Hello Stake App Review 2025 – Pros & Cons Revealed

Hello Stake is an online brokerage platform that also offers a fully-fledged app. The provider stands out for several reasons – notably for its commission-free offering. That is to say, you can buy over 3,800+ US-listed stocks and ETFs without being charged a dime.

The platform is available in several regions – including that of Australia, New Zealand, and Latin America. However, for the purpose of this review, we are going to focus on the UK version of Hello Stake. With that said, its platform is somewhat similar across all of the countries it supports.

In this review, we unravel everything there is to know about the Hello Stake app. We discuss what assets you can invest in, whether there are any hidden fees, and crucially – how safe your money is.

-

-

What is Hello Stake?

On top of giving non-US residents access to the NYSE and NASDAQ – the Hello Stake app allows you to invest on a commission-free basis. This means no fees, dealing charges, or monthly subscriptions to worry about.

You will, however, need to pay a currency conversion charge of 0.5% when you make a deposit – at a minimum of $2. If you’re looking for more enhanced features from a stock app, Hello Stake also offers a premium account. This covers instant buying power, pro-level financial data, analyst ratings, and more.

Ordinarily costing $9 per month, you can get the premium plan for free until January 2022. All in all, Hello Stake is what we would call a ‘skin and bones’ mobile investment app. In other words, you can easily buy and sell US-listed shares. But, additional features and trading tools are somewhat thin on the ground.

What Stocks Can You Trade on the Hello Skate App?

As above in the section above, Hello Stake is targeting non-US investors that wish to gain exposure to the American stock markets.

Although at first glance this might sound like an innovative offering – it really isn’t. In fact, any UK stock trading app that is worth its weight in gold will not only allow you to buy US shares with ease – but multiple other markets.

For example, the likes of eToro allow you to buy the best stocks from 17 UK and international markets in a commission-free manner – while Hello Stake focuses on just the two leading US exchanges.

Nevertheless, the Hello Stake app covers the biggest and most recognisable companies listed on the NYSE and NASDAQ. This covers everything from Tesla, Facebook, Amazon, Apple, Disney, Nike, IBM, Berkshire Hathaway, and Ford Motors.

ETFs at Hello Stake

On top of stocks, the Hello Stake app also gives you access to ETFs. Once again, all ETFs are US-listed.

Other Assets at Hello Stake

Other than US shares and ETFs, the Hello Stake app does not support any other asset classes. This means that you are missing out on indices, forex, commodities, cryptocurrencies and more.

Hello Stake Account Types

The Hello Stake app offers to account types – a free account and an ‘upgraded’ paid-for account.

Free Account

Most users at Hello Stake will stick with the free account. This allows you to purchase more than 3,800+ shares and ETFs on a commission-free basis.

Upgraded Account – $9 Per Month (Free Until January 2022)

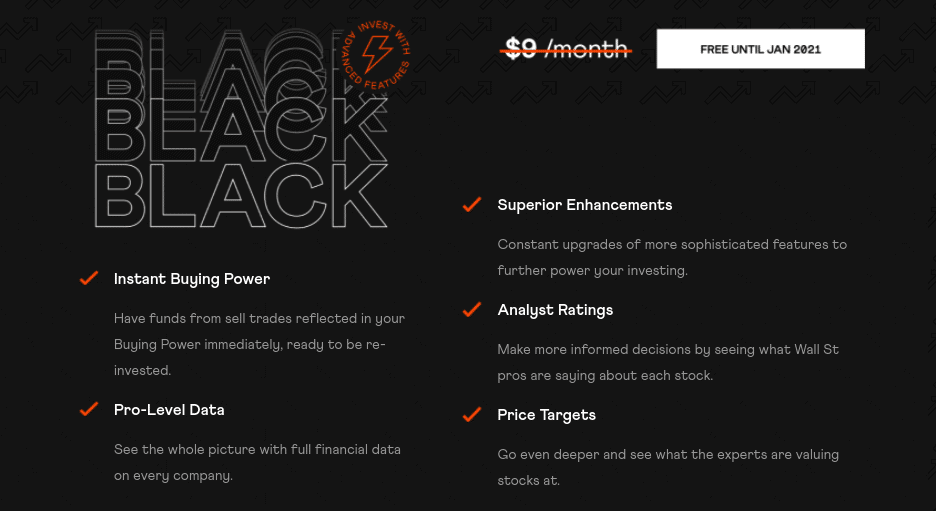

Hello Stake also offers an upgraded account that costs $9 per month. However, you can get your hands on this account for free until January 2022.

