Best Bitcoin Trading App – Cheapest Bitcoin App Revealed

Obtaining a top-rated Bitcoin trading app is crucial if you are looking to make consistent cryptocurrency gains. After all, you’ll never be more than a couple of clicks away from opening or closing a trade.

Additionally, the best Bitcoin trading apps provide you with real-time notifications on everything from pricing alerts to important news developments.

In this guide, we explore the best Bitcoin trading app of 2025. Our selected providers all excel in key areas such as safety, fees, tradable markets, user-friendliness, and customer support.

-

- 1. Coinbase – User-Friendly Bitcoin Trading App With Over 35 Million Customers

- 2. Kraken – Bitcoin App That is Popular in Europe

- 3. Binance – Popular Bitcoin Trading App With Hundreds of Cryptocurrency Pairs

- 4. Gemini – Best Bitcoin Trading App for Security and Safety

- 5. Crypto.com – Good Bitcoin App for Buying Crypto

-

-

- 1. Coinbase – User-Friendly Bitcoin Trading App With Over 35 Million Customers

- 2. Kraken – Bitcoin App That is Popular in Europe

- 3. Binance – Popular Bitcoin Trading App With Hundreds of Cryptocurrency Pairs

- 4. Gemini – Best Bitcoin Trading App for Security and Safety

- 5. Crypto.com – Good Bitcoin App for Buying Crypto

-

Best Bitcoin Trading App 2025

To help you make an informed decision, below you will find a selection of the very best Bitcoin trading apps of 2025. You can scroll down to find out more about what each app offers.

- Coinbase – User-Friendly Bitcoin Trading App With Over 35 Million Customers

- Kraken – Bitcoin App That is Popular in Europe

- Binance – Popular Bitcoin Trading App With Hundreds of Cryptocurrency Pairs

- Gemini – Best Bitcoin Trading App for Security and Safety

- Crypto.com – Good Bitcoin App for Buying Crypto

The popularity of mobile trading in the Bitcoin scene is growing at a rapid pace. With this in mind, there are now heaps of Bitcoin trading apps to choose from.

This does make it difficult to know which application is right for your financial goals and personal preferences.

