Options Trading: What are Options in Stocks?

Options trading is a speculative trading style that allows investors to predict the future price movements of individual stocks or the entire stock market. With a stock option contract, a trader can buy or sell a security at an agreed amount and date, but they are not mandated to.

Trading options in the stock market is common among investors because they offer less risk exposure. Options predict that the price of the underlying shares of a stock will either rise or fall in the future. So, you’re probably wondering, “What are options in stock?” This guide demystifies the trading concept.

-

-

Definition and Basics of Options

Before answering the question, “What are options in stock?”, understanding how options work is crucial to beginner traders. A detailed grasp of the concept will help you decipher how to leverage options trading for significant profits in the volatile stock market.

What are Options?

An option is a financial derivative instrument whose value is determined by an underlying asset. You can find options tied to securities like stocks, exchange-traded funds (ETFs), and indexes on numerous stock trading apps.

In other words, an option represents a security in a contract, so you don’t own its underlying asset. Similarly, options derive their values from the value of their underlying securities. For instance, 100 shares of a stock usually make up a unit of its equity options.

When a stock trader enters an options contract, a stock option (or equity option) allows them to buy or sell a stock at a mutually agreed price and time. However, the options trader isn’t obligated to purchase or trade the stock at the said price and date.

Every options contract has an expiration date. The idea is for investors to exercise their right to buy or sell the option on any options trading app before the contract expires. That means an options trader can decide to buy or sell their stock at their preferred price before or on the day the contract expires.

Unlike futures in stocks, which mandate a trader to purchase or sell an asset at an agreed time and date, options trading gives you the freedom to decide whether or not to do so.

Usually, options traders use the investment option as a hedge against market volatility. This is because an options contract can help protect your investments from adverse price swings. In other cases, traders opt for options trading on various stock investment apps because of their potential profits from market speculations.

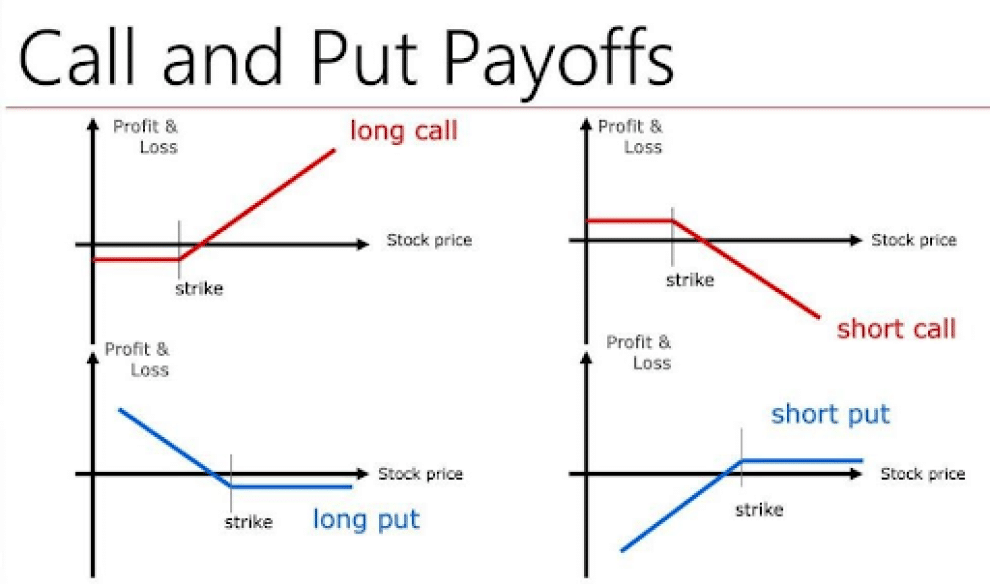

Call Options vs Put Options

Call and put options are the major types of options strategies to know when considering how to trade options.

A call option gives a trader the opportunity to purchase an asset at a predetermined amount and timeframe but without a compulsion to do so. Usually, a call option increases in value as the underlying asset’s price increases.

Conversely, a put option allows an options trader to sell its underlying asset at a predetermined price before the contract expires. Unlike the call option, a put option and its associated stock have a negative relationship. If the stock price goes up, a put option’s value declines.

