What Are Meme Stocks? How Do They Work and Why Invest in Them

Meme coins are an integral part of the stock market and they have become popular in recent years. In this article, we will be answering the question of what are meme stocks and how do they work. We will also look at the history of meme stocks and some of the popular meme stocks in recent years.

-

-

What are Meme Stocks?

The stock market is one of the oldest investment markets globally. However, with the advent of technology, the market has evolved in recent times, offering meme stocks as one of the latest investment opportunities and forcing new investors to ask the question “How do stocks work?”

A meme stock is a company’s share that increases in value due to massive social media hype. Unlike other kinds of stocks, meme stocks experience sudden price pumps through conversations on social media platforms.

However, the common question among investors is, “How do stocks work in relation to meme stocks?” We demystify meme stocks in this guide.

How Do Stocks Work? What are Meme Stocks?

The first question a beginner just hearing about meme stocks would ask is, what are meme stocks? As stated earlier, meme stocks are company shares that have their values easily influenced by social media conversations or events among investors on platforms like Reddit and Twitter. These stocks often experience a sudden boom in price over a short period because their price rallies are not organic.

However, these short-term price surges offer investors the opportunity for immediate gains before a market reversal. For instance, some short-term traders can arbitrage meme stocks on two of the best day trading apps and pocket the difference on both platforms as profit.

Meme stocks are more volatile than the average stock, as market rebounds are almost imminent after a meme stock price rally. In other words, you can compare meme stocks with the meme coins in the crypto space that are also easily influenced by social media hype.

It’s important to note that meme stocks are also listed on popular stock exchanges, including the New York Stock Exchange (NYSE) and the National Association of Securities Dealers Automated Quotations (NASDAQ). So, traders can buy and sell them on online brokerages for potential profit.

How Do Meme Stocks Work?

Since meme stocks are not regular company stocks, it’s normal for inexperienced investors to ask, “How do stocks work?” when thinking of investing in them. At their core, meme stocks are not precisely valuable digital assets. Online communities and lots of social media noise back them.

The communities have massive followings on platforms like Reddit, so the account owners influence traders’ decisions through a coordinated approach. This is similar to how crypto whales influence the prices of cryptocurrencies like Bitcoin.

Based on the information the community members consider valid, they buy and sell the assets their “leaders” mention. Their trading activities then result in increased stock prices.

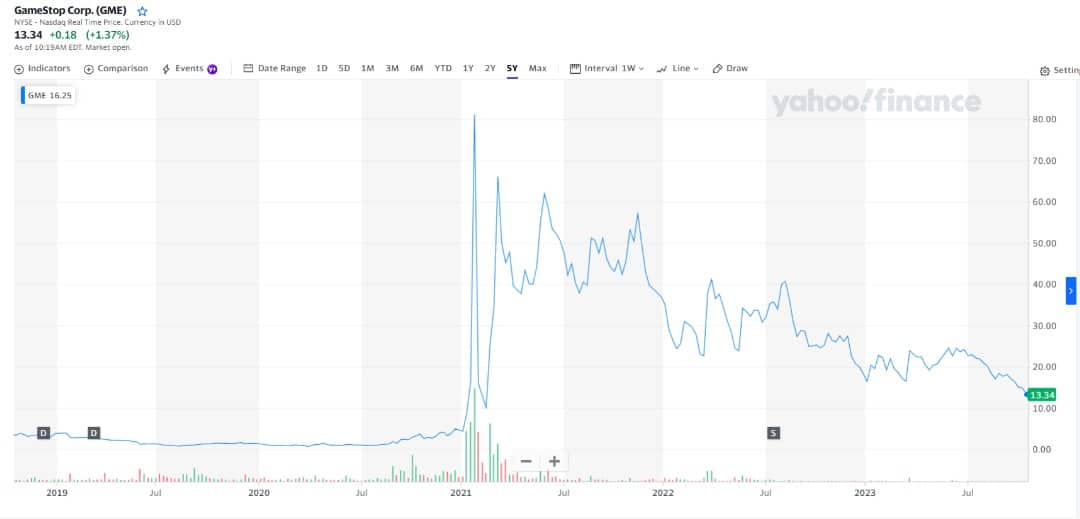

For instance, the chart below shows a sudden spike in the price of Gamestop Corp. shares that saw it reach a new high of around $120 on January 25, 2021. However, the stock closed at $81.25 the same day and subsequently experienced a continuous price fall.

At the time of writing, a GameStop Corp. share sells at $13.45 – an 89% decline from its previously mentioned January 2021 price.

Top Meme Stocks List

Though GameStop is arguably the most popular meme stock, there are other options to consider when thinking of how to invest in stock assets. We list the top 5 meme stock companies below based on their positive year-to-date (YTD) performances at the time of writing.

