How to Buy Netflix Shares UK

Streaming giant Netflix was one of the biggest winners of the COVID-19 pandemic – the stock gained a whopping 66% last year. But as the streaming wars heat up and the pandemic comes to a close, is Netflix still a buy?

We’ll show you how to buy Netflix shares in the UK.

-

-

Find a tock App to Buy Netflix Shares UK

The first step to buy Netflix shares is to find the a popular UK stock app for the job. With a stock app, you can buy and sell Netflix stock on the go, monitor price action to find a suitable time to buy, and easily manage your portfolio from anywhere.

1. Libertex

The Libertex app is built with technical traders in mind. It offers more than 70 different technical studies and drawing tools, all of which can be seamlessly modified with just a few taps on your device. The platform also includes a news feed and economic calendar to help you stay ahead of market events that could move the price of Netflix shares.

Another thing to like about Libertex is that it offers a built-in market sentiment gauge. So, you can see whether other traders using the Libertex app are buying or selling Netflix and plan your trades accordingly.

Libertex takes a different approach to pricing than many other UK stock apps. The platform charges a low commission of around 0.1% per stock trade, but doesn’t have any variable spreads. The total cost is comparable to other apps that charge a spread, but it’s nice to know exactly how much buying or selling shares will cost you every single time.

Libertex is regulated by the Cyprus Securities and Exchange Commission (CySEC), which is a well-respected European financial watchdog. The broker offers 24/5 email support, although you’ll have to go outside the app to get help.

Sponsored ad. Your capital is at risk. 75.3% of retail CFD accounts lose money when trading CFDs with this provider.

Analyse Netflix Shares

Before you buy Netflix shares in the UK, it’s essential that you research this stock to understand it.

Netflix Share Price UK

Netflix stock began trading on the NASDAQ stock exchange in the US in May 2002, right after the dot-com bust. At the time, the company’s business model was mailing out DVDs, and it’s biggest competition was from the video rental company Blockbuster. Shares started trading at just $15.

Shares quickly rose to over $70 per share by 2004, at which point Netflix announced a 2-for-1 stock split. The company announced an additional 7-for-1 stock split in 2015.

The turning point for Netflix came in 2007, when the company launched an online video streaming platform alongside its DVD rental business. At the time, this was one of the first subscription streaming platforms in the world.

Netflix was virtually alone in this market until around 2017, when competitors like Amazon, HBO, Disney, and others began to jump into the subscription streaming arena. From 2007 to 2017, accounting for the 2015 stock split, Netflix shares grew 5,700% – jumping from just over $3 per share to nearly $200 per share.

Sponsored ad. Your capital is at risk. 68% of retail CFD accounts lose money when trading CFDs with this provider.

Netflix shares hit a high of $408 per share in 2018, but then had a rocky year as the streaming wars began to heat up. At the start of the coronavirus pandemic, Netflix had fallen to $380 per share.

The potential impact of the pandemic on Netflix stock was immediately clear to investors. The shares didn’t tumble with the rest of the market in March 2020, and in fact climbed to a high of $556 per share in September last year. Over the course of 2020, Netflix shares gained a whopping 66%.

Netflix shares have so far traded flat in 2021. The shares are currently priced at $538 apiece.

Netflix Stock Fundamentals

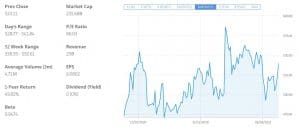

At the current share price, Netflix has a market cap of $231.7 billion. It is the 22nd largest company in the US.

Netflix has reported incredibly fast earnings growth. In 2018, the company posted $2.68 in earnings per share (EPS). In 2019, EPS grew to $4.13, and in 2020 it grew to $6.08. At the current stock price, Netflix has a price to earnings ratio (P/E ratio) of 86.03.

Netflix Dividend Information

Netflix does not pay a dividend and never has. The company reinvests a significant portion of its revenue into production – Netflix is expected to spend more than $19 billion on new movies and TV shows in 2021.

Huge Lead in the Streaming Market

For more than a decade, Netflix was the only player in the online streaming subscription market. That has given the company a massive first-mover advantage that its peers – Disney, Amazon, HBO, and others – will have a hard time catching up with.

Just look at the sheer number of users that Netflix has. The company currently has around 200 million paying subscribers in over 190 countries around the world. By contrast, Disney+, the next largest dedicated streaming service, has around 95 million subscribers.

It’s not fully clear whether streaming will be a winner-take-all market, but there are some indications that it could be. For example, surveys have shown that people are only willing to pay for 1-2 streaming services at a time.

FAQs

How many subscribers does Netflix have?

Netflix has 203 million subscribers. Around 73 million of paid subscribers are in the US.

How much money does Netflix spend on content production?

Netflix spent an estimated $17 billion on original TV show and movie production in 2020. The company is expected to spend around $19 billion in 2021.

What streaming services does Netflix compete with?

Netflix competes with streaming platforms like Disney+ (Disney), HBO Max (AT&T), Peacock (NBCUniversal), CBS All Access (ViacomCBS), and Discovery+ (Discovery).

Does Netflix operate in China?

Netflix does not operate in China and has not announced plans to launch a service there. However, Netflix has targeted Mandarin-speaking viewers around the world with a series of Mandarin-language movies and shows.

Who is the CEO of Netflix?

Reed Hastings is the founder and CEO of Netflix. Ted Sarandos was appointed co-CEO in 2020 and may be tapped as Hastings’ successor in the future.

Kane Pepi

Kane Pepi

Kane Pepi is a British researcher and writer that specializes in finance, financial crime, and blockchain technology. Now based in Malta, Kane writes for a number of platforms in the online domain. In particular, Kane is skilled at explaining complex financial subjects in a user-friendly manner. Kane has also written for websites such as MoneyCheck, the Motley Fool, InsideBitcoins, Blockonomi, Learnbonds, and the Malta Association of Compliance Officers.View all posts by Kane Pepi

stockapps.com has no intention that any of the information it provides is used for illegal purposes. It is your own personal responsibility to make sure that all age and other relevant requirements are adhered to before registering with a trading, investing or betting operator. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice.By continuing to use this website you agree to our terms and conditions and privacy policy.

Trading is risky and you might lose part, or all your capital invested. Information provided is for informational and educational purposes only and does not represent any type of financial advice and/or investment recommendation.

Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers.

© stockapps.com All Rights Reserved 2026

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up