What Are Futures in Stocks?

Predicting the future is almost impossible – it is common knowledge. No one could have accurately predicted the COVID-19 pandemic or the death of a celebrity. However, what most people mistake for future predictions is using history to way out the possibility of reoccurrence.

In the financial market, individuals cannot predict what stocks, cryptocurrencies, commodities, or other digital assets will arrive at a particular time. Instead, they can try to predict or put a hedge against these assets’ future value.

In this guide, we will discuss “What are futures in stocks?” by exploring various concepts, including their types, key players, risk assessment, limitations, and future advances.

-

-

Definition and Basics of Futures Contracts

As we get into “What is futures trading,” we would like to define and highlight the basics of futures contracts. It would give an understanding of why they are traded and an insight into its participants and operation mechanism.

What are Futures Contracts?

Stock market futures (or Futures Contracts in stocks) is the delivery or cash settlement following a derivative contract agreement to buy or sell a commodity asset at a particular time in the future for a specific price. Thus, it is a contract involving two parties – a buyer and a seller.

The buyer and seller must agree on the price of a commodity asset at a specific time in the future. That means even if the asset’s price changes due to market fluctuations, the buyer still has a purchasing power of the agreed amount at the expiration period.

Futures are used for hedging prices in underlying assets’ trading to prevent accumulating losses due to unfavorable market price changes. In this situation, the buyer holds an opposite/parallel position with the asset so that in case of losses, money made on futures can offset them.

Simply, if they hold a long-standing position to expect the underlying asset’s price to rise, they can take a short-standing position for the price to fall in the futures market or vice-versa.

Key Components of a Futures Contract

In Futures contracts, four key components exist, namely;

-

Underlying Asset

The underlying asset is a major component of a futures contract, and its information is embedded in a code. Assets are in various forms – in this case, a particular stock.

-

Expiration Period (or Date)

During open trading, the price-deadline of the asset in the futures contract is negotiated by the buyer and seller. The expiration date is when the trading period of the underlying asset in a futures contract closes; hence, initiating cash settlement and delivery begin.

-

Leverage

Also, leverage is crucial during futures contract trading. It involves using borrowed funds to finance profits or losses. It is important to carefully set leverage, however, as it poses potential risks or profits during trade. And when leverage is chosen, it influences margin requirements.

-

Price

The common understanding of price is the amount of money agreed upon by an individual to buy or sell the asset before the expiration date. This price is often set based on a number of factors, including value predictions from market cap analysis.

Historical Overview of Futures Trading

Historical reports show that the first futures exchange ever started in Osaka, Japan, in 1710 – the Dojima Rice Exchange. It was established to trade rice futures successfully.

Over a century later (1877), the London Metal Market and Exchange Company (also called the London Metal Exchange) was established. It was built on a foundation laid by England’s western commodity futures market in 1571, where the Royal Exchange, London began.

Futures trading began in the United States in 1848, with corn being the first traded contract. A few years later, soybeans and wheat were introduced.

They were all traded under the Chicago Board of Trade (CBOT) – an arm originally for railroads and telegraph, until its interest in agriculture.

Also, a few years later, the agricultural industry witnessed significant progress, and cotton became the largest traded futures contract. As a result, the New York Cotton Exchange (NYCE) was established.

Ultimately, the country’s food supply grew, and several financial centers were founded.

In 1970, financial futures contracts were developed – the transition from agriculture. It allowed business centers to trade assets for future value of interest.

Apparently, this evolution became the foundation for commodity futures today across different industries, i.e., energy, stocks, cryptocurrency trading, etc.

Purpose and Participants in Futures Markets

So, why trade Futures market? Who are the participants in futures trading? New investors and traders may have their work cut out with a proper understanding of its purpose. See below.

Why Trade Futures?

Before learning how to trade futures, individuals should learn the “why?”

Previously, futures markets were described as a way of speculating or hedging against the future price movement of an underlying stock asset. The purpose seems to make a profit off commodity trading at an expected date in the future, regardless of the market situation.

However, it goes beyond that. Here are four reasons that futures contracts are traded.

-

Diversifying Portfolio

Diversifying a financial portfolio is every investor or trader’s goal. Most individuals look for ways to invest or trade assets that they believe could potentially do well. And while this may not be the case at all times, futures provide exposure to these assets, including secondary products.

