Best Stock Trading Signals for 2025

Every stock trader’s primary objective is surveying the market to generate passive income from principal profits or gratuities. Even though the road of investments is filled with risks, investors take the alternative of receiving top stock trading signals from service providers to reduce the risk of losses and improve the potential of profits.

However, to receive these services, investors should interest themselves in the best stock trading signals with the highest success rates compared to the general market standard and the impacts on the investor’s gross prospects.

These criteria and beyond will be reviewed in this thorough directory.

-

-

-

-

The Top Stock Trading Signals Providers Ranked

The stock trading signal provider society has been inspected by our experts, who have then narrowed down the list to eight service providers. Here are the best 8 stock signal providers in 2025 that traders can inspect:

- Altindex: For stock market investors interested in alternative data services, AltIndex is the best platform to receive such services. The platform bases its stock signal services on factors like social sentiments alongside data analytics, machine learning, and AI. Boasting a success rate of 75% since inception, AltIndex is a top service provider.

- Seeking Alpha: To receive significant data that can help make essential and credible predictions, investors require the services of a collective stock analytical platform like Seeking Alpha. It offers reputable stock tip services, especially for long-term investments.

- Trade Dots: Trade Dots is a straightforward signal service provider that provides trading signals on trading instruments, including stocks, to investors. This signal uses a variety of criteria, like moving averages with significant tactics, giving investors awareness of price movements.

- Stock Region: This American company publicizes top-notch analysis of the best-performing stocks and alternatives. It is a prospective desktop trading software that offers various trading tools for share traders.

- ShareMarketCap: This platform offers investors data on stocks and ETFs and updates the world’s financial markets. The platform goes further to provide AI-based ratings of stocks, and the performance of the stocks is measured with a system, the ShareMarketCap (SMC) score.

- Danelfin: Only a few stock signal trading service providers offer analyzed data that have been extracted from several indicators, including technical and social opinions. One of these service providers is Danelfin. It offers a top-class stocking trading signal using Artificial Intelligence.

- Alpha Picks: This stock trading signal platform is reputable for using data-based tactics that mix fundamental and quantitative analysis to predict the potential price change in stocks. The platform provides all these services on an annual subscription of $199.

- Kavout: This company is a capital management establishment that focuses its search on attracting investors with diverse investment strategies. This platform uses machine learning to acquire stock and market data understanding.

Reviewing the Best Stock Tips Services

Stock tips give investors valuable insights into navigating stocks and forecasting price movements to maximize profit. In this section, we review the best stock tips services out there—their features, pricing, pros, and cons.

