Best Paper Trading Apps 2025 – Pros & Cons

Paper trading apps allow you to buy and sell assets in a 100% risk-free environment. This is because you will be trading via the demo account facility offered by your chosen broker. In this guide, we discuss the best paper trading app of 2025. We’ll review each of our selection providers in terms of tradable assets, user-friendliness, spreads, safety, and more.

-

- 1. eToro – Overall Best Paper Trading App

- 2. WeBull – Best Paper Trading App for Experienced Traders

- 3. Interactive Brokers – Best Forex Paper Trading App

- 4. Ally Invest – Great Paper Stock Trading App

- 5. IG – Best Paper Trading App for Android Users

- 6. TD Ameritrade – Best Paper Trading App for US Citizens

- 7. Forex.com – Best Paper Trading App for Forex

- 8. Charles Schwab – Best Paper Trading App for OTC Trading

-

-

- 1. eToro – Overall Best Paper Trading App

- 2. WeBull – Best Paper Trading App for Experienced Traders

- 3. Interactive Brokers – Best Forex Paper Trading App

- 4. Ally Invest – Great Paper Stock Trading App

- 5. IG – Best Paper Trading App for Android Users

- 6. TD Ameritrade – Best Paper Trading App for US Citizens

- 7. Forex.com – Best Paper Trading App for Forex

- 8. Charles Schwab – Best Paper Trading App for OTC Trading

-

Top 10 Paper Trading Apps 2025

Here’s a breakdown of our top 10 paper trading apps of 2025. For more information on one of the apps listed below – scroll down!

- eToro – Overall Best Paper Trading App (Disclaimer: Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong.)

- WeBull – Best Paper Trading App for Experienced Traders

- Interactive Brokers – Best Forex Paper Trading App

- Ally Invest – Great Paper Stock Trading App

- IG – Best Paper Trading App for Android Users

- TD Ameritrade – Best Paper Trading App for US Citizens

- Forex.com – Best Paper Trading App for Forex

- Charles Schwab – Best Paper Trading App for OTC Trading

The Best Paper Trading Apps of 2025

In order to find a paper trading app that meets your needs, you’ll need to look at more than just the demo facility itself. After all, it’s likely that you are looking for an app that you eventually plan to use for real-money trading. If this is the case, important metrics to consider include:

- Trading tools and features

- Fees, commissions, and spreads

- Tradable assets (forex, CFDs, etc.)

- Supported payment methods

- Minimum deposit amount

- Regulation

- Education and research materials

Taking all of the above into account, finding a suitable paper money trading app for you and your long-term financial goals can be time-consuming. As such, we’ve saved you the legwork by listing 10 of the best paper training apps currently in the market.

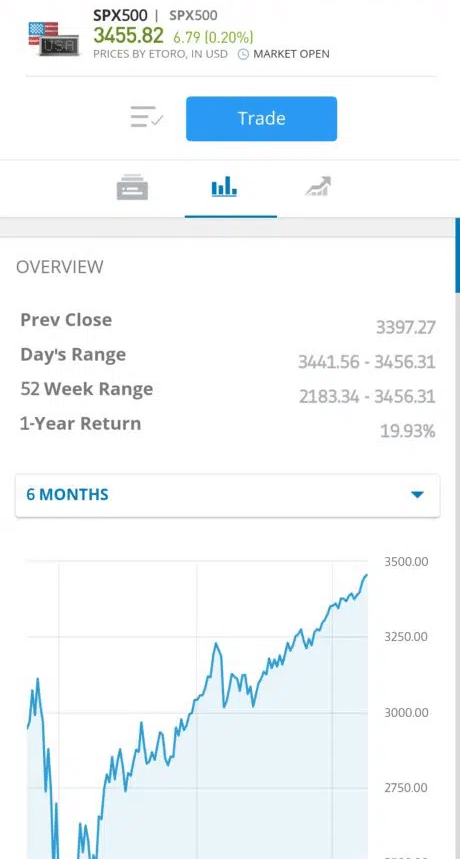

1. eToro – Overall Best Paper Trading App

This isn’t a copy trading app or anything of that sort, but its more than enough for you to learn the ins and outs of how online trading works and set you up to be proitable,or not. In terms of what you can trade, eToro offers most asset classes. In terms of direct ownership, you can buy shares, ETFs, and cryptocurrencies. If you’re keener on short-term trading strategies, eToro also offers CFDs. This covers many of the best stocks, indices, digital currencies, forex, commodities, and interest rates.

Irrespective of what you decide to trade on the eToro app, the provider does not charge any commissions. This means that when you eventually get around to trading with your own capital – you’ll be able to do so in a super cost-effective manner. Going back to the demo account facility momentarily, it is important to note that this mirrors live market conditions. That is to say, whatever you see on the paper trading platform is mirrored like-for-like with actual eToro buy and sell orders.

