Webull App Review – Fees, Features, Pros & Cons Revealed

Webull is a relative newcomer to financial markets. The broker launched in 2017 with a mobile app and commission-free stock trading in a clear attempt to overturn Robinhood, which was quickly growing in popularity at the time.

Webull is more than just a Robinhood look-alike, though. This app offers an impressive range of technical analysis tools for stock, ETF, options, and cryptocurrency trading. There are no minimum deposits or trading commissions to use Webull, which is a plus for beginner and expert traders alike.

So, is Webull the best stock trading app for you?

In this review, we’ll take a comprehensive look at everything you need to know about the Webull app. In particular, we’ll focus in on details like the app experience, trading tools, fees, and more.

-

-

What is Webull?

Webull set out from the start to take market share away from the Robinhood app, the upstart mobile broker that helped popularize commission-free trading. Compared to Robinhood, Webull has fewer assets to trade but gives traders many more analytical tools. For example, the Webull app comes with very in-depth technical charts, while there are almost no charting tools whatsoever in the Robinhood app.

The other important factor that differentiates Webull is that you can trade on margin with this broker without paying any account fees. Unlike for Robinhood, you don’t need a subscription to access margin. Interest rates start at under 7% and can drop to just 4% depending on your account balance.

What Can You Trade on the Webull App?

Webull’s selection of assets isn’t enormous compared to other top brokerage apps. But you’ll find more than enough to trade if you’re primarily interested in stocks.

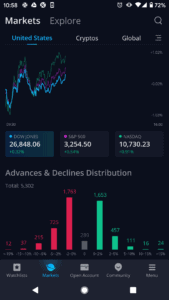

To start, you can trade stocks and ETFs from the three major US exchanges – the NYSE, NASDAQ, and AMEX exchanges. In all, there are several thousand stocks and ETFs available through these exchanges. The app also allows you to trade American Depository Receipts (ADRs) for stocks from the UK, Europe, Canada, China, Israel, Singapore, India, and Hong Kong.

You’re not limited to simply buying stocks, either. Webull allows you to short stocks on margin with no fees other than interest on the money you borrow. You can also trade stock options, although the selection is largely limited to US stocks.

Notably, Webull does not currently offer trading on over-the-counter markets in the US, so you won’t find a wide selection of loosely regulated penny stocks on this app. That’s important if you’re comparing Webull against Robinhood, since penny stocks are available and widely popular on Robinhood.

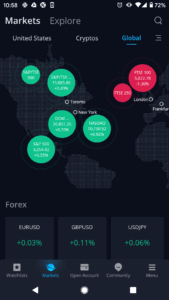

Webull also offers cryptocurrency trading for around a dozen top coins. All coins are traded against the US dollar. You cannot trade forex, commodities, or contracts for difference (CFDs) with Webull.

Webull Account Types

Webull doesn’t offer any account tiers. That said, you do have an option between opening a standard brokerage account or a tax-advantaged IRA account (traditional or Roth). Both standard and IRA accounts are completely free at Webull.

Webull is currently only available to US residents.

Webull Fees & Commissions

Webull is a fully commission-free brokerage app that keeps costs to an absolute minimum.

To start, there are almost no fees associated with your account. That means no deposit or withdrawal fees, no monthly subscription, and no inactivity fee if you go a few months without trading. You can get charged for some transactions like wire transfers, but the majority of traders will never run into these fees.

All trading on Webull is completely commission-free. That is true regardless of whether you’re trading US stocks or ETFs, ADRs, options, or cryptocurrency.

However, since Webull allows you to place trades with major US exchanges, there are some small fees imposed by regulators. For example, the Securities and Exchange Commission charges several cents on every trade. Since these fees are charged by US regulators and not by Webull, they are the same across most brokerage apps that allow you to buy stocks outright.

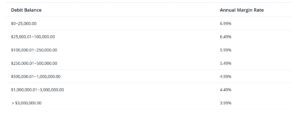

Webull allows all traders to access margin with a free account. The interest rate for borrowed money starts at 6.99% if you have $25,000 or less in your trading account. It drops in increments of 0.50% depending on your total account value, down to a minimum of 3.99% if you have more than $3 million in assets with Webull.

Webull App User Experience

The Webull app recently underwent a full redesign, and its emerged for the better. The app is now very seamless, with a streamlined bottom menu that puts the pages most traders need within one tap. Less frequently access features are stored in a dedicated menu page, which is itself easy to navigate.

Importantly, setting up trades through the Webull app is quick and easy. Simply tap on any stock, ETF, or cryptocurrency to bring up that asset’s page. That page features the current price and the day’s price change, a technical chart of the price, and a scrolling bar that highlights breaking news about the stock. At the bottom of the screen, a trading-specific menu offers a selection of tools for opening a new trade, viewing stock options, or setting up price alerts.

