How to Buy Penny Stocks – An Educational Guide

One of the ways successful stock investors maximize market opportunities is by investing in budding companies with massive potential to be successful in the future. The stocks of such companies are usually referred to as penny stocks.

You’ve probably heard that adding penny stocks to your portfolio is suitable for short and long-term investing. However, what are penny stocks, and are they good for you? Read on as our detailed guide demystifies how to buy penny stocks, the best penny stocks to buy, and the highs and lows of penny stock investing for beginners.

-

-

Defining Penny Stocks

Before you learn how to invest in penny stocks, understanding what they are and how they work is crucial in determining if they are the right investments for you. So, what is a penny stock, and is it a good idea to buy penny stocks?

What are Penny Stocks and their Market Cap Range

A penny stock is a stock of a small-sized company that is valued below $5 per share in the stock market. As the name suggests, penny stocks are low-value stocks that offer investors with limited capital the chance to accrue many shares. When you invest in penny stocks, the goal is to profit from the company’s growth, which increases its stock price.

In other words, you can think of penny stocks as securities you can invest in without breaking the bank. The assets are available for trading on the best penny stocks apps, allowing you to find up-and-coming businesses to back before they go big.

Besides their market value, usually below $5 per share, you can find penny stocks by looking for companies with a market capitalization below $250 to $300 million. Stocks from such low-cap companies have the potential to surge high, making them ideal for short-term investors.

However, penny stocks are highly volatile and speculative. Your investments can take a hit if the company you acquire its penny stock fails to meet your expectations.

Regulatory Considerations for Penny Stocks

When it comes to penny stock trading, there are regulatory guidelines to have at the back of your mind. First, penny stocks are securities owned by small companies that don’t meet the exchange listing requirements.

Unlike major stock options, you won’t find most penny stocks on public exchanges like the New York Stock Exchange (NYSE) or NASDAQ. The US securities legislation mandates the trading of penny stocks via the over-the-counter (OTC) market.

The broker-dealer network comprises stock issuers, brokers, and dealers under the administration of the US Securities and Exchange Commission (SEC). The information about penny stock companies is not readily available like companies on public exchanges.

To protect customers, the SEC states that you must receive a statement from your broker detailing information about the penny stocks market. You must also acknowledge receipt by signing the statement before your first penny stock trading.

Similarly, the broker must wait at least two business days before buying penny stocks on your behalf.

What Are the Common Characteristics of Penny Stocks?

Now that you know what a penny stock is and its regulatory requirements, learn the key characteristics of the asset class for finding the best penny stocks to buy.

- The market price is generally below $5 per unit.

- Low liquidity and trading volumes.

- Penny stock issues are low-cap businesses.

- Penny stocks lack historical information.

- Most penny stocks are traded in the OTC market.

- They are high-risk investments offering high returns.

What Are the Risks and Rewards of Penny Stock Investing?

Every investment has its share of risks and rewards. As such, it’s essential that you understand the pros and cons of penny stock trading to determine if it is the best investment route for you.

High Volatility and Speculative Nature

Market volatility is the most significant downside of investing in any stock. However, penny stocks take it a notch higher. When you invest in penny stocks, your decision is highly speculative and can be impacted by price volatility. This is because penny stocks are low-volume securities with limited investors. As such, they are less liquid than major stock options, and their prices can fall to zero unexpectedly.

You can read our educational guide on how stocks work for more understanding of the risks of penny stock trading.

Potential for High Returns and Quick Gains

On the upside, you can make a lot of money by investing in penny stocks. This is also due to the asset’s volatility, which may result in sudden price surges. For instance, a penny stock can return 500x your initial investment if its issuing company experiences a massive upturn in its finances.

The higher the company’s profits and market value, the bigger your potential gains. So, if you’re a short-term investor, you can diversify across multiple penny stocks for quick gains.

Distinguishing Between Genuine Opportunities and Scams

Finding solid information on penny stock companies is challenging because their shares are not publicly available. Penny stock scammers exploit this loophole to defraud unsuspecting investors, especially beginners. Since many scams plague the penny stock market, you must take extra caution when investing. These include adequate research (DYOR) to understand the company you want to invest in thoroughly.