This ensures that you get the most from your paper trading endeavors. If you decide to upgrade to a real money account, eToro is licensed by the Financial Conduct Authority, CySEC, and ASIC. The platform requires a minimum deposit of just $200 – which you can find with a debit/credit card, e-wallet, or bank transfer. Credit Cards and PayPal are not available for users under UK/ FCA regulation. Once you have funded your account, you will then have access to the eToro Copy Trading feature. This allows you to trade passively – as your chosen investor will buy and sell assets on your behalf.

If you want to learn more about eToro, you can check out our eToro app review for a more detailed look at what this broker has to offer.

Pros

- Regulated by the Financial Conduct Authority, CySEC, and ASIC

- Trusted brand with over 30 million client accounts worldwide

- Trade forex without paying any commission or monthly charges

- Social and copy trading features

- Trade with leverage

- 3,000+ stocks listed on multiple international markets

- Personalised eToro account where you can set up trading price alerts

- Excellent forex paper trading app option

Cons

- Not suitable for advanced traders who like to perform technical analysis

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong.

2. WeBull – Best Paper Trading App for Experienced Traders

If you’re looking for a reliable paper trading app to buy and sell stocks, this WeBull app review singles out a paper trading feature that is worth considering.

This platform has gained a solid reputation in the online trading community, particularly in teaching how stocks work. With WeBull’s paper trading, you can access a wide range of stocks.

One of the significant advantages of using WeBull’s paper trading is that you can trade stocks without commission fees. Additionally, the spreads offered are competitive. Moreover, you can trade stocks on leverage, allowing you to amplify potential gains.

As for the paper trading app itself, WeBull provides you with a virtual balance of $100,000 to practice with. You can use this balance to trade stocks and explore different investment strategies. Furthermore, WeBull offers a user-friendly interface and intuitive tools that make the trading experience seamless and enjoyable.

If you transition to a real money account, WeBull requires a minimum deposit of $0. Supported payment methods include bank transfers and wire transfers. It’s worth mentioning that WeBull’s platform is secure, and they hold the necessary licenses and regulatory approvals to operate as a brokerage firm.

Pros

- Thousands of financial instruments supported

- Super-tight spreads on forex pairs

- Several trading platforms – including MetaTrader 4 and 5

- Regulated in several jurisdictions

- Great for news and market insights

- Low account minimums

Cons

- Best suited for more experienced traders

3. Interactive Brokers – Best Forex Paper Trading App

Interactive Brokers offers a paper trading feature that allows you to simulate real trading scenarios without using money. When you open a paper trading account with Interactive Brokers, you start with $1,000,000 of paper trading equity. This allows you to experiment with the full range of Interactive Brokers’ trading facilities in a simulated environment.

During the paper trading process, you’ll have access to real-time market data, enabling you to analyze and make informed decisions based on current market conditions. This can help you refine your trading strategies and understand how different market factors impact your trades.

To open a paper trading account, you must first have a regular trading account with Interactive Brokers that has been approved and funded. Once your regular trading account is set up, you can apply for a paper trading account. The paper trading account is typically available within 24 hours under normal business circumstances.

As for the cost of a real account with Interactive Brokers, it’s important to note that it offers different pricing structures and account types. The cost of a real account will depend on factors such as the type of account you choose, the trading activity, and the market data subscriptions you require.

