Libertex App Review – Fees, Features, Pros & Cons Revealed

Are you looking to speculate on the future price movements of assets without taking ownership of them? Libertex is a top-rated CFD broker that may already be on your radar. But does the Libertex app suit your trading needs and goals? Read this Libertex review to find out.

By reading this Libertex app review we will have covered everything there is to know about this popular broker from fees and commissions to user experience and key features.

-

-

What is Libertex?

Libertex provides access to more than 250 tradable assets while keeping its brokerage offerings and services as simple as possible. With the Libertex app, you can access a range of markets including stocks, cryptos, ETFs, indices, commodities, and more.

86% of retail investor accounts lose money when trading CFDs with this provider.

As Libertex is primarily a CFD broker, UK-based traders can invest with leverage of up to 1:30 providing greater purchasing power. Simply put, a £100 account balance could give you access to £3,000 in trading capital. If you’re a professional trader you’ll have access to maximum leverage of up to 1:500.

What trading platforms does the Libertex app support?

When it comes to trading platforms, Libertex offers several options. Beginner traders will appreciate the native web-based platform and the user-friendly Libertex app. Experienced traders, on the other hand, who prefer using advanced technical indicators and robo-advisory features will feel more comfortable using either MetaTrader 4 or MetaTrader 5.

What Stocks Can You Trade on the Libertex App?

In this section of our Libertex review, we’ll explore what tradable assets you can buy and sell on the Libertex app. CFD trading comes with multiple benefits including the ability to go either long or short. This means that if you believe the market price of an asset will increase you place a buy order, whereas if you forecast a price drop you open a sell order.

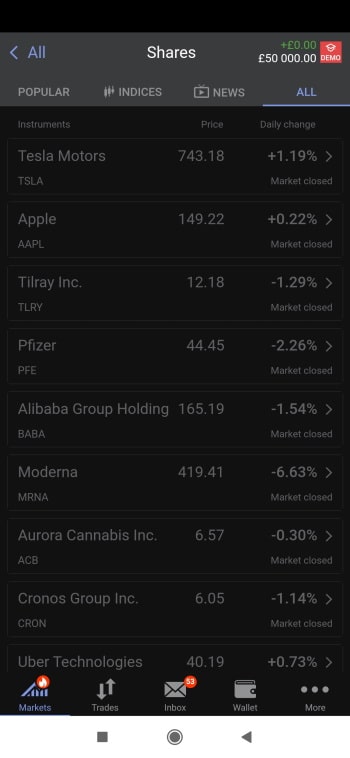

Stocks CFDs on the Libertex app

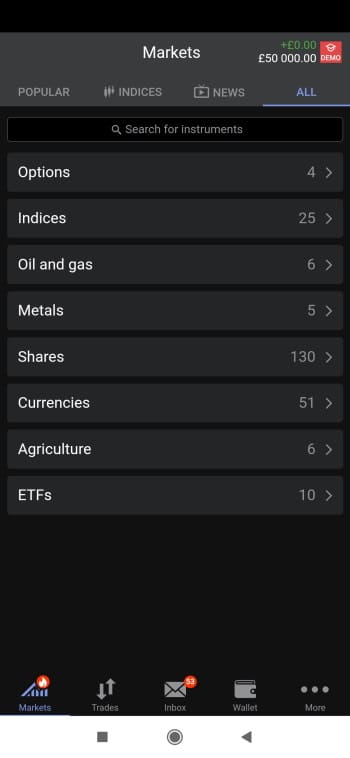

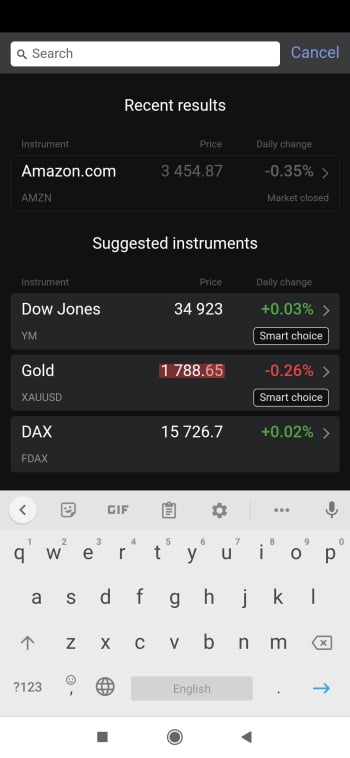

When you open the Libertex app and tap on the Markets tab at the bottom left-hand corner of the screen, you’ll see that you have access to 130 share CFDs. Trading CFD derivatives means that you do not take ownership of the underlying assets but instead you are speculating on the potential price movements.

