What is a Put in Stocks and How Does It Work?

Buying stock and waiting for its price to increase is not the only way to profit from the market. Put in stocks provides an opportunity to profit from a market crash. You can also use it as a hedge for your investments if you are an expert trader with a deep knowledge of price fluctuations.

“What is a put in stocks, and how does it work?” is a question that is likely bugging your mind now. The concept is relatively easy to understand; we’ll explain and compare it to the call options. You’ll learn the purpose of put in stocks as well as the associated risks of trading them.

We’ll cover practical use cases of put in stocks and recommend a stock trading app to get you started. With that in mind, let us begin by answering the question: What is a put in stocks, and how does it work?

-

-

What is a Put Option?

Definition and explanation of a put option in the context of stocks

A put option is a contract that gives you the right to sell a specified quantity of an underlying stock at a specific price. You can simply refer to it as a put. Also, this contract occurs within a fixed period.

We can pick out two things from the above explanation: time and selling price. These are as follows:

- Strike price: This is the agreed price to sell the stock quantity within a fixed period.

- Expiration: This covers when you buy the put option and when the contract to sell expires.

The contract for put in stocks is not free, and you don’t have to buy any stocks to sell them later. Instead, the seller provides this option at a premium. This price often appears as the per-share offer on options trading apps that support put options.

We must understand the concept of derivatives when answering the question. Derivatives are financial contracts that depend on underlying assets or benchmarks. In the context of put in stocks, the underlying asset is a stock.

Price fluctuations in the underlying asset affect the price of the derivative. That is something you must never forget when trading put options. The next section will explore the components of put options and how they work.

The Basic Structure and Components Of A Put Option Contract

Profiting from put in stocks requires the stock’s price to crash below the strike price. Also, this crash must occur within the expiration period for you to exercise your right to sell at the strike price. The contract becomes a loss if the stock’s price does not fall below your strike price.

Here are the components of a typical put option contract:

- The premium: This is the price you pay the seller to earn the right. The asking premium applies to the put option price for each share of stock. In addition, you can only purchase in multiples of 100 units of shares for every put option contract.

- The stock price: This is the price at the beginning of the contract. The strike price (refer to the previous section) can be higher or lower than the current stock price.

When establishing put in stocks contracts, you will set the following:

- The number of contracts: This refers to the number of shares you want. Two contracts mean 200 shares. Remember, each contract is rated at 100 shares.

- The underlying stock: This will be represented by the ticker symbol

- Time in force: If you are an active trader with day trading apps, you can go with day orders. Other types are available.

These are the few settings you’ll need to set up a put options trade. Others can include strategy, action, and order types.

Market volatility remains your most significant risk when investing in put options. While we can’t predict a stock’s price movement with 100% certainty, you should have enough details before buying put in stocks. You can use stock analysis apps to learn about the underlying stock for put options trading.

Put Options vs. Call Options

These are the popular options you’ll find when looking for financial derivatives. They are opposites of each other. However, they are helpful in different cases.

Understanding the difference between put options and call options will help you know when to use one over the other. With that in mind, let us review their differences.

Clarifying the difference between put options and call options

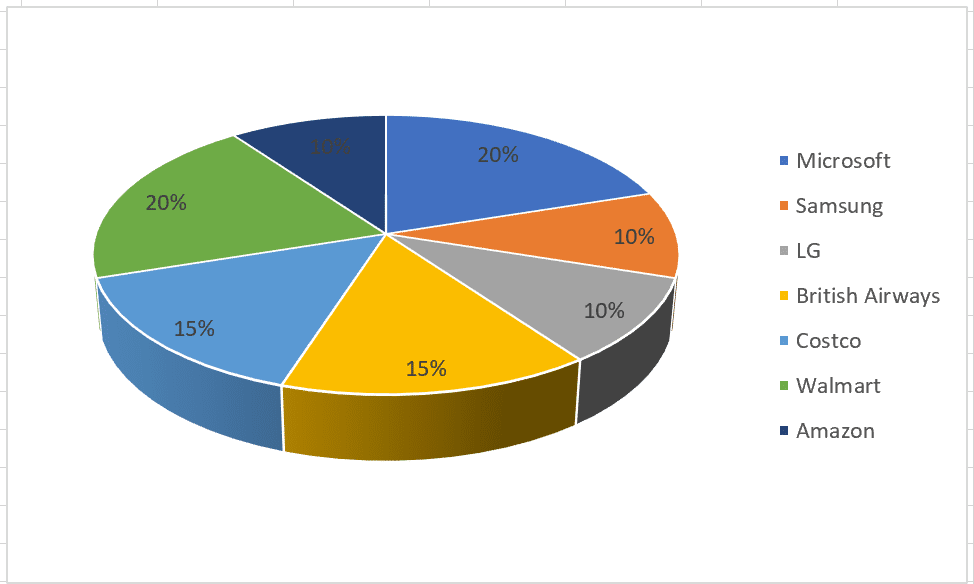

The table below shows the differences between put options and call options:

Parameter Put options Call options Price movement for profit Profit comes from market crash Profit comes with a price increase Action You earn the right to sell You earn the right to buy Account type You need a short-selling account no restrictions on trading account type In-the-money It is considered in-the-money if the current stock price is lower than the strike price. It is considered in the money if the strike price is lower than the current stock price. Understanding when and why investors use put options

We’ve explored what put options are and how they work in trading. To maximize their potential, you need to have a portfolio and use portfolio trackers to monitor them. Profiting from them involves speculating on a market crash, something you do through extensive stock monitoring.

You can use assets in your portfolio or outside for put options trading. Either way, you must be confident in a market crash.

Investors use put options when expecting a market crash within a specific period. You can use them to avoid buying the actual stock, which is usually more expensive than the premium required. With that in mind, here are the popular reasons investors use put options:

- To short-sell an asset without directly owning or borrowing it. You can sell the put options instead of buying the stock for resale.

- To profit from an upcoming bearish run. News or events can be strong indicators of an impending market crash. Hence, investors will prefer put options as they can’t profit from buying the stock and selling afterward.

There are other reasons for this approach, which include hedging and speculation. We will explore them in more detail in the subsequent section.

Purpose of Put Options

Using stock market research and analysis software can take time and effort, especially for beginners. Knowing and applying technical indicators requires expert knowledge. Contrarily, you only need price fluctuations when trading put options.

This simplicity makes put options a more exciting alternative to trading stocks or other assets. However, you can do more with it than for quick profits.

Explaining the primary purpose of using put options in stock trading

Stock price fluctuations are a mix of bear and bull runs. The price might increase exponentially or steadily in the next few weeks. Then, it can fall drastically in the coming months.

This uncertainty calls for different trading strategies. The primary purpose of using put options in stock trading is to profit from price declines (bear runs).

In adverse market conditions, you can use put options as an insurance policy for assets in your portfolio. The option allows you to limit your losses and still sell stock at a higher price when it crashes.

With this downside insurance, you can explore the stock market more confidently. When done right, put options help manage risk and provide room to recover quickly from market crashes.

Of course, put options in trading have their associated risks. We will explore these soon. You’ll see what it means to be on the other side of the divide, selling put options to investors.

The role of put options in hedging and speculation strategies

Speculation strategies involve high risk. However, they come with the potential for exponential gain. Going in for these high-risk assets without sufficient protection can result in significant losses.

If you used speculation strategies to find stocks for your portfolio, put options are essential for hedging your investments. You can sell assets in your portfolio at a favorable price during a market downturn. Hence, you can protect your capital in highly volatile markets.

Besides hedging against a volatile market, you can use put options to profit from these volatile markets. That happens whether you own the stocks or not. You can use alternative data services to tell which assets are overvalued and at high risk of a crash.

Speculative strategies require alternative data. Mega events, market sentiment, social media metrics, job postings, etc., can indicate the potential for a bear or bull market. For example, more job postings indicate expansion, which can set a company’s stock up for an increase.

You can use speculative strategies for low-priced and high-priced stocks. Whichever way you opt for, ensure you have enough information.

Buying and Selling Put Options

We’ve identified two ways to deal with put options. You can either buy or sell them. Both require different approaches and are at opposing ends.

You must understand the difference between buying and selling put options. This section will provide a step-by-step guide on how to buy and the concept of selling. You’ll also see the implications if you sell (write) instead of buying alone.

Step-by-step guide on how to buy a put option to profit from a stock price decline

Follow the steps below to buy a put option from an underlying stock:

- Open an account with an options trading brokerage

- Fund your account with enough money to execute trades

- Open the assets section and choose which stocks you want to buy put options in

- Go to the put options trading page

- Choose “buy to open” in the action category

- Choose the number of contracts. This refers to the number of shares you want. One contract represents 100 shares of the underlying stock.

- Set an expiration date (how long do you want the contract to be valid?).

- Input the strike price (when selecting a trade, the seller will have a set strike price).

- Use limit orders for the order type.

- Enter the price for the put option. The total cost will equal the put option price multiplied by 100 and the number of contracts.

If a put option has a price of $0.40 and you buy two contracts, you will pay the following:

Total price = $0.40 * 100 * 2

= $80.00

The concept of writing (selling) put options and its implications for option sellers

Some traders who ask the question, (What is a put in stocks?) only want to buy put options. However, you can still make money selling them. The latter has different implications and profit opportunities when trading.

