What Happens to Stocks in a Recession?

Recession is part of every country’s economic cycle. Unfortunately, when there is an economic recession, it negatively impacts every sector. From a personal standpoint, your purchasing power reduces during an economic downturn, making stock investments unlikely. The same applies to other stock investors during a stock market recession.

The good news is that a stock market crash recession is not entirely bad. During this period, you can find recession stocks to invest in for future gains. However, navigating a recession stock market is tricky. This guide explores what happens during a stock market recession and its impact on your investments.

-

-

Overview of Recessions and Their Impact on Stocks

Your capital is at risk.

Understanding the concept of recession is crucial before learning about investing in a down market or finding the best investments during a recession. What is an economic recession, and how does it relate to stock performance?

Defining Recessions and Economic Contractions

A recession is a substantial and temporary decline in a country’s economic and industrial activities. Usually, recessions last for a limited period, often a few months. However, in some cases, a recession can span across a couple of years.

If you’re familiar with the economic jargon, you must have seen people interchangeably using terminologies like recession and economic contractions. Though they go hand-in-hand, they are not exactly the same.

While economic recessions and contractions indicate a significant economic decline, a recession is much more severe than a contraction. A contraction is characterized by a short period of economic downturn, while a recession is a more extended period of economic contraction.

You can consider a recession a market downturn after the economy has reached its peak levels.

Historical Patterns of Stock Market Behavior During Recessions

Like other financial markets, the stock market is negatively impacted during a period of recession. Over the past recessions, a common trend in the stock market is that recessions came a few weeks after the market peaked.

Do you remember the Great Recession in 2008? At the time, the recession was the greatest globally, and it was the aftermath of the market correction after an overvaluation of the stock and real estate markets. After the recession hit, the prices of securities began to fall on stock trading apps, shedding about 55% from the market’s peak to trough.

Something similar happened in 2021 after COVID-19 was declared a pandemic. The announcement negatively influenced the stock market, as many investors panicked due to uncertainties. The free fall saw the S&P 500 index plummet due to the bearish behavior in the stock and cryptocurrency markets.

Ultimately, a stock market crash recession is usually preceded by a general economic contraction that affects production and other industrial activities.

Link Between Economic Indicators and Stock Performance

Economic indicators often serve as guides for investors in the financial markets. These statistical data, including consumer spending (purchasing power), unemployment rates, inflation, and gross domestic product (GDP), can help predict future trends in the stock market.

This is because these indicators affect investor behavior and decisions. For instance, if you realize that your country’s inflation rate is at an all-time high, you’ll likely avoid speculative investments, right? But with positive economic growth, you can invest more in the stock market to profit from potential price increases.

The Psychological Aspect of Investor Sentiment

One of the reasons the stock market takes a hit during economic downturns is that macroeconomic realities influence investor behavior. These broader financial behaviors determine the overall market sentiment, resulting in a recession in the stock market.

Fear and Uncertainty in the Market in a Recession

Fear and uncertainty are the worst combinations with the stock market’s volatility. Investors tend to panic when uncertain or confused about government policies, market potential, and a recession’s longevity.

During economic downturns, investors are usually pessimistic, causing an increase in the market’s fear and greed index. Excessive fear and lower greed cause lower stock prices because the market sentiment is bearish.

It’s important to note that even the fear of a recession is enough to fuel investor anxiety. The uncertainty causes traders to panic-sell their securities to avoid significant losses if a stock market recession happens. Even penny stockholders with securities below $5 trade their assets for money on penny stock apps.

Behavioral Finance Insights During Economic Downturns

You can use behavioral finance insights to navigate the tumultuous financial markets during a recession. Behavioral finance aims to determine whether the stock market downturns result from investors’ rational behaviors or reactions to sentiments and biases. This is because many investors make irrational decisions during this period.

In other words, using behavioral finance insights can help you understand how investors are really behaving instead of how they ought to behave under economic stress. A general notion from behavioral finance is that a stock can be undervalued or overvalued because of investors’ biases.

For instance, Investor A may believe that a stock will continue to increase in price because of its impressive price history. This is called the gambler’s fallacy because such an investor will only consider data backing their belief and ignore alternative insights.

Similarly, Investor B can find an experienced trader to copy on a copy trading app and blindly follow what they say instead of getting insights from the news and other sources. This is called herd behavior because the investor will believe their trader friend is infallible when on a winning streak.

As a result, studying behavioral economics is crucial because it helps you understand how other investors behave and how their actions connect to the broader market during economic downturns.

Impact of Investor Sentiment on Stock Prices

Investors’ sentiment or belief about a stock can impact its price. That is why it’s a crucial metric for understanding the broader market sentiment. For example, when you see a stock’s price not agreeing with its fundamental analysis, it’s because investors’ sentiment has altered its actual value. So, it is either undervalued or overvalued.

Investors may be bullish on the stock because of recent market activity, like new information or trading signals from famous traders. This results in a bullish investor sentiment that leaves it overvalued.