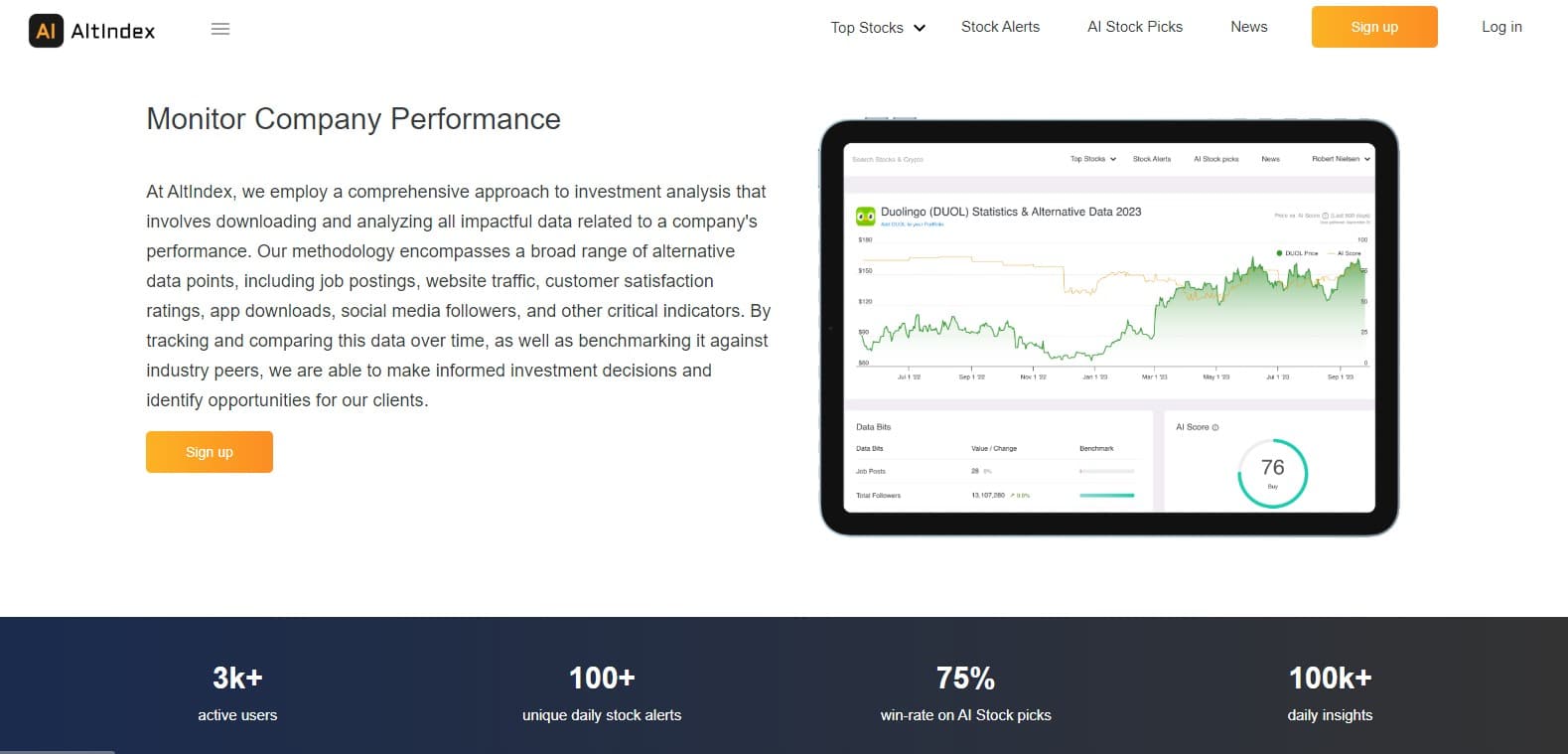

1. AltIndex – Overall Best Stock Trading Signal Based on Alternative Data

AltIndex is a high-ranking stock tips service that provides investors with timely insights on stocks, ETFs, and cryptocurrencies.

Proven to be one of the best alternative data services, it gathers data from job postings, social media following, market insights, and competition ranking of a target company and links it to its stock performance. This service also maximizes alternative data to broaden its focus on forecasting and prediction of stock price movements.

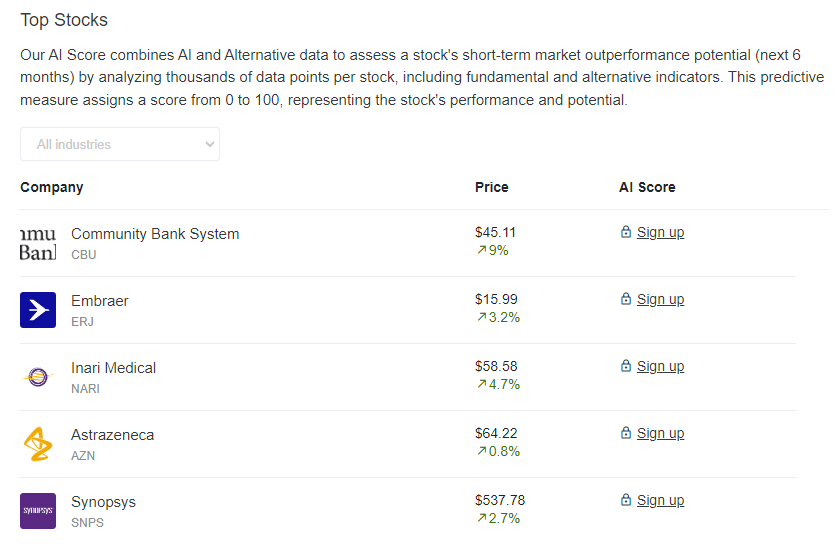

By leveraging AI, AltIndex can combine analysts’ opinions, chart patterns, conversations on social media such as Twitter and Reddit, recruitment, expansions, layoffs, and downsizes to score the investment potential of a particular company and its shares. Altindex uses a 1-100 score point system to rate a company’s stocks. Depending on the scores, it can inspire investors to either remain or exit their positions.

For instance, if the conversation about a stock on social media is positive, AltIndex is likely to rate that asset highly. But if a stock brokerage or a company with a publicly listed asset lays off several employees, Altindex is likely to rate the stock low.

Once AltIndex generates significant ratings on the investment potential of stocks, it sends out recommendations and stock alerts to users who have signed up and paid for its services. While investors may consider some of the best stock portfolio trackers, recommendations from AltIndex often go a long way.

Features of AltIndex

Below are some features of AltIndex that make it one of the best stock tips services.

- Alternative data insight: AltIndex uses alternative data obtained from unconventional sources. The platform offers investment-related information that isn’t available for everyone to use. It prioritizes artificial intelligence and machine learning to track conversations on social media, company news, recruitment, expansion, and layoffs to get valuable insights into the performance of a stock.

- AI Ranking Score: After tracking and analyzing alternative data, AltIndex has an AI ranking score that compares each of these data and scores them on a scale of 1 to 100. High numbers show the stock is likely to outperform.

- Stock Alerts: The stock trading signal frequently sends out stock alerts to its users, helping them to keep tabs on stock market signals as well as their investment portfolio. The alerts notify investors about movements in the stock market.

- Trending stocks: AltIndex has a feature that tracks trending stocks in the market. The platform uses overall sentiments and the number of mentions on WallStreetBets to compile its trending stock list.

- AI Stock Picks: AltIndex’s AI stock picks are an automated feature that provides investors with real-time stock buy and sell signals. Investors can choose from the best AI stock trading apps available in the industry.

Pricing of AltIndex

AltIndex has four different packages with variable costs. It has a free package, which is characterized by limited features. The table below highlights the packages and pricing of Altindex and the features available to each.

