Best Stocks to Buy to Buy Now

In the age of mobile investing, it has never been easier to buy and sell stocks online. In fact, the best stock apps now give you access to heaps of international markets. Whether that’s the NYSE, NASDAQ, or LSE – buying stocks on your phone can be completed in minutes.

However – with thousands of potential investments sitting at your fingertips, how do you know which stock to buy?

In this edition of our weekly opinion piece, we look at the best stocks to buy in May 2021 – with our analysis covering May 10th to May 16th.

-

- 1. Amazon – Best Tech Stock to Buy

- 2. Tesla – Best Long Term Stock to Buy

- 3. Moderna – Best Vaccine Stock to Buy

- 4. Delta Airlines – Best Cheap Stock to Buy

- 5. GoPro – Best Penny Stock to Buy

- 6. Canopy Growth Corp – Best Marijuana Stock to Buy

- 7. Johnson & Johnson – Best Dividend Stocks to Buy

- 8. British American Tobacco – Best Stock to Buy For Beginners

- 9. Hargreaves Lansdown PLC – Best UK Stock to Buy

- 10. Netflix – Best Growth Stock to Buy

-

- 1. Amazon – Best Tech Stock to Buy

- 2. Tesla – Best Long Term Stock to Buy

- 3. Moderna – Best Vaccine Stock to Buy

- 4. Delta Airlines – Best Cheap Stock to Buy

- 5. GoPro – Best Penny Stock to Buy

- 6. Canopy Growth Corp – Best Marijuana Stock to Buy

- 7. Johnson & Johnson – Best Dividend Stocks to Buy

- 8. British American Tobacco – Best Stock to Buy For Beginners

- 9. Hargreaves Lansdown PLC – Best UK Stock to Buy

- 10. Netflix – Best Growth Stock to Buy

Top 10 Stocks to Buy Today

Before we look at the best stocks to buy in more detail, here’s a quick rundown of our top stock picks for 2021.

- Amazon – Buy with 0% Commission Now

- Tesla – Buy with 0% Commission Now

- Moderna – Buy with 0% Commission Now

- Delta Airlines – Buy with 0% Commission Now

- GoPro – Buy with 0% Commission Now

- Canopy – Buy with 0% Commission Now

- Johnson & Johnson – Buy with 0% Commission Now

- British American Tobacco – Buy with 0% Commission Now

- Hargreaves Lansdown – Buy with 0% Commission Now

- Netflix – Buy with 0% Commission Now

The Best Stocks to Invest in Right Now

The best stock apps typically allow you to buy shares from dozens of domestic and international exchanges. This means that there are plenty of opportunities to build a diversified portfolio of stocks with ease. Taking into account the vast number of options that you have, below we discuss the hottest stocks to buy right now.

1. Amazon – Best Tech Stock to Buy

May 10th – May 16th: Amazon shares have traded in a narrow range around $3,250 for several months now, and the stock shows no signs of breaking out this week. However, look for the stock to retest its all-time high of $3,550, which could signal the start of a significant move higher for Amazon shares. For now, Amazon shares are sitting at $3,203 apiece.

If there was one industry, in particular, that proved its resistance to the global coronavirus pandemic – it was tech. This does make sense when you consider the wider lockdown measures that kept people indoors for several months. While there are many tech stocks that have flourished in 2020, we would argue that Amazon stocks stand out from the crowd.

At the turn of the year, the tech giant was priced at just under $1,900 per share on the NASDAQ. Although the stocks went on a very brief downward trajectory in March, it’s been up, up, and away ever since. In fact, Amazon stock hit all-time highs in September was just over $3,500 per share. Not only does this translate into a 9-month increase of over 87%, but Amazon is now home to a market valuation of well over $1.5 trillion.

In terms of the fundamentals, Amazon smashed through market expectations in its most recent earnings report. Its core business model – online retail, is thriving, as is its subsidiary divisions. In particular, Amazon is building its presence in the services sector – with the likes of Amazon Prime displaying strong results, making this one of the very best stocks to buy now.

2. Tesla – Best Long Term Stock to Buy

May 10th – May 16th: Tesla shares continued to trade below the $600 last week after sliding more than 6% the week before. The company has been taking the brunt of selling action as investors worry about inflation and the direction of the US economic recovery. However, little about Tesla’s potential has changed and the car maker is rapidly expanding production of its electric vehicles. For now, the stock is over 35% off it’s all-time high from earlier in the year.

Much like Amazon, Tesla has had a fantastic 2020. Back at the start of the year, Tesla stocks were priced at $86. This price takes into account its recent 5-for-1 stock split. Just 9 months later, the same stocks hit all-time highs of just over $500 per share. This means that Tesla investors are looking at 2020 returns of over 5x – which is huge.

With that being said, most would argue that Tesla stocks are one of the long-term portfolios. After all, the electric car manufacturer is only just about making a profit. It has a plethora of models in development, and it is working on a more efficient and cost-effective battery that could be a game-changer in the electric vehicle space.

We should also note that Tesla is in the process of developing consumer-based solar panels. Amongst several other notable projects – this NASDAQ powerhouse is an all-round innovator. At the time of writing, Tesla is home to a market capitalisation of over $360 billion. This could be a drop in the ocean when you consider just how big the firm could become in the next decade.