Pros

- FCA-regulated

- Lots of currency pairs to trade

- Choose from several trading platforms

- 0% commission on all assets

- Tight spreads

Cons

- Complicated pricing structure

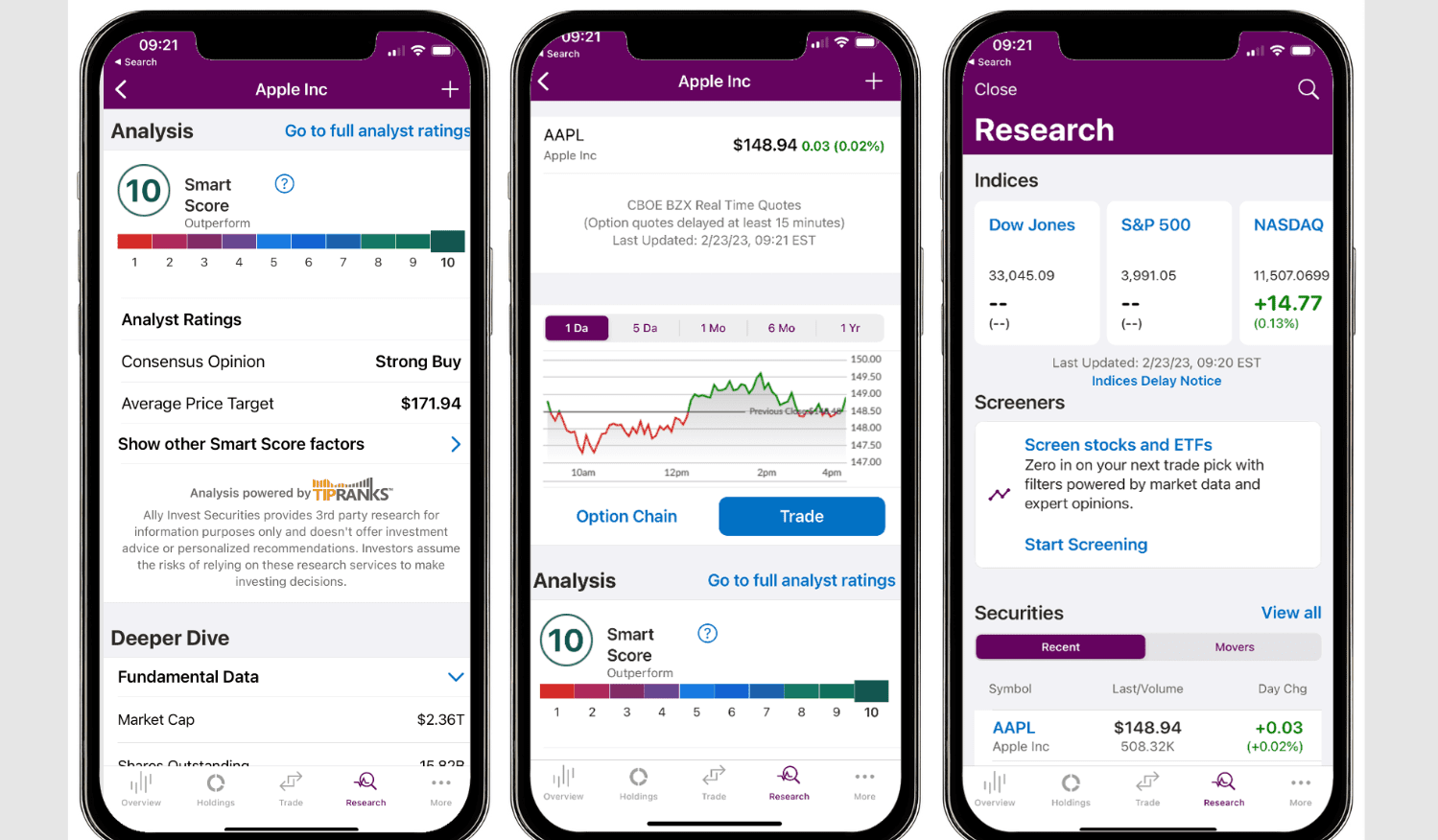

4. Ally Invest – Great Paper Stock Trading App

Ally Invest is a widely recognized online platform offering a paper trading feature. This platform has gained popularity with a customer base of numerous users. With Ally Invest, you can trade various financial instruments, including stocks, options, ETFs, etc.

The paper trading feature allows you to practice trading strategies and test the platform’s functionality without risking real money. Ally Invest offers a 30-day demo account with a virtual balance of $50,000 for paper trading. You can access the paper trading account through the Ally Invest website or mobile app.

In addition to the paper trading feature, Ally Invest provides a wealth of educational resources to support your trading journey. These resources include educational articles, videos, webinars, and interactive tools to help you enhance your trading skills and knowledge.

Ally Invest offers different account types to cater to various trading preferences. You can choose between individual, joint, or retirement accounts depending on your needs. Each account type may have different features and benefits, such as commission-free trades or access to research tools.

Pros

- 0% commission on all asset classes – including forex

- No minimum deposit

- Excellent reviews on Google Play and Apple Stores

- More than 250,000 trusted clients

Cons

- Limited fundamental analysis tools

5. IG – Best Paper Trading App for Android Users

This covers everything from stocks, hard metals, energies, bonds, indices, and more. The demo account comes pre-loaded with a $10,000 paper fund balance, and all market orders reflect real-world trading conditions. If you decide to join over 239,000 clients by opening a real money account, then you will benefit from commission-free CFD trading.

The only exception to this is stock CFDs – which come with a variable percentage fee. Spreads are very tight on most asset classes, and leverage is available on all CFD markets. If you opt for traditional shares at IG, then you will pay £8 per trade. If you are able to trade at least three times per month, then this is reduced to £3. IG offers two trading platforms – both of which can be accessed on your mobile phone.

This includes MT4 and IG’s native platform. In terms of opening a real account, you’ll need to deposit at least £250. IG supports debit cards, credit cards, and bank wire transfer. You fund your account with the Android app, but not iOS. Finally, it goes without saying that IG is heavily regulated. This includes licenses with the FCA and ASIC – so safety should be of no concern.

Want to learn more about the IG trading app? Check out our expert IG review.

Pros

- Trusted broker with a long-standing reputation

- More than 17,000 markets listed

- Over 90+ currency pairs supported

- Leverage and short-selling also available

- 0% commissions on forex trading

- Access to dozens of international markets

- Great research department

Cons

- Minimum deposit of £250

- US stocks have a $15 minimum commission

6. TD Ameritrade – Best Paper Trading App for US Citizens

If you’re based in the US – then there is every chance that you have heard of TD Ameritrade. After all, the broker is one of the biggest and most trusted trading platforms in the domestic marketplace. Although most traders prefer to use the online platform – TD Ameritrade also offers a fully-fledged mobile app.

The mobile app – which is called ‘thinkorswim®’ is available to download and install from the Google Play and Apple Store. Best of all, you can start off with a paper trading facility to help you get to grips with how the application works. The TD Ameritrade app gives you access to most features and tools as found on its main desktop site.

