Best Day Trading App 2024 – Top App Revealed

The stock market moves extremely quickly, and day trading requires you to always stay one step ahead. In order to do that, you need a top day trading app that can help you quickly conduct research, manage risk, and more.

In this guide, we’ll take a closer look at the 8 best day trading apps in 2024 to help you find the one that’s right for you.

-

- 1. eToro – Overall Best Free Day Trading App with 0% Commission

- 2. Libertex – Best for Forex and Crypto Trading

- 3. Robinhood – Best for Discovering Hot Stocks

- 4. TD Ameritrade – Best Mobile Charting Tools

- 5. Webull – Best User Experience

- 6. Plus500 – Best for Ultra-low CFD spreads

- 7. E*TRADE – Best for Stock Options Trading

-

- 1. eToro – Overall Best Free Day Trading App with 0% Commission

- 2. Libertex – Best for Forex and Crypto Trading

- 3. Robinhood – Best for Discovering Hot Stocks

- 4. TD Ameritrade – Best Mobile Charting Tools

- 5. Webull – Best User Experience

- 6. Plus500 – Best for Ultra-low CFD spreads

- 7. E*TRADE – Best for Stock Options Trading

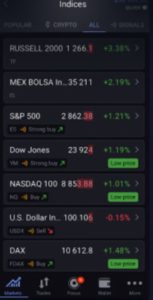

Best Apps for Day Trading 2024

- eToro – Overall Best Free Day Trading App with 0% Commission

- Libertex – Best for Forex and Crypto Trading

- Robinhood – Best for Discovering Hot Stocks

- TD Ameritrade – Best Mobile Charting Tools

- Webull – Best User Experience

- Plus500 – Best for Ultra-low CFD spreads

- E*TRADE – Best for Stock Options Trading

Best Day Trading App Reviewed

We’ve tested out dozens of trading apps to find out which ones are best for day trading. All of our recommended best apps for day trading provide access to a wide range of markets, excellent trading and research tools, and a seamless mobile user experience.

With that in mind, let’s take a closer look at the 8 best apps for day trading.

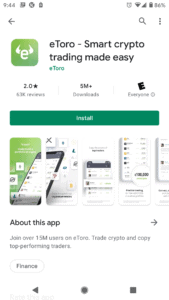

1. eToro – Overall Best Free Day Trading App with 0% Commission

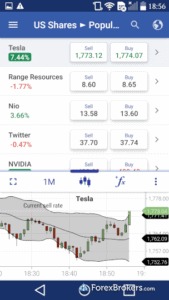

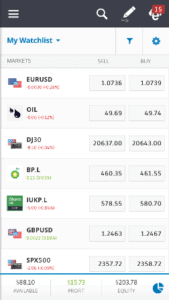

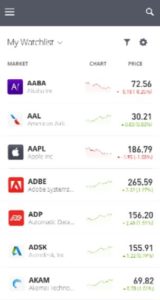

The eToro mobile app is packed with features for day trading. You can quickly pull up technical charts in full-screen mode and compare price movements between assets. The stock trading app also includes a real-time market news feed, price alerts, and watchlists.

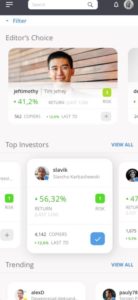

Even better, eToro’s app includes a built-in social network. You can see which stocks are hot based on what other traders are talking about or share strategies with other day traders. eToro also offers a market sentiment score for every asset, so you can see whether a stock is gaining or losing momentum throughout the day.

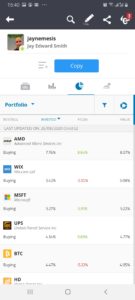

This app also supports copy portfolios, which enables you to set a portion of your portfolio so that it automatically copies another trader’s positions. This means that you can day trade with some of your money on your own, while also committing some of your money to a professional day trader’s ideas.