3. Moderna – Best Vaccine Stock to Buy

May 10th – May 16th: Moderna shares traded flat last week, as investors wait for more information about whether the US will suspend patent rights on the company’s COVID-19 vaccine. Regardless of what the government decides, we think this is a buying opportunity. Moderna will still retain its intellectual property and it’s the company’s mRNA technology that makes it valuable. Moderna shares are still up more than 50% since the start of the year.

While 12 months ago there is every likelihood that you hadn’t heard of the pharmaceutical firm – Moderna has been hitting global headlines since its COVID-19 vaccine was approved in several key regions. This includes the US, Europe, UK, and more.

The most attractive thing about the Moderna vaccine is that it is a lot easier to store and distribute in comparison to its Pfner counterpart. This key characteristic is now fully evident in the firm’s ever-growing stock price. In fact, in the 12 months prior to writing this article, Moderna stocks were priced at just $22.74 each.

Fast forward to January 2021 and the same stocks are worth $151. This translates into 1-year gains of over 550% – which is incredible. You might be concerned that you have missed the boat with this top-rated vaccine stock – especially when you consider you could have entered the market last year at sub-$23.

However, Moderna is still carrying a market capitalization of just $60 billion on the NASDAQ. Although this might sound like a lot, it’s actually just a fraction of what many other NASDAQ-listed pharma stocks are worth. As such, it could be argued that Moderna stocks still offer a lot of upside potential.

4. Delta Airlines – Best Cheap Stock to Buy

May 10th – May 16th: When we first added Delta Airlines stocks to our portfolio in September 2020, the shares were priced at just $29. We argued that at this price level, the shares were heavily undervalued. At the time of writing, the same shares are priced at $45.21 each. Even with the 75% gain we’ve achieved, Delta stock is still nearly 20% lower than it was prior to the COVID-19 pandemic shut down travel.

Alongside the oil and gas arena – airlines were hit extremely hard when global travel came to a standstill in March 2020. On the one hand, it remains to be seen when domestic and international travel will resume to pre-pandemic levels. On the other hand, people were flying before COV-19 came to fruition, and they will once again be flying in the future.

With this in mind, most airline stocks can now be purchased on the cheap in the anticipation of ‘normality’ someday in the next couple of years. At the time of writing, the good news is that we have not seen any airlines file for bankruptcy. The problem is which airline to pick.

While there are several that look tempting based on current prices, Delta Airlines arguably stands out. The US-based carrier started the year at just under $60 per share. The very same shares are now worth just $29 – representing a decline of over 50%. Delta Airlines is once again back in the air – albeit, at vastly reduced capacity levels.

But, it is generating cash flow, which is a crucial component in weathering the coronavirus storm. If and when Delta Airlines stock is able to get back to pre-pandemic levels, you would be looking at an upside of over 100%. Although Delta Airlines has since cut its dividend, this is something else to look forward to in the near future.

5. GoPro – Best Penny Stock to Buy

May 10th – May 16th: GoPro shares rose 2% this week, continuing the stock’s recent bullish momentum. This penny stock has been extremely volatile, but the reversal pattern we predicted has been developing just as we expected. In any case, this penny stock is up over 100% since entering our portfolio.

Penny stocks are defined as shares with a value of $5 or less. In most cases, the underlying company is either up and coming, or relatively small in size. Either way, you will find that the best penny stocks to buy now have a much higher risk vs reward ratio. That is to say, both the upside and downside potential can be huge. This is why you are best advised to keep your stakes to a minimum – and ensure that you are well diversified.

If we were to pick one penny stock, in particular, that looks somewhat attractive, it would have to be GoPro. The US-based firm is known for its cutting-edge camera technology, alongside video editing and mobile software. It should be noted that the firm’s corporate journey hasn’t been overly positive since it was launched on the NASDAQ in 2014.

Sure, its stock went from $34 to $86 in the space of a few months, but it’s been a capitulation ever since. Much of this is due to the firm’s inability to meet its operating profit forecasts. As a result, the stock is now worth just $4. However, there are certain signs that suggest GoPro stocks could be about to move in the right direction.

For example, year-on-year sales grew by over 40% in Q4 2019. Furthermore, the stocks are worth 58% more today than they were 6 months ago. Even more impressively, the firm’s premium subscription service is now home to over 350,000 paying customers. All in all, GoPro stocks could be worth a punt at current prices – but only at small stakes.

6. Canopy Growth Corp – Best Marijuana Stock to Buy

May 10th – May 16th: Canopy Growth shares traded flat this week, as investors try to decide whether this company has further to fall. Currently, the stock is trading more than 50% below its all-time high of $56.50 from February, so this could be a chance to pick up more Canopy Growth stock at a bargain price. We’re not overly concerned about the recent drop in price considering that the shares are up 103% since joining our portfolio in September.)

Canopy Growth Corp is a Canada-based cannabis grower that is now active in several jurisdictions. The stock first went public back in 1996 – long before cannabis was legalised in Canada. Back then, you would have been able to buy the stocks at just $2 each. Fast forward to 2019 and the very same stocks reached highs of $67. This translates into a growth of over 3,250%, showing it’s been one of the best stocks to buy of the last year.

However, the legal marijuana industry is still worth just a fraction of its true potential. The growth of ther marketplace is arguably dictated by government policy. That is to say, as more and more governments around the world continue to relax cannabis-based laws and regulations, this will have a hugely positive impact on stocks like Canopy Growth Corp. We should note that the stocks have tailed off over the past 18 months.