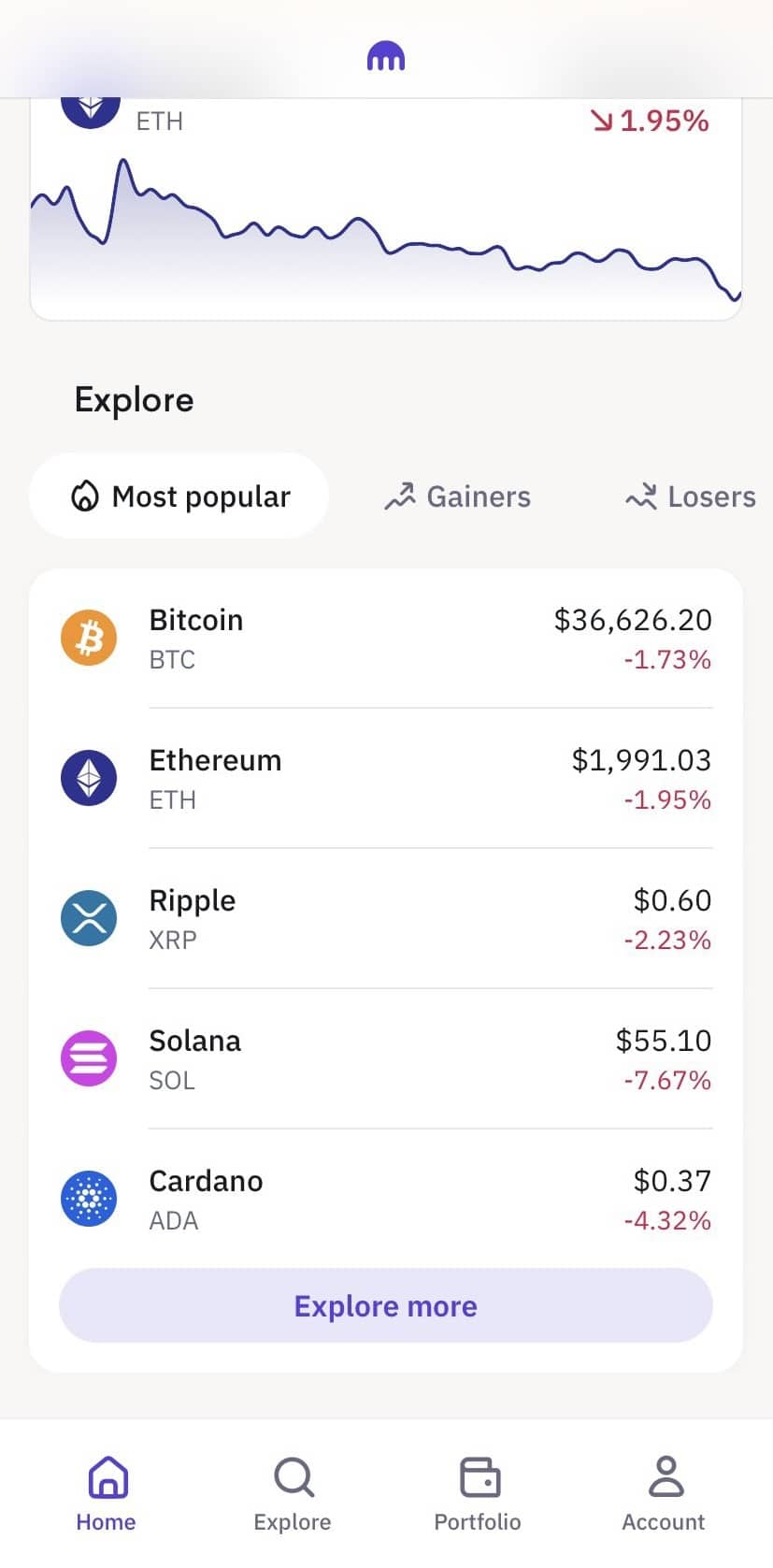

1. Coinbase – User-Friendly Bitcoin Trading App With Over 35 Million Customers

Based in the United States, Coinbase is arguably the most popular cryptocurrency broker in the space. As such, millions of people use its Bitcoin trading app – which is available on both Android and iOS devices.

Based in the United States, Coinbase is arguably the most popular cryptocurrency broker in the space. As such, millions of people use its Bitcoin trading app – which is available on both Android and iOS devices.In terms of the positives, the Coinbase app is extremely easy to use. In fact, it’s often the go-to option for those looking to trading Bitcoin for the very first time. The application gives you access to dozens of digital currencies – all of which can be purchased with a debit card or bank transfer.

We also like Coinbase because it takes regulation seriously and it offers a full range of security controls. For example, 98% of crypto funds are kept in ‘cold storage’ – subsequently making an external hack near-impossible. You can also set up two-factor authentication and email confirmations on key account features.

The main drawback with this particular Bitcoin app is that it is somewhat expensive. For example, debit card purchases cost 3.99% – so a $1,000 Bitcoin order would amount to a fee of $39.90. Standard buy and sell orders also costly at a commission of 1.49% per slide.

Pros:

- Over 35 million customers and a great reputation

- Very user-friendly

- Deposit funds with a debit card or via bank transfer

- Ability to withdraw your coins out to a private Bitcoin wallet

- Handy mobile app

- Holds a license from the Financial Conduct Authority

Cons:

- 3.99% fee on debit card deposits

- 1.49% Bitcoin trading fee

Your capital is at risk.

2. Kraken – Bitcoin App That is Popular in Europe

Once you have funded your account, you can also use the Kraken app to trade cryptocurrency pairs. This covers a wide variety of pairs that contain the US dollar, Euro, and heaps of other digital currencies. You can also use the Kraken Bitcoin app to buy and sell futures.

If you have a higher appetite for risk, the Kraken trading app allows you to obtain leverage. In the futures department, you can get up to 1:50 – meaning that a $50 account balance would get $2,500 in trading capital. Commissions are also really competitive at Kraken, albeit the exact fee will depend on how much you trade throughout the month.

On the other hand, Kraken does fall short when it comes to supported payment methods. This is because traditional bank transfers are the only option on the table, meaning you can’t use a debit/credit card or e-wallet. Nevertheless, this particular Bitcoin app is really easy to use – so newbies will enjoy the user-friendly experience.

Pros:

- One of the most popular Bitcoin trading apps in Europe

- Very low commission structure

- You can buy, sell, and trade a good range of coins

- Offers Bitcoin futures

- Low account minimums

- Leverage of up to 1:50 on offer

- Great reputation

Cons:

- Does not support debit/credit cards or e-wallets

Your capital is at risk.