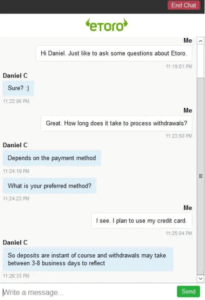

eToro requires a minimum deposit of $200, and you can start trading right away if you make a deposit using a debit or credit card. At this time, the app doesn’t support Google Pay or Apple Pay.

Pros

- 0% trade commissions

- Full-screen technical charts on mobile

- News feed and price alerts

- Built-in social network for day traders

- Supports copy trading

- Selection of DeFi projects available

Cons

- Doesn’t support Google Pay or Apple Pay

68% of retail investors lose money trading CFDs at this site.

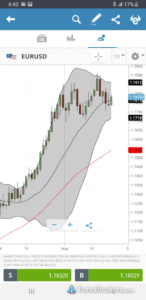

2. Libertex – Best for Forex and Crypto Trading

The Libertex app is very user friendly and offers key features for day traders like watchlists, price alerts, and a real-time news feed. It also gives you a measure of market sentiment for stocks and forex so you can track changes in buying and selling activity throughout the day. Of course, the app also includes full-screen technical charts with easily adjustable indicators.

One thing that sets Libertex apart, particularly for forex traders, is that you can use the MetaTrader 4 mobile app instead of – or in addition to – the Libertex app. MetaTrader 4 offers very advanced charting features on mobile devices, including the ability to create and monitor forex signals and to create your own technical indicators.

Libertex does charge commissions, but they operate in practice much like spreads. Commissions for forex pairs can be as low as 0.03% and for stock pairs can be as low as 0.10%. The main difference is that Libertex’s commissions are fixed for each security, whereas traditional spreads vary throughout the day.

You can start trading with Libertex forex trading app with a deposit of just $20. The app accepts credit or debit card and e-wallet transfers, but not Google Pay or Apple Pay.

Pros

- 50+ forex CFDs

- Very low trading commissions and zero spreads

- Use the Libertex or MetaTrader 4 mobile apps

- Supports forex signals and full-screen charting

- Get started with just $20

Cons

- Limited selection of stocks to trade

- Doesn’t support Google Pay or Apple Pay

75.3% of retail investors lose money trading CFDs at this site.

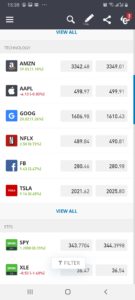

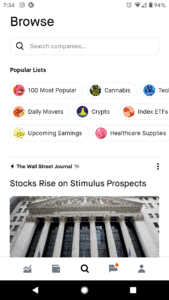

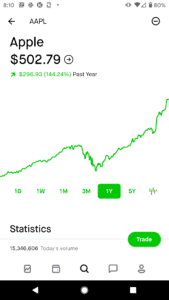

3. Robinhood – Best for Discovering Hot Stocks

One of the most appealing things about the Robinhood app is that it makes finding new stock to trade as easy as possible. You’ll find lists of stocks specifically for ‘Daily Movers,’ ‘Upcoming Earnings.’ and the ‘100 Most Popular’ stocks among Robinhood traders. The app also has stock lists for highly volatile market sectors like cannabis and tech.

In addition, when you view an individual stock page, the Robinhood app suggests related stocks based on what other traders who own that stock also own. So, it’s easy to find companies that you may not have heard of in a trending market sector.

Notably, the Robinhood app offers very little in the way of technical charting. You can view candlestick price charts, but they’re not very customizable and you cannot add technical indicators. This makes it much easier to navigate the app, but it can be problematic if you rely on technical charts for decision-making.

Robinhood does have a market news feed and provides fundamental information as well as analyst forecasts. However, this data isn’t quite as helpful for day trading as having access to real-time price analysis tools.

Pros

- 0% commission trading

- No minimum deposit required

- Lists of hot stocks and market sectors

- Easily discover related stocks

- Includes news feed and analyst ratings

Cons

- Very limited technical charts

- No price alerts

Your capital is at risk.