With that said, you can trade popular share CFDs including Apple (AAPL), Tesla (TSLA), Pfizer (PFE), AMC Entertainment Holdings (AMC), as well as trending meme stocks such as GameStop Corp. shares UK (GME).

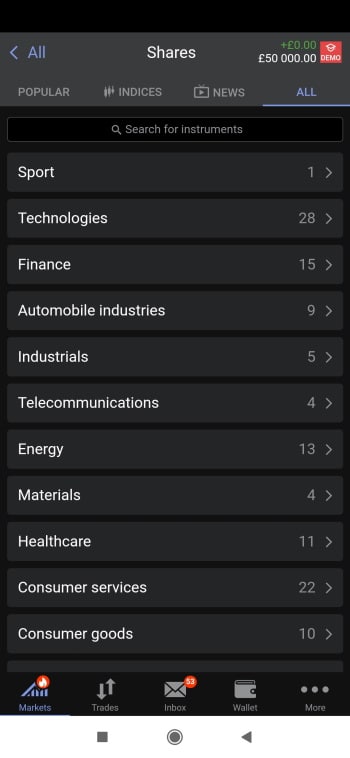

By scrolling down and tapping on the button marked Show all you’ll be able to browse through all the supported stock CFDs based on their relevant categories ranging from technologies and energy to consumer services and finance. Alternatively, you could also search for your preferred financial instruments using the convenient search bar at the top of the Libertex app.

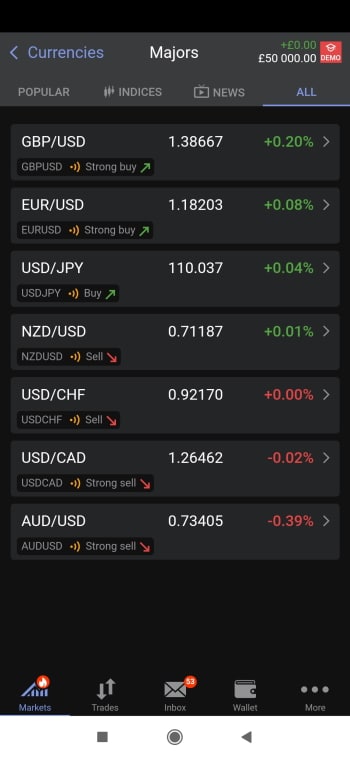

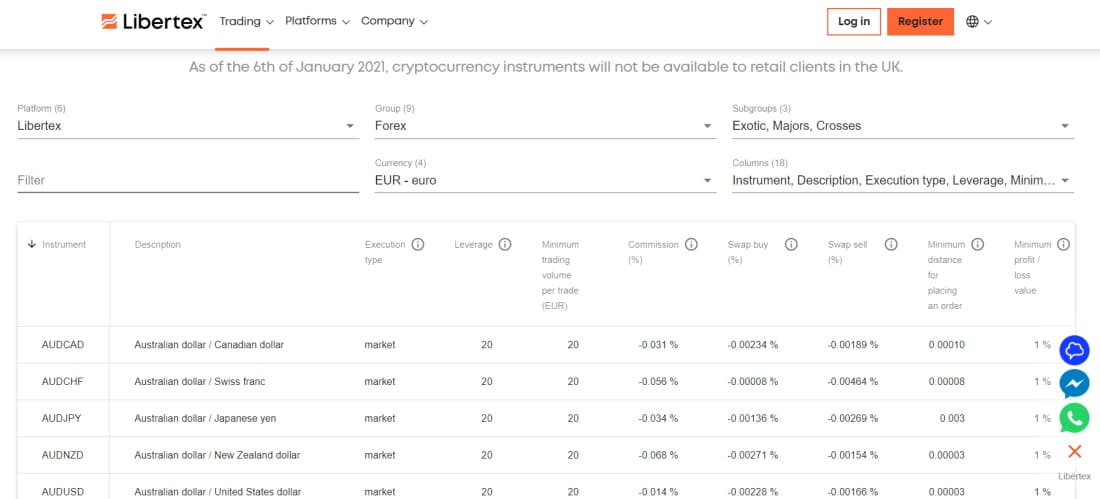

Forex trading on CFDs on the Libertex app

With the forex market being the largest financial market in the world, it’s perhaps no surprise that the Libertex forex trading app provides access to more than 51 currency pairs ranging from 7 majors, 23 crosses, and 21 exotic pairs. These include but are not limited to GBP/USD, EUR/USD, USD/JPY, NZD/USD, USD/CHF, USD/CAD, AUD/USD.

