Best Demo Trading App – Trading Guide 2026

Mistakes in real-world trades can lead to huge financial losses, put stress on your day-to-day life and even result in debt. That is often the case with inexperienced traders who get so excited that they skip learning the fundamentals. The best demo trading app has features to help you practice in real-world trading scenarios before depositing real money.

Besides using the best demo trading app to learn more about trading, you have the opportunity to explore the features. This leverage allows you to test several apps to find the one most suitable for your trading strategy and portfolio. Almost all the features, including charts, technical indicators, copy trades, screeners, etc., will be available to you.

We will review several platforms to help you decide which is the best app for demo trading. Of course, you’ll have our recommendation, but this article covers even more. You’ll learn about the trading tools and features, including strategies to practice with as you hone your skills.

-

-

Best Demo Trading Apps List

- Plus500: The best demo trading app for futures

- Oanda: The Best Demo Trading App for Forex Pairs

- Forex.com: The Best Demo Trading App for Simulated Trading

Best Demo Trading Apps Reviewed

Our team has tested and reviewed over a dozen apps to find the best demo trading app. We considered the similarity to the actual trading platform, ease of use, markets, instruments, learning resources, time limits, etc. These factors are essential to getting an inexperienced trader up to speed, from how stocks work to winning strategies.

With that in mind, here are our top recommendations for the best app for demo trading:

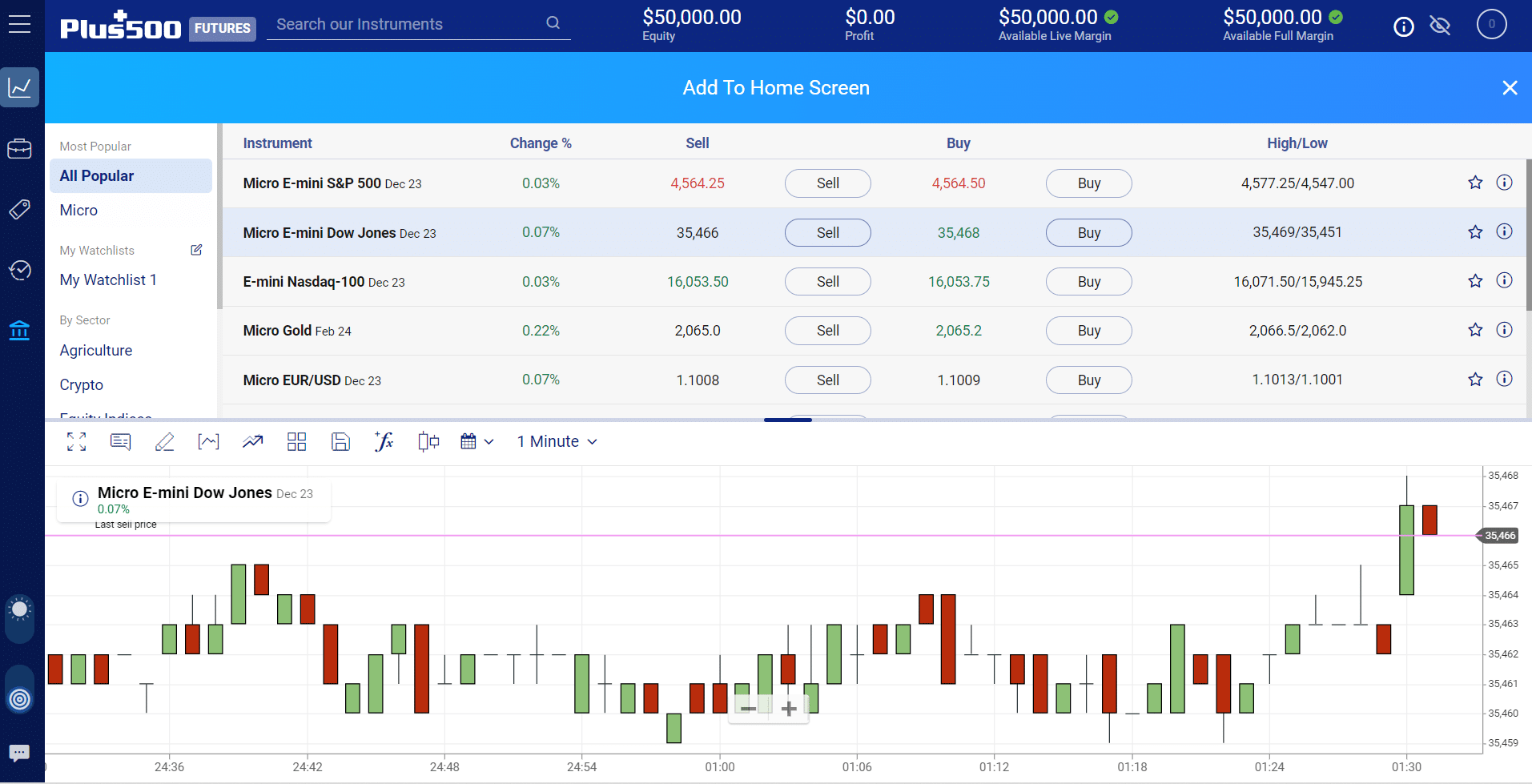

1- Plus500: The Best Demo Trading App for Futures

Besides starting the demo, you can always switch back to it during live trades. Plus500 offers demo live quotes for strategy building, making it the best demo trading app for futures. The demo platform is easy to use, with all the essential tools to help you learn trading.

Plus500 quickly sets you up with $50,000 when you open the demo account. You can search for instruments or trim the options by different sectors. This app offers futures in agriculture, cryptocurrency, forex, equity indices, interest rates, metals, and energy.

You can practice day trading with the Plus500 demo account. You can set up watchlists, view your open and closed positions, and review pending orders. These function with actual instruments and market conditions.

Plus500 has different chart types to help you understand how they work in real-world trades. The real-money account brings several benefits, including a low $100 deposit, zero platform and market data fees, 2,800 instruments, etc.

This trading platform is reputable and reliable. Its membership in the National Futures Association and the CME Group boosts its standing as the best app for demo trading. The platform is SSL-secured.

You can download the Plus500 mobile app on Android and iOS devices. The Futures Trading Academy offers videos and articles to bring you up to speed in futures trading. Also, you can access the academy even with a live trading account

Feature Overview Technical Charts These function like real-world charts with technical indicators and resolutions. Notifications Center You can set notifications for alerts, margin call warnings, orders fulfilled, auto-liquidation, announcements, etc. Pros:

- Smooth user experience

- The demo account is funded with $50,000

- You can set up alerts

- You can add instruments to the watchlist

- Live statistics are available

Cons:

- There isn’t enough information and technical tools

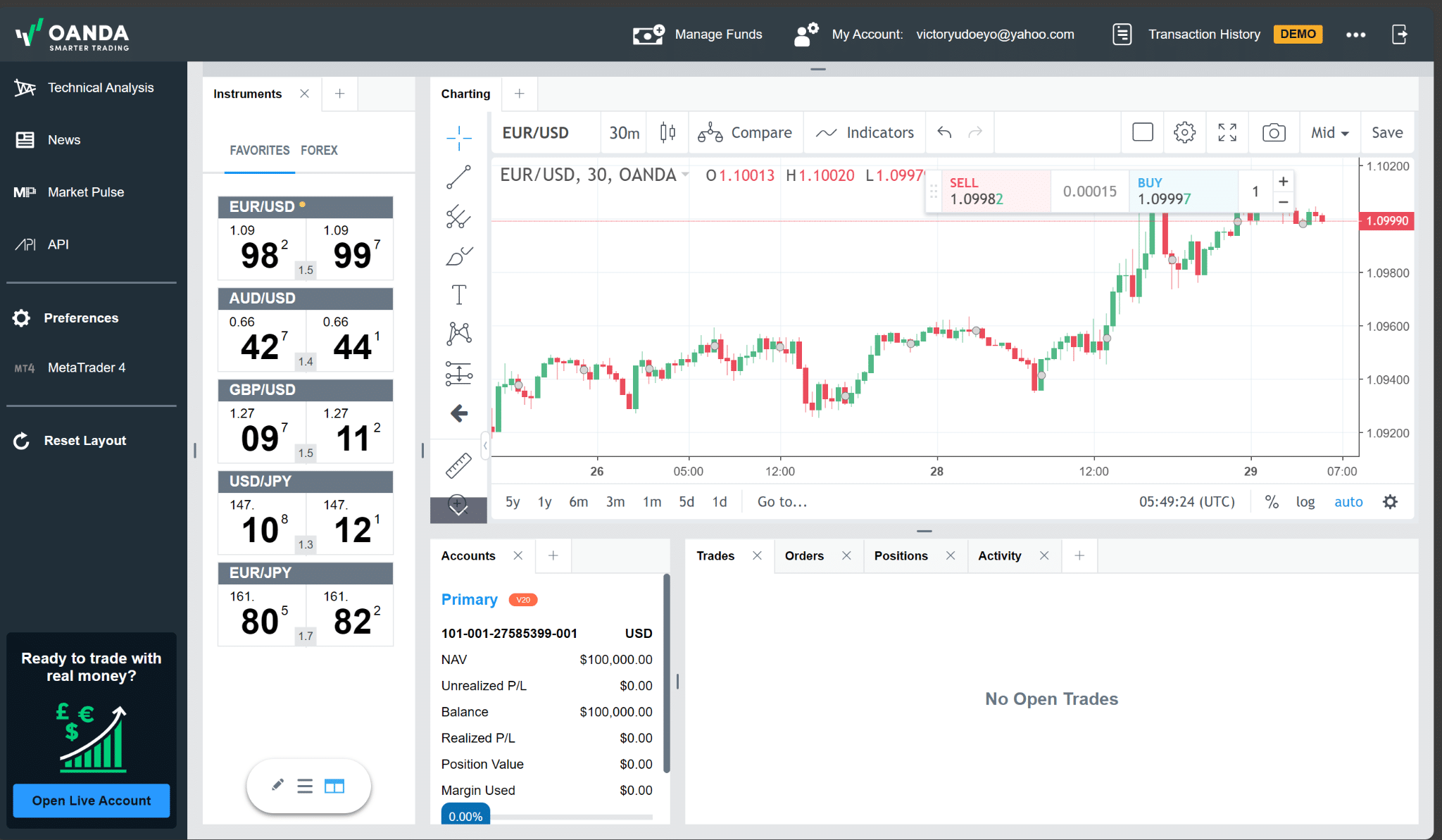

2- Oanda: The Best Demo Trading App for Forex Pairs

Forex trading has gained popularity over the years because of its simplicity, 24hr availability, and high liquidity. Oanda is the best app for demo trading if forex is your primary forex. The online broker is regulated by the National Futures Association.

Oanda’s demo account will get you started on forex trading in no time. It is easy to use with a user-friendly interface. Notwithstanding, it has advanced tools to give your skills a nudge for the better.

The primary interface offers technical charts. You can add technical indicators to the charts, compare different symbols, use drawing tools, add a trend line, and view the long position.

Oanda will fund your demo account with $100,000, enough to get you through the training phase. Besides the technical tools, the broker adds other crucial elements and features. While it doesn’t beat alternative data services out there, the market pulse offers news and analysis.

With the market pulses, you can get exclusive news on forex, indices, crypto, and commodities. While it is not the best demo stock trading app, its focus on forex makes it outstanding. The demo is restricted to forex, but the live account adds crypto.

Oanda adds a currency heat map, an essential feature to navigate the forex market. You can see strong and weak currencies, use that for your trades, and finetune your strategy.