When determining which is more suitable between call vs put options, it’s crucial to consider factors like your options strategies, risk tolerance, and overall investment goals.

Options Trading Type Trading Mechanism Call Option Allows you to buy an asset at an agreed price and timeframe without an obligation Put Option Allows you to sell an option’s underlying asset (without obligation) at a predetermined price within a contract expiry period Key Terminology in Options Trading

Like cryptocurrencies and other digital assets, options trading has unique terminologies that investors use when communicating. Understanding the different jargon and their meanings will help you find your feet quicker in the options trading space. We highlight the most common options trading terminologies below.

Terminology Meaning At the money An option contract with the same strike price and spot market price for its underlying asset. Intrinsic value The amount of the theoretical profit of an option after it’s exercised. It is determined by the difference between the asset’s strike price and its current spot price in the market. Assignment An obligation from a stock option buyer to the seller to exercise an options contract in line with the agreed terms. Underlying asset (stock) The stock that determines the value of a specific equity option. Premium The price a buyer (option holder) pays or a seller (option writer) receives per share in an options contract. Strike price The price per share to buy or sell a stock option after it is exercised. American style An options contract that allows the holder to exercise their option anytime between purchase and expiration dates. European option A stock option that traders can only exercise on the contract expiration day and not before. Decay Describes how an option’s theoretical value declines with time. Breakeven point A stock price at which an option doesn’t gain or lose money (according to its overall P&L). All-or-none order An order that a broker must completely fill or not fill at all after execution. Expiration date The day an option contract expires – after which a trader cannot exercise the option. American option An option that supports an execution before or on the day its contract expires. Arbitrage The process of buying a security at a lower price on one exchange and selling at a higher price on another for profits. Binary option An option that pays off traders with either a fixed monetary amount or no amount at all. Exercise The process of an options trader invoking their options contract right or terms. Cash-settled An option that a trader can settle in cash instead of using an underlying asset. Back month The farther month for an option spread with two expiration months. Cost-to-carry The total costs required to enter and maintain a stock option position. Delta The projected change in a theoretical option’s price after a unit (point) change in the value of its underlying asset. Historical volatility A measurement of a stock’s actual volatility over a specific period (usually a month, quarter, or year). Implied volatility A theoretical prediction of the future volatility of an underlying asset in a stock options contract based on its current market price. Out of the money A call option that has a higher strike price than the current value of the underlying stock price. Historical Context and Evolution of Options Markets

Though options trading is popular among modern traders and investors, the trading mechanism dates back many years. Whether you prefer stock options or want to trade ETF options on any of the best ETF apps on the market, it may surprise you that the options and futures markets didn’t start on Wall Street.

Origins of Options Trading

Different reports of how and when options trading began exist. However, the common ground for the historical reports is that the options markets have existed for many centuries. The earliest record of options trading dates back to 332 BC, when a philosopher named Thales purchased the right to buy olives before their harvest.

According to Aristotle’s book titled “Politics,” Thales studied the stars and predicted that there would be a significant harvest of olives in his locale. So, he wanted to move ahead of the demand curve and profit from selling olives in the future.

However, he didn’t have enough money to buy the quantity of olives he wanted, so he invested his capital in little bits across olive press owners. That way, he bought the right to use their presses during the next harvest. After harvest, the demand for olives skyrocketed, and Thales resold the initial rights to the olive presses to other people at higher costs for massive gains.

Unknown to him, Thales’ action resulted in the first call option, but olive presses were the underlying asset. He bought the right to use the presses during harvest but wasn’t obligated to do so. Instead, he exercised his options for a profit.

Trading Type Options Trading Origin Ancient Greece Historical Date 332 BC First Options Trader Philosopher Thales Growth and Development of Options Markets

Options trading has evolved since the days of Thames and Aristotle. Over the years, the stock trading model has moved across different generations to what currently exists. From the Tulip Mania in the 17th century to the Rusell Sage, modern options trading has become a popular investment tool among traders and investors.

However, today’s modern options contracts were introduced by the Chicago Board of Options Exchange (CBOE) in 1973. As mentioned, options existed centuries before then but were only properly standardized after the CBOE was established.