86% of retail investor accounts lose money when trading CFDs with this provider.

Users will also notice that the Libertex app also displays forex signals that tell you what the consensus is amongst expert forex traders. The forex signals can range from a strong buy rating to a strong sell recommendation depending on various factors such as market volatility and liquidity.

The minimum trading volume per trade for all currency pairs is just £20, and you can use leverage of up to 1:30 and 1:20 depending on the forex pair in question.

Other asset classes on the Libertex app

Our Libertex review found that some tradable asset classes are not available on the Libertex app. This includes crypto CFD trading. But it’s worth noting that since January 6th, 2021, the UK’s Financial Conduct Authority moved to introduce new legislation meaning that cryptocurrency derivatives are not available for retail traders in the UK.

Professional traders, on the other hand, can choose from Bitcoin trading, and a range of altcoins, and other crypto-crosses with the click of a button. According to the Libertex.com website, due to the popularity of crypto CFDs, the brokerage fee has been reduced by 50%.

You can also trade 4 options CFDs, 25 index CFDs, 17 commodities CFDs ranging from oil and gas, metals, and agriculture, and 10 ETF CFDs.

Libertex Review – Account Types

When it comes to account types, our Libertex review found that its offering is very similar to that of eToro. If you haven’t already checked out our in-depth eToro app review be sure to read it after this Libertex app review on StockApps.com.

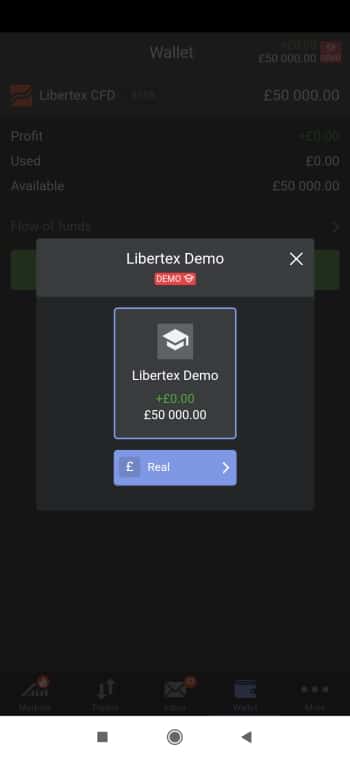

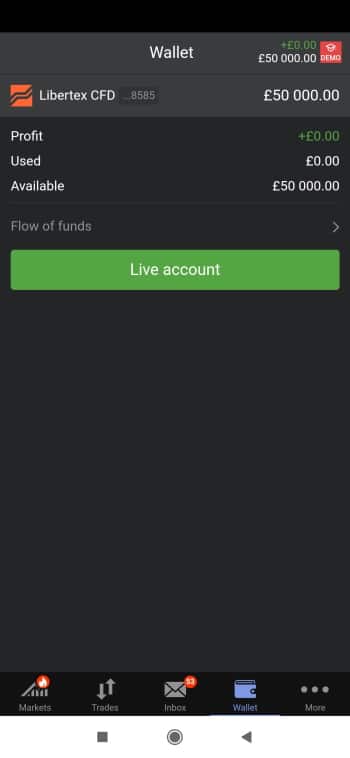

Libertex gives you the option to either open a live trading account or a demo account. What is a demo account? The Libertex demo, otherwise referred to as a paper trading account, allows you to practice your trading strategies without risking any real capital. Instead, the Libertex app gives you £50,000 of virtual funds to practice trading. With such an abundance of markets, features, and even a paper trading account, Libertex is one of the best day trading apps with low fees.