Analyzing investor sentiment alongside other metrics can help understand the market realities better and make informed decisions.

Defensive vs Cyclical Sectors in a Recession

Stock issuers or companies are broadly divided into defensive and cyclical sectors, based on their stability during economic downturns. How do defensive sectors or stocks differ from cyclical ones, and what does it mean when investing in a down market?

Understanding Defensive Sectors in Stock Market Recession

As the name suggests, defensive sectors in the stock market are industries with more financial and corporate stability during economic recessions. The sector’s stability is backed by its provision of essential goods and services that are constantly in demand regardless of the broader economic outlook.

For instance, players in the healthcare sector, including pharmaceutical companies and medical equipment producers, are always in demand. As a result, their stock values and earnings per share (EPS) are less volatile in a recession, making them suitable for long-term investments.

Cyclical Sectors and Their Sensitivity to Economic Cycles

Cyclical sectors include companies with relatively unstable operations during a recession. These companies are sensitive to economic indicators like inflation, regulation, and government policies. As a result, their stock prices are highly volatile, but they offer higher rewards.

Examples of companies in the cyclical sectors include manufacturers of non-durable goods like fashion items or services like travel and leisure. Such goods and services are in less demand when the economy is down.

Are you a short-term investor looking for the best recession stocks for instant gains during an economic downturn? You can consider cyclical stocks on the best day trading apps due to their significant price fluctuations.

Defensive Sector Cyclical Sector Have more stable stocks during a recession Have more volatile stocks during periods of economic downturn Have stable demand for their goods and services in a recession Have reduced demand for their goods and services during economic downturns Are less reactive to economic cycles Are hyperreactive to economic changes Impact of Consumer Discretionary and Staples Sectors

Products in the consumer sector are divided into discretionary and staple goods in a recession or a period of economic uncertainty.

The consumer staples sector includes companies producing goods or offering services that are always in demand. As a result, their growth is steady, and external economic factors do not affect them because consumers can’t do without them.

For instance, no matter the economic situation, you can’t do without food and beverages. That means stocks from staple manufacturers are relatively stable.

Conversely, the discretionary sector comprises businesses with products consumers can forgo during a recession. For example, you can do without new clothes and gadgets when you’re not financially buoyant. Since that’s true for the majority, the revenues of such companies decline during a recession, negatively impacting their stock values.

Discretionary Sector Staples Sector Offer optional consumer goods and services Offer essential consumer goods and services Characterized by a decline in demand during an economic recession Experience relatively stable demand during economic downturns The sector’s stock prices often plummet due to high volatility in a recession The industry’s stocks are less volatile during a stock market recession Safe-Haven Assets and Alternatives During an Economic Recession

Investing in a down market is possible because the best recession stocks offer potentially high gains. However, as a risk-averse investor, you may need alternative investment opportunities to hedge against market downturns and reduce losses.

Gold and Precious Metals as Safe-Haven Investments

Gold and precious metals like silver and platinum are popular alternatives to stock investing in a recession. This is because gold is a reputable store of value, and it’s relatively stable during a recession. Also, history shows increased demand for gold and other valuable metals after the previous stock market recessions. So, you can hedge against recession risks using gold and precious metals.

Interestingly, we have curated a list of the best commodity trading apps to find and invest in these assets.

Government Bonds and Fixed-Income Securities

Investing in bonds and other fixed-income securities is another way to protect your money during a stock market recession. Unlike stock investment options, these securities are less volatile, and their values increase during a recession because they are go-to alternatives.

Since bonds also have a history of outperforming stocks during market downturns, they are a safe haven for investors. However, it’s crucial to note that bonds are also volatile assets, and fixed-income securities carry default and interest rate risks.

Evaluating Cryptocurrencies as Potential Alternatives

Though cryptocurrencies also struggled during the most recent recession caused by the pandemic in 2021, they remain stock alternatives during an economic downturn. A downtrend in the stock market can increase the demand for cryptocurrencies.

For example, Bitcoin trading can surge across cryptocurrency exchanges, resulting in a price increase and a general surge in the broader crypto market. However, cryptocurrencies are also volatile, so ensure you research properly.

Your capital is at risk.

Defensive Investment Strategies in a Stock Market Recession

Taking a defensive approach to stock investing is crucial when the markets are not going in your favor. The best recession investment strategy includes investing in stocks from stable companies with good cash flow.

Focus on Dividend Stocks and Income-Generating Assets

Since you’re likely to lose money from the fall in stock prices during a recession, a viable way of offsetting the losses is by investing in dividend stocks. These income-generating stocks are usually from large-cap companies with decent payouts.

Emphasizing Quality and Stability in Stock Selection

Quality and stable stocks perform well during recessions because they are less reactive to economic cycles. As such, you should focus on investing in noncyclical stocks and securities from the staples industry. These stocks are less volatile than cyclical ones.

Importance of Diversification in Defensive Portfolios

Another defensive approach to managing risks in a recession stock market is building a diversified portfolio combining different securities. Doing so will help you balance risks and rewards, as you can offset losses from one stock with profits from another.