- Sofi Technologies (NASDAQ: SOFI) – Up 66.22% YTD

- Palantir Technologies (NYSE: PLTR) – Up 155.32% YTD

- Blackberry (NYSE: BB) – Up 3.47% YTD

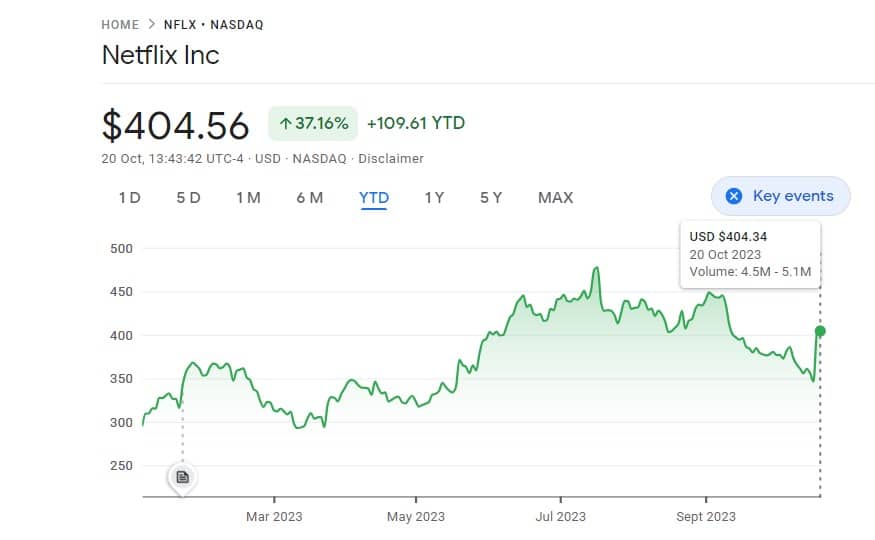

- Netflix Inc. (NASDAQ: NFLX) – Up 37.16% YTD

- Advanced Micro Devices Inc. (NASDAQ: AMD) – Up 58.54% YTD

Best Meme Stocks – Our Review

Now, let’s briefly review each meme stock that made our top list to see their current market performance and why they may be good short-term investment options for traders.

1. Sofi Technologies (NASDAQ: SOFI) – Up 66.22% YTD

Sofi is a top name in the online banking and financial services space. The company has attracted users with its robust mobile app that unifies all its products and services. Additionally, Sofi is notable for its student loans, which have helped it reach millions of customers.

The recent rise in Sofi stocks is due to its strong customer base and high market capitalization, which have attracted meme stock investors. Now, the company’s shares have become one of investors’ favorites in the fintech industry.

2. Palantir Technologies (NYSE: PLTR) – Up 155.32% YTD

With a triple-digit YTD growth of over 150%, Palantir Technologies Inc. is another company with a top-performing stock over the year. The company’s shares became prominent in 2020 amidst other initial public offering (IPO) stocks. Since then, the data and artificial intelligence (AI) company has garnered a lot of attention from investors.

One of the reasons Palantir has a thriving business is its unique business model that combines public and private sector engagements. For instance, the company recently expanded its partnership to Microsoft, Carahsoft Technology, and Google Cloud.

3. Blackberry (NYSE: BB) – Up 3.47% YTD

Blackberry is a mobile phone brand that needs no introduction. Though the demand for its smartphones has dwindled with the advent of Apple and Samsung, the software company remains in the market.

Today, Blackberry provides security software and other software-based products to customers. Interestingly, investors are still interested in its stock, which has soared by nearly 4% YTD. Similarly, the company’s market cap is over $3 billion.

4. Netflix Inc. (NASDAQ: NFLX) – Up 37.16% YTD

Netflix is a global streaming platform with a presence in multiple countries. The company’s popularity as a Video on demand (VOD) service provider for movies and TV shows is one of its attractions to investors. At the same time, the company’s financial standing, with an estimated market value of over $178 billion, is worth noting.

Overall, Netflix has been on a good run so far this year, making it one of the best meme stocks on investment apps.

5. Advanced Micro Devices Inc. (NASDAQ: AMD) – Up 58.54% YTD

Advanced Micro Devices Inc. is our last pick of the best meme stocks to buy right now. The stock has experienced double-digit growth over the year, indicating that investors are bullish. One of the reasons for AMD’s rise in stock price is the public’s massive interest in AI technology.

The tech company uses AI to develop computer processors, data centers, and other computational software. Its long-standing history in software development is another competitive advantage that puts AMD at the forefront of the top meme stocks among tech-focused investors.