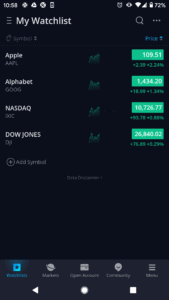

We also liked the approach that the Webull app takes to watchlists. You can set up as many watchlists as you want and switch between them using a simple navigation menu. To add stocks to a watchlist, simply tap a star icon available on every asset’s trading page. Watchlists can be sorted by the day’s price change, making it easy to spot the biggest gainers and losers when you sign into the app.

Webull App Tools and Features

What sets Webull apart from mobile-first competitors like Robinhood is that this stock trading app doesn’t skimp on charting tools. With Webull, technical charts are the default when you head to assets’ trading pages. Without diving into a full-screen chart, you can look at time intervals ranging from one day to five years or switch between candlestick, line, and area charts. Bar intervals from one minute up to one year are available as well.

Webull also comes with a huge range of technical indicators and drawing tools. You can select from any of 50 popular indicators, including frequently used indicators like moving averages and momentum studies. All of the indicators are fully customizable so that you can modify the time window used to calculate them. In addition, when drawing on charts, you can set up layers so that your annotations are clearly visible.

The other key feature that Webull offers is integration with advanced market data. You can subscribe to Level 2 Advance order book data from Nasdaq to see real-time market flows. The app also offers subscriptions for Toronto and Taiwan Stock Exchange data and real-time data from OPRA for options trading.

Another tool worth noting in Webull is the alerts function. This is somewhat more advanced than the price alerts that other brokerage apps offer, as it allows you to set alerts by percent change as well as price. Alerts can also be set by trading volume, and you can choose how often alerts can recur if they are ongoing.

Webull App Education

The Webull app is very light on educational resources for traders. The primary tool for learning how to become a better trader is the demo account, which is accessible through the app. Webull does have some educational articles, but they’re only available through the broker’s website.

Webull App Research and Analysis

The Webull app includes a significant amount of research and analysis at every turn. On every stock page, you’ll find a wealth of fundamental details to give you an overview of a company. There’s also a news tab, where you can find headlines related to the stock. These stories are pulled from major outlets like Reuters, Bloomberg, and CNBC, so the feed is constantly updating throughout the trading day.

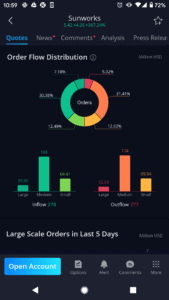

Webull also gives you insight into what other traders think about a stock. You can see the distribution of order flows (that is, buy and sell order) ranked according to whether they are small, medium, or large. The app also tallies analyst recommendations to issue a consensus Buy or Sell rating for every stock. This rating is accompanied by analysts’ price targets, so you can see how the current price stacks up against the expected future price.

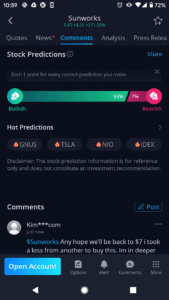

The app also has a limited social network. You and other traders can leave comments on individual stocks, and you can reply within threads to start discussions. What’s particularly helpful about this is that traders can make predictions about whether a stock will rise or fall, so you can see at a glance what traders think about the future of a company.

Notably, Webull doesn’t offer any professional stock analysis of its own. This is something of a departure from other brokers, but it makes sense given Webull’s low-cost business model.

Webull App Bonus

Webull offers traders who sign up for a new account and deposit at least $100 a free stock share, valued at between $8 and $1,600. You do not get to choose which stock you get for free, and there is a 50% chance you will be assigned a stock worth $25 or less. At the time of writing, Webull was running a one-week promotion in which new traders get two free stocks rather than one.

Webull also gives traders a three-month subscription to Level 2 Advance order data from the Nasdaq exchange when you sign up, regardless of whether you deposit funds.

Webull Demo Account

Webull offers a basic paper trading account that gives you full access to the broker’s trading tools. The demo account comes with $1 million in simulated cash and you can reset it at any time.

Payments on the Webull Stock App

Webull doesn’t offer many options for depositing funds to your account. The app essentially requires you to make deposits and withdrawals through ACH bank transfers. Bank transfers are limited to $50,000 each and it typically takes one to five days for the funds to settle in your trading account.

You cannot make payments by credit card, debit card, or e-wallet. Wire transfers are accepted, but they cost $8 for every transaction.

Webull Minimum Deposit

Webull does not require any minimum deposit when you sign up for an account. However, you must deposit at least $100 if you want to receive a free stock.

Webull Supported Countries

Webull is currently only available in the US.

Webull Contact and Customer Service

Webull offers decent customer support, although it could be improved in a few ways. You can get in touch with the company by phone or email, but there isn’t a live chat option. We also found that not all of our emails were answered, and getting a real person on the phone required navigating a labyrinth of menus.

On the plus side, Webull offers support even on weekends and you can access the help center straight from the mobile app.

You can get in touch with Webull’s customer support team by calling (888) 828-0618 or emailing [email protected].

Is the Webull App Safe?

Webull is one of the safest online brokers. Since it only operates in the US, this broker is fully regulated by the US Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA). Nearly all accounts come with up to $500,000 in government protection in case Webull ever goes out of business, including $250,000 in insurance for cash in your account.

