FXCM App Review 2024 – Fees, Features, Pros & Cons Revealed

With the increasing usage of smartphone devices and intelligent applications, mobile trading apps have emerged, providing the average joe trader access to the markets without the hassle of learning sophisticated and complex trading platforms. One trading app that’s especially popular is FXCM, an FCA regulated desktop and mobile trading app that gives traders access to share CFDs, commodities, indices, cryptocurrencies, and FX currency pairs.

In this review, we’ll cover everything you need to know about FXCM trading app. We will take a look at the broker’s regulation, features, fees, markets and products, pros and cons, and more.

-

-

What is FXCM?

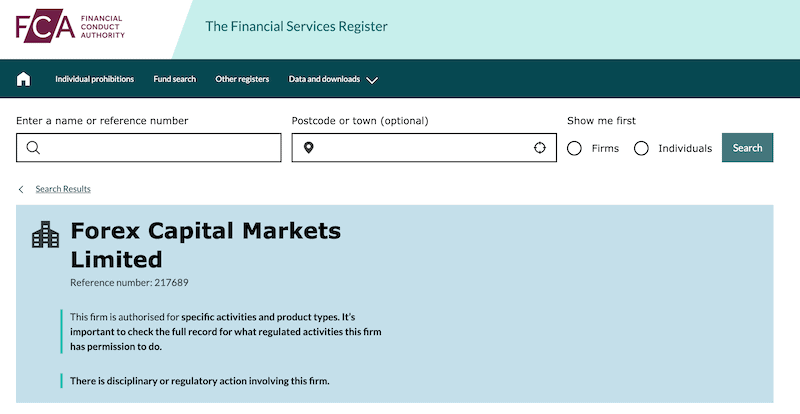

Founded in 1999, Forex Capital Markets (FXCM) is one of the oldest and most well-established brokerage firms in the industry. The company is located at 20 Gresham Street, 4th Floor, London, United Kingdom and holds licenses from top tier regulators including the Financial Conduct Authority under registration number 217689.

FXCM offers clients the ability to trade the foreign exchange markets as well as CFDs on various markets. This broker is very popular among traders as it offers a range of top trading platforms, trading tools, and extremely competitive trading costs and spreads. FXCM was originally designed to answer the needs of traders that are looking for fast execution, minimum slippage and tight spreads. On top of its desktop and web-based platforms, FXCM also provides a selection of mobile trading apps that include the MetaTrader4, the Trading Station app, and plenty of plugins for mobile application.

Though FXCM is also suited for beginner investors, its powerful connectivity and the integration with top liquidity providers make it one of the best brokers for active and experienced traders and those who are looking for robust trading platforms and tools.

What Can You Trade on the FXCM Bank App?

Our FXCM app review reveals that this app hosts a great selection of CFD shares from top stock exchanges around the world, though you’ll have to contact the support team if you want to get access to share trading. Overall, the Trading Station platform lets you trade on a wide range of FX currency pairs, metals (gold silver, and copper,) grains, energy (US and UK oil), and bonds.

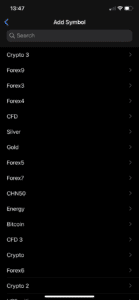

Another way is to trade via the FXCM MetaTrader4 mobile app. On this platform, you will be able to trade on a huge selection of CFDs (contracts for difference) that include cryptocurrencies, crypto baskets, US stock baskets, forex baskets, commodities, indices CFDs, and more.

FXCM Account Types

FXCM offers two account types, the Standard account, and the Active Trader account. Additionally, you can start trading on a demo account for practice. The key difference between the two accounts – The Standard, and the Active Trader account – is that the Active Trader account was designed for traders who actively trade the markets and as such, they must reach a certain trading volume. If they do so, they are entitled to many benefits that include the Active Trader special pricing, dedicated support, API trading, market depth functionality on the Trading Station platform, and custom solutions.