Since then, options trading gained credibility and has become a popular speculative investment strategy for modern-day traders. Instead of Thales’ olive presses and other forms of ancient securities, we now have many financial instruments acting as the underlying assets for an options contract.

Role of Options in Modern Financial Markets

Unlike the ancient options markets with no active trades, modern financial markets are characterized by volatility. The prices of stocks and other financial instruments constantly go up and down, resulting in potential profits or losses.

Since there are no guarantees of how the markets may go, options trading allows investors to speculate on assets’ price movements for money. Besides offering traders profitable opportunities, options trading helps manage financial risks. The trading option can potentially offset losses due to adverse market conditions.

Before trading stock options, it’s essential to research the markets or get insights from stock market research and analysis tools to make informed decisions.

Call Options

Every form of trading involves buying and selling. For options trading, a call option is the buy order. But what is it, and how does it work? Keep reading.

Explanation of Call Options

A call option is an investment contract that gives a buyer (options holder) the right to buy underlying stocks at a price initially agreed with a seller (options writer) within a particular period.

The holder pays the writer a premium per share for the options contract, but they are not bound to fulfill it (purchase the stocks). In other words, call options can expire after the agreed contract period lapses.

As stated earlier, a stock option’s value is tied to its underlying security. Investors don’t need to own the stock to buy a call. Therefore, a call option’s value increases with the price of its associated stock, and vice versa. This is why a call buyer expects a traded stock’s price to rise before expiration.

As a call buyer, you can exercise your call option or purchase an option’s underlying stock at the strike price if its market price moves in your favor. If you prefer to fulfill the contract before expiry, an American option allows you to do so till the expiration date. Conversely, you can only exercise a European option on its expiration date.

Profit and Loss Scenarios for Call Options

Determining if your call option will result in a profit or loss is straightforward. If the spot price of the option’s underlying asset rises beyond the option strike price, you make a profit. However, you lose the premium if the asset’s spot price stays below the set strike price before the contract expires.

The total profit from the transaction is the difference between the eventual spot market price and the option strike price, multiplied by the underlying asset’s incremental value minus the premium paid for the contract.

That is,

Call Option Profit = Asset’s Spot Market Price – Option’s Strike Price x Asset’s Incremental Value – Option’s Premium

Practical Examples of Using Call Options

Before going through a call option example, it’s crucial to note that the value of a stock option is equivalent to 100 shares of the underlying stock.

Suppose you buy a unit of a call option contract on XYZ Stock with a strike price of $20; you’ll pay $2,000 ($20 x 100) for the stock option. Afterward, you pay a premium of $100 to enter the contract.

If XYZ stock rises to $30 on or before the contract’s expiration date, you exercise your right to purchase 100 shares of XYZ stock at $20 each (the strike price). You’ll make a profit after you sell immediately at the new spot market price of $30 per share.

Using the formula above, you paid $2,000 to buy the shares and sold the same shares for $3,000 ($30 x 100). So, you make a gross profit of $1,000. After deducting the $100 premium, you have a net profit of $900, excluding transaction costs or commissions. In other words, you’ve turned an initial capital of $100 to $900 by using a call option.

Put Options

One of the common questions beginner traders ask is, “What is a put in stocks?” Now, let’s see how put options work in options trading.

Understanding Put Options

A put option in stock trading is a contract that lets a trader sell an option’s underlying asset at an agreed strike price. Unlike a call option, a put option’s value increases when its underlying asset’s price decreases.

Profit and Loss Scenarios for Put Options

If the strike price is more than the underlying asset’s market price, an existing put option is in the money (ITM). At this point, the exercise price exceeds the current spot market price, so the trader makes a profit upon expiration.

Conversely, a put option is out of the money (OTM) when the strike price is below the underlying asset’s current spot market value. When an option is in the money, the trader can exercise or sell it. But an out-of-the-money option will expire with no value.

Investors can trade call or put stock options individually or combine both to build different options strategies.

Put Call Option Characteristic In-the-money The strike price is more than the underlying security’s market price upon contract expiration. Out of the money The strike price is lesser than the underlying security’s spot market price upon the options contract expiration. Practical Examples of Using Put Options

If you buy a put option at a value of $10 for Stock A, you are conferred the right to sell 100 shares of the stock at $10 per share before or on the day the contract is to expire. However, if the stock’s price falls below $10 in the future, you can’t sell below the $10 strike price.