At the time writing, this stands at just over $19 – which amounts to a market capitalisation of $7 billion. Although this is nothing to write home about, there is a significant upside of this stock. There is no reason to doubt that Canopy Growth Corp can one day get back to levels of $67. If it does, you’ll be looking at a growth of over 250%.

7. Johnson & Johnson – Best Dividend Stocks to Buy

May 10th – May 16th: Johnson & Johnson shares hardly budged last week. The shares have been unaffected by the Biden administration’s announcement about waiving COVID-19 vaccine patents since the Johnson & Johnson vaccine uses more traditional vaccine technology. The vaccine has already added over $100 million to J&J’s bottom line for the first quarter of 2021.

The best dividend stocks are great if you’re looking to combine growth with regular income. In most cases, dividend-paying companies will make a distribution every three months. However, it should be noted that a significant number of firms have either cut or suspended dividends this year. This is once again a result of the coronavirus pandemic.

With that being said, some of the most consistent dividend payers continue to meet their distribution targets this year – meaning that there are many options on the table. At the forefront of this is heavyweight pharmaceutical stock Johnson & Johnson. In fact, this NYSE powerhouse sits within the remit of a ‘Dividend Aristocat’. This means that the firm has increased its dividend payment every year for the past 25+ years.

In the case of Johnson & Johnson, it has held this feat for over 57 years. In terms of its yield, this dividend stock is currently paying in the region of 2.7%. Although there are certainly more attractive yields out there, holding a strong and stable stock like Johnson & Johnson can be pivotal during times of economic uncertainties which is why we’ve listed it as one of the best stock to buy right now.

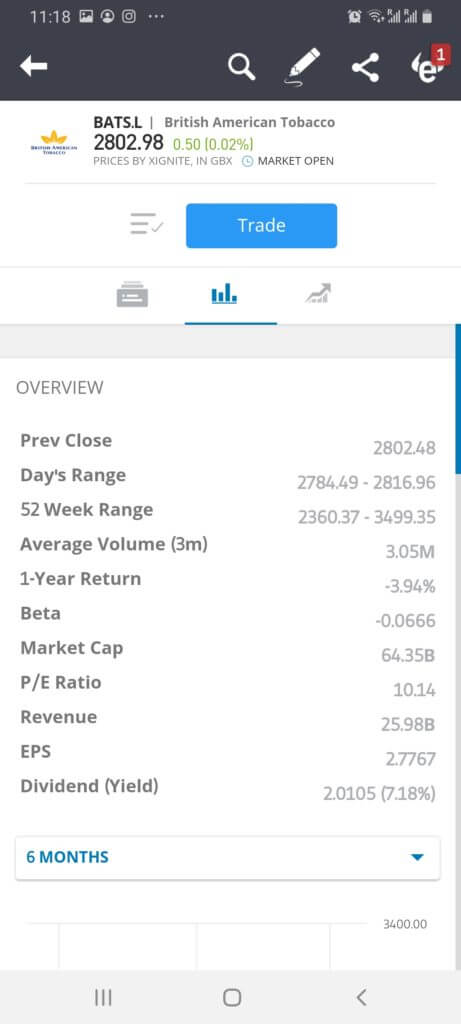

8. British American Tobacco – Best Stock to Buy For Beginners

May 10th – May 16th: British American Tobacco shares traded flat last week. The stock has now fully recovered from the Biden administration’s announcement that it wants to ban menthol cigarettes and require cigarette makers to reduce nicotine to non-addictive levels. If the administration goes through with this new regulation, however, the stock could fall again. For now, British American Tobacco offers a very generous 7% dividend yield, so any price appreciation is just extra good news.

If you’re a complete newbie in the world of stocks and shares, you might want to stick with high-grade companies. In other words, stocks that have a long-standing track record of growth over several decades – alongside an attractive and consistent dividend policy.

While there are many firms that meet these requirements – notably Coca Cola, Disney, Microsoft, and Ford Motors, we are particularly keen on British American Tobacco. First and foremost, this multi-billion dollar company is a market leader in the tobacco arena – with popular brands including Pall Mall, Dunhill, and Lucky Strike.

The global tobacco arena is often described as a ‘staple’ industry – as demand is rarely affected by the health of the wider economy. Additionally, British American Tobacco is an excellent dividend-payer. At the time of writing, this stands at a trialling yield of well over 7%, so it’s easy to see why many consider BAT among the best stock to buy today.

9. Hargreaves Lansdown PLC – Best UK Stock to Buy

May 10th – May 16th: Hargreaves Lansdown shares didn’t move much last week, offering traders a reprieve after a few weeks of volatile trading. We’re still waiting for an upward breakout move to develop to bring the shares to the next level. Now could be a good chance to invest in Hargreaves Lansdown shares before the stock makes another big move higher.

While much of the focus in this guide has been on US-listed firms (with the exception of British American Tobacco), there are heaps of UK stocks that are worth considering. In particular, we like the look of UK brokerage firm Hargreaves Lansdown PLC. The company is a major player in the UK investment scene – with thousands of stocks, funds, and bonds hosted on its platform.

Crucially, brokerage firms like Hargreaves crave volatile market conditions – which has been the case for much of 2020. After all, this results in increased trading volumes and thus – enhanced commissions and dealing fees.