If you approach penny stock trading based on hype or market promotion, you may fall prey to scammers.

Genuine Penny Stocks Scam Penny Stocks Execute less marketing with no promises of returns Usually publicized by heavy marketing and promise of high returns Operate under the SEC’s supervision Are usually not regulated by the SEC Provide information about their financials and stock market activities Offer no information about their company’s activities and structure How to Buy Penny Stocks – Establishing a Solid Foundation

Before buying penny stocks, you must have a solid approach and strategy to help you make the most of your investments. Entering the penny stock market with no investment strategy can result in losing all your capital.

Understanding Your Risk Tolerance

Penny stocks are high-risk investments, making them best suited for traders with a substantial risk appetite. Before penny stock trading, ensure you understand your risk appetite and invest in securities that match your tolerance.

For instance, if you prefer high risk and returns, you can opt for low-cap stocks with high volatility. Conversely, if you’re a risk-averse investor, you may consider blue-chip stocks instead of penny stock options.

Building a Diversified Portfolio Approach in Penny Stocks Trading

Diversifying your portfolio is the easiest way to maximize your profits from penny stock investing. With a diversified investing approach, you can spread your capital across various stocks instead of allowing one security to determine your profitability. For instance, if you want to invest $500, you can combine different penny stocks worth $1 or less into your portfolio to balance risks and rewards.

You can find the best penny stocks to buy using free stock screeners to streamline your options. From there, you can choose which stocks align with your risk tolerance and investment goal.

Importance of Research and Education in Penny Stocks Investing

Continuous research and learning are crucial to your performance in the stock market. The market realities are not constant, so you must stay updated with market trends and other critical information to make informed decisions.

For example, you can sell a company’s penny stock to reduce losses after unfavorable news. Fundamental and technical analyses can also help you evaluate a penny stock before investing.

Not sure how to execute stock market research? You can read our guide on how to research stocks to begin

Choosing a Reliable Brokerage for Penny Stocks

When considering penny stock trading, the first thing to do is find a reputable penny stockbroker to facilitate your trades. Some regulated online stock brokerages for US investors include:

1. TD Ameritrade

You can trade penny stocks in the US via TD Ameritrade. With one account, the broker offers a powerful platform for investing in low-cap stocks on the OTC Bulletin Board (OTCBB) and the Pink Market. However, trading non-US listed stocks like penny stocks on TD Ameritrade attracts a $6.95 fee per trade. You can also leverage the broker’s copy trading platform to mirror successful traders.

2. Charles Schwab

You can buy and sell penny stocks on Charles Schwab via its standard stock trading accounts. The exchange lists stocks valued at less than $5 per share from the OTCBB and Pink Market for trading on the Charles Schwab website or its free stock trading app. There’s a $6.95 fee for trading OTC equities on Charles Schwab.

3. Robinhood

Robinhood is another stockbroker to consider when thinking of how to buy penny stocks in the United States. These shares are priced at $5 or less, making them ideal for investors with small accounts. Notably, the low-cap stocks on Robinhood are not from the OTCBB or pink sheets. They are only low-value securities within the penny stock price range.

The absence of social trading on Robinhood makes it better suited for experienced investors who can assemble portfolios without help. However, the broker offers commission-free trading.

Penny Stockbroker Fees TD Ameritrade $6.95 per trade Charles Schwab $6.95 trading commission Robinhood Commission-free Features to Look for in a Penny Stock Broker

Though we’ve highlighted some reputable US penny stockbrokers to consider when thinking of how to buy penny stocks, it’s crucial to know how to find the best options aligned with your needs. Apart from trading fees and commissions, the things to look out for include;

- The trading platform’s usability and feel

- Maintenance fee

- Inactivity fee

- Deposit and withdrawal fees

- Volume restriction

- Minimum deposit and account balance

- Short selling limitations

- The minimum brokerage per order charges

- Additional trading tools for stock market research and analysis

Fee Structures and Hidden Costs

Fees are the most important details to look out for in an online broker. Penny stock brokerages with low fees increase your profitability, while high charges eat into your overall gains.