Suppose the stock price falls to $8 per share in the future, you can sell your shares at $10 instead of the current price. That way, you save $200 and profit from the following buyer’s premium.

However, if the value of the underlying asset increases to $12, you will lose money.

Exotic Options and Variations

Call and put options are more popular among traders. However, seasoned investors trade exotic options because they are customizable to meet their investment goals and risk tolerance levels.

Overview of Exotic Options (e.g., Binary Options)

Exotic options are a unique category of options contracts outside the American or European style options. They work using different payment structures, expiration dates, and strike prices. With exotic options, traders can combine the American and European options.

European options are not flexible because they allow traders to exercise their rights to buy or sell an option only on the expiry date. American options allow traders to exercise their rights anytime before the contract expires. An exotic option can be somewhere in between both traditional strategies.

For example, a binary option is a popular exotic option that uses a yes or no (all-or-nothing) mechanism. The option either offers a trader a fixed payoff if the market goes their way, or nothing at all, if otherwise.

Exotic options are traded on the over-the-counter (OTC) market instead of using bigger exchanges like the New York Stock Exchange (NYSE). Additionally, an exotic option’s underlying assets vary greatly. They can be commodities like oil and gas, equities, bonds, and foreign exchange (Forex) – allowing a more diversified investment.

Customization and Tailoring Options Contracts

As stated earlier, the appeal of exotic options lies in their ability to let investors customize their stock options according to their needs. You can customize exotic options according to your profit goal and risk tolerance. However, like other options trading models, exotic options don’t guarantee profitable trades despite their flexibility.

Risks and Rewards of Exotic Options

Despite their flexible offerings, exotic options have their downsides. We highlight the pros and cons of exotic options below.

Pros:

- Exotic options are customizable to meet traders’ needs and risk tolerance

- Exotic options usually offer lower premiums than traditional options

- Exotic options offer better risk management than traditional options

- The underlying assets for exotic options are more varied

Cons:

- They are more complicated than traditional options

- Low liquidity of OTC markets can impact exotic options

What are Options in Stocks? – How Options Contracts Work

“What is options trading?” you asked. An options contract is a mutual agreement between an options buyer and a seller to execute a transaction using a stock at a predetermined amount and date. Now that you have an answer to the burning question, let’s look at how options contracts work below.

Option Premiums and Pricing Factors

An option premium is the amount an investor buying an option pays a seller. After the buyer and seller agree on a price and time to trade an option’s underlying security, the buyer must pay a non-refundable premium to initiate the contract. In other words, the premium is the receiver’s primary source of income. However, unlike the buyer, who can back out of the deal, the seller must release the asset if the buyer decides to exercise the option.

Several factors affect option premiums. These include:

- The underlying security’s price

- The strike price

- The option type

- The option’s useful life

- Market volatility

- Moneyness

- Interest rate

You can purchase option contracts from reputable brokers, but we recommend using a paper trading platform to test your strategies before proceeding.

Strike Prices and Expiry Dates

Since the strike price and expiry date affect options contracts, you want to pay attention to them. The closer the strike price to the asset’s current market price, the more likely your profits. The farther the strike price from the underlying security’s market price, the more likely the contract will expire worthless.

Choose a strike price that aligns with your investment goals and analysis from the best stock analysis apps.

Also, ensure you exercise your right to buy or sell an asset before or on the date of contract expiry, depending on your contract option. The longer the period until contract expiration, the more expensive the option. The shorter the duration until expiration, the cheaper the option.

Opt for an expiration date that offers enough time to achieve your goals, but be wary of spending too much time that can erode your option’s value.

Intrinsic Value vs. Time Value of Options

An option’s intrinsic value is the amount of its potential profit after it’s exercised. It is determined by the difference between the contract’s strike price and the current spot price of the underlying asset. The higher a contract’s intrinsic value, the better the profit.