The additional features that you get with the Upgraded Account are:

- Instant Buying Power: This allows you to invest in a new stock or ETF the very moment you offload an investment.

- Pro-Level Data: This gives you access to enhanced financial data on the stocks listed by Hello Stake

- Superior Enhancements: This doesn’t relate to anything specifically. The feature merely promises to constantly give you access to new and improved features.

- Analyst Ratings: This feature shows you what the sentiment is on US-listed stocks – as per Wall Street analysts

- Price Target: This allows you to see what price targets have been set by leading stock market traders

Put simply, the ‘Upgraded’ Account is nothing short of poor – and certainly not worth $9 per month. For example, the likes of enhanced financial data, analysts ratings, and price targets are all available for free elsewhere.

In fact, the best stock trading apps in the space include this data on standard accounts anyway. By all means, it’s probably still worth upgrading to see what these so-called enhanced features are like for yourself for as long as the free trial is in place.

Hello Stake Fees & Commissions

The main selling point of Hello Stake is that it gives you access to US shares in a super cost-effective basis.

The key points are as follows:

- You will not pay any commission or dealing fees when buying stocks and ETFs

- This is the case when you buy and again when you sell

- There is no monthly fee or subscriptions (other than the Upgraded Account)

While it is notable that the Hello Stake app allows you to invest on a fee-free basis – it isn’t the only provider in this space. On the contrary, Robinhood and Stash all offer commission-free trading. Then you have the likes of Capital.com and Plus500 – which both offer commission-free stock CFD trading.

The difference between the aforementioned apps and Hello Stake is that the former offer much more in terms of core features, tools, and tradable markets.

Non-Trading Other Fees

When it comes to making a deposit, you will be charged a 0.5% FX fee. For example, if you deposit £500 then you will pay £2.50. With that said, the minimum FX fee taken by the Hello Stake app is $2.

As such, smaller deposits will pay a higher percentage rate in real terms. If you are able to deposit funds into your Hello Stake with US dollars – then the platform will charge you a flat fee of $5.

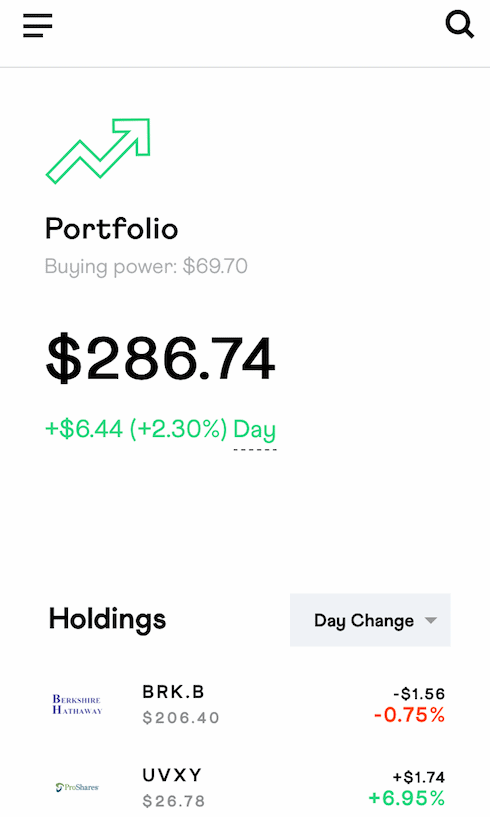

Hello Stake App User Experience

Although the Hello Stake app does lack certain features and tools that you might expect from a mobile broker, the platform is super-easy to use. This is great if you are are a novice and simply want to invest in a seamless manner.

For example, opening an account is straight forward as you are guided through each step by the app. This is also the case when it comes to depositing funds. In terms of the investment process, this is also seamless.

