How to Buy Amazon Shares UK

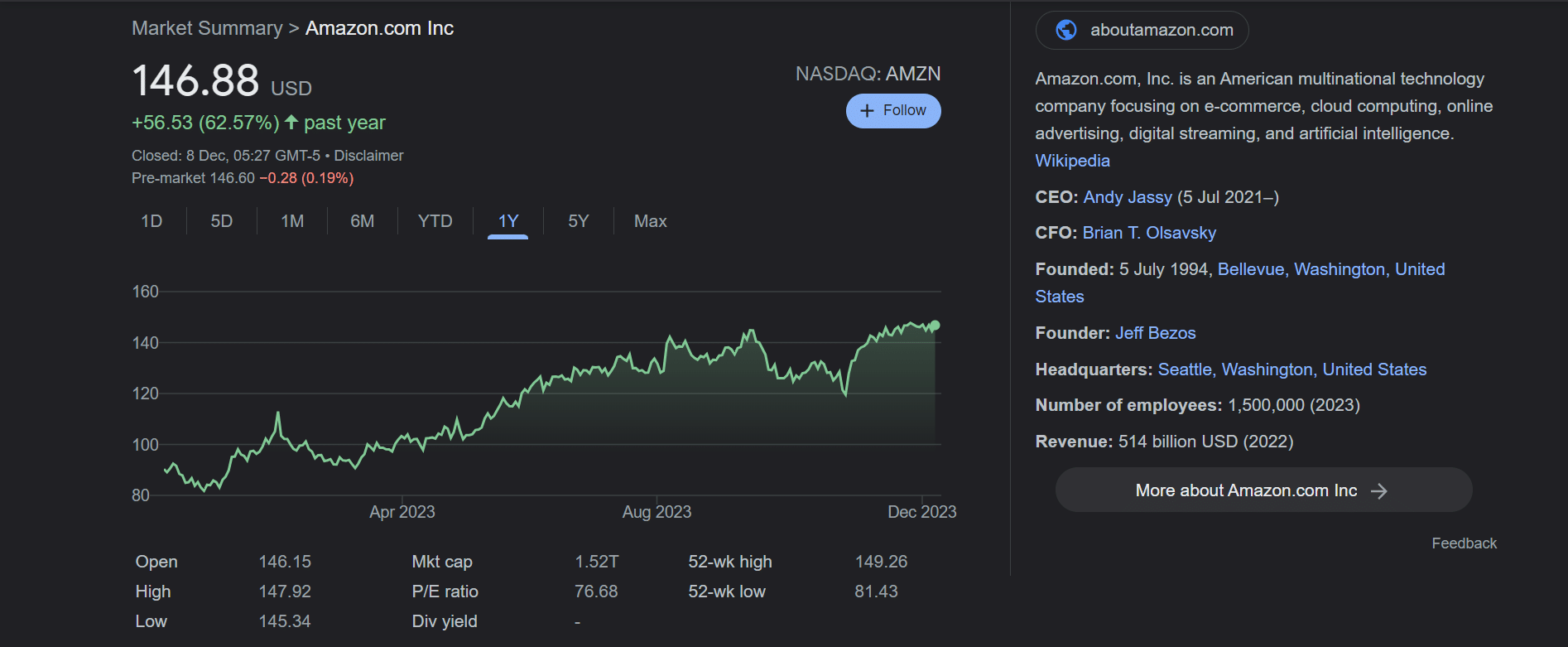

Although the Amazon is yet to pay a single dividend on its common stock since it went public in 1997, the Amazon share price continues to outperform the market year-on-year. In fact, in 2020 alone Amazon shares grew by over 75%, which was followed up by another positive return in 2021. However, the stock has tumbled 49% in 2022, marking the biggest fall since 2000.

In this guide, we show you how you can buy Amazon shares UK. We will also discuss the UK stock investment apps that offer Amazon shares.