Feature Overview Currency Heatmap Shows strong and weak currencies in real-time Position Ratio This sentiment indicator shows the percentage of traders with open, long, or short positions for a specific currency pair Pros:

- MetaTrader 4 is supported

- $100,000 funded demo trading account

- Trades are in real-time with actual market conditions

- A currency heat map is included

- Market news and analysis is available

Cons:

- The mobile platform has few educational materials

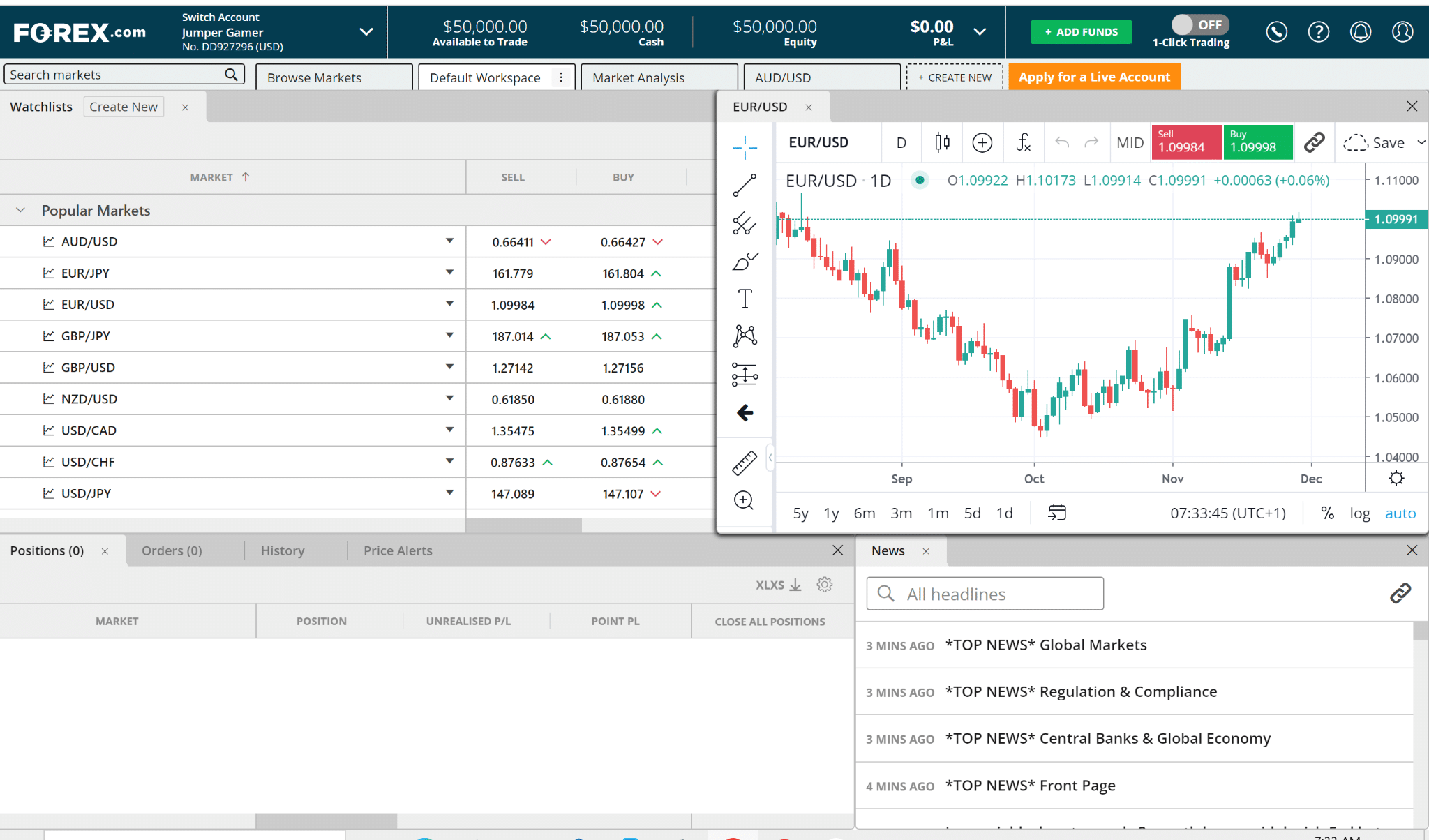

3- Forex.com: The Best Demo Trading App for Simulated Trading

This online broker comes close to being the best demo stock trading app. However, you’ll need the live account to access stock trades and other instruments. The demo account is restricted to forex and metals.