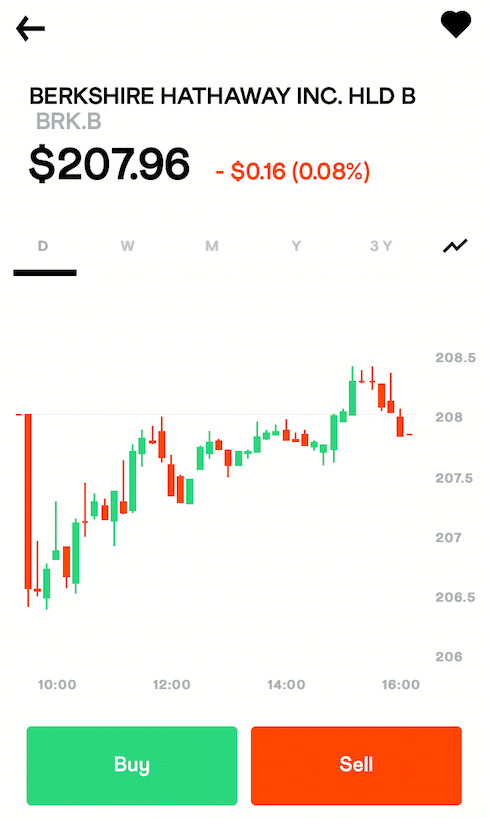

You simply need to search for the stock that you want to purchase and enter the amount you to buy in US dollars. Crucially – whether you hold an Android or iOS device – the Hello Stake app has been built specifically for your operating system.

Hello Stake App Tools

In terms of what tools the app comes with, check out the list below.

Fractional Ownership

Perhaps the most notable tool found on the Hello Stake app is that of its fractional ownership offering. This allows you to buy ‘part’ of a share – which is a crucial feature when buying US stocks. This is because heavyweight firms like Apple, Facebook, Tesla, IBM, Microsoft, and many others have a stock price that is in the hundreds of dollars.

But, by using Hello Stake, you can buy just a few dollars worth of a share. For example, if IBM is worth $100 and you invest $5, then you would own 5% of a share. Any future dividend payments that you are entitled to would then be reflected at any proportionate to what you invest.

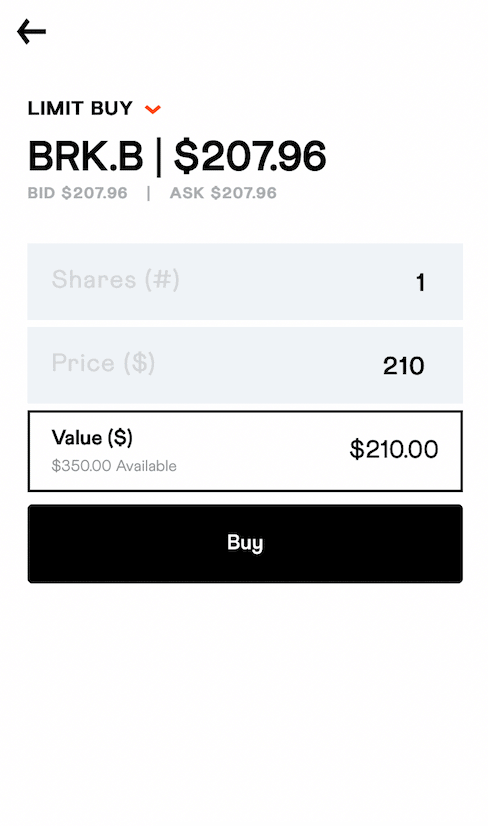

Order Types

The Hello Stake app offers three order types:

- Limit orders: Choose which price your stock or ETF investment is executed at

- Market orders: Have your stock or ETF investment executed at the next available price

- Stop Limit: Otherwise referred to as a stop-loss order, this allows you to determine what price your open position should be closed at when it hits a certain loss. For example, you can sell your Apple shares when they are down by 4%.

Unfortunately, the Hello Stake app does not include take-profit or trialling stop-loss orders. For this, you’ll need to use an app like Plus500 or Capital.com.

