Best Time to Trade Crypto – Pros & Cons

Cryptocurrency trading has exploded recently, with several cryptos, like Bitcoin, making historic price jumps. Like other markets, cryptocurrencies can be highly volatile during specific periods and less volatile in others. Expert traders often consider the best time to trade crypto before investing.

High-risk traders will opt for highly volatile seasons to trade cryptocurrency. Conversely, low-risk traders will opt for low-volatile seasons before trading. Several factors contribute to these market changes.

We will explore the best time to trade crypto in US and other regions and compare them. You will also learn about the prominent factors that influence these times. Ultimately, we hope to grow your expertise in cryptocurrency trading with this article.

[toc]The Non-Stop Nature of the Crypto Market

Cryptocurrencies trade outside the traditional financial market. Hence, they are available all day. While true, the best time to day-trade crypto could be a few hours or less.

You can use stock market research and analysis tools all day, but the trading apps will follow the official closing time for trades. With that, you have a window to strategize and execute your trades during the day. Also, federal holidays and weekends are off the board.

Explanation of the cryptocurrency market’s 24/7 trading hours

The primary reason for the crypto market’s availability 24/7 is its decentralized nature. Most countries have yet to recognize cryptocurrencies as securities and absorb them into standard trading hours. Hence, traders are left with decentralized platforms that may be licensed but operate outside traditional trading hours.

Decentralization leads to peer-to-peer trading. That means you can buy crypto at any time of the day, provided you find someone willing to sell it at your bid price.

Centralized platforms like Binance exist, but trading doesn’t happen like in the traditional stock market. This 24/7 availability poses a challenge to traders who wish to maximize the best time to day trade crypto. Experience helps, but you’ll need the best crypto apps with robust trading features.

Factors contributing to the continuous trading availability

The following are prominent factors that contribute to cryptocurrency’s all-day availability:

- Global access: People worldwide can access cryptocurrency on centralized or decentralized platforms. Traders trade in different time zones. Hence, the best time to trade crypto in US might differ from the best time in Asia.

- Peer-to-peer trading: Some trading platforms offer peer-to-peer services, meaning they have little oversight over who buys and sells. Except when the cryptocurrency is rug-pulled, people will always be there to buy and sell.

- Little federal regulations: Some countries have taken steps to regulate crypto trading platforms to a certain degree. However, the regulations are less tight or heavy than those in the traditional financial market. Moreover, you can always find platforms with fewer regulations to trade crypto assets.

- Demand and the rise of chatbots: We have AI stock trading apps, but they don’t seem to operate as intensely as crypto AI chatbots. These bots can run 24/7, ensuring that demand is met.

- Volatility: Cryptocurrencies are highly volatile. News and a simple tweet can influence a crypto’s price positively or negatively. Hence, traders constantly check the market, ensuring demand holds up all day.

Market Liquidity and Volatility

The number of buyers and sellers in the cryptocurrency market affects its liquidity and volatility. The more buyers and sellers you have, the more liquid cryptocurrency will be. Conversely, the fewer buyers and sellers you have, the less liquid the crypto assets will be.

With more buyers and sellers, trades can occur in large quantities without affecting volatility. Conversely, a crypto asset tends to be more volatile when buyers are fewer than sellers.

How liquidity and volatility vary across different times of the day

Liquidity and volatility will vary during the day. The most noticeable period is during the early hours, as traders traded large volumes in response to news during the night. That results in high liquidity and low volatility in the early hours.

As the day ages, the number of transactions might reduce, resulting in low liquidity and high volatility. We do not imply that the morning hour is the best time to trade crypto in US. Other factors influence liquidity and volatility during the day.

Tweets from prominent figures during the day might increase trading for a specific crypto asset. These make cryptocurrency more susceptible to sentiment.

The impact of trading volume on price movements

Trading volumes often indicate a price movement in a specific direction. For example, a high trading volume might indicate high liquidity, reducing volatility. This is not always the case.

When evaluating trading volumes, you must consider the type of orders. If there is a balance between sales and purchase orders, a higher trading volume might cause the market to be less volatile.

Speed is also crucial when evaluating trading volumes. If large volumes are traded within a short period, that might indicate an impending price swing in the downward trend. You can use trading volume when gauging the best time to trade crypto in US, but add other evaluations like speed and order types.