Meme Stock Glossary

If you’re new to stock investing, you must have heard different jargon from experienced traders. While the slang words may seem intimidating initially, you should know that you’ll understand them with time.

Here are uncommon terms you may hear in the stock trading space from time to time.

Term Definition Arbitrage the process of buying a stock at a lower price from one trading platform and selling it for a higher price at another platform to make a profit from the price difference. ATH means all-time high. The highest price an asset has ever reached since it started trading. BTD an abbreviation for “Buy the Dip.” It is used to encourage traders to buy stocks when their prices drop in anticipation of a future increase that will result in a profit. Bear market A market condition where stock prices fall. It is indicated by a 20% decline in the general market value over an extended period. Bull market This is the opposite of a bear market. The general stock prices are up during a bull market, offering investors gains. Bid the price a buyer is willing to pay a seller for a particular stock. If a bid doesn’t meet the seller’s “ask,” the transaction will not happen. Blue-chip stocks stocks of reputable companies. These companies have a verifiable track record and offer high quality. Day trading the art of buying and selling stocks or shares within 24 hours. Orders from day trading must close before the next day. Diamond hands describes an investor who holds their assets even when there’s a fall in price resulting in massive losses. Go short the process of selling a stock with the hope that it will fall in price and a trader can profit from the potential price difference. This is an advanced trading technique. Go long the opposite of going short. It involves buying stock shares with the hope that their prices will rise and the trader can pocket the difference as profit. Inflation a high rate of increase in the prices of goods and services. It is one of the major macroeconomic challenges of the stock market. Limit order a risk-management strategy that traders use to automatically buy or sell a stock once it reaches a preset price. Paper hands the opposite of diamond hands. It refers to investors who are more likely to sell their assets when there’s a price fall. Stock portfolio refers to an investor’s collection of investments, including stocks, mutual funds, exchange-traded funds (ETFs), and other assets. To the moon means that a stock’s price that’s rising will continue increasing with no end in sight. It is used to show optimism among investors. Meme Stocks History

Meme stocks began trading in 2020, and the first successful meme stock was GameStop Corp. (GME). The creation of the earliest meme stocks was mainly influenced by retail investors’ interest in stocks from commission-free trading companies like Robinhood.

Ultimately, the online investing communities grew across various social media platforms like Reddit and Stocktwits, resulting in more investments in highly-publicized stocks, now known as meme stocks.

In 2021, there was a massive meme stock craze off the back of COVID-19 and the last crypto bull run. This was because investors were looking for different opportunities to make money. So, they tilted toward alternative and hot investment opportunities like meme stocks, non-fungible tokens (NFTs), and market-topping cryptocurrencies like Bitcoin and Ethereum.

At the time, meme stocks like GameStop returned huge profits to investors, with some becoming millionaires. Other meme stocks also emerged and had different levels of success.

However, the meme stock market has now cooled off, evident by the price collapse of the most popular options like GameStop Corp. (GME) and AMC Entertainment Holdings Inc. (AMC).

Nonetheless, investors with a high appetite for risk are still making money from meme stocks, as some of the popular options still offer decent returns despite the market downturn.

What is a Meme Stock ETF?

When investing in stocks, there are two primary ways to consider. You either invest in individual stocks like SOFI or diversify your capital across different stock options to expand your stock portfolio.

Investing in individual stocks is riskier because single assets are more volatile. So, the way to diversify your stock investment is through stock ETFs. Doing so will help you manage risks better as stock prices move up and down. But it’s important to note that ETFs track one stock index at a time.

In other words, risk-averse investors can opt for meme stock ETFs instead of individual meme stocks. These ETFs function similarly to renowned meme stocks like GameStop and AMC, but they also combine a few strong meme stocks like Peloton and Tesla.

We highlight the most popular meme stock ETFs below.

1. Roundhill MEME ETF

The Roundhill MEME ETF (NYSE: MEME) was the first ETF to calculate its holdings using social experiments. MEME tracks the popular Solactive Roundhill Meme Stock Index, which consists of 25 different equity securities that are prominent on social media and attract investors who are short-selling. In other words, you can invest in 25 meme stocks in one ETF using the Roundhill MEME ETF.

2. Roundhill Ball Metaverse ETF

As the name suggests, the Roundhill Ball Metaverse ETF (NYSE: METV) monitors the performance of Roundhill’s in-house Ball Metaverse Index. The ETF contains a mix of reputable companies operating in the Metaverse. These include Roblox Corporation (NYSE: RBLX) and NVIDIA Corporation (NASDAQ: NVDA).

3. Fidelity Crypto Industry and Digital Payments ETF

While meme stocks investors often go after stocks, players in the finance world often expand their investments to crypto projects. An example of an ETF this category of investors opt for is the Fidelity Crypto Industry and Digital Payments ETF (NASDAQ: FDIG).