For instance, instead of investing in an individual stock, you can buy exchange-traded funds (ETFs). These funds combine different stocks across various sectors. So, you can opt for ETFs with shares from your preferred sector on ETF trading apps.

Opportunistic Approaches in a Stock Market Downturn

Stock market recessions are inevitable. They are the lows to the market highs. Building an approach to find opportunities during a stock market crash recession can help you profit hedge against market uncertainties during recessions.

Identifying Bargain Opportunities Amidst Market Volatility

You can consider bargain investing to navigate the market’s ups and downs during a recession. Investing in bargain stocks involves buying stocks at prices below their actual market values.

For instance, suppose Stock X is worth $10 per share before a recession, and its value drops to $2.5 per share during a recession. In that case, you can buy it at a low price and hold it until the markets bounce back, potentially profiting from its increased price.

Contrarian Investing Strategies During Recessions

Contrarian investing involves taking a direction opposite to the general market sentiment. For instance, buying stocks during periods of bearish market sentiment or selling when bullish is contrarian.

The investing strategy is suitable for long-term traders, as it may take some time before the market goes in your predicted direction.

Navigating the Challenges of Market Timing

Market timing is a common investment option among traders. It involves buying or selling a stock based on future price expectations instead of actual market realities. For instance, contrarian and bargain investing are popular market timing strategies. Though you can profit from market timing, it is highly risky because of market delays during recessions.

If the market fails to meet your expectations, you’ll lose money. So, leverage fundamental and technical analysis-based strategies and gauge the overall market sentiment to time your investment properly.

Risk Management and Portfolio Adjustments

Now that you know you can invest in the best stocks for recession to make profits, you may be tempted to jump into the market for the best recession stocks. However, efficient risk-management strategies are crucial for investing in a contracted market.

Setting Realistic Expectations for Portfolio Returns

One of the ways to manage risks associated with investing during a recession is by having realistic expectations of profits. Let your investment decisions align with detailed stock research and analysis. Also, understand that it may take some time before the markets recover for you to make profits. So, don’t approach investing in a down market with a get-rich-quick mindset.

Assessing and Adjusting Risk Tolerance

Market recessions allow investors to make quick gains from price volatility or long-term profits from relatively stable investments. Ensure your investment strategy aligns with your risk tolerance to avoid errors and losses. For instance, choose safe investment options with decent profit margins if you are risk-averse. Conversely, investors with a penchant for risk can opt for high-risk securities with potentially bigger margins.

The Role of Stop-Loss Orders and Exit Strategies

Finally, you can manage risks associated with investing during a recession by leveraging risk-management tools like the stop-loss to exit trades. The order lets you determine the price to buy or sell a stock – so a broker doesn’t exceed the limit if the asset’s price falls. You can also use a limit order to buy or sell a stock at a preferred or higher price instead of monitoring trades for hours.

Alternatively, you can enter speculative contracts like options trading to reduce risk exposure.

Central Bank Policies and Interest Rates

The central bank usually determines the macroeconomic factors affecting its country’s economy. Various central bank policies have positive or adverse effects on the stock market.

Role of Central Banks in Economic Stabilization

As the apex bank, the central bank is saddled with the responsibility of stabilizing a country’s economy. The entity makes monetary policies to manage economic fluctuations like inflation, maintain low unemployment rates, and achieve economic growth.

The most common way the central bank manages the economy is by controlling the amount of money in circulation. A healthy balance in its currency’s demand and supply will help stabilize and limit inflation.

Impact of Interest Rate Adjustments on Stock Markets

Another way the central bank controls currency supply is by increasing interest rates. To combat oversupply, central banks hike interest rates. Since there’s an indirect relationship between interest rates and money supply, higher interest rates reduce money supply.

During a period of higher rates, stock prices and earnings are negatively impacted because people have less money to spend or invest, and accessing loans is more difficult. As a result, investors opt for alternative options like bonds and commodities.

Quantitative Easing and its Effects on Equities

During economic downturns like inflation, the central bank may choose quantitative easing measures like currency devaluation to cut interest rates and increase money supply. With more money in circulation, inflation reduces and purchasing power increases.

With more value for money, investors enter the stock market for high-risk opportunities for significant returns. The increased interest ultimately drives up stock prices.

Similarly, stock companies can improve their bottom line because of low-interest debt servicing, causing a surge in their equity prices.

Fiscal Stimulus and Government Spending During a Recession

Every country faces economic downturns, but how can the government ease financial hardships during a recession?

Government Intervention to Boost Economic Activity

During a recession, governments can implement various fiscal policies to increase spending and boost economic activities. For instance, a country can introduce reduced tax rates to give citizens more disposable income for spending, saving, and investing.

The government can also increase its spending on stimulus programs, offering consumers more money to spend. With more cash in circulation, it can boost economic activities in the private sector.