-

Leverage Gain

Gaining leverage is beneficial to every futures contract trader. It allows individuals to generate higher returns – even more than the invested amount. For instance, a margin account may require 40% or more on an asset’s value; futures, on the other hand, may require less (2 to 10%).

-

Easy Short Selling

Short Selling involves opening a margin account with a broker and borrowing shares to sell. This process is simple with futures contract trading compared to other trading systems where stocks are impossible to borrow.

Also, it means that the margin requirement remains constant for long-standing or short-standing positions.

-

Paper Investments

Typically, Futures contracts are paper investments. They are traded for the significant purpose of making speculative profits rather than being held and stored. The irony is also that it doesn’t require any bookkeeping.

-

Efficiency and Fairness

Futures trading is a less complex venture. It is highly efficient since it involves trading market aggregates. In this process, it gives individual investors and traders a chance at transparency and fairness.

-

Tax Benefits

Tax Benefits are also good reasons to trade futures. For instance, they operate on a 60/40 tax rule – where 60% are long-term capital taxes, and 40% are ordinary income taxes. It is much better than short-term trading or stock trading with stringent requirements on profits and taxes.

Major Participants in the Futures Market

Most participants are commercial or commodity producers and consumers. They utilize futures contracts, depending on their approach.

The key players in the futures market are;

- Speculators

- Hedgers

- Arbitrageurs

Speculators Hedgers Arbitrageurs - Depend on the market outlook to take a position in trading futures.

Invested in volatility periods. They protect their investment portfolio values using futures contracts. Real traders. They sell overpriced futures contracts and buy similar stock quantities in cash. - Risk takers

Risk avoiders Neutral/low-risk takers. A table showing the differences between Speculators, Hedgers, and Arbitrageurs.

Role of Speculators, Hedgers, and Arbitrageurs

Let’s take a look at the role of these major participants in the futures market.

-

Speculators

A Speculator’s role in futures trading is to enter the market with the sole aim of profiting from it. They predict price direction and take a position based on market situation. For every risk taken, there is always a 50-50 possibility of a gain or loss.

Speculators impact futures trading – their presence enhances the market’s efficiency and liquidity.

-

Hedgers

A Hedger’s role in futures trading is to manage risk associated with varying prices in underlying assets by utilizing the futures contracts. They avoid risks and protect themselves from adverse price changes due to market volatility using their own assets.

Speculators impact futures contracts’ liquidity and price discovery by locking in the underlying asset’s price to avoid future uncertainty.

-

Arbitrageurs

An Arbitrageur’s role in futures trading is to exploit price differences between two different but related markets.

They simultaneously sell overly priced futures contracts in the market and buy a similar quantity of assets (stock trading) in the cash market while making risk-free profits.

Arbitrageurs capitalize on price imbalances while also making sure that prices align across different markets.

How Futures Contracts Work?

Getting an insight into the futures market, such as understanding its purpose and participants, is one thing; knowing how futures contracts work is another.

Contract Specifications and Standardization

Futures contracts (also known as an Investment Vehicle) is a standardized financial agreement between two parties to buy and sell underlying assets over a future price on exchanges.

Due to this standardization, futures contracts have unique specifications, which include:

- The measurement unit

- The trade settlement technique – physical delivery or cash

- The quantity of underlying assets covered or ready for delivery under the agreement

- The unit of currency

- The quoted currency for futures

- The quality of underlying assets.

Margin Requirements in Futures Trading

Margins are deposited funds to secure a futures position whenever it is open.

Margins are deposited funds to secure a futures position whenever it is open.

This operating margin must be maintained at a decent level, as requested by a broker. The reason is that while it acts as a security deposit, it will ensure traders have sufficient funds whenever there are losses.

Generally, Margins establish a long position for investor trading in futures, but it does come with its risks. Thus, brokers set various requirements for futures trading. Below are some.

-

Initial Margin

An Initial Margin is the initial deposited fund required when opening a futures position with a broker. It assures the broker that an individual has enough funds to cover when losses are incurred.

For most brokers, initial margins are calculated based on the percentage of the futures contract’s aggregate value.