Package Price Dashboard Visit Stocks in Portfolio AI stock Picks Stock Alerts Stock Screeners Free Free 20 2 1 2 Limited Acess Starter $29/Month Unlimited 10 10 10 Full Access Pro $99/Month Unlimited 50 25 50 Full Access Enterprise Not Published Unlimited Unlimited Unlimited Unlimited Full Access Below are the pros and cons associated with using Altindex.

Pros

- Best stock tips service that uses alternative data in 2025.

- AltIndex tracks thousands of publicly listed stocks and securities.

- Investors can get first-mover insights based on sentiments and mentions on WallStreetBets.

- Unrestricted access to an AI stock picks service that gives investors impressive results.

- Investors get daily stock alerts sent to their emails.

Cons

- Investors need to pay a monthly fee, starting at $29 per month, to get unrestricted access to Altindex’s services.

- The monthly pricing plan is expensive and may not be sustainable for small retail investors.

- The AI stock-picking service doesn’t have a long track record.

2. Seeking Alpha – Vast Availability of Financial and Investment Resources

Founded in 2004, Seeking Alpha is a reputable financial and investment information source that is frequently quoted in the industry. The platform offers free access to its website, which contains vast financial articles that track the performance of stocks and other securities.

With contributors curating thousands of financial-related content, Seeking Alpha provides investors with vast materials that they can leverage to track the performance of stocks and their portfolio at large.

Investors who desire a vast wealth of knowledge on Seeking Alpha just need to sign up on the website. Let’s explore the features, pricing, pros, and cons of Seeking Alpha.

Features of Seeking Alpha

Seeking Alpha has vast features, and below are some of them:

- A short ideas section for short-selling insights.

- An author and performance rating section to score contributors based on their opinions and relevance to investors.

- The dividend grade rates companies based on the safety, growth, yield, and consistency of the dividends.

- The stock quant rating ranks stocks quantitatively using more than 100 metrics.

- The rating screener rates stocks based on their level of strength.

- Idea screeners are available to investors who need to filter stocks based on the opportunities they present for the long and short term.

Pricing of Seeking Alpha

The price options for Seeking Alpha vary depending on the package an investor desires. The table below highlights the pricing of Seeking Alpha based on the package and accessible features.

Package Price Accessible Features Basic Free Investors are mandated to sign up on the platform but will have limited access to the features Premium $29.99 per month $239 per year

Sign-up is mandatory, plus you have unlimited access to all available features PRO $69.99 per month $499.99 per year

Sign-up is mandatory, and investors get access to all features available in the basic and premium plans, plus more. It’s worth mentioning that Seeking Alpha has a 14-day free trial that comes with each subscription. Investors who sign up on the platform and choose either the premium or pro packages can access all features and cancel once the free trial is over.

Pros

- Seeking Alpha has a reputation for providing investment and financial information in the industry.

- The service tracks several stocks using multiple ratings and explanations for easier understanding.

- The service has different plans which investors can choose from based on their budget.

- The platform provides a wealth of knowledge that new and experienced investors can leverage based on their trading strategies.

- All packages on Seeking Alpha come with a 14-day free trial period.

Cons

- The service doesn’t provide investors with specific stock recommendations. Rather, investors have to make choices based on the ratings and information the platform provides.

- Options for refund aren’t available.

- The wealth of information on the platform can be overwhelming for new investors.

- Compared to Altindex, Seeking Alpha does not provide investors with AI stock picks for higher returns.