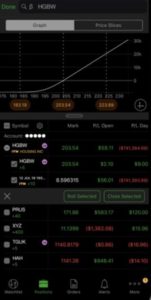

4. TD Ameritrade – Best Mobile Charting Tools

All stock and options trades are commission-free. Notably, TD Ameritrade doesn’t offer CFD trading, but you can trade on margin with this brokerage app. Margin rates aren’t the cheapest we’ve seen, but they’re still fairly competitive (rates start at 9.50%).

TD Ameritrade offers two different mobile apps: TD Ameritrade Mobile and thinkorswim Mobile. The TD Ameritrade Mobile app is good for placing quick trades, but we strongly prefer thinkorswim Mobile for day trading. In fact, thinkorswim Mobile is one of the best free day trading apps available from any broker.

With this app, you can access full-screen technical charts and overlay any of hundreds of premade indicators. All indicators are infinitely customizable – if the parameters you want to modify aren’t readily available, you can dive into the code underlying the indicator to change it. thinkorswim’s coding language takes some practice to get used to, but it’s simple enough for any trader to use.

This app is also terrific if you want to trade stock options. thinkorswim Mobile enables you to analyze options trades with up to 4 legs and offers tons of tools for analyzing risk based on different hypothetical price movements.

One catch to using TD Ameritrade is that this broker doesn’t support credit or debit cards for payment, nor Google Pay or Apple Pay. You’ll have to transfer money via direct deposit and wait a few days for the transaction to clear before you can start trading.

Pros

- Enormous selection of stocks and options

- Commission-free trading

- Two mobile apps available

- Fully customizable indicators with thinkorswim scripts

- Analyze 4-leg options trades

Cons

- Only accepts bank transfers for payment

- Relatively pricey margin rates

Your capital is at risk.

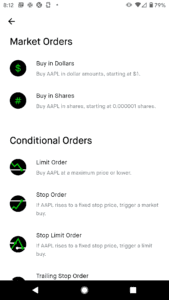

5. Webull – Best User Experience

All trades with Webull are commission-free, and this app stands out for it’s incredibly low rates for trading on margin. Interest rates start at just 6.99%, and you can access margin with as little as $2,000 in your trading account.

We love the Webull app, which offers a user experience that few brokerage apps can match. You get access to very capable technical charts with dozens of built-in technical indicators. If you need to modify parameters, Webull allows you to type in the new numbers – there’s no messing around with sliders or dials.

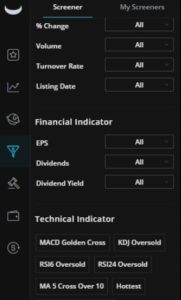

The app also makes it easy to find new trading opportunities using the integrated stock screener. You can filter stocks by technical indicators, including by setups like an MACD golden cross that are frequently targeted by day traders.

When it comes time to place a trade, the Webull app offers both a standard and advanced order entry panel. This makes it easy to quickly place orders when you want to execute a simple buy or sell, while ensuring that you have plenty of tools for risk management available if you need them.

Pros

- 5,000+ US stocks and ETFs

- 100% commission-free trading

- Very affordable margin rates

- Advanced technical charts with modifiable parameters

- Integrated stock screener with day trading filters

Cons

- Few stock discovery features

- Only accepts deposits by bank transfer

Your capital is at risk.

6. Plus500 – Best for Ultra-low CFD spreads

The Plus500 mobile app was built specifically with day traders in mind. You can load half-screen technical charts alongside your watchlists, giving you the ability to quickly scan the day’s activity while diving deeper into potential trading opportunities. To view full-screen charts, all you need to do is turn your phone horizontal. The only major issue we had was that Plus500’s included technical indicators aren’t as customizable as some day traders might like.

The app also includes helpful tools like a real-time market news feed, economic calendar, and price alerts. The alerts are especially nice because you can set them based on common technical parameters in addition to price levels. Day traders will also like Plus500’s trailing stop order, which enables you to automatically lock in profits as a stock’s value rises.