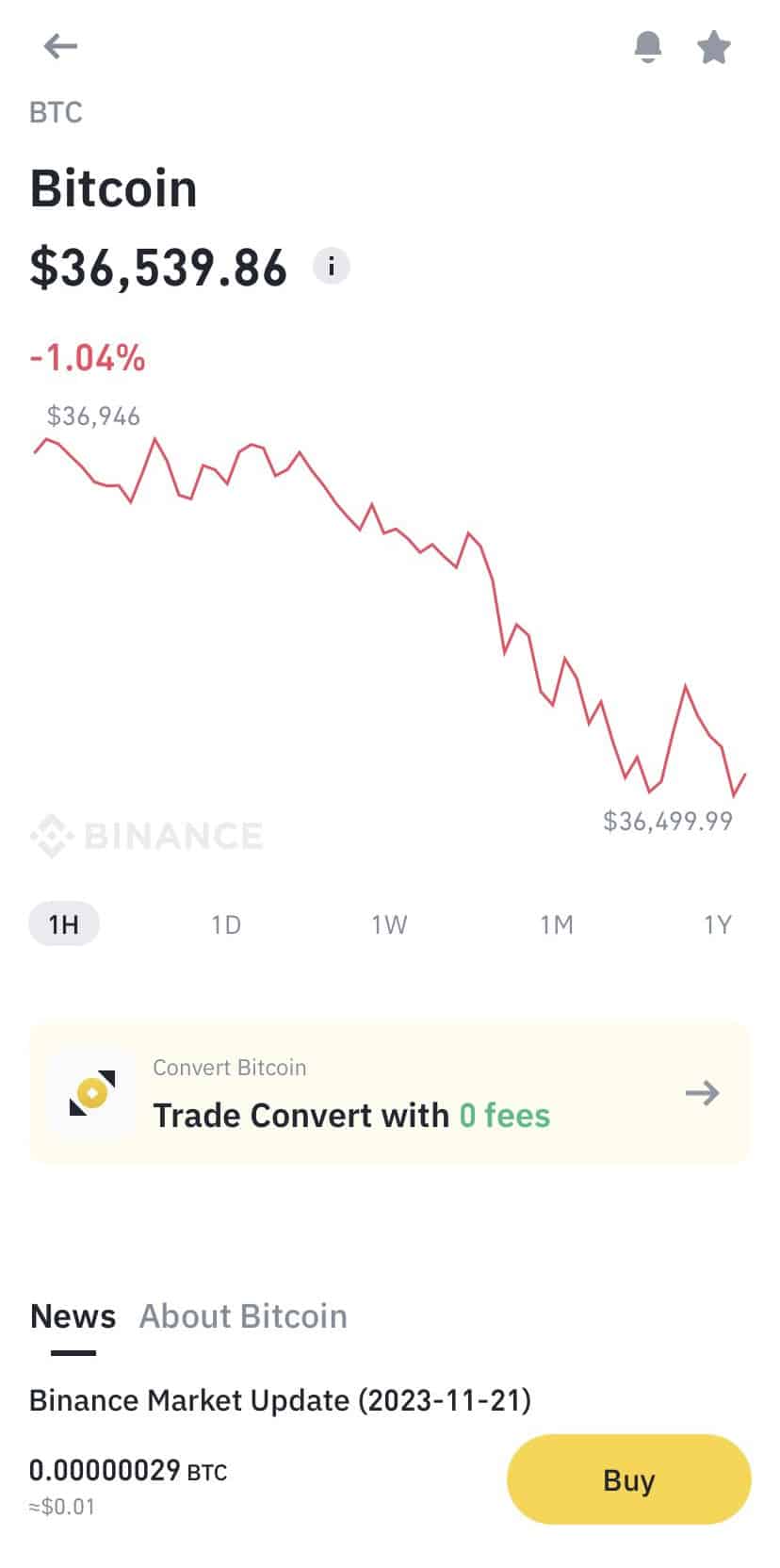

3. Binance – Popular Bitcoin Trading App With Hundreds of Cryptocurrency Pairs

Binance is another popular Bitcoin app that is especially useful if you are a seasoned trader. In fact, Binance is one of the largest Bitcoin exchanges in terms of daily trading volume. This is often between $10 and $20 billion every 24 hours. Additionally, Binance has become one of the most popular and best NFT apps available on the market today.

There are several reasons why Binance is able to attract such a large amount of capital. Firstly, the platform is home to hundreds of cryptocurrency pairs. Not only does this cover major blockchain coins like Bitcoin and Ripple, but heaps of smaller projects.

Binance is also popular because it offers an abundance of trading tools. This includes advanced chart reading features and technical indicators – both of which are crucial if you are looking to outperform the market on a regular basis. This particular Bitcoin trading app – which is compatible with both Android and iOS, is also competitive in the fee department.

This starts at just 0.10% per buy and sell order – meaning a $1,000 position would cost you a commission of $1. Lower commissions are available for larger volumes. On the flip side, if you are planning to deposit funds into your Binance account with a debit or credit card, you’ll pay a hefty fee of 2%. This can be avoided by transferring funds from your local bank account.