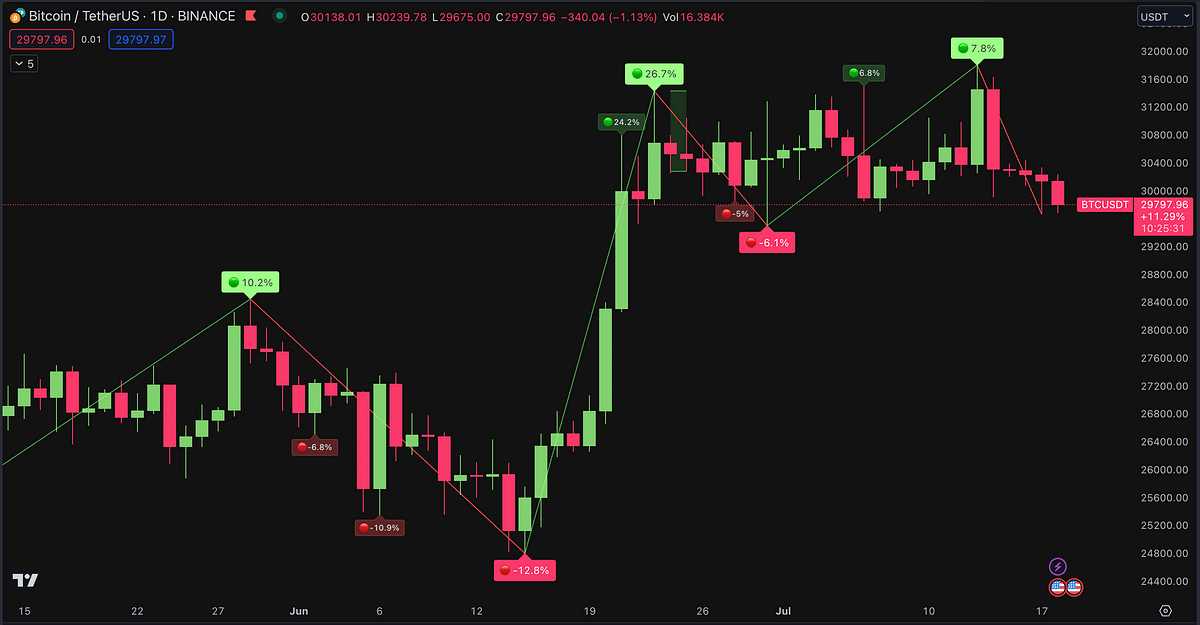

3. Trade Dots – Best for Reversal Signals

Trade Dots is a stock trading tips service that provides valuable suggestions to investors in the area of stocks, cryptocurrency, and other securities. The service’s software is compatible with TradingView, and investors can leverage it to track market reversals.

Trade Dots is a reliable service that helps short and long-term investors keep tabs on potential price actions in the market. The service works such that when a market is in a bearish or bullish state and a reversal is occurring, Trade Dots will signal investors to go long or short.

With the concept of candlesticks explained, understanding the methodology of TradeDots is pretty easy. A green flash indicates investors should go short, and red signals long. The Trade Dots TradingView signal has now been integrated into a Telegram bot. The bot automatically sends investors notifications when it is time to sell or buy stocks.

Trade Dots boasts an overall 94% success rate. Let’s explore the features, pricing, pros, and cons of Trade Dots.

Features of Trade Dots

- Trade Dots have pivot signals labeled red and green that signal reversal from a bearish and bullish state, respectively.

- It has breakout signals that indicate strong trends in price action, breaking the reversal.

- Telegram bot feature to receive notifications.

Pricing of Trade Dots

Trade Dots does not have a free or basic plan. Its subscription is not package-based but depends on the duration. Investors can always choose either the monthly, quarterly, or yearly plan to unlock access to all the platform’s services.

Here is a summary of the pricing:

- Monthly plan: $74.99

- Quarterly plan: $179.99

- Yearly plan: $629.916

Pros

- The service has unique tools that signal market reversals.

- Access to automated notifications through a Telegram bot.

- It has a 94% success rate.

- Supports vast classes of assets—stocks, cryptocurrencies, and other securities.

- Customer support is available all day.

- The indicator can be integrated with TradingView.

- A free trial period is available without the need to enter credit or debit card details.

Cons

- Sufficient data is not available to support performance claims.

- Investors need to be familiar with margin trading to maximize the potential of Trade Dots.

- A free or basic plan isn’t available.

4. Stock Region – Best Copy-Trading for U.S. Investors

Stock Region is a regional stock trading tips service that allows investors to use copy trading strategies to navigate the market. Backed by AI, Stock Region also offers regional events and market research. The platform offers investors over 30 AI-backed stock and options signals per day and a webinar crash course for new investors.

The services of the Stock Region are available to only investors based in the U.S. Luckily, investors can integrate this signal with any of the best copy trading apps in the market.

Features of Stock Region

- Has a public server that offers a daily watchlist, online community access, and delayed stock and option signals at no cost.

- Accurate signals powered by AI, quantitative short and long-term strategies, and developments in the market.

- All-day data collection using AI scanners to help investors and businesses identify long and short term trends and patterns.

Pricing of Stock Region

Stock Region has variable prices based on packages. The table below highlights the pricing of each package and available features and services.

Package Pricing Services Public server $0 Delayed stock signals, online community access, news, and daily watchlist. Basic server $10.99 per week Everything in the public server plus 20 stock signals per day, momentum signals,10% daily total returns, and more. Advanced server $499.99 per year Everything in the basic server plus 30 daily stock signals, a beginner webinar course, 15% annual total returns, and more. Pros

- Daily stock alerts, news, and watchlist.

- Beginner webinar crash course.

- Mobile app reservation and access.

- An AI-backed stock scanner is available.

- It has a free public server.

Cons

- Stock Region is only available to investors in the U.S.