Plus500 offers 24/7 customer support, which is another plus for day traders. If anything happens to your account, you can be confident that the support team will be available to help you right away.

You can start trading with Plus500 with a minimum $100 deposit. The broker accepts not only credit and debit cards, but also e-wallets like Neteller and Skrill as well as Google Pay and Apple Pay.

Pros

- Extremely low trading spreads

- View watchlists and charts side-by-side

- Supports trailing stop orders

- 24/7 customer support

- Accepts Google Pay and Apple Pay

Cons

- Technical studies aren’t very customizable

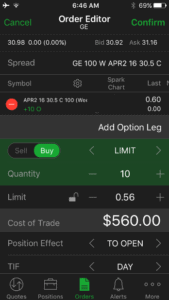

7. E*TRADE – Best for Stock Options Trading

The E*TRADE mobile app has been rated the #1 investment app by Kiplinger, and it’s a solid option for day traders. But E*TRADE also has a dedicated mobile app for active traders called Power E*TRADE.

This is one of the best day trading apps for iPhone and Android, particularly if you’re interested in trading stock options.What makes this app so great is that you can easily analyze and trade multi-leg options strategies, up to 4 legs. Power E*TRADE offers interactive risk management tools so you can calculate your potential profit and loss under different future price scenarios. The app also gives you access to raw options chains, so you can spot opportunities that might not be obvious from a broad overview of the options market.

On top of that, Power E*TRADE’s charting capabilities are second only to thinkorswim Mobile from TD Ameritrade. You get access to hundreds of built-in studies, all of which can be customized to suit your trading strategy. We especially appreciated that you can save sets of indicators as chart defaults, which makes it easy to load complicated strategies on your smartphone.

There’s no minimum balance required to open an account with E*TRADE and this broker doesn’t charge any account fees. The only catch is that you can only fund your account with a bank transfer, not with a credit card, debit card, Apple Pay, or Google Pay.

Pros

- Huge selection of stocks and options

- Trade multi-leg options strategies

- Access options chains

- Extremely customizable charting interface

- Save indicator sets for future use

Cons

- Only accepts direct deposit to fund account

Your capital is at risk.

How to Choose the Best Day Trading App for You

There are a lot of considerations that go into picking the best day trading app for iPhone or Android. Some apps are better for trading specific assets, while others may be better suited for different trading styles and strategies.

To help you pick the best app for day trading, let’s take a look at the key factors you need to consider.

Regulation

Regulation is an often overlooked, but incredibly important thing to consider when picking the best day trading app. Regulated apps are required to play by a set of financial rules that protect you from fraud and prevent your trades from being discriminated against in the marketplace.

We highly recommend choosing a regulated app for day trading. In fact, all of the best apps for day trading we reviewed are regulated by FINRA (the Financial Industry Regulatory Authority) in the US, the Financial Conduct Authority (Financial Conduct Authority) in the UK, or CySEC (the Cyprus Securities and Exchange Commission) in Cyprus.

User Experience

As a day trader, you’ll spend a lot of time on your app. Whether it’s to navigate between your watchlists and charts pages or between the news feed and order form, you need the process of moving through your trading app to be seamless.

If it’s not, you’re potentially falling behind the market and missing opportunities – or even worse, losing money.

So, pay close attention to how natural it feels to use an app. Look at the menu layout to see if you can easily switch between research, discovery, and trading. Also play with the charting interface to see whether you can easily add and customize technical indicators.

Overall, the easier it is to use a mobile app, the more likely you are to trade with it. More than that, the better chance you’ll have of catching opportunities and acting on them before they disappear.

The good news is that most day trading apps offer demo accounts. It’s a good idea to sign up for paper trading before committing to an app so you can try it out and explore all of its features.

Tradable Assets

Another key thing to note is what types of assets you can trade with a day trading app and how many total assets are available. All of the apps we reviewed offer stock trading, but many also offer stock options, forex, cryptocurrencies, and more.