Time value (or extrinsic value) is the excess premium above an option’s intrinsic value that a trader is willing to pay for the options contract. It is calculated by subtracting the premium from the asset’s market price. The longer an option contract’s lifespan, the greater the time value.

Option Trading Strategies

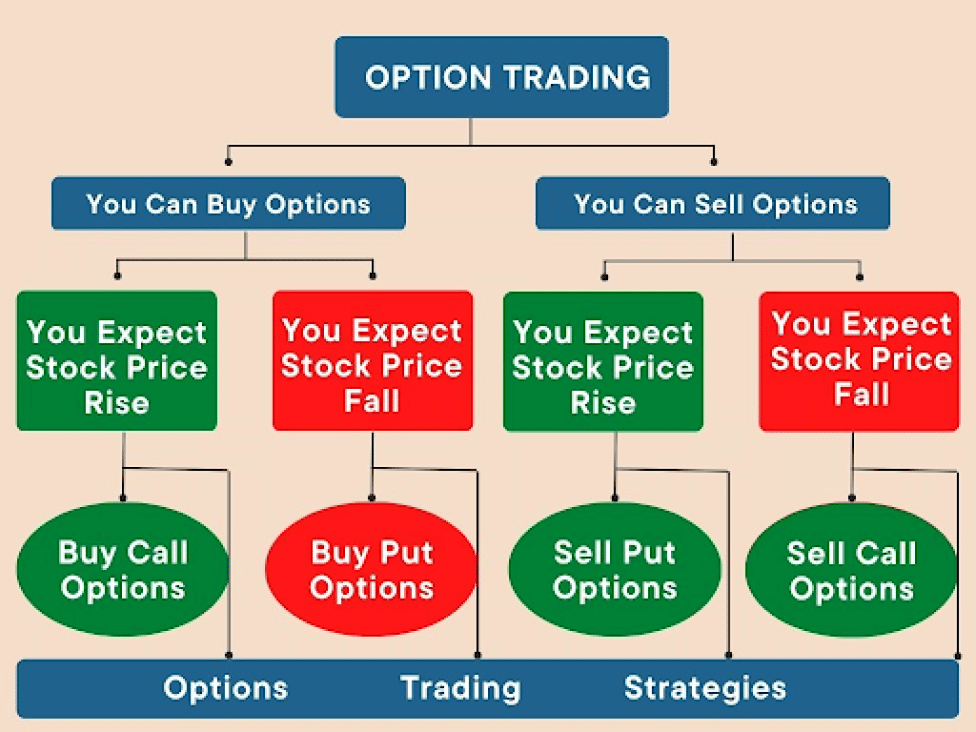

Basic Strategies (e.g., Buying Calls or Puts)

Basic options strategies are traditional trading options primarily used by investors to speculate market conditions in a low-risk environment. However, they do not allow for flexibility. The basic options strategies include:

- Buying puts

- Selling puts

- Buying calls

- Selling calls

Advanced Strategies (e.g., Spreads and Straddles)

Advanced options strategies are flexible trading features for exotic stock options. These stock options allow investors to customize risk and rewards in accordance with their goals and risk appetite. Popular advanced options strategies include:

- Chooser options

- Compound options

- Binary options

- Spread options

- Shout options

Risk Management in Options Trading

Being a successful options trader requires an adequate balance between risk and reward. Though options trading offers less risk exposure, limiting your losses to the lowest possible levels is imperative. Here are some risk management tips for stock options trading.

- Learn how to trade stock options and always do your own research (DYOR).

- Diversify your investment using leverage.

- Develop an options trading strategy according to your needs.

- Invest in a quality stock investment tool and analysis software.

- Leverage risk-management strategies like a protective put or use a stop-loss order.

Risks Associated with Options Trading

As mentioned above, trading stock options is risky due to many reasons. We review the major risks associated with options trading in the next sections.

Volatility and Market Risk

Market volatility is the most significant risk of speculative trades and general stock trading. As long as the stock market is active, asset prices remain unstable. The possibility of an underlying asset’s price rising or falling drastically makes options trading challenging. The markets can go against your contract position and result in losses.

Understanding Options Greek (Delta, Gamma, Theta, Vega)

Another downside to options trading is its complexity and broad language use. Unlike trading individual stocks, options trading requires a deep learning curve. Besides learning how to trade options, you also need to familiarize yourself with the trading terminologies and Greeks.