You can switch between your live trading account and the Libertex demo account seamlessly by simply tapping on the demo button at the top right-hand corner of the Libertex app. The minimum deposit is 10 EUR for all payment methods excluding Bank transfers. If you’re depositing funds for the first time, the minimum deposit amount is 100 euros.

Libertex Fees and Commissions

Spread-free CFD trading

One of the best selling points when it comes to the Libertex fees is that you do not have to pay the market spread. It’s rare for CFD brokers to offer zero spread trading, as the bid-ask spread is how most online brokers make their money.

For those who are unfamiliar with spreads, simply put the market spread is the difference between the buy and sell prices of an asset. This means that if the spread is 1.2% you will need to make a minimum profit of 1.2% just to break even. While this zero-spread offering is good news for potential gains, there are trading commissions that come into play.

Libertex fees – Trading Commissions

Given that there are zero spreads, our Libertex review found that the CFD broker charges a commission when opening a position. The commissions start from 0% and vary depending on the asset class. For example, at the time of writing this Libertex app review, you can trade Robinhood Markets Inc (NASDAQ: HOOD) share CFDs with 0% commission and zero spreads, with leverage of up to 1:5.

All in all, if you’re looking for a low-cost trading app, with access to CFD instruments and a user-friendly interface, the Libertex app is certainly one of the best stock apps to use right now.

Non-trading fees

When trading CFDs a common non-trading fee that you will encounter is the overnight financing fee. Otherwise referred to as the Swap Fee, this is a fee you’ll be charged for leaving open trades overnight after standard trading hours. CFD derivatives are leveraged trading instruments that gather interest charges. For instance, the swap buy fee and swap sell fee for leaving open trades overnight for (NASDAQ: AMZN) Amazon stock CFDs is -0.0302 % and -0.0254 %.

If the Client’s Account is inactive for 180 calendar days (i.e. there is no trading, no open positions, no withdrawals or deposits), the Company reserves the right to charge an account maintenance fee of 10 EUR per month. (Applies to clients with total account balance less than 5000 euros).

Libertex App – User Experience

If you’re new to the world of online trading, the Libertex trading platform is a great option for beginners. The onboarding process is fully digital and straightforward. Downloading the Libertex app can be done on both Apple iOS and Android devices via the App Store and Google Play Store and only takes a few seconds to install.

86% of retail investor accounts lose money when trading CFDs with this provider.

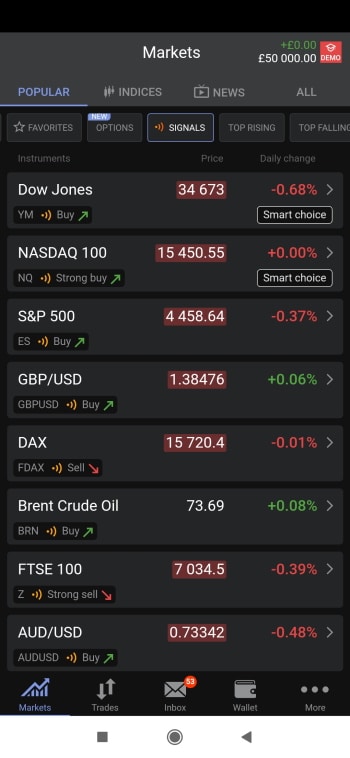

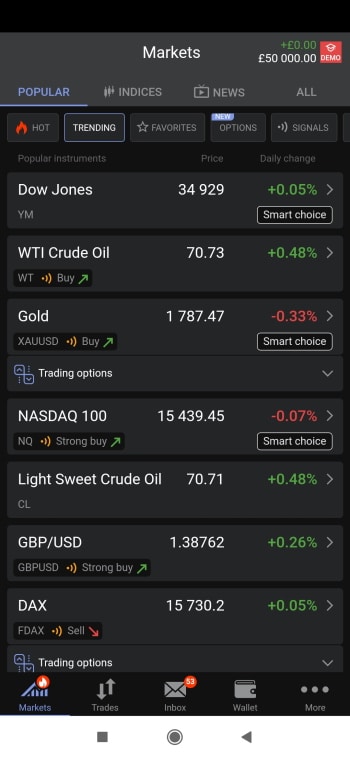

At the bottom of the Libertex app, you’ll find a useful navigation bar consisting of Markets, Trades, Inbox, Wallet, and More. You can browse through all the supported assets based on a range of criteria and filters. These include:

- Hot

- Top Falling

- Trending

- Favorites

- Options

- Signals

- Top Volatility (1 Day)

- Uprising Trend 30D

- Top Rising

- Falling Trend 30D

This Libertex app review found that you can manage your CFD portfolio anywhere, anytime. You can also deposit funds, buy and sell assets, set up price alerts, and more from your mobile device.