Infrastructure Spending and its Influence on Certain Sectors

Government spending on infrastructure projects can also boost the economy during a recession. With more infrastructural projects like roads and bridges, unemployment rates are reduced, and there’s more money in circulation.

However, infrastructure projects take extensive periods to complete, so they may not have instant macroeconomic impacts.

Evaluating the Long-Term Effects of Fiscal Policies

Fiscal policies can be contractionary or expansionary. Contractionary policies strive to reduce the money in circulation through high interest rates. On the other hand, expansionary policies boost economic activities through reduced tax rates and increased government spending.

While both fiscal policies may immediately impact the macroeconomic realities, they differ in long-term effects. Over the long term, contractionary fiscal policies negatively impact a country’s gross domestic product (GDP) because of high unemployment rates and reduced purchasing power. However, it often leads to higher outputs in the future.

Conversely, expansionary fiscal policies result in inflation and devaluation. They also tend to achieve lower future outputs.

Your capital is at risk.

Best Recession Stocks to Buy

Below, we highlight some of the best defensive stocks to consider during a stock market recession. The best recession stocks are relatively stable and experience minimal losses during market downturns.

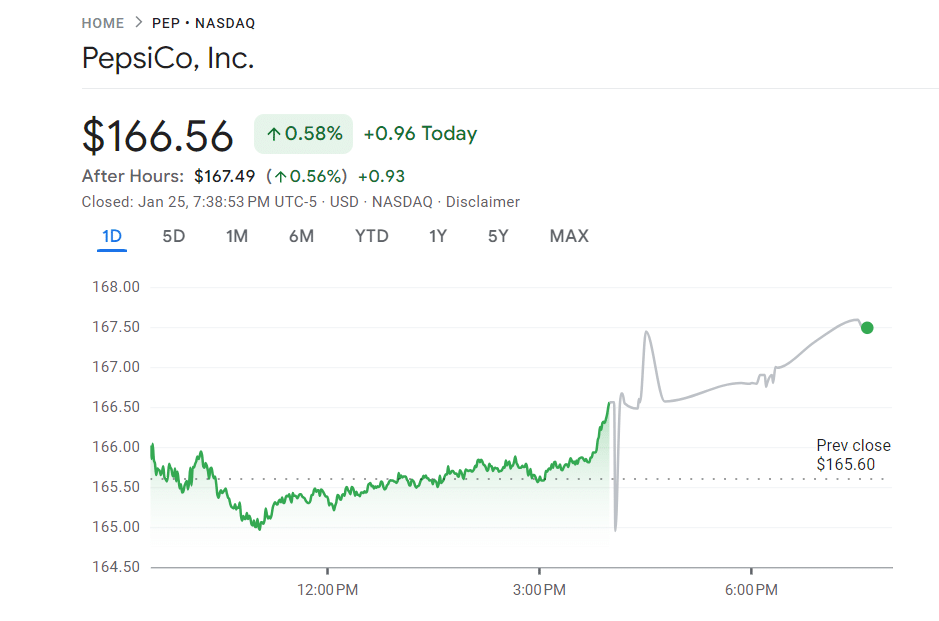

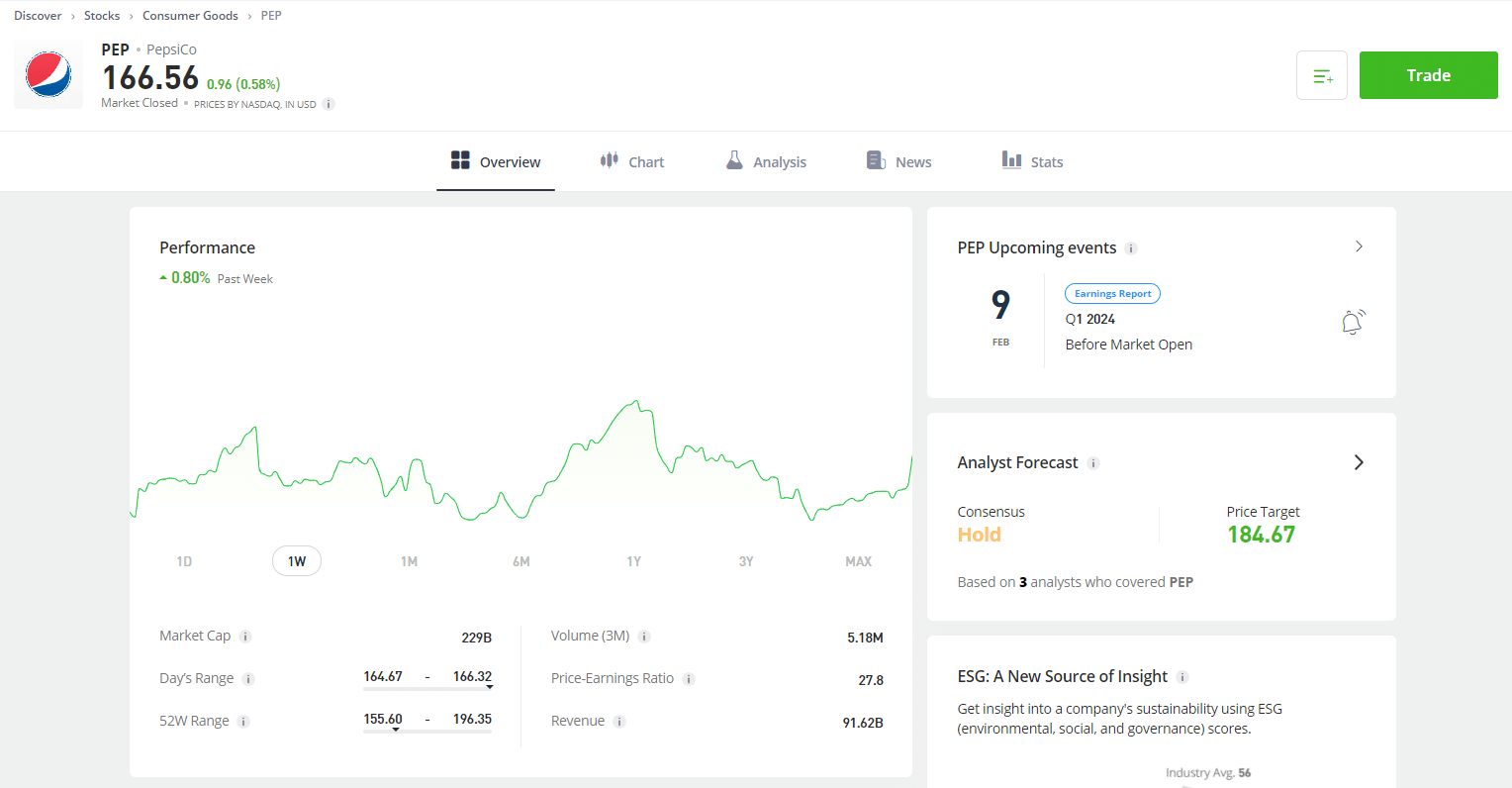

1. PepsiCo (PEP)

PepsiCo is a global entity in the food and beverage industry. The American company is famous for its products like Pepsi, Mirinda, Quaker Oats, and Aquafina Water. Pepsi’s product range and constant staple demands make its stock one of the best recession stocks to buy.

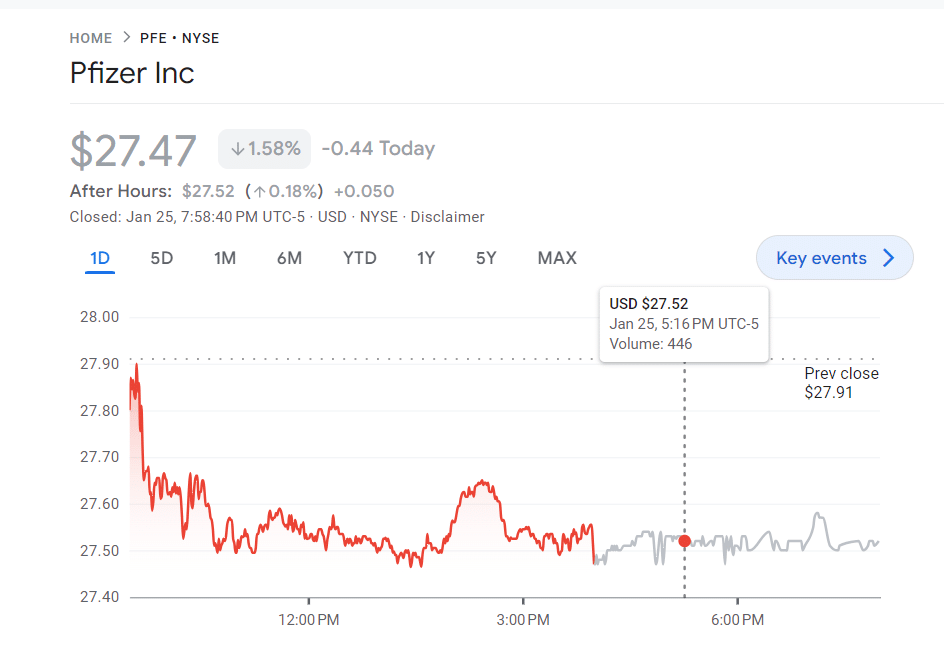

2. Pfizer (PFE)

Pfizer needs no introduction in the global biopharmaceutical industry. The company produces some of the world’s in-demand medicines and vaccines for various sicknesses and diseases. With hundreds of products worldwide, Pfizer is always in demand regardless of the economic realities. So, the company has one of the best stocks for recession.