This includes to ability to place real-time market orders, view and explore integrated charts and quotes, and even create watchlists. What we also like about this trading app is that you can set up price alerts. For example, if you want to trade Apple shares when the price hits $400 – you will receive a notification on your phone.

In terms of the specifics, real money accounts come with free stock and ETF trades. This is great, as TD Ameritrade was charging $6.95 as recently as 2019. You can also trade options at a fee of $0.065 per contract. Additionally, the TD Ameritrade app gives you access to over 11,000 funds, which is great for passive investments.

Pros

- Trusted US brokerage firm

- App is available on iOS and Android devices

- Buy stocks and ETFs commission-free

- Options can be traded at just $0.65 per contract

- Fully-fledged paper trading account

- More than 11,000 mutual funds to choose from

- No account minimum

Cons

- Not as user-friendly as other trading apps in the market

- The sheer size of tradable markets on offer can appear overwhelming

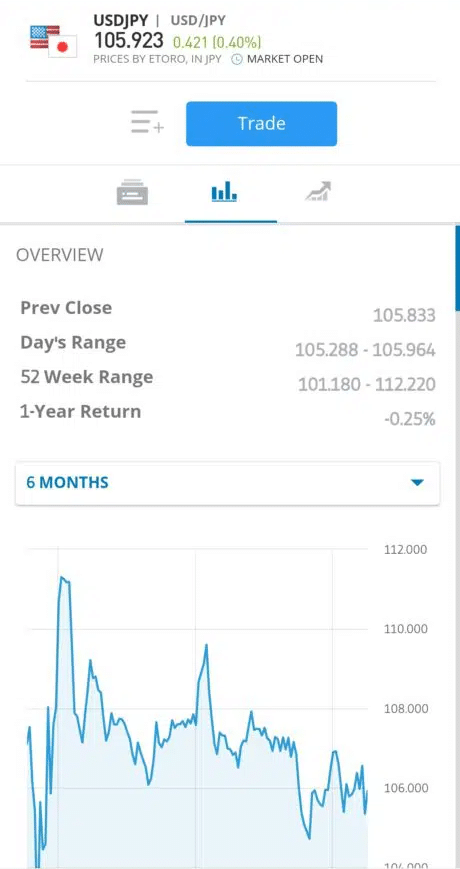

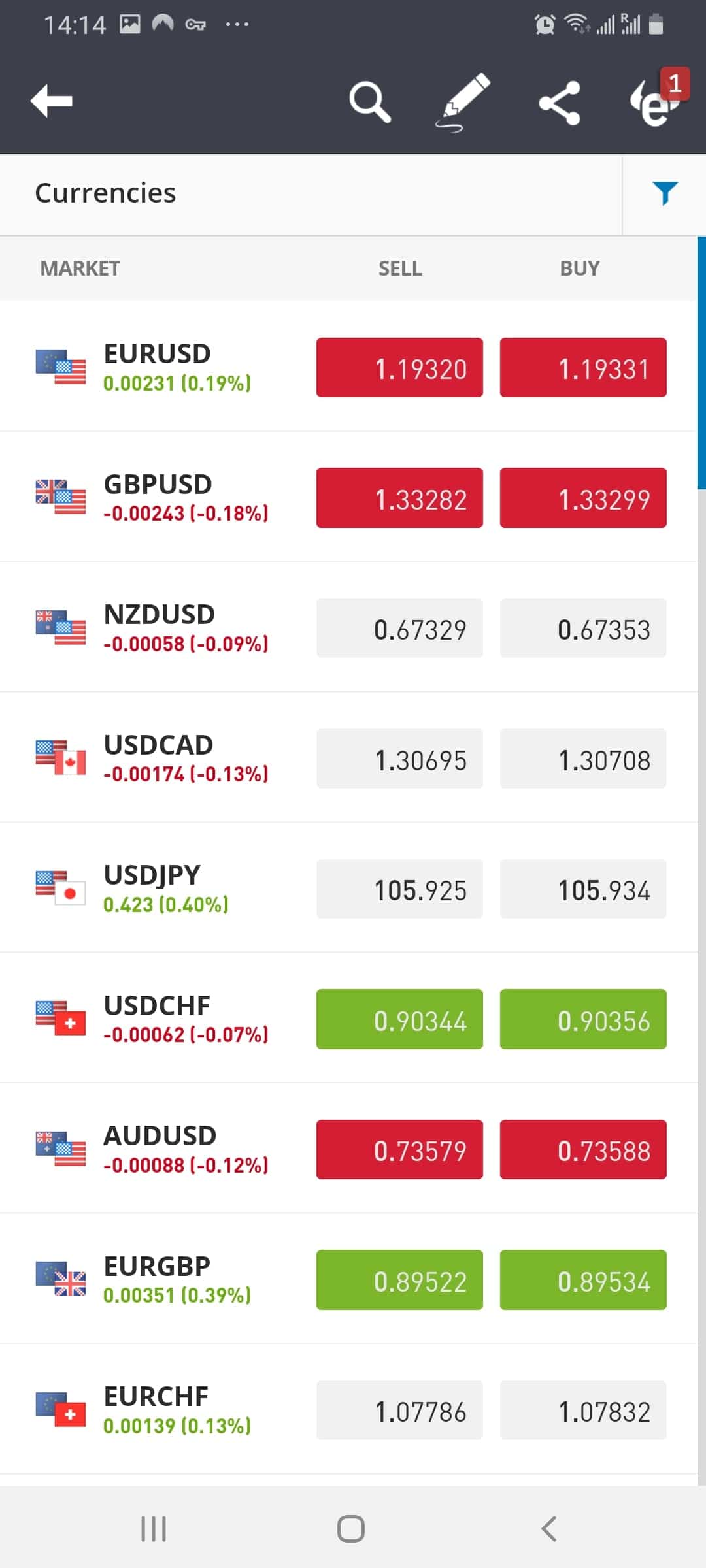

7. Forex.com – Best Paper Trading App for Forex

If you’re looking to gain exposure to the multi-trillion dollar currency trading scene – from this Forex.com app review, you’ll know this option is the best paper trading app for forex. This forex specialist offers its trading platform online or via a fully-fledged mobile app. You will have access to over 90+ currency pairs – which is huge.

While this includes all major and minor pairs, the Forex.com app is also great for exotic currencies. You most likely won’t be told the best crypto to buy or to sell, but the platform accommodates such currencies. You can test the Forex.com app out for yourself via its demo account facility. Each account comes with a life span of 30 days – which should be enough time to get to grips with how the app works.

The application comes packed with tools and features. This includes technical indicators like moving averages, and chart drawing tools – alongside leverage. If you’re based in the US, then you will know first hand that this is capped at 1:50 on majors and less on other pair types.

If you decide to use the Forex.com app to trade with real money, there is no minimum deposit amount when opting for a bank wire. Debit and credit card deposits come with a minimum of $50. In terms of fees, you can choose from a commission-free or standard account. If opting for the latter, you will $5 per standard lot – but you will benefit from really tights spreads.

Pros

- It is a specialist forex trading app

- Access to dozens of currency pairs

- Particularly strong when it comes to exotic currencies

- No minimum deposit when opting for a bank wire

- Also offers CFDs

- Heavily regulated – including US licenses

- Top-notch forex and economic news

Cons

- Does not support e-wallets like Paypal and Skrill

8. Charles Schwab – Best Paper Trading App for OTC Trading

Charles Schwab offers a paper trading feature that allows users to practice trading strategies without using real money. This feature is available through their platform and provides users with a virtual buying power of $100,000 to simulate trades in a live market environment.