In terms of the numbers, Hargreaves Lansdown PLC was priced at just over 1,400p on the London Stock Exchange 6 months prior to writing this page. Fast forward to August and the same stocks hit 2020 highs of 1,885p. This represents growth of over 34%. Although the stocks have since cooled off slightly to 1,500p-ish, there is plenty of upside potential, with this firm.

10. Netflix – Best Growth Stock to Buy

May 10th – May 16th: Netflix shares closed above $500 on Thursday, but finished slightly below that mark to end the week. The stock is about 10% below the level it held in April, and we continue to believe that this represents a chance to buy Netflix shares at a bargain. This company has been working hard to shore up its dominant position in the global streaming market. Even if its growth won’t be explosive in the coming year, it has plenty of tailwinds behind it.

Although Netflix was first launched in 1997, it wasn’t until 2007 that it began offering streaming services. Since then, the firm has been on an upward trajectory that has only been amplified by the coronavirus pandemic. After all, with much of the world forced to remain indoors during lockdown restrictions, many turned to Netflix for their stay-at-home entertainment.

This subsequently resulted in Netflix stock smashing through market expectations – especially in terms of subscriber numbers. For example, at just over 192 million subscribers in Q2 2020, this is 10 million more than the previous quarter. Most analysts estimate that over the course of coming years, digital content subscribers like Netflix will continue to chip away at traditional TV and cable providers.

As such, there is potentially a long way for this stock to go. In terms of the financials, Netflix started 2020 at $329 per share. The stocks are now just below all-time high territory at $473. This means that Netflix has returned investors over 79% just this year, making it one of the best stocks to invest in.

How to Identify the Best Stocks to Buy Now

If you’re looking to take your investment endeavours to the next level, it is crucial that you understand how to identity stocks yourself. Make no mistake about it – this is no easy feat. In fact, it can take many months for you to understand the ins and outs of what it takes to select viable stocks to buy.

With that being said, below you will find some handy pointers to help you identify the best stocks to buy right now.

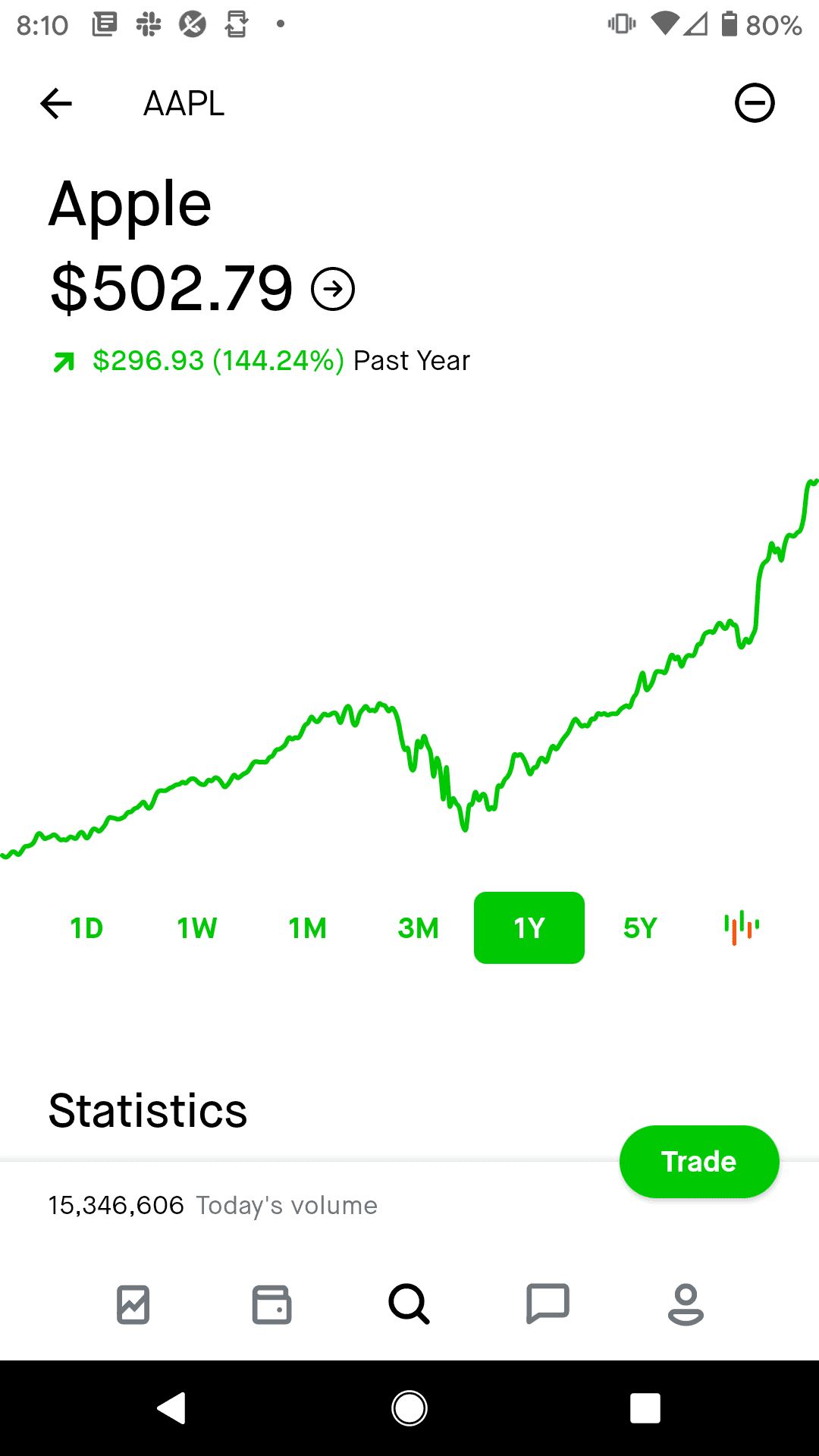

Recent Performance

One of the most important metrics to look at when identifying the best stocks for 2020 is that of the financials. For those unaware, publicly-listed companies are required to release their financial results each and every quarter. This allows investors to gauge how the company has performed over the past three months – against that of market expectations.