-

Maintenance Margin

A Maintenance Margin is the minimum balance a trader must have in a brokerage account to keep a futures position open. If the balance falls under, the trader will receive a margin call to deposit more funds or risk futures closing.

Maintenance margins are also calculated based on the contract’s aggregate value – only lesser than the initial margin.

Initial Margin Maintenance Margin Initial deposit to open futures Minimum balance to keep futures open A % of the contract’s total value. Lesser % of the contract’s total value Doesn’t trigger Margin Call. Triggers Margin Call. A table showing the differences between two margin requirements by brokers, i.e., initial margin and maintenance margin.

Settlement and Delivery Processes

Conversely, settlement and delivery processes are significant specifications in futures contracts. They determine how a trader will be settled when acquiring futures and the mechanism of delivery.

Generally, two modes of settlement/delivery are known – Cash Settlement and Physical Delivery.

Cash Settlement is the process of settling futures contracts agreements without requiring physical delivery of underlying assets. Typically, it involves cash. This settlement is done on the agreed date and time of commodity execution, where the buyer pays the net amount to the seller.

Physical Delivery is the process of settling futures contracts agreement by actual physical delivery of underlying asset. The settlement process is coordinated by the broker so that the buyer and seller set positions for delivery.

For instance, if the buyer takes a short position, physical delivery of futures becomes their responsibility. On the other hand, if they take a long position, physical delivery of futures becomes the seller’s responsibility.

Consequently, several debates on which is the better and most preferred method have been ongoing. However, the choice of settlement and delivery entirely depends on the individual and the circumstances surrounding their positions in the futures market.

Cash Settlement Physical Delivery Involves cash Involves physical delivery Most popular in financial futures contracts Popular in commodity futures contracts Convenient Less convenient Offers good liquidity Rigid with limited liquidity Reduces risk associated with commodity Risk exposure Suitable for traders interested in financial gains Suitable for producers or consumers A table highlighting the differences between cash settlement and physical delivery.

Leverage and Risk Management in Futures

In our “What are futures in stocks” guide, we also aim to describe the importance of leverage and risk management in futures trading.

Ideally, asset trading poses some risks, and traders or individual investors must understand and develop strategies to mitigate them. Check below on how to leverage positions with futures and risk management practices that would help.

Leveraging Positions with Futures

Leverage allows traders in the futures market to control a large contract value using a relatively small capital – less than 10%.

The significant advantages are an increased position and good profits when trading futures. Unfortunately, the limitation is increased risk.

Conversely, knowing how futures contracts work is consequential – a good example is – if an individual is interested in one contract of diamond futures, anc they make a deposit margin of 20%, that automatically means a leverage trading capital by 20x.

Risk and Reward Considerations in Futures Trading

Sometimes, it’s not all about futures prices; at times, individuals have to think about risk and rewards. What sets a good trader apart from everyone else is the ability to consider key factors, such as entry & exit points and risk & rewards.

Some major risks to be mindful of in futures trading are:

- Leverage Risk: Since futures contracts are leveraged, some risks are existential. There is a likelihood of incurring losses when leveraging positions in the market.

- Market Risk: The market works on a supply-demand dynamic, leading to unpredictable price changes, and this poses some risk. In futures trading, individuals may have to consider the impact of this factor and others like geolocations and market indicators.

- Liquidity Risk: The liquidity of assets, i.e., futures contracts, makes it possible to trade easily. Unfortunately, this comes with a risk of slippage, whereby trades may not be executed at targeted prices.

- Interest Risk: Profiting is a huge part of trading, but interest rates influence contracts. If there are adverse changes to interest rates, it poses a huge risk to traders.

Some major rewards to consider in futures trading are:

- Profiting: Every trader’s goal is to make profits off the futures market. Thus, leveraging positions may potentially yield increased returns.

- Portfolio Diversification: Futures trading offers individuals an opportunity to invest further in various underlying assets, such as commodities, interest rates, stock shares, etc. while gaining exposure.

- Hedging Benefits: Futures contracts offer a hedging advantage, such that investors and traders can manage price movement risks with underlying assets.

Finding a successful balance between these two concepts, i.e., the risk-reward ratio, will allow traders to gain meaningfully in the futures market.

Strategies for Risk Mitigation in Futures

Usually, two risk management types exist in futures trading – account level and trade level risks. The former focuses on reducing overall financial risk on a trader’s account until all trades are managed.