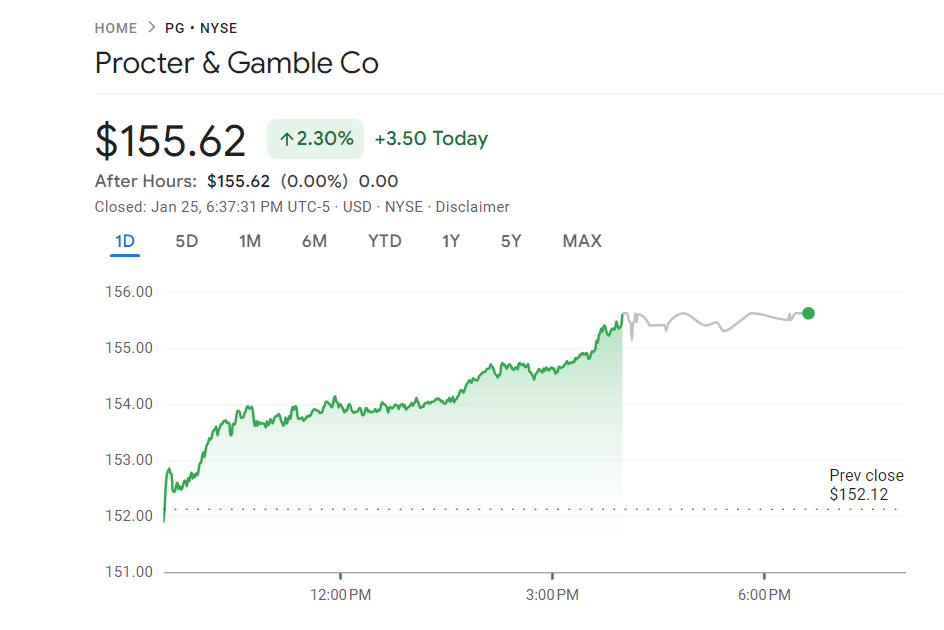

3. Procter & Gamble (PG)

Headquartered in Ohio, USA, Procter & Gamble is a global consumer goods company producing essential household items. The brand is famous for products like Pampers, Gillette, and Old Spice. These are major staples with constant demand during a recession, making its stock noncyclical.

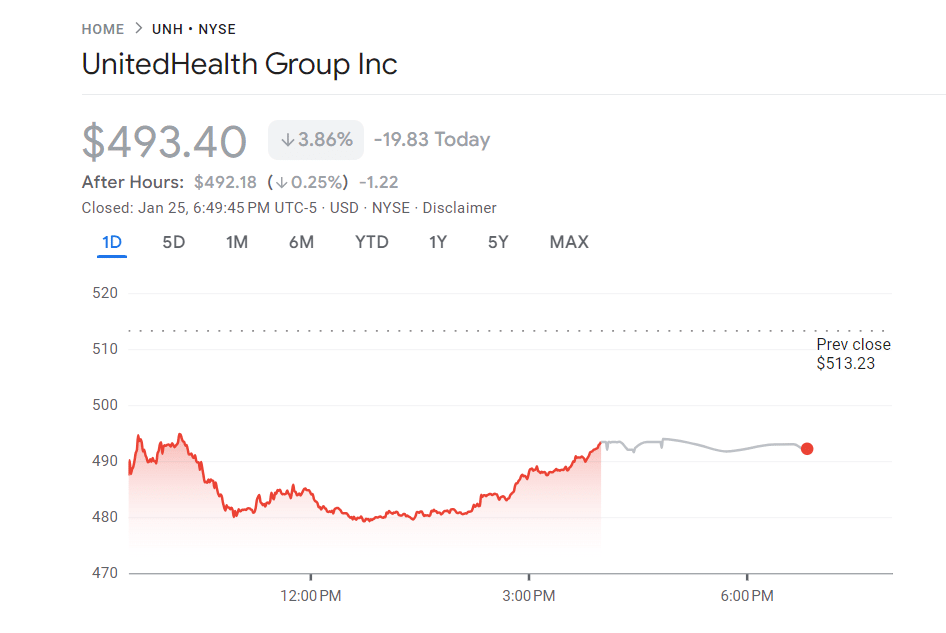

4. UnitedHealth Group (UNH)

UnitedHealth Group is a renowned American healthcare service provider in Minnesota, USA. The company has diverse products and services, including a chain of pharmaceutical suppliers in 36 locations across the country.