Bear in mind that the Active Trader account is available for clients that deposit a minimum of £25,000 while the minimum deposit requirement for the Standard account is just £300.

FXCM Fees & Commissions

FXCM has two pricing models for forex and CFD trading, one for the Standard account and the second for the Active Trader account. When trading on the Standard account, FXCM allows you to buy and sell currency pairs and CFDs without paying any commissions. On this trading account, the EUR/USD spread is listed at 1.3 pips, which is slightly above the average in the industry but is still very competitive. Active Traders that choose to trade on the ActiveTrader account will receive a spread 0.2 pips on the EUR/USD, but also a $25 commission per 10 standard lots.

Non-Trading Fees

When it comes to financing fees, our FXCM review found that this app does not charge any deposit and withdrawal fees nor account management fees. However, it does charge an inactivity fee of £50 per year after one year of inactivity.

FXCM App User Experience

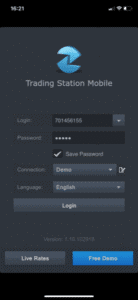

As we mentioned previously, FXCM offers two mobile trading apps. If you are a newbie investor, you will find the Trading Station especially easy to use. The Trading Station application is simple and was specially designed for beginner traders who are looking for simplicity. This ensures that the learning curve is shortened for newcomers and you’ll most likely find yourself using it without any problem.

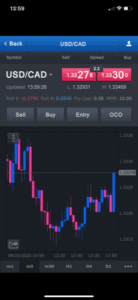

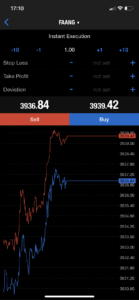

The app is equipped with in-build basic charting package and some of the most basic features for trading that a trader would need. Once you enter the application, you’ll see a screen with instruments quotes. If you want to analyse the instrument or place an order, click on the instrument and you’ll be transferred to the instrument page, as you can see in the image below.

On the other hand, the MetaTrader4 – though it is not that complicated- is more suitable for active day traders that use technical analysis and place many orders in the market.

FXCM Trading Tools and Features

In this section of our FXCM app review, we are going to discuss some of the key tools and features available on the FXCM trading mobile apps.

ZuluTrade

FXCM offers its users the ZuluTrade, which is one of the largest social trading platforms in the world and is available on desktop and mobile apps. Essentially, the ZuluTrade allows traders to copy the trades of experienced traders in the forex and CFD market and also interact with other members of the community. You should note, however, that you can only use ZuluTrade on the Trading Station account.

Stock Baskets

Another great tool that FXCM offers is Stock Baskets. These allow you to speculate on the performance of a certain sector that contains a number of individual stocks. By holding a basket of stocks, you can reduce your exposure to one individual stock and diversify your portfolio.

At the time of writing, FXCM supports the following stock baskets on its mobile app: FAANG (Facebook, Amazon, Apple, Netflix, and Alphabet), Biotech, Cannabis, eSports & Gaming, China Tech, and China eCommerce.

FXCM App Education, Research and Analysis

FXCM has a dedicated education section for beginner traders as well as a research centre for active traders. On the FXCM website, you’ll get access to an economic calendar, market news, trading signals, market scanner, and daily technical levels newsletter service. However, these educational and research features are not available through any of the mobile apps, which means that you’ll have to find other sources of news when trading from your mobile phone or enter the FXCM web platform.

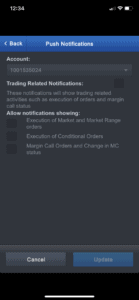

But even though you’ll not get access to market news and research tools on the Trading Station app, you can use the notification service that sends a push notification to your smartphone when trading related activity has been made.

If you choose the MT4 platform, you’ll get access to a variety of its built-in charting tools with advanced order types. All in all, there’s a lot of room for improvement in terms of what FXCM offers on its mobile apps and both mobile apps are far more suitable for active trading for experienced investors.

FXCM App Bonus

Our FXCM app review found that it offers a welcome bonus of $20 when opening an account with at least $50.