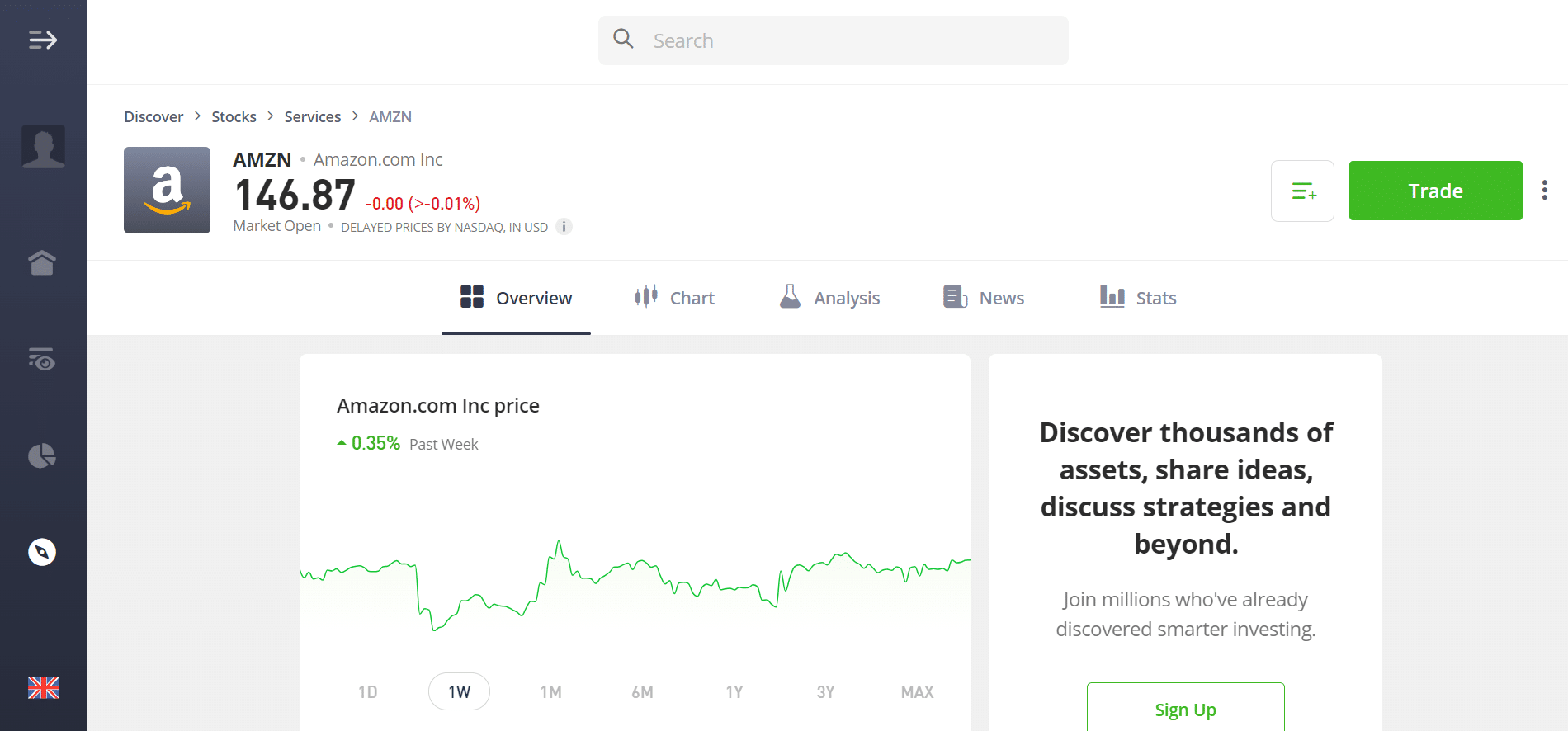

This is an exchange that hosts the largest tech stocks in the world – including Google, Microsoft, Facebook, and Netflix shares, to name a few. As such, you’ll need to ensure that your chosen UK stock trading app gives you access to the NASDAQ in a cost-effective way. Below we have listed two share dealing platforms in particular that allow you to buy Amazon shares in the UK. Once you have decided which stock app you want to use – and whether you want to buy or trade Amazon shares, it’s then time to do a bit of research. After all, even though Amazon’s share price is up over 85% in the past five years, it doesn’t mean that the stocks will continue to rise indefinitely. As such, the sections below will outline some key information that traders often take into account before you invest in Amazon UK. Had you shared the vision of Jeff Bezos back in 1997 when Amazon first went public, you would now be looking at unprecedented gains. Back then, the shares would have cost you just $18 each. However, we need to adjust this future to take into account the many stock-splits that Amazon has initiated. As such, the initial Amazon share price UK was effectively just $1.73. Fast forward to 2023 and the same Amazon shares will cost you over $1362 each. That works out at end-to-end gains of over 78,000%. In simple terms, had you invested £1,000 into Amazon back in 1997, your investment would now be worth over £1.36 million. However, it’s not always been smooth-sailing for Amazon shares. On the contrary, the stock was heavily impacted by the Dot Com bubble of the early 2000s. In fact, it took over a decade just for Amazon shares to get back to pre-bubble levels. But, as we now know, it’s been up, up, and away ever since. In more recent times, it goes without saying that Amazon benefited from the coronavirus pandemic. While most of its divisions and subsidiaries performed well in 2020, it was its core retail platform that smashed through market and stock tip services expectations. In turn, Amazon shares started the year at $1,900 each – representing a 12-month increase of 75%. All in all, this means that Amazon is now a multi-trillion dollar company. Since the pandemic, Amazon has gone from strength to strength, diversifying into various high-growth markets. One of the most exciting elements of Amazon’s ongoing strategy is within the flourishing cloud-computing sector, where Amazon holds the largest market share through the company’s Amazon Web Services (AWS) division. According to Yahoo Finance, this market is expected to be valued at $947 billion by 2026 – almost double its 2022 value. This highlights the vast growth opportunity that Amazon has here, which is bolstered by its e-commerce and streaming segments. When you think about the characteristics that a company needs to pay its shareholders dividends, Amazon possesses them all. This includes a long-standing listing on a major stock exchange, continued growth, market dominance, and of course, billions of dollars worth of cash on hand. However, you might be surprised that to this date, Amazon is yet to pay a single penny in dividends. This is the case with other so-called FAANG stocks such as Facebook, Netflix, and Google. This isn’t uncommon for high-growth companies to opt not to pay a dividend, as they tend to reinvest profits to provide further growth. However, this does mean that any gains you make from Amazon shares will come through share price increases. As per its most recent annual report for Q3 2023, Amazon has an earnings-per-share (EPS) of $0.94. This easily beat the best stock analysis apps expectation, prompting a boost in the share price. At the time of writing, Amazon stocks carry a price-to-earnings (P/E) ratio of 74.11. Ordinarily, a P/E ratio this high would indicate that investors are overly focused on the ‘potential’ of Amazon as opposed to what