This earnings report will contain a plethora of key data – such as revenue, operating profit, margins, debt levels, and more. Once the figures are released, this will generally have an impact of the respective stock. For example, when Apple released its results in Q3 2020 – subsequently smashing through expectations, its stock price went up.

As such, you as an investor should ensure that you keep an eye out on key earnings reports. The best stock apps in the online space will offer an economic calendar that outlines the specific date of major company announcements. This allows you to invest on the back of the financials – as opposed to following the advice of somebody else.

Dividends or Growth?

You also need to assess what the long-term strategy is with your chosen stock investment. Some investors will seek strong and stable stocks that have a long-standing track record of paying dividends. This includes the likes of AstraZeneca, British American Tobacco, and Johnson & Johnson.

While growth will be somewhat limited, investors are attracted to the regular income that dividend stocks generate. At the other end of the spectrum, some investors will target firms that have the potential to keep growing over many years.

Often referred to as ‘Growth Stocks’, this generally covers firms that are still relatively new in the corporate scene – or that have products and services that still unproven. Although riskier, the upside potential with growth stocks is going to be much higher in comparison to strong and stable dividend-payers.

The Balance Sheet

A company lives or dies on the strength or weakness of its balance sheet. This sits at the core of stock – as it highlights the financial position of the organisation. For example, a company with a super-strong balance sheet will likely have vast cash resources and very little debt.

Think along the lines of Apple and Amazon. Having a strong balance sheet means that these companies can arguably whether any economic storm that presents itself. However, those with too much debt and little cash reserves will ultimately pay the price. This became evident in May 2020 when car rental firm Hertz Global Holdings – which was launched over 100 years prior, filed for bankruptcy.

Look for Value

Value stocks are those that have a current share price that lower than its perceived market value. One of the best ways to find undervalued stocks is to utilise the price-to-earnings (P/E) ratio. In order to do this, you need to dividend the company’s earnings per share into its current price.

This will yield a P/E ratio. The lower the ratio, the more chance there is that the stock is undervalued. With that being said, you also need to see what the average P/E ratio is for the sector that the stock operates in. As a simple example, if your chosen stock has a P/E ratio of 5, and the sector average is 8, then the stock might be undervalued.

What is the Best Time to Buy and Sell Stock?

One of the most challenging aspects of the stocks and shares space is timing the market. After all, the markets move in cycles. Some cycles might last a few days or weeks, while others (such as recessions) can last for years. The best thing about being able to time the market well is that it doesn’t matter which way the trend is moving.

As long as you can make an informed decision on the direction of the cycle, you stand the chance of making a profit. For example, when the stock markets are bullish, you can keep adding to your position for as long as the trend remains in place. At the other end of the spectrum, a downward market can be capitalised on by placing a series of short-selling orders.

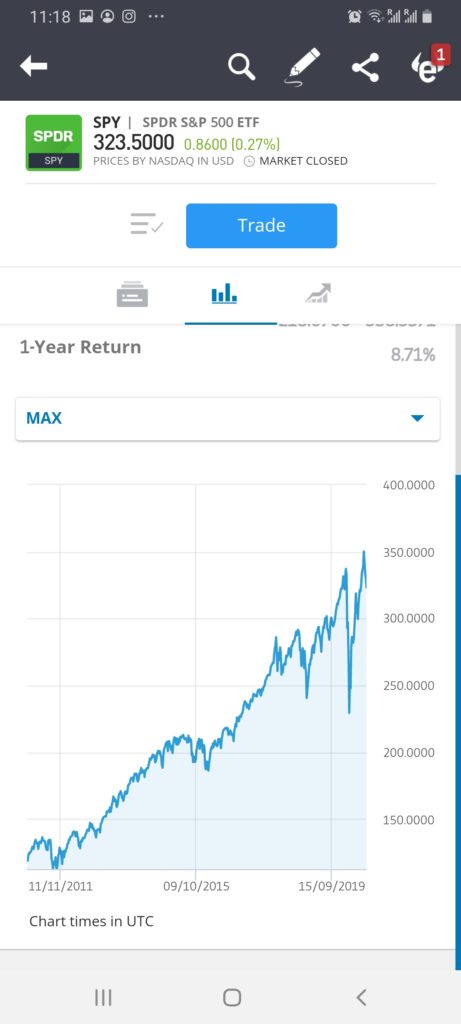

With that being said, experienced investors that are in it for the long-term have no interest in timing the market. On the contrary, they will continue to build on their stock positions over the course of time. This is with the view that while the markets will always go through ups and downs – long-term success is more of a probability than a possibility.

One only needs to look at stock market indexes like the S&P 500 to see that long-term investors have been rewarded by remaining patient and avoiding the irrational sell-offs. This is because, since the Index’s inception in 1926, it has returned average annualised gains of over 10%.