The only downside to Webull is that the app doesn’t offer negative balance protection. So, if you trade on margin, it is possible to lose more money than you have deposited in your account.

How to Use the Webull App

Ready to start trading with the Webull app? Follow these simple steps to open account and place your first trade:

Step 1: Download and Install the Webull AppThe Webull mobile app is available for iOS and Android.The Webull mobile app is available for iOS and Android. Head to the Apple App Store or the Google Play Store and search for ‘Webull.’ Tap ‘Install’ to download and install the app on your device.

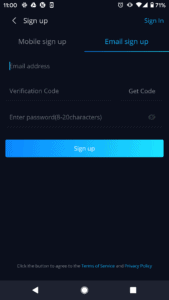

Step 2: Open an AccountOpen the Webull app and tap the ‘Open Account’ tab in the menu at the bottom of the app. Then tap the ‘Open Account’ button to start a new brokerage account application.

Enter your email address and create a password, then fill in personal details like your name and address. Webull also asks for your social security number in order to verify your identity, in compliance with government regulations. Finally, select whether you want to open a standard brokerage account or an IRA account.

Step 3: Deposit FundsYou don’t have to make a deposit when you first sign up for a Webull account. But if you deposit at least $100, you’ll get a free stock.

To make a deposit, tap ‘Deposit’ in the app menu and then ‘Make Your First Deposit’. Connect your bank account, select how much money you want to transfer to Webull, and then tap ‘Deposit.’ Funds transferred through a bank account typically settle in your account in one to five days.

Step 4: Place Your First TradeTo place your first trade, select an asset from Webull’s top market names or search for a specific stock or ETF. On the stock page, tap ‘Trade’ to open a new order form.

In the order form, specify how many shares you want to buy or sell, what type of order you want to place, and how long your order should be good for. You can also select whether or not your order should be active during pre- and after-market trading hours. When your trade is ready, tap ‘Place Order’ to open your position.

How to Sell on Webull App

Closing a trade on the Webull app is simple. The broker shows all of your current open positions on the app’s dashboard page. Tap any position to view that asset, and then tap ‘Trade’ to access an order form.

Select ‘Sell’ as your position side, and then select ‘Sell All’ for the quantity. You can also choose your order type and whether it should be active outside normal market hours. When you’re done, tap ‘Place Order’ to sell your shares.

Webull Stock App Pros & Cons

Pros

- Commission-free trading with no account fees

- Global stock, ETF, options, and crypto trading

- Includes highly advanced technical charts

- Fully customizable indicators

- Set up unlimited watchlists and complex alerts

- Includes basic social network and analyst recommendations

- Highly regulated in the US

Cons

- Only available to US traders

- No forex or commodity CFD trading

- Payments are only by bank or wire transfer

- Limited educational resources

- Less than optimal customer support

The Verdict

Webull is a very capable brokerage app for US traders. The app offers fully commission-free trading with no account fees, so it’s truly a low-cost options for buying and selling stocks, ETFs, options, and cryptocurrency. We also like that Webull gives traders access to nearly the entire US stock market, with the notable exception of penny stocks.

What really sets Webull apart from other brokerage apps is that it offers a significant number of advanced charting and analysis features. You can view highly customizable technical charts for any asset as well as fully customize any of 50 popular indicators. Webull also lets you import Level 2 Advance data from Nasdaq so you can track order flows through the market.

In addition, the app includes analyst recommendations and price targets for most popular stocks. A basic social network lets you see what other traders think about different assets and swap ideas.

FAQs

Can I short sell stocks with Webull?

Yes, Webull allows you to short sell stocks using margin. You must have your account approved to trade with margin in order to short sell an asset.

What cryptocurrencies can I trade with Webull?

Webull currently supports trading for 15 cryptocurrencies: BTC, ETH, EOS, BCH, XRP, XLM, LTC, TRX, XMR, DASH, ETC, NEO, ZEC, BTG, and VET.

Can I follow other traders on Webull?

Webull does allow you to follow other traders through its social network. However, following only surfaces a trader’s comments in your feed. You cannot see information about their trades or account.

What ETFs can I trade with Webull?

All ETFs that trade on the NYSE, NASDAQ, and Amex exchanges in the US are available for trading on Webull.

Are there any deposit or withdrawal fees at Webull?

Webull does not charge any deposit or withdrawal fees for bank transfers. However, there is a fee of $8 for wire transfers.

Michael Graw

Michael Graw

Michael Graw is a freelance finance and trading journalist based in Bellingham, Washington. Michael’s expert trading guides and investment analysis articles have featured in many leading publications, such as TechRadar, Tom’s Guide, LearnBonds, and BuyShares.View all posts by Michael Grawstockapps.com has no intention that any of the information it provides is used for illegal purposes. It is your own personal responsibility to make sure that all age and other relevant requirements are adhered to before registering with a trading, investing or betting operator. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice.By continuing to use this website you agree to our terms and conditions and privacy policy.

Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers.

© stockapps.com All Rights Reserved 2024

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.OkScroll Up