When it comes to safety, we should note that Binance isn’t regulated by a reputable body such as the Financial Conduct Authority or SEC. But, the Bitcoin app does offer excellent security features. At the forefront of this is the

Secure Asset Fund for Users (SAFU). This is a reserve pot Binance funds from trading commissions and is to be used in the unfortunate event of a third-party hack.Pros:

- Largest cryptocurrency exchange in terms of trading volume

- Hundreds of cryptocurrency pairs supported

- Trading commission of just 0.1%

- Supports debit/credit cards and bank transfers

- Great reputation in the cryptocurrency scene

- Ideal for advanced traders that seek sophisticated tools and features

Cons:

- Not great for newbie investors

- Standard charge of 2% on debit/credit card deposits

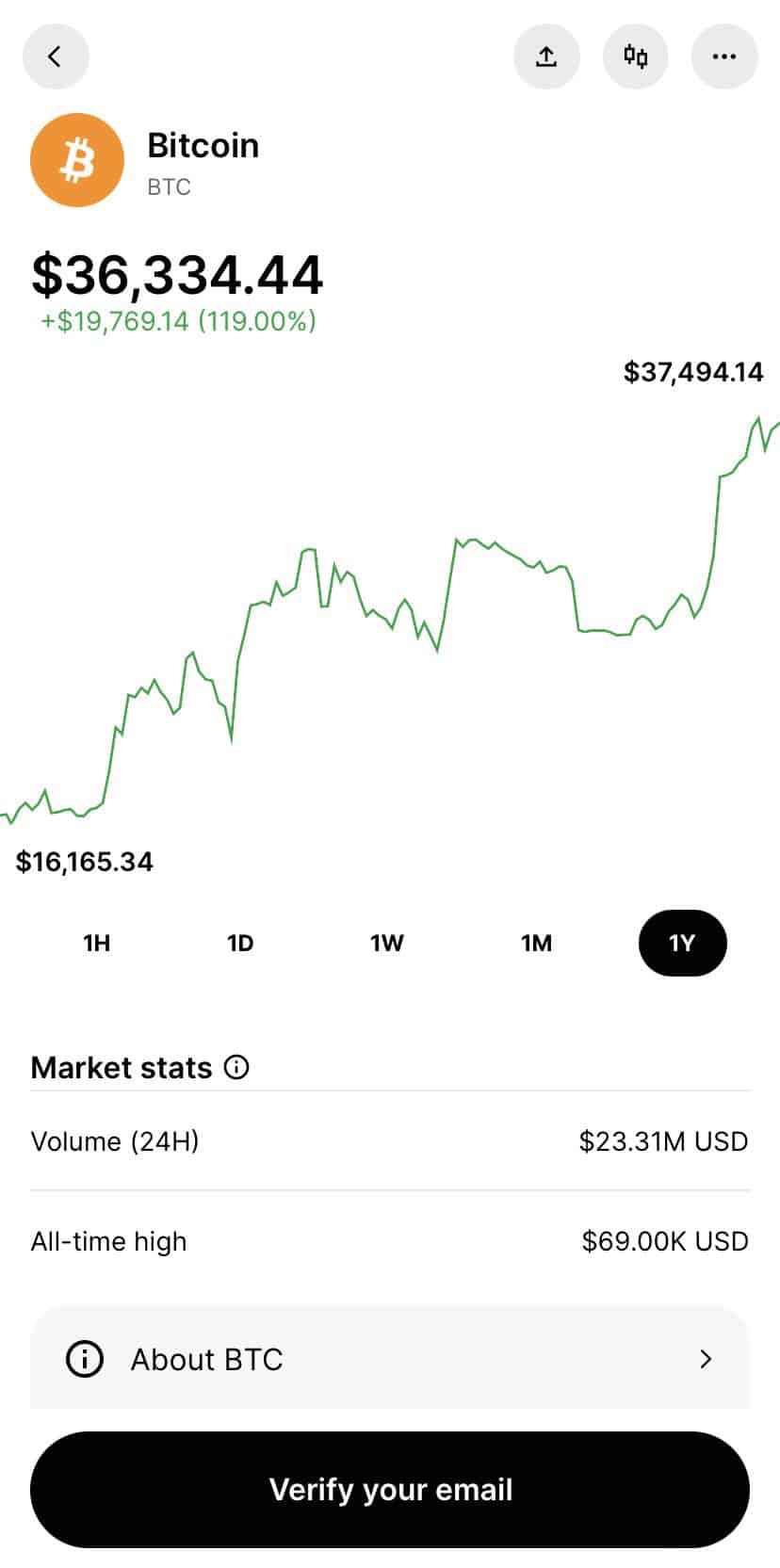

4. Gemini – Best Bitcoin Trading App for Security and Safety

Gemini is a huge cryptocurrency exchange that is super-popular with large-scale investors and traders. On top of offering heaps of liquidity and volume, Gemini is well-received for its top-notch security practices.

For example, it is compliant with all relevant bodies in the US – meaning that all account holders are required to go through a KYC (Know Your Customer) process. In turn, this ensures that financial crime is kept away from the platform.