Disclaimer: Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

Trading Sessions Around the World

Overview of major crypto trading sessions (Asia, Europe, and North America)

Crypto trading hours influence liquidity, volatility, and trading volume worldwide. Three major crypto trading sessions exist, namely, Asian, European, and North American. The table below describes an overview of these sessions and how they influence the best time to day-trade crypto.

| Trading session | Overview |

| Asian trading session | The Asian market consists of Japan, China, and South Korea. They usually begin the global crypto trading day. |

| European trading session | The prominent contributors in this session are London and Frankfurt. It takes over from the Asian market, continuing the day’s trading. |

| North American trading session | New York is a significant hub for crypto trading in this market, with the United States in the lead. The session takes over from the European trading session. |

Key characteristics of each trading session

The following are the characteristics of the major crypto trading sessions and how they influence the best time to day-trade crypto:

The Asian trading session

- This session starts the global trading day.

- Trading volume and liquidity are relatively low compared to other sessions.

- Price movements are often more subtle and gradual.

- Swift reaction to economic news, regulations, and other alternative data

The European trading session

- Relatively higher trading volume and liquidity

- Quick price fluctuations result in higher volatility.

- Increased trading opportunities

The North American trading session

- Influence from home and international market shocks

- Fast-paced and susceptible to sudden price swings

- Peak trading volumes often occur, making it the best time to trade crypto in the US.

Overlapping Trading Sessions

Trading sessions overlap as one session closes and another begins. For example, the Asian session overlaps with the European session. Two sessions are active during overlaps, giving rise to increased trading activity.

Identifying periods of higher trading activity due to session overlaps

Surges often occur when two trading sessions overlap. This overlap can be between the Asian and European sessions, the European and North American sessions, or the North American and Asian sessions. However, the most significant overlap is between the European and North American sessions.

There is no fixed time for the regions. However, most traders will agree that the following often marks the best time to trade crypto in these regions:

- Asian session: From 23:00 GMT to 07:00 GMT

- European session: From 07:00 GMT to 15:00 GMT

- North American session: From 12:00 to 19:00 GMG

You’ll notice that the North American session overlaps the European session significantly. Ensure you go for the best Bitcoin trading app that allows for risk management.

Advantages and disadvantages of trading during overlaps

Advantages:

Disadvantages:

Disclaimer: Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

News and Events Impacting Prices

Cryptocurrency’s speculative nature makes it susceptible to news and events. A prominent example is Binance, where the founder stepped down and pleaded guilty. That news resulted in panic withdrawals amounting to over $1 billion.

The significance of news and events on crypto price movements

Stocks and other traditional assets have an advantage. You can quickly join an alternative data service to analyze significant news and events. Cryptocurrency is different, although most platforms try to account for news and events.

Positive news can cause uptrends for crypto assets. For example, Elon Musk’s tweet about Dogecoin resulted in a 20% increase. Conversely, negative news can cause panic, resulting in reduced liquidity, like in the case of Binance’s former CEO.

How do major announcements affect different timeframes?

While looking for the best time to day-trade crypto, you must consider the reaction times to significant announcements. The reaction time falls into the following categories:

- Immediate reaction: This reaction often occurs a few minutes after the announcement. It can extend to several hours. Such a kneejerk reaction was seen in FTX’s collapse when investors pulled their assets after realizing that FTX assets were invented tokens.

- Short-term reactions: This often occurs within a few hours to a few days. Trends can shift and become sustained in an uptrend or downtrend. Follow closely enough, and you might identify trading opportunities.

- Long-term reactions: This often happens when a prominent regulation or significant change occurs. Examples include technological upgrades like the Ethereum Shapella hard fork, etc. Long-term reactions take weeks.

Disclaimer: Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

Market Sentiment and Trading Volumes

You can gauge the best time to day-trade crypto more effectively by comparing market sentiment and trading volumes. Market sentiment covers the mood and perception of traders. If traders feel good about a crypto asset, they often trade more.

Understanding the correlation between market sentiment and trading volumes

Market sentiment and trading volumes can correlate in two ways:

- A positive market sentiment causes a higher trading volume. More traders are willing to buy and sell without fear of significant price swings.

- A negative market sentiment causes lower trading volume. Often, more traders are willing to sell than there are to buy.