Fortunately, Forex.com provides a startup virtual capital of $50,000. That should be enough for you to explore the technical tools and jargon related to forex trading. For the former, the broker provides several features, including charts and headlines.

The interface is well-designed as it manages to contain the instruments, charts, positions, and headlines. However, you can adjust the section you want more pronounced while trading. The chart section is an ideal spot to start for a better grasp of the tools.

Forex.com is the best app for demo trading with simulations. Even though you have a live account, you can still run simulated trades. Simulations are available on the mobile app and MetaTrader4 platforms.

Simulations allow you to test trades under real market conditions and back-test your strategy without any risk. In addition, the broker has an extensive learning section with courses and quizzes to help you master trading.

The demo account has a dedicated market analysis section. You can get short-term, intermediate, and long-term analysis on various forex pairs. This section also shows a summary of all technical events that have occurred.

Price alerts are also available on the demo account. Forex.com offers an unrivalled demo trading experience that feels like the real world.

Feature Overview Market Analysis This section provides short, intermediate, and long-term analysis with technical events Pros:

- $50,000 is available for trading in the demo account

- Market analysis is available

- Price alerts are available

Cons:

- The demo account does not support stock trading

Demo Trading Explained

You can kickstart your trading journey today with the best demo stock trading app or one focused on your preferred instrument. We recommend doing that before using real money from your live account. The volatility and price swings in the actual market can be shattering if you are not adequately prepared.

Some online brokers offer simulations to support trading strategies. Although that is not directly tied to demo accounts, it is still useful. Most importantly, simulations are free without any risk.

Demo trading is where you learn things like Fibonacci retracement, moving averages, relative strength index, put options, leverage, etc. These terms can be confusing, but they are necessary to master the stock market. Fortunately, the best demo stock trading app will provide access to them.

This section will address what demo trading is and things to consider when choosing the best demo stock trading app for your portfolio. The online broker you settle with can make all the difference in your daily or periodic trades. That does not rule out the volatility of the stock market.

What is Demo trading?

Demo trading involves trading actual instruments in real market conditions with virtual cash. The profits are not real money, but they will be reflected in your demo account. In other words, there are few limitations except for making real money.

Summarily, the best demo stock trading app will provide the following:

- Virtual cash in your demo account

- Real instruments, including stocks, crypto, commodity, metals, forex, indices, etc.

- Trading tools like charts, technical indicators, drawing tools, comparisons, etc.

- Added features like comparison tools, heatmaps, market analysis, watchlists, copy trading, etc.

The added features are how we get the best demo stock trading app. Some brokers provide a more realistic introduction to actual market trading. Also, we prefer those that offer advanced tools to train beginners even further.

Demo trading was unavailable for the stock market until the advent of electronic trades. You can take advantage of them today to grow your knowledge and skills. Speaking of knowledge, adding courses as you trade with the virtual cash is essential.

With education and training materials on one side and a virtual trading environment on the other, you are sure to learn much. You can quickly apply concepts from the training videos and articles to your demo trades.

By offering real market conditions, the best demo stock trading app introduces you to the real emotions of winning and losing. Even experts report losses now and then but develop strategies to offset them. An example is the Richard Driehaus options trading strategy to offset losses.

With that in mind, let’s take you through essential considerations for choosing the best demo stock trading app. These include regulations, assets offered, tools, features, and mobile compatibility.

Regulation

Your assets and profits can be seized on an unregulated platform, even if it is the best demo stock trading app. In the US, all online brokers that accept real money trades from citizens must be registered with the appropriate body. The Securities Exchange Commission is the overall regulatory body in the country.