Additionally, all USD deposits held at Gemini are FDIC insured. Other security controls include two-factor authentication and email confirmations on withdrawal requests. In terms of its mobile trading app, this is available on both Android and iOS devices. You can buy, sell, and trade more than 20 digital currencies at Gemini.

When it comes to trading commissions, this is slightly on the higher side. For example, entry-level traders will pay 0.50% per slide.

Pros:

- Popular with large-scale investors and seasoned traders

- Institutional-grade security practices

- Buy, sell, and trade 20+ digital currencies

- Based in the US

- USD deposits are FDIC insured

- Easy to deposit and withdraw funds with fiat currency

Cons:

- Not a great option for newbies

- Charges a commission of 0.5% per slide

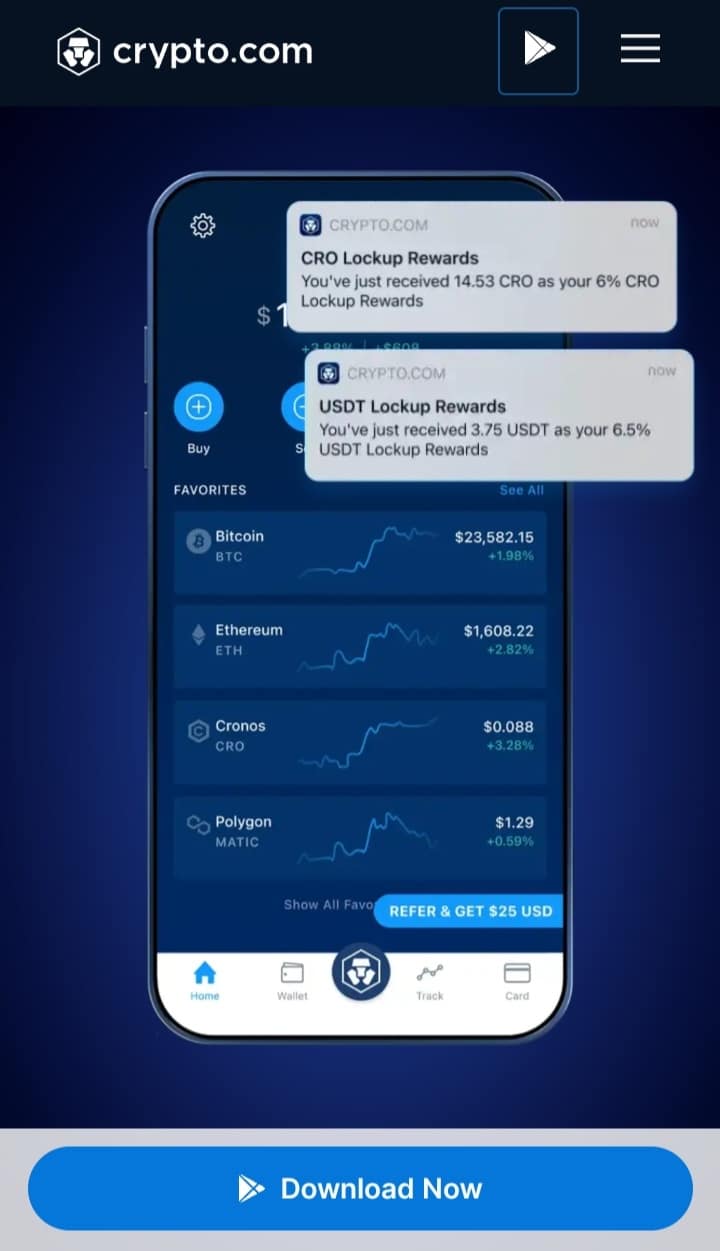

5. Crypto.com – Good Bitcoin App for Buying Crypto

The Bitcoin App is a ideal for individuals who wish to go beyond simply buying and holding cryptocurrency. It caters to active traders and those interested in utilizing crypto as a practical currency rather than just an investment.

The Crypto.com mobile app serves as the central hub for accessing the platform’s features and services. It is available for both Android and iOS devices, ensuring widespread accessibility for users. Through the Crypto.com app, users can conveniently view their portfolio and explore a list of trading education content.

New users on Crypto.com who do not have any CRO (platform’s native currency) staking will incur a trading fee of 0.075% for trades with a total monthly trading volume below $250,000. While these fees are slightly lower compared to some major industry competitors, they may not be the lowest available in the market. It’s important to note that there are no additional per-trade fees on Crypto.com, making it a competitive option in terms of pricing.

Pros:

- Extensive selection of cryptocurrencies

- The platform offers relatively low trading fees

- Straightforward staking program,

- All-in-one ecosystem

- The platform’s website provides excellent educational materials

Cons:

- Limited availability in the US

- High withdrawal fees

What is a Bitcoin App?