Weekly Emails

The team at Hello Stake will send all account holders a weekly email that contains various market insights. This might be a brief discussion on the week’s biggest winners and losers, or certain sectors and industries to look out for.

Features Lacking at Hello Stake

The skin and bones service offered by Hello Stake means that you are missing out on some of the core features listed below:

- Leverage and margin trading

- Short-selling

- Copy Trading

- Price alerts and notifications

- Technical and fundamental analysis

Hello Stake App Bonus

Although the Hello Stake app was previously running a promotion whereby it gave new clients a free share – this no longer appears to be the case. That is to say when you click on the respective promotion, you are presented with an error page.

Payments on the Hello Stake App

On the one hand, the Hello Stake app does not allow you to deposit with a debit/credit card or e-wallet. However, you can still benefit from instant deposits as the app is partnered with Open Banking (via TrueLayer). For those unaware, the provider is a regulated financial payment gateway that sits between you, your bank, and the merchant (Hello Stake in this example).

As such, you can instantly deposit funds into your Hello Stake account and thus – purchase shares straight away. Although you won’t pay a deposit fee per-say – it is important to remember that all incoming transfers come with a 0.5% FX conversion charge.

Withdrawals

Much like the deposit process, all withdrawals on the Hello Stake app are subject to a 0.5% FX fee. It typically takes two business days for the payments team to authorise your withdrawal request. As such, a withdrawal made on Friday might not be processed until Tuesday.

The Hello Stake app offers a premium withdrawal service, too. At 0.5% of the withdrawal amount – the funds will arrive in your bank account the next working day. This comes at a minimum of $2.

Hello Stake Minimum Deposit

There is no minimum deposit amount at Hello Stake, which is great. However, don’t forget about the $2 minimum fee that is applied via the FX charge. In other words, if you deposit just $10, you’re paying an effective rate of 20%.

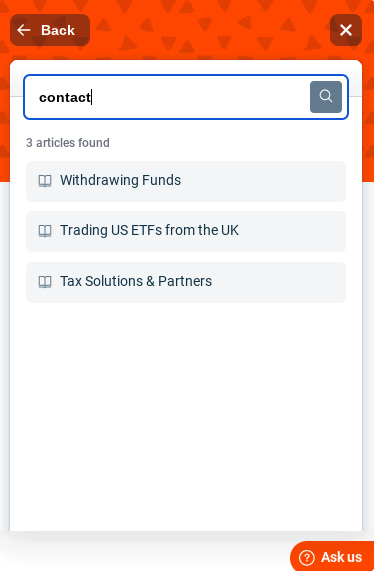

Hello Stake Contact and Customer Service

Upon using the app, you will see a pop-up little logo at the bottom right-hand side of the screen that says ‘Ask Us’. Our initial thought was that this was a conventional live chat facility – which would have been great. However, this is simply an automated FAQ box that shows you help articles based on what you type.

When we finally found the contact button, we were asked to fill in a support ticket. As such – not only is there no live chat facility, but you can’t contact Hello Stake by telephone, either. We have to say that this is really disappointing – especially if you are in need of urgent assistance on your account.

Is Hello Stake Safe?

In a nutshell, Hello Stake is regulated by the Financial Conduct Authority (FCA). This means that your funds are safe at all times. For example, the trading app will be required to store client funds is separate bank accounts from its own.

In even greater news, the Hello Stake app (via DriveWelath, LLC) is a member of SIPC. This protects you up to the first $500,000 ($250,000 in cash) if the broker were to go bankrupt.

Additionally, the Hello Stake app offers two-factor authentication (2FA). This adds an extra layer of security on your funds.

How to Use the Hello Stake App

If you like the sound of what Hello Stake offers and wish to open an account today – follow the steps outlined below.

Step 1: Download the Hello Stake AppHead over to the Hello Stake website via your mobile browser and download/install the app. To clarify, the app is available on both iOS and Android devices.

Step 2: Open an AccountHello Stake will now guide you through the account opening process. This will require some personal information – such as your full name, home address, date of birth, and national insurance number.