Some day trading apps only offer a few dozen stocks, while others offer thousands. Think about what markets you want to trade and whether having a wider range of stocks to trade can help you find overlooked opportunities.

Stock options trading is also particularly noteworthy. Many day traders use options strategies to manage risk and increase profits. If you plan to trade complex, multi-leg options strategies, make sure that your free day trading app offers analysis tools for these strategies.

Fees

Understanding fees is critical to choosing the best day trading app. In fact, trading and account fees can be the difference between trading profitably and losing money for many day traders.

To start, check an app’s trading fees. Many of the top day trading apps have now switched to a 0% commission model, which means you pay no money to trade stocks or CFDs. Some brokers also offer commission-free stock options trading, although you may still face fees for each contract you purchase or exercise.

In the absence of commissions, most brokers charge spreads. This is the difference between the bid and ask price of a security. Spreads can be tiny – as low as 0.03% of your trade value at some brokers – or significant – up to 1% in the most extreme cases. Keep in mind that spreads are charged on both ends of a trade, so they can add up quickly.

Some trading apps also charge account fees, regardless of how much you trade. You won’t find these account fees with most of the trading apps we reviewed, since we think they’re generally bad for traders. Watch out for monthly subscription charges, inactivity fees, or exchange fees that can eat into your trading profits.

Day Trading Tools & Resources

Day trading successfully requires a lot of research and a lot of tools. So, what should you be looking for in the best day trading app?

To start, you absolutely need customizable technical charts. Price action is at the heart of day trading, and charts are key to analyzing price movements. Look for full-screen charts with dozens or even hundreds of built-in technical indicators. Having the option to build custom indicators may also be important to more experienced day traders.

Next, look for a real-time news feed. Market news has a huge impact on stock prices throughout the day. If you’re not watching the news, there’s no way to know why a stock’s price might be jumping – and there’s certainly no way to trade around the price movement. Ideally, your app’s news feed should be fast-paced and easily searched for headlines about specific stocks.

Watchlists and alerts are also key for day traders. Watchlists allow you to easily monitor a group of stocks that are setting up for potential trades. Alerts allow you to know when a stock has reached a certain trigger price or when a technical indicator has crossed an important threshold. The more customizable your watchlists and alerts, the better.

There are plenty of other worthwhile tools, too. Some day trading apps offer trade ideas to help you identify potential setups. Others offer social networks or discovery features to help you find hot stocks to trade. It’s a good idea to use demo accounts to evaluate the quality of these tools and to figure out how they can integrate into your day trading strategy.

Device Compatibility

Are you looking for the best day trading app for Android? Or the best day trading app for iPhone? What about iPad compatibility?

Depending on what devices you have, it’s important to find out how compatible a day trading app will be with a range of systems. All of the apps we reviewed are compatible with both Android and iOS operating systems, including those used in tablets and iPads.

In addition, many of these day trading apps have web platforms that you can access from any Windows or Mac computer. You might find the mobile app is perfect for trading on the go, but prefer to use the web platform when you’re at your desk.

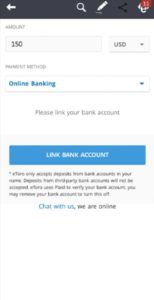

Payment methods

Having multiple payment methods available to fund your account is important when you first sign up for a brokerage app.

Some traditional brokers like E*TRADE and TD Ameritrade only accept bank transfers, which isn’t very convenient. Bank transfers also take several days to clear before you can access your funds and start trading.

We recommend looking for apps that allow you to pay by credit or debit card, e-wallet, or Google Pay or Apple Pay. Typically, you can start trading immediately when you pay using one of these methods.

Customer service

Customer service might not seem like a big deal – at least up until the moment when you run into an issue with your trading account. Then, you’ll be glad you chose a broker that offers highly available and highly responsive support.

Many of the best day trading brokers offer support by phone and live chat so that you can get in touch with a customer service agent right away. After all, if you have to send an email and wait days for help, you could be missing out on huge market opportunities in the meantime.