In a nutshell, a Bitcoin trading app allows you to buy and sell digital currencies. In all but a few cases, those behind the Bitcoin trading app in question will be a fully-fledged cryptocurrency exchange or broker. That is to say, the vast majority of the platform’s trading volume will be facilitated via the main desktop website.

The overarching purpose of using a Bitcoin app is that you can place buy and sell orders while on the move. You’ll never need to miss a trading opportunity again, and you can exit a losing position at the click of a button. Additionally, the best Bitcoin trading apps provide real-time pricing alerts and relevant news developments.

The standard process of using a Bitcoin trading app is as follows:

- After choosing a Bitcoin DeFi app that you like, you download the application to your phone.

- You open an account and make a deposit. The best Bitcoin trading apps support debit/credit cards and e-wallets.

- Once your account is funded, you can then use the app to invest in Bitcoin or engage in short-term trading.

- You place a buy or sell order – depending on which way you think the market will go

- At any given time, you can withdraw your money from the Bitcoin app and back to your bank account

It goes without saying that there are hundreds of Bitcoin trading apps active in the market. Knowing which provider to choose can be challenging, so we present some pointers in the next section.

How to Choose the Right Bitcoin Trading App for You

You should never open an account with a Bitcoin trading or crypto metaverse app without first doing a bit of research on the provider.

After all, the wider cryptocurrency scene has been fraught with exchange hacks and scams – so it’s crucial that you tread carefully. On top of safety, you also need to look at metrics such as fees and commissions, customer support, and trading tools.

To help point you in the right direction, below you will find the most important factors that need to be considered in your search for the best Bitcoin trading app of 2022.

Regulation and Safety

At the forefront of this is the regulatory status of the app provider. As you might have guessed, the vast majority of Bitcoin trading apps are actually unlicensed.

This is because cryptocurrencies regulation is still in infancy, and somewhat of a grey area in most countries. Tradable Bitcoin Markets

The term ‘Bitcoin trading app’ is somewhat of a loose one. This is because there are several ways in which you can trade Bitcoin.

Own Bitcoin (Long-Term Investors)

The best Bitcoin trading apps allow you to buy cryptocurrencies directly from the provider. This means that as soon as the purchase is complete, you will retain 100% ownership of Bitcoin.

This is ideal for those of you that are looking to take a long-term buy and hold strategy. In other words, you are planning to purchase Bitcoin and hold onto your investment for several months or years.

Trade Bitcoin (Short-Term Investors)