The app will then run this information against third-party sources. If it is able to verify your identity electronically, you’ll be able to proceed to the next step. If not, you will receive an email from Hello Stake request a copy of your passport or driver’s license. You will also need to provide an official document that verifies your home address.

Step 3: Transfer FundsOnce your account is opened, you can transfer funds from your UK bank. This part of the process is taking care of by Open Banking (via TrueLayer). You will be asked to log in to your online bank account via the app and then enter the amount you wish to transfer. Take note, Hello Stake nor TrueLayer have access to the details you enter – as everything is encrypted.

Step 4: Buy a StockAs soon as your funds arrive (which is usually instantly), you can buy your first stock. The easiest way to do this is to search for the stock that you wish to buy. Then, it’s just a case of entering the amount that you wish to invest.

Don’t forget – the Hello Stake app supports fractional ownership. As such, you can invest any amount that you like – even it’s just a fraction of the actual stock price.

Finally, click on the ‘Buy’ button to complete your order.

How to Sell on Stake App

If you want to sell your shares, head over to the portfolio section of the app and find the stock you wish to sell. You’ll then be asked to enter the amount that you wish to offload. This can be some or all of the shares that you have outstanding.

Hello Stake Stock App Pros & Cons

Below you will find an overview of our Hello Stake stock app findings.

Pros

- Invest completely fee-free

- Supports 3,800+ stocks and ETFs

- Access the US stock markets from overseas

- Instant deposits via Open Banking

- Easy to use

- Regulated by the FCA

Cons

- Virtually no research or educational resources

- No debit/credit cards or e-wallets

- 0.5% currency conversion fee on all deposits and withdrawals

- No stock markets supported other than the US

- No demo account

- Does not support CFD trading or leverage

The Verdict

In summary, it’s difficult to get excited about the Hello Stake app. Sure, you can buy shares in US companies without paying any commission – but this isn’t anything overly special.

This includes the UK, Canada, Germany, France, Spain, and more. Additionally, there is a serious lack of features. For example, there is nothing in the way of research or education – unless you are prepared to pay $9 per month. Even then, the financial data available to you is readily available on other fee-free trading apps.

You will also be missing out on other asset classes by using Hello Stake. For example, if you’re looking to trade cryptocurrencies, oil, gas, or forex – you’ll need to look elsewhere. As CFDs aren’t supported either – there is no option to apply leverage or short-sell stocks.

FAQs

What device is the Hello Stake app available on?

Hello Stake can be downloaded on Android and iOS devices.

What shares can you buy on the Hello Stake app?

In total, Hello Stake offers just over 3,800+ stocks and ETFs. All instruments are listed in the US.

Is the Hello Stake app legit?

Yes, the Hello Stake app is regulated by the FCA. Furthermore, you will benefit from SIPC protections of $500,000 ($250,000 in cash) in the event the broker collapsed.

What payment methods does the Hello Stake app support?

Hello Stake only supports bank transfers. However, if you are transferring funds from the UK, the app has partnered with Open Banking. This means that you can deposit funds instantly.

What is the Hello Stake minimum deposit?

There is no minimum deposit amount at Hello Stake. However, all deposits come with a 0.5% FX fee at a minimum of $2.

Kane Pepi

Kane Pepi

Kane Pepi is a British researcher and writer that specializes in finance, financial crime, and blockchain technology. Now based in Malta, Kane writes for a number of platforms in the online domain. In particular, Kane is skilled at explaining complex financial subjects in a user-friendly manner. Kane has also written for websites such as MoneyCheck, the Motley Fool, InsideBitcoins, Blockonomi, Learnbonds, and the Malta Association of Compliance Officers.View all posts by Kane Pepistockapps.com has no intention that any of the information it provides is used for illegal purposes. It is your own personal responsibility to make sure that all age and other relevant requirements are adhered to before registering with a trading, investing or betting operator. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice.By continuing to use this website you agree to our terms and conditions and privacy policy.

Trading is risky and you might lose part, or all your capital invested. Information provided is for informational and educational purposes only and does not represent any type of financial advice and/or investment recommendation.

Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers.

© stockapps.com All Rights Reserved 2025

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.OkScroll Up