Libertex Review – Trading Tools and Features

Libertex is a CFD broker, meaning you have access to leverage depending on your preferred asset class. For example, this means that you can trade share CFDs with 5:1 leverage, and forex CFDs with 20:1 and 30:1 leverage depending on the currency pair.

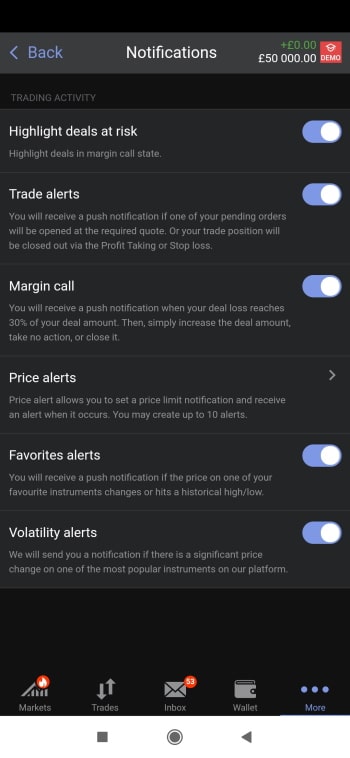

Setting Price Alerts on the Libertex App

Setting price alerts is a great trading tool to use as you can always stay in the loop with market movements in real-time. You can set up a wide range of notifications including:

- Highlight deals at risk – Highlight deals that are in a margin call state.

- Trade alerts – You will receive push notifications if any of your pending orders will be opened at the required quote, or your trade position will be closed out via the Stop-Loss or Take-Profit orders.

- Margin call – You’ll receive real-time alerts when your deal loss reaches 30% of your deal amount.

- Price alerts – Price alerts allow you to set a price limit notification and receive a push notification when it is triggered. You can set up a maximum of 10 price alerts.

- Favorites alerts – You’ll receive alerts if the market price of one or more of your favorite instruments fluctuates or hits record highs/lows.

- Volatility alerts – the Libertex app will send you alerts if there are significant market movements on one of the most popular instruments on the platform.

Libertex App Education, Research and Analysis

86% of retail investor accounts lose money when trading CFDs with this provider.

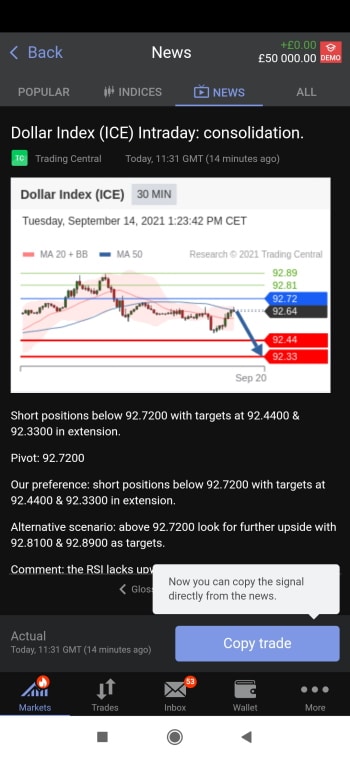

In terms of research and analysis, you can access real-time news and trading signals directly from the Libertex app by clicking on the News tab at the top of the screen. You can also select the news sources which range from Trading Central, Libertex, BeInCrypto, Quick News, Latest News, and more.

Charts

Our Libertex review found that the mobile trading app offers fully interactive and customizable charts. You can tailor the charts to suit your trading style by switching between candlestick, line, area, and bar charts. You can also change the time intervals from one second to one month. Additionally, you can implement a range of technical indicators and moving averages such as RSI, MACD, and MA10 just to name a few.

Libertex App Demo Account

Our Libertex app review found that the Libertex demo account offers the same functionality as the live trading account just without any associated risks. Demo accounts are a great tool that newbies can use to familiarize themselves with the trading app. You can also practice your trading strategies to see what works best for you without risking any of your hard-earned money.