The latter, however, focuses on preventing an unfavorable trade from allowing a trader to incur losses.

Developing helpful strategies to mitigate them is paramount, irrespective of the risk management types. Below are some insightful considerations.

-

Invest in Trade Sizing

Investing in trade sizing is an effective way of mitigating account and trade-level risks. Individuals must acknowledge and determine the trade size suitable for their account to avoid incurring losses. This strategy would help maintain consistency while building rich futures trading experience.

-

Diversify Futures Contracts

Futures range across a number of assets, and diversifying helps reduce risk exposure. Individuals may invest in financial futures, commodity futures, or currency futures, depending on their capabilities.

-

Understand the Futures Market

Finally, understanding the futures market is the most important strategy. Investors or traders shouldn’t predict or hedge against a futures contract without appropriate research on the market.

Resources, events, historical trends, reports, and any other useful materials that show market movement are highly recommended.

Types of Futures Contracts

Futures contracts exist in various forms but operate on a similar mechanism – an agreement between a buyer and a seller to deliver futures at a specific later date.

Below are the three main types of futures contracts existing.

Commodity Futures

Commodity futures are described as commodity assets, such as agricultural products (like grain, livestock, coffee, cocoa), metals (gold, silver, diamond), and energy products (crude oil, biofuel, propane gas).

Financial Futures

Financial futures are in two types – index and interest rate contracts. The former involves hedging against unique market indexes, while the latter is on the interest rate of unique debt instruments, like bonds, treasury bills, etc.

The U.S. Treasury Bonds and E-Mini S&P 500 are examples of financial futures.

Currency Futures

Financial futures are currency assets, i.e., allows trade on currencies (real or cryptocurrency) at a specific rate at a future date. For example, buying EUR futures with CAD to protect against appreciation in the future.

Global Futures Exchanges

Futures exchanges are futures marketplaces where various contracts are traded. These exchange platforms are ONLY accessible to brokers and registered users and there are certain criteria that must be met to use successfully.

For instance, individuals have to register with a licensed broker to start trading futures contracts on these marketplaces.

Overview of Major Futures Exchanges

According to the Commodity Futures Trading Commission and the National Futures Association, the top futures exchange platforms existing are:

-

Chicago Mercantile Exchange (CME)

CME is the world’s largest futures exchange, established in 1898. It allows the trading of a wide range of futures contracts. This exchange has been significantly known by several individuals for its liquidity and transparency in price discovery.

-

Chicago Board of Trade (CBOT)

CME group is the parent company of CBOT. It was founded in 1848 but acquired in 2007. Most traders know this platform for its series of agricultural futures and financial futures.

-

ICE Futures Europe

ICE Futures Europe is a London-based exchange offering individuals the privilege to trade several futures, including energy, financial, and agricultural contracts. Unlike others, this exchange runs an e-trading platform, allowing it to reach a broader audience of traders conveniently.

-

Hong Kong Futures Exchange

For Hong Kong-based traders, this futures exchange platform is a top spot. It offers a wide range of trading in interest rates and commodity futures. Hong Kong Futures Exchange gained prominence across all of Asia because of several significant trading benefits.

-

Tokyo Commodity Exchange

Likewise, Tokyo Commodity Exchange is another alternative in the Asian market. It specializes in trading commodity futures. It has an excellent reputation for its liquidity and how it constantly uses technology.

Regional Differences in Futures Trading

Unfortunately, regional differences exist in futures trading as factors such as regulatory requirements, market participants, and socio-economic conditions play a significant role in determining the contracts’ situation. This impacts individuals in several ways.

Also, futures markets have specific trading hours, and due to time zone differences, some parts of the world may benefit greatly while the rest don’t. For example, a trader in Hong Kong may benefit from a trade more than another in the USA due to this time difference.

Similarly, some regions invest largely in their agricultural industry and may consequently experience higher volumes of futures contracts than others who don’t. Usually, Asian and European exchanges have a better advantage than those in America.

Accessibility and Liquidity in Global Markets

Accessibility and liquidity in global markets vary. For instance, traders on CBOT, CME, ICE London Exchange, and Tokyo Commodity Exchange may gain easier access than others.

The reason these exchange platforms attract more traders is that they have liquid future markets.