You can explore our stock trading education content for more insights into these terminologies and the overall stock market.

Assignment and Exercise Risks

Assignment and exercise are the opening and closing commands of an options contract. Both factors influence pricing and premiums in stock options trading. After a contract assignment, your account must be able to buy or sell the equivalent amount of shares in your options contract.

If you lack financial power, the broker can increase the transaction’s margin requirements or place a margin call. Eliminate the assignment risk by buying the call option if you don’t want to sell your shares. Alternatively, you can choose not to exercise your right and close your position before it expires.

Benefits and Opportunities in Options Trading

There are many perks to options trading. Find out the most significant benefits below.

Leverage and Potential for Higher Returns

Options trading offers you the opportunity to spread a small capital across diverse investments for high returns. With a low barrier to entry, the average investor doesn’t need much capital to start trading options for significant returns.

Hedging and Risk Mitigation with Options

Trading options provides a low-risk environment for investors. Instead of trading individual stocks that are more volatile, an options contract lets you combine and trade multiple derivatives with stocks as their underlying assets. You can hedge against losses with stock options whenever the actual stock is affected.

The freedom to determine the price you want to buy or sell your asset and when makes options trading less risky.

Income Generation Strategies with Options

Finally, options offer diverse income generation strategies to ensure you continue earning money with fewer risks. Some of these strategies include:

- Selling covered calls

- Trading cash-secured puts

- Trading married puts

- Selling a protective collar

- Trading straddle options

Key Takeaways and Summarization

- Stock options are speculative investments that allow traders to buy or sell shares of a stock at a predetermined price and time.

- A trader in a stock option contract has no obligation to exercise their rights on the agreed date.

- Traders don’t need to own a stock to trade its options.

- A stock option represents 100 shares of an underlying security.

- Calls and puts are the most popular stock options contracts.

- Stock option contracts have expiry dates that a buyer and seller must agree to.

What are Options in Stocks? – Conclusion

Options trading gives you the right to buy or sell units of a stock at a specified amount and date. The derivatives trading option lets you trade stocks with fewer risks and better leverage.

Remember that options trading is risky. Ensure you research adequately and consider alternative data services to guide you.

References

- https://en.wikipedia.org/wiki/Wall_Street

- https://www.cnbc.com/select/what-are-etfs-should-you-invest/

- http://premium.working-money.com/wm/display.asp?art=430

- https://www.dailyfx.com/education/forex-trading-basics/risk-management-techniques-for-trading.html

- https://www.ig.com/en/risk-management/what-is-leverage

- https://www.cboe.com/

FAQs

How do options work in stocks?

A stock option allows you to trade units of a particular stock in an options contract. You determine the price and date you want to purchase or trade the underlying stock.

What is an example of a stock option?

A stock option example is purchasing a call option for a Tesla stock in anticipation that its price will rise in the future. Regardless of the future market price, the contract’s strike price will be your purchase price when you are ready to exercise your right.

Are options better than stocks?

Options can be more rewarding than stocks because they carry higher risks and rewards. However, investors should learn how to manage risks.

Are stock options really worth it?

Stock options are valuable investments for the future. You can’t spend or trade them immediately.

How much money do you need to start buying options?

The minimum amount required to start trading stock options isn’t fixed. Many brokers set varying transaction minimums for their customers. However, you must have enough capital to cover the cost of the options you want to trade.

Adewunmi Adedayo

View all posts by Adewunmi AdedayoAdewunmi Adedayo is a seasoned finance and cryptocurrency writer with a passion for demystifying financial and crypto concepts to her readers. She has written several content for top websites such as IBtimes UK and The Nigerian Tribune. Adewunmi's style entails transforming technical topics into simple, captivating, and concise content for her audience.

stockapps.com has no intention that any of the information it provides is used for illegal purposes. It is your own personal responsibility to make sure that all age and other relevant requirements are adhered to before registering with a trading, investing or betting operator. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice.By continuing to use this website you agree to our terms and conditions and privacy policy.

Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers.

© stockapps.com All Rights Reserved 2024

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.OkScroll Up