In other words, investors use the ETF to gauge the social media sentiment around hot crypto projects. For instance, a top holding in the ETF is Coinbase Global (NASDAQ: COIN), which tracks one of the world’s biggest Bitcoin trading apps for social media sentiment.

Overall, these ETFs will help you expand your investments and reduce risks. However, ETFs often offer less returns than individual stock investments.

Pros and Cons of Meme Stock ETFs

Pros:

- Diversified investment opportunities

- Lower risks compared to stocks

- Suitable for beginners

Cons:

- Less control over asset choices

- Lower potential returns

Are Meme Stocks Good or Bad?

Though the meme stock market is far from what it used to be between 2020 and 2021, it’s still possible for investors to make money from meme stocks. For instance, Palantir Technologies Inc. has grown by 155.32% from January to October 2023 (press time).

That means someone who invested $1000 in the meme stock would have over $1,553.20 in gains, bringing the total sum to $2,553.20. However, investing in meme stocks is inherently risky because stock prices are not exactly dependent on the market’s fundamentals. Instead, they thrive on social media hype.

So, knowing which stock will explode and which one will experience price drops is not exactly straightforward. At the same time, stock price predictions are mainly speculative, so your best bet is to invest in meme stocks for short-term gains.

Pros:

- Likely high short-term gains that can return an initial investment in multiple folds

- A learning curve about investing in stocks and its associated risks

- Owning a stake in a newly-discovered meme stock before it gains significant attention and explodes

Cons:

- Loss of money due to unpredictable market conditions

- Unprecedented end to rising meme stock prices that may come as a shock

How to Find a Good Meme Stock for Long-Term Investment

At their core, meme stocks are ideal for short-term investors because of their high level of unpredictability and volatility. However, long-term investors looking for opportunities can still find some meme stock options on the market.

Here are some factors to consider when looking for long-term meme stocks.

- A company’s reputation or track record that shows its finances are healthy and there’s a stable cash flow. For instance, a company with healthy profit margins will likely be around for a long time. So, investing in such meme stocks and holding for the future may be a good choice.

- A solid action plan from a company whose stock has attained the meme stock status. The plan will help investors understand how the business intends to benefit from the stock prices and scale using its newly found strengths.

- Internal adjustments to maintain stock price growth by companies that are struggling financially.

How Do Stocks Work? What are Meme Stocks – Conclusion

After the boom of meme stocks in 2020 and their subsequent explosion in 2021, more company shares have attained meme stock status. While the meme stock market has cooled off in 2023, it still provides avenues for active traders and investors looking for short-term gains.

We’ve demystified how meme stocks work in this guide. If you decide to invest in the next viral meme stock, remember to do due diligence and only invest what you can afford to lose.

References

- https://www.cnbc.com/select/what-is-a-meme-stock/

- https://www.nasdaq.com/articles/3-best-meme-etfs-to-buy-now

- https://www.nerdwallet.com/article/investing/meme-stocks

- https://spinninvest.com/finance/the-pros-cons-behind-meme-stock-investing/

FAQs

How can you tell if a stock is a meme?

Meme stocks are shares of companies that are usually monitored and traded by a coordinated online group of investors. These groups often influence stock prices. So, when picking company stocks for your portfolio, watch out for stocks with sudden popularity.

Is Tesla a meme stock?

Tesla is one of the most recent meme stocks. The stock recently went viral on social media because of tweets from the company’s CEO, Elon Musk, resulting in fear of missing out (FOMO) among investors.

Why invest in meme stocks?

Meme stocks can be profitable investments if an investor leverages their sudden price pumps after social media hype. However, these stock types are very volatile, so financial advisors recommend that investors evaluate the potential risks before investing in meme stocks.

What is the problem with meme stocks?

The major challenges of meme stocks are high volatility and market uncertainty. Because their prices don’t follow market fundamentals, a high rise in price can be subsequently followed by a sharp drop, hurting investors’ portfolios.

Adewunmi Adedayo

View all posts by Adewunmi AdedayoAdewunmi Adedayo is a seasoned finance and cryptocurrency writer with a passion for demystifying financial and crypto concepts to her readers. She has written several content for top websites such as IBtimes UK and The Nigerian Tribune. Adewunmi's style entails transforming technical topics into simple, captivating, and concise content for her audience.

stockapps.com has no intention that any of the information it provides is used for illegal purposes. It is your own personal responsibility to make sure that all age and other relevant requirements are adhered to before registering with a trading, investing or betting operator. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice.By continuing to use this website you agree to our terms and conditions and privacy policy.

Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers.

© stockapps.com All Rights Reserved 2024

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.OkScroll Up