With Charles Schwab’s paper trading feature, users can trade various financial instruments, including equities, options, futures, and more. This allows users to gain hands-on experience and test different trading strategies without the risk of losing actual funds.

One advantage of the paper trading feature is the ability to refine and optimize the trading experience. Users can change tool settings and organization to align with their trading workflow and chart patterns overview. This feature allows users to experiment with different configurations and see how these adjustments can enhance their overall trading experience.

Another benefit of Charles Schwab’s paper trading is the ability to track and evaluate performance. Users can access virtual trade data, including profit and loss analysis, to validate or refine their trading strategies. This feature provides insights into trading performance and helps users make informed decisions based on the results.

Pros

- Provides heaps of educational resources

- Great for market insights and market research

- Several account types supported

- One of the largest brokerage firms globally

- Mobile app available on iOS and Android devices

Cons

- The platform isn’t overly user-friendly

Paper trading apps Spread or commission? Amazon shares cost Overnight fees eToro Free Free No overnight fees for stocks. WeBull Free – No overnight fees for stocks. Interactive Brokers Commission 0.0005 to 0.0035 per share No overnight fees for stocks. Ally Invest Spread – No overnight fees for stocks. IG Commission Free if more than three trades made in previous month, $10 if not. No overnight fees for stocks. TD Ameritrade Free Free No overnight fees for stocks. Forex.com Spread 0.04% No overnight fees for stocks. Charles Schwab Spread 0.40% No overnight fees for stocks. Best Paper Trading Apps Features Comparison

If you still can’t decide on the best paper trading app for you, here’s how our top picks compare in terms of the features and trading platforms they offer.

Paper trading apps Trading platforms Features eToro Proprietary Social trading, copy trading, copy portfolios, fractional shares WeBull Proprietary Webinars, beginners courses, news, blog Interactive Brokers Proprietary Market insights, APIs, Market analysis Ally Invest Proprietary Fractional shares, market analysis, trading signals IG Proprietary, MT4, ProRealTime Trading signals, algorithmic trading, APIs, DMA trading TD Ameritrade Proprietary, Thinkorswim Stock screener, options scanner, custom indicators Forex.com Proprietary, MT4, MT5 Trading signals, alerts, trade from charts Charles Schwab Proprietary Social trading, copy trading, options analysis How to Choose the Best Paper Trading App for You

With most online brokerage firms now not only offering mobile applications – but demo accounts, too – knowing which provider to sign up with can be time-consuming. For example, it’s more than likely that you are looking to use a paper trading facility with the view of getting to grips with how things work – or because you are interested in testing out a new strategy.