You can alternate between your live trading account and the demo account via the button located at the top right-hand corner of the screen. Signing up for the Libertex demo account is easy and you can trade with £50,000 worth of paper funds. All in all, the Libertex app is one of the best paper trading apps across the board.

Libertex Review – Payments

Libertex supports multiple payment methods including credit and debit cards, e-wallets, bank wire transfers, and more. There are also no deposit fees and the funds are credited to your account instantly except for wire transfers that take between 3-5 days.

Let’s take a look at a comprehensive table of the supported payment methods for depositing and withdrawing funds, as well as the processing times.

Deposits

Deposit Payment Method Fee Process Time PayPal None Instant Credit/debit card None Instant Sofort None Instant iDeal None Instant SEPA/International Bank Wire None 3-5 days Giropay None Instant Skrill None Instant Trustly None Instant Multibanco None Instant Przelewy24 None Instant Rapid Transfer None Instant Teleingreso None Instant Neteller None Instant Withdrawals

Payment Method Fee Process time PayPal None Instant Credit/debit card €1 1-5 days SEPA/International Bank wire 0.5% min €2, max €10 3-5 days Skrill None Within 24 hours Neteller 1% Within 24 hours Libertex App Review – Customer Support

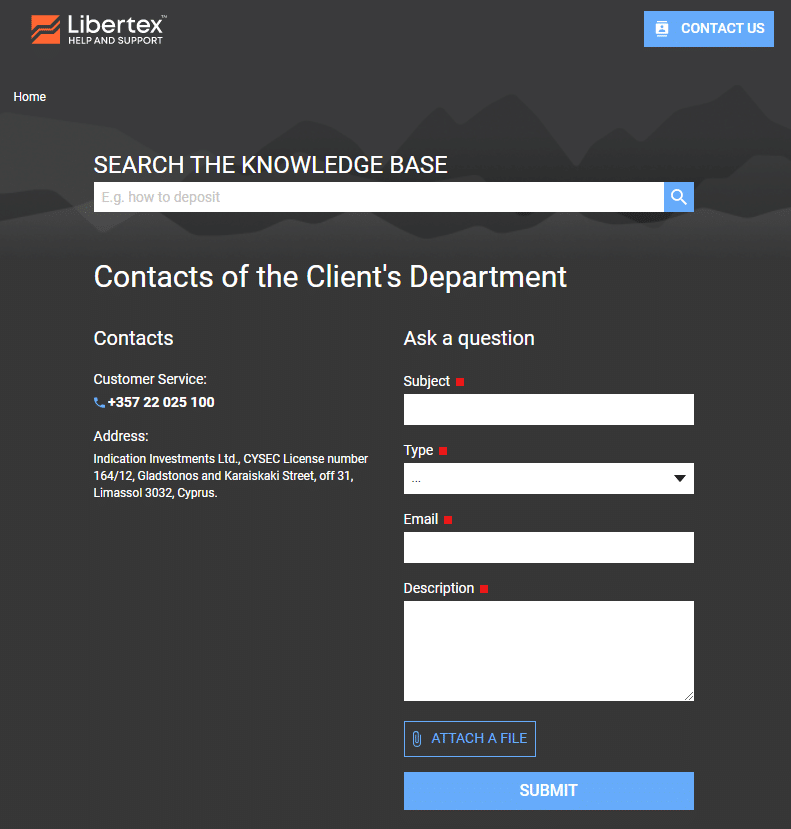

You can contact customer services at Libertex via live chat, email, phone, WhatsApp, and Facebook Messenger.

Furthermore, you can find a convenient FAQs page, news, blog, and economic calendar under the Trading Information section on the Libertex website.

By clicking on the trading education page you can learn the basics of online trading with an easy-to-understand investing course.

Is Libertex safe?

According to the Libertex website ‘LIBERTEX is a trading platform used by Indication Investments Ltd. a Cyprus Investment Firm which is regulated and supervised by the Cyprus Securities and Exchange Commission (CySEC) with CIF Licence number 164/12.’

Indication Investments Ltd is also deemed authorized and regulated by the UK’s Financial Conduct Authority. You can also use two-factor authentication via SMS and Google Authenticator for added account security.

In terms of client fund protection, CySEC regulation requires brokers to hold all clients’ funds in segregated bank accounts. This means that you’re covered up to €20,000 should the company go into liquidation.