For instance, you want to opt for penny stockbrokers with flat fees if you are an active investor trading penny stocks on the best day trading apps. The pegged fee has a reduced impact on your multiple investments, unlike paying trading commissions on a per-share basis.

Also, remember to trade with brokers that provide detailed information about their fee structures to avoid hidden fees or charges.

Accessibility and User Interface

Finally, you should only consider brokers with user-friendly trading platforms and tools. With simplified trading as their core offerings, such brokerages help you navigate the tumultuous penny stock market without hassles.

Common Mistakes to Avoid for Penny Stock Trading

Buying penny stocks goes beyond understanding the basics of what a penny stock is or finding the right brokerages to invest in your favorite penny stock options. Avoiding the common mistakes below will help you minimize risks and losses.

Chasing Hype and Pump-and-Dump Schemes in Penny Stocks Trading

Avoid buying penny stocks based on hype. More often than not, such hype comes from marketers who want to increase an asset’s price inorganically through pump-and-dump schemes. If you fall prey to such scams, you’ll end up buying penny stock at an overpriced value and find it difficult to sell at the same or a higher amount.

Overlooking Liquidity and Trading Volumes in Penny Stock Investing

An asset’s liquidity and trading volume determine its market stability. When investing in penny stocks, look for companies with considerable market cap and trading volume. Stocks with high liquidity and trading volumes are usually in demand and offer short-term gains. Investing in them can help you avoid price manipulation and unprofitable deals.

Failing to Set Realistic Expectations

Though penny stock investing offers potentially high gains, unrealistic expectations can ruin your investments. For instance, expecting a penny stock’s price to double in a few days is unrealistic. Also, hoping that a security’s price will continue increasing after a sudden surge is an unrealistic investment expectation.

Fundamental Analysis of Penny Stocks

Determining the best penny stocks to buy now requires adequate fundamental analysis to evaluate assets’ strengths and potential. You can identify fundamentally strong penny stocks using the tips below.

Evaluating Financial Statements and Ratios

As stated earlier, penny stocks don’t offer traders enough information. With limited information, how good can your investment journey be? You’ll agree that it will be extremely challenging.

Since penny stock issuers usually keep their financial information private, you can use fundamental analysis factors like financial statements and ratios to reduce risks and assess a company’s strengths.

Penny stock issuers with solid financial numbers and good cash flow across their income statements, balance sheets, and other financial records are worth investing in. Also, pay attention to the company’s ratios to determine its trends and potential earnings per share (EPS). These include its liquidity, interest coverage, performance, debt, and valuation ratios.

Assess the Management Team and Corporate Governance

You already know you must get insights into a company’s future and profitability before investing in its stocks, right? But how can you actually review a company’s structure to understand its corporate governance?

First, you want to answer questions related to the people on the firm’s board, the company’s transparency, shareholder rights, and operations strategies.

Why are these details important? They are crucial in determining a company’s current state and future potential. A company’s success and profitability also depend on the decisions of its major stakeholders. So, before you invest in a penny stock, strive to understand its company’s structure and decision-makers.

Analyze Market Trends and Market Potential

When you research the stock market, the goal is to understand industry trends and industry realities. With these details, you can find the best penny stocks to invest in. For instance, if the broader stock market invests heavily in a particular sector, you can follow the trend and find suitable stock options in that space. Similarly, a declined interest in specific stocks can help you decide against investing in them.

What Technical Analysis Strategies are Effective for Penny Stocks?

Like with other speculative investments, you can evaluate an asset before investing in it using a proper technical analysis. Such market analysis offers a more detailed approach to understanding the broader market sentiment. You can improve your penny stock trading journey using technical analysis if you get it right.