At some point, you might decide to upgrade to a real money account. With this in mind, you need to look at everything from fees and spreads, to supported payment methods and regulation.

To help point you in the right direction, below you will find a list of metrics that you need to consider before downloading a paper money trading app.

Eligibility

First and foremost, you need to ensure that you are eligible to open an account with your chosen paper trading app. At the forefront of this is the country in which you are located. For example, a lot of stock apps do not accept Americans as they are required to obtain regulatory approval from US authorities – which can be both costly and time-consuming.

Regulation

Once you have confirmed that you are eligible, you then need to check the regulatory standing of trading app provider. Take note, each and every trading app that we have listed on this page holds at least one regulatory license – often several. Some of the most reputable regulators to look out for as:

- FCA (UK)

- CySEC (Cyprus)

- SEC (US)

- ASIC (Australia)

- MAS (Singapore)

If your chosen paper trading app doesn’t hold a license with a reputable body – avoid it.

Fees

Once you have assessed eligibility and regulation, you should then spend some time understanding the fee structure of your chosen app. After all, this will have a direct impact on your trading margins, should you decide to upgrade to a real money account.

The main fee that you should assess is that of the trading commission. Most of the investment apps listed on this page do not charge any commission, which is great. But, if your chosen app does – this will normally be a percentage fee. For example, you might pay a commission of 0.25% – which is then multiplied against the size of your stake.

Other fees to look out for are:

- Spreads

- Deposit fees

- Withdrawal fees

- Overnight financing fees

- Inactivity fees

You can check all of the above by heading over to the respective trading platform before opening an account.

Platform & Usability

It must be noted that trading on a mobile phone can be challenging. This is because you will be working with a screen that is much smaller in size than that of a desktop device. Sure, the process of placing buy and sell orders, checking the value of your portfolio, and depositing/withdrawing funds can be achieved with ease.

However, when it comes to performing advanced analysis and research – this can be somewhat cumbersome on a mobile phone. With this in mind, you should stick paper trading apps that excel in terms of usability. The good news is that your chosen app will be compatible with your specific operating system – be it Android or iOS.

Trading Tools & Features

Make no mistake about it – most traders in the online scene lose money. This might be for a variety of different reasons – such as the trader being unable to handle the emotions of losing money – or because they fail to implement sensible risk management strategies.

Regarding the latter, this is why you should ensure that your chosen app offers you the required tools to develop a risk-averse trading strategy. For example, this should include stop-loss and take-profit orders at a minimum – albeit, it’s even better if you have the option of trialing-stop and guaranteed-stop orders too.

Education, Research & Analysis

The best paper trading apps offer a good selection of educational tools. This might include guides like “candlesticks explained” and video explainers – or even regular webinars. If this is something you’re after, your best bet is eToro. This is because the aforementioned paper trading apps are perfectly suited to newbies.

Additionally, you should also ensure that your chosen trading app offers a good amount of in-house research. This might include technical indicators such as the MACD and chart drawing tools – as well as economic calendars and financial calculators. When it comes to fundamental analysis, real-time news developments via the app are of great value.

Device Compatibility

Without intending to state the obvious, you also need to make sure that the paper trading app is compatible with your device. Most brokerage firms will launch an app on both iOS and Android. But, one version of the app might be inferior to the other.

A great example of this is IG. While its Android application gives you access to all account features – this isn’t the case with its iOS version. For example, you can’t deposit and withdraw funds through the iOS app – nor can you set up pricing alerts!

Payments

Assuming that you will one day be looking to use your chosen app to trade with real capital – you also need to think about supported payment methods. The easiest way to get money into and out of your brokerage account is to use a debit or credit card. E-wallets are just as convenient – as payments are usually instantly credited fee-free.

With that said, some paper trading apps only support bank transfers. This is somewhat of a draconian way to deposit funds – as you will have the wait several days for the money to arrive! Additionally, you should also check to see whether any fees apply to your chosen payment method and how long the broker takes to process withdrawal requests.

Customer Service

You should also stick with paper trading apps that offer top-notch customer support – especially if you are looking to eventually upgrade to a real money account. The best way to speak with a support agent is via live chat. Next, best is that of phone support – as you will benefit from real-time assistance. After that, you’ll be left with email or a support ticket.

Is paper trading risk-free?

In terms of monetary risk, the answer is clear: yes, paper trading is risk-free. Since you are not using real money, there’s no possibility of financial loss. This provides a cushion for beginners, enabling them to learn the ropes without the fear of monetary setbacks. By allowing individuals to test strategies, analyze stocks, and gain experience, paper trading platforms set the stage for increased confidence and potentially better decision-making when transitioning to real trading.

However, it’s crucial to understand that risk isn’t only financial. One of the subtle risks of paper trading is developing overconfidence. Without the genuine emotional weight of actual financial losses, traders might take higher risks in a simulated environment than they would in the real market. This can lead to bad habits and a false sense of security.