Thus, individuals need to understand various concepts, such as market structure, regulation standards, and the major investment vehicles (such as Exchange Traded Funds (ETFs)). This could offer them a competitive advantage in utilizing these platforms.

Analyzing and Interpreting Futures Prices

Factors Influencing Futures Prices

There are several factors that determine/influence futures prices. They are summed up under a formula, and each component is a must-know. They include;

- Spot Price: It is the current/actual market price of the underlying asset.

- Risk-free Interest Rate: It is the potential interest rate to be earned throughout the year if all things are equal.

- Interest (Dividend) Income: If an underlying asset pays a dividend, this affects the price of the futures.

- Storage: The cost of storing commodities, like grains, energy, etc., may affect the price of futures.

- Convenience Yield: Also, in commodities, the convenience yield (gains from storing the commodity) may affect futures prices.

The formula to calculate futures price is:

Futures Price = S * e ^(r * T)

Where,

S = Spot Price

r = risk-free interest rate

T = maturity time.

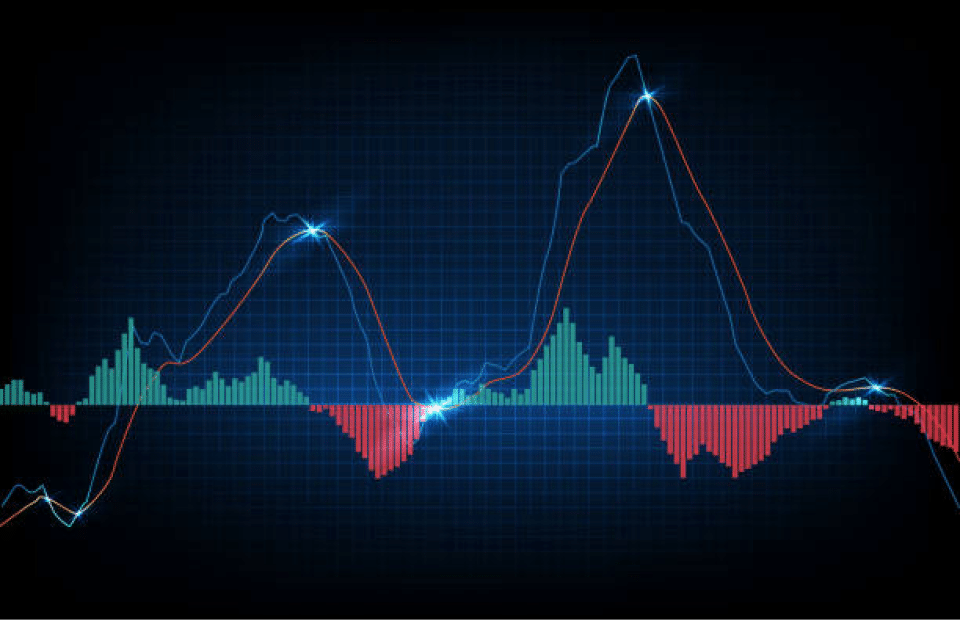

Technical and Fundamental Analysis in Futures Trading

Fundamental Analysis indicates factors contributing to a futures’ demand and supply. Since the market can be complex, the factors may vary from one type to another.

For instance, natural disasters, like floods, may play a significant role in the supply and demand of commodity futures, which may not have been forecasted. Using stock analysis software may not be helpful.

Technical analysis uses chart patterns to determine market movement. Traders can decide to buy or sell futures contracts depending on the price movement, as shown in these charts. While this may not be entirely accurate, it would give them insights into the futures market.

Intermarket Analysis for Futures Traders

Intermarket analysis is a combo of technical analysis and fundamental analysis.

Often, individuals use this analysis to spot potential changes in futures prices as a means to stay ahead of the market.

Its application in futures trading confirms how a trend progresses, i.e., downward or upward.

Risks and Challenges in Futures Trading

Volatility and Margin Calls

Usually, the risk of volatility on underlying assets arise from sudden and unforeseen price movements. Automatically, this triggers a margin call, whereby the market moves against an individual, and the contracts value falls.

When that happens, the trader would have to deposit extra margins.

If a trader doesn’t meet this margin, the broker will have to liquidate the trader’s position to manage losses. Ultimately, this would affect future trading experience.