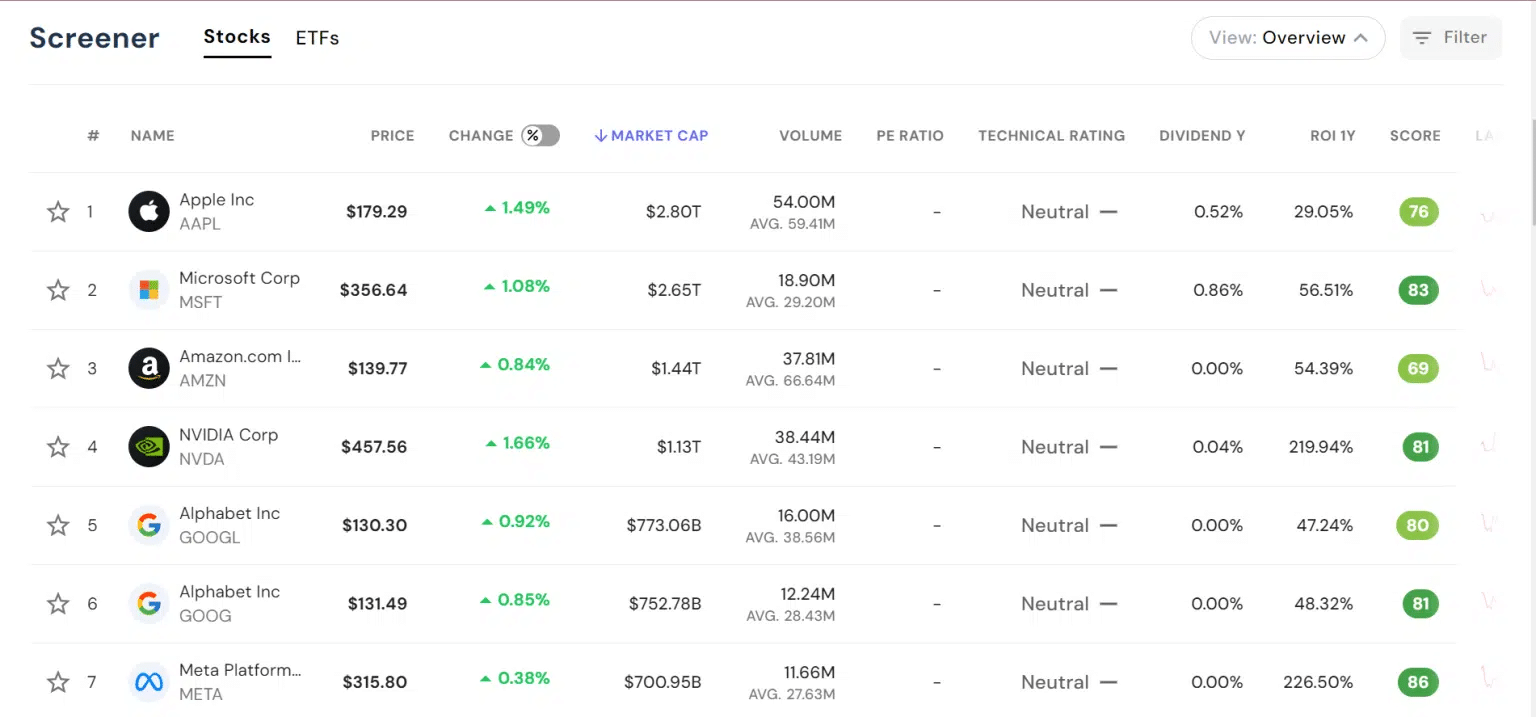

5. ShareMarketCap – Free SMC Scores and Technical Ratings

ShareMarketCap is a service that provides tips on navigating the stock market, covering over 11 global exchanges and 5,800 company stocks. The platform is one of the best stock portfolio trackers in the financial industry.

ShareMarketCap is powered by AI and it provides investors with real-time stock alerts. It also uses a range of metrics to score the performance of a stock on a scale of 1 to 100. The platform also provides an AI-powered price prediction which is updated daily to predict the monthly and weekly price of a stock seamlessly

Even though the platform supports investors with daily newsletters on visualizing stocks before buying them, it doesn’t exactly signal investors which stock to buy. This only means investors must be smart to make valuable decisions.

Pricing of ShareMarketCap

Surprisingly, ShareMarketCap is one of the best stock tips services that can be accessed for free. All services on the platform come at no cost.

Pros

- Free analysis of stocks and ETFs across 11 global exchanges.

- Uses AI to score stocks based on predetermined metrics and facilitate price prediction.

- Provides investors with customized notifications to manage their portfolio effectively.

- All services on ShareMarketCap can be easily accessed at no cost.

Cons

- The platform does not give investors stock-buy signals.

- The data generated by the platform is useful for short-term investors.

6. Danelfin – Recommendations Based on Explainable AI

As one of the best stock tips services in the market, Danelfin analyses data from several stocks and ETFs in the U.S. and Europe using explainable data. By leveraging hundreds of technical indicators, such as the MACD and Fibonacci retracement, the service gives investors a good time managing their portfolios.

After comparing several indicators, Danelfin can generate data based on an AI ranking score, giving investors a clue as to which stocks are likely to outperform. While Danelfin has a free package and a 14-day free trial period, investors who require unlimited reports and hints on stocks and ETFs like, “how to buy bitcoin ETF token“, can use the platform’s paid services. Since January 2017, Danelfin has grown by over 191%.

Danelfin has several features. Let’s go on to explore the pricing, pros, and cons.

Features of Danelfin

- The service analyzes hundreds of stocks and ETFs using explainable AI.

- It uses a stock rating score of 1 to 10, and those with scores of 10/10 have historically outperformed, with a possibility of 20% returns in the next quarter.

- Gives investors valuable insights by offering stock buy signals.

Pricing of Danelfin

Danelfin has a free basic plan. It also has plus and pro packages with variable costs. The table below simplifies the pricing and packaging of the Danelfin service and some features associated with each of them.