Where to Buy the Best Stock

Once you have determined which stocks you like the look of, you then need to find a reliable broker. The best brokerage firms active in the online space now offer fully-fledged stock investment apps. This means that you can invest in the best stocks to buy no matter where you are. However, you need to be extra careful to look at fees and commissions before signing up – as well as user-friendliness and supported stock markets.

To save you countless hours of research, below you will find three of the best stock apps in 2021.

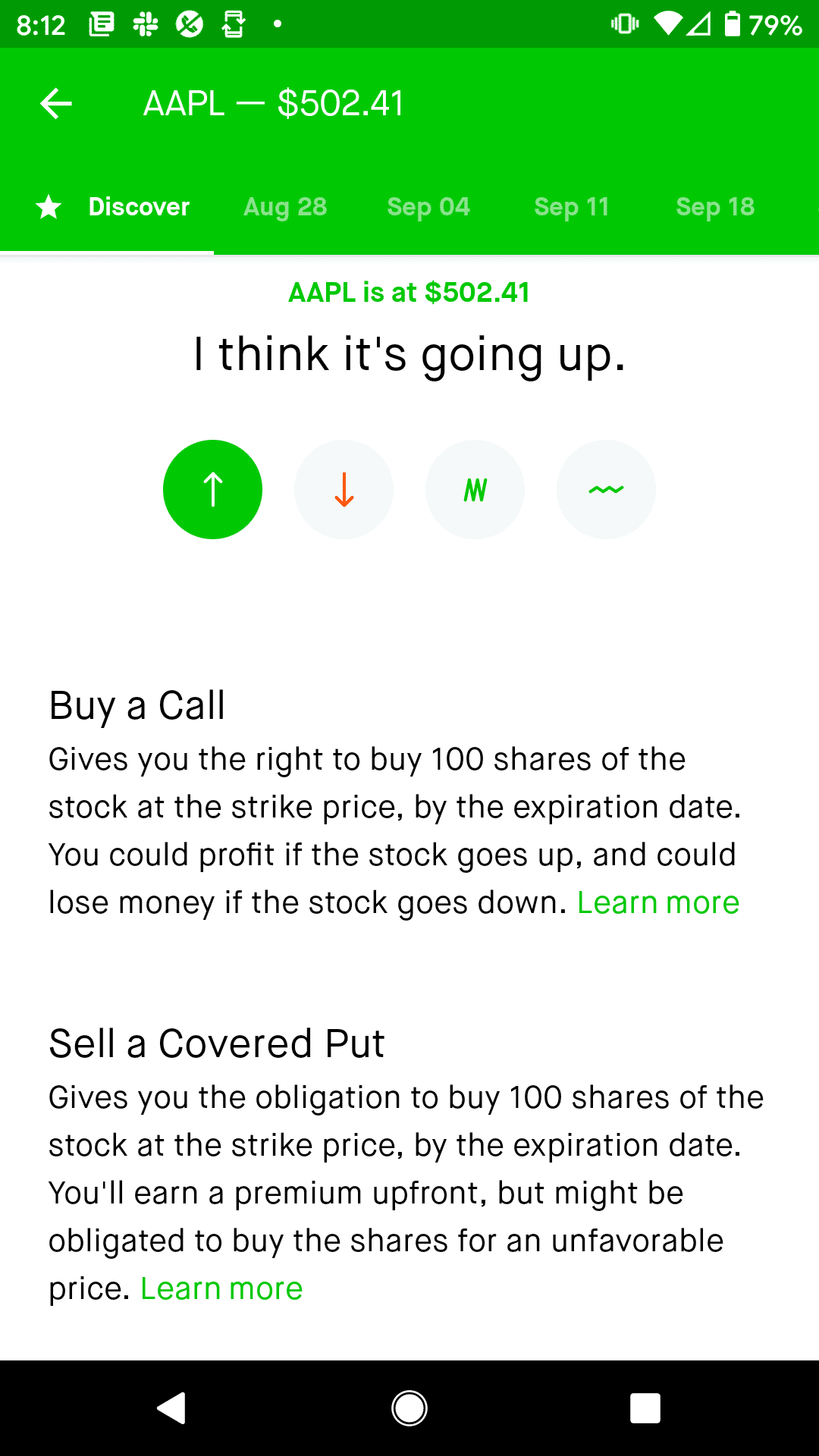

1. Robinhood – Best 0% Fee Investment App for US Residents

Robinhood is by far the most influential stock app in the US market. With over 10 million users, the platform has grown exponentially since its launch in 2013. The main appeal at Robinhood is two-fold.

Firstly, you can invest in stocks without paying any commission. This is essentially appealing if you want to invest small amounts, as you won’t be penalised by flat fees. Secondly, Robinhood is super-easy to use.

You don’t need any prior investment experience – nor do you need to know how to set up complex buy and sell positions. Instead, you simply need to search for the stock that you want to buy and determine the size of your investment. What we also like about Robinhood is that you can purchase ‘fractional’ shares from just $1.

This means that you can gain access to some of the best stocks to buy now like Tesla, Facebook, and Amazon without needing to purchase a full share. In terms of getting started, you can open an account in a matter of minutes via the Robinhood mobile app. You simply need to enter some personal information and then deposit funds from your US checking account.

Read our comprehensive Robinhood app review to find out more about what this firm offers.