However, futures in stocks have higher margin use than its alternative – Options in stocks.

Psychological Challenges for Futures Traders

Trading psychology is a taught concept. It reflects on a trader’s emotions and mental states in the face of successes or failures. However, some psychological challenges that futures’ traders may face are confirmation bias, self-control bias, and overconfidence bias.

Indeed, behavior poses great significance for traders.

Case Studies on Successful and Unsuccessful Futures Trades

A case study on successful futures trades can be seen in the soybean complex. A commodity trader who thoroughly analyzes global weather patterns and predicts possible natural phenomena like drought or flood may take a long position in soybean futures and profit in the future.

A case study on unsuccessful futures trades can be seen in the currency futures. In the case of pre-Bretton woods, for example, risks were not sufficiently managed, and 64% of financial futures failed.

Another reason for failure was using the same risk management practices utilized by existing futures in stocks without considering its earnings per share.

Summary of Key Concepts

- Futures contracts is the delivery or cash settlement for an underlying asset, following an agreement for a future date at a particular price. It involves key components, such as underlying asset, price, leverage, and expiration date.

- Futures trading comprises participants, such as hedgers, speculators, and arbitrageurs – each with specific roles and risk-taking approaches.

- Futures contracts exist in three main types – financial futures, commodity futures, and currency futures.

- Understanding the risk-reward ratio, challenges, benefits, and how to use futures exchanges is important for an excellent trading experience.

Conclusion

This guide on “What are futures in stocks?” provides comprehensive details on what future contracts are and how to trade them successfully. It delves into important areas, such as understanding margin requirements and leverage, and risk and reward management in the futures market.

Futures trading only gets better after enlightenment in these areas, and anyone who is ready can register with a broker to get started.

References

- https://www.nerdwallet.com/article/investing/started-futures-trading

- https://www.fool.com/investing/how-to-invest/stocks/futures-trading/

- https://www.fxcm.com/markets/insights/introduction-to-futures-trading/

- https://www.clearias.com/speculation-hedging-arbitrage-investment/

- https://www.clearias.com/speculation-hedging-arbitrage-investment/

- https://www.cmegroup.com/education/courses/understanding-the-benefits-of-futures/the-power-of-leverage.html

- https://www.bajajfinservsecurities.in/blog/futures-pricing/#Key_Factors_in_Futures_Pricing

- https://www.cmegroup.com/education/courses/using-fundamental-analysis-when-evaluating-trades/fundamental-analysis-vs-technical-analysis.html

- https://fastercapital.com/content/Margin-Call–The-Margin-Call-Dilemma–Managing-Risk-in-Futures-Trading.html

FAQs

How do futures work in the stock market?

Futures in stock market involve an agreement between two entities to buy or sell a stock share at a specific price on a future date. It is standardized based on the stock’s size, expiration date, and other important elements.

What are examples of stock futures?

Stock futures are financial derivatives, and examples include the E-Mini S&P 500, E-Mini Nasdaq-100, and Dow Jones Industrial Average Futures.

What do stock futures tell you?

Stock futures tell a number of things, including market direction, market volatility, expected opening prices, and, sometimes, hedging techniques.

Are futures better than stocks?

Futures and Stocks are two financial investments, and the choice depends on an investor’s or trader’s goals. It is impossible to choose which is better than the other without consideration of factors such as risk tolerance and financial limitations.

How risky is investing in futures?

Investing in futures is almost as risky as investing in other assets in the financial landscape. Its inherent risk, however, are as a result of leverage and underlying asset’s volatility.

Adewunmi Adedayo

View all posts by Adewunmi AdedayoAdewunmi Adedayo is a seasoned finance and cryptocurrency writer with a passion for demystifying financial and crypto concepts to her readers. She has written several content for top websites such as IBtimes UK and The Nigerian Tribune. Adewunmi's style entails transforming technical topics into simple, captivating, and concise content for her audience.

stockapps.com has no intention that any of the information it provides is used for illegal purposes. It is your own personal responsibility to make sure that all age and other relevant requirements are adhered to before registering with a trading, investing or betting operator. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice.By continuing to use this website you agree to our terms and conditions and privacy policy.

Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers.

© stockapps.com All Rights Reserved 2024

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.OkScroll Up