revenues it is generating right now. With that said, above-average P/E ratios seem to be accepted now when it comes to tech-oriented stocks like Tesla shares listed on the NASDAQ. Amazon Q3 2023 Earnings Report So now that we have covered the Amazon share price UK history, dividend policy, and key account ratios – we now need to look at the fundamentals. Amazon is widely considered one of the most popular stocks, but why is this? Below you will find some of the most important factors, including past performance, volatility and future outlook, that people often use to determine whether Amazon shares are a buy or sell. Seasoned investors will always contemplate how likely it is for a stock to defend its self to a wider recession or economic downturn. In this sense, risk-averse investors with the aid of stock portfolio trackers will usually add ‘defensive stocks’ to their portfolio during times of uncertainty. This usually centres on stocks operating in stable industries – such as pharmaceuticals, retail, or tobacco. However, in recent years it was tech stocks like Amazon that led the way. After all, while most stock sectors saw huge losses back in 2020 due to the pandemic, Amazon thrived. In fact, as we noted earlier, Amazon stocks finished the year 75% up. This price increase can be attributed to Amazon’s stellar business model and focus on e-commerce, which was appealing to consumers who were forced to stay inside during the lockdowns. However, other divisions are slowly but surely eating away at this dominance. At the forefront of this is the various service-based subsidiaries that fall under the Amazon brand. For example, Amazon Prime subscriptions continue to rise, as does the content streaming service of the same name. As noted earlier, you also have Amazon Web Services (AWS), which is by far the largest player in the cloud computing arena. We should also mention other up-and-coming Amazon divisions that are likely to thrive in the near future, such as groceries, drone deliveries, and AI. Irrespective of whether or not you think Amazon shares are a buy, there is no getting away from the fact that the firm possesses a considerably strong balance sheet. This shouldn’t be discounted, as the balance sheet is what allows organisations to weather the storm of prolonged economic downturns. In the case of Amazon, the tech stock was sitting on over $64 billion in cash at the end of Q3 2023. Plus, with the firm not tied to a dividend policy of any sort, this means that it can use its vast cash balance to fund new ventures. This is especially important, as Amazon is invested in a wide range of cutting-edge technologies which naturally, will burn through cash until the product or service is financially marketable. Perhaps one of the biggest threats facing Amazon stocks at present is that several key regulators could prove problematic for the firm. For example, the European Commission officially opened a case against Amazon in April 2022 to determine whether the company was in violation of antitrust laws. In turn, the biggest fear for shareholders is that this could lead to several key changes in how Amazon is allowed to run its business. You then need to look at U.S. President Joe Biden’s plan to raise the corporate tax rate in 2023. This would have a huge impact on Amazon’s bottom line – meaning less free cash flow available for reinvestment. So now that we have discussed the ins and outs of what to consider before you invest in Amazon, we are now going to show you how to complete your share purchase online. The steps below will walk you through the typical process with a FCA regulated stock trading platform. So, head over to a regulated broker and open an account. This requires some personal information from you, such as your name, address, date of birth, etc. To verify your account on day trading apps and thus remove withdrawal restrictions, upload a copy