Scams and other vices have risen recently, leading to multi-billion-dollar losses. While we can’t rule out loopholes that allow scam sites to be regulated, you are less likely to lose money to fraud on regulated brokers. If any losses occur, they are often from data breaches/

Besides regulating the activities of online brokers to prevent money laundering, authorities also ensure optimal security. Any broker we recommend as the best demo stock trading app must have the latest SSL encryption. Also, it must provide firewalls and limited access to servers that hold consumer data.

Regulatory authorities also look out for these security measures before licensing an online broker. Don’t be swayed by multiple awards. Instead, always confirm the license of any trading platform before using real money.

You might wonder why regulation is crucial to getting the best demo stock trading app. The tendency to switch to a live account on the same platform is high, especially if you find it competent. Hence, we always recommend reviewing the regulation and licensing parts first.

Assets

The next step after confirming licenses and availability is to check the assets available. You might find the best demo stock trading app, but you are also interested in other assets, like cryptocurrency. Obviously, there will be limitations on what you can trade.

Common assets on the best demo trading app include commodities, stocks, indices, ETFs, futures, crypto, metals, etc. Some brokers will restrict specific assets in the demo account. For example, Forex.com restricts its demo account to forex pairs only.

We recommend online brokers that provide access to a wide range of assets. That will help you explore different scenarios and markets before settling on which assets to add to your portfolio. Then, you can switch to portfolio trackers for real-market trading.

Contact customer support to confirm the availability of your preferred assets before registering. That will spare you the stress of trading assets you don’t like.

You might have your preferences, but nothing stops you from learning about other assets. The learning centers or academies of most online brokers will introduce you to other assets and their markets. We recommend keeping an open mind if you are new to online trading.

Stocks might be your first preference, but you might develop a stronger strategy for forex later. Hence, have a wide grasp of different assets and how their markets perform. This will help to diversify your portfolio between high-risk and low-risk instruments.

You can practice portfolio diversification with your demo account. However, you will need the best demo trading app that supports various assets.

Trading Tools and Features

Regulations and a wide variety of assets are essential. However, the trading tools and features are what give traders an edge. The more tools you have, the better grasp you will have of the market and be able to make informed decisions.

The tools will be overwhelming initially, but with patience and perseverance, you will become an expert. Fortunately, you’ll have a virtual deposit with the best app for demo trading to explore these tools. While exploring tools and features, have a course or training material by the side.

Most tools, even on the best app for demo trading, will not make any sense to a first-time trader. Instead, they will look complex, with no clear grasp of their application to the market. You don’t have to limit yourself to the academic materials on that platform.

The prominent tools you’ll find on the best demo trading app include the following:

- Charts and technical tools: Charts are the first things we see when exploring the viability of a stock for purchase. Some look like line diagrams, while others look like candlesticks. Traders often have preferences, and you will do the same with time.

Technical indicators bring more insights to the charts. Prominent indicators include moving averages, stochastic oscillators, average directional index, distribution lines, etc. You can explore beta in stocks to quickly see a stock’s volatility.

- Risk management tools: Learning risk management is crucial when using the best demo stock trading app. Tools you can use include reward ratios, stop-loss orders, position sizing, etc. These will prevent heavy losses, leaving you enough cash to continue trading.

Other features you can expect include copy trading, market analysis, news, stock alerts, news, etc. Give yourself enough time, and you will master these tools.

Mobile App and Device Compatibility

Our last but not least, consideration for the best demo trading app is mobile compatibility. If you hope to be a day trader, having easy access to your portfolio and executing trades quickly is essential. The best way to do that is through our mobile devices.

Ensure your preferred online broker is available on mobile devices. We prefer those with applications, but you can still trade efficiently with the mobile web browser version. However, the latter must be highly responsive with all the necessary features.

The best demo stock trading app is often available on Android and iOS devices. However, some are only available on iOS devices. Confirm availability and compare with your primary device before signing up.

Another point for mobile compatibility is the availability of features. Some online brokers trim down features for their mobile versions or applications. For example, you might not get specific assets on the mobile version.

