen. For example, in the 24 hours prior to writing this guide, GameStop shares dropped by 30%. However, just a few days earlier, the shares closed for the day at over 67% higher. As such, Gamestop shares are arguably one of the most volatile stocks at present. GameStop is what the markets refer to as a ‘turn around’ company. Put simply, this means that firm is has gone through tough times in recent years, and thus – new management has been brought in to turn GameStop’s fortunes around. With revenues on a rapid decline and ever-growing debt, it will come as no surprise to learn that GameStop is currently not paying dividends. When looking at the financials, GameStop reported an EPS (Earnings Per Shares) of negative $5.38 and $6.59 in 2020 and 2019, respectively. This once again confirms the video game retailer’s recent woes. In terms of its P/E (Price to Earnings) ratio, this presents some interesting reading. At the time of writing, market estimates put the 2021 P/E ratio at -108. A negative P/E ratio means that the company is losing money. Estimates for 2022 are even more alarming, with a projective P/E ratio of -3,750. Taking into account the high levels of volatility involved, you do need to tread with caution if you are thinking about buying GameStop shares. Crucially, both the upside and downside potential is huge. Some of the main considerations that you need to make about GameStop are discussed below: Pump and dumps are typically associated with micro-cap penny stocks that possess tiny valuations. After all, it’s a lot easier to manipulate small stocks as there is such low levels of liquidity in the marketplace. For those unaware, a pump and dump scheme refers to the process of artificially influencing the value of a stock. This is achieved when a group of individuals ‘collude’ with one enough – with the outfit all agreeing to purchase a specific stock at a certain time. In this scenario, that stock was GameStop and the individuals involved came from a sub-Reddit group of small investors known as WallStreetBets. The same thing happened with AMC Entertainment shares and caused certain brokers, such as Robinhood, to suspend retail trading on the stock. The key point here is that GameStop shares haven’t exploded by over 2,700% because the company represents a fantastic growth stock. On the contrary, its price was influenced by a pump and dump operation. Crucially, there is always one key denominator in such a practice – the share price eventually capitulates – often below where it initially started. On the one hand, it is true that those behind the WallStreetBets pump were able to force a ‘short-squeeze’ on hedge funds that were ‘shorting’ GameStop. For those unaware, shorting means that you are speculating on the value of a company or asset going down. In the case of GameStop, this was the most shorted stock on Wall Street. In fact, this was one of the main motivations for the Reddit pump, as forum members view the short-selling processes being employed as nothing short of unethical. After all, short-selling in the traditional sense – as opposed to placing a sell-order via CFD instruments, can force the value of a stock to decline. The only way to do this, rather than closing the position, is to buy the stock they are shorting. In turn, this results in even more upward pressure. As a result, when hedge funds were short-squeeze, the share price of GameStop amplified at an even faster rate. Crucially, it is important to remember that hedge funds are behind a serious amount of capital. As such, there is no so much that retail traders from the WallStreetBets forum can do. In other words, there is every chance that hedge funds will be successful in bringing the share price of GameStop back to reality by continuing their downward pressure. There is no getting away from the fact that GameStop shares were in dire straights before the Reddit saga came to fruition and had been hit hard by the coronavirus pandemic. One only needs to look at the decline of its stocks over the past five years to see this. For example, GameStop shares were worth over $32 in April 2016. In early 2020, the same shares were worth just $5. That’s a decline of over 85%. The key concern for investors is that GameStop is dubbed the next Blockbuster. That is to say, it is involved in an industry that has been completely revolutionalized and overtaken by the growth of the internet. This is fully evident in the financials, not least because GameStop is facing ever-growing debt that before the pump, was arguably unserviceable. Fortunately for the company, the rapid increase in its stock price allowed management at GameStop to settle a $600 million debt via an equity conversion. But, this might only buy GameStop more time. If you have read through the above sections on the fundamentals of GameStop and you wish to continue with a share purchase, the next step is to open an account with your chosen UK broker. First and foremost, visit the website and click on the ‘Join Now’ button. You will be asked to enter a range of personal information and contact details – including your National Insurance Number. You will also be asked to verify your account – as per FCA regulations. For this, you’ll need to upload the following documents: Note: You can still buy GameStop shares now without uploading the above documents. But, you’ll need to do this before you can deposit more than $2,250 and before a withdrawal is permitted. You will now be asked to make a deposit. You can choose from the following UK payment types: Once you have opened an account and made a deposit, you can proceed to buy GameStop shares. To get the ball rolling, enter ‘GameStop’ into the search box and then click on ‘Trade’. Next, enter your stake in US dollars – ensuring you meet a $50 minimum. If the NYSE is open, click on the ‘Open Trade’ button to instantly complete your GameStop share purchase. If the markets are closed, click on ‘Set Order’. In doing so, the broker will complete your investment when the NYSE reopens. GameStop shares have infamously increased by a parabolic amount in recent weeks – owing to the WallStreetBets pump. Whether or not this upward trend continues remains to be seen. As such, you should really tread with caution with this super-volatile stock. Yes, as a major company listed on the NYSE, there are dozens of UK brokers that allow you to buy GameStop shares. With that said, a number of brokers – such as IG, have since restricted buy orders on GameStop, due to increased volatility. Yes, FCA brokers like Fineco Bank allow you to buy GameStop shares in the UK without needing to pay any commission. The platform also requires a minimum trade of just $50 – which is great for limiting your exposure to risk. GameStop is currently not paying dividends as management are looking to get the company back into profit-making territory. The cheapest way to buy GameStop shares is to use a commission-free broker that does not charge a premium for accessing international markets. This is something offered by Fineco Bank, which allows you to buy GameStop shares commission-free. If you want to buy GameStop options, there are a select number of brokers in the UK that may be able to facilitate this for you. The likes of Fineco Bank and SaxoBank are two providers in particular that are strong in the stock options department. stockapps.com has no intention that any of the information it provides is used for illegal purposes. It is your own personal responsibility to make sure that all age and other relevant requirements are adhered to before registering with a trading, investing or betting operator. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice.By continuing to use this website you agree to our terms and conditions and privacy policy. Trading is risky and you might lose part, or all your capital invested. Information provided is for informational and educational purposes only and does not represent any type of financial advice and/or investment recommendation. Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers. © stockapps.com All Rights Reserved 2026

Step 1: Find a UK Stock App that Lists GameStop Shares UK

1. Fineco Bank – Trade Thousands of Global Shares

Step 2: Is GameStop a Good Investment?

GameStop Share Price UK Action

Does GameStop Pay Dividends?

GameStop EPS and P/E Ratios

Why Do People Buy GameStop Shares?

The GameStop Surge is Essentially a Pump and Dump

WallStreetBets is Competing Against Multi-Billion Dollar Hedge Funds

GameStop is Dying Company Operating in a Dying Industry

Step 3: How to Buy GameStop Shares UK

Open a Brokerage Account and Add Funds

Step 4: Invest in GameStop UK

Conclusion

FAQs

Can you buy GameStop stock?

Can you buy GameStop shares in the UK?

Does GameStop pay dividends?

What is the cheapest way to buy GameStop shares in the UK?

How do you buy Gamestop options?

Kane Pepi

Kane Pepi