Package Pricing Accessible features Free $0 10 stocks to buy newsletter, top 20 stock ranking, top 2 trade ideas, and one portfolio Plus $17/month Everything in the basic plan plus unlimited stock reports, unlimited stock rankings, top 25 trade ideas, alpha signals, and more Pro $49/month Everything in the plus plan plus unlimited access to all available services, the ability to export stock CSV (scores and indicators), and overall, technical, fundamental, and sentiment signals. Pros

- Daily updates on what stocks or ETFs to buy or sell.

- The service and its score rating are backed by explainable AI.

- Danelfin boasts a 191% return on investment since January 2017.

- Covers investors in both the United States and Europe.

- A free trial period.

Cons

- Available to only investors in Europe and the U.S.

- The service fails to cover emerging markets.

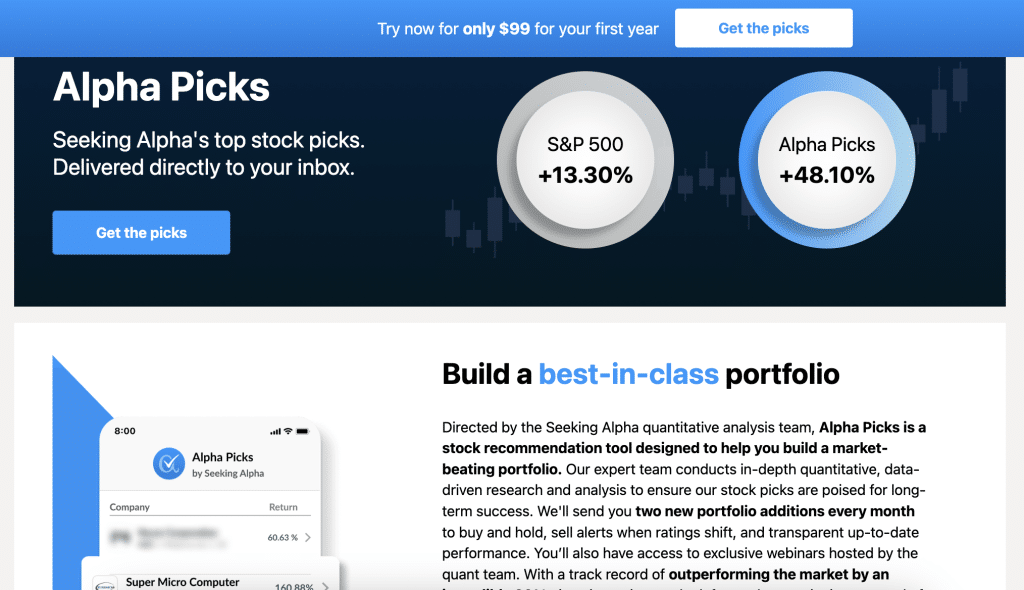

7. Alpha Picks – Quantitative Stock Picks for Investors

Alpha Picks is a unique stock tipping service commonly used by long-term investors using the buy-and-hold strategy. Seeking Alpha empowers this platform, and Steven Cress leads it.

The platform uses quantitative analysis and a range of metrics to identify the best stocks investors can buy and hold for a specific period.

Given that Alpha Picks carefully analyses metrics such as market capitalization and financial ratios, investors would get timely signals on which stocks to buy. The monthly stock tips and the ability to mirror the platform help investors navigate the market based on their long-term strategy.

Since its inception in 2010, Alpha Picks has showcased some impressive results, including outperforming the market benchmark by at least 20%.

Features of Alpha Picks

- It has effective signals that are helpful to buy and hold investors.

- A technology that tracks several metrics and indicators to generate valuable insights.

- Automated notifications: long-term investors receive two newsletters monthly.

Pricing of Alpha Picks

The pricing schedule of Alpha Picks is quite different from other services we’ve explored above. The service charges $99 for the first year and $199 from the second year onward.

Pros

- Annual investment returns of 20% since 2019.

- Charges a $99 yearly subscription fee, that is, around $8.25 per month.

- Ideal for long-term investors who buy and hold stocks to earn passively.

- Being backed by Seeking Alpha, Alpha Picks will benefit from the reputation of the former.

Cons

- Monthly plans are not available on Alpha Picks.

- The average annual investment returns have not started.

8. Kavout – Systematic and Quantitative Equity Strategies Via AI

Kavout pioneers a cutting-edge artificial intelligence-driven investment tool and analysis platform, revolutionizing how investors, from novices to seasoned professionals, manage portfolios. Unlike traditional platforms, Kavout integrates AI, big data, and machine learning, providing unparalleled insights and informed decision-making capabilities.

Kavout’s research-backed equity signals, delivered as an automated data feed, cater to quantitative and systematic investment professionals, offering timely, cost-efficient, and validated investment strategies.

Kavout stands as a pioneering force, providing institutional clients and high-net-worth individuals, for $49 monthly, with powerful, AI-driven investment solutions for optimal portfolio management.

Features of Kavout

- It can create and track personalized stock watchlists with performance graphs and key metrics.

- Adopt renowned investment philosophies or customize your own screening rules for intelligent stock selection.