This shouldn’t be an issue. Even if there are restrictions, ensure they do not affect your primary assets and tools.

Lastly, test the compatibility with your native browsers. Ensure the pages load quickly and orders are executed quickly.

Demo Trading Strategy

Your performance with a demo account can influence your performance with a live account. Some new traders often write off demo trading because no real money is made. They might even skip it entirely and activate their live accounts immediately.

We’ve shown you that there is much to learn about trading. Hence, demo trading apps are indispensable to bring you up to speed. Besides, the losses are not real enough to affect your actual finances.

The best demo trading app introduces you to real market conditions. Hence, you can apply strategies when trading. These include the following:

- Day trading strategy: This approach requires active monitoring of trades within 24 hours. It involves buying and selling securities within 24 hours, capitalizing on the small price increments within the day. You need sufficient stock alerts to keep up with these daily trades.

- Swing trading strategy: This approach is ideal for short-term profits over a few days or a few weeks. It is less risky than day trading as it offers ample time to monitor your trades and end with a significant price swing. If you are in for quick profits, this is not the strategy for you.

- News trading strategy: Some apps mentioned on this page have extensive news coverage in different sectors. You can ride on that sentiment to invest in your portfolio. Buy stocks when the news indicates a favourable trend. Conversely, sell them when you notice a downward trend.

- Long-term strategy: This approach involves buying a holding for a long time. It might be challenging to do that on platforms that have an expiration date for their demo accounts. Confirm any expiration date before using this strategy.

You can apply other strategies you pick up from the training materials. Test them until you find the best one.

Best Demo Trading App - Conclusion

Demo trading is essential for all new traders. It provides the opportunity to learn about the market, analytical tools, and features to optimize trading decisions. Additionally, you will understand the emotional roller coaster that comes with online trading.

The best demo trading app will provide startup virtual capital for you. Use it to explore the markets and trading tools. Also, back up your trades with vibrant training materials from the learning or education center.

References

- https://www.bloomberg.com/news/articles/2022-12-09/retail-traders-lose-350-billion-in-brutal-year-for-taking-risks

- https://www.wsj.com/graphics/history-of-trading/

- https://www.ftc.gov/news-events/news/press-releases/2023/02/new-ftc-data-show-consumers-reported-losing-nearly-88-billion-scams-2022

- https://www.statista.com/topics/9918/cyber-crime-and-the-financial-industry-in-the-united-states/

- https://www.businessofapps.com/data/stock-trading-app-market/

FAQs

Which is the best app for demo trading?

Many online brokers offer demo accounts for new traders. However, the best apps we recommend are eToro, Plus500, Oanda, and Forex.com.

Is demo trading really useful?

Yes, demo trading is essential for new traders to understand market conditions like upward trends and price swings. It also allows traders to explore and learn about tools and features that can help them make better decisions.

How can I practice trading for free?

Sign up with an online broker that supports demo trading. Receive the virtual funds and start practicing on the demo account.

How to do demo stock trading?

Sign up with the online broker to receive the virtual deposit. Open the instrument list and click stocks to see the available options.

Jeremiah Awogboro

View all posts by Jeremiah AwogboroJeremiah Awogboro is an experienced content writer with over 8 years of experience. He has a qualified MBChB degree and a keen interest in the stock market and the finance industry. His background in the industry has provided him with valuable experience in this field. Awogboro is dedicated to assisting and reaching out to as many people as possible through his writing. In his spare time, he enjoys music, football, traveling, and reading.

stockapps.com has no intention that any of the information it provides is used for illegal purposes. It is your own personal responsibility to make sure that all age and other relevant requirements are adhered to before registering with a trading, investing or betting operator. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice.By continuing to use this website you agree to our terms and conditions and privacy policy.

Trading is risky and you might lose part, or all your capital invested. Information provided is for informational and educational purposes only and does not represent any type of financial advice and/or investment recommendation.

Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers.

© stockapps.com All Rights Reserved 2026

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up