Using sentiment analysis tools for better timing in crypto trading

The market sentiment is broad and challenging to capture alone. Hence, we need analysis tools to do the heavy lifting. Here’s how to use an analysis tool for better timing:

- Multi-timeframe analysis, like using a daily chart for long-term trends and a 4-hour chart for quick entry and exit points

- Gauge market sentiments about a crypto asset or its creators

- Set alerts for price movements

Disclaimer: Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

Scalping and Day Trading

You’ll need the best time to day-trade crypto if you are a short-term trader. Scalping involves paying attention to tiny price movements for buying and selling. Conversely, day-trading involves buying and selling within a day.

The suitability of scalping and day trading in the crypto market

Scalping can be helpful during periods of high uncertainty. Quick price swings present opportunities to make small gains throughout the day. The profits from multiple trades can add up to significant amounts even when there was no best time to day-trade crypto that day.

Day-trading is ideal for short-term traders. It can yield significant gains when sudden positive announcements occur. However, you must find the best time to day-trade crypto to make the most of it.

Recommended timeframes for short-term strategies

We recommend 1-minute charts if you prefer scalping. Conversely, 15-minute charts provide room for a broader assessment. You can make significant gains when used during the best time to day-trade crypto.

Disclaimer: Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

Swing Trading and Position Trading

Utilizing swing trading and position trading techniques in crypto

If you are not looking for the best time to day-trade crypto, swing trading might be a better choice. This technique involves holding your position to profit from extended price swings, often for a few days. There’s less stress and noise as you filter out intra-day price movements.

Position trading is a more extended version of the swing technique. It involves holding your position for weeks or months. You might still need the best time to trade cryptocurrency during your exit day.

Ideal timeframes for holding positions for extended periods

Timeframes for holding positions often range in months. You can hold it for two months or more. However, you must have an end goal and rely more on monthly charts than daily charts.

Monthly charts often show a more stable price movement, except when significant price swings occur. You’ll easily capture long-term trends to influence your investment decisions. Instead of looking for the best time to trade crypto during the day, you will look for the best exit point.

Aligning Trading with Your Lifestyle

Finding the best time to trade crypto can be challenging. The best hours of today might not work for tomorrow. Hence, crypto trading requires active participation.

You can set alerts to notify you, but the best approach is to tailor your trading schedule to meet your daily routine. Then, set realistic expectations for the time you can commit to in the long run.

Tailoring your trading schedule to fit your daily routine

Here are a few tips to tailor your trading schedule to fit your daily routine:

- Trade during your most active hours

- Consider your time zone and when your preferred market is most active.

- Your work hour is not the best time to day trade crypto. You can scalp during your lunch break.

- Don’t trade when you are overworked.

Setting realistic goals based on the time you can commit to trading

A day has 24 hours, and you can allocate everything to trading. Don’t set unrealistic expectations for your trading hours unless you prefer staying indoors daily.

First, allocate time to your essential needs. Then, you can divide the remaining hours for trading. Even so, you must find the best time to day trade crypto to avoid fatigue.

Risk Management and Long-Term Planning

Long-term trading might have fewer risks than short-term, high-volatility trades. However, you must manage and identify the possible risks associated with holding the crypto asset for a long time.

The importance of risk management strategies for any trading timeframe

Risk management strategies provide the following benefits:

- They preserve capital by reducing significant losses.

- They reduce the emotional impact that might result in irrational action.

- You can stay in the market much longer.

- They can help you build a stronger portfolio.

How long-term planning can complement shorter-term trades

You can implement long-term and short-term trades. Long-term trades can have less risk with more stable assets. Conversely, you can take on more risk in short-term trades with high potential.

Assets that suit long-term trades might not fit short-term trades. Finding the best time to day trade crypto might not matter as their price movements are more stable. Hence, you can build a diversified portfolio.

Disclaimer: Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

Best Time to Trade Crypto – eToro Complete Guide

The best time to day trade crypto can change from day to day. News and events affect market sentiment and trading volume. Hence, you need a robust trading app like eToro to accommodate a volatile market.

eToro is our top recommendation for the best time to trade crypto. The app will complement that with several features, including social posts (to follow trends) and technical charts. If you are still experimenting with the best time to trade crypto, you can use its demo account with a virtual balance.

Note: Only cryptocurrencies eToro customers in the United States will be able to trade on the platform will be Bitcoin, Bitcoin Cash, and Ethereum.