Leverage Chart Patterns and Trends

You already know by now that stock prices move up and down from time to time. Technical analysis tools like charts can help understand market trends and price movements. For instance, a candlestick chart can help you identify an uptrend or downtrend to determine the best opportunities to enter and exit the market.

Identify Support and Resistance Levels

Knowing a penny stock’s support and resistance levels can aid your price prediction and decision-making skills. Lower-low support and lower-high resistance levels indicate a downward trend, while higher-low support and higher-high resistance levels suggest an upward trend.

You can use their chart representations to identify favorable price points to execute trades.

Utilize Indicators and Oscillators

Besides charts and candlesticks, you can use technical indicators and oscillators to analyze a penny stock’s price movement, market trends, volatility, and other essential factors. The oscillator helps determine the highest-high and lowest-low prices at a particular time for more data-backed decisions.

Risk Management in Penny Stock Investments

Since penny stocks are highly volatile, adopting a cautious approach to penny stock investing is critical to being a successful investor. Some risk-management strategies to adopt when trading penny stocks include:

Set Stop-Loss Orders and Exit Strategies

Use stop-loss orders to automatically exit trades or close your position at a predetermined price. This will help you ensure you don’t incur losses if the stock’s price falls significantly. Similarly, the trade management skill will help ensure you keep your capital and profits, depending on the selected price.

Consider Diversification and Position Sizing

Another way you can minimize risks and losses from penny stock trading is by diversifying your assets and adopting an effective position-sizing strategy. A diversified portfolio helps you spread your capital across multiple investments to mitigate the risks of single trades. Conversely, you can manage risks with position sizing, which determines how much you want to invest in a trade at a specific period based on its risk level.

The general rule to position sizing is to ensure you commit at most 2% of your capital to a single trade.

Understanding and Accepting the Risks Involved

When buying penny stocks, you must come to terms with the fact that they carry inherent risks. Unfortunately, you can’t completely avoid these risks, but you can manage them. Adopt an efficient risk-management strategy to reduce your investment’s risk exposure. With efficient management, you can cut down on losses and make more money.

Best Penny Stocks to Buy

You are here because you want to know how to buy penny stocks and the best penny stocks to buy now. We review the top penny stocks below for investors’ consideration.

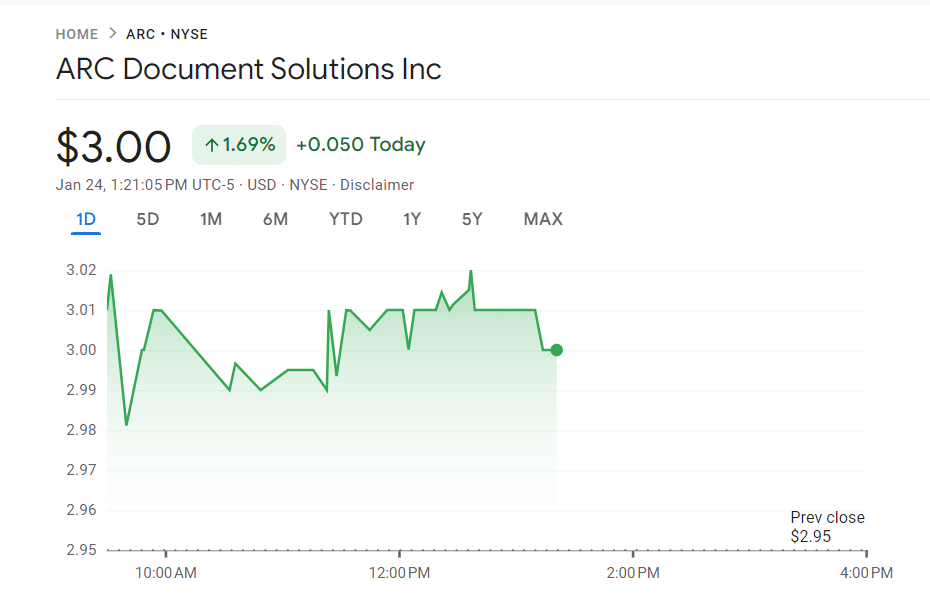

1. Arc Document Solutions (ARC)

Arc Document Solutions Inc is a printing company providing various sectors with color and digital printing services. With a market cap of $126.74 million and a trading price of $3.0 per share, the penny stock is a low-cost option for investors. The company’s share repurchase plan can result in its price appreciation over the next few years.