FXCM Demo Account

Much like the majority of forex and CFD brokers, FXCM gives you access to a demo trading account with £50,000 of virtual money. This is available on both trading platforms offered by FXCM – the TradingStation or the MetaTrader 4. If you are a beginner in the trading world, we advise you to explore both platforms and see which fits your needs. before you start trading the live markets.

While the TradingStation is more user friendly and intuitive for beginners, the MetaTrader is one of the best platforms out there for professional traders as it comes with an advanced charting package and an enormous selection of built-in plugins.

Payments on the FXCM Stock App

Our FXCM review found that it currently supports the following payment methods:

- Debit/Credit card

- EFT/Bank Wire

- Skrill

- Neteller

- Klarna

- Rapid Transfer

Take note that if you wish to fund your accounts via the FXCM Trading Station Mobile app, you have to use a Debit or Credit Card as a payment method.

FXCM Minimum Deposit

The minimum deposit at Forex Capital Markets (FXCM) for the Standard Account is £300. Traders who want to start trading on the ActiveTrader must meet a minimum requirement of £25,000.

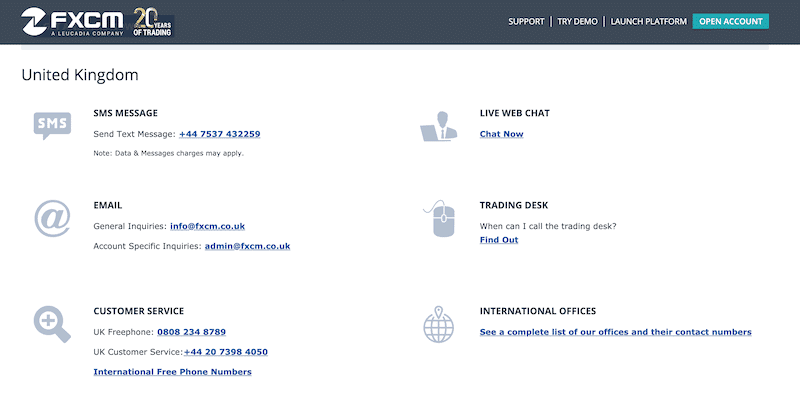

FXCM Contact and Customer Service

As a well-established broker, FXCM efforts to provide responsive customer service to its clients. As such, you can contact the support team 24/7 via SMS message, Live Web Chat, email, and phone. As for phone support, FXCM offers international freephone numbers in 42 countries.

With that in mind, users cannot contact the support team via mobile trading apps, which is somewhat disappointing.

Is FXCM Safe?

FXCM has been around since 1999 and is considered one of the most reliable and well-reputed CFD and forex trading apps in the industry. In the UK, Forex Capital Markets Limited is regulated by the Financial Conduct Authority (FCA), which means the broker must meet strict financial and capital adequacy requirements and submit financial reports to regulators.

On top of that, clients’ funds are held in segregated accounts and the broker’s users have the right to compensation of up to £85,000 by the Financial Services Compensation Scheme (FSCS).

How to Use the FXCM App

If you want to get started trading at FXCM, we’ll walk you through the process of signing up for a trading account, installing the app, and placing your first order.

Step 1: Download and Install the FXCM Mobile AppThe first thing you need to do is find the FXCM app and download it to your mobile phone. The Trading Station mobile app is the default platform for most of FXCM’s users and the process of installing the platform is very simple – all you need to do is to search for ‘FXCM’ on Apple Store or Google Play and download it to your mobile device.

As a side note, if you prefer trading on the popular MT4, you should simply download the MetaTrader app from Google or Apple stores and login with the credentials given to you by FXCM.