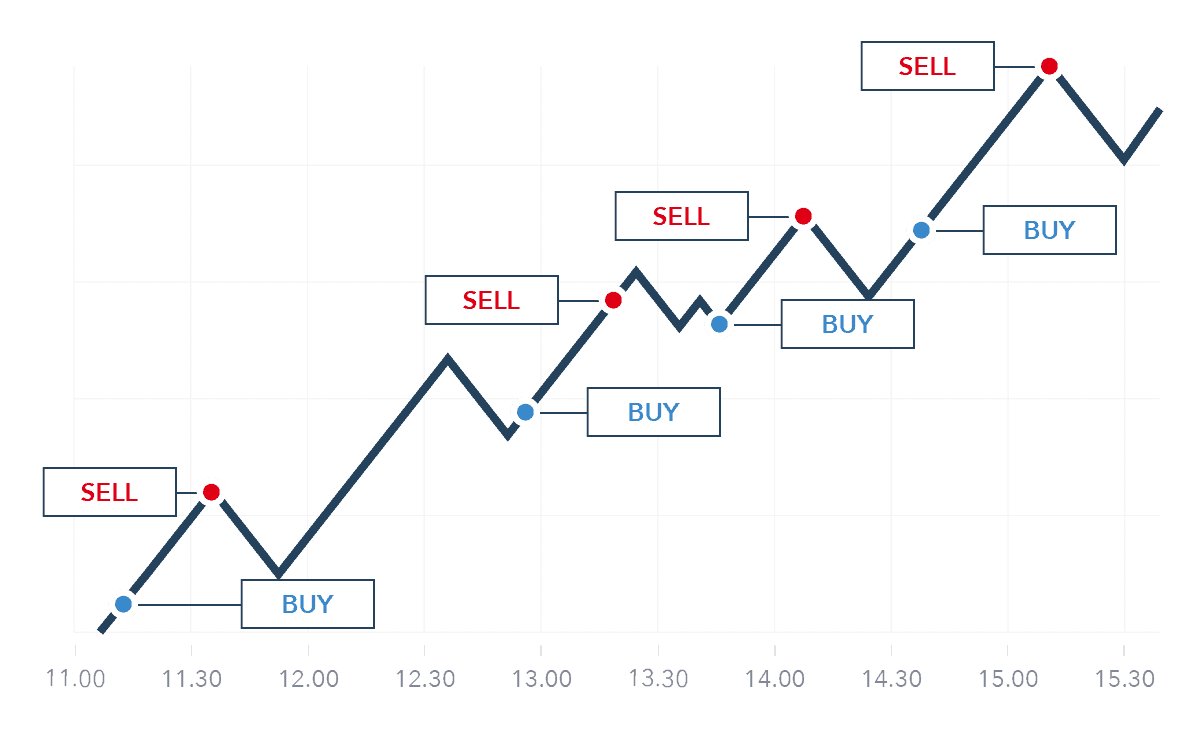

At the other end of the spectrum, some Bitcoin trading apps are designed with short-term traders in mind. This will interest those of you that are looking to engage in day trading, swing trading, or scalping.

For example, you might be looking to trade Bitcoin and keep the position open for a few days, hours, or even minutes. In doing so, you will be looking to make small but frequent profits.

If short-term trading is what you are interested in, the best Bitcoin trading apps cover fiat-to-crypto and crypto-to-crypto pairs.

For those unaware:

- Fiat-to-crypto pairs contain a cryptocurrency like Bitcoin alongside a fiat currency such as the US dollar. This pair – which is identified as BTC/USD, is the largest cryptocurrency market in terms of volume and liquidity.

- Crypto-to-crypto pairs contain two competing digital currencies. For example, BTC/XRP consists of Bitcoin and Ripple – so you will be speculating on the exchange rate between the two coins.

Fees and Commissions

When using a Bitcoin trading app to buy and sell cryptocurrencies – you will need to pay the provider a fee of some sort. After all, the app is in the business of making money.

There are several fees that you might come across when using a Bitcoin trading app – the most common of which we have listed below:

Commissions

Much like a traditional stock trading app or forex trading app, you will usually pay a commission on every buy and sell order that you place.

For example, you will pay a whopping 1.49% at Coinbase. Over at Gemini, this is more competitive at 0.5%, while at Binance it’s just 0.1%.

Spreads

Newbies often forget to take the spread into consideration when using a Bitcoin trading app for the first time. This is simply the difference between the ‘buy’ and ‘sell’ price of the Bitcoin pair you are trading.

For example, if the gap between the buy and sell price on BTC/USD amounts to 0.6%, you need to make gains of at least 0.6% just to break even. As such, the best Bitcoin trading apps are those that offer tight spreads.

Administration and Ad-Hoc Fees

Other fees to consider when using a Bitcoin trading app include:

- Deposits/Withdrawals: The likes of Coinbase charge 3.99% on debit card withdrawals, while this stands at 2% at Binance.

- Inactivity: Your crypto trading app account might be marked as dormant if you fail to place an order within a certain time period. This isn’t an issue if your account balance is empty. But, if you have funds in your account, expect to pay an inactivity fee. This usually kicks in after 12 months of inactivity and is charged on a monthly basis.

As you can see from the above sections, the process of checking fees when choosing a Bitcoin trading app is really important.

Payments

Once you feel confident that the Bitcoin trading app is safe and cost-effective, it’s then time to turn your attention to supported payment methods.

This is an important metric, as you will be required to deposit funds before you can start trading. And of course – there will hopefully come a time where you decide to cash your profits out.

Without a doubt, the best Bitcoin trading apps are those that support instantly-processed payment methods.

By opting for a Bitcoin wallet app that supports debit/credit cards and e-wallets, you don’t need to wait several days to get started. This is why you might want to avoid a traditional bank wire.

On top of supported payment methods, you also need to check what the minimum deposit amount is. Additionally, check to see how long the Bitcoin trading app provider takes to authorize and process withdrawals.

Real-Time Notifications

We mentioned earlier that the best Bitcoin trading apps offer real-time notifications. This is crucial, as the likelihood is that you will have your mobile phone with you no matter where you are.

Some of the most important notifications that you can receive on a Bitcoin day trading app are as follows:

Pricing Alerts

As the name implies, pricing alerts will notify you when a specific price-point has been hit on your chosen Bitcoin market.

- For example, let’s suppose that BTC/USD is currently priced at $25,000

- You want confirmation that Bitcoin is in a long-term upward trend before placing an order

- As such, you set up a pricing alert at $28,000

- If and when BTC/USD hits $28,000 – your Bitcoin trading app will send you a notification in real-time

Ultimately, this ensures that you can place a suitable trade the very second that your price-point has been triggered.

Volatility Alerts

The best Bitcoin trading apps will notify you when your chosen Bitcoin pairs go through a period of above-average volatility. For example, this might centre on Bitcoin decreasing by 15% in a single day.

In particular, this will be super-useful if you have an outstanding position on Bitcoin, especially if it is dropping in value.