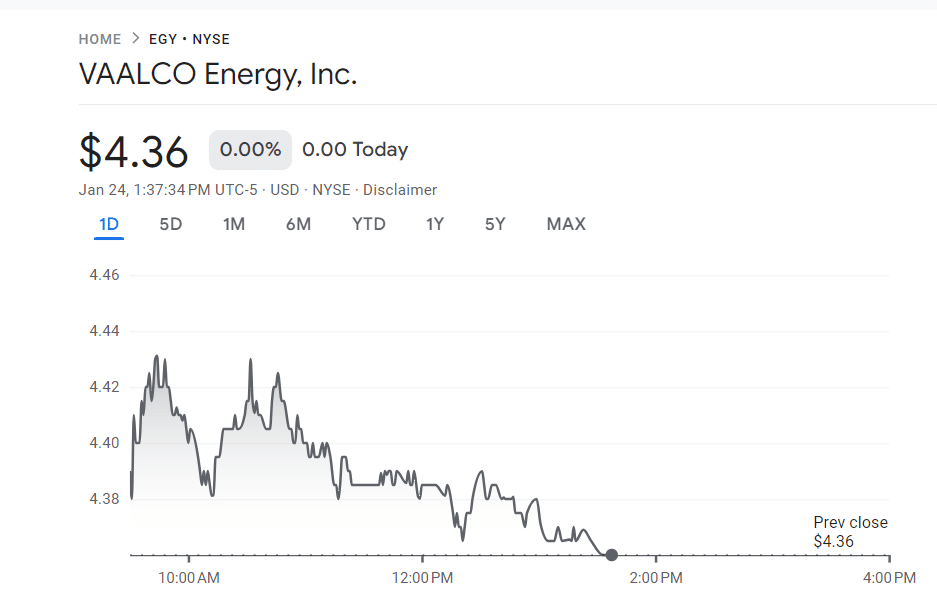

Vaalco Energy (EGY)

Vaalco Energy (EGY) is a player in the crude oil industry. The decline in crude oil prices has recently impacted the company’s stock value, allowing investors to acquire its penny stocks at a low price. With a trading price of $4.36 per share at press time, EGY has shown impressive green flashes and great potential.

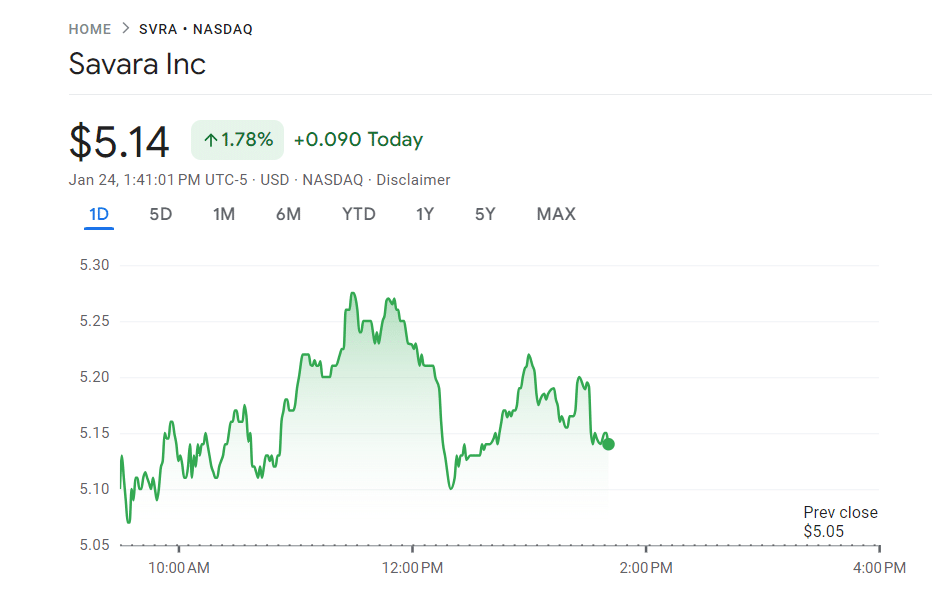

Savara (SVRA)