Step 2: Sign Up for A Trading AccountNext, you will be asked to open an online trading account. FXCM does not enable users to complete the registration process directly from the mobile so you’ll have to visit the broker’s site and click on the ‘Open Account’ button. You will then be channeled to a secure server to complete your online application. On this step, you’ll be asked to enter the following information:

- Full Name

- Country of Residence

- Home Address

- Date of Birth

- National Tax Number (e.g. social security number)

- Contact Details

- Username and Password

As FXCM is an FCA regulated firm, you’ll also have to verify your identity by uploading a government-issued photo ID and proof of residence.

Take note that FXCM allows you to test the platform directly from your mobile phone as soon as you download it.

Step 3: Deposit FundsOnce you are ready to start trading the live markets, you are required to make a deposit. As we mentioned previously, FXCM maintains a minimum deposit requirement of £300 for UK investors. This can be done directly from the mobile app as well as from the MyFXCM client portal.

Step 4: Trade Stocks//ETFs/ US BasketsAs soon as you have added funds to your FXCM stock trading account, you can place your first order. For this demonstration, we’ll show you how to place an order on the FXCM MT4 share dealing account. To start, select one of the available products on the list that you wish to trade. As per the below, we are looking to invest in the FAANG basket. For those unaware, the FAANG basket refers to Facebook, Amazon, Apple, Netflix, and Google (Alphabet).

Next, you will be transferred to the instrument order page where you’ll need to place an order. If you wish to buy the share/ETF/basket, click on the ‘Buy’ button. Whenever you want to view your position and monitor it, navigate to the Trade screen.

FXCM Stock App Pros & Cons

Below you will find an overview of our FXCM stock app findings.

Pros

- Offers two mobile trading apps – the TradingStation and the MetaTrader4

- Huge range os shares from Europe, North America, and Asia Pacific

- Suitable for beginners and professional traders

- Competitive spreads, particularly for active traders

- Social trading is available via ZuluTrade

- Connects investors with top liquidity providers

- Leverage of up to 400:1 for professional traders

Cons

- High minimum deposit requirement

- No education and research features on mobile apps

- Charges high inactivity fee

The Verdict

FXCM is an excellent solution for beginners and experienced traders alike. Unlike most brokerage firms in the industry that offer one mobile trading apps, FXCM has a huge advantage by offering two choices, the TradingStation, and the MetaTrader4. On top of that, you get commission-free and competitive spreads on a solid selection of currency pairs, commodities, shares, indices, cryptocurrencies, and ready-made baskets.

FAQs

Is FXCM available in the US?

No, FXCM is not available in the United States.

What stocks does FXCM offer?

FXCM offers a wide range of share from Europe, Asia Pacific, and North America. Some of the shares offered by FXCM include Netflix, Tesla, Google (Alphabet), Apple, Amazon, Facebook, Pfizer, etc.

Can you short-sell stocks on the FXCM?

Yes, you can. FXCM is a CFD broker, meaning you can buy and short sell any of the products available on the platform.

Is FXCM regulated?

Yes, FXCM is authorized and regulated by the Financial Conduct Authority in the United Kingdom. It is also regulated in Australia by the Australian Securities and Investments Commission (ASIC) and in South Africa by the Financial Sector Conduct Authority (FSCA).

Is FXCM available on iOS?

Yes, FXCM offers two mobile app – the TradingStation and MetaTrader4 – both are available on the App store and Google Play

Tom Chen

Tom Chen

Tom is an experienced financial analyst and a former grains derivatives day trader specializing in futures, commodities, forex, and cryptocurrency. He has over 10 years of experience in the Finance industry spanning across a day trader position at Futures First, and a web content editor and writer at FXEmpire. Tom has has also written for The Motley Fool, FX Empire, Yahoo Finance InsideBitcoins, and Learnbonds.View all posts by Tom Chenstockapps.com has no intention that any of the information it provides is used for illegal purposes. It is your own personal responsibility to make sure that all age and other relevant requirements are adhered to before registering with a trading, investing or betting operator. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice.By continuing to use this website you agree to our terms and conditions and privacy policy.

Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers.

© stockapps.com All Rights Reserved 2024

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.OkScroll Up