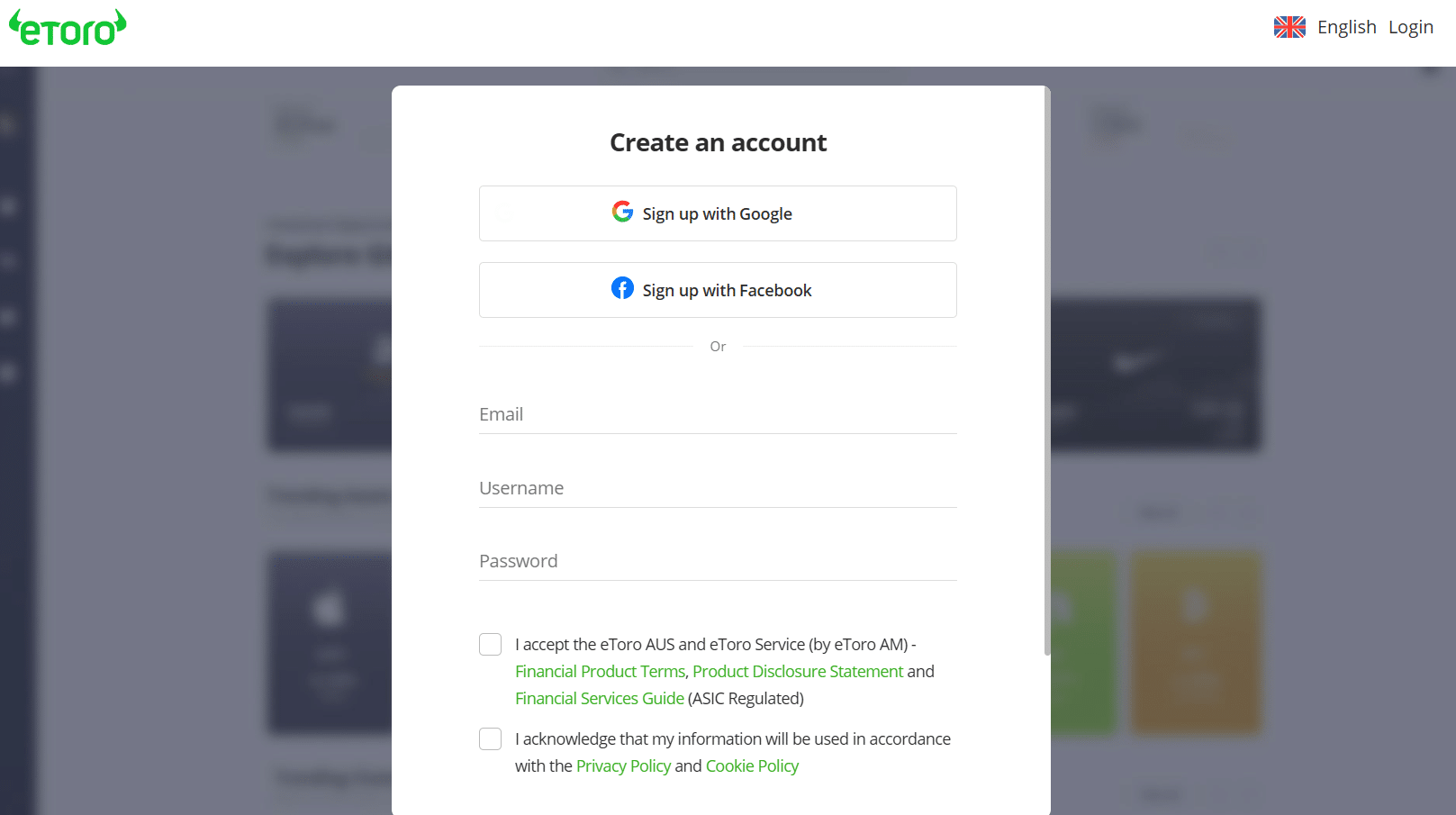

Here are the steps to sign up with eToro:

Best Time to Trade Crypto: Conclusion

The best time to trade crypto is unfixed. It could be in today’s morning or tomorrow’s evening. Hence, you should keep a close eye on the markets.

Adapt your trading sessions to suit the best time to trade crypto daily. Use risk management strategies and understand your risk tolerance. Incorporate market sentiment into your trading.

To start trading crypto today, visit eToro and open an account.

Disclaimer: Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

References

https://edition.cnn.com/2020/12/20/investing/elon-musk-bitcoin-dogecoin/index.html

https://cointelegraph.com/news/ethereum-s-shapella-hard-fork-executed-on-mainnet

https://medium.com/@d46651751/the-psychology-of-crypto-emotions-in-trading-0ed49360f9e8