Writing or selling put options involves creating the contract and inviting buyers to invest. A few things to note about writing put options include the following:

- You decide the premium that investors will pay for your contract

- You essentially bet the stock price will rise and stay above the strike price. The same applies to the stock price remaining the same throughout the contract’s duration.

- You must have enough money to buy the shares if the buyer exercises their right in the contract.

This strategy is only viable when you notice an upcoming bull run. You can use AI stock-picking services to determine which stocks have the best potential for a bull run. These services can be helpful if you are a beginner.

If the market goes bearish and the buyer exercises their option, you may have to buy the stock at a loss. That occurs if the strike price is lower than what you paid to purchase the stock before the contract. For writers, buying back the stock when the buyer exercises the contract is obligatory.

The table below shows the primary differences between buying and selling put options

Parameter Buying Selling Price fluctuations for profit The price must decline to profit from buying put options The price must increase or remain the same (above the strike price) to profit from writing put options Loss The premium is the only loss incurred if it doesn’t work The losses involve buying back the stock below your original purchase price Put Option Payoff Diagram

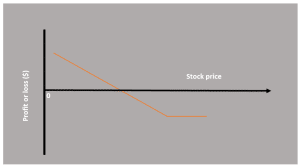

The payoff diagram will help you calculate how much profit you will make from buying put options.

Visual Representation of The Put Option Payoff Diagram And Its Interpretation

In a typical put option payoff diagram, you will find the profit and loss on the Y-axis. The X-axis shows the stock price. Both directions start at zero.

In the diagram below, the orange line represents your profit or loss. The point it touches the stock price line shows the price needed to break even. That means how much the stock should cost for you to have no losses or profits.

Let’s look at an example to see how break-even works. Assume you buy a put option at $5 for a strike price of $45.

The break-even point is the difference between the cost of the put and the strike price. In this case, we have:

Break-even = $45 – $5

= $40

You will neither profit nor lose if you execute the contract when the stock price is $40. If the stock price rises above $45, you will start to lose. That is because the profit from put options is calculated as follows:

Profit = Strike price – stock price – put price

= $45 – $45 – $5

= $5

You do not need the contract once the stock remains above the strike price. Hence, your only loss will be the premium paid for the put options.

Remember that put options are calculated in multiples of 100 shares. Hence, the actual loss for one contract will be $500 ($5 * 100).

How put option payoffs vary with changes in the underlying stock’s price

From the diagram in the previous section, the payoff increases as the stock price approaches zero. This applies to option buyers. Losses begin as the stock price increases beyond the break-even point.

The story differs for sellers. To them, the stock price must increase above the strike price to profit from the trade. They will retain the premiums paid for the trade as profit.

However, sellers bear a greater risk. If the stock price falls towards zero, they must buy it at a higher price. That brings losses, which equal the difference between the strike price and the final stock price during contract execution.

Risks and Costs of Put Options

Throughout this article, we’ve mentioned a few risks associated with put options. The losses can be substantial, depending on how many contracts you buy. Let’s review the risks and factors that affect the cost of put options.

Discussing the risks involved in trading put options, including the premium paid

The primary risk in trading put options is losing the premium paid to purchase the contract. That happens if there is no market decline to bring the stock’s price below the strike price. While this is the maximum amount you can lose, it can still leave deep holes in your investment bankroll.

Time decay is another risk involved. We have discussed the question extensively: What is a put in stocks and how does it work? One essential parameter is time.

As the contract nears its expiration, it loses value. Each passing day eats away at the profits you could’ve made.

We understand that some stocks can crash drastically within a few days. That often happens after revelations of scandals or fraud. FTX’s collapse is a clear example of how quickly a company can fall.

For put option writers, they have even more risk to bear. The premium represents their profits. However, they can be forced to buy the stock at a lower price, resulting in losses.

You can get stock alert services to maximize your opportunity for profit. These software programs will alert you to price movements, allowing you to execute the contract at the right time.

Factors affecting the cost and pricing of put options

The factors that affect the cost and pricing of put options include the following:

- The underlying stock price: Put options derive their values from underlying stocks.

- The strike price: This value affects how much is paid as a premium to purchase a put option contract. Lower strike prices often have higher premiums and vice versa.

- Expiration date: The longer the expiration date, the lower the premium, even when they have the same strike price.

- Interest rates: The overall market interest rates will cause the premiums to fluctuate. Higher interest rates result in higher premiums.

- Market volatility: A highly volatile market will have higher premiums.

Demand and supply still affect the cost and pricing of put options. The more people you have selling options for a specific stock, the lower the premium. That is because you can always bid for a lower price or switch to a seller with a lower price.

Practical Use Cases

Although put options look simple, they are vital for volatile markets. With that in mind, let’s review real-world examples of how investors will use put options to protect their portfolios.