Furthermore, paper trading platforms might not always replicate live market conditions perfectly. There could be differences in execution speed, available tools, or even price data. So, while a strategy may be effective in a simulated setting, it doesn’t guarantee success in live trading.

In conclusion, while paper trading eliminates financial risk, it isn’t entirely devoid of pitfalls. Aspiring traders should use these platforms as a learning tool, but remain mindful of the differences between simulated and real trading environments.

Is Paper Trading Worth It?

Yes, paper trading is definitely worth it. Using a paper trading account before live trading is the best way to practice new strategies and trading tools before you put any real money at risk. Paper trading can also be used to tweak existing strategies to keep up with market volatility. Most regulated trading platforms and apps provide paper trading services to help their users develop strong trading strategies that lead to profitable trades.

How to Get Started with a Paper Trading App

Found a paper trading app that meets your needs, but not too sure how to get started? If so, we are now going to walk you through the process of setting up a demo account facility with eToro – which is our top-rated paper trading app. You can, however, use any provider of your choosing, not least because the process is virtually like-for-like across all platforms.

Step 1: Download and Install the eToro AppVisit the eToro website via your mobile web browser and download the app. This is available on both iOS and Android devices.

Step 2: Open a Paper Trading AccountYou will need to open an account before you can use the eToro paper trading facility. The process simply requires some personal information from you – such as your full name, home address, and date of birth.

Step 3: Switch to Virtual PortfolioOnce you have opened an account and confirmed your email address and phone number – you can start trading with paper money. All you need to do is switch the account from ‘Real Money’ to ‘Virtual Portfolio’.

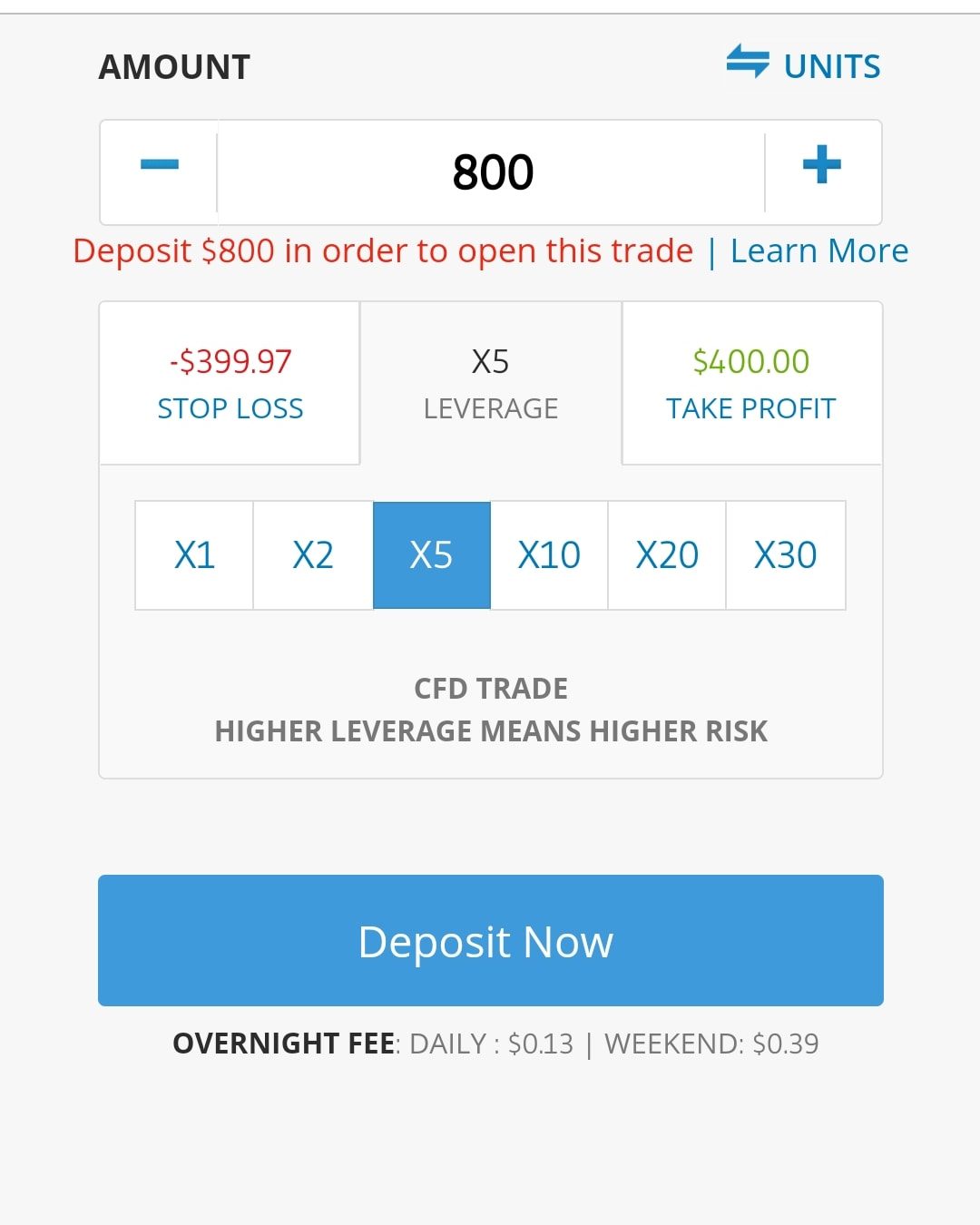

Step 4: Place a TradeIn order to trade, you first need to search for an asset. You can do this by clicking on the ‘Trade Markets’ button and browsing the many asset classes hosted by the app. This includes stocks, commodities, forex, ETFs, and more. Or, you can simply search for the asset that you wish to trade.