Savara (SVRA) is one of the top options to consider if you’re thinking of penny stock companies in the healthcare industry. The stock is trading at $5.14, with a YTD performance of over 12%, showing early signs of what you can expect this year. This is off the back of an impressive run in 2023 that saw it rated as one of the best breakthrough biopharmaceutical companies in the US.

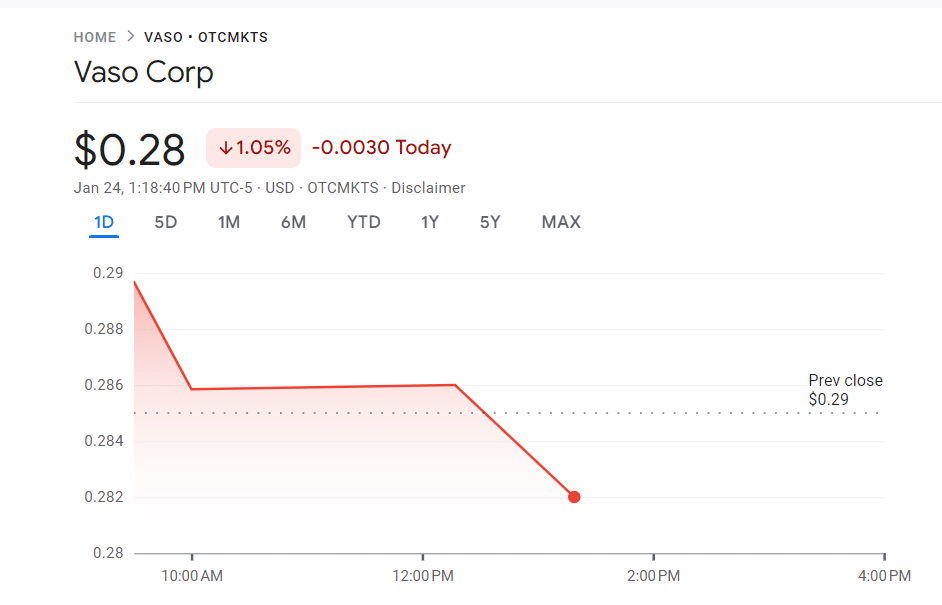

Vaso Corp (VASO)

Are you looking for penny stocks below $1 per share? For $0.28 per share, Vaso offers one of the cheapest stocks on the market. The healthcare equipment and information technology company also has a market cap of over $52 million, with a long-standing history dating back to 1987.