Pros

- Heavily regulated in the US

- More than 10 million traders using the app

- Buy and sell stocks without paying any commission

- No minimum deposit in place

- No monthly or annual maintenance fees

- More than 5,000 US stocks supported

- Also invest and trade ETFs, options, and cryptocurrencies

- Perfect for newbie traders

Cons

- Only 250+ foreign stocks listed

- Unable to deposit with a debit/credit card or e-wallet

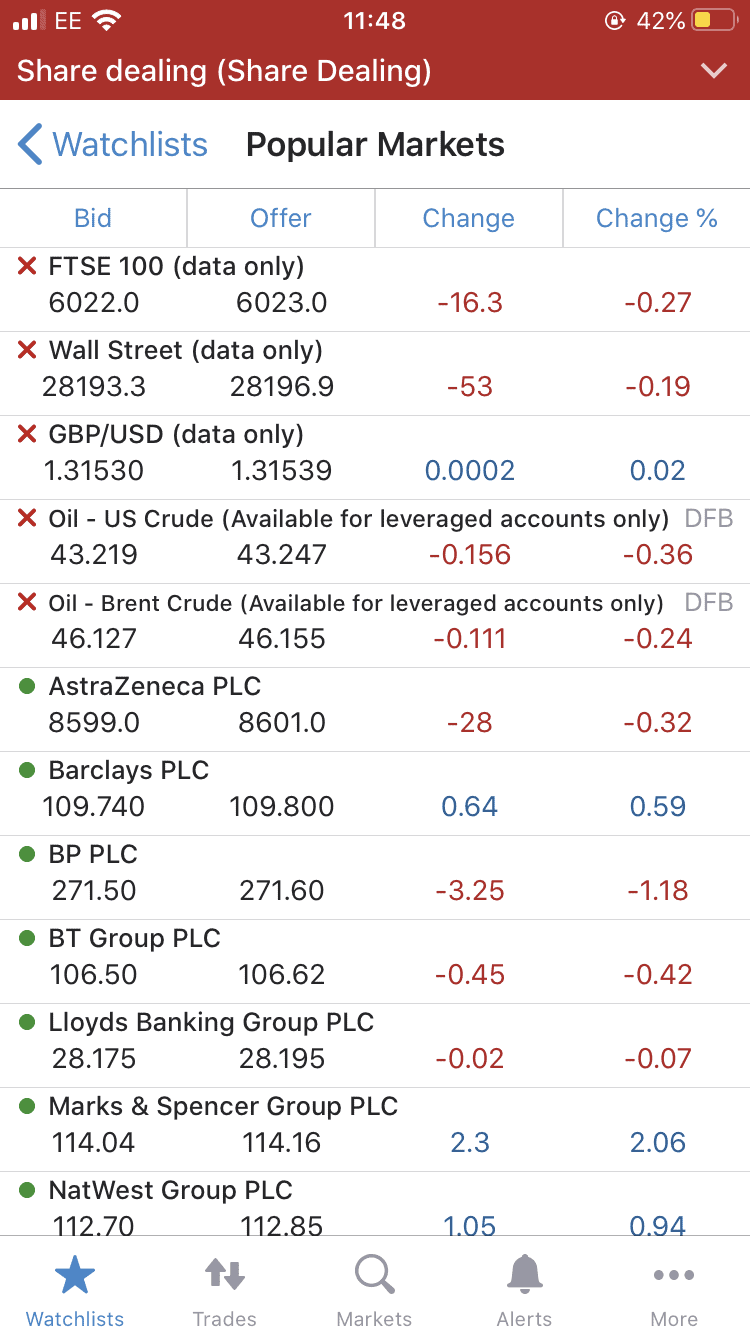

2. IG – Best Investment App for UK Residents (10,000+ Stocks)

If you’re based in the UK and you’re looking for a stock app with a huge library of markets – then you might want to consider IG. If you haven’t heard of this brokerage firm, it was first launched back in 1974. As a market leader in the UK trading scene, IG is nows listed on the London Stock Exchange.

Nevertheless, this stock app gives you access to over 10,000 shares and ETFs. You will need to pay a commission on each trade that you place. This starts at £8 per trade and is reduced to £3 when you trade more than three times in a 30-day period.

Although cheaper options exist elsewhere, you will struggle to finds a stock app with so much choice. Not only can you invest in UK companies listed on the London Stock Exchange and AIM – but dozens of international markets. This includes both large-cap and small-cap exchanges.

The IG mobile app is available on iOS and Android devices. The minimum deposit amounts to £250, which you fund with a debit card or bank transfer. Take note, iOS users need to deposit and withdraw via the main IG website. Finally, IG is licensed by the FCA so your funds are in safe hands at all times.

Read our comprehensive IG app review to find out more.

Pros

- Trusted investment app with a long-standing reputation

- More than 10,000 stocks listed

- Good value share dealing services – fees as low as £3 per trade

- Leverage and short-selling also available

- Spread betting and CFD products (Spread betting is only available to clients in the UK)

- Access to dozens of international markets

- Great research department

Cons

- A minimum deposit of £250

- US stocks have a $15 minimum commission

The Verdict

There are thousands of stocks to choose from across dozens of international markets. The best stock apps in the space allow you to access these markets at the click of a button – regardless of where you are. The most difficult part of the process is knowing which stock to buy. With this in mind, we hope that our guide has helped point you in the right direction.

FAQs

What are the best stock options to buy today?