Check the customer service hours that your broker offers, and prioritize brokers that offer 24/5 or 24/7 support. Also be sure to note whether you can reach customer service from within the mobile app, or whether you have to go searching around the web to get help.

Getting Started with the Best App for Day Trading

Ready to start day trading? We’ll show you how to use the eToro trading app, which offers multi-asset trading, 0% commissions, and a built-in social network.

Step 1: Download the eToro AppTo get started, open Google Play or the Apple App Store on your mobile device and search for ‘eToro.’ Download and install the app on your device.

Step 2: Create an eToro AccountOpen the eToro app and click ‘Join Now’ to create a new account. You can enter a new username and password, or sign up using your Google or Facebook account.

In order to comply with financial regulations, eToro requires that you verify your identity when creating a new account. You can complete this step in the app by taking a photo of your driver’s license or passport as well as a photo of a recent bill that shows your address.

Step 3: Deposit FundsOnce your account is set up, you can deposit funds. eToro requires a minimum deposit of $200, which you can pay by credit or debit card, PayPal, Neteller, or Skrill. You can also fund your account with a bank transfer if you deposit at least $500.

Step 4: Start TradingNow you’re ready to start trading. Head to your account dashboard to find hot stocks and other assets to trade. You can also tap the magnifying glass at the top of the screen and enter any stock by name.

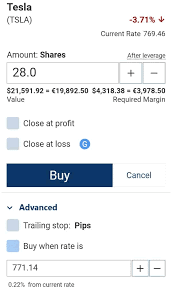

Once you find an asset to trade, tap on it and then tap ‘Trade.’ This will open a new order form. Choose how much you want to invest and whether you want to apply leverage. Then choose a stop-loss level and a take-profit level for your trade.

When you’re ready, tap ‘Open Trade’ to execute your first day trade.

Conclusion

Day trading can be an exciting way to make money from the stock market. But in order to trade successfully, you need the best app for day trading. Low fees, a wide range of assets, and powerful tools like stock screeners to help you research setups are all key features to look for when choosing the best day trading app for you.

Ready to place your first day trade? Click the link below to get started with eToro!

eToro – Best Day Trading App with 0% Commission

75% of retail investor accounts lose money when trading CFDs with this provider.

FAQs

Can I day trade stock options?

Yes, stock options are popular among day traders and are supported by many of the best iPhone and Android day trading apps. Look for apps that offer commission-free options trading.

How much money do I need to day trade?

We recommend committing at least $500 to be successful when you first start day trading. However, if your broker is regulated by FINRA, you must have at least $25,000 in your account to day trade.

What is a pattern day trader?

A pattern day trader is a designation given by FINRA, the US regulator, to anyone who places more than 3 days trades within a 5-day period. If you are designated a pattern day trader, you must have an account balance of at least $25,000 to continue day trading.

Should I use margin when day trading?

Margin is borrowed money from your broker that enables you to invest in larger positions than you would be able to using only your own money. Margin can increase your profits, but it can also increase your losses. So, use it carefully when day trading.

How do I find stocks to day trade?

The best apps for day trading tools to help you find potential stocks to trade. For example, some apps have a stock screener, while others have a social network or daily trade ideas. You can also use third-party tools and services to find day trading ideas.

Michael Graw

Michael Graw

Michael Graw is a freelance finance and trading journalist based in Bellingham, Washington. Michael’s expert trading guides and investment analysis articles have featured in many leading publications, such as TechRadar, Tom’s Guide, LearnBonds, and BuyShares.View all posts by Michael GrawVISIT ETOROYour capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.stockapps.com has no intention that any of the information it provides is used for illegal purposes. It is your own personal responsibility to make sure that all age and other relevant requirements are adhered to before registering with a trading, investing or betting operator. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice.By continuing to use this website you agree to our terms and conditions and privacy policy.

Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers.

© stockapps.com All Rights Reserved 2024

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.OkScroll Up