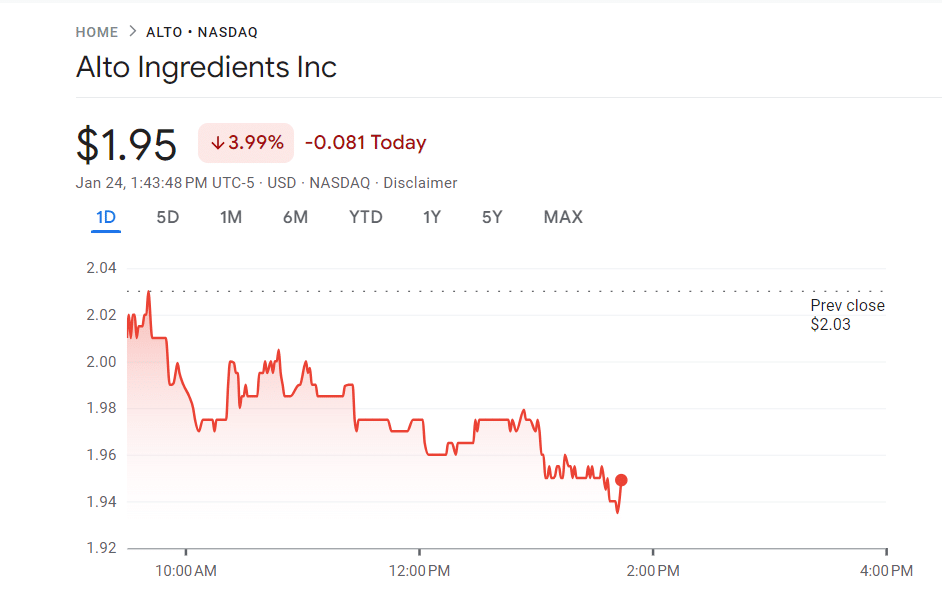

Alto Ingredients (ALTO)

Alto Ingredients (ALTO) is another low-market cap company you can consider for penny stock investing. The alcohol and essential ingredients producing and distributing company boasts diversified revenue channels across the health, beauty, and food & beverage sectors. Its stock is also trading at $1.95 per share.

Penny Stock Issuer Sector Market Cap Price Per Share Arc Document Solutions Printing $126.74 million $2.96 Vaalco Energy Energy $460.6 million $4.37 Savara Biopharmaceutical $661.82 million $4.88 Vaso Corp Healthcare Equipment and IT $52.51 million $0.29 Alto Ingredients Specialty Alcohols $157.61 million $2.07 Short-Term vs. Long-Term Penny Stock Trading

You have already learned that penny stocks are highly volatile. So, it goes without saying that they are more suitable for short-term traders looking for instant gains.

However, what’s in it for long-term investors? Let’s assess how risk-averse traders can also take advantage of penny stocks’ low price points for potential profits.

Day Trading Strategies for Penny Stocks

If you’re an active trader looking to open and close positions within a day, you can trade across many penny stocks to profit from their price fluctuations. For instance, you can initiate a penny stock trade with a market order to get it at the current best price. Not only that. You can also use a limit order to buy or sell the stock at a preferred price.

Do you remember risk management tools like the stop loss? Set a buy-stop or sell-stop price to manage risks.

Holding Penny Stocks for Potential Growth

You are a long-term penny stock investor with a low appetite for risk. There’s no issue with that, provided you are willing to hold your asset with the hope that its price will rise in the future. This is a common practice in stock trading, and the company’s future growth determines your potential profit. However, holding penny stocks requires patience, as you may not experience favorable market conditions for years.

Balancing Strategies Based on Market Conditions

Do you prefer short or long-term penny stock trading? Both preferences can only be successful by adapting to market conditions. To do this, develop a flexible trading strategy that allows you to make investment decisions based on the ongoing market conditions.

For instance, if your technical and fundamental analyses suggest that a penny stock’s price will surge in a few days, you may opt for swing trading instead of day trading.

Long-term investors can also sell their penny stocks instead of holding them, especially if they believe the stock has reached its peak price.

Staying Informed and Adapting When Investing in Penny Stocks

Having the right information will help you maximize your penny stock investing journey.

Keeping Abreast of Market News and Catalysts

When you hear bad news about a city, you most likely won’t visit there, right? The same applies to stock traders. Market news can positively or negatively influence stock prices.

How so?

An encouraging conversation about a stock or the broader stock market will affect your sentiment, just like that of other traders. That means stock prices will increase with good news, while the opposite negatively impacts the market sentiment and stock prices.

Stay up to date with the industry events to understand current realities during a specific period and make strategy adjustments, if necessary.

Adjusting Strategies Based on Market Sentiment

After gauging the overall market sentiment, ensure you tweak your trading strategy in line with the new information. Doing so will help you take advantage of price movements and other market changes that could have a negative impact.

Learn from Your Trading Experiences and Evolving Strategies

Becoming a professional stock trader requires constant practice – you already know this. So, a viable way to develop your skills is by continually trading and practicing new strategies. Learn from your mistakes and make conscious efforts to reduce risks and losses.