Stock options are best reserved for experienced investors that have the potential to analyse the markets comprehensively. If you’re not yet able to do this on a DIY basis, we would suggest avoiding stock options. Instead, stick with traditional equities.

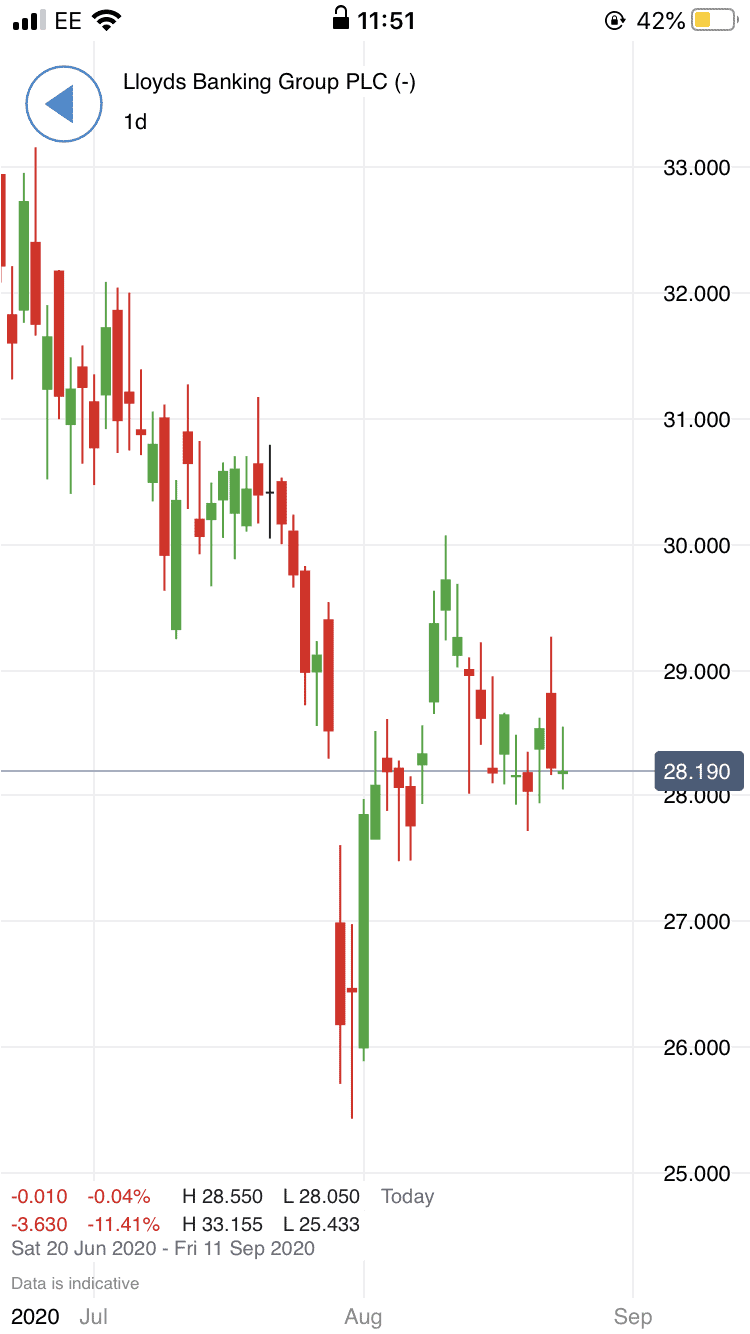

What is the best bank stock to buy?

If you’re looking for value, it might be worth focusing on the UK banking scene. Firms like HSBC and Natwest Group as staring at significant losses in 2020 – as per the coronavirus pandemic. As such, some discounts are potentially on offer. However, keep your stakes low with this sector – as the risks are much higher.

What is the best gold stock to buy?

By investing in gold stock, you are effectively investing in the future value of the asset. After all, as the value of gold increases, firms active in the space can make more money. However, gold stocks are fraught with risk – as there are more failures than success stories. As such, you might be best to stick with an ETF that tracks the value of gold.

What is the best pharma stock to buy?

If you’re looking for a strong and stable pharma stock with an impressive track record in paying dividends – it might be worth looking at Johnson & Johnson.

What is the best airline stock to buy?

Most airlines are currently worth just a fraction of what they were before the coronavirus pandemic came into full force. As such, this particular space is fraught with both risks and high rewards. If we were to select one, Delta Airlines potentially offers the lease risk in this space – owning to its ability to generate fast incoming cash flows.

Kane Pepi

Kane Pepi

Kane Pepi is a British researcher and writer that specializes in finance, financial crime, and blockchain technology. Now based in Malta, Kane writes for a number of platforms in the online domain. In particular, Kane is skilled at explaining complex financial subjects in a user-friendly manner. Kane has also written for websites such as MoneyCheck, the Motley Fool, InsideBitcoins, Blockonomi, Learnbonds, and the Malta Association of Compliance Officers.View all posts by Kane Pepi

stockapps.com has no intention that any of the information it provides is used for illegal purposes. It is your own personal responsibility to make sure that all age and other relevant requirements are adhered to before registering with a trading, investing or betting operator. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice.By continuing to use this website you agree to our terms and conditions and privacy policy.

Trading is risky and you might lose part, or all your capital invested. Information provided is for informational and educational purposes only and does not represent any type of financial advice and/or investment recommendation.

Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers.

© stockapps.com All Rights Reserved 2025

Scroll Up