- An overview of top stock performers by industry or sector for strategic decision-making.

- Numerical ranking based on stock attributes and future performance for effective stock comparison.

- Monitor individual stock performance throughout the week with customizable sector and market cap selection

Pricing of Kavout

Kavout’s pricing model may pose challenges for smaller investors seeking clarity upfront. The platform appears tailored primarily for larger institutional clients and money managers, with just a $49 monthly subscription.

Although Kavout advertises services for retail investors, accessing transparent pricing details is a process that requires potential customers to select a specific service before obtaining any cost estimates.

Pros

- User-friendly platform layout that can explored easily

- Easy access to information

- Access to up-to-date market data, analysis and news

- Stress-free investment experience

Cons

- Complex information which might be a problem for beginner’s comprehension

- Excess articles without signification of importance

What are Stock Tips Services?

Stock tips are standard services rendered to investors with little or no time to observe the financial market or no experience in trading that could help them make a detailed investment decision. They are the systematic form of inspection by a stock analyst who aims to provide frequent recommendations about stock trading using a blend of artificial intelligence and machine learning to generate valuable data.

These tips are services given to investors by analysts and establishments called stock signal service providers. Although investors survey the market using the best stock analysis apps, the data collected from the apps might not be helpful for investors who cannot understand the details of the data. Stock tip service providers are the solution to this problem as they offer comprehensive information and signals to investors.

After collecting and analyzing data from the financial market, the tip service providers compile the data into reports that help investors stay updated on the market. The reports are created by experts in the financial market using metrics, software, and chart patterns. These services rendered by the service providers help investors minimize losses and maximize profits.

When investors select a stock tip service, several factors must be considered. Some of these include the success rate of the service provider, previous accomplishments concerning the market standard, and the availability of free sessions to test the alignment of the signals to the investor’s objectives.

Analysts who generate stock tips frequently make use of several tools and strategies to predict the market movements and the values of primary stocks. These service providers usually have a professional and experienced team of examiners who aim to help investors make decisions by generating and analyzing data.

How do Stock Tips Services Work?

The main mission of the stock tips services is to provide vital information to guide investors through the decision-making journey in stock trading. However, while aspiring to use these services, it is essential to understand how stocks work.

Stock Tips Services analyzes market data using indicators like chart patterns, artificial intelligence, machine learning, Fibonacci retracement, and trends. After the analysis, these data are organized into information and distributed to the subscribers as alerts or reports.

Stock signal services frequently make suggestions to investors, recommending the appropriate time to acquire or sell a particular stock, given the market’s movement. Several orthodox services use fundamental and practical analysis to obtain these data. However, the frequent use of advanced technological methods like Artificial Intelligence (AI) has promoted confident and comfortable investments.

Aside from the support of AI, several platforms use alternative data. This operation includes tracing metrics and indices which does not involve orthodox economic and practical analysis. Take AltIndex into consideration; it uses alternative data to monitor information like the internet community existence of a company, expansion, dismissals, and appointments, among several other methods to predict the price of stocks.

To receive the services of these stock tip organizations depends on the establishment. Some organizations offer free services, while others demand a fee before offering them to investors. Some services that require a fee provide free trials for a specific time before the regular subscription, while others don’t. In some organizations, there are different fees attached to the service rendered. All these subscriptions are dependent on the service firms.

How to Choose the Best Stock Tips Service

Choosing a stock tip service to use is no plain or straightforward task. There are various factors an investor needs to consider when reviewing each stock tip service rather than making a random choice. These are major factors to be considered by any investor:

-

Performance of the service provider

This is the most important factor that should be looked into by any investor. It is essential to know the success rate of the platform, how often the signals provided result in profits, and the past and present record of the platform compared to the market benchmark. The success rate can be inspected using the best stock market research and analysis software.

The platform must provide signals that can frequently help its investors outperform the market and records exceeding the market annual standard to be recognized as a reputable stock trading tips service provider.

-

Methods of Data Analysis

The uniqueness of a service provider is dependent on the methods used in generating data and giving suggestions. These suggestions reduce the rate investors invest based on groundless strategies like assumption. A well-analyzed strategy would help investors trade stocks with more confidence and fewer worries.

Consider AltIndex, which uses a blend of alternative data alongside AI to develop investment data for technological advancement and social community relations.

-

Duration and Frequency of the Tips

How long would a signal be useful? How often do these service providers distribute their signals? These are questions that an investor should have when inspecting a platform. There should be different tips for different market conditions because not every tip can function in all market conditions.

Investors need to assess the service providers based on the frequency at which they provide their subscribers with trading signals. Some service providers are more into long-term investment and hence might send trading signals a few times a month, while some are available for active investors who prefer daily investments.

-

Pricing and Value for Money

Another important factor in reviewing a stock tip service provider is pricing and value for money. What is the catch to enjoying the services offered by the tip providers? Some services provide completely free tips. However, the prominent ones who are confident and more successful require a subscription fee, either yearly or monthly, for their signals.

These subscriptions usually come in different package types, with each type offering a more advanced signal service than the previous one, as the fees also improve compared to the less advanced tips. Investors looking to use these services for a long time need to consider the cost of receiving these tips and the package that suits their goals.