Exit Strategies and Profit-Taking

Recognizing Signs to Exit a Penny Stock Position

When is the best time to exit a penny stock trading position? The truth is that there are no right answers. However, you can make decisions to exit a trade when you discover new market conditions that are better than the previous ones you entered the trade with.

What exactly do we mean?

In simple terms, you can exit your position if the current fundamentals are better than the previous. Additionally, you can exit a stock trading position and take profits if the indicators suggest an upcoming price drop. A negative news or macroeconomic event can also inform your exit strategy.

Taking Profits and Managing Losses

Did you know there are different tools to manage risks when trading stocks? You can utilize risk management tools and orders like the stop loss, take profit, and limit orders to reduce losses and exit your position with profits. You can use any of the tools individually or combine them for a more effective approach to taking profits from your trading position.

Reassess and Adjust Strategies Regularly

Now that you know the various risk-management options for penny stock investing, what should you do?

Continually research the market to develop new strategies and improve your trading skills. Since the market constantly changes, you can combine different strategies to achieve success.

Key Takeaways on Penny Stocks

- A penny stock is a company’s share trading at less than $5.

- Penny stocks are more volatile and riskier than blue-chip stocks.

- A penny stock is characterized by low market cap and liquidity.

- Most penny stocks are tradeable on the OTC markets or pink sheets.

- Investors can enjoy short-term high returns from penny stock trading.

How to Buy Penny Stocks – Conclusion

In this guide on how to buy penny stocks, we’ve touched on everything you need to know about penny stock trading. The investment option is suitable for short and long-term investors looking for low-cost asset options to trade.

However, it’s essential to know that penny stocks are high-risk, high-reward investments before trading them. Ensure you have adequate knowledge of how they work and leverage risk-management strategies to reduce potential losses.

References

- https://en.wikipedia.org/wiki/Over-the-counter_(finance)

- https://www.sec.gov/investor/schedule15g.htm

- https://www.investor.gov/introduction-investing/investing-basics/glossary/listing-standards#:~:text=Before%20a%20company’s%20stock%20can,publicly%20traded%20shares%20and%20shareholders

- https://en.wikipedia.org/wiki/Blue_chip_(stock_market)

- https://en.wikipedia.org/wiki/OTC_Bulletin_Board

- https://fastercapital.com/topics/managing-risk-with-position-sizing-and-diversification.html

FAQs

How do beginners buy penny stocks?

After researching and understanding the risks, beginners can buy penny stocks by choosing a trusted brokerage, creating a trading account, funding the account, and finding the best penny stocks to buy. Start your journey on a demo trading app before switching to a live account

Can I buy penny stocks on my own?

The only way to buy penny stocks is through a broker offering such assets. You can create a stock trading account with such brokerages to purchase penny stocks.

Can you make money from penny stocks?

Penny stocks offer investors the opportunity to make money from price fluctuations. You can leverage the stock’s high volatility for significant gains. However, investing in small companies is risky

How do I find penny stocks to buy?

You can find penny stocks on online brokerages and OTC Bulletin Boards (OTCBB). Penny stocks that meet listing requirements are also available on public exchanges like the NYSE and NASDAQ.

What are good $1 stocks?

Good stocks under $1 that you can invest in include Vaso Corp, Invitae Corporation, and Kezar Life Sciences Inc.

Adewunmi Adedayo

View all posts by Adewunmi AdedayoAdewunmi Adedayo is a seasoned finance and cryptocurrency writer with a passion for demystifying financial and crypto concepts to her readers. She has written several content for top websites such as IBtimes UK and The Nigerian Tribune. Adewunmi's style entails transforming technical topics into simple, captivating, and concise content for her audience.

VISIT ETOROYour capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.stockapps.com has no intention that any of the information it provides is used for illegal purposes. It is your own personal responsibility to make sure that all age and other relevant requirements are adhered to before registering with a trading, investing or betting operator. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice.By continuing to use this website you agree to our terms and conditions and privacy policy.

Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers.

© stockapps.com All Rights Reserved 2024

Scroll Up