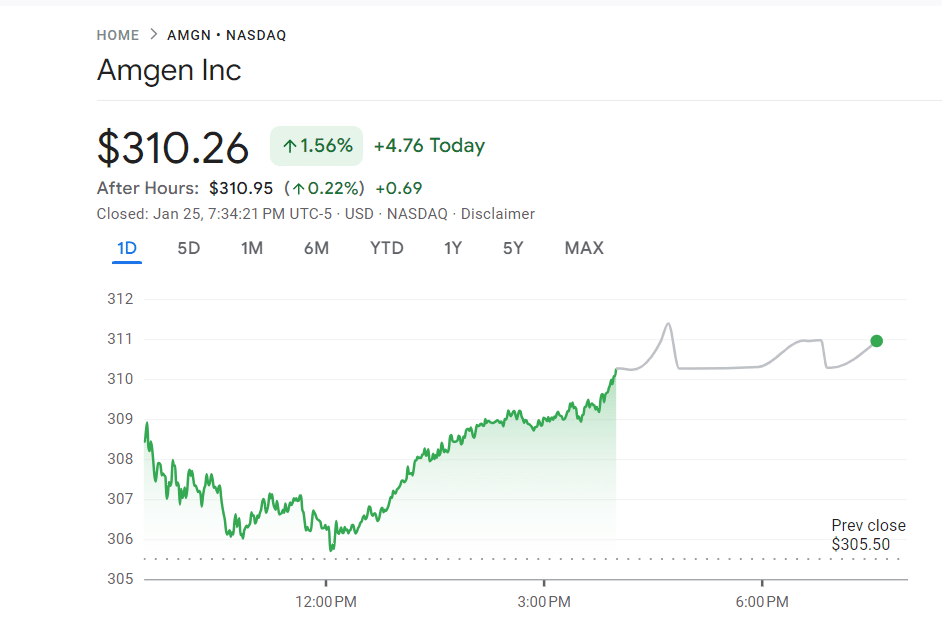

5. Amgen Inc. (AMGN)

Amgen Inc. is located in California, USA. The company is a top player in the biotechnology industry, with medicines for various illnesses, including severe asthma and other cardiovascular diseases. The firm’s strong presence in the essential sector and 100 countries makes its stock recession-proof.

Recap of Key Insights on Stocks During a Recession

- An economic recession negatively influences stock prices and returns.

- Stock prices usually plummet during periods of economic recessions.

- A stock market recession usually begins after the market attains its peak levels.

- Defensive stocks are good investment options during a stock market recession.

- Noncyclical stocks from consumer staples sectors are good recession investments.

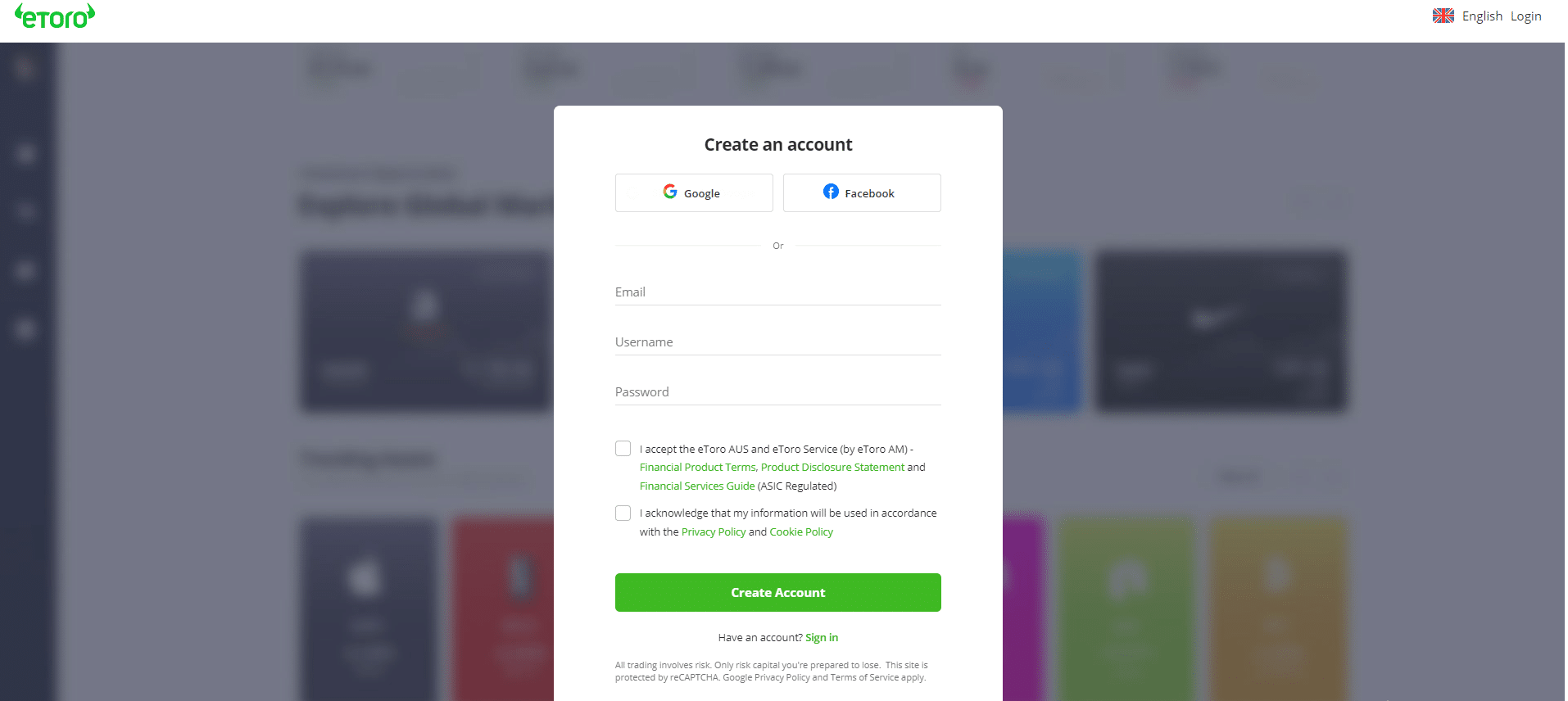

How to Trade Recession Stocks – eToro Complete Guide

Now that you understand stock market recession and the best recession stocks on the market, it’s time to invest. eToro is one of the best free stock apps on the market, with thousands of financial instruments to trade and invest in. Follow the steps below to invest in recession-proof stocks on eToro.