of the following two documents: Now it’s time to make a deposit. You can instantly deposit funds at most brokers with the following payment methods: The prediction about Amazon’s market cap in 2030 suggests that it could reach around $2.5 trillion. This reflects a compound annual growth rate of approximately 7.5%. However, it’s important to note that predicting future market performance is inherently uncertain. Based on stock market research and analysis softwares, Amazon has seen its market cap increase sixfold over the past seven years. While it may be challenging for the company to replicate such exponential growth in the next seven years, significant expansion is still expected. Factors that could contribute to Amazon’s future growth include its continued dominance in e-commerce, expansion into new markets and industries, innovations in technology and logistics, and potential acquisitions or strategic partnerships. This guide has walked you through the process of how to buy Amazon shares online in the UK. While one of the most popular stocks to buy, remember to do lots of research and weigh up the risks if you’re considering investing in Amazon shares. Amazon became a public company in 1997 when it was listed on the NASDAQ exchange. The shares were initially listed at $18 each. But, when you factor in the several stock-splits that Amazon has since initiated, its IPO price actually stands at $1.73! You certainly can, as most stock apps in the UK now give you access to the NASDAQ. However, you need to keep an eye on trading fees and commissions, as a lot of stock apps will charge a premium to buy non-stocks. No, like a lot of FAANG stocks, Amazon does not pay dividends. It has no plans to change its dividend policy any time soon, so your ability to make money will come from an increased stock price. The cheapest way to buy Amazon shares in the UK is to use a 0% commission stock broker. Much like any stocks, the price of Amazon shares will go up and down throughout the day. At the time of writing in April 2022, one Amazon stock will cost you over $2800. However, by using a fractional share app, you can invest from just $10 (£7.70). stockapps.com has no intention that any of the information it provides is used for illegal purposes. It is your own personal responsibility to make sure that all age and other relevant requirements are adhered to before registering with a trading, investing or betting operator. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice.By continuing to use this website you agree to our terms and conditions and privacy policy. Trading is risky and you might lose part, or all your capital invested. Information provided is for informational and educational purposes only and does not represent any type of financial advice and/or investment recommendation. Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers. © stockapps.com All Rights Reserved 2026

Step 1: Find a UK Stock App that Lists Amazon Shares UK

Step 2: Why do People Invest in Amazon?

Amazon Share Price UK Action

Does Amazon Pay Dividends?

Amazon EPS and P/E Ratios

Revenue

143.08B USD

12.57% ⬆️ YoY

Net Income

9.88B USD

243.98% ⬆️ YoY

Diluted EPS

0.94

235.71% ⬆️ YoY

Net Profit Margin

6.9%

205.31% ⬆️ YoY

Cost of Revenue

75.02B USD

6.77% ⬆️ YoY

Is Amazon a Popular Investment Among Traders?

Amazon has Shown That it is Immune to the Covid Pandemic

Services Divisions are Doing Really Well

Strong and Stable Balance Sheet

Regulators are a Potential Chink in the Armour

Step 3: How to Buy Amazon Shares in the UK

Open a Brokerage Account and Add Funds

Step 4: How to Invest in Amazon UK

Amazon 2030 Price Prediction

Conclusion

References

FAQs

When did Amazon first go public?

Can you buy Amazon shares in the UK?

Does Amazon pay dividends?

What is the cheapest way to buy Amazon shares in the UK?

How much are Amazon shares?

Kane Pepi

Kane Pepi