Can You Really Make Money with Stock Tips?

The main objective of every investor trading stocks is to generate profits while minimizing the risks of the instrument. The function of stock tips is to help investors make detailed decisions on stock trading, which would affect their trading experiences positively, ensuring the investors increase the possibility of profit-making.

But to what extent do stock tips services help investors make money?

Stock tips services give investors insight to make the right investment decisions – how long to hold an asset, which stocks to buy, or sell? If an investor uses the recommendation of a stock tips service and makes a profit, it means the tip augmented the profitability of the asset and minimized potential losses.

Let’s explore how stock tips services help investors make money.

✅ Stock tips boost the earning speed and frequency of investors and minimize the potential for losses at the same time.

✅ Investors can make even more profits by following the best tips provided by experts. For instance, short-term traders can leverage the Trade Dots service to short stocks as soon as the indicator changes to green, a sign of a reversal from a bullish to a bearish state.

✅ Stock tips can recommend that investors buy particular shares at a lower price and prepare to sell them when the prices are much higher. Long-term investors often practice this strategy, but they get better directions with recommended stock tips.

How to Sign Up on AltIndex

Getting started with a stock alert service is pretty easy. One service that investors must leverage to make smarter decisions and maximize profit is AltIndex. But how can you sign up on AltIndex?

The steps below outline how users can get started with receiving stock alerts on AltIndex.

Step 1Visit the AltIndex website and click sign up on the top-right section of the page if you are using a desktop device. If you are using a mobile device, navigate to the middle of your screen, where you will find the signup link, and then click it.

Step 2To sign up, you can choose either to sign up using your Google account or, alternatively, enter your name, email address, and desired password. Ensure to set a strong password, which should be kept secure at all times. Ensure that you use your real name and email address for security and compliance purposes.

By signing up, you will agree to the terms and conditions of using AltIndex. Additionally, once on the platform, you can start building your portfolio and, consequently, selecting key indicators you want to receive alerts for, observing how they influence the stocks in your portfolio.

Step 3AltIndex comes with several subscription packages according to investors’ needs and desired features. The basic plan comes with limited features, which may be a turn-off for large-scale investors or those with diversified portfolios. The starter and pro plans come with 25 and 50 monthly stock alerts, respectively.

Best Stock Trading Signals – Conclusion

Stock trading creates an avenue for investors to earn passively. Stock trading, just like every investment, is characterized by certain risks that can cause an investor to lose funds. Several stock trading signals exist, and they empower investors to make worthwhile decisions and minimize losses.

AltIndex, based on our investigation and recommendation, ranks as the overall best stock trading signal with one of the best stock tips services in the industry. Its uniqueness comes from the use of alternative data and artificial intelligence in the generation of insightful stock data.

References

- https://www.cnbc.com/2020/04/09/what-happened-in-every-us-recession-since-the-great-depression.html

- https://www.finra.org/investors/insights/get-bench-look-benchmarks

- https://www.cnbc.com/2023/10/02/the-benchmark-for-small-cap-stocks-the-russell-2000-turned-negative-for-the-year.html

- https://www.londonstockexchange.com/indices/ftse-100

- https://corporatefinanceinstitute.com/resources/career-map/sell-side/capital-markets/stock-performance-benchmarking/

FAQs

Are stock trading signals available for seasoned traders?

Although, with their time and experience in the financial markets, seasoned traders have developed their own trading strategies, barely relying on signal service providers. However, these signals are made available for traders who are relatively new to investments and seasoned traders who might have lost connection to the recent progress of the market.

What is the best stock tips service provider?

After surveying the stock trading signal service providers available in the financial world, our experts have deduced that AltIndex is the best platform for providing the best service, with a top-notch success rate of 75% across all signals since its inception.

Are stock signals reliable?

The reliability of stock signals depends heavily on the service providers. The record and history of the service since its inception. Its performance, how often it outperforms the market, and its average annual return compared to the market benchmark. All these factors determine if the signal is reliable or not.

How are the stock trading signals received?

An investor who needs stock trading signals must first register with a preferred stock trading tips service provider who will distribute their stock recommendations to the investors through email, SMS, or any social platform, depending on the platform. Some services require a subscription fee before an investor can receive their signals.

Lucy Adegbe

View all posts by Lucy AdegbeLucy Adegbe is an accomplished personal finance, crypto, stock, and tech writer who has an extensive portfolio of over 200 articles, guides, and market insights.

Based in London and with over five years of experience, Lucy has built a reputation for providing clear explanations of complex financial and tech topics. Lucy has appeared on Investopedia, The Balance, Top10.com, and Black Woman Great.

stockapps.com has no intention that any of the information it provides is used for illegal purposes. It is your own personal responsibility to make sure that all age and other relevant requirements are adhered to before registering with a trading, investing or betting operator. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice.By continuing to use this website you agree to our terms and conditions and privacy policy.

Trading is risky and you might lose part, or all your capital invested. Information provided is for informational and educational purposes only and does not represent any type of financial advice and/or investment recommendation.

Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers.

© stockapps.com All Rights Reserved 2025

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.OkScroll Up