How to Use the Libertex App

Step 1: Download and Install the Libertex App86% of retail investor accounts lose money when trading CFDs with this provider.

Next, sign up for either a demo account or a live trading account. You’ll then be required to enter your details and go through the KYC process to verify your account.

Step 2: Open a Stock Trading AccountEnter your name, address, and national insurance number. These are required as part of the standard KYC (Know Your Customer) regulations set by top-tier financial authorities like the UK’s FCA.

Step 3: Deposit FundsTo deposit funds via the Libertex app simply tap on the ‘Wallet’ tab at the bottom of the screen, and then click on ‘Deposit’. Finally, choose your preferred payment method and deposit funds without any deposit fees.

Step 4: Trade Stock CFDs and other assetsTap on the market tab at the bottom of the screen and browse through hundreds of stock CFDs or you can search for your preferred assets using the search bar.

How to Sell on the Libertex App

You can sell instruments by closing an open position or by tapping on the red Sell button on the Libertex app.

Libertex Stock App Pros & Cons

Pros

- CFD trading with leverage and zero spreads

- No deposit fees

- Regulated by CySEC

- Wide range of payment methods

- User-friendly demo account with £50,000 of virtual funds

Cons

- Lack of fundamental data

Libertex Review – Expert Verdict

Operating since 1997, Libertex has won more than 40 prestigious awards worldwide and serves more than 2.2 million traders. With that said, if you’re looking to trade CFDs with zero spreads and commissions starting from 0% on certain assets, the Libertex app is one of the best options out there.

In summary, the Libertex app is ideal for beginner traders looking to trade leveraged CFD instruments with zero spreads and tight commissions. So, to start trading right now simply click the link below and download the Libertex app today!

Libertex – Trade CFDs with Zero Spreads and Low Commissions

86% of retail investor accounts lose money when trading CFDs with this provider.

Libertex Review – FAQs

Can you withdraw money from Libertex?

Yes, you can withdraw capital if you have open positions. PayPal is the fastest withdrawal method that not only comes with zero withdrawal fees but is also processed instantly. Other withdrawal methods include SEPA/International bank wire transfers, PayPal, credit cards, debit cards, Skrill, Jeton, and Neteller.

Is Libertex a good broker?

With over 40 prestigious awards under its belt, Libertex is one of the top-rated and trusted online trading platforms out there. As a market-making broker, Libertex only charges a commission as opposed to the bid-ask spread.

What is the minimum deposit for Libertex?

The minimum deposit for Libertex is 10 EUR for all payment options other than Bank Transfers. However, if you’re depositing funds for the first time, the minimum deposit amount is 100 EUR.

What is the best app for trading stocks?

The Libertex app is one of the best mobile apps for trading stock CFDs right now. If you’re interested in CFD trading then Libertex’s zero-spread offering is certainly one of the cheapest options available. On the other hand, if you’re looking to trade real stocks and take ownership of the underlying asset, eToro is another leading trading app that offers real stocks as well as CFDs with leverage with 0% commission.

How do I fund my Libertex account?

To fund your Libertex trading account simply log into the trading platform with your credentials. For those using the top-rated Libertex app, tap on the Wallet tab, then hit the button marked Deposit, and choose your preferred payment method. There are also no deposit fees to worry about.

Kane Pepi

Kane Pepi

Kane Pepi is a British researcher and writer that specializes in finance, financial crime, and blockchain technology. Now based in Malta, Kane writes for a number of platforms in the online domain. In particular, Kane is skilled at explaining complex financial subjects in a user-friendly manner. Kane has also written for websites such as MoneyCheck, the Motley Fool, InsideBitcoins, Blockonomi, Learnbonds, and the Malta Association of Compliance Officers.View all posts by Kane Pepistockapps.com has no intention that any of the information it provides is used for illegal purposes. It is your own personal responsibility to make sure that all age and other relevant requirements are adhered to before registering with a trading, investing or betting operator. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice.By continuing to use this website you agree to our terms and conditions and privacy policy.

Trading is risky and you might lose part, or all your capital invested. Information provided is for informational and educational purposes only and does not represent any type of financial advice and/or investment recommendation.

Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers.

© stockapps.com All Rights Reserved 2026

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up