Real-world examples of how investors use put options to protect portfolios or speculate on price declines

The examples are as follows:

- Hedging: Put options can cushion volatile markets, even though you might still suffer losses. Once formed, you reserve the right to sell the stock at a higher price if it crashes below the strike price. That is especially useful in steep stock declines, like the 2008 financial crisis.

- Overvalued stocks: These present an ideal opportunity to buy put options. Overvalued stocks tend to crash, giving the put option investor profits.

- Scandal outbreak: Instead of owning stocks, investors can turn to put options when there is a tip of an upcoming scandal. These events cause steep market crashes, leaving many opportunities to profit.

Case studies of well-known financial events involving put options

Put options have been at the heart of major economic events, including the following:

- The Black Monday of 1987: This sad event occurred after several years of a bull run. Stock prices had tripled before the Dow Jones Industrial Average lost 22% in a single day. The primary cause was portfolio insurance, which involved short-selling stock index futures.

- As trades reached specific loss targets, more stocks were liquidated, lowering prices.

- The Long-Term Management Capital (LTMC) Crisis of 1998: The LTMC hedge fund faced a near collapse as its massive put option positions on bond futures collapsed. This was due to the Russian debt default and the Asian financial crisis. LTMC’s put positions lost value, ultimately requiring a bailout.

- The Flash Crash of 2010: Although the US stock market recovered rapidly, the initial decline was sudden and substantial. This crash was caused by high-frequency trading algorithms, which included put options.

Strategies with Put Options

Efficient strategies are the next step after answering the question of the article. Let’s explore some strategies when using put options and considerations to get the most out of them.

Introduction to common strategies like protective puts and bearish bets using put options

The common strategies when using put options include the following:

- Protective puts: In this strategy, you buy a put option for an asset in your portfolio. With protective puts, you have downside protection if the asset’s value falls below the strike price. While you may lose the premium if the asset’s value increases, you are still left with the gains if you sell it.

- Bearish bets: This strategy aims to profit from a market crash. You can purchase only or spread your bet by buying and selling options on the same underlying asset. The sold option (lower strike price) offsets the purchase cost (higher strike price), while the latter hedges against crashes.

Considerations and tactics for implementing put option strategies effectively

Here are some strategies to implement put options strategies effectively:

- Consider your risk tolerance when buying put options

- Use stock alert services to receive real-time updates on price movements

- Pick long-term put options for a more affordable premium

- Use research and market analysis tools to find out more about the underlying asset

What is a Put in Stocks and How Does It Work? – Conclusion

With put options, you can sell a stock at a higher price even during a market crash. They can be profitable, and you don’t need to own any stocks to trade them. Furthermore, you can use them as a hedge for your investments.

Besides buying, you can also sell put options for a premium. Consider your risk tolerance levels and only invest the amount that matches them.

References

- https://edition.cnn.com/2022/11/18/business/ftx-crypto-downfall-explained/index.html

- https://money.usnews.com/investing/articles/biggest-corporate-frauds-in-history

- https://www.forbes.com/sites/johnjennings/2023/10/19/black-monday-the-improbable-crash-its-causes-and-timeless-lessons-for-investors/?sh=421758096bde

- https://www.federalreservehistory.org/essays/ltcm-near-failure

- https://money.usnews.com/money/blogs/the-smarter-mutual-fund-investor/slideshows/economic-factors-that-influence-stocks

FAQs

How do you make money on a stock put?

You’ll make money on a stock put when the price falls below the strike level. Then, you can sell it for profit.

What does $100 put mean?

A $100 put stands for the amount paid for 100 shares in one put option contract. Consequently, it means that you are paying $1 per share.

What is an example of a put option?

Company A asks for $0.40 for a put option with a $35 strike price for two months. That means you will pay $40 for one contract with multiples of 100 shares if you want to increase the number of contracts.

Why would you buy a put option?

A put option can be profitable if the stock falls below the strike price. In addition, you can use it to hedge assets in your portfolio.

Jeremiah Awogboro

View all posts by Jeremiah AwogboroJeremiah Awogboro is an experienced content writer with over 8 years of experience. He has a qualified MBChB degree and a keen interest in the stock market and the finance industry. His background in the industry has provided him with valuable experience in this field. Awogboro is dedicated to assisting and reaching out to as many people as possible through his writing. In his spare time, he enjoys music, football, traveling, and reading.

stockapps.com has no intention that any of the information it provides is used for illegal purposes. It is your own personal responsibility to make sure that all age and other relevant requirements are adhered to before registering with a trading, investing or betting operator. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice.By continuing to use this website you agree to our terms and conditions and privacy policy.

Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers.

© stockapps.com All Rights Reserved 2024