You will then be asked to set up an order. All this requires is:

- Whether it’s a buy or sell order

- Your stake

- Whether you want to apply leverage

- Whether you want to install stop-loss and take-profit orders (recommended)

Finally, confirm the trade. And that’s it – you’ve just utilised the eToro paper trading facility in a matter of minutes!

Step 5: Upgrade to Real Money Account (KYC)If you want to start trading with real money, you will need to provide some ID to eToro. This is because eToro is heavily regulated, so it must comply with anti-money laundering laws. All you need to do is upload a copy of your passport/driver’s license and a utility bill/bank account statement. Then, eToro should be able to verify the documents within a matter of minutes.

Step 6: Deposit FundsYou will then be asked to deposit some funds. This can be done with a debit/credit card, e-wallet, or bank wire. You will, however, need to deposit at least $200. Once your deposit is confirmed, you can then start trading with real capital! Credit Cards and PayPal are not available for users under UK/ FCA regulation.

eToro – Overall Best Paper Trading App with Low Fees

In summary, paper trading apps are ideal if you are looking to start a career in trading – but you’ve got little to no experience. This is because most demo accounts come packed with all of the same tools and features as you will find on the provider’s real money account. Furthermore, the paper trading facility will usually mirror that of live market conditions.

This allows you to get a feel for how the financial markets work without needing to risk your own money. With that said, paper trading apps are not only suited for beginners. On the contrary, a lot of experienced traders use them as a means to test out new strategies and ideas.

If you’re still undecided as to which paper trading app is right for you – we would suggest checking out eToro. This heavily regulated provider offers thousands of trading markets. Your paper trading account will come packed with a pre-loaded balance of $100,000 – which is more than enough time to test the provider out before upgrading to a real money account.

You can get started with eToro right now by clicking on the link below!

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong.

References

- https://time.com/personal-finance/article/what-is-a-paper-trade/

- https://corporatefinanceinstitute.com/resources/career-map/sell-side/capital-markets/paper-trading/

- https://www.financestrategists.com/wealth-management/investment-management/paper-trade/

- https://smartasset.com/investing/paper-trading

- https://capital.com/paper-trading-definition-guide-buy-sell-risk-free

FAQs

What is paper trading?

Paper trading refers to the process of trading with an online or mobile brokerage firm – but with demo funds. In other words, you get to practice trade in a 100% risk-free environment.

What is the best paper trading app?

While there are hundreds of paper trading apps to choose from, we think that eToro stands out from the crowd. You’ll get a pre-loaded balance of $100,000 – and have access to thousands of financial instruments.

Can you make money from a paper trading app?

No, paper trading apps allow you to trade with demo funds – meaning that you will not be risking or making real money. If you do want to make money from your trading endeavors, you will need to upgrade to a real money account by making a deposit.

What assets can you trade on a paper trading app?

This can vary wildly depending on your chosen paper trading app. In the case of our top-rated app eToro – you can trade everything from stocks, ETFs, indices, commodities, forex, and cryptocurrencies.

Are paper trading apps safe?

As long as your chosen paper trading app is licensed by a tier-one regulator (like the FCA or ASIC), you should have no concerns surrounding safety.

In which app can I do paper trading?

In this article we have provided 10 apps that allow paper trading. eToro is the best app that allows you to do paper trading as well as social trading.

Kane Pepi

Kane Pepi

Kane Pepi is a British researcher and writer that specializes in finance, financial crime, and blockchain technology. Now based in Malta, Kane writes for a number of platforms in the online domain. In particular, Kane is skilled at explaining complex financial subjects in a user-friendly manner. Kane has also written for websites such as MoneyCheck, the Motley Fool, InsideBitcoins, Blockonomi, Learnbonds, and the Malta Association of Compliance Officers.View all posts by Kane PepiVISIT ETOROYour capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.stockapps.com has no intention that any of the information it provides is used for illegal purposes. It is your own personal responsibility to make sure that all age and other relevant requirements are adhered to before registering with a trading, investing or betting operator. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice.By continuing to use this website you agree to our terms and conditions and privacy policy.

Trading is risky and you might lose part, or all your capital invested. Information provided is for informational and educational purposes only and does not represent any type of financial advice and/or investment recommendation.

Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers.

© stockapps.com All Rights Reserved 2025

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.OkScroll Up