Step 1Create a new eToro Trading Account by visiting the broker’s website and completing the registration form. Enter information like your email address, a unique username, and create a new password. Click “Create Account” to complete the initial registration.

For illustration purpose only.

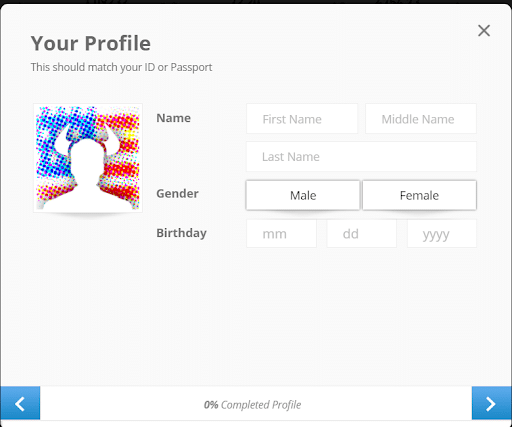

Step 2Submit ID documents to complete eToro’s identity verification (KYC) process.

For illustration purpose only.

Step 3Deposit funds using any available payment method, including ACH bank transfers, digital wallets, or cryptocurrencies.

Step 4Search for recession-proof stocks by entering the ticker symbol in the search box at the top of the screen.

For illustration purpose only.

Step 5Start trading recession stocks on eToro by clicking the green “Trade” button.

For illustration purpose only.

Note that eToro offers a paper trading feature for beginners to test the platform with paper money and build confidence before trading with their capital.

What Happens to Stocks in a Recession? – Conclusion

Stock prices can hit rock bottom during a stock market recession, leaving you with significant losses. This guide has explored how to prepare, find the best recession stocks, and make the best investments during a downturn.

eToro is our top recommended stockbroker for US investors. With zero-commission stock trading, over 4500 tradeable instruments, and a range of trading tools, you’re set on the right path to investing in a down market. However, remember that trading during a stock market recession is risky because of high market volatility.

Your capital is at risk.

References

- https://edition.cnn.com/markets/fear-and-greed

- https://en.wikipedia.org/wiki/Great_Recession

- https://www.etmoney.com/blog/gamblers-fallacy-what-is-it-and-how-to-avoid-it-while-investing/

- https://www.tsinetwork.ca/tag/bargain-stocks/#:~:text=and%20low%20debt.-,Bargain%20stocks%20are%20typically%20stocks%20trading%20at%20low%20prices%20that,cash%20flow%20and%20low%20debt.

- https://en.wikipedia.org/wiki/Contrarian_investing

FAQs

Do stocks do well in a recession

The stock market usually declines during a recession. Stock prices and earnings plummet, causing investment losses.

Should I sell my stocks before a recession?

Though selling your stocks during a stock market recession can be tempting, it may not be the best decision. Market recessions are temporary, so holding your investments during market lows may be better.

How much do stocks drop during a recession?

Stock prices drop significantly during recessions. The broad market decline can leave your portfolio in the red zone, even if you invest in the S&P 500 companies.

What stocks do worst in a recession?

Most stocks struggle during a market recession. However, cyclical stocks, especially equities from the discretionary sectors like energy and infrastructure, are the worst hit. This is because their companies are highly reactive to macroeconomic influences.

Where is the safest place to put your money during a recession?

No investment is entirely devoid of risks. However, alternative investment options you can consider during a stock market recession include gold (and other precious metals like silver and platinum), government bonds, fixed-income securities, and cryptocurrencies.

Adewunmi Adedayo

View all posts by Adewunmi AdedayoAdewunmi Adedayo is a seasoned finance and cryptocurrency writer with a passion for demystifying financial and crypto concepts to her readers. She has written several content for top websites such as IBtimes UK and The Nigerian Tribune. Adewunmi's style entails transforming technical topics into simple, captivating, and concise content for her audience.

VISIT ETOROYour capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.stockapps.com has no intention that any of the information it provides is used for illegal purposes. It is your own personal responsibility to make sure that all age and other relevant requirements are adhered to before registering with a trading, investing or betting operator. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice.By continuing to use this website you agree to our terms and conditions and privacy policy.

Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers.

© stockapps.com All Rights Reserved 2024

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.OkScroll Up