This is because a real-time volatility alert will allow you to exit a losing position at the click of a button – as opposed to only finding out about it when you get home.

Financial News

By using a Bitcoin trading app that offers financial news in real-time, you will always be kept abreast of key market developments. As you might know, a single news story – whether that’s positive or negative, can have a major impact on the value of Bitcoin, letting you know the best time to trade crypto.

This might centre around regulation or a large-scale institution that has decided to support cryptocurrencies. Either way, you’ll want to be in the know-how the very second the story breaks. This is something that the best Bitcoin trading apps can facilitate.

Technical Analysis

Unless you are planning to take a long-term buy and hold approach to Bitcoin investing, it is crucial that you perform technical analysis. This means that you will be studying Bitcoin pricing charts with the view of predicting future trends.

On the one hand, being able to read charts and deploy technical indicators on a mobile phone isn’t the easiest thing to do. However, the best Bitcoin trading apps fully-optimize their charting tools so that analysis can be performed on a smaller screen, and they also provide demo trading apps to test your analysis.

Automated Trading Tools

Just because you have never traded a single cryptocurrency in your life, this doesn’t mind that you need to miss out. On the contrary, the best Bitcoin trading apps will offer a range of tools that allow you to automate your investment endeavours.

User-Friendliness

Don’t forget about user-friendliness, as not all Bitcoin trading apps have been designed well. You’ll want to ensure that your chosen app provider makes it an easy task to find your preferred trading market and subsequently place orders.

You should also be able to keep tabs on your outstanding positions and be able to deposit and withdraw funds directly throughout the app.

Customer Support

Customer support can vary wildly depending on your chosen provider.

With that said, some Bitcoin trading apps will only offer support via email. This means that you might need to wait a few days before you receive a reply to your query. You should also check what hours the customer service team works – especially if you are using a Bitcoin trading app that is based overseas.

Conclusion

In summary, there are hundreds of Bitcoin trading apps to choose from. The main problem is that the vast majority operate without a regulatory license. Even if the app is regulated, you still need to spend some time assessing fees, tradable markets, customer support, and user-friendliness.

References

- https://www.forbes.com/advisor/in/investing/cryptocurrency/bitcoin-trading/

- https://www.bitcoin.com/get-started/how-bitcoin-exchange-works/

- https://www.loc.gov/item/2021687419/

- https://www.britannica.com/money/cryptocurrency-regulation

- https://cointelegraph.com/learn/how-to-trade-cryptocurrencies-the-ultimate-beginners-guide

Frequently Asked Questions on Bitcoin Trading Apps

What is the best Bitcoin Trading app for iOS?

As per our in-depth research, we found that eToro is the best Bitcoin trading app for iOS. It allows you to trade Bitcoin commission-free in a 100% regulated environment.

What is the best Bitcoin Trading app Android?

Not only did we find that eToro is the best Bitcoin trading app for iPhone, but Android too. As noted above, the app provider is regulated by ASIC, the Financial Conduct Authority, and CySEC – and it doesn’t charge any trading commissions.

What is a Bitcoin trading app?

Bitcoin trading apps allow you to buy, sell, and trade digital assets. You will either be trading Bitcoin against a fiat currency like pounds or dollars – or against another cryptocurrency like Ethereum.

Can you make money with a Bitcoin trading app?

Yes, Bitcoin trading apps operate much the same as a traditional stock or forex trading app. That is to say, if you correctly speculate on which direction the price of Bitcoin goes, you will make a profit. If you speculate incorrectly, you will make a loss.

Are Bitcoin trading apps legal?

Regulation in the Bitcoin trading arena is somewhat of a grey area – with many providers choosing to remain unlicensed. The good news is that providers like eToro are heavily regulated – meaning that you can trade Bitcoin safely.

Kane Pepi

Kane Pepi

Kane Pepi is a British researcher and writer that specializes in finance, financial crime, and blockchain technology. Now based in Malta, Kane writes for a number of platforms in the online domain. In particular, Kane is skilled at explaining complex financial subjects in a user-friendly manner. Kane has also written for websites such as MoneyCheck, the Motley Fool, InsideBitcoins, Blockonomi, Learnbonds, and the Malta Association of Compliance Officers.View all posts by Kane Pepi

stockapps.com has no intention that any of the information it provides is used for illegal purposes. It is your own personal responsibility to make sure that all age and other relevant requirements are adhered to before registering with a trading, investing or betting operator. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice.By continuing to use this website you agree to our terms and conditions and privacy policy.

Trading is risky and you might lose part, or all your capital invested. Information provided is for informational and educational purposes only and does not represent any type of financial advice and/or investment recommendation.

Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers.

© stockapps.com All Rights Reserved 2025

Scroll Up